Deck 6: Inventory and Cost of Goods Sold

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/112

Play

Full screen (f)

Deck 6: Inventory and Cost of Goods Sold

1

The gross profit rate is calculated as:

A)gross profit divided by net sales revenue.

B)net sales revenue minus gross profit on sales.

C)cost of goods sold divided by net sales revenue.

D)net sales revenue minus cost of goods sold.

A)gross profit divided by net sales revenue.

B)net sales revenue minus gross profit on sales.

C)cost of goods sold divided by net sales revenue.

D)net sales revenue minus cost of goods sold.

A

2

Deciding on which inventory method a company should use affects:

A)the values of ratios reported from the balance sheet.

B)the profits to be reported.

C)the income taxes to be paid.

D)all of the above.

A)the values of ratios reported from the balance sheet.

B)the profits to be reported.

C)the income taxes to be paid.

D)all of the above.

D

3

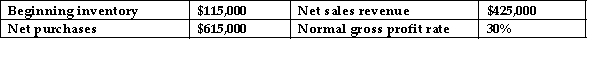

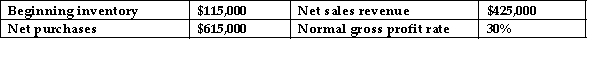

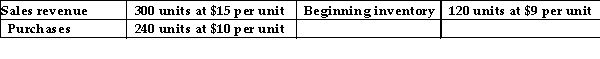

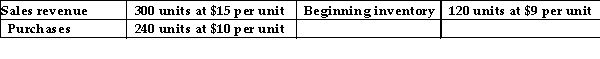

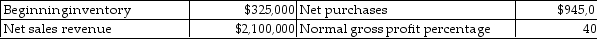

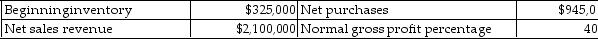

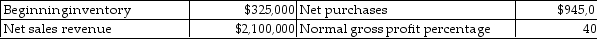

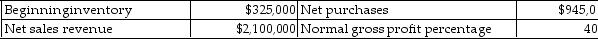

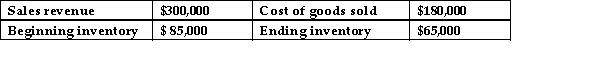

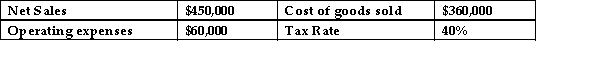

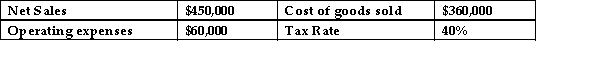

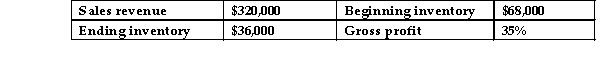

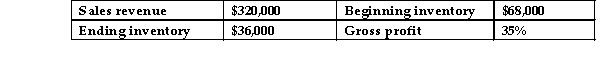

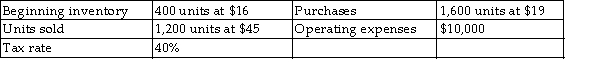

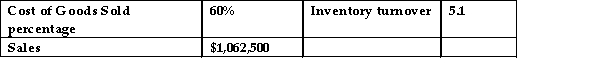

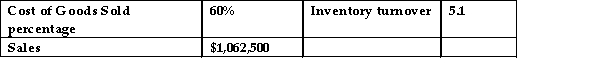

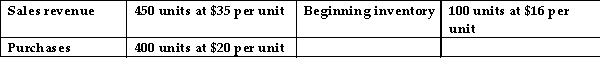

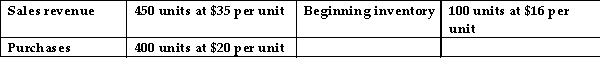

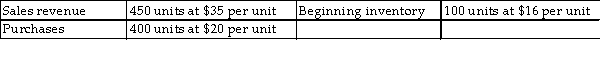

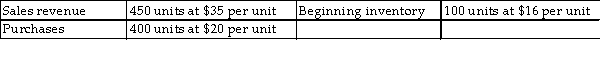

The following data are for Tina's Candle Store for January 2006: What is the company's estimated cost of goods sold for the month?

A)$224,500

B)$297,500

C)$184,500

D)$432,500

A)$224,500

B)$297,500

C)$184,500

D)$432,500

B

4

If ending inventory on December 31, 2007, is overstated, then:

A)cost of goods sold for the year ended December 31, 2008, will be understated.

B)gross profit for the year ended December 31, 2008, will be understated.

C)cost of goods sold for the year ended December 31, 2007, will be overstated.

D)gross profit for the year ended December 31, 2007, will be understated.

A)cost of goods sold for the year ended December 31, 2008, will be understated.

B)gross profit for the year ended December 31, 2008, will be understated.

C)cost of goods sold for the year ended December 31, 2007, will be overstated.

D)gross profit for the year ended December 31, 2007, will be understated.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

5

Beginning inventory for the year ended December 31, 2008, is understated. How will this error affect net income for 2008 and 2009?

A)2008 overstated; 2009 no effect

B)2008 understated; 2009 overstated

C)2008 understated; 2009 no effect

D)2008 overstated; 2009 understated

A)2008 overstated; 2009 no effect

B)2008 understated; 2009 overstated

C)2008 understated; 2009 no effect

D)2008 overstated; 2009 understated

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

6

How do purchase returns and allowances and purchase discounts affect net purchases?

A)Both are added to purchases.

B)Both are subtracted from purchases.

C)Purchase returns and allowances are added to purchases; purchase discounts are subtracted from purchases.

D)Purchase returns and allowances are subtracted from purchases; purchase discounts are added to purchases.

A)Both are added to purchases.

B)Both are subtracted from purchases.

C)Purchase returns and allowances are added to purchases; purchase discounts are subtracted from purchases.

D)Purchase returns and allowances are subtracted from purchases; purchase discounts are added to purchases.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

7

When using the average- cost method to determine the cost of inventory, the average cost per unit is calculated as the cost of goods:

A)in ending inventory divided by the number of units in ending inventory.

B)sold divided by the number of units sold.

C)sold divided by the average number of units in inventory.

D)available for sale divided by the number of units available for sale.

A)in ending inventory divided by the number of units in ending inventory.

B)sold divided by the number of units sold.

C)sold divided by the average number of units in inventory.

D)available for sale divided by the number of units available for sale.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

8

Inventory turnover is calculated as:

A)average inventory multiplied by cost of goods sold.

B)cost of goods sold minus ending inventory.

C)cost of goods sold divided by average inventory.

D)average inventory divided by cost of goods sold.

A)average inventory multiplied by cost of goods sold.

B)cost of goods sold minus ending inventory.

C)cost of goods sold divided by average inventory.

D)average inventory divided by cost of goods sold.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

9

A widely used method for estimating the value of ending inventory is the:

A)lower- of- cost- or- market method.

B)gross profit method.

C)perpetual method.

D)periodic method.

A)lower- of- cost- or- market method.

B)gross profit method.

C)perpetual method.

D)periodic method.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

10

If year- end inventory is reduced from cost to a lower replacement cost, which of the following accurately depicts the results?

A)Cost of goods sold is increased and beginning inventory of the next period is decreased by the same amount.

B)The capital account balance is increased and beginning inventory of the next period is reduced by the same amount.

C)Cost of goods sold is reduced and beginning inventory of the next period is reduced by the same amount.

D)Year- end inventory is reduced and cost of goods sold is reduced by the same amount.

A)Cost of goods sold is increased and beginning inventory of the next period is decreased by the same amount.

B)The capital account balance is increased and beginning inventory of the next period is reduced by the same amount.

C)Cost of goods sold is reduced and beginning inventory of the next period is reduced by the same amount.

D)Year- end inventory is reduced and cost of goods sold is reduced by the same amount.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

11

Happy House Corporation reported net sales of $425,000 for the current year. After the financial statements had been prepared, it was discovered that ending inventory had been understated by $25,000. If the tax rate is 40%, after the error has been corrected, net income will:

A)decrease by $25,000.

B)increase by $15,000.

C)decrease by $15,000.

D)increase by $25,000.

A)decrease by $25,000.

B)increase by $15,000.

C)decrease by $15,000.

D)increase by $25,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

12

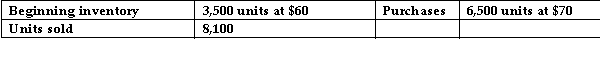

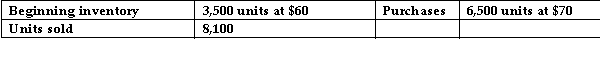

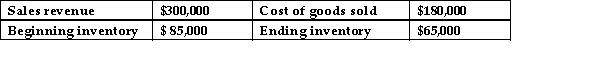

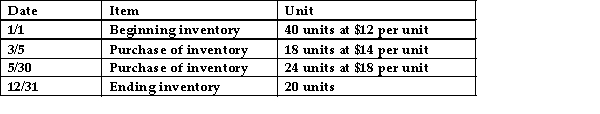

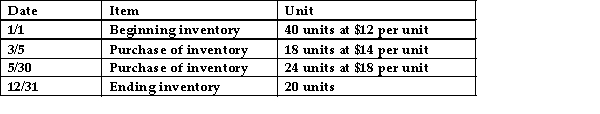

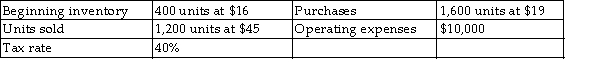

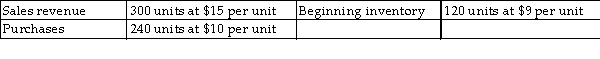

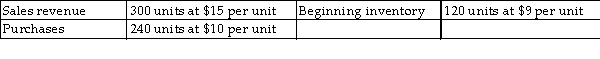

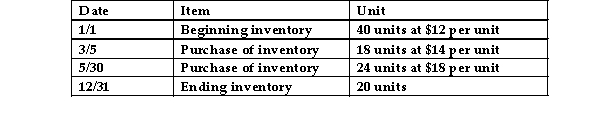

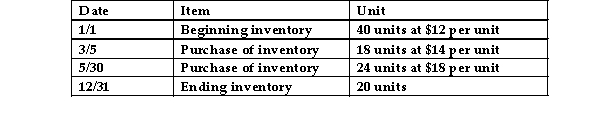

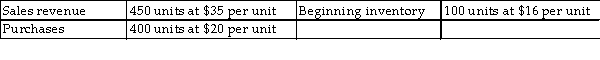

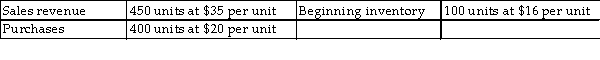

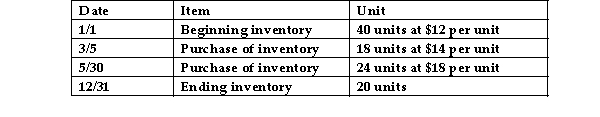

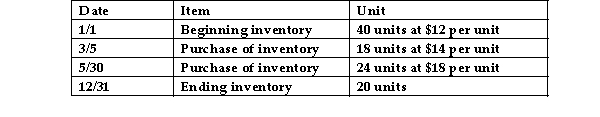

Given the following data, by how much would taxable income change if LIFO is used rather than FIFO?

A)Decrease by $15,000

B)Decrease by $19,000

C)Increase by $19,000

D)Increase by $15,000

A)Decrease by $15,000

B)Decrease by $19,000

C)Increase by $19,000

D)Increase by $15,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

13

Charles Scrab Inc. has beginning inventory of $15,000, purchases of $25,000, and ending inventory of $10,000, sales of $75,000, operating expenses of $30,000, and a tax rate of 40% for 2008. An accounting clerk input the ending inventory as $12,000. What is the effect on 2008 cost of goods sold?

A)Cost of Goods Sold will be $2,000 lower.

B)Cost of Goods Sold will be $2,000 higher.

C)Cost of Goods Sold will be $1,200 higher.

D)Cost of Goods Sold will be $1,200 lower.

A)Cost of Goods Sold will be $2,000 lower.

B)Cost of Goods Sold will be $2,000 higher.

C)Cost of Goods Sold will be $1,200 higher.

D)Cost of Goods Sold will be $1,200 lower.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

14

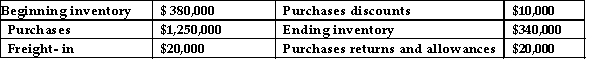

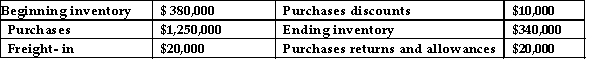

Given the following data, what is the cost of beginning inventory?

A)$205,000

B)$1,485,000

C)$415,000

D)$1,035,000

A)$205,000

B)$1,485,000

C)$415,000

D)$1,035,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

15

BMX Co. sells item XJ15 for $1,000 per unit, and has a cost of goods sold percentage of 80%. The gross profit to be found for selling 20 items is:

A)$ 4,000.

B)$20,000.

C)$16,000.

D)No gross margin can be calculated with a cost of goods sold percentage greater than 50%.

A)$ 4,000.

B)$20,000.

C)$16,000.

D)No gross margin can be calculated with a cost of goods sold percentage greater than 50%.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

16

A company purchased inventory for $800 per unit. The inventory was marked up to sell for $1,000 per unit. The entries to record the sale and the cost of a unit of inventory would include debits to which of the following accounts?

A)Cash, $1,000; Cost of Goods Sold, $800

B)Cash, $800; Cost of Goods Sold, $1,000

C)Sales, $800; Inventory, $800

D)Sales, $1,000; Inventory, $800

A)Cash, $1,000; Cost of Goods Sold, $800

B)Cash, $800; Cost of Goods Sold, $1,000

C)Sales, $800; Inventory, $800

D)Sales, $1,000; Inventory, $800

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

17

Wonkie Company's ending inventory at cost)was $75,000. The market value of the ending inventory was $65,000. How will this affect the reported ending inventory and cost of goods sold?

A)It will increase both ending inventory and cost of goods sold by $10,000.

B)It will increase ending inventory by $10,000 and have no effect on cost of goods sold.

C)It will have no effect on either ending inventory or cost of goods sold.

D)It will decrease ending inventory by $10,000 and increase cost of goods sold by $10,000.

A)It will increase both ending inventory and cost of goods sold by $10,000.

B)It will increase ending inventory by $10,000 and have no effect on cost of goods sold.

C)It will have no effect on either ending inventory or cost of goods sold.

D)It will decrease ending inventory by $10,000 and increase cost of goods sold by $10,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

18

The use of the FIFO method increases taxable income:

A)when prices are declining.

B)when prices are increasing.

C)under all circumstances.

D)when prices are constant.

A)when prices are declining.

B)when prices are increasing.

C)under all circumstances.

D)when prices are constant.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

19

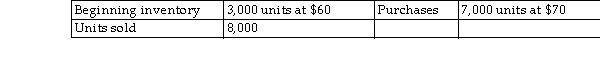

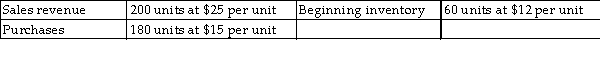

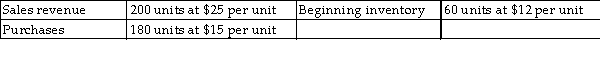

Given the following data, what is the value of cost of goods sold as determined by the FIFO method?

A)$4,500

B)$2,912

C)$2,940

D)$2,880

A)$4,500

B)$2,912

C)$2,940

D)$2,880

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

20

Which inventory method gives the most realistic net income?

A)Average- cost, because it averages old and recent costs

B)FIFO, because it uses cost in the order in which they were incurred

C)LIFO, because it includes the most recent costs in cost of goods sold

D)The answer depends on whether prices are rising or falling.

A)Average- cost, because it averages old and recent costs

B)FIFO, because it uses cost in the order in which they were incurred

C)LIFO, because it includes the most recent costs in cost of goods sold

D)The answer depends on whether prices are rising or falling.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

21

The largest expense category on the income statement of most merchandising companies is:

A)administrative expenses.

B)cost of goods sold.

C)selling expenses.

D)other expenses.

A)administrative expenses.

B)cost of goods sold.

C)selling expenses.

D)other expenses.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

22

An error in the ending inventory for the year ended December 31, 2009:

A)has no effect on the 2009 financial statements, but will create an error in the 2010 financial statements.

B)automatically creates errors in cost of goods in the 2009 and 2010 financial statements.

C)automatically creates errors in the ending inventory balance in the 2009 and 2010 financial statements.

D)affects only the 2009 financial statements.

A)has no effect on the 2009 financial statements, but will create an error in the 2010 financial statements.

B)automatically creates errors in cost of goods in the 2009 and 2010 financial statements.

C)automatically creates errors in the ending inventory balance in the 2009 and 2010 financial statements.

D)affects only the 2009 financial statements.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

23

If ending inventory for the year ended December 31, 2007, is understated, this error will cause owners' equity to be:

A)understated at the end of 2007 and overstated at the end of 2008.

B)overstated at the end of 2007 and understated at the end of 2008.

C)understated at the end of 2007 and correctly stated at the end of 2008.

D)overstated at the end of 2007 and correctly stated at the end of 2008.

A)understated at the end of 2007 and overstated at the end of 2008.

B)overstated at the end of 2007 and understated at the end of 2008.

C)understated at the end of 2007 and correctly stated at the end of 2008.

D)overstated at the end of 2007 and correctly stated at the end of 2008.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

24

When the LIFO method is used, cost of goods sold is assumed to consist of:

A)units with the lowest per unit cost.

B)oldest units.

C)units with the highest per unit cost.

D)most recently purchased units.

A)units with the lowest per unit cost.

B)oldest units.

C)units with the highest per unit cost.

D)most recently purchased units.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

25

The conservatism principle in accounting means that a company should:

A)use the same accounting methods and procedures from period to period.

B)report enough information in its financial statements for outsiders to make knowledgeable decisions about the company.

C)perform strictly proper accounting for items and transactions that are significant to the company's financial statements.

D)report items in the financial statements at amounts that lead to the most pessimistic immediate financial results.

A)use the same accounting methods and procedures from period to period.

B)report enough information in its financial statements for outsiders to make knowledgeable decisions about the company.

C)perform strictly proper accounting for items and transactions that are significant to the company's financial statements.

D)report items in the financial statements at amounts that lead to the most pessimistic immediate financial results.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

26

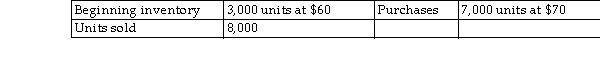

Char Daniels, controller for Chaka Inc., has the following items: Inventory turnover is:

A)4.00.

B)2.12.

C)2.00.

D)2.40.

A)4.00.

B)2.12.

C)2.00.

D)2.40.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

27

The lower- of- cost- or- market rule requires a company to report inventories at the lesser of:

A)current replacement cost or sales invoice price.

B)historical cost or current replacement cost.

C)historical cost or current sales price.

D)FIFO cost or LIFO cost.

A)current replacement cost or sales invoice price.

B)historical cost or current replacement cost.

C)historical cost or current sales price.

D)FIFO cost or LIFO cost.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

28

Ace Company began the current accounting period with 9,000 units of inventory purchased for $100 per unit. Ace sells its units at $300 per unit. Ace would experience a LIFO liquidation if:

A)the level of ending inventory falls below 9,000 units.

B)the sales price falls below $300 per unit.

C)the purchase price falls below $100 per unit.

D)any of the above scenarios happened.

A)the level of ending inventory falls below 9,000 units.

B)the sales price falls below $300 per unit.

C)the purchase price falls below $100 per unit.

D)any of the above scenarios happened.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

29

When the FIFO method is used, ending inventory is assumed to consist of the:

A)units with the lowest per unit cost.

B)most recently purchased units.

C)units with the highest per unit cost.

D)oldest units.

A)units with the lowest per unit cost.

B)most recently purchased units.

C)units with the highest per unit cost.

D)oldest units.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

30

Pat and Company's ending inventory at cost)was $87,500. The company would have had to pay $100,000 to replace the ending inventory. Before consideration of the lower- of- cost- or- market rule, the company's cost of goods sold was $60,000. Which of the following statements reflect the correct application of the LCM rule?

A)The Ending Inventory balance will be $87,500, and Cost of Goods Sold will be $60,000.

B)Ending Inventory balance will be $100,000, and Cost of Goods Sold will be $72,500.

C)The Ending Inventory balance will be $87,500, and Cost of Goods Sold will be $72,500.

D)The Ending Inventory balance will be $100,000, and Cost of Goods Sold will be $72,500.

A)The Ending Inventory balance will be $87,500, and Cost of Goods Sold will be $60,000.

B)Ending Inventory balance will be $100,000, and Cost of Goods Sold will be $72,500.

C)The Ending Inventory balance will be $87,500, and Cost of Goods Sold will be $72,500.

D)The Ending Inventory balance will be $100,000, and Cost of Goods Sold will be $72,500.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

31

Exter Co. receives terms of 2/10, n/30 on all invoices from Garn Industries. On January 15, 2008, Exter purchased items from Garn for $4,200, excluding taxes and shipping costs. What amount would Exter use as the purchase discount if the invoice was paid on January 28, 2008?

A)$ 84

B)$4,200

C)$4,116

D)$ 0

A)$ 84

B)$4,200

C)$4,116

D)$ 0

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

32

A company mistakenly destroys a unit of inventory that originally cost $12. The company included the cost of the destroyed unit in cost of goods sold on the income statement, rather than recognizing it as a loss. This action is justifiable based on:

A)the materiality concept.

B)the revenue concept.

C)accounting conservatism.

D)none of the above answers. All of them are incorrect; according to GAAP, a separate loss must be recognized.

A)the materiality concept.

B)the revenue concept.

C)accounting conservatism.

D)none of the above answers. All of them are incorrect; according to GAAP, a separate loss must be recognized.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

33

Happy House Corporation reported net income of $425,000 for the current year. After the financial statements had been prepared, it was discovered that ending inventory had been overstated by $25,000. The correct net income was:

A)$300,000.

B)$450,000.

C)$425,000.

D)$400,000.

A)$300,000.

B)$450,000.

C)$425,000.

D)$400,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

34

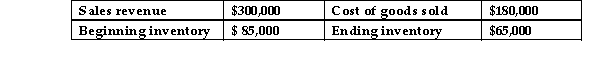

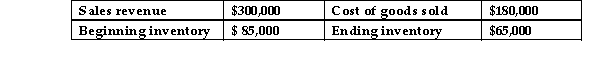

The following data are for the Bi- Star Technologies for the year ended December 31, 2006: 0

What is the estimated ending inventory?

What is the estimated ending inventory?

A)$635,000

B)$ 10,000

C)$167,500

D)$840,000

What is the estimated ending inventory?

What is the estimated ending inventory?A)$635,000

B)$ 10,000

C)$167,500

D)$840,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

35

Charles Scrab Inc has beginning inventory of $15,000, purchases of $25,000, and ending inventory of $10,000, sales of $75,000, operating expenses of $30,000, and a tax rate of 40% for 2008. An accounting clerk input the ending inventory as $12,000. What is the effect on 2009 net income?

A)Net income for 2009 will be $10,200.

B)Net income for 2009 will be $1,200 higher than 2008.

C)Net income for 2009 will be $1,200 lower than 2008.

D)Net income for 2009 cannot be calculated with the information given.

A)Net income for 2009 will be $10,200.

B)Net income for 2009 will be $1,200 higher than 2008.

C)Net income for 2009 will be $1,200 lower than 2008.

D)Net income for 2009 cannot be calculated with the information given.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

36

Char Daniels, controller for Chaka Inc., has the following items: The gross profit rate is:

A)20%.

B)60%.

C)50%.

D)40%.

A)20%.

B)60%.

C)50%.

D)40%.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

37

Given the following data, by how much would taxable income change if FIFO is used rather than LIFO?

A)Decrease by $20,000

B)Increase by $19,000

C)Increase by $20,000

D)Decrease by $19,000

A)Decrease by $20,000

B)Increase by $19,000

C)Increase by $20,000

D)Decrease by $19,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

38

Given the following data, what would the net income be if the company uses LIFO?

A)$ 8,960

B)$12,720

C)$ 6,800

D)$13,440

A)$ 8,960

B)$12,720

C)$ 6,800

D)$13,440

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

39

Given the following data, calculate the dollar amount of goods available for sale of using the average- cost method.

A)$ 283.90

B)$14.19512

C)$ 851.71

D)$1,164.00

A)$ 283.90

B)$14.19512

C)$ 851.71

D)$1,164.00

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

40

In a merchandising business, gross profit is equal to sales revenue minus:

A)cost of goods sold and operating expenses combined.

B)cost of goods sold and sales commissions combined.

C)cost of goods sold only.

D)cost of goods sold, operating expenses, and prepaid expenses combined.

A)cost of goods sold and operating expenses combined.

B)cost of goods sold and sales commissions combined.

C)cost of goods sold only.

D)cost of goods sold, operating expenses, and prepaid expenses combined.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

41

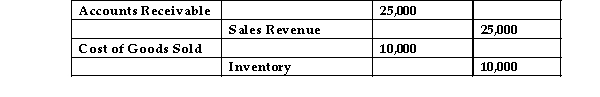

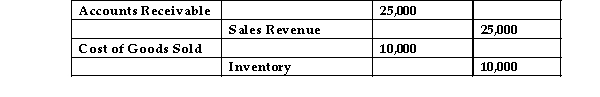

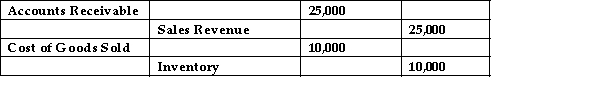

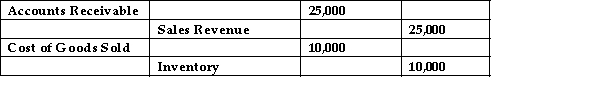

On July 16, 2009, Martson and Co. made the following journal entry:  Martson and Co. is using the Inventory system.

Martson and Co. is using the Inventory system.

A)LIFO

B)FIFO

C)Periodic

D)Perpetual

Martson and Co. is using the Inventory system.

Martson and Co. is using the Inventory system.A)LIFO

B)FIFO

C)Periodic

D)Perpetual

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

42

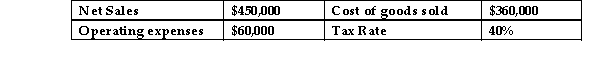

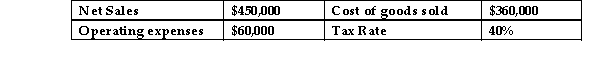

Tonga Industries reported the following: The net income is:

A)$ 18,000.

B)$ 12,000.

C)$ 30,000.

D)$180,000.

A)$ 18,000.

B)$ 12,000.

C)$ 30,000.

D)$180,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

43

The purchasing manager for East Coast Hoggs is attempting to determine how much inventory to purchase for the upcoming month. The following information has been collected: The manager wishes to end the month with ending inventory of $25,000. How much inventory must the company purchase?

A)$82,000

B)$67,000

C)$85,000

D)$73,000

A)$82,000

B)$67,000

C)$85,000

D)$73,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

44

When applying the lower- of- cost- or- market rule, market value generally refers to:

A)LIFO cost using the periodic method.

B)FIFO cost using the periodic method.

C)current sales price of the inventory.

D)current replacement cost.

A)LIFO cost using the periodic method.

B)FIFO cost using the periodic method.

C)current sales price of the inventory.

D)current replacement cost.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

45

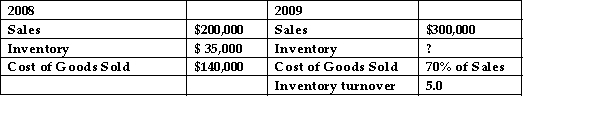

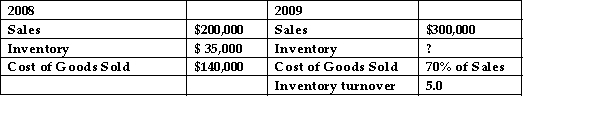

John's Appliances has the following items for 2008 and 2009: What is the inventory amount for 2009?

A)$49,000

B)$29,000

C)$85,000

D)$ 7,000

A)$49,000

B)$29,000

C)$85,000

D)$ 7,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

46

The disclosure principle requires that management prepare financial reports that disclose all of the following types of information EXCEPT:

A)information that facilitates comparison with other companies' financial reports.

B)information that is relevant to decision making.

C)forecasts of expected future earnings to help investors decide whether to invest in the company.

D)the method of inventory used.

A)information that facilitates comparison with other companies' financial reports.

B)information that is relevant to decision making.

C)forecasts of expected future earnings to help investors decide whether to invest in the company.

D)the method of inventory used.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

47

Harmon Fraiser Industries had beginning inventory of 20,000 candles and an ending inventory of 15,000 candles. Harmon originally paid $1.80 each when it purchased the candles. The current replacement cost of the candles is $2.20 each. Each candle retails for $3.00. Harmon uses the LIFO method to account for its inventory. How did the LIFO liquidation affect the company's taxable income?

A)Taxable income increased because of the liquidation.

B)Taxable income remained the same despite the liquidation.

C)Taxable income decreased because of the liquidation.

D)Taxable income is indeterminable with the given data.

A)Taxable income increased because of the liquidation.

B)Taxable income remained the same despite the liquidation.

C)Taxable income decreased because of the liquidation.

D)Taxable income is indeterminable with the given data.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

48

A company whose inventory consists of very unique items would probably use which inventory method?

A)Specific unit cost

B)Weighted- average of only the unique items

C)F- in, first- out

D)Last- in, first- out

A)Specific unit cost

B)Weighted- average of only the unique items

C)F- in, first- out

D)Last- in, first- out

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

49

In a merchandising company's income statement, which of the following would NOT be included in the Cost of Goods Sold calculation?

A)Sales taxes on inventory purchases, as shown on the invoices

B)Sales commissions

C)Returns of inventory purchases

D)Shipping costs from the manufacturer to the merchandiser

A)Sales taxes on inventory purchases, as shown on the invoices

B)Sales commissions

C)Returns of inventory purchases

D)Shipping costs from the manufacturer to the merchandiser

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

50

Max from Darnel Inc. has the following items: Inventory turnover is:

A)4.31.

B)2.15.

C)6.15.

D)4.00.

A)4.31.

B)2.15.

C)6.15.

D)4.00.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

51

Given the following data, what is the cost of goods sold?

A)$1,210,000

B)$1,300,000

C)$1,280,000

D)$1,290,000

A)$1,210,000

B)$1,300,000

C)$1,280,000

D)$1,290,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

52

Ending inventory for the year ended December 31, 2008, is understated. How will this error affect net income for 2008 and 2009?

A)2008 overstated; 2009 understated

B)2008 overstated; 2009 no effect

C)2008 understated; 2009 overstated

D)2008 understated; 2009 no effect

A)2008 overstated; 2009 understated

B)2008 overstated; 2009 no effect

C)2008 understated; 2009 overstated

D)2008 understated; 2009 no effect

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

53

A perpetual inventory system offers which of the following advantages?

A)This system helps to determine if there is a sufficient supply of inventory on hand to fill customer orders, just by reviewing the inventory records.

B)This system is more expensive than a periodic system.

C)This system is used for inexpensive goods.

D)Inventory balances have to be counted to be accurate.

A)This system helps to determine if there is a sufficient supply of inventory on hand to fill customer orders, just by reviewing the inventory records.

B)This system is more expensive than a periodic system.

C)This system is used for inexpensive goods.

D)Inventory balances have to be counted to be accurate.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

54

Given the following data, what would the income tax amount be if the company uses FIFO?

A)$13,440

B)$ 8,960

C)$10,200

D)$ 6,80

A)$13,440

B)$ 8,960

C)$10,200

D)$ 6,80

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

55

Charles Scrab Inc. has beginning inventory of $15,000, purchases of $25,000, and ending inventory of $10,000, sales of $75,000, operating expenses of $30,000, and a tax rate of 40% for 2008. An accounting clerk input the ending inventory as $12,000. What is the effect on 2008 net income?

A)Net income will be $2,000 lower.

B)Net income will be $1,200 lower.

C)Net income will be $1,200 higher.

D)Net income will be $2,000 higher.

A)Net income will be $2,000 lower.

B)Net income will be $1,200 lower.

C)Net income will be $1,200 higher.

D)Net income will be $2,000 higher.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

56

Unlike the periodic inventory system, the perpetual inventory system:

A)does not require a physical count of the ending inventory.

B)provides a continuous record of inventory on hand.

C)includes only the inventory purchased for cash.

D)is not required by GAAP.

A)does not require a physical count of the ending inventory.

B)provides a continuous record of inventory on hand.

C)includes only the inventory purchased for cash.

D)is not required by GAAP.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

57

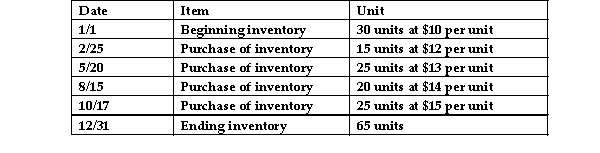

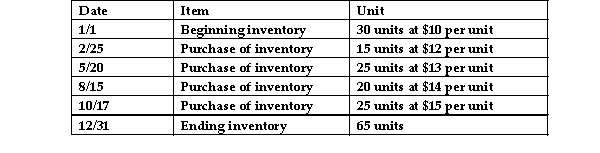

The following data was collected from the accounting records of Ambrose, Inc., which currently uses the FIFO method of valuing inventory. What would have been the difference in Ambrose's ending inventory under the LIFO costing method?

A)Ending inventory is the same under both methods.

B)Ending inventory would have been $120 higher.

C)Ending inventory would have been $120 lower.

D)The difference cannot be determined using this information.

A)Ending inventory is the same under both methods.

B)Ending inventory would have been $120 higher.

C)Ending inventory would have been $120 lower.

D)The difference cannot be determined using this information.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

58

A company purchased merchandise inventory on credit for $600 per unit, and later sold the inventory for $800 per unit. The journal entry to record the purchase of inventory included a debit to:

A)Inventory.

B)Accounts Receivable.

C)Cost of Goods Sold.

D)Accounts Payable.

A)Inventory.

B)Accounts Receivable.

C)Cost of Goods Sold.

D)Accounts Payable.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

59

All of the following are reasons for choosing the FIFO versus the LIFO costing method EXCEPT:

A)FIFO reports the most up- to- date inventory values on the balance sheet.

B)FIFO uses more current costs in calculating the value of ending inventory.

C)FIFO generally results in higher income taxes paid.

D)FIFO is generally more conservative.

A)FIFO reports the most up- to- date inventory values on the balance sheet.

B)FIFO uses more current costs in calculating the value of ending inventory.

C)FIFO generally results in higher income taxes paid.

D)FIFO is generally more conservative.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

60

Papa Gene's has the following information: Papa Gene's average inventory is:

A)$104,167.

B)$ 83,333.

C)$125,000.

D)$ 62,500.

A)$104,167.

B)$ 83,333.

C)$125,000.

D)$ 62,500.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

61

Tonga Industries reported the following: The gross profit percentage is:

A)32%.

B)80%.

C)20%.

D)60%.

A)32%.

B)80%.

C)20%.

D)60%.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

62

The following data was extracted from the records of Winsam Company: Winsam's most recent balance sheet showed ending inventory of $800. Which method was used for valuing inventory?

A)LIFO

B)Specific identification

C)FIFO

D)Average- cost

A)LIFO

B)Specific identification

C)FIFO

D)Average- cost

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

63

Given the following data, calculate the cost of ending inventory using the LIFO costing method.

A)$545

B)$720

C)$915

D)$740

A)$545

B)$720

C)$915

D)$740

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

64

When inventory prices are increasing, the FIFO costing method will generally yield a cost of goods sold that is:

A)equal to the gross profit under the LIFO method.

B)higher than cost of goods sold under the LIFO method.

C)less than cost of goods sold under the LIFO method.

D)equal to cost of goods sold under the LIFO method.

A)equal to the gross profit under the LIFO method.

B)higher than cost of goods sold under the LIFO method.

C)less than cost of goods sold under the LIFO method.

D)equal to cost of goods sold under the LIFO method.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

65

What is the formula used to calculate net purchases?

A)Purchases less Purchase Returns and Allowances plus Purchase Discounts

B)Purchases less Purchase Returns and Allowances less Purchase Discounts

C)Purchases plus Purchase Returns and Allowances less Purchase Discounts

D)Beginning Inventory less Purchases

A)Purchases less Purchase Returns and Allowances plus Purchase Discounts

B)Purchases less Purchase Returns and Allowances less Purchase Discounts

C)Purchases plus Purchase Returns and Allowances less Purchase Discounts

D)Beginning Inventory less Purchases

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

66

Happy House Corporation reported net sales of $425,000 for the current year. After the financial statements had been prepared, it was discovered that ending inventory had been understated by $25,000. If the tax rate is 40%, after the error has been corrected, net income will:

A)never be correct, unless there is a correcting entry.

B)be correct in the present year.

C)not be corrected for two years.

D)be correct in the next year.

A)never be correct, unless there is a correcting entry.

B)be correct in the present year.

C)not be corrected for two years.

D)be correct in the next year.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

67

The following data was extracted from the records of Winsam Company: Winsam's most recent income statement showed cost of goods sold of $8,800. Which method was used for valuing inventory?

A)Average- cost

B)Specific identification

C)LIFO

D)FIFO

A)Average- cost

B)Specific identification

C)LIFO

D)FIFO

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

68

Barney Google Industries has a Beginning inventory of 50 units, Net purchases of 450 units and Sales of 350 units. What is the dollar amount of the Ending inventory, if each unit costs $10?

A)$4,500

B)$3,500

C)$2,500

D)$1,500

A)$4,500

B)$3,500

C)$2,500

D)$1,500

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

69

When inventory prices are falling, the LIFO costing method will generally result in a:

A)lower owners' equity balance than under FIFO.

B)lower inventory value than under FIFO.

C)higher gross profit than under FIFO.

D)lower gross profit than under FIFO.

A)lower owners' equity balance than under FIFO.

B)lower inventory value than under FIFO.

C)higher gross profit than under FIFO.

D)lower gross profit than under FIFO.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

70

For a company using FIFO-and assuming rising prices-large purchases of inventory near the end of the year will:

A)increase the value of ending inventory.

B)increase income taxes paid.

C)increase gross profit.

D)result in all of the above.

A)increase the value of ending inventory.

B)increase income taxes paid.

C)increase gross profit.

D)result in all of the above.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

71

Given the following data, what is the value of the gross profit as determined by the LIFO method?

A)$1,560

B)$2,940

C)$1,620

D)$2,880

A)$1,560

B)$2,940

C)$1,620

D)$2,880

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

72

A company using a perpetual inventory system will use which of the following accounts?

A)Inventory Returns

B)Sales Returns and Allowances

C)Cost of Goods Purchases

D)Inventory

A)Inventory Returns

B)Sales Returns and Allowances

C)Cost of Goods Purchases

D)Inventory

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

73

Given the following data, calculate the gross profit using the average- cost method, if the selling price was $20 per unit.

A)$634.78

B)$851.71

C)$283.90

D)$359.90

A)$634.78

B)$851.71

C)$283.90

D)$359.90

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

74

The lower- of- cost- or- market rule is based on accounting:

A)the materiality concept.

B)conservatism.

C)disclosure.

D)revenue concept.

A)the materiality concept.

B)conservatism.

C)disclosure.

D)revenue concept.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

75

Bonz, Inc. is using a perpetual inventory system with a December 31 year end date. The balance in this company's inventory account as of September 30 would be equal to:

A)beginning inventory as of January 01 plus all purchases from the beginning of the year through September 30 less all items sold from the beginning of the year through September 30.

B)beginning inventory as of January 01 plus all purchases from the beginning of the year through September 30.

C)beginning inventory as of January 01.

D)all purchases from the beginning of the year through September 30.

A)beginning inventory as of January 01 plus all purchases from the beginning of the year through September 30 less all items sold from the beginning of the year through September 30.

B)beginning inventory as of January 01 plus all purchases from the beginning of the year through September 30.

C)beginning inventory as of January 01.

D)all purchases from the beginning of the year through September 30.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

76

Ending inventory for the year ended December 31, 2008, is overstated by $10,000. How will this affect net income for 2009?

A)Net income for 2009 will be understated by $20,000.

B)Net income for 2009 will be understated by $10,000.

C)Net income for 2009 will be overstated by $10,000.

D)Net income for 2009 will be overstated by $20,000.

A)Net income for 2009 will be understated by $20,000.

B)Net income for 2009 will be understated by $10,000.

C)Net income for 2009 will be overstated by $10,000.

D)Net income for 2009 will be overstated by $20,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

77

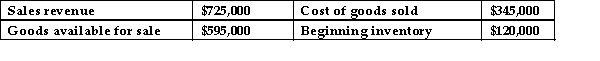

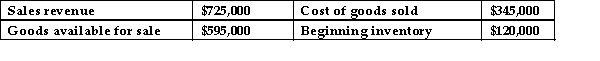

Given the following data, what is the cost of purchases?

A)$465,000

B)$370,000

C)$475,000

D)$595,000

A)$465,000

B)$370,000

C)$475,000

D)$595,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

78

On July 16, 2009, Martson and Co. made the following journal entry:  What is the Gross Profit from this sale?

What is the Gross Profit from this sale?

A)$25,000

B)$15,000

C)$ 0

D)$10,000

What is the Gross Profit from this sale?

What is the Gross Profit from this sale?A)$25,000

B)$15,000

C)$ 0

D)$10,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

79

The following data was extracted from the records of Winsam Company: What is the gross profit using the FIFO method?

A)$8,800

B)$8,600

C)$7,150

D)$6,950

A)$8,800

B)$8,600

C)$7,150

D)$6,950

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

80

Given the following data, calculate the value of ending inventory using the average- cost method.

A)$ 851.71

B)$1,164.00

C)$14.19512

D)$ 283.90

A)$ 851.71

B)$1,164.00

C)$14.19512

D)$ 283.90

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck