Deck 17: Trusts

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/8

Play

Full screen (f)

Deck 17: Trusts

1

Your friend Andrew has heard that you are studying Canadian income taxation. He has heard people

discussing something called the '21-Year Rule' with regard to trusts. He has come to you with

questions regarding this rule, since his father recently established inter vivos trusts for both Andrew and his mother.

Required:

Briefly answer the following questions:

With regard to non-spousal trusts:

A)What is the purpose of the 21-Year Rule?

B)What event occurs on the 21st anniversary of a trust?

C)What types of properties are subject to the 21-Year Rule?

D)How can the consequences of the 21-Year Rule be avoided?

With regard to spousal trusts:

E)What is the exception to the 21-Year Rule for spousal trusts?

discussing something called the '21-Year Rule' with regard to trusts. He has come to you with

questions regarding this rule, since his father recently established inter vivos trusts for both Andrew and his mother.

Required:

Briefly answer the following questions:

With regard to non-spousal trusts:

A)What is the purpose of the 21-Year Rule?

B)What event occurs on the 21st anniversary of a trust?

C)What types of properties are subject to the 21-Year Rule?

D)How can the consequences of the 21-Year Rule be avoided?

With regard to spousal trusts:

E)What is the exception to the 21-Year Rule for spousal trusts?

A)The 21 Year Rule prevents trusts from escaping tax on specific types of property held for long periods of time.

B)The specific properties of the trust are deemed to be sold and reacquired at their market values, realizing tax gains and losses on the deemed disposition.

C)Capital properties (non-depreciable), depreciable properties, land that is inventory, and resource property are subject to the 21 Year Rule.

D)Properties can be transferred to the beneficiaries prior to the 21st anniversary, at their tax cost, thereby deferring the tax effects.

E)Spousal trusts are exempt from realizing a deemed disposition of the properties at the first 21 Year anniversary.

B)The specific properties of the trust are deemed to be sold and reacquired at their market values, realizing tax gains and losses on the deemed disposition.

C)Capital properties (non-depreciable), depreciable properties, land that is inventory, and resource property are subject to the 21 Year Rule.

D)Properties can be transferred to the beneficiaries prior to the 21st anniversary, at their tax cost, thereby deferring the tax effects.

E)Spousal trusts are exempt from realizing a deemed disposition of the properties at the first 21 Year anniversary.

2

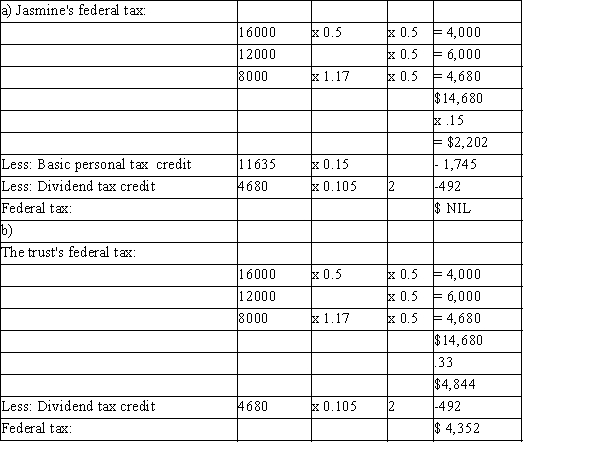

Jasmine is the beneficiary of an inter vivos trust. During 20x4 the trust received the following income:

Capital gains: $16,000 Interest: $12,000

Non-eligible dividends: $8,000

One half of the trust's income from 20x4 was paid to Jasmine, who does not currently have any other sources of income. The remainder of the income remained in the trust.

Required:

a)Determine Jasmine's personal federal tax. (Round to zero decimal places)

b)Calculate the federal tax for the trust.

Capital gains: $16,000 Interest: $12,000

Non-eligible dividends: $8,000

One half of the trust's income from 20x4 was paid to Jasmine, who does not currently have any other sources of income. The remainder of the income remained in the trust.

Required:

a)Determine Jasmine's personal federal tax. (Round to zero decimal places)

b)Calculate the federal tax for the trust.

3

Which of the following statements accurately describes the rules pertaining to qualified graduated rate estate trusts?

A)Trusts that qualify as graduated rate estate trusts must use the calendar year as their taxation year, and they may apply the full range of rates from the personal graduated tax rate scale.

B)Trusts that qualify as graduated rate estate trusts must use the calendar year as their taxation year, and they are subject to the highest federal personal tax rate.

C)Trusts that qualify as graduated rate estate trusts may use a non-calendar tax year, and they may apply the full range of rates from the personal graduated tax rate scale.

D)Trusts that qualify as graduated rate estate trusts may use a non-calendar tax year, and they are subject to the highest federal personal tax rate.

A)Trusts that qualify as graduated rate estate trusts must use the calendar year as their taxation year, and they may apply the full range of rates from the personal graduated tax rate scale.

B)Trusts that qualify as graduated rate estate trusts must use the calendar year as their taxation year, and they are subject to the highest federal personal tax rate.

C)Trusts that qualify as graduated rate estate trusts may use a non-calendar tax year, and they may apply the full range of rates from the personal graduated tax rate scale.

D)Trusts that qualify as graduated rate estate trusts may use a non-calendar tax year, and they are subject to the highest federal personal tax rate.

C

4

Which of the following statements is TRUE regarding trusts?

A)Losses that exceed income in a trust are allocated to the beneficiary for tax purposes.

B)Income that is payable to a beneficiary cannot be deducted from the trust's income.

C)Inter vivos trusts may be used for commercial purposes.

D)The residence of a trust is determined by the residence of the trustees.

A)Losses that exceed income in a trust are allocated to the beneficiary for tax purposes.

B)Income that is payable to a beneficiary cannot be deducted from the trust's income.

C)Inter vivos trusts may be used for commercial purposes.

D)The residence of a trust is determined by the residence of the trustees.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

5

A trust account holds two buildings as its assets. Building 1 originally cost $150,000 and Building 2 originally cost $210,000. It is now the 21st anniversary of the trust, and the assets have not been transferred to the beneficiary. The undepreciated capital cost of

Building 1 is $85,000 and its market value is $200,000. The undepreciated capital cost of Building 2 is $145,000 and its market value is $190,000. Which costs will be the deemed acquisition values of the buildings for the trust?

A)B1 = $200,000; B2 = $210,000

B)B1 = $85,000; B2 = $145,000

C)B1 = $200,000; B2 = $190,000

D)B1 = $150,000; B2 = $210,000

Building 1 is $85,000 and its market value is $200,000. The undepreciated capital cost of Building 2 is $145,000 and its market value is $190,000. Which costs will be the deemed acquisition values of the buildings for the trust?

A)B1 = $200,000; B2 = $210,000

B)B1 = $85,000; B2 = $145,000

C)B1 = $200,000; B2 = $190,000

D)B1 = $150,000; B2 = $210,000

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

6

If a trust qualifies as a spousal trust, which of the following is FALSE?

A)Property is deemed to have been sold at its cost amount when transferred to the trust.

B)The 21-year rule is waived for the trust's first 21-year anniversary.

C)Both the spouse and any adult children can receive the capital of the trust prior to the spouse's death.

D)Upon the death of the surviving spouse, the trust property is deemed to be sold at market value.

A)Property is deemed to have been sold at its cost amount when transferred to the trust.

B)The 21-year rule is waived for the trust's first 21-year anniversary.

C)Both the spouse and any adult children can receive the capital of the trust prior to the spouse's death.

D)Upon the death of the surviving spouse, the trust property is deemed to be sold at market value.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

7

A trust that is created upon the death of an individual and is taxed applying the full range of tax rates within the individual's progressive rate scale is a(n):

A)Unit investment trust

B)Investment trust

C)Graduated rate estate trust

D)Inter vivos trust

A)Unit investment trust

B)Investment trust

C)Graduated rate estate trust

D)Inter vivos trust

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

8

Walter passed away this year at the age of 62.

Previously, Walter had structured his will to bequeath his wife with $80,000 in cash, in addition to h and land, to be held in a trust on her behalf. The trust will pay her the annual income generated by th during her lifetime.

Additionally, Walter's 33 year old son, Steven, is to receive a building to be held in a trust until Stev the age of 45. Steven will also receive the assets in his mother's (Walter's wife)trust upon her death.

The assets transferred to Walter's wife consist of land with an ACB of $100,000 and a FMV of $300, stocks valued at $200,000 with a cost base of $150,000.

The building transferred to Steven has an ACB of $200,000, UCC of $180,000, and FMV of

$300,000.

Required:

A)What type(s)of trusts will be established upon Walter's death?

B)What are the immediate tax consequences (income type and amount)that will be recognized on W tax return? Show calculations

C)What are the immediate tax consequences for the assets transferred to Walter's wife?

Previously, Walter had structured his will to bequeath his wife with $80,000 in cash, in addition to h and land, to be held in a trust on her behalf. The trust will pay her the annual income generated by th during her lifetime.

Additionally, Walter's 33 year old son, Steven, is to receive a building to be held in a trust until Stev the age of 45. Steven will also receive the assets in his mother's (Walter's wife)trust upon her death.

The assets transferred to Walter's wife consist of land with an ACB of $100,000 and a FMV of $300, stocks valued at $200,000 with a cost base of $150,000.

The building transferred to Steven has an ACB of $200,000, UCC of $180,000, and FMV of

$300,000.

Required:

A)What type(s)of trusts will be established upon Walter's death?

B)What are the immediate tax consequences (income type and amount)that will be recognized on W tax return? Show calculations

C)What are the immediate tax consequences for the assets transferred to Walter's wife?

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck