Deck 16: Simple Interest

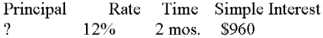

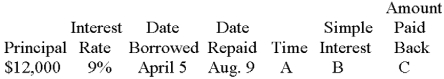

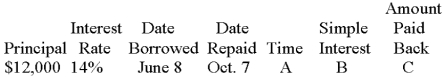

Question

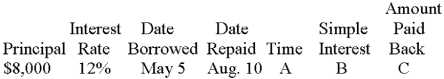

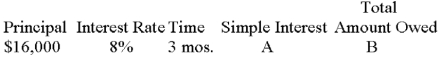

Question

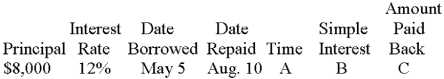

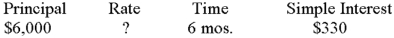

Question

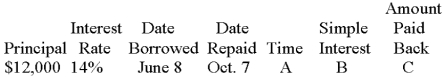

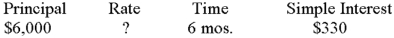

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

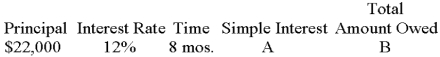

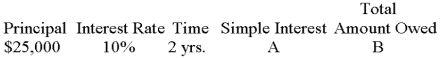

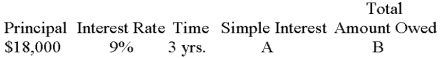

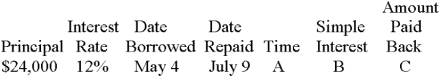

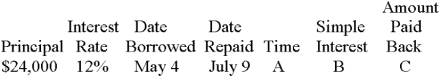

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

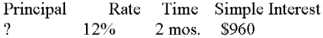

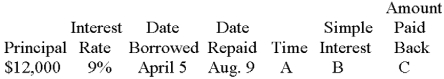

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/69

Play

Full screen (f)

Deck 16: Simple Interest

1

July 10 to March 15 is 119 days.

False

2

The interest is the amount of money borrowed.

False

3

Interest is the cost of borrowing.

True

4

The federal government likes to use ordinary interest.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

5

Simple interest loans are usually more than one year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

6

Ordinary interest is never used by banks.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

7

To convert time in days, it is necessary to multiply the time in years times 360 or 365.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

8

The time of a loan could be expressed in months, years, or days.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

9

Principal is equal to rate divided by interest times time.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

10

The U.S. Rule is a method that allows the borrower to receive proper interest credit when a debt is paid off in more than one payment before the maturity date.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

11

Interest = principal * rate.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

12

The amount a bank charges for the use of money is called interest.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

13

Ordinary interest is required by all banks.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

14

In the U.S. Rule, the partial payment first covers the interest and the remainder reduces the principal.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

15

The exact interest method represents time as the exact number of days divided by 365.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

16

Rate is equal to interest divided by the principal times time.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

17

Ordinary interest results in a slightly higher rate of interest than exact interest.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

18

18 months is the same as 1.5 years.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

19

In the U.S. Rule, the first step is to calculate interest on the total life of the loan.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

20

The U.S. Rule is seldom used in today's workplace.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is not true of the U.S. Rule?

A) Calculate interest on principal from date of loan to date of first payment

B) Allows borrower to receive proper interest credits

C) Can use 360 days in its calculations

D) Can involve more than one payment before maturity date

E) None of these

A) Calculate interest on principal from date of loan to date of first payment

B) Allows borrower to receive proper interest credits

C) Can use 360 days in its calculations

D) Can involve more than one payment before maturity date

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

22

Janet Home went to Citizen Bank. She borrowed $7,000 at a rate of 8%. The date of the loan was September 20. Janet hoped to repay the loan on January 20. Assuming the loan is based on ordinary interest, Janet will pay back how much interest on January 20?

A) $188.22

B) $187.18

C) $189.78

D) $187.17

E) None of these

A) $188.22

B) $187.18

C) $189.78

D) $187.17

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

23

Jill Ley took out a loan for $60,000 to pay for her child's education. The loan would be repaid at the end of eight years in one payment with interest of 6%. The total amount Jill has to pay back at the end of the loan is:

A) $88,008

B) $80,800

C) $88,800

D) $28,800

E) None of these

A) $88,008

B) $80,800

C) $88,800

D) $28,800

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

24

Joan Roe borrowed $85,000 at a rate of 11 3/4%. The date of the loan was July 8. Joan is to repay the loan on Sept. 14. Assuming the loan is based on exact interest, the interest Joan will pay on Sept. 14 is:

A) $86,860.68

B) $1,860.68

C) $1,886.53

D) $86,886.53

E) None of these

A) $86,860.68

B) $1,860.68

C) $1,886.53

D) $86,886.53

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

25

Interest on $5,255 at 12% for 30 days (use ordinary interest) is:

A) $52.55

B) $55.25

C) $5.26

D) $5.25

E) None of these

A) $52.55

B) $55.25

C) $5.26

D) $5.25

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

26

The amount charged for the use of a bank's money is called:

A) Principal

B) Interest

C) Rate

D) Time

E) None of these

A) Principal

B) Interest

C) Rate

D) Time

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

27

At maturity, using the U.S. Rule, the interest calculated from the last partial payment is:

A) Subtracted from adjusted balance

B) Added to beginning balance

C) Subtracted from beginning balance

D) Added to adjusted balance

E) None of these

A) Subtracted from adjusted balance

B) Added to beginning balance

C) Subtracted from beginning balance

D) Added to adjusted balance

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

28

The U.S. Rule:

A) Is used only by banks

B) Is never used by banks

C) Allows borrowers to receive interest credit

D) Is hardly used today

E) None of these

A) Is used only by banks

B) Is never used by banks

C) Allows borrowers to receive interest credit

D) Is hardly used today

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

29

Simple interest usually represents a loan of:

A) One month or less

B) One year or less

C) Two years or less

D) Six months or less

E) None of these

A) One month or less

B) One year or less

C) Two years or less

D) Six months or less

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

30

Interest is equal to:

A) Principal * rate divided by time

B) Principal divided by rate * time

C) Principal * time

D) Principal * rate * time

E) None of these

A) Principal * rate divided by time

B) Principal divided by rate * time

C) Principal * time

D) Principal * rate * time

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

31

Joe Flynn visits his local bank to see how long it will take for $1,200 to amount to $2,100 at a simple interest rate of 7%. The time is (round time in years to nearest tenth):

A) 9.2 years

B) 11.1 years

C) 10.7 years

D) 17.1 years

E) None of these

A) 9.2 years

B) 11.1 years

C) 10.7 years

D) 17.1 years

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

32

The number of days between Aug. 9 and Jan. 3 is:

A) 145

B) 144

C) 147

D) 148

E) None of these

A) 145

B) 144

C) 147

D) 148

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

33

A note dated August 18 and due on March 9 runs for exactly:

A) 230 days

B) 227 days

C) 272 days

D) 203 days

E) None of these

A) 230 days

B) 227 days

C) 272 days

D) 203 days

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

34

Given interest of $11,900 at 6% for 50 days (ordinary interest), one can calculate the principal as:

A) $1,428,005.70

B) $4,128,005.70

C) $1,428,05.70

D) $1,420.70

E) None of these

A) $1,428,005.70

B) $4,128,005.70

C) $1,428,05.70

D) $1,420.70

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

35

Matty Kaminsky owns a new Volvo. His June monthly interest is $400. The rate is 8 ½%. Matty's principal balance at the beginning of June is (use 360 days):

A) $65,740.85

B) $64,470.85

C) $65,704.85

D) $56,470.85

E) None of these

A) $65,740.85

B) $64,470.85

C) $65,704.85

D) $56,470.85

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

36

A note dated Dec. 13 and due July 5 runs for exactly:

A) 11 days

B) 161 days

C) 204 days

D) 347 days

E) None of these

A) 11 days

B) 161 days

C) 204 days

D) 347 days

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

37

Interest of $1,632 with principal of $16,000 for 306 days (ordinary interest) results in a rate of:

A) 10%

B) 12%

C) 12 1/2%

D) 13%

E) None of these

A) 10%

B) 12%

C) 12 1/2%

D) 13%

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

38

Federal Reserve banks as well as the federal government like to calculate simple interest based on:

A) Exact interest, ordinary interest

B) Using 30 days in each month

C) Using 31 days in each month

D) Exact interest

E) None of these

A) Exact interest, ordinary interest

B) Using 30 days in each month

C) Using 31 days in each month

D) Exact interest

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

39

A $40,000 loan at 4% dated June 10 is due to be paid on October 11. The amount of interest is (assume ordinary interest):

A) $503.00

B) $2,500.00

C) $546.67

D) $105.33

E) None of these

A) $503.00

B) $2,500.00

C) $546.67

D) $105.33

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

40

In calculating interest in the U.S. Rule from the last partial payment, the interest is subtracted from the adjusted balance.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

41

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

42

Janet took out a loan of $50,000 from Bank of America at 8% on March 19, 2012, which is due on July 8, 2012 Using exact interest, the amount of Janet's interest cost is:

