Deck 5: Accounting for Retail Businesses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/273

Play

Full screen (f)

Deck 5: Accounting for Retail Businesses

1

When merchandise that was sold is returned, a credit to Customer Refunds Payable is made.

False

2

Estimated Returns Inventory is an account used when adjusting for expected merchandise sales in the next period.

False

3

Customer Refunds Payable is an account used to record merchandise returns from customers.

True

4

In a perpetual inventory system, the Inventory account is only used to reflect the beginning inventory.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

5

In a perpetual inventory system, when merchandise is returned to the supplier, Cost of Goods Sold is debited as part of the transaction.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

6

The cost of inventory is limited to the purchase price less any purchase discounts.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

7

Sales to customers who use bank credit cards, such as MasterCard and VISA, are generally treated as credit sales.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

8

Freight-in is the amount paid by the company to deliver merchandise sold to a customer.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

9

Under the perpetual inventory system, when a sale is made, both the sale and cost of goods sold are recorded.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

10

In retail businesses, inventory is reported as a current asset.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

11

If payment is due by the end of the month in which the sale is made, the invoice terms are expressed as n/30.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

12

Under a periodic inventory system, the cost of inventory on hand at the end of the accounting period is determined by a physical count of the inventory.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

13

The most important differences between a service business and a retail business are reflected in their operating cycles and financial statements.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

14

Cost of goods sold is the amount that the merchandising company pays for the merchandise it intends to sell.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

15

Freight-in is considered a cost of purchasing inventory.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

16

Most retailers record all credit card sales as credit sales.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

17

Buyers and sellers do not normally record the list prices of merchandise and the trade discounts in accounts.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

18

In a merchandising business, sales minus operating expenses equals net income.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

19

Service businesses provide services for income, while a merchandising business sells merchandise.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

20

The fees associated with credit card sales are periodically recorded as expenses.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

21

The chart of accounts for a merchandising business would include an account called Delivery Expense.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

22

Sellers and buyers are required to record trade discounts.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

23

A seller may grant a buyer a reduction in selling price, and this is called a customer discount.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

24

When merchandise is sold for $600 plus 6% sales tax, the Sales account should be credited for $636.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

25

A sales discount encourages customers to pay accounts more quickly than if a discount were not available.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

26

When the terms of sale are FOB shipping point, the buyer pays the freight charges.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

27

Purchases of merchandise are typically credited to the inventory account under the perpetual inventory system.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

28

If the ownership of merchandise passes to the buyer when the seller delivers the merchandise for shipment, the terms are stated as FOB destination.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

29

When the seller offers a sales discount, even if borrowing has to be done, it is generally advantageous for the buyer to pay within the discount period.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

30

Under the perpetual inventory system, a company purchases merchandise on terms 2/10, n/30. The entry to record the purchase will include a debit to Cash and a credit to Sales.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

31

If the buyer bears the freight costs related to a purchase, the terms are said to be FOB destination.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

32

When a large quantity of merchandise is purchased, a reduction allowed on the sale price is called a trade discount.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

33

The abbreviation FOB stands for "free on board."

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

34

A sale of $750 on account subject to a sales tax of 6% would be recorded as an account receivable of $750.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

35

A buyer who acquires merchandise under credit terms of 1/10, n/30 has 30 days after the invoice date to take advantage of the sales discount.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

36

Inventory normally has a debit balance.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

37

In a perpetual inventory system, merchandise returned to vendors reduces the inventory account.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

38

Merchandise is sold for $3,600, terms FOB destination, 2/10, n/30, with prepaid freight costs of $150. The sales amount recorded is $3,528.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

39

If merchandise costing $3,500, terms FOB destination, 2/10, n/30, with prepaid freight costs of $125, is paid within 10 days, the amount of the purchases discount is $70.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

40

A deduction allowed to wholesalers and retailers from the price of merchandise listed in catalogs is called cash discounts.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

41

Because many companies use computerized accounting systems, periodic inventory is widely used.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

42

The single-step income statement is easier to prepare, but a criticism of this format is that gross profit and income from operations are not readily available.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

43

Purchased goods in transit should be included in the ending inventory of the buyer if the goods were shipped FOB shipping point.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

44

Most companies will not take a purchase discount, because 1% or 2% discounts are insignificant.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

45

A business using the perpetual inventory system, with its detailed subsidiary records, does not need to take a physical inventory.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

46

Sales is equal to the cost of goods sold less the gross profit.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

47

If the perpetual inventory system is used, an account entitled Cost of Goods Sold is included in the general ledger.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

48

Title to merchandise shipped FOB shipping point passes to the buyer upon delivery of the merchandise to the buyer's place of business.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

49

The form of the balance sheet in which assets, liabilities, and stockholders' equity are presented in a downward sequence is called the report form.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

50

In a multiple-step income statement, the dollar amount for income from operations is always the same as net income.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

51

On the income statement in the single-step form, the total of all expenses is deducted from the total of all revenues.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

52

Purchased goods in transit, shipped FOB destination, should be excluded from ending inventory of the buyer.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

53

Gross profit minus selling expenses equals net income.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

54

The seller records the sales tax as part of the sales amount.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

55

Income that cannot be associated definitely with operations, such as a gain from the sale of a fixed asset, is listed as Other Revenue on the multiple-step income statement.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

56

The seller may prepay the freight costs even though the terms are FOB shipping point.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

57

As we compare a merchandising business to a service business, the financial statement that changes the most is the balance sheet.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

58

In the merchandising income statement, sales will be reduced by administrative expenses to arrive at operating income.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

59

Cost of goods sold is often the largest expense on a merchandising company income statement.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

60

When companies use a perpetual inventory system, the recording of the purchase of inventory will include a debit to Purchases.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

61

Dollar Co. sold merchandise to Pound Co. on account, $25,500, terms 2/15, net 45. Pound Co. paid the invoice within the discount period. What is the sales amount to be recorded in the above transactions?

A)$25,500

B)$26,010

C)$24,990

D)$16,000

A)$25,500

B)$26,010

C)$24,990

D)$16,000

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

62

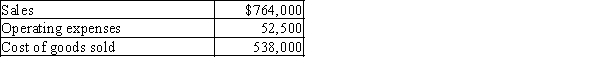

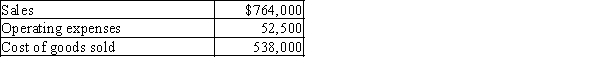

Calculate income from operations for Jonas Company based on the following data:

A)$485,500

B)$711,500

C)$173,500

D)$226,000

A)$485,500

B)$711,500

C)$173,500

D)$226,000

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

63

In a periodic inventory system, the cost of merchandise purchased includes the cost of freight in.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

64

Gross profit is equal to

A)sales plus cost of goods sold

B)sales plus selling expenses

C)sales less selling expenses

D)sales less cost of goods sold

A)sales plus cost of goods sold

B)sales plus selling expenses

C)sales less selling expenses

D)sales less cost of goods sold

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

65

Closing entries for a merchandising business are not similar to those for a service business.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

66

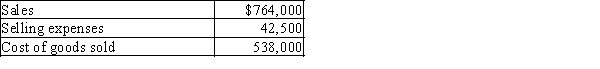

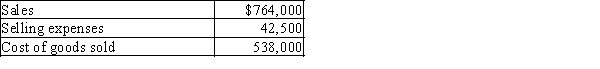

Calculate the gross profit for Jefferson Company based on the following:

A)$495,500

B)$183,500

C)$721,500

D)$226,000

A)$495,500

B)$183,500

C)$721,500

D)$226,000

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

67

Under a periodic inventory system, the accounts Purchases, Purchases Returns and Allowances, Purchases Discounts, and Freight In are found on the balance sheet.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

68

Inventory is classified on the balance sheet as a

A)current liability

B)current asset

C)long-term asset

D)long-term liability

A)current liability

B)current asset

C)long-term asset

D)long-term liability

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

69

The asset turnover ratio measures how effectively a business is using its assets to generate sales.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

70

The inventory system employing accounting records that continuously disclose the amount of inventory is called

A)retail

B)periodic

C)physical

D)perpetual

A)retail

B)periodic

C)physical

D)perpetual

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

71

Under the periodic inventory system, the cost of goods sold is recorded when sales are made.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

72

What is the term applied to the excess of sales over the cost of goods sold?

A)gross profit

B)operations

C)net income

D)gross sales

A)gross profit

B)operations

C)net income

D)gross sales

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

73

Other revenue and expenses are items that are not related to the primary operating activity.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

74

In the periodic inventory system, purchases of merchandise for resale are debited to the Purchases account.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

75

Net income plus operating expenses is equal to

A)cost of goods sold

B)cost of merchandise

C)sales

D)gross profit

A)cost of goods sold

B)cost of merchandise

C)sales

D)gross profit

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

76

Under the periodic inventory system, the cost of goods sold is equal to the beginning inventory plus the cost of merchandise purchased plus the ending inventory.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

77

When a merchandising business is compared to a service business, the financial statement that is not affected by that change is the statement of stockholders' equity.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

78

When comparing a retail business to a service business, the financial statement that changes the most is the

A)balance sheet

B)income statement

C)statement of stockholders' equity

D)statement of cash flows

A)balance sheet

B)income statement

C)statement of stockholders' equity

D)statement of cash flows

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is not a difference between a retail business and a service business?

A)in what is sold

B)the inclusion of gross profit on the income statement

C)accounting equation

D)inventory included on the balance sheet

A)in what is sold

B)the inclusion of gross profit on the income statement

C)accounting equation

D)inventory included on the balance sheet

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

80

The primary difference between the periodic and perpetual inventory systems is that a

A)periodic system determines the inventory on hand only at the end of the accounting period

B)periodic system keeps a record showing the inventory on hand at all times

C)periodic system provides an easy means to determine inventory shrinkage

D)periodic system records the cost of the sale on the date the sale is made

A)periodic system determines the inventory on hand only at the end of the accounting period

B)periodic system keeps a record showing the inventory on hand at all times

C)periodic system provides an easy means to determine inventory shrinkage

D)periodic system records the cost of the sale on the date the sale is made

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck