Deck 8: Gains and Losses on the Disposition of Capital Propertycapital Gains

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/8

Play

Full screen (f)

Deck 8: Gains and Losses on the Disposition of Capital Propertycapital Gains

1

Sarah Green purchased a piece of land in 20x8 with plans to build and operate a greenhouse and evergreen nursery. Sarah is a full-time teacher, but has always dreamed of also running her own business. It is now 20x9 and Sarah has not yet started her

Business, and upon receiving an offer to teach on a tropical island, has decided to sell the land. Which of the following statements is TRUE?

A)The intent of the purchase is insignificant when determining the type of income to report.

B)Sarah's primary intent suggests that the income should be treated as a business transaction.

C)Sarah purchased the land with the primary intent to recognize a long-term economic benefit.

D)Sarah purchased the land with the primary intent to resell it at a profit.

Business, and upon receiving an offer to teach on a tropical island, has decided to sell the land. Which of the following statements is TRUE?

A)The intent of the purchase is insignificant when determining the type of income to report.

B)Sarah's primary intent suggests that the income should be treated as a business transaction.

C)Sarah purchased the land with the primary intent to recognize a long-term economic benefit.

D)Sarah purchased the land with the primary intent to resell it at a profit.

C

2

Mandy holds shares in Y Co. Recently, the shares have been experiencing a decline in market value. She originally purchased 1000 shares in 20x0 at $5 per share. On September 22nd of 20x1 she sold the shares when they were trading for only $3 per

Share. On October 3rd she felt optimistic that the market value would rise substantially by the end of the year, so she repurchased 1000 shares of Y Co. at $2.50 per share.

Which of the following is true for Mandy?

A)Mandy can recognize a $2,000 capital loss on the sale of her shares on her 20x1 tax return.

B)The adjusted cost base of Mandy's new shares is $4,500.

C)Mandy can recognize a $2,000 superficial loss on the sale of her shares on her 20x1 tax return.

D)The adjusted cost base of Mandy's new shares is $2,500.

Share. On October 3rd she felt optimistic that the market value would rise substantially by the end of the year, so she repurchased 1000 shares of Y Co. at $2.50 per share.

Which of the following is true for Mandy?

A)Mandy can recognize a $2,000 capital loss on the sale of her shares on her 20x1 tax return.

B)The adjusted cost base of Mandy's new shares is $4,500.

C)Mandy can recognize a $2,000 superficial loss on the sale of her shares on her 20x1 tax return.

D)The adjusted cost base of Mandy's new shares is $2,500.

B

3

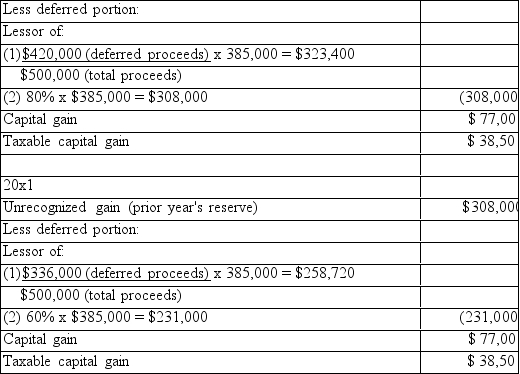

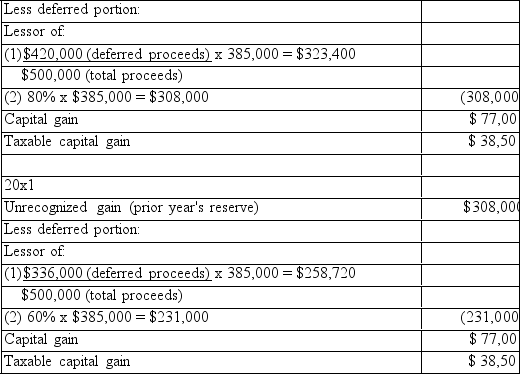

Mr. Yee sold a piece of land in 20x0 for $500,000. He originally paid $100,000 for the land. Selling totaled $15,000. The land is classified as capital property. The purchaser of the land paid Mr. Yee $8 20x0, and will pay $84,000 each year for the next five years.

Required:

Calculate the taxable capital gain that Mr. Yee will have to include in his income for tax purposes in 20x0 and 20x1.

Required:

Calculate the taxable capital gain that Mr. Yee will have to include in his income for tax purposes in 20x0 and 20x1.

4

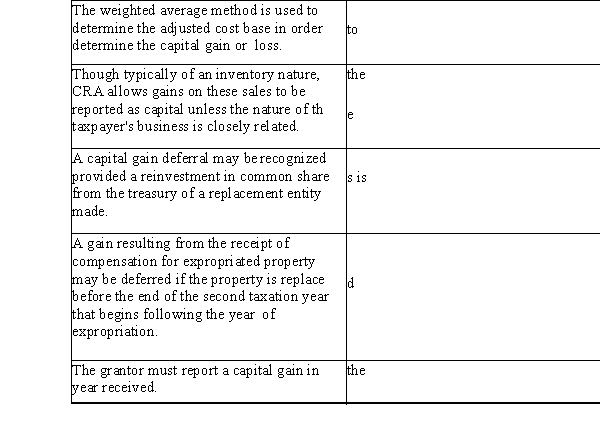

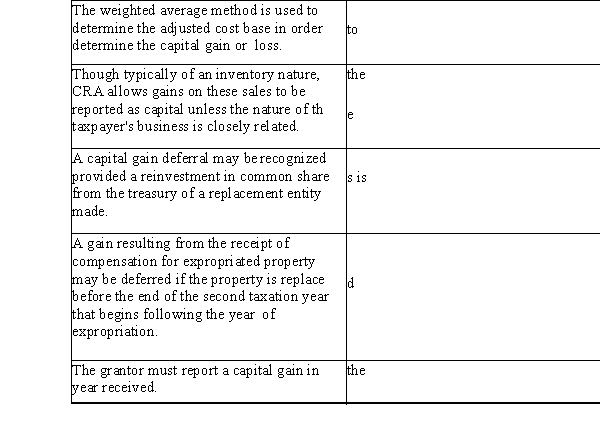

The following cases pertain to some of the unique aspects regarding the sale of various types of capit properties. Next to each case, identify (from the list)the type of capital property that applies. (Select category of capital property for each case and use each category only once.)  List of capital properties:

List of capital properties:

1. Identical properties

2. Options

3. Commodities and futures transactions

4. Voluntary and involuntary dispositions

5. Eligible small-business investments

6. Gifts of Canadian public securities

List of capital properties:

List of capital properties:1. Identical properties

2. Options

3. Commodities and futures transactions

4. Voluntary and involuntary dispositions

5. Eligible small-business investments

6. Gifts of Canadian public securities

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following rules regarding the tax treatment of a principal residence is FALSE?

A)If a taxpayer only owns one residence, the 'principal residence formula' reduces any capital gain on the sale to nil.

B)When a taxpayer owns more than one residence, the decision to designate a particular property as the 'principal residence' occurs at the time of sale.

C)A capital loss cannot be realized on the sale of a principal residence.

D)Properties can be designated to each married or common-law partner in a family for the purpose of reducing the gains on the sale of two principal residences.

A)If a taxpayer only owns one residence, the 'principal residence formula' reduces any capital gain on the sale to nil.

B)When a taxpayer owns more than one residence, the decision to designate a particular property as the 'principal residence' occurs at the time of sale.

C)A capital loss cannot be realized on the sale of a principal residence.

D)Properties can be designated to each married or common-law partner in a family for the purpose of reducing the gains on the sale of two principal residences.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

6

Evergreen Trees Inc. is a CCPC operating in your province. The company has a December 31st

year-end.

Three asset sales occurred prior to the end of 20x1. The following information pertains to the net gai sale of the assets:

Asset 1: Building (One of several owned by the company)

The building was previously purchased for $80,000. At the time of the sale in 20x1, the accumulated amortization on the building was $10,000. The UCC balance was $65,000. The full payment of $110 received before the end of the year.

Asset 2: Land

The land was purchased for $200,000 and sold in 20x1 for $250,000. Proceeds of $60,000 will be rec year. The remainder of the payment will be received in equal installments over the next eight years.

Asset 3: Marketable Securities

The company sold its entire public portfolio this year. The adjusted cost base of the shares was $100, market value of the shares at the time of sale in 20x1 was $135,000. Selling costs on the sale were $5

Required:

A)Calculate the minimum taxable capital gain that Evergreen Trees Inc. will have to report in 20x1.

B)Calculate the minimum taxable capital gain that must be reported in 20x2.

year-end.

Three asset sales occurred prior to the end of 20x1. The following information pertains to the net gai sale of the assets:

Asset 1: Building (One of several owned by the company)

The building was previously purchased for $80,000. At the time of the sale in 20x1, the accumulated amortization on the building was $10,000. The UCC balance was $65,000. The full payment of $110 received before the end of the year.

Asset 2: Land

The land was purchased for $200,000 and sold in 20x1 for $250,000. Proceeds of $60,000 will be rec year. The remainder of the payment will be received in equal installments over the next eight years.

Asset 3: Marketable Securities

The company sold its entire public portfolio this year. The adjusted cost base of the shares was $100, market value of the shares at the time of sale in 20x1 was $135,000. Selling costs on the sale were $5

Required:

A)Calculate the minimum taxable capital gain that Evergreen Trees Inc. will have to report in 20x1.

B)Calculate the minimum taxable capital gain that must be reported in 20x2.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

7

When establishing whether the sale of an asset is capital income or business income, which of the following is not one of the factors which the courts take into consideration when determining the original intention of a transaction?

A)Number and frequency of transactions

B)Period of ownership

C)Relation of transaction to taxpayer's business

D)Canadian residency test

A)Number and frequency of transactions

B)Period of ownership

C)Relation of transaction to taxpayer's business

D)Canadian residency test

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

8

Anne Smith acquired her house in 20x0 for $150,000 and her cottage in 20x4 for $100,000. Due to a estate prices, she has decided to sell both properties and backpack around the world for two years. B properties were sold in October of 20x8. Anne received proceeds of $375,000 for the house, and $25 the cottage.

Required:

Calculate the minimum taxable capital gain that Anne will report for her house and her cottage on he tax return. Show all calculations, identifying the taxable capital gain for each property.

Required:

Calculate the minimum taxable capital gain that Anne will report for her house and her cottage on he tax return. Show all calculations, identifying the taxable capital gain for each property.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck