Deck 39: Current Issues in Macro Theory and Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/225

Play

Full screen (f)

Deck 39: Current Issues in Macro Theory and Policy

1

Monetarists say that the relationship between the amount of money that households and businesses want to hold and the level of national output and income

A)has decreased historically because of increased accessibility to credit.

B)rises during recession and falls during periods of full employment.

C)falls during recession and rises during periods of full employment.

D)is relatively stable.

A)has decreased historically because of increased accessibility to credit.

B)rises during recession and falls during periods of full employment.

C)falls during recession and rises during periods of full employment.

D)is relatively stable.

is relatively stable.

2

Economist Milton Friedman is most closely associated with

A)Keynesian economics.

B)the rational expectations theory.

C)supply-side economics.

D)monetarism.

A)Keynesian economics.

B)the rational expectations theory.

C)supply-side economics.

D)monetarism.

monetarism.

3

The mainstream view of macro instability is that

A)changes in the money supply directly cause changes in aggregate demand and thus cause changes in real GDP.

B)changes in investment shift the aggregate demand curve and thus cause changes in real GDP.

C)bursts of innovation put the economy on an unsustainable growth path, eventually producing recession.

D)changes in technology and resource availability are the two main sources of fluctuations of real GDP.

A)changes in the money supply directly cause changes in aggregate demand and thus cause changes in real GDP.

B)changes in investment shift the aggregate demand curve and thus cause changes in real GDP.

C)bursts of innovation put the economy on an unsustainable growth path, eventually producing recession.

D)changes in technology and resource availability are the two main sources of fluctuations of real GDP.

changes in investment shift the aggregate demand curve and thus cause changes in real GDP.

4

The velocity of money is equal to

A)1/MPS.

B)1/reserve ratio.

C)M/GDP.

D)none of these.

A)1/MPS.

B)1/reserve ratio.

C)M/GDP.

D)none of these.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

5

The velocity of money is equal to

A)1/MPS.

B)nominal GDP/M.

C)1/reserve ratio.

D)nominal GDP/P.

A)1/MPS.

B)nominal GDP/M.

C)1/reserve ratio.

D)nominal GDP/P.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

6

Answer the question on the basis of the following information for a hypothetical economy.All values are in nominal terms.

M = $100

V = 2

Ca = $160

Xn = $10

G = $10

Nominal GDP is

A)$100.

B)$200.

C)$180.

D)$50.

M = $100

V = 2

Ca = $160

Xn = $10

G = $10

Nominal GDP is

A)$100.

B)$200.

C)$180.

D)$50.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

7

If M is $400, P is $4, and Q is 300, then V must be

A)1.33.

B)3.

C)5.33.

D)100.

A)1.33.

B)3.

C)5.33.

D)100.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

8

In the equation of exchange, V indicates the

A)value or purchasing power of the dollar.

B)number of times per year the average dollar is spent.

C)quantity of real output.

D)reciprocal of the price level.

A)value or purchasing power of the dollar.

B)number of times per year the average dollar is spent.

C)quantity of real output.

D)reciprocal of the price level.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

9

Monetarists believe that

A)prices and wages are inflexible or sticky.

B)both product and resource markets are monopolistic.

C)velocity is relatively stable.

D)the economy is more stable when active fiscal and monetary policy are used.

A)prices and wages are inflexible or sticky.

B)both product and resource markets are monopolistic.

C)velocity is relatively stable.

D)the economy is more stable when active fiscal and monetary policy are used.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

10

If the amount of money in circulation is $180 billion and the value of the economy's total output is $540 billion, then the

A)circulation period of money must be one-fourth of a year.

B)velocity of money is 4.

C)average price per final good sold is $3.

D)velocity of money is 3.

A)circulation period of money must be one-fourth of a year.

B)velocity of money is 4.

C)average price per final good sold is $3.

D)velocity of money is 3.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is a component of the equation of exchange?

A)consumption

B)the interest rate

C)investment

D)the velocity of money

A)consumption

B)the interest rate

C)investment

D)the velocity of money

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

12

The mainstream view is that macro instability is caused by

A)erratic growth of the nation's money supply.

B)government interference in the economy.

C)significant changes in investment spending.

D)consumption "booms" and "busts."

A)erratic growth of the nation's money supply.

B)government interference in the economy.

C)significant changes in investment spending.

D)consumption "booms" and "busts."

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

13

Answer the question on the basis of the following information for a hypothetical economy.All values are in nominal terms.

M = $100

V = 2

Ca = $160

Xn = $10

G = $10

If the price level P is 4, Q is

A)50.

B)100.

C)200.

D)500.

M = $100

V = 2

Ca = $160

Xn = $10

G = $10

If the price level P is 4, Q is

A)50.

B)100.

C)200.

D)500.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

14

The equation of exchange suggests that, if the supply and velocity of money remain unchanged, an increase in the physical volume of goods and services produced will cause

A)the unemployment rate to rise.

B)the Federal Reserve Banks to sell securities in the open market.

C)a decline in the price level.

D)an automatic budget deficit.

A)the unemployment rate to rise.

B)the Federal Reserve Banks to sell securities in the open market.

C)a decline in the price level.

D)an automatic budget deficit.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

15

Answer the question on the basis of the following information for a hypothetical economy.All values are in nominal terms.

M = $100

V = 2

Ca = $160

Xn = $10

G = $10

In equilibrium, Ig is

A)$20.

B)$10.

C)$5.

D)$50.

M = $100

V = 2

Ca = $160

Xn = $10

G = $10

In equilibrium, Ig is

A)$20.

B)$10.

C)$5.

D)$50.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

16

The equation underlying the mainstream view of macroeconomics is

A)MV = PQ.

B)Ca + Ig + Xn + G = GDP.

C)S = a − bY.

D)GDP = P × Q.

A)MV = PQ.

B)Ca + Ig + Xn + G = GDP.

C)S = a − bY.

D)GDP = P × Q.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

17

The velocity of money is the

A)relationship between the money supply and the price level.

B)number of times per year the average dollar is spent on final goods and services.

C)relationship between asset and transactions demands for money.

D)price level divided by aggregate supply.

A)relationship between the money supply and the price level.

B)number of times per year the average dollar is spent on final goods and services.

C)relationship between asset and transactions demands for money.

D)price level divided by aggregate supply.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

18

According to the equation of exchange, changes in the money supply can affect

A)only the velocity of money.

B)both the price level and real output.

C)only real output and employment.

D)only the price level.

A)only the velocity of money.

B)both the price level and real output.

C)only real output and employment.

D)only the price level.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

19

If a certain household earns and spends $24,000 per year and, on the average, holds a money balance of $6,000, then the velocity of money for this household is

A)6.

B)1/6.

C)4.

D)1/4.

A)6.

B)1/6.

C)4.

D)1/4.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

20

The velocity of money measures the

A)proportion of the money supply held as an asset.

B)ratio of the transactions demand to the asset demand for money.

C)average annual rate of increase in the money supply.

D)number of times per year the average dollar is spent on final goods and services.

A)proportion of the money supply held as an asset.

B)ratio of the transactions demand to the asset demand for money.

C)average annual rate of increase in the money supply.

D)number of times per year the average dollar is spent on final goods and services.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

21

To determine the velocity of money, you would need to know

A)nominal GDP and real GDP.

B)the money supply and the price level.

C)nominal GDP and the money supply.

D)nominal GDP and the interest rate.

A)nominal GDP and real GDP.

B)the money supply and the price level.

C)nominal GDP and the money supply.

D)nominal GDP and the interest rate.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

22

According to monetarists, a change in the money supply changes

A)the velocity of money, which in turn changes the nominal GDP.

B)investment spending, which in turn changes the nominal GDP.

C)the interest rate, which in turn changes the nominal GDP.

D)aggregate demand, which in turn changes the nominal GDP.

A)the velocity of money, which in turn changes the nominal GDP.

B)investment spending, which in turn changes the nominal GDP.

C)the interest rate, which in turn changes the nominal GDP.

D)aggregate demand, which in turn changes the nominal GDP.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

23

In the equation of exchange, the nominal GDP is designated by

A)PQ/M.

B)MV/P.

C)PQ.

D)MV.

A)PQ/M.

B)MV/P.

C)PQ.

D)MV.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

24

A coordination failure

A)is a real-business-cycle event.

B)is a self-fulfilling prophesy.

C)results from the spending-income multiplier.

D)is a direct outcome of inappropriate fiscal policy.

A)is a real-business-cycle event.

B)is a self-fulfilling prophesy.

C)results from the spending-income multiplier.

D)is a direct outcome of inappropriate fiscal policy.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

25

The idea that an economy can get stuck in either an unemployment equilibrium or an inflation equilibrium is most closely associated with

A)new classical economics.

B)the real-business-cycle theory.

C)monetarism.

D)the idea of coordination failures.

A)new classical economics.

B)the real-business-cycle theory.

C)monetarism.

D)the idea of coordination failures.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

26

New classical economists say that an unanticipated decrease in aggregate demand first

A)decreases the price level and real output, and then decreases long-run aggregate supply.

B)decreases long-run aggregate supply, and then decreases the price level and real output.

C)reduces short-run aggregate supply, and then reduces long-run aggregate supply.

D)decreases the price level and real output, and then increases short-run aggregate supply such that the economy returns to the full-employment level of output.

A)decreases the price level and real output, and then decreases long-run aggregate supply.

B)decreases long-run aggregate supply, and then decreases the price level and real output.

C)reduces short-run aggregate supply, and then reduces long-run aggregate supply.

D)decreases the price level and real output, and then increases short-run aggregate supply such that the economy returns to the full-employment level of output.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

27

According to monetarists, the Great Depression in the United States largely resulted from

A)contractionary fiscal policy.

B)excessive imports relative to exports.

C)significant changes in technology and resource availability.

D)inappropriate monetary policy.

A)contractionary fiscal policy.

B)excessive imports relative to exports.

C)significant changes in technology and resource availability.

D)inappropriate monetary policy.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

28

When most consumers and firms reduce spending only because they expect other consumers and firms to reduce spending, and a recession results,

A)a self-correction has occurred.

B)an adverse aggregate supply shock has occurred.

C)a coordination failure has occurred.

D)a real-business downturn has occurred.

A)a self-correction has occurred.

B)an adverse aggregate supply shock has occurred.

C)a coordination failure has occurred.

D)a real-business downturn has occurred.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

29

If the nominal GDP is $477 billion and the velocity of money is 4.5, then the money supply is

A)$122 billion.

B)$98 billion.

C)$106 billion.

D)$477 billion.

A)$122 billion.

B)$98 billion.

C)$106 billion.

D)$477 billion.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

30

New classical economists

A)stress the importance of federal budget deficits in stimulating aggregate demand.

B)hold that, left alone, the economy gravitates to its full-employment level of output.

C)emphasize tax cuts as means of increasing aggregate supply.

D)advocate active use of monetary policy to stabilize the economy.

A)stress the importance of federal budget deficits in stimulating aggregate demand.

B)hold that, left alone, the economy gravitates to its full-employment level of output.

C)emphasize tax cuts as means of increasing aggregate supply.

D)advocate active use of monetary policy to stabilize the economy.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

31

Assume that many households and businesses reduce their spending only because they expect other households and consumers to reduce their spending.Also suppose that all households and consumers would be better off if they did not reduce their spending.This situation best describes the

A)real-business-cycle theory.

B)rational expectations theory.

C)concept of coordination failures.

D)adaptive expectations theory.

A)real-business-cycle theory.

B)rational expectations theory.

C)concept of coordination failures.

D)adaptive expectations theory.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

32

According to real-business-cycle theory,

A)monetary factors affecting aggregate demand cause macroeconomic instability.

B)recessions result from declines in long-run aggregate supply, rather than decreases in aggregate demand.

C)when real wages fall during recessions, "real" unemployment rates rise.

D)the net long-run costs of business fluctuations are severe.

A)monetary factors affecting aggregate demand cause macroeconomic instability.

B)recessions result from declines in long-run aggregate supply, rather than decreases in aggregate demand.

C)when real wages fall during recessions, "real" unemployment rates rise.

D)the net long-run costs of business fluctuations are severe.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

33

The real-business-cycle theory holds that business fluctuations are caused by

A)factors affecting aggregate demand.

B)incorrectly anticipated government stabilization policies.

C)significant changes in technology and resource availability.

D)"stop-and-go" monetary policies.

A)factors affecting aggregate demand.

B)incorrectly anticipated government stabilization policies.

C)significant changes in technology and resource availability.

D)"stop-and-go" monetary policies.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

34

According to new classical economists, the

A)short-run demand for labor curve is vertical.

B)short-run aggregate demand curve is vertical.

C)long-run aggregate supply curve is horizontal.

D)long-run aggregate supply curve is vertical.

A)short-run demand for labor curve is vertical.

B)short-run aggregate demand curve is vertical.

C)long-run aggregate supply curve is horizontal.

D)long-run aggregate supply curve is vertical.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

35

If the money supply is constant when both nominal and real GDP are rising, we can conclude that

A)tax rates have been increased.

B)the velocity of money must be increasing.

C)interest rates are falling.

D)the unemployment rate is rising.

A)tax rates have been increased.

B)the velocity of money must be increasing.

C)interest rates are falling.

D)the unemployment rate is rising.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

36

Monetarists say

A)that, because P is stable, a change in M will change Q proportionately in the opposite direction.

B)a change in the money supply will change aggregate demand and therefore the nominal GDP.

C)a change in the money supply will change velocity, which in turn will change nominal GDP.

D)a change in the money supply will change the interest rate, which will change investment spending and nominal GDP.

A)that, because P is stable, a change in M will change Q proportionately in the opposite direction.

B)a change in the money supply will change aggregate demand and therefore the nominal GDP.

C)a change in the money supply will change velocity, which in turn will change nominal GDP.

D)a change in the money supply will change the interest rate, which will change investment spending and nominal GDP.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

37

Monetarists believe the private economy is inherently

A)unstable and the public sector should be small.

B)unstable and the public sector should be large.

C)stable but that the public sector should be large.

D)stable and that the government sector should be small.

A)unstable and the public sector should be small.

B)unstable and the public sector should be large.

C)stable but that the public sector should be large.

D)stable and that the government sector should be small.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

38

The real-business-cycle theory

A)is a monetarist view of the business cycle.

B)is the mainstream view of the business cycle.

C)assumes that the supply of money is constant.

D)says that macro instability results from shifts in the long-run aggregate supply curve.

A)is a monetarist view of the business cycle.

B)is the mainstream view of the business cycle.

C)assumes that the supply of money is constant.

D)says that macro instability results from shifts in the long-run aggregate supply curve.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

39

In a full-employment economy, a rise in M will cause inflation unless

A)V rises in proportion to the increase in M.

B)the quantity of goods produced declines proportionately.

C)tax reductions accompany the increase in the money supply.

D)the velocity of money diminishes.

A)V rises in proportion to the increase in M.

B)the quantity of goods produced declines proportionately.

C)tax reductions accompany the increase in the money supply.

D)the velocity of money diminishes.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

40

As monetarists view the equation of exchange,

A)V changes erratically and unpredictably.

B)V is quite stable.

C)V usually changes in the same direction of any given change in M.

D)V usually changes in the opposite direction of any given change in M.

A)V changes erratically and unpredictably.

B)V is quite stable.

C)V usually changes in the same direction of any given change in M.

D)V usually changes in the opposite direction of any given change in M.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

41

In the insider-outsider theory,

A)outsiders are workers who retain employment during recession.

B)insiders are managers who have more information about their firms' performance than outsiders.

C)insiders are "principals" and outsiders are "agents."

D)outsiders are laid-off workers and other qualified unemployed workers.

A)outsiders are workers who retain employment during recession.

B)insiders are managers who have more information about their firms' performance than outsiders.

C)insiders are "principals" and outsiders are "agents."

D)outsiders are laid-off workers and other qualified unemployed workers.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

42

Assume there is an increase in government spending and a reduction in net taxes.With a specific money supply, the consequent

A)contractionary impact might be lessened by the resulting increase in the interest rate.

B)expansionary impact might be lessened by the resulting increase in the interest rate.

C)contractionary impact might be enhanced by the resulting decline in the interest rate.

D)expansionary impact might be enhanced by the resulting decline in the interest rate.

A)contractionary impact might be lessened by the resulting increase in the interest rate.

B)expansionary impact might be lessened by the resulting increase in the interest rate.

C)contractionary impact might be enhanced by the resulting decline in the interest rate.

D)expansionary impact might be enhanced by the resulting decline in the interest rate.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

43

If firms are paying efficiency wages, they

A)may be reluctant to increase nominal wages when aggregate demand increases.

B)are highly vulnerable to import competition.

C)may be targeted for takeover by firms paying market wages.

D)may be reluctant to cut wages when aggregate demand declines.

A)may be reluctant to increase nominal wages when aggregate demand increases.

B)are highly vulnerable to import competition.

C)may be targeted for takeover by firms paying market wages.

D)may be reluctant to cut wages when aggregate demand declines.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following pairs helps explain why self-correction from a decline in aggregate demand in the economy may be slow rather than rapid?

A)theory of compensation wage differentials; theory of derived demand for labor

B)efficiency wage theory; insider-outsider theory

C)insider-outsider theory; principle-agent problem

D)externalities; efficiency wage theory

A)theory of compensation wage differentials; theory of derived demand for labor

B)efficiency wage theory; insider-outsider theory

C)insider-outsider theory; principle-agent problem

D)externalities; efficiency wage theory

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

45

Suppose aggregate demand in the economy sharply declines.Mainstream economists say that the price level (at least for a time) will and real output will .

A)decrease; remain constant

B)increase; remain constant

C)remain constant; decrease

D)remain constant; increase

A)decrease; remain constant

B)increase; remain constant

C)remain constant; decrease

D)remain constant; increase

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

46

If prices and wages are inflexible downward, a decrease in aggregate demand will

A)reduce the price level but not real output.

B)increase short-run aggregate supply.

C)decrease short-run aggregate supply.

D)reduce real output but not the price level.

A)reduce the price level but not real output.

B)increase short-run aggregate supply.

C)decrease short-run aggregate supply.

D)reduce real output but not the price level.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

47

Mainstream economists question the new classical assumption that

A)excessive growth of the money supply is a cause of inflation.

B)the price level is determined by aggregate demand and aggregate supply.

C)demand creates its own supply.

D)wages and prices are equally flexible upward and downward.

A)excessive growth of the money supply is a cause of inflation.

B)the price level is determined by aggregate demand and aggregate supply.

C)demand creates its own supply.

D)wages and prices are equally flexible upward and downward.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

48

According to monetarists, an expansionary fiscal policy is a weak stabilization tool because

A)the asset demand for money varies inversely with the rate of interest.

B)government borrowing to finance a deficit will raise the interest rate and reduce private investment.

C)government borrowing will reduce the supply of money in circulation and depress the GDP.

D)government borrowing to finance a deficit will lower interest rates, increase money balances, and lower velocity.

A)the asset demand for money varies inversely with the rate of interest.

B)government borrowing to finance a deficit will raise the interest rate and reduce private investment.

C)government borrowing will reduce the supply of money in circulation and depress the GDP.

D)government borrowing to finance a deficit will lower interest rates, increase money balances, and lower velocity.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

49

In new classical economics, a "price-level surprise"

A)has no effect on the economy.

B)causes a temporary change in real output.

C)causes a permanent change in real output.

D)can never occur since people correctly anticipate the future.

A)has no effect on the economy.

B)causes a temporary change in real output.

C)causes a permanent change in real output.

D)can never occur since people correctly anticipate the future.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

50

New classical economists say that a fully anticipated decrease in aggregate demand

A)shifts the long-run aggregate supply curve to the right.

B)shifts the long-run aggregate supply curve to the left.

C)moves the economy down along its vertical long-run aggregate supply curve.

D)eventually results in a self-correcting increase in aggregate demand.

A)shifts the long-run aggregate supply curve to the right.

B)shifts the long-run aggregate supply curve to the left.

C)moves the economy down along its vertical long-run aggregate supply curve.

D)eventually results in a self-correcting increase in aggregate demand.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

51

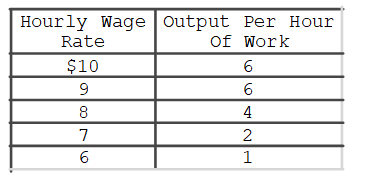

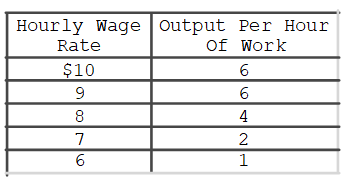

Refer to the table.At the $8 wage, labor cost per unit of output is

A)$1.25.

B)$1.50.

C)$2.00.

D)$1.67.Type: Table

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

52

In new classical economics, the change in output caused by a "price-level surprise"

A)is shown as a shift of the long-run aggregate supply curve.

B)does not alter the rate of unemployment, even in the short run.

C)is soon reversed through a shift of the short-run aggregate supply curve.

D)permanently changes the rate of unemployment.

A)is shown as a shift of the long-run aggregate supply curve.

B)does not alter the rate of unemployment, even in the short run.

C)is soon reversed through a shift of the short-run aggregate supply curve.

D)permanently changes the rate of unemployment.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

53

The crowding-out effect refers to the possibility that

A)when used simultaneously, expansionary fiscal and monetary policies are counterproductive.

B)the asset demand for money varies inversely with the interest rate.

C)deficit financing will increase the interest rate and reduce investment.

D)an increase in the supply of money will result in a decline in velocity.

A)when used simultaneously, expansionary fiscal and monetary policies are counterproductive.

B)the asset demand for money varies inversely with the interest rate.

C)deficit financing will increase the interest rate and reduce investment.

D)an increase in the supply of money will result in a decline in velocity.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

54

Adherents of the traditional monetary rule advocate that the

A)functional finance approach to fiscal policy be adopted.

B)money supply should be increased by a constant rate year after year.

C)money supply should be reduced during inflation and increased during recession.

D)money supply should be increased during inflation and reduced during recession.

A)functional finance approach to fiscal policy be adopted.

B)money supply should be increased by a constant rate year after year.

C)money supply should be reduced during inflation and increased during recession.

D)money supply should be increased during inflation and reduced during recession.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

55

Refer to the table.The efficiency wage is

A)$10.

B)$9.

C)$8

D)$6.Type: Table

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

56

New classical economists say that a fully anticipated increase in aggregate demand

A)shifts the long-run aggregate supply curve to the right.

B)shifts the long-run aggregate supply curve to the left.

C)moves the economy up along its vertical long-run aggregate supply curve.

D)eventually results in a self-correcting decrease in aggregate demand.

A)shifts the long-run aggregate supply curve to the right.

B)shifts the long-run aggregate supply curve to the left.

C)moves the economy up along its vertical long-run aggregate supply curve.

D)eventually results in a self-correcting decrease in aggregate demand.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

57

Suppose laid-off workers and other qualified unemployed workers offer to work for less than the wages being paid existing employed workers, but employers do not hire these workers for fear that existing workers will refuse to cooperate with them.This situation best describes the

A)efficiency wage theory.

B)theory of compensating wage differentials.

C)insider-outsider theory.

D)rational expectations theory.

A)efficiency wage theory.

B)theory of compensating wage differentials.

C)insider-outsider theory.

D)rational expectations theory.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

58

An efficiency wage is

A)a wage payment necessary to compensate workers for risk of injury on the job.

B)a "wage" that contains a profit-sharing component as well as traditional hourly pay.

C)an above-market wage that minimizes a firm's labor cost per unit of output.

D)a wage that automatically rises with the national index of labor productivity.

A)a wage payment necessary to compensate workers for risk of injury on the job.

B)a "wage" that contains a profit-sharing component as well as traditional hourly pay.

C)an above-market wage that minimizes a firm's labor cost per unit of output.

D)a wage that automatically rises with the national index of labor productivity.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

59

A higher wage could result in a lower labor cost per unit of output than a lower wage if the higher wage

A)is accompanied by an offsetting decline in fringe benefits.

B)increases supervision costs.

C)reduces job turnover.

D)increases worker absenteeism.

A)is accompanied by an offsetting decline in fringe benefits.

B)increases supervision costs.

C)reduces job turnover.

D)increases worker absenteeism.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

60

An efficiency wage is

A)a below-market wage.

B)an above-market wage.

C)a "wage" that contains a profit-sharing component.

D)a wage that is free to rise or fall from day to day, depending on labor supply and demand.

A)a below-market wage.

B)an above-market wage.

C)a "wage" that contains a profit-sharing component.

D)a wage that is free to rise or fall from day to day, depending on labor supply and demand.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

61

Mainstream economists contend that, as stabilization tools,

A)discretionary fiscal policy is effective, but discretionary monetary policy is not.

B)discretionary monetary policy is effective, but discretionary fiscal policy is not.

C)both discretionary fiscal policy and discretionary monetary policy can be effective if appropriately used.

D)discretionary fiscal policy and discretionary monetary policy cause more instability than they cure.

A)discretionary fiscal policy is effective, but discretionary monetary policy is not.

B)discretionary monetary policy is effective, but discretionary fiscal policy is not.

C)both discretionary fiscal policy and discretionary monetary policy can be effective if appropriately used.

D)discretionary fiscal policy and discretionary monetary policy cause more instability than they cure.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

62

In recent years, economists holding monetarist views have replaced their call for a monetary rule with a call for

A)artful Fed management of interest rates.

B)inflation targeting.

C)nominal GDP targeting.

D)inflationary and recessionary gap analysis.

A)artful Fed management of interest rates.

B)inflation targeting.

C)nominal GDP targeting.

D)inflationary and recessionary gap analysis.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

63

In 2012, the Fed

A)adopted a strict monetary rule of 2 percent per year.

B)adopted inflation targeting, setting a target rate of 2 percent per year.

C)relaxed all monetary rules and targets in favor of a fully flexible monetary policy.

D)adopted a nominal GDP growth rate target of 6 percent per year.

A)adopted a strict monetary rule of 2 percent per year.

B)adopted inflation targeting, setting a target rate of 2 percent per year.

C)relaxed all monetary rules and targets in favor of a fully flexible monetary policy.

D)adopted a nominal GDP growth rate target of 6 percent per year.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

64

Proponents of inflation targeting generally think that

A)the economy will have fewer, shorter, and less severe business cycles if the Fed holds the rate of inflation to low, targeted levels from year to year.

B)low interest rates are inflationary and high interest rates are deflationary.

C)fiscal policy is more effective in stabilizing the economy than monetary policy.

D)the Fed should strive to achieve zero inflation.

A)the economy will have fewer, shorter, and less severe business cycles if the Fed holds the rate of inflation to low, targeted levels from year to year.

B)low interest rates are inflationary and high interest rates are deflationary.

C)fiscal policy is more effective in stabilizing the economy than monetary policy.

D)the Fed should strive to achieve zero inflation.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

65

The theory of rational expectations concludes that

A)the public's expectations can influence the outcome of monetary policy but not of fiscal policy.

B)the public's expectations can influence the outcome of fiscal policy but not of monetary policy.

C)the public's expectations as to the effects of economic policies tends to reinforce the effectiveness of those policies.

D)by reacting in its self-interest to the expected effects of stabilization policy, the public tends to negate the impact of those policies.

A)the public's expectations can influence the outcome of monetary policy but not of fiscal policy.

B)the public's expectations can influence the outcome of fiscal policy but not of monetary policy.

C)the public's expectations as to the effects of economic policies tends to reinforce the effectiveness of those policies.

D)by reacting in its self-interest to the expected effects of stabilization policy, the public tends to negate the impact of those policies.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

66

Most mainstream macroeconomists oppose a strict requirement to balance the federal budget annually because they conclude that such a requirement would

A)increase real interest rates and drive out investment spending.

B)eliminate monetary policy as a stabilization tool.

C)force government to undertake expansionary fiscal policy during inflation and contractionary fiscal policy during recession.

D)expand the size of the federal government.

A)increase real interest rates and drive out investment spending.

B)eliminate monetary policy as a stabilization tool.

C)force government to undertake expansionary fiscal policy during inflation and contractionary fiscal policy during recession.

D)expand the size of the federal government.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following groups of economists believe that cost-push inflation is impossible in the long run without excessive monetary growth?

A)mainstream economists and monetarists

B)mainstream economists and rational expectations economists

C)monetarists and rational expectations economists

D)mainstream economists, monetarists, and rational expectations economists

A)mainstream economists and monetarists

B)mainstream economists and rational expectations economists

C)monetarists and rational expectations economists

D)mainstream economists, monetarists, and rational expectations economists

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

68

According to mainstream economists, the Fed's adherence to a traditional monetary rule rather than to discretionary monetary policy is likely to

A)reduce the severity of business cycles.

B)increase the amount of instability in the economy.

C)increase the rate of inflation.

D)crowd out much-needed investment spending during times of rapid inflation.

A)reduce the severity of business cycles.

B)increase the amount of instability in the economy.

C)increase the rate of inflation.

D)crowd out much-needed investment spending during times of rapid inflation.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

69

In comparing monetarism and rational expectations theory, we find that

A)both favor policy rules and for the same reasons.

B)both favor policy rules, but for different reasons.

C)both favor discretionary policies.

D)the former favors discretionary policy, while the latter favors policy rules.

A)both favor policy rules and for the same reasons.

B)both favor policy rules, but for different reasons.

C)both favor discretionary policies.

D)the former favors discretionary policy, while the latter favors policy rules.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

70

Mainstream economists favor

A)the use of discretionary monetary policy and fiscal policy.

B)a monetary rule.

C)a balanced-budget amendment.

D)wage and price controls.

A)the use of discretionary monetary policy and fiscal policy.

B)a monetary rule.

C)a balanced-budget amendment.

D)wage and price controls.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

71

According to mainstream economists, a restrictive monetary policy might be frustrated, wholly or in part, by

A)Treasury sales of gold bullion.

B)a Treasury surplus.

C)the desire of households and businesses to hold smaller money balances.

D)a decrease in V.

A)Treasury sales of gold bullion.

B)a Treasury surplus.

C)the desire of households and businesses to hold smaller money balances.

D)a decrease in V.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following ideas of the rational expectations theory has been absorbed into mainstream macroeconomics?

A)the monetary rule

B)the idea that "money doesn't matter"

C)the monetary multiplier

D)the idea that "expectations are important"

A)the monetary rule

B)the idea that "money doesn't matter"

C)the monetary multiplier

D)the idea that "expectations are important"

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

73

Modern mainstream macroeconomists agree with the monetarists that

A)the Fed should increase the money supply at a fixed annual rate.

B)velocity is highly stable.

C)fiscal policy is largely ineffective.

D)"money matters" in the macroeconomy.

A)the Fed should increase the money supply at a fixed annual rate.

B)velocity is highly stable.

C)fiscal policy is largely ineffective.

D)"money matters" in the macroeconomy.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

74

The view that excessive growth of the money supply over long periods leads to inflation

A)is accepted by the monetarists but not by mainstream macroeconomists.

B)is the main contribution of the rational expectations theory.

C)had been absorbed into the mainstream of macroeconomics.

D)is known as the monetary rule.

A)is accepted by the monetarists but not by mainstream macroeconomists.

B)is the main contribution of the rational expectations theory.

C)had been absorbed into the mainstream of macroeconomics.

D)is known as the monetary rule.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

75

Mainstream macroeconomics has embraced the

A)rational expectations view that stabilization policy is totally ineffective.

B)monetarist view that the Fed should increase the money supply at a fixed annual rate.

C)rational expectations view that expectations can shift the aggregate demand and aggregate supply curves.

D)monetarist view that an increase in government spending crowds out an equal amount of investment spending.

A)rational expectations view that stabilization policy is totally ineffective.

B)monetarist view that the Fed should increase the money supply at a fixed annual rate.

C)rational expectations view that expectations can shift the aggregate demand and aggregate supply curves.

D)monetarist view that an increase in government spending crowds out an equal amount of investment spending.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following perspectives believes that both wages and prices are stuck in the immediate short run and that prices are inflexible downward but flexible upward?

A)monetarism

B)mainstream economists

C)rational expectations economists

D)None of these-they all see wages and prices as flexible.

A)monetarism

B)mainstream economists

C)rational expectations economists

D)None of these-they all see wages and prices as flexible.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

77

According to monetarists, a fiscal deficit will be associated with an increase in real output

A)regardless of the character of accompanying changes in M or V.

B)only if it is accompanied by an increase in the demand for money.

C)only if it is accompanied by an increase in the supply of money.

D)only if it is financed by selling government bonds to the public.

A)regardless of the character of accompanying changes in M or V.

B)only if it is accompanied by an increase in the demand for money.

C)only if it is accompanied by an increase in the supply of money.

D)only if it is financed by selling government bonds to the public.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

78

The rational expectations perspective suggests that

A)fiscal policy is more powerful than monetary policy.

B)monetary policy is more powerful than fiscal policy.

C)fiscal and monetary policy are not likely to achieve their stated aims.

D)fiscal policy works only to the extent that it is accompanied by fully anticipated changes in the money supply.

A)fiscal policy is more powerful than monetary policy.

B)monetary policy is more powerful than fiscal policy.

C)fiscal and monetary policy are not likely to achieve their stated aims.

D)fiscal policy works only to the extent that it is accompanied by fully anticipated changes in the money supply.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following groups of economists is most likely to favor annually balanced federal budgets?

A)mainstream economists

B)supply-side economists

C)rational expectations economists

D)functional finance economists

A)mainstream economists

B)supply-side economists

C)rational expectations economists

D)functional finance economists

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck

80

(Consider This) The 2007-2009 recession began with reductions in investment and consumption spending, precipitated by a financial crisis.This explanation for the recession is consistent with

A)the monetarist view of macroeconomic instability.

B)the rational expectations view of macroeconomic instability.

C)the mainstream view of macroeconomic instability.

D)none of these views of macroeconomic instability.

A)the monetarist view of macroeconomic instability.

B)the rational expectations view of macroeconomic instability.

C)the mainstream view of macroeconomic instability.

D)none of these views of macroeconomic instability.

Unlock Deck

Unlock for access to all 225 flashcards in this deck.

Unlock Deck

k this deck