Deck 14: Capital Investment Decisions: the Impact of Capital Rationing, Taxation, Inflation and Risk

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/25

Play

Full screen (f)

Deck 14: Capital Investment Decisions: the Impact of Capital Rationing, Taxation, Inflation and Risk

1

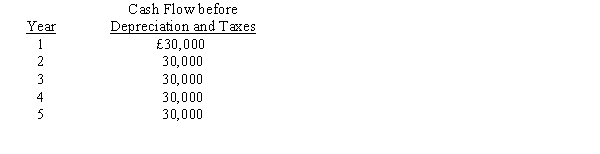

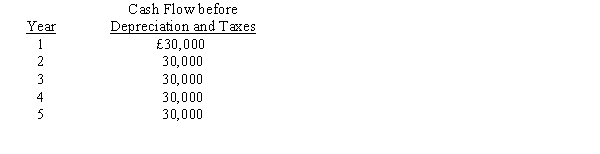

Houston Ltd.is considering an investment in equipment for £45,000. Data related to the investment are as follows:  Cost of capital is 18 per cent. Houston claims capital allowances (WDV's) using the straight-line method of depreciation. In addition, their tax rate is 40 per cent, and the life of the equipment is five years with no salvage value.

Cost of capital is 18 per cent. Houston claims capital allowances (WDV's) using the straight-line method of depreciation. In addition, their tax rate is 40 per cent, and the life of the equipment is five years with no salvage value.

What is the net present value of the investment?

A) £67,543

B) £22,543

C) £48,810

D) £11,286

Cost of capital is 18 per cent. Houston claims capital allowances (WDV's) using the straight-line method of depreciation. In addition, their tax rate is 40 per cent, and the life of the equipment is five years with no salvage value.

Cost of capital is 18 per cent. Houston claims capital allowances (WDV's) using the straight-line method of depreciation. In addition, their tax rate is 40 per cent, and the life of the equipment is five years with no salvage value.What is the net present value of the investment?

A) £67,543

B) £22,543

C) £48,810

D) £11,286

B

2

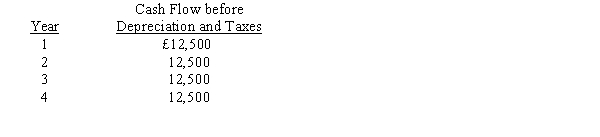

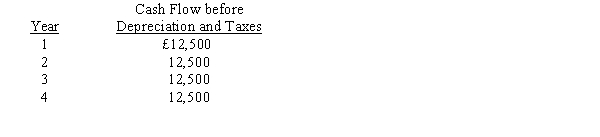

Jolly Ltd.is considering an investment in equipment for £25,000. Data related to the investment are as follows:  Jolly claims capital allowances using the straight-line method of depreciation. In addition, its tax rate is 40 per cent, and the life of the equipment is four years with no salvage value. Cost of capital is 12 per cent. What is the net present value of the investment?

Jolly claims capital allowances using the straight-line method of depreciation. In addition, its tax rate is 40 per cent, and the life of the equipment is four years with no salvage value. Cost of capital is 12 per cent. What is the net present value of the investment?

A) £30,370

B) £(2,222)

C) £12,962

D) £5,370

Jolly claims capital allowances using the straight-line method of depreciation. In addition, its tax rate is 40 per cent, and the life of the equipment is four years with no salvage value. Cost of capital is 12 per cent. What is the net present value of the investment?

Jolly claims capital allowances using the straight-line method of depreciation. In addition, its tax rate is 40 per cent, and the life of the equipment is four years with no salvage value. Cost of capital is 12 per cent. What is the net present value of the investment?A) £30,370

B) £(2,222)

C) £12,962

D) £5,370

D

3

Which of the following is included in calculating the weighted average cost of capital?

A) interest rate paid on borrowed money

B) average return earned by stockholders

C) taxes

D) all of the above

A) interest rate paid on borrowed money

B) average return earned by stockholders

C) taxes

D) all of the above

D

4

If an asset is sold for less than its tax written down value,

A) a gain results and additional taxes are incurred.

B) a gain and tax savings result.

C) a loss results and additional taxes are incurred.

D) a loss and tax savings result.

A) a gain results and additional taxes are incurred.

B) a gain and tax savings result.

C) a loss results and additional taxes are incurred.

D) a loss and tax savings result.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

5

If an asset is sold for more than its tax written down value,

A) a gain results and additional taxes are incurred.

B) a gain and tax savings result.

C) a loss results and additional taxes are incurred.

D) a loss and tax savings result.

A) a gain results and additional taxes are incurred.

B) a gain and tax savings result.

C) a loss results and additional taxes are incurred.

D) a loss and tax savings result.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

6

If the tax rate is 40 per cent and a company has pre-tax cash inflows from operations of £600,000, the company's after-tax net cash inflow from operations would be

A) £396,000.

B) £360,000.

C) £240,000.

D) £204,000.

A) £396,000.

B) £360,000.

C) £240,000.

D) £204,000.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

7

Young Company has a tax rate of 40 per cent. Information for the company is as follows:  What is the weighted cost of capital?

What is the weighted cost of capital?

A) 0.1098

B) 0.2480

C) 0.0827

D) 0.0366

What is the weighted cost of capital?

What is the weighted cost of capital?A) 0.1098

B) 0.2480

C) 0.0827

D) 0.0366

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is a common adjustment to net present value models to incorporate risks inherent in an investment project?

A) The discount rate used in the analysis can be increased.

B) The payback period can be increased.

C) A lower discount rate can be used.

D) Risk is never considered in a model since it can not be quantified.

A) The discount rate used in the analysis can be increased.

B) The payback period can be increased.

C) A lower discount rate can be used.

D) Risk is never considered in a model since it can not be quantified.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

9

A follow-up analysis of an investment decision is called a(n)

A) performance review.

B) feedback session.

C) audit.

D) postaudit.

A) performance review.

B) feedback session.

C) audit.

D) postaudit.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is least likely to affect taxes as a result of a capital budgeting decision?

A) an increase in operating income

B) the disposition of an old asset that is fully depreciated and worthless

C) salvage value of a new asset

D) depreciation of a new asset

A) an increase in operating income

B) the disposition of an old asset that is fully depreciated and worthless

C) salvage value of a new asset

D) depreciation of a new asset

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

11

A firm has £1,000,000 of long-term bonds paying 8 per cent interest and £3,000,000 of common stock. The firm is considered to be of average risk with the return to the stockholders estimated to be 12 per cent. If the company's tax rate is 35 per cent, what is the firm's weighted average cost of capital?

A) 11.00%

B) 7.15%

C) 10.30%

D) none of the above

A) 11.00%

B) 7.15%

C) 10.30%

D) none of the above

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

12

____ is the process of altering key variables to assess the effect on the original outcome.

A) Alteration analysis

B) Experimentation

C) Net present value

D) Sensitivity analysis

A) Alteration analysis

B) Experimentation

C) Net present value

D) Sensitivity analysis

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

13

Tax savings from tax allowable depreciation (i.e. writing down allowances) is calculated as

A) Depreciation deduction * Tax rate.

B) Depreciation deduction * (1 - Tax rate).

C) Asset cost * MACRS percentage.

D) Depreciation is not a cash flow; therefore, there is no tax savings from depreciation.

A) Depreciation deduction * Tax rate.

B) Depreciation deduction * (1 - Tax rate).

C) Asset cost * MACRS percentage.

D) Depreciation is not a cash flow; therefore, there is no tax savings from depreciation.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

14

A firm has £2,000,000 of long-term bonds paying 8 per cent interest and £8,000,000 of common stock. The firm is considered to be of average risk with the return to the stockholders estimated to be 14 per cent. If the company's tax rate is 40 per cent, what is the firm's weighted average cost of capital?

A) 12.80%

B) 12.16%

C) 8.32%

D) none of the above

A) 12.80%

B) 12.16%

C) 8.32%

D) none of the above

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

15

The depreciation tax shield is:

A) the increase in taxes due to the deductibility of depreciation from taxable revenues.

B) the reduction in taxes due to the deductibility of depreciation from taxable revenues.

C) the fact that equipment is not depreciable for accounting purposes.

D) the fact that equipment is not depreciable for tax purposes.

A) the increase in taxes due to the deductibility of depreciation from taxable revenues.

B) the reduction in taxes due to the deductibility of depreciation from taxable revenues.

C) the fact that equipment is not depreciable for accounting purposes.

D) the fact that equipment is not depreciable for tax purposes.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

16

The annual tax deduction for depreciation:

A) is not accompanied by a direct cash outlay.

B) provides an indirect cash inflow by reducing taxes.

C) multiplied by the tax rate equals the depreciation tax shield (i.e. the tax benefit from capital allowances.

D) all of the above

A) is not accompanied by a direct cash outlay.

B) provides an indirect cash inflow by reducing taxes.

C) multiplied by the tax rate equals the depreciation tax shield (i.e. the tax benefit from capital allowances.

D) all of the above

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

17

Clemens Company is considering the purchase of a new machine for £160,000. The machine would generate an annual cash flow before depreciation and taxes of £62,588 for four years. At the end of four years, the machine would have no salvage value. The company's cost of capital is 12 per cent. The company claims capital allowances using straight-line depreciation and has a 40 per cent tax rate. What is the net present value for the machine?

A) £162,640

B) £2,640

C) £30,080

D) (£45,952)

A) £162,640

B) £2,640

C) £30,080

D) (£45,952)

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

18

A company has pre-tax cash inflows from operations of £500,000. If the company's tax rate is 35 per cent, the company's after-tax net cash inflow from operations would be

A) £166,667.

B) £175,000.

C) £325,000.

D) £333,333.

A) £166,667.

B) £175,000.

C) £325,000.

D) £333,333.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

19

Springer Company is considering the purchase of a new machine for £80,000. The machine would generate an annual cash flow before depreciation and taxes of £28,778 for five years. At the end of five years, the machine would have no salvage value. The company's cost of capital is 12 per cent. The company claims capital allowances based on straight-line depreciation and has a 40 per cent tax rate. What is the net present value for the machine?

A) £5,318

B) £-0-

C) £85,318

D) £23,744

A) £5,318

B) £-0-

C) £85,318

D) £23,744

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

20

If the tax rate is 35 per cent, a tax depreciation deduction (WDA)of £75,000 would result in a tax savings of

A) £25,000.

B) £26,250.

C) £48,750.

D) £50,000.

A) £25,000.

B) £26,250.

C) £48,750.

D) £50,000.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

21

A postaudit compares

A) estimated benefits and costs with budgeted benefits and cost.

B) estimated benefits with estimated costs.

C) actual benefits with actual costs.

D) actual benefits and costs with estimated benefits and costs.

A) estimated benefits and costs with budgeted benefits and cost.

B) estimated benefits with estimated costs.

C) actual benefits with actual costs.

D) actual benefits and costs with estimated benefits and costs.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

22

What are some of the types of sources of risk that a typical capital expenditures project can entail?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

23

Ramsey Construction is considering the purchase of a backhoe for £300,000. The expected life is 4 years. The company uses the straight-line method of depreciation with no mid-year convention. The company's tax rate is 34 per cent. The present value factors at the company's cost of capital are as follows:  Required:

Required:

Determine the present value of the tax shield (i.e. tax benefits) assuming that capital allowances are based on the straight-line method. Present your answer in good format.

Required:

Required:Determine the present value of the tax shield (i.e. tax benefits) assuming that capital allowances are based on the straight-line method. Present your answer in good format.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

24

Redding Industries is considering the acquisition of a new machine that would reduce operating costs by £100,000 per year throughout its life. The machine has a cost of £300,000 and has an expected salvage value of £25,000 at the end of 4 years. The tax shield (i.e. tax savings) from capital allowances is £34,000; £45,344; £15,111; and £7,555 for Years 1-4, respectively. The company is at the 34 per cent tax rate. The present value factors at the company's required rate of return are as follows:  Required:

Required:

(Round all calculations to the nearest pound.)

a.

Compute the after-tax operating cost savings per year.

b.

Determine the tax cost or tax savings related to the sale of the machine at the end of its useful life.

c.

Prepare a schedule computing the net present value of Redding Industries' investment in the machine.

Required:

Required:(Round all calculations to the nearest pound.)

a.

Compute the after-tax operating cost savings per year.

b.

Determine the tax cost or tax savings related to the sale of the machine at the end of its useful life.

c.

Prepare a schedule computing the net present value of Redding Industries' investment in the machine.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

25

Why should a company conduct postaudits of its investment projects?

A) It ensures that investment resources were used wisely.

B) Accountable managers would make goal-congruent decisions.

C) It provides feedback for future decision making.

D) all of the above

A) It ensures that investment resources were used wisely.

B) Accountable managers would make goal-congruent decisions.

C) It provides feedback for future decision making.

D) all of the above

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck