Deck 13: The Canadian-Controlled Private Corporation

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/8

Play

Full screen (f)

Deck 13: The Canadian-Controlled Private Corporation

1

There are several benefits to incorporating a business. Some of those benefits are:

A)The shareholder may choose when they will receive dividend income from the corporation; a capital gains deduction may be available if conditions are met when shares are transferred to the shareholder's children; and active business income

Under $500,000 is eligible for a lower tax rate.

B)Lower tax rates are often recognized; the shareholder may receive compensation; and the corporation offers preferable tax rates on the business' investment income.

C)A tax deferral is available if the shareholder requires the corporation's profits for personal use in the year; the shareholder may participate in a registered pension plan through the corporation; and dividend payments may be deferred until after a shareholder has retired.

D)There is greater flexibility to bring family members on board as owners; non-taxable benefits may be provided to the shareholder; and dividend distributions are deductible for tax purposes.

A)The shareholder may choose when they will receive dividend income from the corporation; a capital gains deduction may be available if conditions are met when shares are transferred to the shareholder's children; and active business income

Under $500,000 is eligible for a lower tax rate.

B)Lower tax rates are often recognized; the shareholder may receive compensation; and the corporation offers preferable tax rates on the business' investment income.

C)A tax deferral is available if the shareholder requires the corporation's profits for personal use in the year; the shareholder may participate in a registered pension plan through the corporation; and dividend payments may be deferred until after a shareholder has retired.

D)There is greater flexibility to bring family members on board as owners; non-taxable benefits may be provided to the shareholder; and dividend distributions are deductible for tax purposes.

A

2

Which of the following scenarios are not associated corporations (in a de jure context)?

A)Kelly Booker owns 100% of the shares of Read Co. His mother and father each own 30% of the shares of Write Co. A friend, Mr. Words, owns 10% of Write Co., and Kelly owns the remaining shares.

B)Mr. and Mrs. Field each own 50% of the shares of Green Co. Their children, Sue and Tim, each own 40% of Brown Co., and Mrs. Field owns the remaining 20% of the shares.

C)Blue Corp. owns 90% of the shares of White Corp.

D)Yellow Corp. is wholly owned by Mrs. Smith. James Smith (Mrs. Smith's son), owns 65% of the shares of Green Corp. His mother owns the remaining 35% of the shares.

A)Kelly Booker owns 100% of the shares of Read Co. His mother and father each own 30% of the shares of Write Co. A friend, Mr. Words, owns 10% of Write Co., and Kelly owns the remaining shares.

B)Mr. and Mrs. Field each own 50% of the shares of Green Co. Their children, Sue and Tim, each own 40% of Brown Co., and Mrs. Field owns the remaining 20% of the shares.

C)Blue Corp. owns 90% of the shares of White Corp.

D)Yellow Corp. is wholly owned by Mrs. Smith. James Smith (Mrs. Smith's son), owns 65% of the shares of Green Corp. His mother owns the remaining 35% of the shares.

B

3

Bean Co. is a Canadian-controlled private corporation with a December 31 year-end. The company had financial profits of $200,000 in 20x7. Of this amount, $15,000 was from dividend income

received from a taxable Canadian corporation. The remaining income was from active business. Additional information:

The dividends were received from Grow Ltd., a connected Canadian-controlled private corporation. Grow has only one class of shares, and the total amount of dividends paid in 20x7 was $50,000.

Grow received a refund of $9,000 as a result of paying the dividend.

Bean Co. had a balance in its Refundable Dividend Tax on Hand Account of $3,000 at the end of 20x6. The company did not receive a dividend refund in 20x6.

Bean Co. is associated with Pea Co. Pea Co. used $220,000 of the small business deduction limit on its 20x7 tax return

Bean Co.'s 20x7 profits include a donation expense of $1,000.

Amortization of $30,000 was expensed on the income statement in 20x7. CCA has been correctly ca at $28,500 for 20x7 and has not been transferred from the tax accounts to the financial statements. B utilizes the maximum CCA deduction each year.

Bean Co. paid dividends totaling $5,000 during 20x7. Required:

A)Calculate Bean Co.'s 20x7 net income for tax purposes.

B)Calculate Bean Co.'s 20x7 taxable income.

C)Calculate the small-business deduction for Bean Co. for 20x7. (Identify the values for Bean Co.'s business income, taxable income, and annual limit amount.)

D)Calculate Bean Co.'s 20x7 Part IV tax and dividend refund, if applicable.

received from a taxable Canadian corporation. The remaining income was from active business. Additional information:

The dividends were received from Grow Ltd., a connected Canadian-controlled private corporation. Grow has only one class of shares, and the total amount of dividends paid in 20x7 was $50,000.

Grow received a refund of $9,000 as a result of paying the dividend.

Bean Co. had a balance in its Refundable Dividend Tax on Hand Account of $3,000 at the end of 20x6. The company did not receive a dividend refund in 20x6.

Bean Co. is associated with Pea Co. Pea Co. used $220,000 of the small business deduction limit on its 20x7 tax return

Bean Co.'s 20x7 profits include a donation expense of $1,000.

Amortization of $30,000 was expensed on the income statement in 20x7. CCA has been correctly ca at $28,500 for 20x7 and has not been transferred from the tax accounts to the financial statements. B utilizes the maximum CCA deduction each year.

Bean Co. paid dividends totaling $5,000 during 20x7. Required:

A)Calculate Bean Co.'s 20x7 net income for tax purposes.

B)Calculate Bean Co.'s 20x7 taxable income.

C)Calculate the small-business deduction for Bean Co. for 20x7. (Identify the values for Bean Co.'s business income, taxable income, and annual limit amount.)

D)Calculate Bean Co.'s 20x7 Part IV tax and dividend refund, if applicable.

$1,917

4

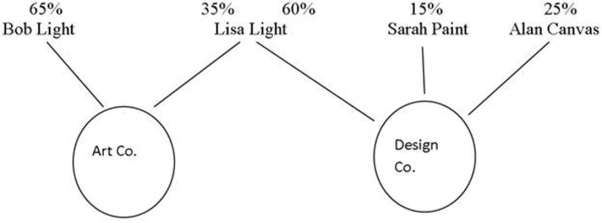

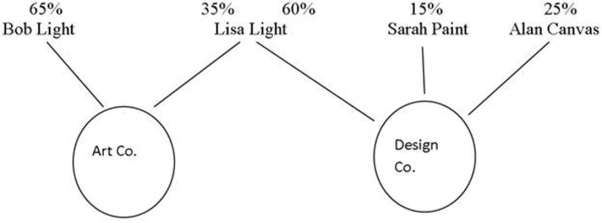

The following diagram depicts the ownership structure of two CCPCs. Bob Light is Lisa Light's son.

Sarah Paint and Alan Canvas are not related to Bob and Lisa in any manner, whatsoever, or to one another. All of the shares held are common.

Required:

Required:

A)Determine if the two companies are associated, referring to the applicable section of the Income Tax Act.

B)Briefly explain what the most significant tax implication is when two or more corporations are associated.

Sarah Paint and Alan Canvas are not related to Bob and Lisa in any manner, whatsoever, or to one another. All of the shares held are common.

Required:

Required: A)Determine if the two companies are associated, referring to the applicable section of the Income Tax Act.

B)Briefly explain what the most significant tax implication is when two or more corporations are associated.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

5

Corporation X had an RDTOH balance of $15,000 at the end of 20x0, and the dividend refund to the company that year was $7,000. The company's Part IV tax for 20x1 is $8,000. The company's active business income is $475,000 and its taxable income is

$410,000. Corporation Y, which is associated with Corporation X, was allocated

$125,000 of the small business deduction in 20x1. Corporation X's aggregate investment income was $50,000 in 20x1. Part I tax for 20x1 was $60,000. What is the RDTOH

Balance at the end of 20x1? (Round all numbers)

A)$8,000

B)$26,735

C)$16,000

D)$65,625

$410,000. Corporation Y, which is associated with Corporation X, was allocated

$125,000 of the small business deduction in 20x1. Corporation X's aggregate investment income was $50,000 in 20x1. Part I tax for 20x1 was $60,000. What is the RDTOH

Balance at the end of 20x1? (Round all numbers)

A)$8,000

B)$26,735

C)$16,000

D)$65,625

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

6

Private Co. received a $5,000 dividend from Public Co., which is a non-connected corporation. Which of the following applies?

A)The dividend will be subject to a tax rate of 38 1/3%.

B)Receipt of the dividend will result in an immediate dividend refund for Private Co.

C)The dividends can be reinvested by Private Co. on a tax-free basis.

D)The dividend will be subject to Part I tax.

A)The dividend will be subject to a tax rate of 38 1/3%.

B)Receipt of the dividend will result in an immediate dividend refund for Private Co.

C)The dividends can be reinvested by Private Co. on a tax-free basis.

D)The dividend will be subject to Part I tax.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following types of corporate income are subject to the special refundable tax of 10 2/3%, and a tax reduction of 30 2/3% upon distribution of the income to shareholders?

A)Specified investment income and taxable capital gains.

B)Specified investment income and dividend income.

C)Dividend income and net taxable capital gains.

D)Business income and net property income.

A)Specified investment income and taxable capital gains.

B)Specified investment income and dividend income.

C)Dividend income and net taxable capital gains.

D)Business income and net property income.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

8

Chartered Tours Inc. (CTI)started operations this year and had a net income for tax purposes of

$800,000. (Chartered Tours Inc. operates in a province which has a provincial tax reduction on income earned from manufacturing and processing.)

During the year, CTI:

a)made a contribution of $25,000 to eligible charities;

b)received $30,000 in dividends from taxable Canadian corporations;

c)recognized manufacturing and processing profits of $250,000; and

d)had active business income of $770,000.

For tax purposes, CTI is associated with Rocky Mountain Hikers Inc. (RMHI). RMHI used

$310,000 of the small business deduction for its active business income. Required:

Calculate the following, ignoring provincial taxes:

a)CTI's taxable income

b)CTI's small business deduction

c)The M & P deduction available to CTI

d)CTI's general rate reduction

e)The balance in CTI's GRIP account at the end of the year

$800,000. (Chartered Tours Inc. operates in a province which has a provincial tax reduction on income earned from manufacturing and processing.)

During the year, CTI:

a)made a contribution of $25,000 to eligible charities;

b)received $30,000 in dividends from taxable Canadian corporations;

c)recognized manufacturing and processing profits of $250,000; and

d)had active business income of $770,000.

For tax purposes, CTI is associated with Rocky Mountain Hikers Inc. (RMHI). RMHI used

$310,000 of the small business deduction for its active business income. Required:

Calculate the following, ignoring provincial taxes:

a)CTI's taxable income

b)CTI's small business deduction

c)The M & P deduction available to CTI

d)CTI's general rate reduction

e)The balance in CTI's GRIP account at the end of the year

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck