Deck 2: A Further Look at Financial Statements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/129

Play

Full screen (f)

Deck 2: A Further Look at Financial Statements

1

Calculating financial ratios can give clues to underlying conditions that may not be noticed by examining each financial statement item separately.

True

2

The statement of financial position is normally presented as follows, when listed in order of liquidity: Current assets, current liabilities, non-current assets, non-current liabilities, and shareholders' equity.

False

3

The price-earnings ratio is a measure of liquidity.

False

4

From a creditor's point of view, the higher the total debt to total assets ratio, the lower the risk that the company may be unable to pay its obligations.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

5

Profitability means having enough funds on hand to pay debts when they are due.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

6

Listing assets and liabilities in reverse order of liquidity is not permitted in Canada.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

7

Long-term investments appear in the property, plant, and equipment section of the statement of financial position.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

8

A liability is normally classified as a current liability if it is to be paid within the coming year.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

9

The main difference between intangible assets and property, plant, and equipment is the length of the asset's life.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

10

Intracompany comparisons are based on comparisons with competitors in the same industry.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

11

The debt to total assets ratio measures the percentage of assets financed by creditors rather than shareholders.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

12

A single ratio by itself is not very meaningful.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

13

Liquidity ratios are concerned with the frequency and amounts of dividend payments.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

14

Analysis of financial statements is enhanced with the use of comparative data.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

15

The investment classification on the statement of financial position normally includes investments that are intended to be held for a short period of time (less than one year).

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

16

Special rights and privileges that provide a future economic benefit to the company are classified as intangible assets.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

17

The most liquid resource is inventory.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

18

Solvency ratios measure the short-term ability of the company to pay its maturing obligations.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

19

Mortgages and pension liabilities are examples of non-current liabilities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

20

Solvency ratios measure the entity's ability to survive over a long period.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

21

Comparability in accounting means that a company uses the same generally accepted accounting principles from one accounting period to the next.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

22

Companies using Accounting Standards for Private Enterprises (ASPE) are not required to present basic earnings per share information in their financial statements.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

23

Under the going concern assumption, reporting assets, such as land, at their cost may be more appropriate than reporting land at its fair value.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

24

A conceptual framework is still under development for companies using International Financial Reporting Standards (IFRS).

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

25

In order for information to be relevant, it must be reported on a timely basis.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

26

The higher the price-earnings ratio, the higher are investors' expectations of the company's future profitability.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

27

The cost basis of accounting states that assets and liabilities should be recorded at their cost not only when originally acquired, but also during the time the entity holds them.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

28

Enhancing qualitative characteristics include timeliness and comparability.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

29

Consistency aids comparability when a company uses the same accounting principles and methods from year to year or when companies with similar circumstances use the same accounting principles.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

30

Qualitative characteristics help ensure that the information provided in financial statements is useful.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

31

Comparability and understandability are examples of enhancing qualitative characteristics.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

32

The conceptual framework is fundamentally similar for both Canadian publicly traded companies and Canadian private companies.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

33

Two measurement principles are historical cost and current value.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

34

Elements of financial statements include assets, equity, and expenses, but not liabilities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

35

Materiality and relevance are both defined in terms of what influences or makes a difference to a decision maker.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

36

In general, standard setters require that most assets be recorded using historical cost because cost is representationally faithful.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

37

Faithful representation means that accounting information must be complete, neutral, and free from error.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

38

Using a simplified version of Canadian GAAP for small companies in order to reduce the cost of providing financial information is an example of the application of materiality.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

39

Information has verifiability if the information is comparable.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

40

Financial reporting does not have to present the economic substance of a transaction in order to provide a faithful representation of what really happened.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

41

All property, plant and equipment

(a)have estimated useful lives over which they are expected to generate revenue.

(b)are depreciated over their estimated useful lives.

(c)with finite lives, including land, are depreciated.

(d)contribute to the generation of revenue.

(a)have estimated useful lives over which they are expected to generate revenue.

(b)are depreciated over their estimated useful lives.

(c)with finite lives, including land, are depreciated.

(d)contribute to the generation of revenue.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

42

The difference between cost and accumulated depreciation is referred to as

(a)net depreciation.

(b)carrying amount.

(c)fair value.

(d)cost value.

(a)net depreciation.

(b)carrying amount.

(c)fair value.

(d)cost value.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

43

An intangible asset

(a)derives its value from the rights and privileges it provides the company.

(b)is worthless because it has no physical substance.

(c)is converted into a tangible asset during the year.

(d)cannot be classified on the statement of financial position because it lacks physical substance.

(a)derives its value from the rights and privileges it provides the company.

(b)is worthless because it has no physical substance.

(c)is converted into a tangible asset during the year.

(d)cannot be classified on the statement of financial position because it lacks physical substance.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

44

On a statement of financial position

(a)Cash and Office Supplies are both classified as current assets.

(b)Inventories and Prepaid Expenses are classified as long-term investments.

(c)Land and Buildings are classified as long-term investments.

(d)Depreciation Expense is classified as property, plant and equipment.

(a)Cash and Office Supplies are both classified as current assets.

(b)Inventories and Prepaid Expenses are classified as long-term investments.

(c)Land and Buildings are classified as long-term investments.

(d)Depreciation Expense is classified as property, plant and equipment.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

45

Office equipment is classified on the statement of financial position as

(a)a current asset.

(b)property, plant, and equipment.

(c)shareholders' equity.

(d)a long-term investment.

(a)a current asset.

(b)property, plant, and equipment.

(c)shareholders' equity.

(d)a long-term investment.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is not normally a current liability?

(a)salaries payable

(b)accounts payable

(c)income tax payable

(d)bonds payable

(a)salaries payable

(b)accounts payable

(c)income tax payable

(d)bonds payable

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

47

Long-lived assets without physical substance are

(a)listed directly under current assets on the statement of financial position.

(b)not listed on the statement of financial position because they do not have physical substance.

(c)are listed as intangible assets on the statement of financial position.

(d)listed as a long-term investment on the statement of financial position.

(a)listed directly under current assets on the statement of financial position.

(b)not listed on the statement of financial position because they do not have physical substance.

(c)are listed as intangible assets on the statement of financial position.

(d)listed as a long-term investment on the statement of financial position.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

