Deck 5: Modern Portfolio Concepts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/112

Play

Full screen (f)

Deck 5: Modern Portfolio Concepts

1

U. S. based companies such as Coca Cola and Caterpillar have no exchange rate risk.

False

2

Correlation is a measure of the relationship between two series of numbers.

True

3

Negatively correlated assets reduce risk more than positively correlated assets.

True

4

Hannah owns the following portfolio of stocks. What is the return on her portfolio?

A) 7.27%

B) 10.93%

C) 11.49%

D) 32.8%

A) 7.27%

B) 10.93%

C) 11.49%

D) 32.8%

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

5

In severe market downturns different asset classes become less correlated.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

6

The stock of a technology company has an expected return of 15% and a standard deviation of 20%. The stock of a pharmaceutical company has an expected return of 13% and a standard deviation of 18%. A portfolio consisting of 50% invested in each stock will have an expected return of 14 % and a standard deviation

A) less than the average of 20% and 18%.

B) the average of 20% and 18%.

C) greater than the average of 20% and 18%.

D) The answer cannot be determined with the information given.

A) less than the average of 20% and 18%.

B) the average of 20% and 18%.

C) greater than the average of 20% and 18%.

D) The answer cannot be determined with the information given.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

7

Xander owns the following portfolio of stocks. What is the return on his portfolio?

A) 3.93%

B) 6.61%

C) 10.76%

D) 9.97%

A) 3.93%

B) 6.61%

C) 10.76%

D) 9.97%

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

8

Investing in emerging markets is an effective means of diversifying a U.S. portfolio.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

9

The statement "A portfolio is less than the sum of its parts." means

A) it is less expensive to buy a group of assets than to buy those assets individually.

B) portfolio returns will always be lower than the returns on individual stocks.

C) a diversified group of assets will be less volatile than the individual assets within the group.

D) for reasons that are not well understood, the value of a portfolio is less than the sum of the values of its components.

A) it is less expensive to buy a group of assets than to buy those assets individually.

B) portfolio returns will always be lower than the returns on individual stocks.

C) a diversified group of assets will be less volatile than the individual assets within the group.

D) for reasons that are not well understood, the value of a portfolio is less than the sum of the values of its components.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

10

Coefficients of correlation range from a maximum of +10 to a minimum of -10.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

11

Most assets show a slight degree of negative correlation.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

12

By plotting the efficient frontier, investors can find the unique portfolio that is ideal for all investors.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

13

If the actual rate of return on an investment portfolio is constant from year to year, the standard deviation of that portfolio is zero.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

14

Portfolio objectives should be established independently of tax considerations.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

15

Portfolio objectives should be established before beginning to invest.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

16

All possible combinations of assets in a given portfolio will lie along the efficient frontier.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

17

An efficient portfolio maximizes the rate of return without consideration of risk.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

18

Investing globally offers better diversification than investing only domestically.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

19

Studies have shown that about half of all stocks listed on the major exchanges are negatively correlated.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

20

A portfolio consisting of four stocks is expected to produce returns of 9%, -11%, 13% and 17%, respectively, over the next four years. What is the standard deviation of these expected returns?

A) 10.05%

B) 11.60%

C) 12.44%

D) 33.42%

A) 10.05%

B) 11.60%

C) 12.44%

D) 33.42%

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

21

The returns on the stock of DEF and GHI companies over a 4 year period are shown below: From this limited data you should conclude that returns on

A) DEF and GHI are negatively correlated.

B) DEF and GHI are somewhat positively correlated.

C) DEF and GHI are perfectly positively correlated.

D) DEF and GHI are uncorrelated.

A) DEF and GHI are negatively correlated.

B) DEF and GHI are somewhat positively correlated.

C) DEF and GHI are perfectly positively correlated.

D) DEF and GHI are uncorrelated.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

22

Combining perfectly, positively correlated assets will

A) increase the overall risk level of a portfolio.

B) decrease the overall risk level of a portfolio.

C) not change the overall risk level of a portfolio.

D) increase or decrease the portfolio's risk depending on the risk of each single asset portfolio.

A) increase the overall risk level of a portfolio.

B) decrease the overall risk level of a portfolio.

C) not change the overall risk level of a portfolio.

D) increase or decrease the portfolio's risk depending on the risk of each single asset portfolio.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

23

Standard deviation is a measure that indicates how the price of an individual security responds to market forces.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

24

The index used to represent market returns is always assigned a beta of 1.0.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

25

In the real world, most of the assets available to investors

A) tend to be somewhat positively correlated.

B) tend to be somewhat negatively correlated.

C) tend to be uncorrelated.

D) tend to be either perfectly positively or perfectly negatively correlated.

A) tend to be somewhat positively correlated.

B) tend to be somewhat negatively correlated.

C) tend to be uncorrelated.

D) tend to be either perfectly positively or perfectly negatively correlated.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

26

American Depositary Receipts (ADR) are

A) dollar denominated shares of foreign companies traded on the U.S. markets.

B) shares of American companies traded on foreign markets.

C) foreign currency deposits in American banks.

D) American currency deposits in foreign banks.

A) dollar denominated shares of foreign companies traded on the U.S. markets.

B) shares of American companies traded on foreign markets.

C) foreign currency deposits in American banks.

D) American currency deposits in foreign banks.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

27

A negative beta means that on average a stock moves in the opposite direction of the market.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

28

The betas of most stocks are constant over time.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

29

If there is no relationship between the rates of return of two assets over time, these assets are

A) positively correlated.

B) negatively correlated.

C) perfectly negatively correlated.

D) uncorrelated.

A) positively correlated.

B) negatively correlated.

C) perfectly negatively correlated.

D) uncorrelated.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following investments will provide some measure of international diversification to a portfolio?

A) mutual funds with an international focus

B) stocks of U.S. based companies with extensive foreign sales and/or operations

C) American Depositary Receipts

D) All of the above

A) mutual funds with an international focus

B) stocks of U.S. based companies with extensive foreign sales and/or operations

C) American Depositary Receipts

D) All of the above

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

31

Which one of the following will provide the greatest international diversification?

A) directly purchasing a foreign stock

B) purchasing stock of a U.S. multinational firm

C) purchasing an ADR

D) purchasing shares of an international mutual fund

A) directly purchasing a foreign stock

B) purchasing stock of a U.S. multinational firm

C) purchasing an ADR

D) purchasing shares of an international mutual fund

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

32

Diversifiable risk is also called systematic risk.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

33

Market return is estimated from the average return on a large sample of stocks such as those in the Standard & Poor's 500 Stock Composite Index.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

34

The risk measured by beta can be reduced by diversification.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

35

Explain the relationship between correlation, diversification, and risk reduction.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

36

A beta of 0.5 means that a stock is half as risky the overall market.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

37

Two assets have a coefficient of correlation of -.4. Asset A has a standard deviation of 20% and asset B has a standard deviation of 40%. Relative to holding a portfolio consisting of 100% of Asset B, what happens to risk if you combine these assets into a 50-50 weighted portfolio?

A) Combining these assets will increase risk.

B) Combining these assets will have no effect on risk.

C) Combining these assets may either raise or lower risk.

D) Combining these assets will reduce risk.

A) Combining these assets will increase risk.

B) Combining these assets will have no effect on risk.

C) Combining these assets may either raise or lower risk.

D) Combining these assets will reduce risk.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

38

The risk of a portfolio consisting of two uncorrelated assets will be

A) equal to zero.

B) greater than the risk of the least risky asset but less than the risk level of the more risky asset.

C) greater than zero but less than the risk of the more risky asset.

D) equal to the average of the risk level of the two assets.

A) equal to zero.

B) greater than the risk of the least risky asset but less than the risk level of the more risky asset.

C) greater than zero but less than the risk of the more risky asset.

D) equal to the average of the risk level of the two assets.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

39

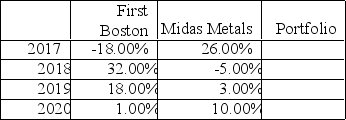

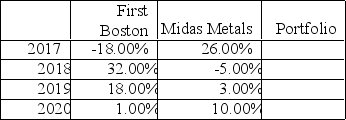

Returns on the stock of First Boston and Midas Metals for the years 2017-2020 are shown below.

a. Compute the average annual return for each stock and a portfolio consisting of 50% First Boston and 50% Midas.

a. Compute the average annual return for each stock and a portfolio consisting of 50% First Boston and 50% Midas.

b. Compute the standard deviation for each stock and the portfolio.

c. Are the stocks positively or negatively correlated and what is the effect on risk?

a. Compute the average annual return for each stock and a portfolio consisting of 50% First Boston and 50% Midas.

a. Compute the average annual return for each stock and a portfolio consisting of 50% First Boston and 50% Midas.b. Compute the standard deviation for each stock and the portfolio.

c. Are the stocks positively or negatively correlated and what is the effect on risk?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

40

Betas for actively traded stocks. are readily available from online sources.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

41

Stock of Gould and Silber Inc. has a beta of -1. If the market declines by 10%, Gould and Silber would be expected to

A) decline by 10%.

B) rise by 10%.

C) not respond to market fluctuations.

D) decline by 1%.

A) decline by 10%.

B) rise by 10%.

C) not respond to market fluctuations.

D) decline by 1%.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following represent undiversifiable risks?

I) The Federal Reserve raises interest rates.

II) A product is recalled because of safety problems.

III) The economy slips into a recession.

IV) The CEO 's divorce settlement forces him to sell off half of his stock holdings.

A) I, II and IV only

B) II and IV only

C) I and III only

D) I, II and III only

I) The Federal Reserve raises interest rates.

II) A product is recalled because of safety problems.

III) The economy slips into a recession.

IV) The CEO 's divorce settlement forces him to sell off half of his stock holdings.

A) I, II and IV only

B) II and IV only

C) I and III only

D) I, II and III only

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

43

Beta can be defined as the slope of the line that explains the relationship between

A) the return on a security and the return on the market.

B) the returns on a security and various points in time.

C) the return on stocks and the returns on bonds.

D) the risk free rate of return versus the market rate of return.

A) the return on a security and the return on the market.

B) the returns on a security and various points in time.

C) the return on stocks and the returns on bonds.

D) the risk free rate of return versus the market rate of return.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following represent systematic risks?

I) the president of a company suddenly resigns

II) the economy goes into a recessionary period

III) a company's product is recalled for defects

IV) the Federal Reserve unexpectedly changes interest rates

A) I, II and IV only

B) II and IV only

C) I and III only

D) I, II and III only

I) the president of a company suddenly resigns

II) the economy goes into a recessionary period

III) a company's product is recalled for defects

IV) the Federal Reserve unexpectedly changes interest rates

A) I, II and IV only

B) II and IV only

C) I and III only

D) I, II and III only

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

45

In designing a portfolio, relevant risk is

A) total risk.

B) unsystematic risk.

C) event risk.

D) nondiversifiable risk.

A) total risk.

B) unsystematic risk.

C) event risk.

D) nondiversifiable risk.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

46

Which one of the following conditions can be effectively eliminated through portfolio diversification?

A) a general price increase nationwide

B) an interest rate reduction by the Federal Reserve

C) increased government regulation of auto emissions

D) change in the political party that controls Congress

A) a general price increase nationwide

B) an interest rate reduction by the Federal Reserve

C) increased government regulation of auto emissions

D) change in the political party that controls Congress

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

47

A stock with a higher beta is riskier than a stock with a lower beta.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

48

The total risk of a portfolio is measured by its

A) beta.

B) coefficient of correlation.

C) standard deviation.

D) standard deviation plus beta.

A) beta.

B) coefficient of correlation.

C) standard deviation.

D) standard deviation plus beta.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

49

Which one of the following conditions can be effectively eliminated through portfolio diversification?

A) a general price increase nationwide

B) an interest rate reduction by the Federal Reserve

C) increased government regulation of auto emissions

D) change in the political party that controls Congress

A) a general price increase nationwide

B) an interest rate reduction by the Federal Reserve

C) increased government regulation of auto emissions

D) change in the political party that controls Congress

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

50

The beta of the market is

A) -1.0.

B) 0.0.

C) 1.0.

D) undefined.

A) -1.0.

B) 0.0.

C) 1.0.

D) undefined.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following best describes the relationship between a stock's beta and the standard deviation of the stock's returns?

A) The higher the standard deviation, the higher the beta.

B) The higher the standard deviation, the lower the beta.

C) The relationship depends on the correlation between the stock's returns and the market's returns.

D) Standard deviation and beta are different ways of measuring the same thing.

A) The higher the standard deviation, the higher the beta.

B) The higher the standard deviation, the lower the beta.

C) The relationship depends on the correlation between the stock's returns and the market's returns.

D) Standard deviation and beta are different ways of measuring the same thing.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

52

By design, half of all stocks betas are positive betas and half are negative.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

53

If the returns on a stock are positively correlated with market returns, the stock will have a positive beta.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

54

Which one of the following types of risk cannot be effectively eliminated through portfolio diversification?

A) inflation risk

B) labor problems

C) materials shortages

D) product recalls

A) inflation risk

B) labor problems

C) materials shortages

D) product recalls

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

55

A measure of systematic risk is

A) standard deviation.

B) correlation coefficient.

C) beta.

D) variance.

A) standard deviation.

B) correlation coefficient.

C) beta.

D) variance.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

56

Adding stocks with higher standard deviations to a portfolio will necessarily increase the portfolio's risk.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

57

The best stock to own when the stock market is at a peak and is expected to decline in value is one with a beta of

A) +1.5.

B) +1.0.

C) -1.0.

D) -0.5.

A) +1.5.

B) +1.0.

C) -1.0.

D) -0.5.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

58

When the stock market has bottomed out and is beginning to recover, the best portfolio to own is the one with a beta of

A) 0.0.

B) +0.5.

C) +1.5.

D) +2.0.

A) 0.0.

B) +0.5.

C) +1.5.

D) +2.0.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

59

Exposure to systematic or market risk can be reduced by

A) investing in a variety of economic sectors.

B) adding low or negative beta stocks to the portfolio.

C) diversifying internationally.

D) cannot be reduced or avoided.

A) investing in a variety of economic sectors.

B) adding low or negative beta stocks to the portfolio.

C) diversifying internationally.

D) cannot be reduced or avoided.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

60

Estimates of a stock's beta may vary depending on

I) when the estimate was made.

II) the risk-free rate of interest used.

III) how many months of returns were used to estimate the beta.

IV) the index used to represent market returns.

A) I, II and IV only

B) II and IV only

C) I, III and IV only

D) I, II and III only

I) when the estimate was made.

II) the risk-free rate of interest used.

III) how many months of returns were used to estimate the beta.

IV) the index used to represent market returns.

A) I, II and IV only

B) II and IV only

C) I, III and IV only

D) I, II and III only

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

61

You have gathered the following information concerning a particular investment and conditions in the market. According to the Capital Asset Pricing Model, the required return for this investment is

A) 8.15.50%.

B) 11.48%.

C) 11.75%.

D) 13.00%.

A) 8.15.50%.

B) 11.48%.

C) 11.75%.

D) 13.00%.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

62

In the Capital Asset Pricing Model, a stock's expected rate of return will depend on its total risk.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

63

Beta is the slope of the best fit line for the points with coordinates representing the______ and the_____ for each one of several years.

A) rate of return; level of risk for an individual security

B) rate of inflation; rate of return for an individual security

C) risk level of a stock; market rate of return

D) market rate of return; security's rate of return

A) rate of return; level of risk for an individual security

B) rate of inflation; rate of return for an individual security

C) risk level of a stock; market rate of return

D) market rate of return; security's rate of return

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

64

The Capital Asset Pricing Model (CAPM) is a mathematical model that depicts the

A) positive relationship between risk and return.

B) standard deviation between a risk premium and an investment's expected return.

C) exact price that an investor should be willing to pay for any given investment.

D) difference between a risk-free return and the expected rate of inflation.

A) positive relationship between risk and return.

B) standard deviation between a risk premium and an investment's expected return.

C) exact price that an investor should be willing to pay for any given investment.

D) difference between a risk-free return and the expected rate of inflation.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

65

According to MSN money, the stock of Orange Corporation has a beta of 1.5, but according to Yahoo Finance it is 1.75. The expected rate of return on the market is 12% and the risk free rate is 2%. What is the difference between the required rates of return calculated using each of these betas?

A) 1.50%

B) 1.75%

C) 2.0%

D) 2.5%

A) 1.50%

B) 1.75%

C) 2.0%

D) 2.5%

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

66

The risk premium to be used in the Capital Asset Pricing Model is calculated as (rf-rm).

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

67

According to the CAPM, the required rate of a return on a stock can be estimated using only beta and the risk-free rate.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

68

Analysts commonly use the______ to measure market return.

A) the Dow Jones Industrial Average

B) the rate of return on 10 year Treasury bonds

C) some large, mainstream company such as General Electric

D) the Standard & Poor's 500 Index

A) the Dow Jones Industrial Average

B) the rate of return on 10 year Treasury bonds

C) some large, mainstream company such as General Electric

D) the Standard & Poor's 500 Index

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following factors comprise the CAPM?

I) dividend yield

II) risk-free rate of return

III) the expected rate of return on the market

IV) risk premium for the firm

A) I and III only

B) II and IV only

C) III and IV only

D) II, III and IV only

I) dividend yield

II) risk-free rate of return

III) the expected rate of return on the market

IV) risk premium for the firm

A) I and III only

B) II and IV only

C) III and IV only

D) II, III and IV only

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

70

The Dow Jones Industrial Average of thirty stocks is customarily used to represent market returns in the CAPM.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

71

The CAPM estimates the required rate of return on a stock held as part of a well diversified portfolio.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

72

When the Capital Asset Pricing Model is depicted graphically, the result is the

A) standard deviation line.

B) coefficient of variation line.

C) security market line.

D) alpha-beta line.

A) standard deviation line.

B) coefficient of variation line.

C) security market line.

D) alpha-beta line.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following statements concerning beta are correct?

I) Stock with high standard deviations of returns will always have high betas.

II) The higher the beta, the higher the expected return.

III) A beta can be positive, negative, or equal to zero.

IV) A beta of 0.35 indicates a lower rate of risk than a beta of 0.50.

A) II and III only

B) I and IV only

C) II, III and IV only

D) I, II, III and IV

I) Stock with high standard deviations of returns will always have high betas.

II) The higher the beta, the higher the expected return.

III) A beta can be positive, negative, or equal to zero.

IV) A beta of 0.35 indicates a lower rate of risk than a beta of 0.50.

A) II and III only

B) I and IV only

C) II, III and IV only

D) I, II, III and IV

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

74

MacroN Company has a beta of 1.75. By what percent will the required rate of return on the stock of MacroN Company increase if the expected market rate of return rises by 4%?

A) 7.00%

B) 7.5%

C) 4.75%

D) 5.70%

A) 7.00%

B) 7.5%

C) 4.75%

D) 5.70%

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

75

The basic theory linking portfolio risk and return is the Capital Asset Pricing Model.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

76

Explain what beta measures and how investors can use beta.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

77

If the expected rate of return on AZNG is 12.72, its beta is 1.09 and the market risk premium is 8%, what is the risk-free rate?

A) 4.72%

B) 5.42%

C) 8.72%

D) 4.0%

A) 4.72%

B) 5.42%

C) 8.72%

D) 4.0%

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

78

The stock of NOP, Inc. has a beta of 1.80. The market rate of return is expected to increase by by 3%. Beta predicts that ABC stock should

A) increase in value by 2.4%.

B) increase in value by 5.4%.

C) decrease in value by .8%.

D) increase in value by 1.8%.

A) increase in value by 2.4%.

B) increase in value by 5.4%.

C) decrease in value by .8%.

D) increase in value by 1.8%.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

79

OKAY stock has a beta of 0.8. The market as a whole is expected to decline by 12% thereby causing OKAY stock to

A) decline by 9.6%.

B) decline by 12.5%.

C) increase by 9.6%.

D) increase by 12%.

A) decline by 9.6%.

B) decline by 12.5%.

C) increase by 9.6%.

D) increase by 12%.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

80

The market rate of return increased by 8% while the rate of return on XYZ stock increased by 4%. The beta of XYZ stock is

A) -2.0.

B) -0.40.

C) 0.50.

D) 2.0.

A) -2.0.

B) -0.40.

C) 0.50.

D) 2.0.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck