Deck 7: Industry Analysis and Financial Policies and Strategies

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/8

Play

Full screen (f)

Deck 7: Industry Analysis and Financial Policies and Strategies

1

Economies of scale are present where the cost of producing each unit declines as the quantity of product produced increases.In this environment, large-scale firms have a cost advantage.Thus, economies of scale serve to ____the cost of entry into an industry.

A)increase

B)decrease

A)increase

B)decrease

increase

2

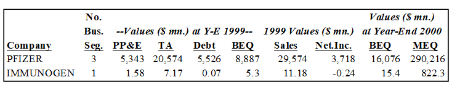

For the following problem requires the data shown below for a large firm (Pfizer) and a smaller firm (Immunogen) in the Chemicals & Allied Products industry:

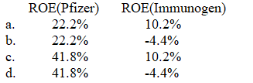

Calculate each firm's 2000 ROE.

Calculate each firm's 2000 ROE.

D

3

The ____hypothesis posits that a firm may choose high leverage as a competitive strategy to either win market share from rivals or to deter entry into the industry.

A)long-purse

B)strategic capital structure

C)competitive leverage

D)leverage aggressiveness

A)long-purse

B)strategic capital structure

C)competitive leverage

D)leverage aggressiveness

leverage aggressiveness

4

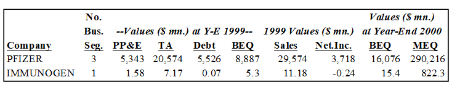

For the following problem requires the data shown below for a large firm (Pfizer) and a smaller firm (Immunogen) in the Chemicals & Allied Products industry:

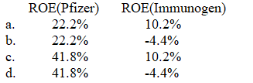

-Conduct a DuPont ROE breakdown analysis for each firm.Which breakdown ratio is most important in explaining ROE differential between the two firms?

A)profit margin

B)total asset turnover

C)leverage

-Conduct a DuPont ROE breakdown analysis for each firm.Which breakdown ratio is most important in explaining ROE differential between the two firms?

A)profit margin

B)total asset turnover

C)leverage

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

5

Capacity surpluses result in (i) product prices and (ii) profit margins. (i) (ii)

A)lower higher

B)higher lower

C)lower lower

D)higher higher

A)lower higher

B)higher lower

C)lower lower

D)higher higher

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

6

In a theoretical paper, Williams (1995) develops a model of industry equilibrium that incorporates agency costs due to both creditor-shareholder and management-shareholder conflicts.His model has implications for the distribution of firms within an industry in equilibrium.Which of the following statements correctly describes Williams' depiction of industry equilibrium?

A)Each industry has a core of large, profitable, secure, capital-intensive firms, each with at least some external debt, and a competitive fringe of small, marginally profitable or unprofitable, risky, labor-intensive firms.

B)All firms in an industry will ultimately be large, labor-intensive firms with large proportions of debt in their capital structures.

C)All firms in an industry will ultimately be small, capital-intensive firms with no debt.

D)All firms in an industry will ultimately be large, capital-intensive firms with large proportions of debt in their capital structures.

A)Each industry has a core of large, profitable, secure, capital-intensive firms, each with at least some external debt, and a competitive fringe of small, marginally profitable or unprofitable, risky, labor-intensive firms.

B)All firms in an industry will ultimately be large, labor-intensive firms with large proportions of debt in their capital structures.

C)All firms in an industry will ultimately be small, capital-intensive firms with no debt.

D)All firms in an industry will ultimately be large, capital-intensive firms with large proportions of debt in their capital structures.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

7

The following problem requires the data shown below for a large firm (Pfizer) and a smaller firm (Immunogen) in the Chemicals & Allied Products industry:

-Which of the following factors most likely explains the difference in the profitabilities of these two firms?

A)differential ability to secure debt financing

B)differential economies of scale

C)the difference in the number of business segments

-Which of the following factors most likely explains the difference in the profitabilities of these two firms?

A)differential ability to secure debt financing

B)differential economies of scale

C)the difference in the number of business segments

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

8

The ____hypothesis posits that a firm may choose low leverage as a competitive strategy to squeeze other, more highly levered, firms out of its industry.

A)having a long-purse

B)strategic capital structure

C)competitive leverage

D)leverage aggressiveness

A)having a long-purse

B)strategic capital structure

C)competitive leverage

D)leverage aggressiveness

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck