Deck 9: Reporting and Analyzing Long-Lived Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/219

Play

Full screen (f)

Deck 9: Reporting and Analyzing Long-Lived Assets

1

The book value of a plant asset is always equal to its fair market value.

False

2

The declining-balance method of depreciation is called an accelerated depreciation method because it depreciates an asset in a shorter period of time than the asset's useful life.

False

3

The IRS does not require the taxpayer to use the same depreciation method on the tax return that is used in preparing financial statements.

True

4

In calculating depreciation, both plant asset cost and useful life are based on estimates.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

5

Recording depreciation on plant assets affects both the balance sheet and the income statement.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

6

When purchasing land, the costs for clearing, draining, filling, and grading should be charged to a Land Improvements account.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

7

The book value of a long-term asset is calculated by subtracting its salvage value from its cost.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

8

A change in the estimated useful life of a plant asset may cause a change in the amount of depreciation recognized in the current and future periods, but not in prior periods.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

9

Once cost is established for a plant asset, it becomes the basis of accounting for the asset unless the asset appreciates in value, in which case, market value becomes the basis for accountability.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

10

Land improvements are generally charged to the Land account.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

11

When a change in estimate is made, there is no correction of previously recorded depreciation expense.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

12

Using the units-of-activity method of depreciating factory equipment will generally result in more depreciation expense being recorded over the life of the asset than if the straight-line method had been used.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

13

Recording depreciation in each period is an application of the matching principle.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

14

All plant assets (fixed assets) must be depreciated for accounting purposes.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

15

Additions and improvements to a plant asset that increase the asset's operating efficiency, productive capacity, or expected useful life are generally expensed in the period incurred.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

16

The Accumulated Depreciation account represents a cash fund available to replace plant assets.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

17

The depreciable cost of a plant asset is its original cost minus obsolescence.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

18

A change in the estimated salvage value of a plant asset requires a restatement of prior years' depreciation.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

19

When purchasing delivery equipment, sales taxes and motor vehicle licenses should be charged to Equipment.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

20

One advantage of leasing a long-term asset is that it can reduce the risk of obsolescence.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

21

Companies only dispose of plant assets by either sale or exchange.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

22

If an acquired franchise or license is for an indefinite time period, then the cost of the asset should not be amortized.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

23

Franchises are classified as plant assets.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

24

A permanent decline in the market value of an asset is referred to as an impairment.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

25

A loss on disposal of a plant asset as a result of a sale or a retirement is calculated in the same way as a gain on disposal.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

26

A characteristic of capital expenditures is that the expenditures occur frequently during the period of ownership.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

27

If the proceeds from the sale of a plant asset exceed its book value, a gain on disposal occurs.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

28

The cost of an intangible asset must be amortized over a 20-year period.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

29

Goodwill is recorded only when there is an exchange transaction that involves the purchase of an entire business.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

30

Ordinary repairs should be recognized when incurred as revenue expenditures.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

31

Capital expenditures are expenditures that increase the company's investment in productive facilities.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

32

A plant asset must be fully depreciated before it can be removed from the books.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

33

When an entire business is purchased, goodwill is the excess of cost over the book value of the net assets acquired.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

34

The cost of a patent should be amortized over its legal life or useful life, whichever is shorter.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

35

If a plant asset is sold at a gain, the gain on disposal should reduce the cost of goods sold section of the income statement.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

36

Intangible assets are rights, privileges, and competitive advantages that result from ownership of long-lived assets without physical substance.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

37

A loss on disposal of a plant asset occurs if the cash proceeds received from the asset sale is less than the asset's book value.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

38

The return on assets ratio indicates how efficiently a company uses its assets.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

39

The book value of a plant asset is the amount originally paid for the asset less anticipated salvage value.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

40

Research and development costs that result in a successful product that is patentable are charged to the Patent account.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

41

The Land account would include all of the following costs except

A)drainage costs.

B)the cost of building a fence.

C)commissions paid to real estate agents.

D)the cost of tearing down a building.

A)drainage costs.

B)the cost of building a fence.

C)commissions paid to real estate agents.

D)the cost of tearing down a building.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

42

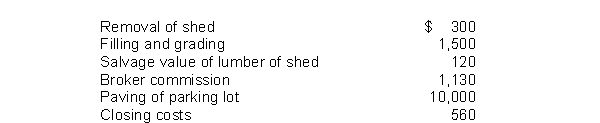

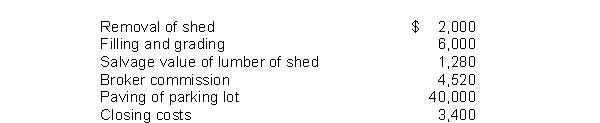

Shaffer Company acquires land for $77,000 cash.Additional costs are as follows.  Shaffer will record the acquisition cost of the land as

Shaffer will record the acquisition cost of the land as

A)$77,000.

B)$78,690.

C)$80,610.

D)$80,370.

Shaffer will record the acquisition cost of the land as

Shaffer will record the acquisition cost of the land asA)$77,000.

B)$78,690.

C)$80,610.

D)$80,370.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following would not be charged to the Equipment account?

A)Installation costs

B)Freight costs

C)Cost of trial runs

D)Electricity used by the machine

A)Installation costs

B)Freight costs

C)Cost of trial runs

D)Electricity used by the machine

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

44

Burke Company purchases land for $180,000 cash.Burke assumes $5,000 in property taxes due on the land.The title and attorney fees totaled $2,000.Burke has the land graded for $4,400.They paid $20,000 for paving of a parking lot.What amount does Burke record as the cost for the land?

A)$186,400

B)$211,400

C)$191,400

D)$180,000

A)$186,400

B)$211,400

C)$191,400

D)$180,000

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following assets does not decline in service potential over the course of its useful life?

A)Equipment

B)Furnishings

C)Land

D)Fixtures

A)Equipment

B)Furnishings

C)Land

D)Fixtures

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

46

The four subdivisions of plant assets are

A)land, land improvements, buildings, and equipment.

B)intangibles, land, buildings, and equipment.

C)furnishings and fixtures, land, buildings, and equipment.

D)property, plant, equipment, and land.

A)land, land improvements, buildings, and equipment.

B)intangibles, land, buildings, and equipment.

C)furnishings and fixtures, land, buildings, and equipment.

D)property, plant, equipment, and land.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

47

Aber Company buys land for $145,000 in 2021.As of 3/31/22, the land has appreciated in value to $151,000.On 12/31/22, the land has an appraised value of $155,400.By what amount should the Land account be increased in 2022?

A)$0

B)$6,000

C)$4,400

D)$10,400

A)$0

B)$6,000

C)$4,400

D)$10,400

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

48

A company purchased land for $94,000 cash.The real estate brokers' commission was $5,000 and $7,000 was spent for demolishing an old building on the land before construction of a new building could start.Proceeds from salvage of the demolished building were $1,200.Under the historical cost principle, the cost of land is

A)$104,800.

B)$94,000.

C)$99,800.

D)$106,000.

A)$104,800.

B)$94,000.

C)$99,800.

D)$106,000.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

49

In the notes to the financial statements, the depreciation and amortization methods used should be described.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

50

The cost of land does not include

A)real estate brokers' commission.

B)annual property taxes.

C)accrued property taxes assumed by the purchaser.

D)title fees.

A)real estate brokers' commission.

B)annual property taxes.

C)accrued property taxes assumed by the purchaser.

D)title fees.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

51

One characteristic of a plant asset is that it is

A)intangible.

B)used in the operations of a business.

C)held for sale in the ordinary course of the business.

D)not currently used in the business but held for future use.

A)intangible.

B)used in the operations of a business.

C)held for sale in the ordinary course of the business.

D)not currently used in the business but held for future use.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

52

A company purchased land for $350,000 cash.The real estate brokers' commission was $25,000 and $35,000 was spent for demolishing an old building on the land before construction of a new building could start.Under the historical cost principle, the cost of land is

A)$385,000.

B)$350,000.

C)$375,000.

D)$410,000.

A)$385,000.

B)$350,000.

C)$375,000.

D)$410,000.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

53

The return on assets ratio can be computed from the profit margin ratio and the asset turnover ratio.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following assets is not properly classified as property, plant, and equipment?

A)A building used as a factory

B)Land used in ordinary business operations

C)A truck held for resale by an automobile dealership

D)Land improvements, such as parking lots and fences

A)A building used as a factory

B)Land used in ordinary business operations

C)A truck held for resale by an automobile dealership

D)Land improvements, such as parking lots and fences

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

55

Whyte Clinic purchases land for $420,000 cash.The clinic assumes $4,500 in property taxes due on the land.The title and attorney fees totaled $3,000.The clinic had the land graded for $6,600.What amount does Whyte Clinic record as the cost for the land?

A)$426,600

B)$420,000

C)$434,100

D)$427,500

A)$426,600

B)$420,000

C)$434,100

D)$427,500

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

56

Salvage value is not subtracted from plant asset cost in determining depreciation expense under the declining-balance method of depreciation.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

57

The asset turnover is calculated as net sales divided by ending total assets.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

58

Which one of the following items is not considered a part of the cost of a truck purchased for business use?

A)Sales tax

B)Truck license

C)Freight charges

D)Cost of lettering on side of truck

A)Sales tax

B)Truck license

C)Freight charges

D)Cost of lettering on side of truck

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

59

Under the double-declining-balance method, the depreciation rate used each year remains constant.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

60

Givens Retail purchased land for a new parking lot for $125,000.The paving cost $175,000 and the lights to illuminate the new parking area cost $60,000.Which of the following statements is true with respect to these additions?

A)$300,000 should be debited to the Land account.

B)$235,000 should be debited to Land Improvements.

C)$360,000 should be debited to the Land account.

D)$360,000 should be debited to Land Improvements.

A)$300,000 should be debited to the Land account.

B)$235,000 should be debited to Land Improvements.

C)$360,000 should be debited to the Land account.

D)$360,000 should be debited to Land Improvements.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

61

Runge Company purchased machinery on January 1 at a list price of $300,000, with credit terms 2/10, n/30.Payment was made within the discount period.Runge paid $15,000 sales tax on the machinery and paid installation charges of $5,300.Prior to installation, Runge paid $12,000 to pour a concrete slab on which to place the machinery.What is the total cost of the new machinery?

A)$314,300

B)$326,300

C)$332,300

D)$309,000

A)$314,300

B)$326,300

C)$332,300

D)$309,000

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

62

Which one of the following items is not a consideration when recording periodic depreciation expense on plant assets?

A)Salvage value.

B)Estimated useful life.

C)Cash needed to replace the plant asset.

D)Cost.

A)Salvage value.

B)Estimated useful life.

C)Cash needed to replace the plant asset.

D)Cost.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

63

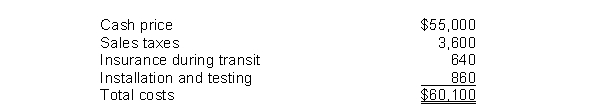

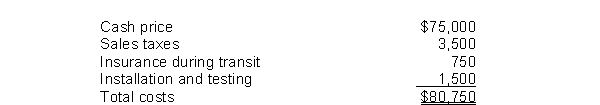

Rodgers Company purchased equipment and these costs were incurred:  Rodgers will record the acquisition cost of the equipment as

Rodgers will record the acquisition cost of the equipment as

A)$55,000.

B)$58,600.

C)$59,240.

D)$60,100.

Rodgers will record the acquisition cost of the equipment as

Rodgers will record the acquisition cost of the equipment asA)$55,000.

B)$58,600.

C)$59,240.

D)$60,100.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

64

Schrock Company purchases a new delivery van for $70,000.The sales taxes are $5,250.The logo of the company is painted on the side of the van for $1,400.The van's annual license is $140.The van undergoes safety testing for $250.What does Schrock record as the cost of the new van?

A)$77,040

B)$76,900

C)$75,250

D)$76,650

A)$77,040

B)$76,900

C)$75,250

D)$76,650

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

65

Arnold Company purchases a new delivery truck for $45,000.The sales taxes are $2,500.The logo of the company is painted on the side of the truck for $1,200.The truck's annual license is $120.The truck undergoes safety testing for $220.What does Arnold record as the cost of the new truck?

A)$49,040.

B)$48,920.

C)$47,500.

D)$46,920.

A)$49,040.

B)$48,920.

C)$47,500.

D)$46,920.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

66

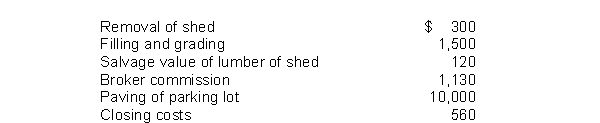

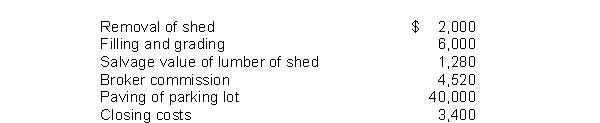

Ramirez Company acquires land for $240,000 cash.Additional costs are as follow.  Ramirez will record the acquisition cost of the land as

Ramirez will record the acquisition cost of the land as

A)$254,640.

B)$257,200.

C)$255,920.

D)$240,000.

Ramirez will record the acquisition cost of the land as

Ramirez will record the acquisition cost of the land asA)$254,640.

B)$257,200.

C)$255,920.

D)$240,000.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

67

Wesley Hospital installs a new parking lot.The paving cost $60,000 and the lights to illuminate the new parking area cost $24,000.Which of the following statements is true with respect to these additions?

A)$60,000 should be debited to the Land account.

B)$24,000 should be debited to Land Improvements.

C)$84,000 should be debited to the Land account.

D)$84,000 should be debited to Land Improvements.

A)$60,000 should be debited to the Land account.

B)$24,000 should be debited to Land Improvements.

C)$84,000 should be debited to the Land account.

D)$84,000 should be debited to Land Improvements.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

68

The term applied to the periodic expiration of a plant asset's cost is

A)amortization.

B)depletion.

C)depreciation.

D)cost expiration.

A)amortization.

B)depletion.

C)depreciation.

D)cost expiration.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

69

The balance in the Accumulated Depreciation account represents the

A)cash fund to be used to replace plant assets.

B)amount to be deducted from the cost of the plant asset to arrive at its fair market value.

C)amount charged to expense in the current period.

D)amount charged to expense since the acquisition of the plant asset.

A)cash fund to be used to replace plant assets.

B)amount to be deducted from the cost of the plant asset to arrive at its fair market value.

C)amount charged to expense in the current period.

D)amount charged to expense since the acquisition of the plant asset.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

70

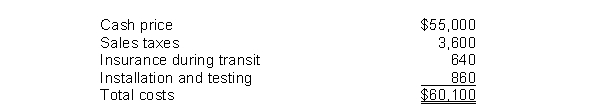

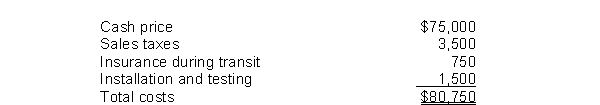

Carpino Company purchased equipment and these costs were incurred:  What amount should be recorded as the cost of the equipment?

What amount should be recorded as the cost of the equipment?

A)$75,000

B)$78,500

C)$79,250

D)$80,750

What amount should be recorded as the cost of the equipment?

What amount should be recorded as the cost of the equipment?A)$75,000

B)$78,500

C)$79,250

D)$80,750

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

71

Kathy's Blooms purchased a delivery van with a $60,000 list price.The company was given a $6,000 cash discount by the dealer and paid $3,000 sales tax.Annual insurance on the van is $1,500.As a result of the purchase, by how much will Kathy's Blooms increase its van account?

A)$60,000

B)$54,000

C)$58,500

D)$57,000

A)$60,000

B)$54,000

C)$58,500

D)$57,000

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following is not an advantage of leasing a long-term asset?

A)shared tax benefits

B)no depreciation

C)reduced risk of obsolescence

D)lower down payment

A)shared tax benefits

B)no depreciation

C)reduced risk of obsolescence

D)lower down payment

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

73

National Molding is building a new plant that will take three years to construct.The construction will be financed in part by funds borrowed during the construction period.There are significant architect fees, excavation fees, and building permit fees.Which of the following statements is true?

A)Excavation fees are capitalized but building permit fees are not.

B)Architect fees are capitalized but building permit fees are not.

C)Interest is capitalized during the construction as part of the cost of the building.

D)The capitalized cost is equal to the contract price to build the plant less any interest on borrowed funds.

A)Excavation fees are capitalized but building permit fees are not.

B)Architect fees are capitalized but building permit fees are not.

C)Interest is capitalized during the construction as part of the cost of the building.

D)The capitalized cost is equal to the contract price to build the plant less any interest on borrowed funds.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

74

Interest may be included in the acquisition cost of a plant asset

A)during the construction period of a self-constructed asset.

B)if the asset is purchased on credit.

C)if the asset acquisition is financed by a long-term note payable.

D)if it is a part of a lump-sum purchase.

A)during the construction period of a self-constructed asset.

B)if the asset is purchased on credit.

C)if the asset acquisition is financed by a long-term note payable.

D)if it is a part of a lump-sum purchase.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

75

Rains Company purchased equipment on January 1 at a list price of $125,000, with credit terms 2/10, n/30.Payment was made within the discount period.Rains paid $6,250 sales tax on the equipment and paid installation charges of $2,200.Prior to installation, Rains paid $5,000 to pour a concrete slab on which to place the equipment.What is the total cost of the new equipment?

A)$131,250

B)$135,950

C)$138,450

D)$126,250

A)$131,250

B)$135,950

C)$138,450

D)$126,250

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

76

A company purchases a remote building site for computer operations.The building will be suitable for operations after some expenditures.The wiring must be replaced to computer specifications.The roof is leaky and must be replaced.All rooms must be repainted and recarpeted and there will also be some plumbing work done.Which of the following statements is true?

A)The cost of the building will not include the repainting and recarpeting costs.

B)The cost of the building will include the cost of replacing the roof.

C)The cost of the building is the purchase price of the building, while the additional expenditures are all capitalized as Building Improvements.

D)The wiring is part of the computer costs, not the building cost.

A)The cost of the building will not include the repainting and recarpeting costs.

B)The cost of the building will include the cost of replacing the roof.

C)The cost of the building is the purchase price of the building, while the additional expenditures are all capitalized as Building Improvements.

D)The wiring is part of the computer costs, not the building cost.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is included in the cost of constructing a building?

A)Cost of paving a parking lot.

B)Cost of repairing vandalism damage incurred shortly after construction is complete.

C)Interest incurred during construction.

D)Cost of removing the demolished building existing on the land when it was purchased.

A)Cost of paving a parking lot.

B)Cost of repairing vandalism damage incurred shortly after construction is complete.

C)Interest incurred during construction.

D)Cost of removing the demolished building existing on the land when it was purchased.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

78

Ryan, Inc.purchased a delivery truck with a $48,000 list price.The company was given a $4,800 cash discount by the dealer and paid $2,400 sales tax.Annual insurance on the truck is $1,200.As a result of the purchase, by how much will Ryan, Inc.increase its truck account?

A)$48,000

B)$43,200

C)$46,800

D)$45,600

A)$48,000

B)$43,200

C)$46,800

D)$45,600

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

79

Depreciation is the process of allocating the cost of a plant asset over its useful life in a(n)

A)equal and equitable manner.

B)accelerated and accurate manner.

C)systematic and rational manner.

D)conservative market-based manner.

A)equal and equitable manner.

B)accelerated and accurate manner.

C)systematic and rational manner.

D)conservative market-based manner.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck

80

Land improvements should be depreciated over the useful life of the

A)land.

B)buildings on the land.

C)land or land improvements, whichever is longer.

D)land improvements.

A)land.

B)buildings on the land.

C)land or land improvements, whichever is longer.

D)land improvements.

Unlock Deck

Unlock for access to all 219 flashcards in this deck.

Unlock Deck

k this deck