A) $5,018.44

B) $2,561.44

C) $5,261.44

D) $5,216.44

E) None of these

A) $5,018.44

B) $2,561.44

C) $5,261.44

D) $5,216.44

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

43

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

44

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

45

Joyce took out a loan for $21,900 at 12% on March 18, 2013, which will be due on January 9, 2014. Using ordinary interest, Joyce will pay back on Jan. 9 a total amount of:

A) $2,167.10

B) $24,068.10

C) $24,038.40

D) $2,138.40

E) None of these

A) $2,167.10

B) $24,068.10

C) $24,038.40

D) $2,138.40

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

46

Solve:

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

47

Use exact interest:

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

48

Jim Murphy borrowed $30,000 on a 120-day 14% note. Jim paid $5,000 toward the note on day 95. On day 105 he paid an additional $6,000. Using the U.S. Rule, Jim's adjusted balance after the first payment is:

A) $25,000

B) $28,891.67

C) $1,108.33

D) $26,108.33

E) None of these

A) $25,000

B) $28,891.67

C) $1,108.33

D) $26,108.33

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

49

Given: a 11% 120-day $9,000 note. Find the adjusted balance (principal) using the U.S. Rule (360 days) after the first payment on the 65th day of $1,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

50

Use ordinary interest:

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

51

Round all answers to the nearest cent. Angel Hall borrowed $82,000 for her granddaughter's college education. She must repay the loan at the end of nine years with 9¼% interest. What is the maturity value Angel must repay?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

52

Sandra Gloy borrowed $5,000 on a 120-day 5% note. Sandra paid $500 toward the note on day 40. On day 90 she paid an additional $500. Using the U.S. Rule, her adjusted balance after the first payment is:

A) $4,527.87

B) $4,725.87

C) $4,725.70

D) $4,527.78

E) None of these

A) $4,527.87

B) $4,725.87

C) $4,725.70

D) $4,527.78

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

53

Given: a 12% 90-day $4,000 note. Find the adjusted balance (principal) using the U.S. rule (360 days) after the first $800 payment on the 40th day.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

54

Use ordinary interest:

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

55

Christina Hercher borrowed $50,000 on a 90-day 8% note. Christina paid $3,000 toward the note on day 40. On day 60 she paid an additional $4,000. Using the U.S. Rule, Christina's adjusted balance after the first payment is:

A) $1,008.89

B) $48,008.89

C) $47,444.44

D) $44,744.44

E) None of these

A) $1,008.89

B) $48,008.89

C) $47,444.44

D) $44,744.44

E) None of these

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

56

Use exact interest:

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

57

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

58

Round all answers to the nearest cent. Lou Valdez is buying a truck. His monthly interest is $155 at 10 1/4 %. What is Lou's principal balance after the beginning of November? Use 360 days. DO NOT round the denominator in your calculation.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

59

Round all answers to the nearest cent. Woody's Café's real estate tax of $1,110.85 was due on November 1, 2014. Due to financial problems, Woody was unable to pay his café's real estate tax bill until January 15, 2015. The penalty for late payment is 8 1/4% ordinary interest. (A) What is the penalty Woody will have to pay and (B) what will Woody pay on January 15?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

60

Round all answers to the nearest cent. Amy Koy met Pat Quin on Sept. 8 at Queen Bank. After talking with Pat, Amy decided she would like to consider a $9,000 loan at 10 1/2% to be repaid on Feb. 17 of the next year on exact interest. Calculate the amount that Amy would pay at maturity under this assumption.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

61

Molly Joy owns her own car. Her June monthly interest was $205. The rate is 13 1/2%. Find out what Joy's principal balance is at the beginning of June. Use 360 days. (Do not round denominator in calculation.)

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

62

Abby borrowed $3,000 at 12 3/4% on Sept. 10. The loan is due on Jan. 29. Assuming the loan is based on ordinary interest, how much will Abby pay on Jan. 29?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

63

Solve:

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

64

Solve:

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

65

Alice took out a loan for $19,500 at 13 1/2% on March 4, 2013, which will be due on

January 14, 2014. Using ordinary interest, what will be the interest cost and what amount will Alice pay back on January 14, 2014?

January 14, 2014. Using ordinary interest, what will be the interest cost and what amount will Alice pay back on January 14, 2014?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

66

Bill Roe visits his local bank to see how long it will take for $1,000 to amount to $1,900 at a simple interest rate of 12 1/2%. Can you provide Bill with the solution to his problem in years?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

67

Bruce Seem took out the same loan as Alice, but his terms were exact interest. What is the difference in interest, and what will Bruce pay back on January 14, 2014?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

68

Solve:

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

69

Jane Smith took out a loan for $40,000 to pay for her child's education. The loan would be repaid at the end of eight years in one payment with interest of 12%. What is the total amount Jane has to pay back at the end of the loan?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck