Deck 9: Other Income, Other Deductions, and Special Rules for Completing Net Income for Tax Purposes

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/6

Play

Full screen (f)

Deck 9: Other Income, Other Deductions, and Special Rules for Completing Net Income for Tax Purposes

1

Car Co. is selling its land and building to Truck Co. for $340,000 (Land $200,000; Building $140,000). These values have not been officially appraised, and Truck Co. thinks that the land is only worth $150,000 and the building is worth $190,000. (Car Co. originally paid $100,000 for the land and constructed the building for $150,000. The UCC on the building is currently $130,000.) Which of the following statements is TRUE based on these facts?

A) Future CCA will be higher for Truck Co. if Car Co.'s terms are accurate

B) Car Co. will recognize higher net capital gains if Truck Co.'s terms are accurate

C)Car Co. will recognize higher recapture if Truck Co.'s terms are accurate.

D) The allocation of the costs is irrelevant for tax purposes as the total price is the same under both sets of terms.

A) Future CCA will be higher for Truck Co. if Car Co.'s terms are accurate

B) Car Co. will recognize higher net capital gains if Truck Co.'s terms are accurate

C)Car Co. will recognize higher recapture if Truck Co.'s terms are accurate.

D) The allocation of the costs is irrelevant for tax purposes as the total price is the same under both sets of terms.

C

2

Which of the following is FALSE regarding Tax Free Savings Accounts (TFSAs)?

A) There is no mandatory age by which a TFSA must be wound up.

B)TFSA contributions are tax deductible.

C) Any unused amounts not contributed in a year may be carried forward indefinitely to future years.

D) Capital gains earned within TFSAs are not taxed.

A) There is no mandatory age by which a TFSA must be wound up.

B)TFSA contributions are tax deductible.

C) Any unused amounts not contributed in a year may be carried forward indefinitely to future years.

D) Capital gains earned within TFSAs are not taxed.

B

3

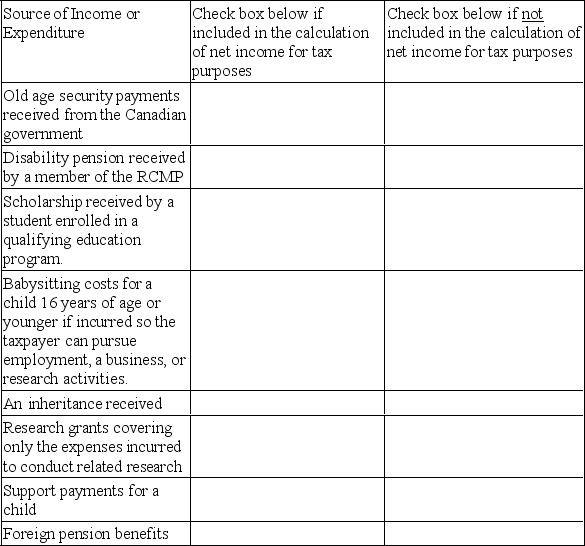

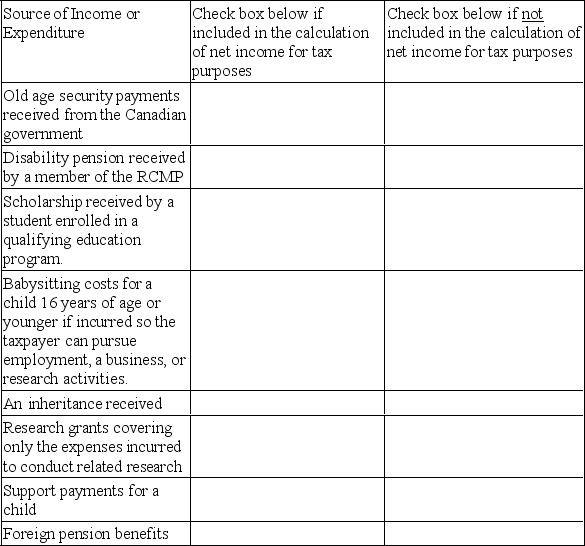

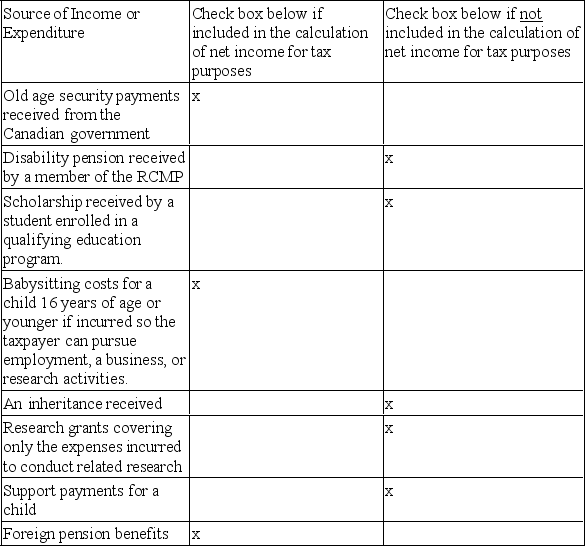

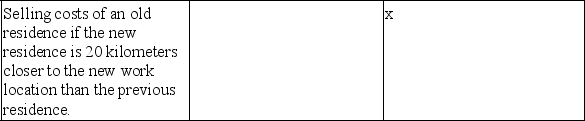

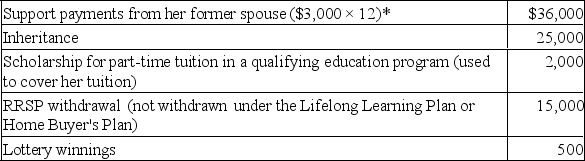

Identify whether the following sources of income and expenditures are included for the calculation of net income for tax purposes.

4

Which of the following examples of income received from private corporations would not be excluded from tax on split income for adult family members?

A) A capital gain from the sale of qualified small business corporation shares

B)Income received from a related business

C) Income received by a 68-year-old business owner's spouse

D) Income received by an uncle

A) A capital gain from the sale of qualified small business corporation shares

B)Income received from a related business

C) Income received by a 68-year-old business owner's spouse

D) Income received by an uncle

Unlock Deck

Unlock for access to all 6 flashcards in this deck.

Unlock Deck

k this deck

5

Steve gifted shares in a public corporation to his fifteen-year-old son, Simon. The ACB of the shares was $10,000. During the year, Simon received $500 in dividends from the shares. Simon then sold the shares for $12,000. Which of the following is true for Steve and Simon?

A) Simon will have to claim the dividends and capital gain on his tax return.

B)Steve will have to claim the dividends on his tax return and Simon will have to recognize the capital gain on his tax return.

C) Steve will have to claim the dividends and a capital gain on his tax return.

D) Simon will have to claim the dividends on his tax return and Steve will have to recognize the capital gain on his tax return.

A) Simon will have to claim the dividends and capital gain on his tax return.

B)Steve will have to claim the dividends on his tax return and Simon will have to recognize the capital gain on his tax return.

C) Steve will have to claim the dividends and a capital gain on his tax return.

D) Simon will have to claim the dividends on his tax return and Steve will have to recognize the capital gain on his tax return.

Unlock Deck

Unlock for access to all 6 flashcards in this deck.

Unlock Deck

k this deck

6

Agatha earned $35,000 at her job during January 1st - October 10th of 20x4. She accepted a new position with the company in a town 1312 kilometres away and began the new job on November 1st, 20x4, earning a gross salary of $4000 per month.

Agatha's moving expenses included:

$7,000 for a moving van

$300 for meals en route for Agatha and her 4 year-old daughter on the four-day drive

$700 for accommodations en route

$3000 ($150 per day) for 20 nights of temporary lodging in the new location until her apartment was available

$550 in gas receipts

She was not reimbursed for the move.

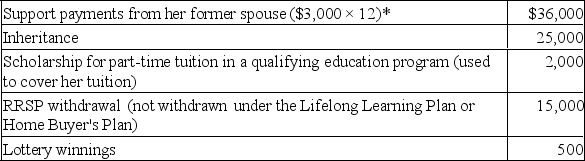

Agatha also received the following in 20x4:

*The support payments are in accordance with Agatha's divorce agreement, which calls for monthly support payments of $1,500 for Agatha and $1,500 for her daughter.

*The support payments are in accordance with Agatha's divorce agreement, which calls for monthly support payments of $1,500 for Agatha and $1,500 for her daughter.

Additional information:

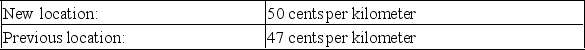

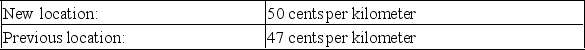

Assumed mileage rates:

Required:

Required:

Determine Agatha's minimum net income for tax purposes for 20x4 in accordance with Section 3 of the Income Tax Act. Show all calculations for her moving expenses and identify any amounts to be carried-forward.

Agatha's moving expenses included:

$7,000 for a moving van

$300 for meals en route for Agatha and her 4 year-old daughter on the four-day drive

$700 for accommodations en route

$3000 ($150 per day) for 20 nights of temporary lodging in the new location until her apartment was available

$550 in gas receipts

She was not reimbursed for the move.

Agatha also received the following in 20x4:

*The support payments are in accordance with Agatha's divorce agreement, which calls for monthly support payments of $1,500 for Agatha and $1,500 for her daughter.

*The support payments are in accordance with Agatha's divorce agreement, which calls for monthly support payments of $1,500 for Agatha and $1,500 for her daughter.Additional information:

Assumed mileage rates:

Required:

Required:Determine Agatha's minimum net income for tax purposes for 20x4 in accordance with Section 3 of the Income Tax Act. Show all calculations for her moving expenses and identify any amounts to be carried-forward.

Unlock Deck

Unlock for access to all 6 flashcards in this deck.

Unlock Deck

k this deck