48

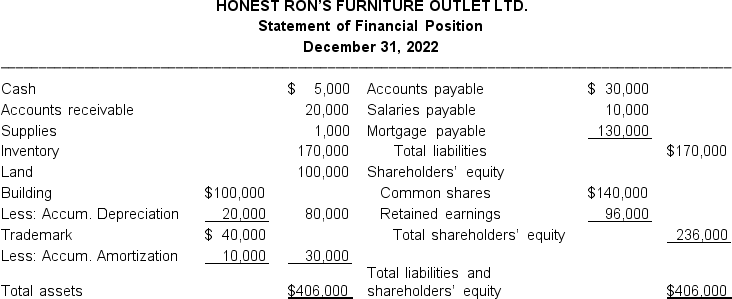

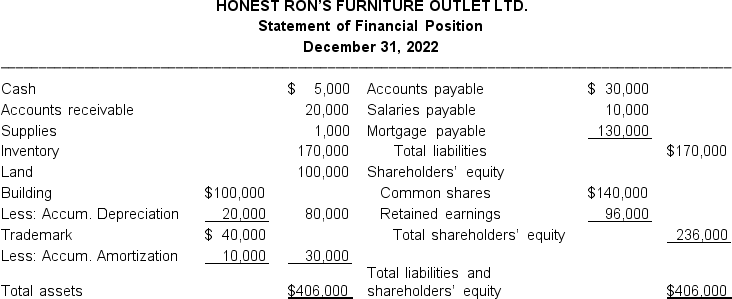

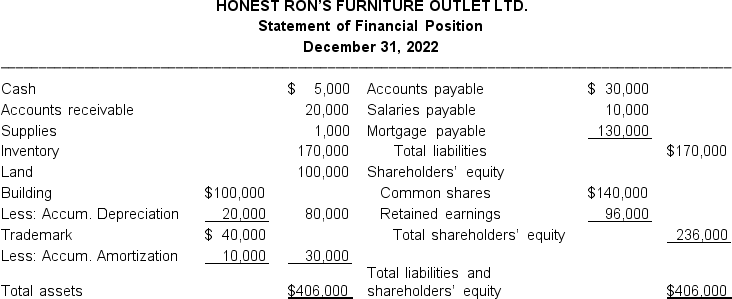

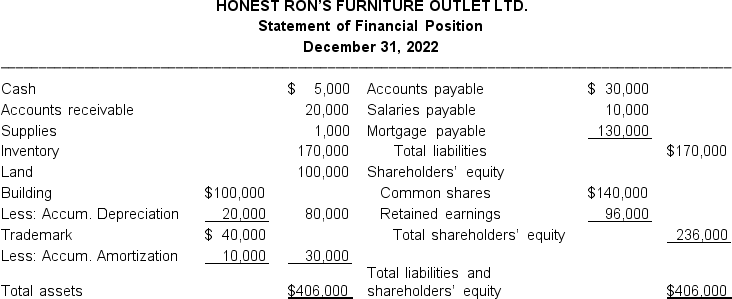

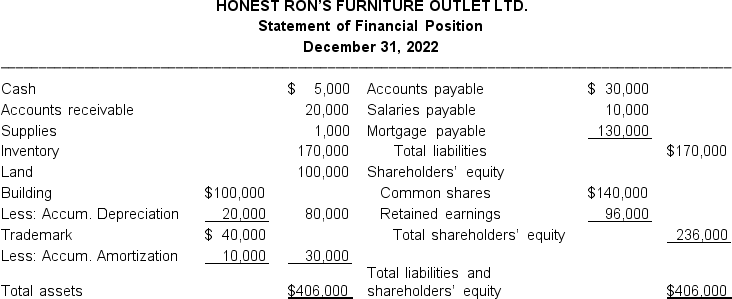

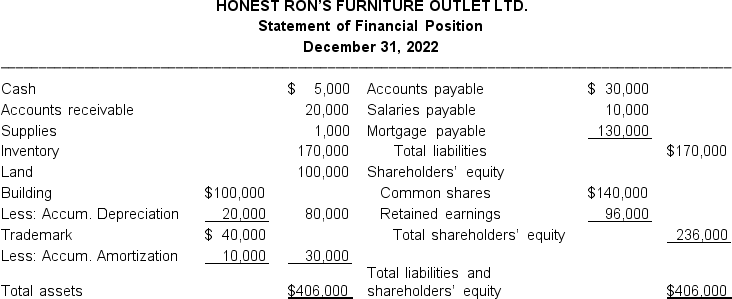

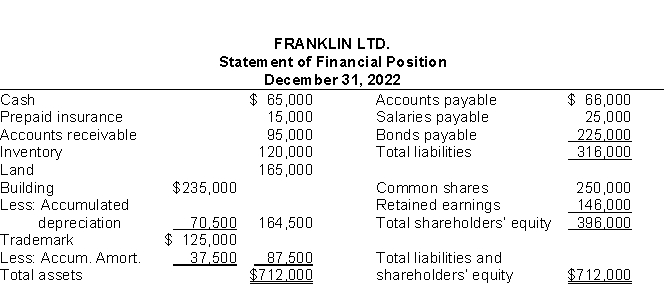

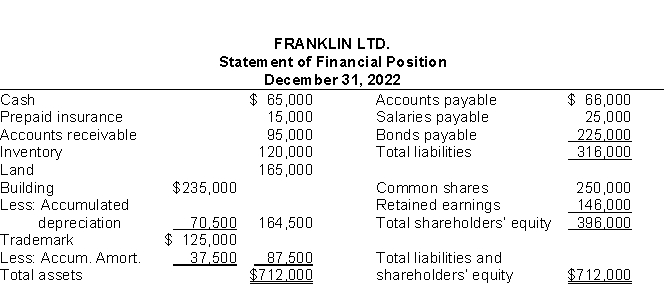

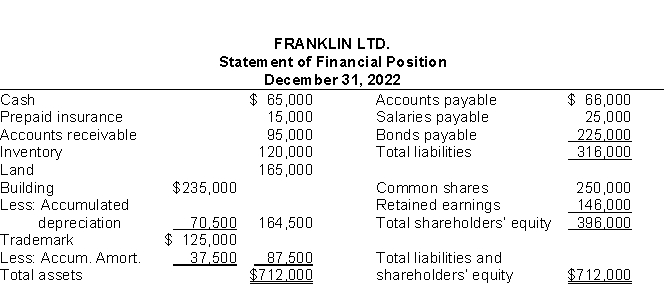

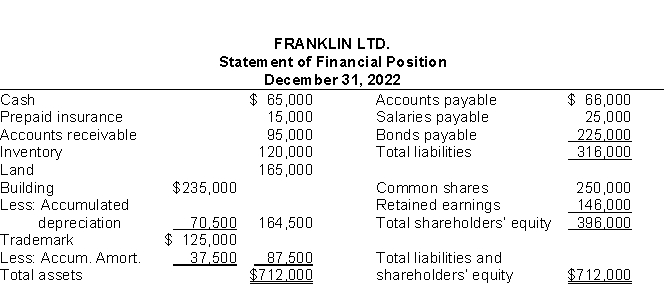

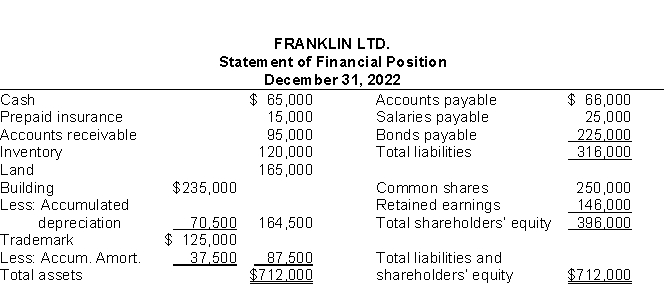

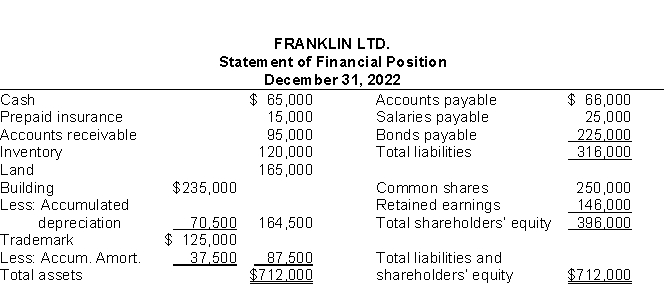

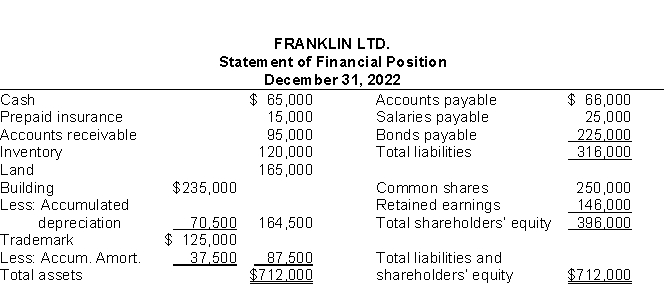

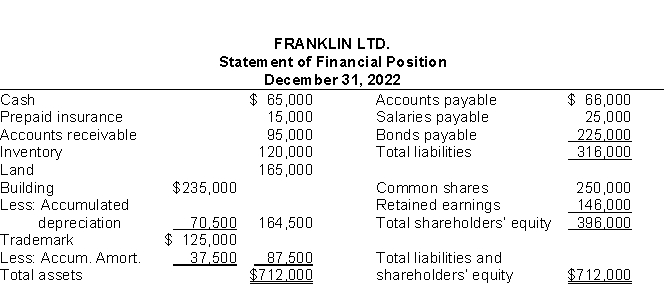

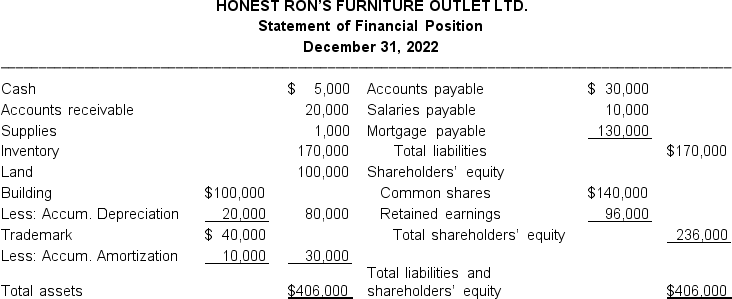

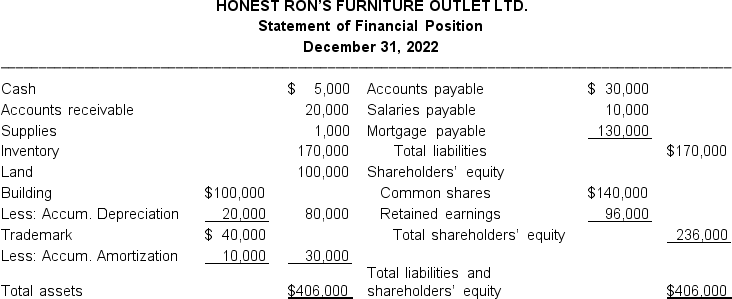

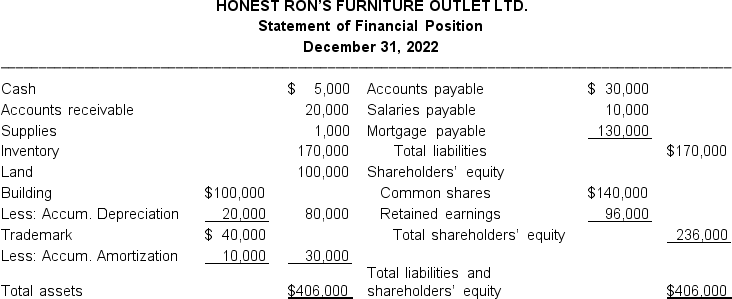

Use the following information to answer questions

The dollar amount of current liabilities is

(a)$196,000.

(b)$170,000.

(c)$ 40,000.

(d)$ 30,000.

The dollar amount of current liabilities is

(a)$196,000.

(b)$170,000.

(c)$ 40,000.

(d)$ 30,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

49

Use the following information to answer questions

The dollar amount of current assets is

(a)$ 26,000.

(b)$ 40,000.

(c)$ 25,000.

(d)$196,000.

The dollar amount of current assets is

(a)$ 26,000.

(b)$ 40,000.

(c)$ 25,000.

(d)$196,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

50

Liabilities are generally classified on a statement of financial position as

(a)small liabilities and large liabilities.

(b)present liabilities and future liabilities.

(c)tangible liabilities and intangible liabilities.

(d)current liabilities and non-current liabilities.

(a)small liabilities and large liabilities.

(b)present liabilities and future liabilities.

(c)tangible liabilities and intangible liabilities.

(d)current liabilities and non-current liabilities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

51

Trademarks would appear in which section of the statement of financial position?

(a)Shareholders' equity

(b)Investments

(c)Intangible assets

(d)Current assets

(a)Shareholders' equity

(b)Investments

(c)Intangible assets

(d)Current assets

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is not considered to be an asset?

(a)equipment

(b)dividends declared

(c)accounts receivable

(d)inventory

(a)equipment

(b)dividends declared

(c)accounts receivable

(d)inventory

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

53

Shareholders' equity

(a)is divided into at least two parts: share capital and retained earnings.

(b)consists of two parts: common and preferred shares.

(c)reflects two parts: dividends declared and share capital.

(d)reflects retained earnings only.

(a)is divided into at least two parts: share capital and retained earnings.

(b)consists of two parts: common and preferred shares.

(c)reflects two parts: dividends declared and share capital.

(d)reflects retained earnings only.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

54

Current liabilities are expected to be

(a)converted to cash within one year.

(b)paid within one year.

(c)used in the business within one year.

(d)acquired within one year.

(a)converted to cash within one year.

(b)paid within one year.

(c)used in the business within one year.

(d)acquired within one year.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

55

Use the following information to answer questions

The dollar amount of net property, plant and equipment is

(a)$ 80,000.

(b)$180,000.

(c)$210,000.

(d)$350,000.

The dollar amount of net property, plant and equipment is

(a)$ 80,000.

(b)$180,000.

(c)$210,000.

(d)$350,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is not classified as a current asset?

(a)supplies

(b)trading investments

(c)a fund to be used to purchase a building within the next year

(d)equipment with an estimated useful life of five years

(a)supplies

(b)trading investments

(c)a fund to be used to purchase a building within the next year

(d)equipment with an estimated useful life of five years

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following would not normally be classified as a non-current liability?

(a)current portion of non-current debt

(b)bonds payable

(c)mortgage payable

(d)lease liabilities

(a)current portion of non-current debt

(b)bonds payable

(c)mortgage payable

(d)lease liabilities

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

58

On a classified statement of financial position, current assets are often listed

(a)in alphabetical order.

(b)with the largest dollar amounts first.

(c)in the order in which they are expected to be converted into cash.

(d)in the order of acquisition.

(a)in alphabetical order.

(b)with the largest dollar amounts first.

(c)in the order in which they are expected to be converted into cash.

(d)in the order of acquisition.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

59

On a classified statement of financial position, prepaid expenses are classified as

(a)a current liability.

(b)property, plant, and equipment.

(c)a current asset.

(d)a long-term investment.

(a)a current liability.

(b)property, plant, and equipment.

(c)a current asset.

(d)a long-term investment.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

60

A current asset is

(a)the last asset purchased by a business.

(b)an asset that is not currently being used to produce a product or service.

(c)usually found as a separate classification in the statement of income.

(d)expected to be converted to cash or used in the business within a relatively short period of time.

(a)the last asset purchased by a business.

(b)an asset that is not currently being used to produce a product or service.

(c)usually found as a separate classification in the statement of income.

(d)expected to be converted to cash or used in the business within a relatively short period of time.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

61

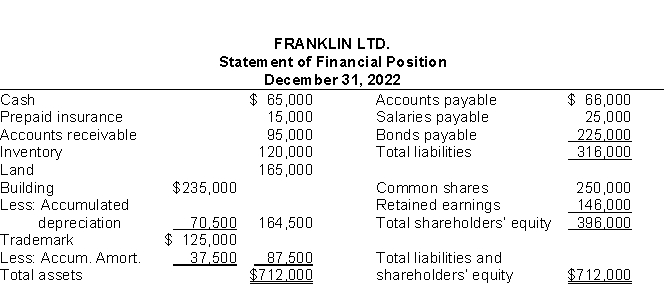

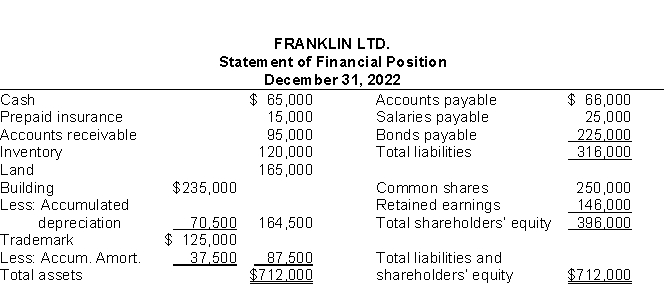

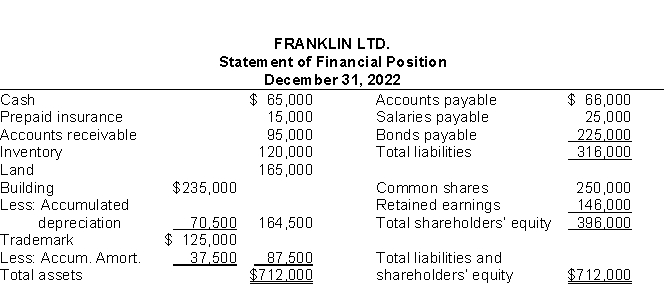

Use the following information to answer questions

The total dollar amount of assets to be classified as investments is

(a)$ 0.

(b)$ 165,000.

(c)$ 525,000.

(d)$400,000.

The total dollar amount of assets to be classified as investments is

(a)$ 0.

(b)$ 165,000.

(c)$ 525,000.

(d)$400,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

62

Use the following information to answer questions

Net income retained for use in the business is

(a)$712,000.

(b)$396,000.

(c)$316,000.

(d)$146,000.

Net income retained for use in the business is

(a)$712,000.

(b)$396,000.

(c)$316,000.

(d)$146,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

63

Basic earnings per share

(a)is calculated by dividing income available to common shareholders for the period by the dollar value in the common shares account.

(b)is the only ratio that must be presented in the financial statements for publicly traded companies.

(c)is frequently compared across companies in the same industry.

(d)is the only ratio that must be presented in the financial statements for both publicly traded companies and privately held companies.

(a)is calculated by dividing income available to common shareholders for the period by the dollar value in the common shares account.

(b)is the only ratio that must be presented in the financial statements for publicly traded companies.

(c)is frequently compared across companies in the same industry.

(d)is the only ratio that must be presented in the financial statements for both publicly traded companies and privately held companies.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

64

Use the following information to answer questions

The total dollar amount of assets to be classified as net property, plant, and equipment is

(a)$329,500.

(b)$164,500.

(c)$252,000.

(d)$235,000.

The total dollar amount of assets to be classified as net property, plant, and equipment is

(a)$329,500.

(b)$164,500.

(c)$252,000.

(d)$235,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

65

The current ratio

(a)is calculated by dividing total assets by total liabilities.

(b)takes into account the composition of current assets.

(c)takes into account the composition of current assets and current liabilities.

(d)is calculated by dividing current assets by current liabilities.

(a)is calculated by dividing total assets by total liabilities.

(b)takes into account the composition of current assets.

(c)takes into account the composition of current assets and current liabilities.

(d)is calculated by dividing current assets by current liabilities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

66

Use the following information to answer questions

Non-current liabilities total

(a)$712,000.

(b)$316,000.

(c)$225,000.

(d)$ 25,000.

Non-current liabilities total

(a)$712,000.

(b)$316,000.

(c)$225,000.

(d)$ 25,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

67

The relationship between current assets and current liabilities is important in evaluating a company's

(a)profitability.

(b)liquidity.

(c)fair value.

(d)solvency.

(a)profitability.

(b)liquidity.

(c)fair value.

(d)solvency.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

68

The price-earnings ratio is calculated by dividing

(a)the market price per share by basic earnings per share.

(b)basic earnings per share by the average number of shares.

(c)net income by the market price per share.

(d)basic earnings per share by the market price per share.

(a)the market price per share by basic earnings per share.

(b)basic earnings per share by the average number of shares.

(c)net income by the market price per share.

(d)basic earnings per share by the market price per share.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

69

Use the following information to answer questions

The total amount in the contra asset accounts is

(a)$ 37,500.

(b)$ 108,000.

(c)$70,500.

(d)$252,000.

The total amount in the contra asset accounts is

(a)$ 37,500.

(b)$ 108,000.

(c)$70,500.

(d)$252,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

70

Use the following information to answer questions

The dollar amount of share capital is

(a)$406,000.

(b)$236,000.

(c)$140,000.

(d)$ 96,000.

The dollar amount of share capital is

(a)$406,000.

(b)$236,000.

(c)$140,000.

(d)$ 96,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

71

The groupings on a classified statement of financial position,

(a)help readers of the financial statements determine whether the company has enough liabilities or debts to pay for its assets.

(b)help readers of the financial statements determine the claims of short-term and long-term creditors on the company`s total assets.

(c)help readers of the financial statements determine the claims of long-term creditors only on the company`s total assets.

(d)are for format purposes only.

(a)help readers of the financial statements determine whether the company has enough liabilities or debts to pay for its assets.

(b)help readers of the financial statements determine the claims of short-term and long-term creditors on the company`s total assets.

(c)help readers of the financial statements determine the claims of long-term creditors only on the company`s total assets.

(d)are for format purposes only.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

72

Use the following information to answer questions

The total dollar amount of assets to be classified as current assets is

(a)$295,000.

(b)$235,000.

(c)$175,000.

(d)$160,000.

The total dollar amount of assets to be classified as current assets is

(a)$295,000.

(b)$235,000.

(c)$175,000.

(d)$160,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

73

Working capital is

(a)the difference between total assets and current liabilities.

(b)the excess of current assets over current liabilities.

(c)the difference between current assets and total liabilities.

(d)the excess of total assets over total liabilities.

(a)the difference between total assets and current liabilities.

(b)the excess of current assets over current liabilities.

(c)the difference between current assets and total liabilities.

(d)the excess of total assets over total liabilities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following statements is true?

(a)A current ratio of 1.2 to 1 indicates that a company's current assets are less than its current liabilities.

(b)All companies, regardless of size, should have a current ratio of at least 2:1.

(c)The current ratio is a more dependable indicator of liquidity than working capital.

(d)The use of the current ratio does not make it possible to compare companies of different sizes.

(a)A current ratio of 1.2 to 1 indicates that a company's current assets are less than its current liabilities.

(b)All companies, regardless of size, should have a current ratio of at least 2:1.

(c)The current ratio is a more dependable indicator of liquidity than working capital.

(d)The use of the current ratio does not make it possible to compare companies of different sizes.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

75

Use the following information to answer questions

The total obligations that have resulted from past transactions are

(a)$ 20,000.

(b)$ 40,000.

(c)$ 96,000.

(d)$170,000.

The total obligations that have resulted from past transactions are

(a)$ 20,000.

(b)$ 40,000.

(c)$ 96,000.

(d)$170,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

76

Basic earnings per share is calculated by dividing

(a)revenue by weighted average shareholders' equity.

(b)revenue by the weighted average number of common shares.

(c)income available to common shareholders by weighted average shareholders' equity.

(d)income available to common shareholders by the weighted average number of common shares.

(a)revenue by weighted average shareholders' equity.

(b)revenue by the weighted average number of common shares.

(c)income available to common shareholders by weighted average shareholders' equity.

(d)income available to common shareholders by the weighted average number of common shares.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

77

A short-term creditor is primarily interested in the ___ of the borrower.

(a)liquidity

(b)profitability

(c)comparability

(d)solvency

(a)liquidity

(b)profitability

(c)comparability

(d)solvency

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

78

A measure of profitability is the

(a)current ratio.

(b)debt to total assets ratio.

(c)basic earnings per share.

(d)working capital.

(a)current ratio.

(b)debt to total assets ratio.

(c)basic earnings per share.

(d)working capital.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

79

What is the difference between intracompany and intercompany comparisons?

(a)Intracompany comparisons are based on comparisons with a competitor in the same industry, while intercompany comparisons cover two or more periods for the same company.

(b)Intercompany comparisons cover two or more periods for the same company, while intracompany comparisons are based on comparisons to average ratios for the industry that a company operates in.

(c)Intracompany comparisons are based on comparisons to average ratios for the industry that a company operates in, while intercompany comparisons are based on comparisons with a competitor in the same industry.

(d)Intercompany comparisons are based on comparisons with a competitor in the same industry, while intracompany comparisons cover two or more periods for the same company.

(a)Intracompany comparisons are based on comparisons with a competitor in the same industry, while intercompany comparisons cover two or more periods for the same company.

(b)Intercompany comparisons cover two or more periods for the same company, while intracompany comparisons are based on comparisons to average ratios for the industry that a company operates in.

(c)Intracompany comparisons are based on comparisons to average ratios for the industry that a company operates in, while intercompany comparisons are based on comparisons with a competitor in the same industry.

(d)Intercompany comparisons are based on comparisons with a competitor in the same industry, while intracompany comparisons cover two or more periods for the same company.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

80

The most important information needed to determine if a company can pay its current obligations is the

(a)net income for this year.

(b)projected net income for next year.

(c)relationship between current assets and current liabilities.

(d)relationship between current and non-current liabilities.

(a)net income for this year.

(b)projected net income for next year.

(c)relationship between current assets and current liabilities.

(d)relationship between current and non-current liabilities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck