Deck 19: Organizational Architecture, Risk Management, and Security Design

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/15

Play

Full screen (f)

Deck 19: Organizational Architecture, Risk Management, and Security Design

1

Firms that face a _____tax rate structure have an incentive to hedge, because it can reduce the firm's expected tax liability.

A)flat

B)regressive (or concave)

C)decelerating

D)progressive (or convex)

A)flat

B)regressive (or concave)

C)decelerating

D)progressive (or convex)

progressive (or convex)

2

The ______is a convertible bond in which the date of conversion is fixed in advance.

A)managed convertible.

B)mandatory convertible.

C)fixed convertible.

D)dated convertible.

A)managed convertible.

B)mandatory convertible.

C)fixed convertible.

D)dated convertible.

mandatory convertible.

3

A ____contract is a private, tailored, bilateral agreement between two parties in which one party agrees to purchase, and the other to sell, a specified number of units of a specified asset at a given future date and at a specified price.

A)swap

B)forward

C)futures

D)warrant

A)swap

B)forward

C)futures

D)warrant

forward

4

The ______gives the bond issuer an option to redeem a specified fraction of the bond issue within a specified period at a predetermined price, but only by using funds from a subsequent equity offering.

A)subsequent events provision

B)clawback provision

C)contingency provision

D)conversion provision

A)subsequent events provision

B)clawback provision

C)contingency provision

D)conversion provision

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

5

The two constructs that form a firm's organizational architecture are:

A)business architecture and economic architecture.

B)economic architecture and financial architecture.

C)business architecture and financial architecture.

D)organizational hierarchy and financial structure.

A)business architecture and economic architecture.

B)economic architecture and financial architecture.

C)business architecture and financial architecture.

D)organizational hierarchy and financial structure.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

6

With a make whole call provision:

A)the firm to pay a call price that is sufficient to provide bondholders an ex post return equal to the return they would have received on a noncallable Treasury bond with the same original maturity as the called bond.

B)the firm must retire either the entire (or whole) bond issue or none of the bonds.

C)bondholders are allowed to redeem their bonds at par value.

D)the firm has the option to restore bondholders' wealth by issuing new bonds, that would sell at par value, in exchange for the original bonds.

A)the firm to pay a call price that is sufficient to provide bondholders an ex post return equal to the return they would have received on a noncallable Treasury bond with the same original maturity as the called bond.

B)the firm must retire either the entire (or whole) bond issue or none of the bonds.

C)bondholders are allowed to redeem their bonds at par value.

D)the firm has the option to restore bondholders' wealth by issuing new bonds, that would sell at par value, in exchange for the original bonds.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

7

Regarding components and elements of the firm's business architecture, which of the following represents the logical direction of causality (i.e., in terms of which component/element drives another component/element) generally runs as follows (indicated by arrows):

A)macroeconomic & fin.market environments internal legal & governance structures.

B)diversification versus focus industry characteristics.

C)business strategies and growth opportunities financial market environment.

D)size and capital intensity macroeconomic & financial market environments.

A)macroeconomic & fin.market environments internal legal & governance structures.

B)diversification versus focus industry characteristics.

C)business strategies and growth opportunities financial market environment.

D)size and capital intensity macroeconomic & financial market environments.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

8

Regarding a firm's overall organizational architecture, the direction of causality (i.e., in terms of which components/elements drive other components/elements) generally runs:

A)business architecture financial architecture.

B)financial architecture business architecture.

C)economic architecture financial architecture.

D)financial architecture economic architecture.

A)business architecture financial architecture.

B)financial architecture business architecture.

C)economic architecture financial architecture.

D)financial architecture economic architecture.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

9

___bonds pay coupon interest in the form of additional bonds instead of cash.

A)Deferred coupon

B)Payment-in-kind

C)Zero-coupon

D)In lieu

A)Deferred coupon

B)Payment-in-kind

C)Zero-coupon

D)In lieu

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

10

A swap contract is in essence a portfolio, or series, of _________

A)forward contracts.

B)futures contracts.

C)repurchase agreements.

D)resettlement agreements.

A)forward contracts.

B)futures contracts.

C)repurchase agreements.

D)resettlement agreements.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is NOT a valid reason for a firm to establish subsidiaries?

A)to better control risk exposure of either parent-to- subsidiary or subsidiary-to-parent.

B)to enhance the company's ability to evaluate individual performance and to create different compensation systems for a diverse set of its businesses.

C)to obfuscate financial reporting.

D)to conform with regulatory requirements specific to a particular business environment.

A)to better control risk exposure of either parent-to- subsidiary or subsidiary-to-parent.

B)to enhance the company's ability to evaluate individual performance and to create different compensation systems for a diverse set of its businesses.

C)to obfuscate financial reporting.

D)to conform with regulatory requirements specific to a particular business environment.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is NOT an element of investors' preferences that influences a firm's financial architecture?

A)preferences for work vs.leisure

B)liquidity needs

C)investment horizon

D)risk tolerance

A)preferences for work vs.leisure

B)liquidity needs

C)investment horizon

D)risk tolerance

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

13

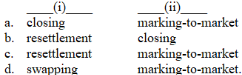

Futures trading features daily ____(i)_in cash and ____(ii)____.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

14

The macroeconomic component of a firm's business architecture includes all of the following elements EXCEPT:

A)economic growth projections, inflation, and taxes.

B)industry characteristics.

C)legal environment.

D)macroeconomic risk factors.

A)economic growth projections, inflation, and taxes.

B)industry characteristics.

C)legal environment.

D)macroeconomic risk factors.

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck

15

____has become an important means by which huge infrastructure projects are privately financed.

A)Private placement financing

B)Infrastructure funding

C)Project finance

D)Country finance

A)Private placement financing

B)Infrastructure funding

C)Project finance

D)Country finance

Unlock Deck

Unlock for access to all 15 flashcards in this deck.

Unlock Deck

k this deck