Deck 9: Financial Planning and Analysis: the Master Budget

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

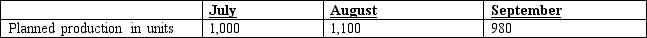

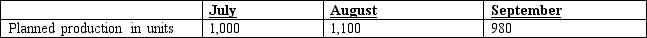

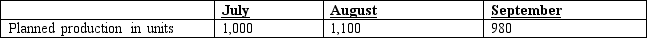

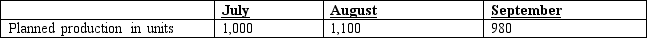

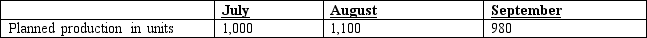

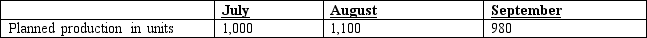

Question

Question

Question

Question

Question

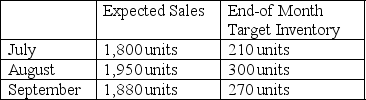

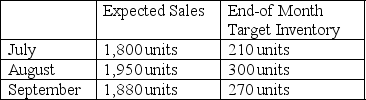

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

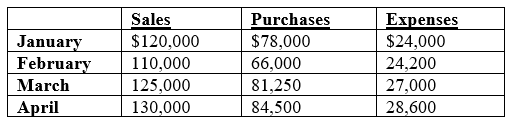

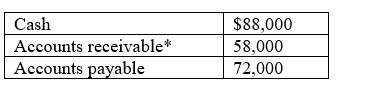

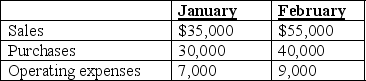

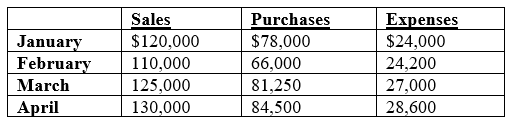

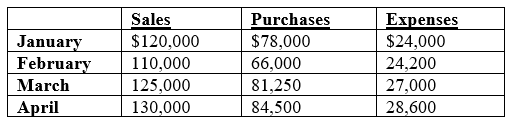

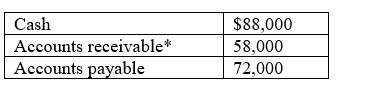

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

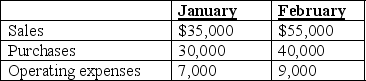

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/112

Play

Full screen (f)

Deck 9: Financial Planning and Analysis: the Master Budget

1

All conversion costs are included in the direct-labor budget.

False

2

The first step in developing a master budget is always the creation of a cash budget.

False

3

Implementation of participative budgeting prevents budget padding.

False

4

Sainte Claire Corporation has a highly automated production facility. Production volume and management judgment are the two factors that would likely have the most direct influence on the company's manufacturing overhead budget.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

5

The budgeting technique that helps managers assess the company's future and know if they are reaching their performance goals is called life-cycle budgeting.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

6

Companies develop a set of operating budgets to project cash flow and likely cash shortfalls and/or surpluses.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

7

Translation of foreign currencies is a challenge faced by the budgeting process in firms with international operations.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

8

Budgetary slack often is used to cope with uncertainty.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

9

The comprehensive set of budgets that serves as a company's overall financial plan is commonly known as the financial budget.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

10

A difference in timing between units sold and units produced can result from logistical lags.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

11

A three-stage allocation process is used in activity-based costing systems.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

12

A budgeted income statement, a budgeted balance sheet, and a budgeted statement of cash flows are the end result of the master budgeting process.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

13

The planning component of the FP&A system is called the sales budget.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

14

A disadvantage of a provider hosted approach through the cloud is that the company's proprietary financial data resides outside of the company's walls.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

15

The risk of being wrong about predictions can sometimes be mitigated by managers' actions.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

16

That employees make little effort to achieve budgetary goals is an outcome sometimes associated with participative budgeting.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

17

A company's sales forecast would likely not consider general economic and industry trends.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

18

A complete financial planning and analysis (FP&A) system includes subsystems for (1) planning, (2) measuring and recording results, and (3) evaluating performance.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

19

Managers typically avoid making assumptions that will be part of the year's financial plan.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

20

Activity-based budgeting (ABB) takes the Activity-based costing model (ABC) and reverses the flow of the analysis.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following budgets is based on many other master-budget components?

A) Direct labor budget.

B) Overhead budget.

C) Sales budget.

D) Cash budget.

E) Selling and administrative expense budget.

A) Direct labor budget.

B) Overhead budget.

C) Sales budget.

D) Cash budget.

E) Selling and administrative expense budget.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

22

A company's plan for the acquisition of long-lived assets, such as buildings and equipment, is commonly called a:

A) pro-forma budget.

B) master budget.

C) financial budget.

D) profit plan.

E) capital budget.

A) pro-forma budget.

B) master budget.

C) financial budget.

D) profit plan.

E) capital budget.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

23

A company's sales forecast would likely consider all of the following factors except:

A) political and legal events.

B) advertising and pricing policies.

C) general economic and industry trends.

D) top management's attitude toward decentralized operating structures.

E) competition.

A) political and legal events.

B) advertising and pricing policies.

C) general economic and industry trends.

D) top management's attitude toward decentralized operating structures.

E) competition.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

24

The budgeted income statement, budgeted balance sheet, and budgeted statement of cash flows comprise:

A) the final portion of the master budget.

B) the depiction of an organization's overall actual financial results.

C) the first step of the master budget.

D) the portion of the master budget prepared after the sales forecast and before the remainder of the operational budgets.

E) the second step of the master budget.

A) the final portion of the master budget.

B) the depiction of an organization's overall actual financial results.

C) the first step of the master budget.

D) the portion of the master budget prepared after the sales forecast and before the remainder of the operational budgets.

E) the second step of the master budget.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

25

Activity-based budgeting:

A) begins with a forecast of products and services to be produced, and customers served.

B) ends with a forecast of products and services to be produced, and customers served.

C) parallels the flow of analysis that is associated with activity-based costing.

D) reverses the flow of analysis that is associated with activity-based costing.

E) None of the answers is correct.

A) begins with a forecast of products and services to be produced, and customers served.

B) ends with a forecast of products and services to be produced, and customers served.

C) parallels the flow of analysis that is associated with activity-based costing.

D) reverses the flow of analysis that is associated with activity-based costing.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

26

A company's expected receipts from sales and planned disbursements to pay bills is commonly called a:

A) pro-forma budget.

B) master budget.

C) financial budget.

D) profit plan.

E) cash budget.

A) pro-forma budget.

B) master budget.

C) financial budget.

D) profit plan.

E) cash budget.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

27

An organization's budgets will often be prepared to cover:

A) one month.

B) one quarter.

C) one year.

D) periods longer than one year.

E) all of the answers are correct.

A) one month.

B) one quarter.

C) one year.

D) periods longer than one year.

E) all of the answers are correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

28

A formal budget program will almost always result in:

A) higher sales.

B) more cash inflows than cash outflows.

C) decreased expenses.

D) improved profits.

E) a detailed plan against which actual results can be compared.

A) higher sales.

B) more cash inflows than cash outflows.

C) decreased expenses.

D) improved profits.

E) a detailed plan against which actual results can be compared.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

29

A company's sales forecast would likely consider all of the following factors except:

A) past sales levels and trends.

B) the company's intended pricing policy.

C) the company's product costing policy.

D) market research studies.

E) planned advertising and promotions.

A) past sales levels and trends.

B) the company's intended pricing policy.

C) the company's product costing policy.

D) market research studies.

E) planned advertising and promotions.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following organizations is not likely to use budgets?

A) Manufacturing firms.

B) Merchandising firms.

C) Firms in service industries.

D) Nonprofit organizations.

E) None of the answers is correct, because all are likely to use budgets.

A) Manufacturing firms.

B) Merchandising firms.

C) Firms in service industries.

D) Nonprofit organizations.

E) None of the answers is correct, because all are likely to use budgets.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

31

A company's plan for the issuance of stock or incurrence of debt is commonly called a:

A) pro-forma budget.

B) master budget.

C) financial budget.

D) profit plan.

E) capital budget.

A) pro-forma budget.

B) master budget.

C) financial budget.

D) profit plan.

E) capital budget.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following budgets is prepared at the end of the budget-construction cycle?

A) Sales budget.

B) Production budget.

C) Budgeted financial statements.

D) Cash budget.

E) Overhead budget.

A) Sales budget.

B) Production budget.

C) Budgeted financial statements.

D) Cash budget.

E) Overhead budget.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

33

Salizar Corporation is budgeting its equipment needs on an on-going basis, with a new quarter being added to the budget as the current quarter is completed. This type of budget is most commonly known as a:

A) capital budget.

B) rolling budget.

C) revised budget.

D) pro-forma budget.

E) financial budget.

A) capital budget.

B) rolling budget.

C) revised budget.

D) pro-forma budget.

E) financial budget.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

34

The comprehensive set of budgets that serves as a company's overall financial plan is commonly known as:

A) an integrated budget.

B) a pro-forma budget.

C) a master budget.

D) a financial budget.

E) a rolling budget.

A) an integrated budget.

B) a pro-forma budget.

C) a master budget.

D) a financial budget.

E) a rolling budget.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

35

Nonprofit organizations begin their budgeting process with:

A) a sales budget.

B) anticipated funding.

C) proforma financial statements.

D) services to be provided.

E) a cash budget.

A) a sales budget.

B) anticipated funding.

C) proforma financial statements.

D) services to be provided.

E) a cash budget.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements best describes the relationship between the sales-forecasting process and the master-budgeting process?

A) The sales forecast is typically completed after completion of the master budget.

B) The sales forecast is typically completed approximately halfway through the master-budget process.

C) The sales forecast is typically completed before the master budget and has no impact on the master budget.

D) The sales forecast is typically completed before the master budget and has little impact on the master budget.

E) The sales forecast is typically completed before the master budget and has significant impact on the master budget.

A) The sales forecast is typically completed after completion of the master budget.

B) The sales forecast is typically completed approximately halfway through the master-budget process.

C) The sales forecast is typically completed before the master budget and has no impact on the master budget.

D) The sales forecast is typically completed before the master budget and has little impact on the master budget.

E) The sales forecast is typically completed before the master budget and has significant impact on the master budget.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

37

Generally speaking, budgets are not used to:

A) identify a company's most profitable products.

B) evaluate performance.

C) create a plan of action.

D) assist in the control of profit and operations.

E) facilitate communication and coordinate activities.

A) identify a company's most profitable products.

B) evaluate performance.

C) create a plan of action.

D) assist in the control of profit and operations.

E) facilitate communication and coordinate activities.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

38

A manufacturing firm would begin preparation of its master budget by constructing a:

A) sales budget.

B) production budget.

C) cash budget.

D) capital budget.

E) set of pro-forma financial statements.

A) sales budget.

B) production budget.

C) cash budget.

D) capital budget.

E) set of pro-forma financial statements.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

39

A budget serves as a benchmark against which:

A) actual results can be compared.

B) allocated results can be compared.

C) actual results become inconsequential.

D) allocated results become inconsequential.

E) cash balances can be compared to expense totals.

A) actual results can be compared.

B) allocated results can be compared.

C) actual results become inconsequential.

D) allocated results become inconsequential.

E) cash balances can be compared to expense totals.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following would depict the logical order for preparing (1) a production budget, (2) a cash budget, (3) a sales budget, and (4) a direct-labor budget?

A) 1-3-4-2.

B) 2-3-1-4.

C) 2-1-3-4.

D) 3-1-4-2.

E) 3-1-2-4.

A) 1-3-4-2.

B) 2-3-1-4.

C) 2-1-3-4.

D) 3-1-4-2.

E) 3-1-2-4.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

41

Houseman, Inc. anticipates sales of 50,000 units, 48,000 units, 51,000 units and 50,000 units in July, August, September and October, respectively. Company policy is to maintain an ending finished-goods inventory equal to 40% of the following month's sales.

-On the basis of this information, how many units would the company plan to produce in September?

A) 46,800.

B) 49,200.

C) 49,800.

D) 50,600.

E) None of the answers is correct.

-On the basis of this information, how many units would the company plan to produce in September?

A) 46,800.

B) 49,200.

C) 49,800.

D) 50,600.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

42

Terrence Corporation plans to sell 41,000 units of its single product in March. The company has 2,800 units in its March 1 finished-goods inventory and anticipates having 2,400 completed units in inventory on March 31. On the basis of this information, how many units does Terrence plan to produce during March?

A) 40,600.

B) 41,400.

C) 43,800.

D) 46,200.

E) None of the answers is correct.

A) 40,600.

B) 41,400.

C) 43,800.

D) 46,200.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

43

Miracle Enterprises sells electronics in retail outlets and on the Internet. It uses activity-based budgeting in the preparation of its selling, general, and administrative expense budget. Which of the following costs would the company likely classify as a unit-level expense on its budget?

A) Media advertising.

B) Retail outlet sales commissions.

C) Salaries of web-site maintenance personnel.

D) Administrative salaries.

E) Salary of the sales manager employed at store no. 23.

A) Media advertising.

B) Retail outlet sales commissions.

C) Salaries of web-site maintenance personnel.

D) Administrative salaries.

E) Salary of the sales manager employed at store no. 23.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

44

Houseman, Inc. anticipates sales of 50,000 units, 48,000 units, and 51,000 units in July, August, and September, respectively. Company policy is to maintain an ending finished-goods inventory equal to 40% of the following month's sales.

- On the basis of this information, how many units would the company plan to produce in July?

A) 46,800.

B) 49,200.

C) 49,800.

D) 52,200.

E) None of the answers is correct.

- On the basis of this information, how many units would the company plan to produce in July?

A) 46,800.

B) 49,200.

C) 49,800.

D) 52,200.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

45

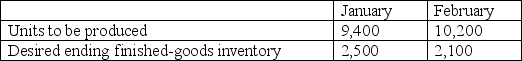

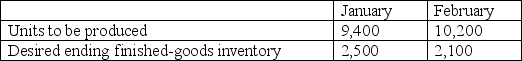

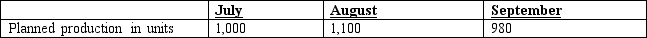

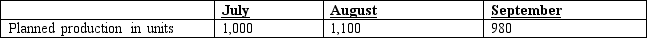

Nevis Motors manufactures a product requiring 0.5 ounces of platinum per unit. The cost of platinum is approximately $360 per ounce; the company maintains an ending platinum inventory equal to 10% of the following month's production usage. The following data were taken from the most recent quarterly production budget:

The cost of platinum to be purchased to support August production is:

A) $195,840.

B) $198,000.

C) $200,160.

D) $391,680.

E) None of the answers is correct.

The cost of platinum to be purchased to support August production is:

A) $195,840.

B) $198,000.

C) $200,160.

D) $391,680.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

46

Wu Production Company, which uses activity-based budgeting, is in the process of preparing a manufacturing overhead budget. Which of the following would likely appear on that budget?

A) Batch-level costs: Production setup.

B) Unit-level costs: Depreciation.

C) Unit-level costs: Maintenance.

D) Product-level costs: Insurance and property taxes.

E) Facility and general operations-level costs: Indirect material.

A) Batch-level costs: Production setup.

B) Unit-level costs: Depreciation.

C) Unit-level costs: Maintenance.

D) Product-level costs: Insurance and property taxes.

E) Facility and general operations-level costs: Indirect material.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

47

To derive the raw material to purchase during an accounting period, an accountant would calculate the raw material required for production and then:

A) add the beginning raw-material inventory and the desired ending raw-material inventory.

B) subtract the beginning raw-material inventory and the desired ending raw-material inventory.

C) add the beginning raw-material inventory and subtract the desired ending raw-material inventory.

D) add the desired ending raw-material inventory and subtract the beginning raw-material inventory.

E) add the desired ending raw-material inventory and subtract both the beginning raw-material inventory and the expected units to be sold.

A) add the beginning raw-material inventory and the desired ending raw-material inventory.

B) subtract the beginning raw-material inventory and the desired ending raw-material inventory.

C) add the beginning raw-material inventory and subtract the desired ending raw-material inventory.

D) add the desired ending raw-material inventory and subtract the beginning raw-material inventory.

E) add the desired ending raw-material inventory and subtract both the beginning raw-material inventory and the expected units to be sold.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

48

For an airline, which of the following would not be an operational budget?

A) A labor budget for flight crew.

B) A budget of planned air miles to be flown.

C) A materials budget for aircraft parts.

D) A fuel budget.

E) A cash receipts budget of flying consumers.

A) A labor budget for flight crew.

B) A budget of planned air miles to be flown.

C) A materials budget for aircraft parts.

D) A fuel budget.

E) A cash receipts budget of flying consumers.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

49

Barre plans to sell 5,000 units each quarter next year. During the first two quarters each unit will sell for $12; during the last two quarters the sales price will increase $1.50 per unit. What is Barre's estimated sales revenue for next year?

A) $240,000.

B) $255,000.

C) $270,000.

D) $244,000.

E) None of the answers is correct.

A) $240,000.

B) $255,000.

C) $270,000.

D) $244,000.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

50

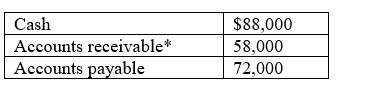

Cycle Sporting Goods sells bicycles throughout the northeastern United States. The following data were taken from the most recent quarterly sales forecast:

On the basis of the information presented, how many bicycles should the company purchase in August?

A) 1,860.

B) 1,950.

C) 2,040.

D) 2,250.

E) None of the answers is correct.

On the basis of the information presented, how many bicycles should the company purchase in August?

A) 1,860.

B) 1,950.

C) 2,040.

D) 2,250.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

51

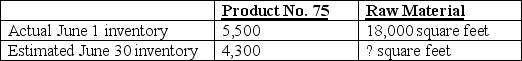

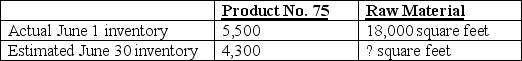

Hsu plans to sell 40,000 units of product no. 75 in June, and each of these units requires five square feet of raw material. Pertinent data follow.

If the company purchases 201,000 square feet of raw material during the month, the estimated raw-material inventory on June 30 would be:

A) 11,000 square feet.

B) 13,000 square feet.

C) 23,000 square feet.

D) 25,000 square feet.

E) None of the answers is correct.

If the company purchases 201,000 square feet of raw material during the month, the estimated raw-material inventory on June 30 would be:

A) 11,000 square feet.

B) 13,000 square feet.

C) 23,000 square feet.

D) 25,000 square feet.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

52

Maki plans to sell 10,000 units of a particular product during July, and expects sales to increase at the rate of 10% per month during the remainder of the year. The June 30 and September 30 ending inventories are anticipated to be 1,100 units and 950 units, respectively. On the basis of this information, how many units should Maki purchase for the quarter ended September 30?

A) 31,850.

B) 32,150.

C) 32,950.

D) 33,250.

E) None of the answers is correct.

A) 31,850.

B) 32,150.

C) 32,950.

D) 33,250.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

53

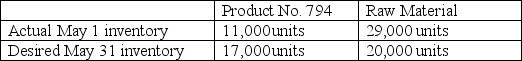

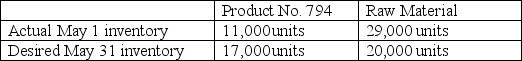

Blaylock plans to sell 85,000 units of product no. 794 in May, and each of these units requires three units of raw material. Pertinent data follow.

On the basis of the information presented, how many units of raw material should Blaylock purchase for use in May production?

A) 228,000.

B) 246,000.

C) 264,000.

D) 282,000.

E) None of the answers is correct.

On the basis of the information presented, how many units of raw material should Blaylock purchase for use in May production?

A) 228,000.

B) 246,000.

C) 264,000.

D) 282,000.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

54

Chong Corporation has a highly automated production facility. Which of the following correctly shows the two factors that would likely have the most direct influence on the company's manufacturing overhead budget?

A) Sales volume and labor hours.

B) Contribution margin and cash payments.

C) Production volume and management judgment.

D) Labor hours and management judgment.

E) Management judgment and indirect labor cost.

A) Sales volume and labor hours.

B) Contribution margin and cash payments.

C) Production volume and management judgment.

D) Labor hours and management judgment.

E) Management judgment and indirect labor cost.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

55

Houseman, Inc. anticipates sales of 50,000 units, 48,000 units, and 51,000 units in July, August, and September, respectively. Company policy is to maintain an ending finished-goods inventory equal to 40% of the following month's sales.

-On the basis of this information, how many units would the company plan to produce in August?

A) 48,000.

B) 49,200.

C) 49,800.

D) 50,600.

E) None of the answers is correct.

-On the basis of this information, how many units would the company plan to produce in August?

A) 48,000.

B) 49,200.

C) 49,800.

D) 50,600.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

56

A manufacturer develops bud?gets for the direct materials, direct labor, and overhead that will be required in the production process from which of the following?

A) The selling and administrative expenses budget.

B) The budget for merchandise purchases.

C) The sales budget.

D) The production budget.

E) The cash budget.

A) The selling and administrative expenses budget.

B) The budget for merchandise purchases.

C) The sales budget.

D) The production budget.

E) The cash budget.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

57

A company that uses activity-based budgeting performs the following:

1-Plans activities for the budget period.

2-Forecasts the demand for products and services as well as the customers to be served.

3-Budgets the resources necessary to carry out activities.

Which of the following denotes the proper order of the preceding activities?

A) 1-2-3.

B) 2-1-3.

C) 2-3-1.

D) 3-1-2.

E) 3-2-1.

1-Plans activities for the budget period.

2-Forecasts the demand for products and services as well as the customers to be served.

3-Budgets the resources necessary to carry out activities.

Which of the following denotes the proper order of the preceding activities?

A) 1-2-3.

B) 2-1-3.

C) 2-3-1.

D) 3-1-2.

E) 3-2-1.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

58

An examination of Hyong Corporation's inventory accounts revealed the following information:

Raw materials, June 1: 46,000 units

Raw materials, June 30: 51,000 units

Purchases of raw materials during June: 185,000 units

Hyong's finished product requires four units of raw materials. On the basis of this information, how many finished products were manufactured during June?

A) 45,000.

B) 47,500.

C) 57,750.

D) 70,500.

E) None of the answers is correct.

Raw materials, June 1: 46,000 units

Raw materials, June 30: 51,000 units

Purchases of raw materials during June: 185,000 units

Hyong's finished product requires four units of raw materials. On the basis of this information, how many finished products were manufactured during June?

A) 45,000.

B) 47,500.

C) 57,750.

D) 70,500.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

59

Elon & Company had 3,000 units in finished-goods inventory on December 31. The following data are available for the upcoming year:

The number of units the company expects to sell in January is:

A) 6,900.

B) 8,900.

C) 9,400.

D) 9,900.

E) 11,900.

The number of units the company expects to sell in January is:

A) 6,900.

B) 8,900.

C) 9,400.

D) 9,900.

E) 11,900.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following would have no effect, either direct or indirect, on an organization's cash budget?

A) Sales revenues.

B) Outlays for professional labor.

C) Advertising expenditures.

D) Raw material purchases.

E) None of the answers is correct, since all of these items would have some influence.

A) Sales revenues.

B) Outlays for professional labor.

C) Advertising expenditures.

D) Raw material purchases.

E) None of the answers is correct, since all of these items would have some influence.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

61

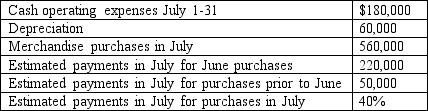

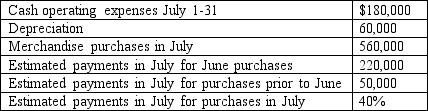

The following selected data pertain to Flagship Corporation:

July's cash disbursements are expected to be:

A) $404,000.

B) $464,000.

C) $674,000.

D) $734,000.

E) None of the answers is correct.

July's cash disbursements are expected to be:

A) $404,000.

B) $464,000.

C) $674,000.

D) $734,000.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

62

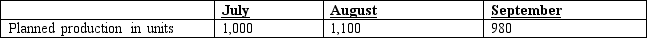

Nevis' production data for a new deluxe product were taken from the most recent quarterly production budget:

In addition, Nevis produces 5,000 units a month of its standard product. It takes two direct labor hours to produce each standard unit and 2.25 direct labor hours to produce each deluxe unit. Nevis' cost per labor hour is $15.

- Direct labor cost for August would be budgeted at:

A) $187,125.

B) $194,750.

C) $197,107.

D) $183,250.

E) None of the answers is correct.

In addition, Nevis produces 5,000 units a month of its standard product. It takes two direct labor hours to produce each standard unit and 2.25 direct labor hours to produce each deluxe unit. Nevis' cost per labor hour is $15.

- Direct labor cost for August would be budgeted at:

A) $187,125.

B) $194,750.

C) $197,107.

D) $183,250.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

63

Gallonte Inc. began operations in April of this year. It makes all sales on account, subject to the following collection pattern: 30% are collected in the month of sale; 60% are collected in the first month after sale; and 10% are collected in the second month after sale. If sales for April, May, and June were $60,000, $80,000, and $70,000, respectively, what were the firm's budgeted collections for April?

A) $18,000.

B) $21,000.

C) $60,000.

D) $65,000.

E) None of the answers is correct.

A) $18,000.

B) $21,000.

C) $60,000.

D) $65,000.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

64

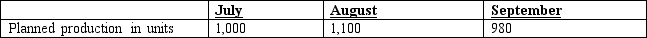

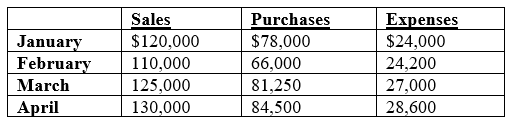

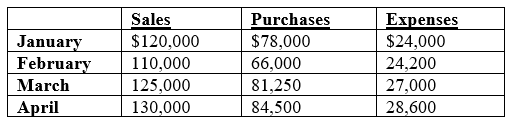

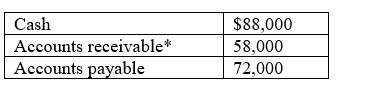

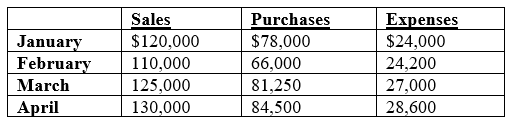

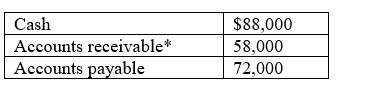

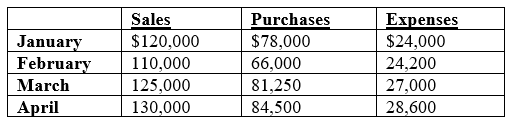

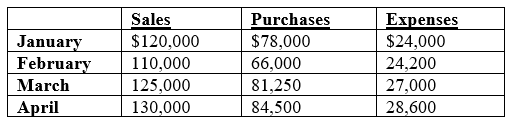

Use the following information to answer the following Questions

Morgan Company's budgeted income statement reflects the following amounts:

Sales are collected 50% in the month of sale, 30% in the month following sale, and 19% in the second month following sale. One percent of sales is uncollectible and expensed at the end of the year.

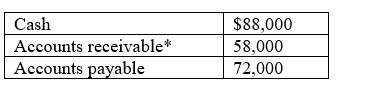

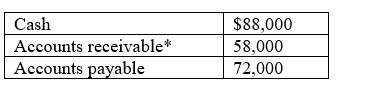

Morgan pays for all purchases in the month following purchase and takes advantage of a 3% discount. The following balances are as of January 1:

*Of this balance, $35,000 will be collected in January and the remaining amount will be collected in February.

The monthly expense figures include $5,000 of depreciation. The expenses are paid in the month incurred

-Morgan's budgeted cash payments in February are:

A) $75,660.

B) $94,860.

C) $97,200.

D) $99,860.

E) $102,200.

Morgan Company's budgeted income statement reflects the following amounts:

Sales are collected 50% in the month of sale, 30% in the month following sale, and 19% in the second month following sale. One percent of sales is uncollectible and expensed at the end of the year.

Morgan pays for all purchases in the month following purchase and takes advantage of a 3% discount. The following balances are as of January 1:

*Of this balance, $35,000 will be collected in January and the remaining amount will be collected in February.

The monthly expense figures include $5,000 of depreciation. The expenses are paid in the month incurred

-Morgan's budgeted cash payments in February are:

A) $75,660.

B) $94,860.

C) $97,200.

D) $99,860.

E) $102,200.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

65

Nevis' production data for a new deluxe product were taken from the most recent quarterly production budget:

In addition, Nevis produces 5,000 units a month of its standard product. It takes two direct labor hours to produce each standard unit and 2.25 direct labor hours to produce each deluxe unit. Nevis' cost per labor hour is $15.

- Direct labor cost for September would be budgeted at:

A) $187,125.

B) $183,075.

C) $194,750.

D) $197,075.

E) None of the answers is correct.

In addition, Nevis produces 5,000 units a month of its standard product. It takes two direct labor hours to produce each standard unit and 2.25 direct labor hours to produce each deluxe unit. Nevis' cost per labor hour is $15.

- Direct labor cost for September would be budgeted at:

A) $187,125.

B) $183,075.

C) $194,750.

D) $197,075.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

66

Gallonte Inc. began operations in April of this year. It makes all sales on account, subject to the following collection pattern: 30% are collected in the month of sale; 60% are collected in the first month after sale; and 10% are collected in the second month after sale.

- If sales for April, May, and June were $60,000, $80,000, and $70,000, respectively, what were the firm's budgeted collections for the quarter?

A) $121,000.

B) $140,000.

C) $153,000.

D) $175,000.

E) None of the answers is correct.

- If sales for April, May, and June were $60,000, $80,000, and $70,000, respectively, what were the firm's budgeted collections for the quarter?

A) $121,000.

B) $140,000.

C) $153,000.

D) $175,000.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

67

End-of-period figures for accounts receivable and payables to suppliers would be found on the:

A) cash budget.

B) budgeted schedule of cost of goods manufactured.

C) budgeted income statement.

D) budgeted balance sheet.

E) budgeted statement of cash flows.

A) cash budget.

B) budgeted schedule of cost of goods manufactured.

C) budgeted income statement.

D) budgeted balance sheet.

E) budgeted statement of cash flows.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following statements is false regarding the budgeted schedule of cost of goods manufactured and sold?

A) This budget schedule first summarizes the various costs of production from other budget schedules to compute the period's total manufacturing costs.

B) This budget adjusts for the beginning and ending cost of work-in-process inventory to compute the cost of goods manufactured.

C) This budget computes cost of goods sold by adjusting cost of goods manufactured by the beginning and ending balances in finished goods inventory.

D) This budget uses a format that is prepared by companies for external reporting purposes.

E) This budget shows produc?tion costs that are expected to flow through the inventory accounts.

A) This budget schedule first summarizes the various costs of production from other budget schedules to compute the period's total manufacturing costs.

B) This budget adjusts for the beginning and ending cost of work-in-process inventory to compute the cost of goods manufactured.

C) This budget computes cost of goods sold by adjusting cost of goods manufactured by the beginning and ending balances in finished goods inventory.

D) This budget uses a format that is prepared by companies for external reporting purposes.

E) This budget shows produc?tion costs that are expected to flow through the inventory accounts.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

69

Virginia Enterprises makes all purchases on account, subject to the following payment pattern:

Paid in the month of purchase: 30%

Paid in the first month following purchase: 65%

Paid in the second month following purchase: 5%

If purchases for April, May, and June were $200,000, $160,000, and $250,000, respectively, what was the firm's budgeted payables balance on June 30?

A) $175,000.

B) $179,000.

C) $183,000.

D) $189,000.

E) None of the answers is correct.

Paid in the month of purchase: 30%

Paid in the first month following purchase: 65%

Paid in the second month following purchase: 5%

If purchases for April, May, and June were $200,000, $160,000, and $250,000, respectively, what was the firm's budgeted payables balance on June 30?

A) $175,000.

B) $179,000.

C) $183,000.

D) $189,000.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

70

Nevis' production data for a new deluxe product were taken from the most recent quarterly production budget:

In addition, Nevis produces 5,000 units a month of its standard product. It takes two direct labor hours to produce each standard unit and 2.25 direct labor hours to produce each deluxe unit. Nevis' cost per labor hour is $15.

- Direct labor cost for the quarter would be budgeted at:

A) $519,075.

B) $533,125.

C) $547,750.

D) $553,950.

E) None of the answers is correct.

In addition, Nevis produces 5,000 units a month of its standard product. It takes two direct labor hours to produce each standard unit and 2.25 direct labor hours to produce each deluxe unit. Nevis' cost per labor hour is $15.

- Direct labor cost for the quarter would be budgeted at:

A) $519,075.

B) $533,125.

C) $547,750.

D) $553,950.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

71

Dalton Industries makes all purchases on account, subject to the following payment pattern:

Paid in the month of purchase: 30%

Paid in the first month following purchase: 60%

Paid in the second month following purchase: 10%

If purchases for January, February, and March were $200,000, $180,000, and $230,000, respectively, what were the firm's budgeted payments in March?

A) $69,000.

B) $138,000.

C) $177,000.

D) $197,000.

E) None of the answers is correct.

Paid in the month of purchase: 30%

Paid in the first month following purchase: 60%

Paid in the second month following purchase: 10%

If purchases for January, February, and March were $200,000, $180,000, and $230,000, respectively, what were the firm's budgeted payments in March?

A) $69,000.

B) $138,000.

C) $177,000.

D) $197,000.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

72

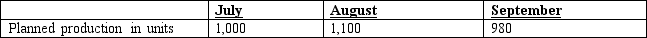

Nevis' production data for one of its products were taken from the most recent quarterly production budget:

If it takes two direct labor hours to produce each unit and Nevis' cost per labor hour is $15, direct labor cost for August would be budgeted at:

A) $16,500.

B) $31,200.

C) $33,000.

D) $34,800.

E) None of the answers is correct.

If it takes two direct labor hours to produce each unit and Nevis' cost per labor hour is $15, direct labor cost for August would be budgeted at:

A) $16,500.

B) $31,200.

C) $33,000.

D) $34,800.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

73

Use the following information to answer the following Questions

Morgan Company's budgeted income statement reflects the following amounts:

Sales are collected 50% in the month of sale, 30% in the month following sale, and 19% in the second month following sale. One percent of sales is uncollectible and expensed at the end of the year.

Morgan pays for all purchases in the month following purchase and takes advantage of a 3% discount. The following balances are as of January 1:

*Of this balance, $35,000 will be collected in January and the remaining amount will be collected in February.

The monthly expense figures include $5,000 of depreciation. The expenses are paid in the month incurred

-Morgan's expected cash balance at the end of January is:

A) $87,000.

B) $89,160.

C) $92,000.

D) $94,160.

E) $113,160.

Morgan Company's budgeted income statement reflects the following amounts:

Sales are collected 50% in the month of sale, 30% in the month following sale, and 19% in the second month following sale. One percent of sales is uncollectible and expensed at the end of the year.

Morgan pays for all purchases in the month following purchase and takes advantage of a 3% discount. The following balances are as of January 1:

*Of this balance, $35,000 will be collected in January and the remaining amount will be collected in February.

The monthly expense figures include $5,000 of depreciation. The expenses are paid in the month incurred

-Morgan's expected cash balance at the end of January is:

A) $87,000.

B) $89,160.

C) $92,000.

D) $94,160.

E) $113,160.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

74

Gallonte Inc. began operations in April of this year. It makes all sales on account, subject to the following collection pattern: 30% are collected in the month of sale; 60% are collected in the first month after sale; and 10% are collected in the second month after sale.

- If sales for April, May, and June were $60,000, $80,000, and $70,000, respectively, what were the firm's budgeted collections for May?

A) $21,000.

B) $60,000.

C) $69,000.

D) $75,000.

E) None of the answers is correct.

- If sales for April, May, and June were $60,000, $80,000, and $70,000, respectively, what were the firm's budgeted collections for May?

A) $21,000.

B) $60,000.

C) $69,000.

D) $75,000.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

75

Rainbow, Inc. began operations on January 1 of the current year with a $12,000 cash balance. Forty percent of sales are collected in the month of sale; 60% are collected in the month following sale. Similarly, 20% of purchases are paid in the month of purchase, and 80% are paid in the month following purchase. The following data apply to January and February:

If operating expenses are paid in the month incurred and include monthly depreciation charges of $2,500, determine the change in Rainbow's cash balance during February.

A) $2,000 increase.

B) $4,500 increase.

C) $5,000 increase.

D) $7,500 increase.

E) None of the answers is correct.

If operating expenses are paid in the month incurred and include monthly depreciation charges of $2,500, determine the change in Rainbow's cash balance during February.

A) $2,000 increase.

B) $4,500 increase.

C) $5,000 increase.

D) $7,500 increase.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

76

Parvis makes all sales on account, subject to the following collection pattern: 20% are collected in the month of sale; 70% are collected in the first month after sale; and 10% are collected in the second month after sale. If sales for October, November, and December were $70,000, $60,000, and $50,000, respectively, what was the budgeted receivables balance on December 31?

A) $40,000.

B) $46,000.

C) $49,000.

D) $59,000.

E) None of the answers is correct.

A) $40,000.

B) $46,000.

C) $49,000.

D) $59,000.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

77

Use the following information to answer the following Questions

Morgan Company's budgeted income statement reflects the following amounts:

Sales are collected 50% in the month of sale, 30% in the month following sale, and 19% in the second month following sale. One percent of sales is uncollectible and expensed at the end of the year.

Morgan pays for all purchases in the month following purchase and takes advantage of a 3% discount. The following balances are as of January 1:

*Of this balance, $35,000 will be collected in January and the remaining amount will be collected in February.

The monthly expense figures include $5,000 of depreciation. The expenses are paid in the month incurred

-Morgan's budgeted cash receipts in February are:

A) $91,000.

B) $95,000.

C) $113,090.

D) $113,640.

E) $114,000.

Morgan Company's budgeted income statement reflects the following amounts:

Sales are collected 50% in the month of sale, 30% in the month following sale, and 19% in the second month following sale. One percent of sales is uncollectible and expensed at the end of the year.

Morgan pays for all purchases in the month following purchase and takes advantage of a 3% discount. The following balances are as of January 1:

*Of this balance, $35,000 will be collected in January and the remaining amount will be collected in February.

The monthly expense figures include $5,000 of depreciation. The expenses are paid in the month incurred

-Morgan's budgeted cash receipts in February are:

A) $91,000.

B) $95,000.

C) $113,090.

D) $113,640.

E) $114,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

78

Use the following information to answer the following Questions

Morgan Company's budgeted income statement reflects the following amounts:

Sales are collected 50% in the month of sale, 30% in the month following sale, and 19% in the second month following sale. One percent of sales is uncollectible and expensed at the end of the year.

Morgan pays for all purchases in the month following purchase and takes advantage of a 3% discount. The following balances are as of January 1:

*Of this balance, $35,000 will be collected in January and the remaining amount will be collected in February.

The monthly expense figures include $5,000 of depreciation. The expenses are paid in the month incurred

-Morgan's expected cash balance at the end of February is:

A) $87,000.

B) $89,160.

C) $92,000.

D) $94,160.

E) $113,300.

Morgan Company's budgeted income statement reflects the following amounts:

Sales are collected 50% in the month of sale, 30% in the month following sale, and 19% in the second month following sale. One percent of sales is uncollectible and expensed at the end of the year.

Morgan pays for all purchases in the month following purchase and takes advantage of a 3% discount. The following balances are as of January 1:

*Of this balance, $35,000 will be collected in January and the remaining amount will be collected in February.

The monthly expense figures include $5,000 of depreciation. The expenses are paid in the month incurred

-Morgan's expected cash balance at the end of February is:

A) $87,000.

B) $89,160.

C) $92,000.

D) $94,160.

E) $113,300.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

79

Gallonte Inc. began operations in April of this year. It makes all sales on account, subject to the following collection pattern: 30% are collected in the month of sale; 60% are collected in the first month after sale; and 10% are collected in the second month after sale.

- If sales for April, May, and June were $60,000, $80,000, and $70,000, respectively, what were the firm's budgeted collections for June?

A) $21,000.

B) $60,000.

C) $69,000.

D) $75,000.

E) None of the answers is correct.

- If sales for April, May, and June were $60,000, $80,000, and $70,000, respectively, what were the firm's budgeted collections for June?

A) $21,000.

B) $60,000.

C) $69,000.

D) $75,000.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

80

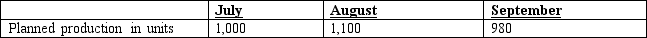

Nevis' production data for a new deluxe product were taken from the most recent quarterly production budget:

In addition, Nevis produces 5,000 units a month of its standard product. It takes two direct labor hours to produce each standard unit and 2.25 direct labor hours to produce each deluxe unit. Nevis' cost per labor hour is $15.

-Direct labor cost for July would be budgeted at:

A) $183,750.

B) $187,125.

C) $189,125.

D) $194,750.

E) None of the answers is correct.

In addition, Nevis produces 5,000 units a month of its standard product. It takes two direct labor hours to produce each standard unit and 2.25 direct labor hours to produce each deluxe unit. Nevis' cost per labor hour is $15.

-Direct labor cost for July would be budgeted at:

A) $183,750.

B) $187,125.

C) $189,125.

D) $194,750.

E) None of the answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck