Deck 9: Market Efficiency, Event Studies, Cost of Equity Capital, and Equity Valuation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/12

Play

Full screen (f)

Deck 9: Market Efficiency, Event Studies, Cost of Equity Capital, and Equity Valuation

1

At date 0, the market's expectation for the year 1 dividend on firm XYZ's stock is D1=$1.45.The market also expects dividends to grow at an annual rate of gS=2% in the following 3 years after which dividends will grow at an annual rate of gN=6% into perpetuity.If the firm's cost of equity capital is rE=1%, the value of XYZ stock is:

A)$31.52

B)$25.52

C)$19.52

D)$13.52

A)$31.52

B)$25.52

C)$19.52

D)$13.52

$31.52

2

The following information on the stock of Avon, Inc.was obtained on Thurs., Nov.11, 1999: Stock price = VE = $28.50;

Latest annual dividends per share = Dt-1 = $0.72

5-year average earnings growth rate = ghistorical = 4.31%

Suppose dividends per share for the next year are projected to be Dt = $0.75.If we also assume that the market is pricing Avon stock to have an expected return of rE = 9%, is the market pricing Avon stock to have _____earnings growth rate, g, than/as it had over the past 5 years?

A)a higher

B)a lower

C)the same

Latest annual dividends per share = Dt-1 = $0.72

5-year average earnings growth rate = ghistorical = 4.31%

Suppose dividends per share for the next year are projected to be Dt = $0.75.If we also assume that the market is pricing Avon stock to have an expected return of rE = 9%, is the market pricing Avon stock to have _____earnings growth rate, g, than/as it had over the past 5 years?

A)a higher

B)a lower

C)the same

a higher

3

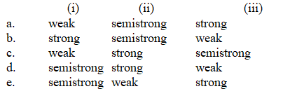

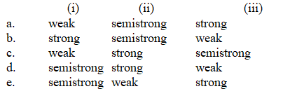

In the ____(i)_of the efficient market hypothesis (EMH), a security's price reflects all publicly available information.In the _____(ii)_ form of the EMH, a security's price reflects all information that may be contained in the historical prices of a security.In the ____(iii)_of the EMH, a security's price reflects all information, whether it is public information or information held privately.

E

4

The management of firm XYZ tends to pay out 35% of its earnings in dividends each year, while the remainder is retained for capital investments that provide an expected ROE of 18%.If the firm's cost of equity capital is 13% and next year's expected dividend is Dt=$0.50 per share, compute the value of the firm's shares using the constant dividend growth model as interpreted through the sustainable growth model.

A)$7.46

B)$17.46

C)$27.46

D)$37.46

A)$7.46

B)$17.46

C)$27.46

D)$37.46

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

5

Masulis (1980) documented evidence that the market generally reacts favorably to a leverage- increasing debt-for-equity swap, and unfavorably to a leverage decreasing equity-for-debt swap.Which of the following is NOT a legitimate theoretical explanation for these market reactions?

A)Increasing leverage increases the tax shield of debt, while extinguishing debt decreases it.

B)Increasing leverage induces an expropriation of wealth from existing creditors, while extinguishing debt accomplishes the opposite.

C)Increasing leverage via a swap involves paying a dividend to shareholders while decreasing leverage via a swap forces the firm to issue equity.

D)Increasing leverage disciplines management to act in shareholders' interest by absorbing free cash flow, while decreasing leverage increases management's ability to pursue self-serving activities.

A)Increasing leverage increases the tax shield of debt, while extinguishing debt decreases it.

B)Increasing leverage induces an expropriation of wealth from existing creditors, while extinguishing debt accomplishes the opposite.

C)Increasing leverage via a swap involves paying a dividend to shareholders while decreasing leverage via a swap forces the firm to issue equity.

D)Increasing leverage disciplines management to act in shareholders' interest by absorbing free cash flow, while decreasing leverage increases management's ability to pursue self-serving activities.

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

6

In recent years, Sears, Roebuck & Co.has paid out only 32% of its earnings in dividends.Retained earnings have been invested in expansion projects that have yielded an average ROE of 20%.If Sears' cost of equity capital is 16% and next year's expected dividend is $1 per share, compute the value of Sears' shares using the constant dividend growth model as interpreted through the sustainable growth model.

A)$5.01

B)$9.87

C)$20.47

D)$41.67

A)$5.01

B)$9.87

C)$20.47

D)$41.67

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

7

The beta ( ) of Ames' stock is 2.5.The riskfree rate is 2%, and the expected return on the market portfolio is 16%.What is the expected return on Ames' stock?

A)22%

B)27%

C)32%

D)37%

A)22%

B)27%

C)32%

D)37%

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

8

If the securities markets are efficient, the market's reaction to new information about a firm's value (such as an earnings announcement) should be:

A)gradual, as investors rationally deliberate the effect of the information on the stock's value.

B)immediate and unbiased.

C)slow or fast, depending on the amount of 'surprise' contained in the new information.

D)negligible (the information would have already been impounded into the firm's stock price).

A)gradual, as investors rationally deliberate the effect of the information on the stock's value.

B)immediate and unbiased.

C)slow or fast, depending on the amount of 'surprise' contained in the new information.

D)negligible (the information would have already been impounded into the firm's stock price).

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

9

Over the weekend prior to April 3, 2000, a U.S.District Court ruled that Microsoft Corp.is a monopoly.On Monday, April 3, Microsoft's stock return was -14.47%, while the return on the S&P500 (the 'market') was 0.49%.For the two years leading up to this date, the 'market model' relationship between Microsoft's daily returns and the market's daily returns was as given below.Using this market model relationship, compute the 'abnormal return' on Microsoft's stock on April 3, 2000.

RMSFT=0.19% + 0.60(RMKT) + .

A)-2.56%

B)-5.56%

C)-8.56%

D)-14.95%

RMSFT=0.19% + 0.60(RMKT) + .

A)-2.56%

B)-5.56%

C)-8.56%

D)-14.95%

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

10

In an event study, what two steps does a researcher take to adjust for the valuation effects of other new (and simultaneously-revealed) value-relevant information, in order to isolate the valuation effect of a specific event?

A)(i) using the market model to remove the effects of other firm-specific factors; and (ii) averaging abnormal returns across many firms with a similar event to wash out the effect of the market.

B)(i) using the market model to remove the effect of the market; and (ii) averaging abnormal returns across many firms with a similar event to wash out the effects of other firm-specific factors.

C)(i) averaging returns on 'event' stocks over several days to 'smooth' the information impact; and (ii) washing out the effect of the market by including only days when the market return was small.

D)(i) averaging returns on 'event' stocks over several days by including only days when the market return was small; and (ii) washing out the effect of the market to 'smooth' the information impact.

A)(i) using the market model to remove the effects of other firm-specific factors; and (ii) averaging abnormal returns across many firms with a similar event to wash out the effect of the market.

B)(i) using the market model to remove the effect of the market; and (ii) averaging abnormal returns across many firms with a similar event to wash out the effects of other firm-specific factors.

C)(i) averaging returns on 'event' stocks over several days to 'smooth' the information impact; and (ii) washing out the effect of the market by including only days when the market return was small.

D)(i) averaging returns on 'event' stocks over several days by including only days when the market return was small; and (ii) washing out the effect of the market to 'smooth' the information impact.

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

11

The price of GE stock is $38, and its latest annual earnings per share was $1.37.If the appropriate discount rate for GE stock is rE=10%, what is the present value of GE's profitable future investment opportunities (PVPFIO)?

A)$14.30

B)$19.30

C)$24.30

D)$34.30

A)$14.30

B)$19.30

C)$24.30

D)$34.30

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

12

The following information on the stock of Avon, Inc.was obtained on Thursday, November 11, 1999: P/E ratio = 24.36, and the latest annual earnings is Et = 1.17 per share.If we assume that the expected return on Avon stock is rE=9%, what is the present value of Avon's profitable future investment opportunities (PVPFIO)?

A)$ 7.25

B)$13.25

C)$20.25

D)$27.25

A)$ 7.25

B)$13.25

C)$20.25

D)$27.25

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck