Deck 18: Corporations: Organizations and Stock

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/124

Play

Full screen (f)

Deck 18: Corporations: Organizations and Stock

1

A board of directors:

A) are officers elected by the government to represent the company.

B) establish policies for the company.

C) may not include stockholders in the corporation.

D) All of the above are correct.

A) are officers elected by the government to represent the company.

B) establish policies for the company.

C) may not include stockholders in the corporation.

D) All of the above are correct.

B

2

Paid-in capital represents:

A) the cumulative earnings of the company.

B) the investments of the owners into the company.

C) the undistributed earnings of the company.

D) None of the above

A) the cumulative earnings of the company.

B) the investments of the owners into the company.

C) the undistributed earnings of the company.

D) None of the above

B

3

The corporation's charter and the articles of incorporation are available for the public to view.

True

4

Which of the following is a characteristic of a corporation?

A) Ease of raising capital

B) No mutual agency

C) Unlimited life

D) All of the above are correct.

A) Ease of raising capital

B) No mutual agency

C) Unlimited life

D) All of the above are correct.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

5

Stockholders cannot sell or transfer their stock.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

6

Articles of incorporation contain all of the following except:

A) the purpose of the business.

B) the types of stock to be offered.

C) the name of the president.

D) organizational structure.

A) the purpose of the business.

B) the types of stock to be offered.

C) the name of the president.

D) organizational structure.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

7

When the shares of stock are sold by the stockholder, the sale has an effect on the company's assets and liabilities.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

8

An advantage of a corporation would be:

A) limited liability for the shareholders.

B) limited life.

C) double taxation (income of corporation and dividends to shareholders).

D) both A and B are correct.

A) limited liability for the shareholders.

B) limited life.

C) double taxation (income of corporation and dividends to shareholders).

D) both A and B are correct.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

9

Characteristics of a corporation include:

A) stockholders having limited liability.

B) direct management by the stockholders.

C) mutual agency.

D) Both A and C are correct.

A) stockholders having limited liability.

B) direct management by the stockholders.

C) mutual agency.

D) Both A and C are correct.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

10

The maximum number of shares of capital stock that a corporation can sell is known as:

A) issued capital stock.

B) outstanding capital stock.

C) authorized capital stock.

D) treasury capital stock.

A) issued capital stock.

B) outstanding capital stock.

C) authorized capital stock.

D) treasury capital stock.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

11

The stockholders of a corporation have mutual agency.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

12

The financial loss that each stockholder in a corporation can incur is limited.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

13

With a limited liability corporation, stockholders:

A) are relieved from personal liability for obligations of the corporation.

B) can only lose their investment amount in the business.

C) are personally liable for the obligations of the corporation.

D) Both A and B are correct.

A) are relieved from personal liability for obligations of the corporation.

B) can only lose their investment amount in the business.

C) are personally liable for the obligations of the corporation.

D) Both A and B are correct.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

14

Stockholders:

A) own stock in the corporation.

B) are officers elected to represent the company.

C) establish policies for the company.

D) are a government agency.

A) own stock in the corporation.

B) are officers elected to represent the company.

C) establish policies for the company.

D) are a government agency.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

15

Double taxation is a disadvantage of a corporation.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

16

The document granted by the state authorizing the creation of a corporation is known as:

A) the articles of incorporation.

B) the certificate of achievement.

C) the certificate of incorporation.

D) the minutes book.

A) the articles of incorporation.

B) the certificate of achievement.

C) the certificate of incorporation.

D) the minutes book.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

17

An advantage of a corporation is ease of raising capital.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

18

A major disadvantage of a corporation is the:

A) difficulty in transferring ownership.

B) limited life.

C) difficulty in raising capital.

D) double taxation of income to the corporation and of dividends paid to shareholders.

A) difficulty in transferring ownership.

B) limited life.

C) difficulty in raising capital.

D) double taxation of income to the corporation and of dividends paid to shareholders.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

19

List and discuss the (a) advantages and (b) disadvantages of the corporation form of business.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

20

Officers of the corporation are:

A) appointed by the stockholders.

B) stockholders of the corporation.

C) appointed by the board of directors.

D) None of these answers is correct.

A) appointed by the stockholders.

B) stockholders of the corporation.

C) appointed by the board of directors.

D) None of these answers is correct.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

21

The two major components of the Stockholders' Equity section of the balance sheet are:

A) Paid-in Capital and Retained Earnings.

B) Stock and Retained Earnings.

C) Stock and Paid-in Capital.

D) Authorized Stock and Preferred Stock.

A) Paid-in Capital and Retained Earnings.

B) Stock and Retained Earnings.

C) Stock and Paid-in Capital.

D) Authorized Stock and Preferred Stock.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

22

What is a right a preferred stockholder often gives up when purchasing preferred stock?

A) Voting rights

B) Preemptive rights

C) Ability to sell stock

D) A and B are correct.

A) Voting rights

B) Preemptive rights

C) Ability to sell stock

D) A and B are correct.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

23

Retained earnings:

A) are the same thing as cash.

B) are not a part of stockholders' equity.

C) are accumulated profits that are kept in the corporation.

D) represent what stockholders have invested into the corporation.

A) are the same thing as cash.

B) are not a part of stockholders' equity.

C) are accumulated profits that are kept in the corporation.

D) represent what stockholders have invested into the corporation.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

24

No-par value stock with an assigned amount determined by the corporation's board of directors is:

A) par value.

B) stated value.

C) book value.

D) market value.

A) par value.

B) stated value.

C) book value.

D) market value.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

25

Stated value means market value.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

26

Dividends owed to cumulative preferred stockholders that must be paid before common stockholders can receive their dividends are:

A) common stock.

B) preferred stock.

C) stated value stock.

D) dividends in arrears.

A) common stock.

B) preferred stock.

C) stated value stock.

D) dividends in arrears.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

27

Preferred stock is considered to be non-participating when:

A) preferred stockholders get their yearly dividend and the remainder goes to common stockholders.

B) preferred stockholders have a right to the current year's dividend, but do not receive holdovers from past years when dividends were not paid.

C) preferred stockholders have a right to a certain dividend every year.

D) None of these answers is correct.

A) preferred stockholders get their yearly dividend and the remainder goes to common stockholders.

B) preferred stockholders have a right to the current year's dividend, but do not receive holdovers from past years when dividends were not paid.

C) preferred stockholders have a right to a certain dividend every year.

D) None of these answers is correct.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is a characteristic of common stock?

A) The right to share profits by receiving dividends

B) The right to vote

C) The right to sell their stock

D) All of the above are correct.

A) The right to share profits by receiving dividends

B) The right to vote

C) The right to sell their stock

D) All of the above are correct.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

29

Each share of a corporation's capital stock gives its owner the right to:

A) vote at stockholders' meetings.

B) set company policy.

C) manage the daily operations of the business.

D) determine the amount of dividends to be paid.

A) vote at stockholders' meetings.

B) set company policy.

C) manage the daily operations of the business.

D) determine the amount of dividends to be paid.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

30

Voting rights are a characteristic of which type of stock?

A) Common but not preferred

B) Preferred but not common

C) Both common and preferred

D) Neither common nor preferred

A) Common but not preferred

B) Preferred but not common

C) Both common and preferred

D) Neither common nor preferred

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

31

Noran Corporation has issued 4,800 shares of stock. Emily owns 490 shares. If the corporation issues an additional 900 shares, how many shares does Emily have the preemptive right to purchase? (Round intermediary calculations to two decimal places and the final answer to the nearest whole number.)

A) 490 shares

B) 49 shares

C) 90 shares

D) 900 shares

A) 490 shares

B) 49 shares

C) 90 shares

D) 900 shares

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

32

A type of preferred stock that entitles its holders an opportunity to share in additional dividends with common stockholders is known as:

A) participating.

B) cumulative.

C) non-cumulative.

D) capital.

A) participating.

B) cumulative.

C) non-cumulative.

D) capital.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

33

Preferred stock:

A) is usually a more risky investment than common stock.

B) gives preference to a corporation's profits and assets.

C) usually maintains voting rights.

D) None of the above are correct.

A) is usually a more risky investment than common stock.

B) gives preference to a corporation's profits and assets.

C) usually maintains voting rights.

D) None of the above are correct.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

34

Preemptive rights allow a stockholder to:

A) share in profits first.

B) maintain a proportionate ownership interest in the corporation.

C) vote their shares at the annual meeting.

D) dispose or sell their stock without notice.

A) share in profits first.

B) maintain a proportionate ownership interest in the corporation.

C) vote their shares at the annual meeting.

D) dispose or sell their stock without notice.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

35

Preferred stock that entitles its holders to any undeclared dividends accumulated before common stockholders receive dividends is:

A) non-participating.

B) non-cumulative.

C) cumulative.

D) participating.

A) non-participating.

B) non-cumulative.

C) cumulative.

D) participating.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

36

Preferred stockholders have what right over common stockholders?

A) More risk than common stockholders

B) Voting rights

C) Prior claim to dividends

D) Preemptive rights

A) More risk than common stockholders

B) Voting rights

C) Prior claim to dividends

D) Preemptive rights

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

37

Par value represents:

A) the market value of the stock.

B) an arbitrary value that is placed on each share of stock.

C) the legal capital of the corporation.

D) Both B and C are correct.

A) the market value of the stock.

B) an arbitrary value that is placed on each share of stock.

C) the legal capital of the corporation.

D) Both B and C are correct.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

38

For no-par value stock with a stated value:

A) the stated value is like par value, but it is not printed on stock certificates.

B) Directors cannot change stated value without approval of the state.

C) stated value is the market value.

D) All of the above are correct.

A) the stated value is like par value, but it is not printed on stock certificates.

B) Directors cannot change stated value without approval of the state.

C) stated value is the market value.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

39

No-par value is placed on stock certificate when the stock has no-par value and no stated value.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

40

Stockholders with a right to current-year dividends but not dividends in arrears are:

A) common stockholders.

B) cumulative preferred stockholders.

C) noncumulative preferred stockholders.

D) None of the above are correct.

A) common stockholders.

B) cumulative preferred stockholders.

C) noncumulative preferred stockholders.

D) None of the above are correct.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

41

A cumulative preferred stockholder must be paid dividends in arrears before any dividends are paid to common stockholders.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

42

Nonparticipating preferred stock allows stockholders an opportunity to receive a higher percentage of dividends than promised, before any dividends are paid to common stockholders.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

43

Eight hundred shares of $22 par common stock were exchanged for a piece of equipment with a fair market value of $18,700. The journal entry to record the transaction would include a:

A) credit to Equipment for $17,600.

B) debit to Common Stock for $18,700.

C) credit to Paid-In Capital in Excess of Par Value-Common for $1,100.

D) credit to Common Stock for $18,700.

A) credit to Equipment for $17,600.

B) debit to Common Stock for $18,700.

C) credit to Paid-In Capital in Excess of Par Value-Common for $1,100.

D) credit to Common Stock for $18,700.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

44

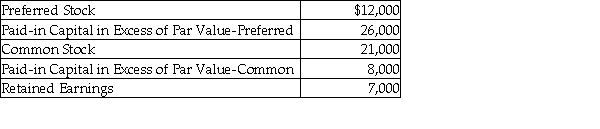

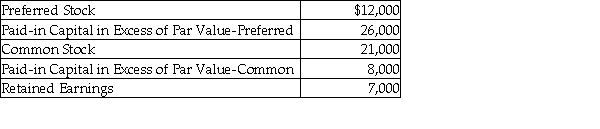

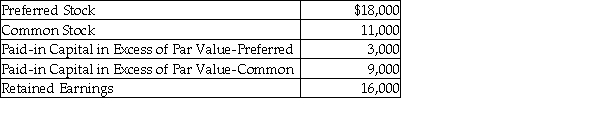

RH Corporation Stockholders' Equity section includes the following information:

Total paid-in capital is:

A) $60,000.

B) $67,000.

C) $34,000.

D) $74,000.

Total paid-in capital is:

A) $60,000.

B) $67,000.

C) $34,000.

D) $74,000.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

45

Organization costs are:

A) part of the company's start-up and are listed as expenses.

B) listed as an intangible asset on the balance sheet.

C) a current asset on the balance sheet.

D) a liability on the balance sheet.

A) part of the company's start-up and are listed as expenses.

B) listed as an intangible asset on the balance sheet.

C) a current asset on the balance sheet.

D) a liability on the balance sheet.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

46

The two main sources of stockholders' equity are investments by stockholders and net income retained in the corporation.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

47

The entry to record selling 1,200 shares of no-par common stock with a stated value of $67 for $71 would be to:

A) debit Cash $85,200; credit Common Stock $85,200.

B) debit Cash $80,400; credit Common Stock $80,400.

C) debit Cash $80,400; credit Common Stock $85,200; debit Paid-in Capital in Excess of Par Value-Common $4,800.

D) debit Cash $85,200; credit Common Stock $80,400; credit Paid-in Capital in Excess of Stated Value-Common $4,800.

A) debit Cash $85,200; credit Common Stock $85,200.

B) debit Cash $80,400; credit Common Stock $80,400.

C) debit Cash $80,400; credit Common Stock $85,200; debit Paid-in Capital in Excess of Par Value-Common $4,800.

D) debit Cash $85,200; credit Common Stock $80,400; credit Paid-in Capital in Excess of Stated Value-Common $4,800.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

48

A common shareholder's right to purchase an equivalent percentage of new stock is his/her participating right.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

49

Shares of outstanding stock may not equal the number of shares of authorized stock.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

50

Yellow Corporation has 270 shares of $100, 9% noncumulative nonparticipating preferred stock and 1,510 shares of $8 par value common stock outstanding. The company paid $7,500 cash dividends to stockholders in the current year. Preferred stockholders received:

A) $4,860.

B) $5,070.

C) $2,430.

D) $7,500.

A) $4,860.

B) $5,070.

C) $2,430.

D) $7,500.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

51

If preferred dividends are limited to the stated rate of dividend, the preferred stock is:

A) non-cumulative.

B) cumulative.

C) participating.

D) nonparticipating.

A) non-cumulative.

B) cumulative.

C) participating.

D) nonparticipating.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

52

1,000 shares of $30 par common stock was exchanged for a piece of land with a fair market value of $30,000. The journal entry to record the transaction would include a:

A) credit to Land for $30,000.

B) credit to Common Stock for $15,000.

C) credit to Paid-In Capital in Excess of Par Value-Common for $15,000.

D) debit to Land for $30,000.

A) credit to Land for $30,000.

B) credit to Common Stock for $15,000.

C) credit to Paid-In Capital in Excess of Par Value-Common for $15,000.

D) debit to Land for $30,000.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

53

Yellow Corporation has 250 shares of $140, 9% noncumulative nonparticipating preferred stock and 1,470 shares of $8 par value common stock outstanding. The company paid $7,500 cash dividends to stockholders in the current year. Common stockholders received:

A) $3,150.

B) $6,300.

C) $4,350.

D) $7,500.

A) $3,150.

B) $6,300.

C) $4,350.

D) $7,500.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

54

More stable earnings are a benefit of owning preferred stock.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

55

An intangible asset that records the initial cost of forming the corporation, such as legal and incorporating fees is called:

A) Common Stock.

B) Organization cost.

C) Preferred Stock.

D) Paid-in Capital.

A) Common Stock.

B) Organization cost.

C) Preferred Stock.

D) Paid-in Capital.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

56

A corporation is required to pay dividends.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

57

When a corporation has only one class of capital stock, it will be common stock.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is NOT one of the procedural steps for calculating dividends with cumulative, fully participating preferred stock?

A) Calculate the preferred dividends.

B) Calculate the total par value.

C) Calculate common dividends.

D) Calculate treasury stock.

A) Calculate the preferred dividends.

B) Calculate the total par value.

C) Calculate common dividends.

D) Calculate treasury stock.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

59

List and discuss the following:

a. Rights of common stockholders

b. Rights of preferred stockholders

a. Rights of common stockholders

b. Rights of preferred stockholders

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

60

The entry to record MidIowa.net selling 1,000 shares of $8.00 par value common stock at $10.00 would be to:

A) debit Cash $10,000; credit Common Stock $8,000; credit Paid-in Capital in Excess of Par Value-Common $2,000.

B) debit Cash $10,000; credit Common Stock $10,000.

C) debit Cash $8,000; debit Paid-in Capital in Excess of Par Value-Common $2,000; credit Common Stock $10,000.

D) None of these answers is correct.

A) debit Cash $10,000; credit Common Stock $8,000; credit Paid-in Capital in Excess of Par Value-Common $2,000.

B) debit Cash $10,000; credit Common Stock $10,000.

C) debit Cash $8,000; debit Paid-in Capital in Excess of Par Value-Common $2,000; credit Common Stock $10,000.

D) None of these answers is correct.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

61

The Mars Company issued 150 shares of its $13 par value stock for $21 per share. The entry to record the receipt of cash and issuance of the stock would include a:

A) debit to Cash of $1,950; credit to Common Stock for $1,950.

B) debit to Cash for $3,150.

C) credit to Common Stock for $3,150.

D) debit to Discount on Common Stock for $1,200.

A) debit to Cash of $1,950; credit to Common Stock for $1,950.

B) debit to Cash for $3,150.

C) credit to Common Stock for $3,150.

D) debit to Discount on Common Stock for $1,200.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

62

Washington Corporation issued 7,000 shares of its $28 par value common stock for $31 per share. The entry to record the issuance would include a:

A) credit to Cash for $217,000.

B) credit to Common Stock for $21,000.

C) credit to Common Stock for $196,000.

D) debit to Paid-in Capital in Excess of Par Value-Common for $21,000.

A) credit to Cash for $217,000.

B) credit to Common Stock for $21,000.

C) credit to Common Stock for $196,000.

D) debit to Paid-in Capital in Excess of Par Value-Common for $21,000.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

63

The entry to record selling 2,000 shares of no-par common stock with no stated value at $180 per share would be to:

A) debit Cash $360,000; credit Common Stock $360,000.

B) debit Common Stock $360,000; credit Cash $360,000.

C) debit Cash $340,000; debit Paid-in Capital in Excess of Par Value-Common $20,000; credit Common Stock $360,000.

D) None of the above are correct.

A) debit Cash $360,000; credit Common Stock $360,000.

B) debit Common Stock $360,000; credit Cash $360,000.

C) debit Cash $340,000; debit Paid-in Capital in Excess of Par Value-Common $20,000; credit Common Stock $360,000.

D) None of the above are correct.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

64

Dolly's Best issued 200 shares of its $6 common stock in exchange for used packaging equipment with a fair market value of $3,000. The entry to record the acquisition of the equipment would include a:

A) debit to Equipment for $1,200.

B) credit to Paid-in Capital in Excess of Par Value-Common for $1,800.

C) credit to Common Stock for $3,000.

D) credit to Equipment for $3,000.

A) debit to Equipment for $1,200.

B) credit to Paid-in Capital in Excess of Par Value-Common for $1,800.

C) credit to Common Stock for $3,000.

D) credit to Equipment for $3,000.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

65

Nelson Inc. sells 430 shares of its $16 par common stock for $31 per share. The entry would entail the following credit(s):

A) Cash of $13,330.

B) Paid-in Capital in Excess of Par Value-Common for $6,880; Common Stock for $6,450.

C) Paid-in Capital in Excess of Par Value-Common for $6,450; Common Stock for $6,880.

D) Common Stock for $13,330.

A) Cash of $13,330.

B) Paid-in Capital in Excess of Par Value-Common for $6,880; Common Stock for $6,450.

C) Paid-in Capital in Excess of Par Value-Common for $6,450; Common Stock for $6,880.

D) Common Stock for $13,330.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

66

When a company sells stock at an amount less then par value, the amount is referred to as:

A) a discount.

B) a premium.

C) a bonus.

D) Companies cannot sell stock for more than par value.

A) a discount.

B) a premium.

C) a bonus.

D) Companies cannot sell stock for more than par value.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

67

Ariel Company sells preferred stock at par value, and records a:

A) debit to Cash and a credit to Common Stock.

B) debit to Preferred Stock and a credit to Cash.

C) debit to Cash and a credit to Preferred Stock.

D) debit to Cash, credit to Preferred Stock and a credit to Paid in Capital in Excess of Par Value-Preferred Stock.

A) debit to Cash and a credit to Common Stock.

B) debit to Preferred Stock and a credit to Cash.

C) debit to Cash and a credit to Preferred Stock.

D) debit to Cash, credit to Preferred Stock and a credit to Paid in Capital in Excess of Par Value-Preferred Stock.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

68

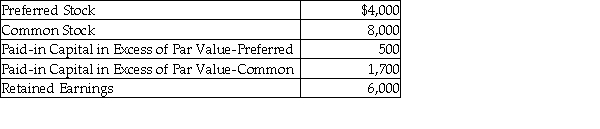

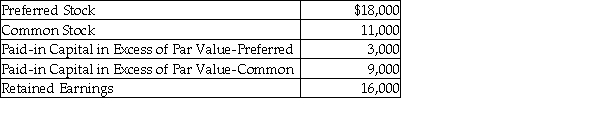

The Michigan Stockholders' Equity section includes the following:

What was the total amount common stock was sold for?

A) $9,700

B) $15,700

C) $14,200

D) $4,500

What was the total amount common stock was sold for?

A) $9,700

B) $15,700

C) $14,200

D) $4,500

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

69

Rhubarb Corporation's outstanding stock is 160 shares of $107, 11% cumulative nonparticipating preferred stock and 2,000 shares of $19 par value common stock. Rhubarb paid $2,200 cash dividends during the year. Common stockholders received: (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.)

A) $0.

B) $38,000.

C) $2,200.

D) $317.

A) $0.

B) $38,000.

C) $2,200.

D) $317.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

70

Luxury Motors issued 510 shares of its $8 common stock in exchange for equipment with a fair market value of $8,200. The entry to record the transaction would include a:

A) debit to Equipment for $4,080.

B) credit to Common Stock for $4,080.

C) debit to Paid-in Capital in Excess of Par Value-Common for $4,120.

D) credit to Common Stock Subscribed for $4,080.

A) debit to Equipment for $4,080.

B) credit to Common Stock for $4,080.

C) debit to Paid-in Capital in Excess of Par Value-Common for $4,120.

D) credit to Common Stock Subscribed for $4,080.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

71

The difference between what stockholders invest and the stated value placed on stock by the board of directors is called:

A) Paid-in Capital in Excess of Par Value-Common.

B) Paid-in Capital in Excess of Stated Value-Common.

C) Common Stock Stated Value.

D) Preferred Stock.

A) Paid-in Capital in Excess of Par Value-Common.

B) Paid-in Capital in Excess of Stated Value-Common.

C) Common Stock Stated Value.

D) Preferred Stock.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

72

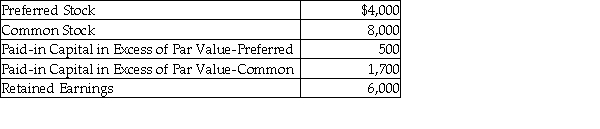

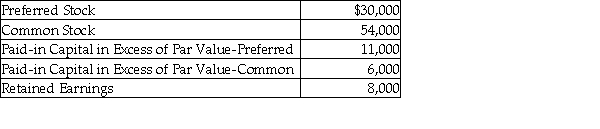

The Miranda Corporation Stockholders' Equity section includes the following:

What was the total amount preferred stock was sold for?

A) $15,000

B) $18,000

C) $21,000

D) $34,000

What was the total amount preferred stock was sold for?

A) $15,000

B) $18,000

C) $21,000

D) $34,000

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

73

If stock shares are sold at more than their par value, the excess money is called:

A) earnings.

B) paid-in capital in excess of par value.

C) gain on issue of stock.

D) discount on issue of stock.

A) earnings.

B) paid-in capital in excess of par value.

C) gain on issue of stock.

D) discount on issue of stock.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

74

The Blanche Corporation issued 50 shares of $28 par value stock to its accountant. The shares are in full payment for her $1,600 fee for assistance in setting up the new company. The entry to record the issuance of the stock would include a:

A) credit to Common Stock for $1,600.

B) debit to Common Stock for $1,600.

C) credit to Common Stock for $1,400.

D) debit to Common Stock for $1,400.

A) credit to Common Stock for $1,600.

B) debit to Common Stock for $1,600.

C) credit to Common Stock for $1,400.

D) debit to Common Stock for $1,400.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

75

Cannes Corporation has 120 shares of $107, 7% cumulative nonparticipating preferred stock and 1,200 shares of $16 par value common stock outstanding. The company paid $11,000 cash dividends including one-year dividends in arrears to preferred stockholders. Preferred stockholders received: (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.)

A) $899.

B) $11,000.

C) $10,101.

D) $1,798.

A) $899.

B) $11,000.

C) $10,101.

D) $1,798.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

76

When Common Stock is sold at a premium:

A) an asset increases and stockholders' equity increases.

B) an asset increases and liabilities increase.

C) a liability increases and stockholders' equity increases.

D) an asset decreases and stockholders' equity decreases.

A) an asset increases and stockholders' equity increases.

B) an asset increases and liabilities increase.

C) a liability increases and stockholders' equity increases.

D) an asset decreases and stockholders' equity decreases.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

77

Common stock sold at a discount is called:

A) at par.

B) above par.

C) at a premium.

D) below par.

A) at par.

B) above par.

C) at a premium.

D) below par.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

78

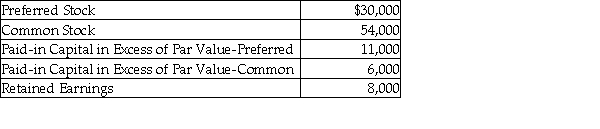

The Zonga Corporation Stockholders' Equity section includes the following:

Total paid-in capital is:

A) $109,000.

B) $17,000.

C) $93,000.

D) $101,000.

Total paid-in capital is:

A) $109,000.

B) $17,000.

C) $93,000.

D) $101,000.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

79

Korgen Company sells common stock at par value, and records a:

A) debit to Common Stock and a credit to Cash.

B) debit to Equipment and a credit to Common Stock.

C) debit to Cash and a credit to Common Stock.

D) debit to Cash, credit to Common Stock and a credit to Paid in Capital in Excess of Par Value-Common Stock.

A) debit to Common Stock and a credit to Cash.

B) debit to Equipment and a credit to Common Stock.

C) debit to Cash and a credit to Common Stock.

D) debit to Cash, credit to Common Stock and a credit to Paid in Capital in Excess of Par Value-Common Stock.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

80

Bannon Corporation has 100 shares of $47 par, 7% cumulative preferred stock and 2,900 shares of 17 par common stock. Bannon paid $19,000 in cash dividends including one-year dividends in arrears to preferred stockholders. Common stockholders will receive: (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.)

A) $0.

B) $658.

C) $329.

D) $18,342.

A) $0.

B) $658.

C) $329.

D) $18,342.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck