Deck 5: Accounting for Merchandising Operations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/201

Play

Full screen (f)

Deck 5: Accounting for Merchandising Operations

1

A periodic system of inventory will give the company much more control over their inventory.

False

2

Purchase discounts are offered to customers for the early payment of the balance due.

True

3

Every seller offers purchase discounts.

False

4

Goods that have been sold in a merchandising company are called cost of goods sold.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

5

Goods available for sale can be defined as inventory.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

6

If sales terms are FOB destination, the buyer is responsible for getting the goods to their intended destination.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

7

A quantity discount is a reduction in price according to the volume of the purchase.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

8

In the perpetual system of inventory, when merchandise is purchased for resale to customers, the account Merchandise Inventory is debited.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

9

A quantity discount is the same as a purchase discount.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

10

A perpetual inventory system makes it easier for the company to answer questions about the availability of merchandise.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

11

The operating expenses of a merchandising company will be different than the operating expenses of a service company.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

12

Operating expenses will only occur in a merchandising company.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

13

A service company will NOT have to measure gross profit.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

14

In a periodic inventory system, detailed records of the goods on hand are kept throughout the period.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

15

A physical count of the inventory system at year end is only required in the periodic system of inventory.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

16

A retail company and a service company have different ways of measuring profit.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

17

Service revenue minus operating expenses equals gross profit.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

18

A perpetual inventory system requires the company only determine the cost of goods sold at the end of the accounting period.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

19

The normal operating cycle of a merchandising company is shorter than the cycle of a service company.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

20

An operating cycle is the average time that it takes to go from cash to cash in producing revenues.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

21

A single-step Income Statement is only done when using the periodic inventory system.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

22

A single-step Income Statement is named because there is only one step in determining profit.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

23

A single-step Income Statement is considered more useful because it provides a detailed breakdown of all the categories of expenses.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

24

Freight costs are always a cost to the purchasing company.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

25

If Gross Profit is $80,000 and operating expenses are $55,000, then the Profit from Operations is $25,000.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

26

If a company purchases goods FOB shipping point, the purchasing company will be responsible for the payment of the freight costs.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

27

The Sales Discount account is a contra revenue account.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

28

The perpetual system requires a second journal entry, increasing cost of goods sold and decreasing merchandise inventory when goods are sold.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

29

FOB Shipping point means that the seller is responsible for the freight costs.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

30

A multiple-step Income Statement is consistent with International Financial Reporting Standards.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

31

Under a perpetual inventory system, any freight which is incurred when purchasing the inventory is debited to the inventory account.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

32

In a multiple-step Income Statement, operating expenses are deducted from Gross Profit to give the Profit from Operations.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

33

The gross profit section for a merchandising company appears on both the multiple-step and single-step forms of an income statement.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

34

The Sales Returns and Allowances account is a contra revenue account.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

35

Sales discounts are only used in a perpetual inventory system.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

36

There are additional steps required in the accounting cycle for a merchandising company than for a service company.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

37

In a perpetual system, there are 2 journal entries when making a sale of goods.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

38

A Sales Returns and Allowances account is only used in a perpetual inventory system.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

39

When a company returns merchandise to its supplier under a perpetual inventory system, the inventory account will be debited.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

40

A large balance in the Sales Returns and Allowances account may indicate that the merchandise which is being sold is of inferior quality.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

41

A decrease in cost of goods sold will always increase a company's gross profit margin.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

42

To increase their gross profit margin, a company should increase their sales.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

43

Artist Company has net sales of $350,000 and cost of goods sold is $275,000. If all other expenses equal $40,000, the company's profit margin is 10%.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

44

When a company returns merchandise to its supplier under a periodic inventory system, the Purchases Account is credited.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

45

An increase in a company's gross profit will mean an increase in gross profit margin.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

46

To increase their gross profit margin, a company should decrease their operating expenses.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

47

Gross profit margin is an example of a liquidity ratio.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

48

If there are no "non- operating" activities, then Profit from Operations equals the company's profit.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

49

Profit is the final outcome of a company's operating and non operating activities.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

50

Non operating expenses are any expenses which are NOT related to the company's main operations.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

51

In the periodic system of accounting, the cost of goods sold is NOT recorded at the time of sale of goods.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

52

An increase in sales will always increase a company's gross profit margin.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

53

In a periodic inventory system, detailed records of each inventory purchase are maintained.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

54

Gross profit margin is net sales divided by cost of goods sold.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

55

An increase in profit when accompanied with a decrease in net sales will increase profit margin.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

56

Gross profit margin is calculated by dividing cost of goods sold by net sales.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

57

A company can improve its profit margin by increasing its gross profit margin.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

58

To increase their gross profit margin, a company should decrease their cost of goods sold.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

59

Purchases is a temporary account reported on the income statement as an expense.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

60

Under a periodic inventory system, the inventory account is updated when the sale is recorded.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

61

Net purchases is determined by adding purchase returns and allowances to total purchases.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

62

When contrasting a perpetual inventory system to a periodic system, the

A) perpetual system requires less clerical work.

B) perpetual system provides better control over inventories.

C) periodic system requires more clerical work.

D) periodic system provides better control over inventories.

A) perpetual system requires less clerical work.

B) perpetual system provides better control over inventories.

C) periodic system requires more clerical work.

D) periodic system provides better control over inventories.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

63

The journal entry to record a return of merchandise purchased on account under a perpetual inventory system would credit

A) Accounts Payable.

B) Purchase Returns and Allowances.

C) Purchase Discounts.

D) Merchandise Inventory.

A) Accounts Payable.

B) Purchase Returns and Allowances.

C) Purchase Discounts.

D) Merchandise Inventory.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

64

A company which sells goods to customers is known as a

A) proprietorship.

B) corporation.

C) merchandising company.

D) service company.

A) proprietorship.

B) corporation.

C) merchandising company.

D) service company.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

65

In a perpetual inventory system, cost of goods sold is recorded

A) on a daily basis.

B) at the end of the accounting period.

C) on an annual basis.

D) with each sale.

A) on a daily basis.

B) at the end of the accounting period.

C) on an annual basis.

D) with each sale.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

66

Cost of goods available for sale, in a periodic inventory system, is deducted from beginning inventory to determine cost of goods purchased.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following is a true statement about inventory systems?

A) Periodic inventory systems require more detailed inventory records.

B) Perpetual inventory systems require more detailed inventory records.

C) A periodic system requires cost of goods sold be determined after each sale.

D) A perpetual system is specifically designed for companies that sell low unit-value items.

A) Periodic inventory systems require more detailed inventory records.

B) Perpetual inventory systems require more detailed inventory records.

C) A periodic system requires cost of goods sold be determined after each sale.

D) A perpetual system is specifically designed for companies that sell low unit-value items.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

68

Operating expenses are

A) expenses incurred to pay employees.

B) expenses avoided to make a sale.

C) expenses incurred in the process of earning revenue.

D) expenses incurred to calculate gross profit.

A) expenses incurred to pay employees.

B) expenses avoided to make a sale.

C) expenses incurred in the process of earning revenue.

D) expenses incurred to calculate gross profit.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

69

In a periodic inventory system, the inventory is adjusted

A) each time inventory is purchased.

B) each time inventory is sold.

C) when inventory is counted at the end of the accounting period.

D) at the end of each month.

A) each time inventory is purchased.

B) each time inventory is sold.

C) when inventory is counted at the end of the accounting period.

D) at the end of each month.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

70

Cost of goods sold, in a periodic inventory system, is determined by adding the cost of goods purchased to the ending inventory.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

71

If a company determines cost of goods sold each time a sale occurs, it

A) must have a computer accounting system.

B) must have a service business.

C) uses a periodic inventory system.

D) uses a perpetual inventory system.

A) must have a computer accounting system.

B) must have a service business.

C) uses a periodic inventory system.

D) uses a perpetual inventory system.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

72

The operating cycle of a merchandising company differs from that of a service company in that it

A) is usually longer in days.

B) is usually shorter in days.

C) involves the purchase of inventory.

D) involves the sale of merchandise.

A) is usually longer in days.

B) is usually shorter in days.

C) involves the purchase of inventory.

D) involves the sale of merchandise.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

73

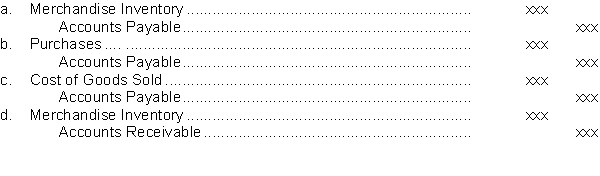

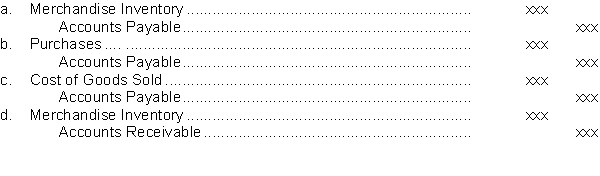

Under a perpetual inventory system, the following entry would be made to record the purchase of inventory on account:

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following statements is correct?

A) A service company does not have Cost of Goods Sold account because it does not sell goods.

B) A service company does have a Cost of Goods Sold account because it sells a service.

C) A merchandising company does not have a Cost of Goods Sold account because it does not sell goods.

D) A merchandising company does not have a Cost of Goods Sold account because it only sells a service.

A) A service company does not have Cost of Goods Sold account because it does not sell goods.

B) A service company does have a Cost of Goods Sold account because it sells a service.

C) A merchandising company does not have a Cost of Goods Sold account because it does not sell goods.

D) A merchandising company does not have a Cost of Goods Sold account because it only sells a service.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

75

Two categories of expenses in merchandising companies are

A) cost of goods sold and financing expenses.

B) operating expenses and financing expenses.

C) cost of goods sold and operating expenses.

D) sales and cost of goods sold.

A) cost of goods sold and financing expenses.

B) operating expenses and financing expenses.

C) cost of goods sold and operating expenses.

D) sales and cost of goods sold.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

76

Under a perpetual inventory system, acquisition of merchandise for resale is debited to the

A) Merchandise Inventory account.

B) Cost of Goods Sold account.

C) Purchase Returns and Allowances account.

D) Purchases account.

A) Merchandise Inventory account.

B) Cost of Goods Sold account.

C) Purchase Returns and Allowances account.

D) Purchases account.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following statements is correct?

A) Under a periodic system, the inventory account is only updated once per period.

B) Under a perpetual system, the inventory account is only updated once per period.

C) Cost of goods sold computed under a periodic system would be higher than under a perpetual system.

D) The value of inventory computed under a periodic system would be lower than under a perpetual system.

A) Under a periodic system, the inventory account is only updated once per period.

B) Under a perpetual system, the inventory account is only updated once per period.

C) Cost of goods sold computed under a periodic system would be higher than under a perpetual system.

D) The value of inventory computed under a periodic system would be lower than under a perpetual system.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

78

A merchandiser differs from a service type business in that it

A) sells goods to customers.

B) has more employees.

C) only operates in one country.

D) requires more government regulation.

A) sells goods to customers.

B) has more employees.

C) only operates in one country.

D) requires more government regulation.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

79

Sales revenue less the cost of goods sold equals

A) operating expenses.

B) gross profit.

C) ending inventory

D) profit.

A) operating expenses.

B) gross profit.

C) ending inventory

D) profit.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following companies would NOT be considered a merchandising company?

A) Mountain Equipment Co-op

B) Walmart

C) Air Canada

D) Microsoft

A) Mountain Equipment Co-op

B) Walmart

C) Air Canada

D) Microsoft

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck