Deck 17: Federal Estate Tax, Federal Gift Tax and Generation-Skipping Transfer Tax

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/56

Play

Full screen (f)

Deck 17: Federal Estate Tax, Federal Gift Tax and Generation-Skipping Transfer Tax

1

Gifts to political organizations are not subject to gift tax.

True

2

No marital deduction is generally available for gifts of terminable interests in property.

True

3

fte gift tax return, Form 709, is due pursuant to gift-splitting at the same time as the Form 706 return.

False

the gift tax return is due by April 15 following the calendar year in which taxable gifts are made

the gift tax return is due by April 15 following the calendar year in which taxable gifts are made

4

Nine months before he died Donald Drucker gave $501,000 to his son. fte gift is includible in his gross estate.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

5

If the spouse of the transferor under the Uniform Transfers to Minors Act is the custodian, the property is includible in the spouse's estate.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

6

fte annual gift tax exclusion does not apply to generation-skipping.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

7

Norma and John Baker's jointly owned home (with right of survivorship) was fully paid for by John. Nevertheless, when Norma predeceased John, one-half the value of the home is includible in her estate.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

8

fte $13,000 gift tax exclusion does not apply to charitable gifts.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

9

Private annuities are more attractive in estate planning under the present tables than under the six percent tables.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

10

Gifts of future interests may be eligible for the marital deduction, but not for the $13,000 exclusion.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

11

fte annual gift tax return is due on the same day as the individual income tax return for a calendar year taxpayer.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

12

Generally, the same valuation principles are used for income, gift and estate tax purposes.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

13

For 2012 the first $5,120,000 of the taxable estate is generally tax-free due to the allowance of a $1,772,800 tax credit.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

14

In 2012, the gift tax exemption is raised to $5.12 million.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

15

fte unified credit is the same for gift tax purposes as for estate tax purposes.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

16

Gift taxes paid on post-1976 gifts are generally allowed as a credit against the tentative estate tax.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

17

fte estate tax is not levied on tax-exempt municipal bonds.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

18

Generation-skipping was brought into the Internal Revenue Code by The 1986 Tax Reform Act.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

19

Testamentary charitable gifts are deductible up to 50 percent of the adjusted gross estate.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

20

fte insured made a transfer of a life insurance policy on his life two years prior to his death. Even though he retained no incidents of ownership in the policy, the proceeds will be includible in his gross estate.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

21

Special Use Valuation is only applicable to truck farms.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

22

fte following is a partial list of relevant items available when filing Wilma Pott's estate tax return: (1.) Two years before she died, Wilma sold stocks, now worth $90,000, then $65,000, for $30,000, to her son. (2.) Wilma owned a summer house, worth $50,000, in joint tenancy with her sister, Betsy, who paid for it.

(3)) Wilma's home was held in a tenancy by the entirety with her husband, Wilbur, who paid for it, and is worth

$150,000.

(4)) Wilma's clothes and shoes are worth $800. From the above, Wilma's gross estate includes:

A) $75,800

B) $100,800

C) $160,800

D) $800

(3)) Wilma's home was held in a tenancy by the entirety with her husband, Wilbur, who paid for it, and is worth

$150,000.

(4)) Wilma's clothes and shoes are worth $800. From the above, Wilma's gross estate includes:

A) $75,800

B) $100,800

C) $160,800

D) $800

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

23

A number of deductions are allowable from the gross estate. Which of the following expenditures is deductible?

A) Postmortem interest on decedent's mortgage

B) A casualty loss sustained by a beneficiary with respect to property distributed from the estate

C) Estimated commissions on the planned sale of land owned by the decedent

D) Funeral expenses

A) Postmortem interest on decedent's mortgage

B) A casualty loss sustained by a beneficiary with respect to property distributed from the estate

C) Estimated commissions on the planned sale of land owned by the decedent

D) Funeral expenses

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following items is not includible in the decedent's gross estate?

A) A lump-sum distribution from a qualified profit-sharing plan to decedent's daughter who elects five-year forward averaging

B) A gift of life insurance two years prior to death to decedent's son

C) Unpaid dividends when death occurred prior to the record date

D) fte widow's statutory share of the estate under the State Probate Act (in lieu of dower)

A) A lump-sum distribution from a qualified profit-sharing plan to decedent's daughter who elects five-year forward averaging

B) A gift of life insurance two years prior to death to decedent's son

C) Unpaid dividends when death occurred prior to the record date

D) fte widow's statutory share of the estate under the State Probate Act (in lieu of dower)

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

25

When a lump-sum distribution from a qualified pension plan is made to a named beneficiary, the following amount is not includible in the plan participant's gross estate.

A) Up to $100,000 if the beneficiary waives favorable income tax treatment on the whole distribution

B) fte amount allocable to the participant's own contributions

C) fte full amount, if the surviving spouse is the beneficiary

D) None of the above

A) Up to $100,000 if the beneficiary waives favorable income tax treatment on the whole distribution

B) fte amount allocable to the participant's own contributions

C) fte full amount, if the surviving spouse is the beneficiary

D) None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

26

fte donee-beneficiary of a trust may be given a number of rights and powers over the trust without the trust fund becoming includible in the donee's gross estate. Such "permissible" rights and powers include the following, except:

A) fte donee may be the trustee and have a life estate in the trust.

B) fte donee may have a special power of appointment over the trust corpus.

C) fte donee may have the power to invade the corpus for support, maintenance, health, and education.

D) fte donee may have the testamentary power to appoint the remainder.

A) fte donee may be the trustee and have a life estate in the trust.

B) fte donee may have a special power of appointment over the trust corpus.

C) fte donee may have the power to invade the corpus for support, maintenance, health, and education.

D) fte donee may have the testamentary power to appoint the remainder.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

27

When Cyrus Caldfield died he left his wife, Brenda, a number of items. Which of the following items includible in Cyrus's gross estate and actually received by Brenda qualifies for the marital deduction?

A) A remainder interest in a vacation home, with Cyrus's mother, Tara, as a life tenant.

B) fte family home, on condition that Brenda survived the probate proceeding, which she did. fte proceedings took four months.

C) fte life income interest in a trust, plus a power to appoint the trust corpus to any or all of her children or grandchildren.

D) A life estate in a trust, plus a testamentary power to appoint corpus to anyone, but only on condition that she never remarried.

A) A remainder interest in a vacation home, with Cyrus's mother, Tara, as a life tenant.

B) fte family home, on condition that Brenda survived the probate proceeding, which she did. fte proceedings took four months.

C) fte life income interest in a trust, plus a power to appoint the trust corpus to any or all of her children or grandchildren.

D) A life estate in a trust, plus a testamentary power to appoint corpus to anyone, but only on condition that she never remarried.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

28

fte gross estate may differ greatly from the probate estate. fte following items are includible in the gross estate, but not the probate estate, except:

A) Life insurance proceeds payable to the decedent's daughter

B) Joint savings account in the names of the decedent and the surviving spouse

C) Real estate held as community property by the decedent and the spouse

D) Property transferred to a revocable trust by the decedent three months before death

A) Life insurance proceeds payable to the decedent's daughter

B) Joint savings account in the names of the decedent and the surviving spouse

C) Real estate held as community property by the decedent and the spouse

D) Property transferred to a revocable trust by the decedent three months before death

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

29

fte following assets, which are not part of the probate estate, nevertheless are includible in the gross estate, except:

A) Property transferred to a revocable trust by the decedent 17 years prior to death

B) Property sold by the decedent two years prior to death for a private annuity of equal value

C) Property transferred to decedent's wife for life, then to their son if the son survives his mother, to the extent of the reversion

D) A life insurance policy transferred two and a half years ago on the decedent's life

A) Property transferred to a revocable trust by the decedent 17 years prior to death

B) Property sold by the decedent two years prior to death for a private annuity of equal value

C) Property transferred to decedent's wife for life, then to their son if the son survives his mother, to the extent of the reversion

D) A life insurance policy transferred two and a half years ago on the decedent's life

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following taxes are not deductible from the gross estate as a claim against the estate?

A) Unpaid gift taxes on gifts made by the decedent

B) Unpaid state income tax on decedent's income

C) Assessed property taxes on hunting lodge jointly held with decedent's brother, who purchased it

D) Assessed, but unpaid, income taxes relating to one of the decedent's previous federal tax returns

A) Unpaid gift taxes on gifts made by the decedent

B) Unpaid state income tax on decedent's income

C) Assessed property taxes on hunting lodge jointly held with decedent's brother, who purchased it

D) Assessed, but unpaid, income taxes relating to one of the decedent's previous federal tax returns

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following retained powers is not an "incident of ownership" in a life insurance policy?

A) A power to use the policy as collateral for loans not to exceed one-half its cash value.

B) A power to select a settlement option spelled out in the policy.

C) fte power to cancel a group policy indirectly by resigning a position.

D) A power to veto a change of beneficiary after the transfer of the policy to the current beneficiary.

A) A power to use the policy as collateral for loans not to exceed one-half its cash value.

B) A power to select a settlement option spelled out in the policy.

C) fte power to cancel a group policy indirectly by resigning a position.

D) A power to veto a change of beneficiary after the transfer of the policy to the current beneficiary.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

32

Assume that John Henry died on July 1, 2012 and that sales of Video Corporation stock that he owned occurred four trading days before his death and two trading days after his death. Also, assume that the mean sales prices were $20 and $15, respectively, and that Mr. Henry owned 1,000 shares at date of death. What is the per share value of John Henry's stock on his date of death?

A) $16.67

B) $18.33

C) $20.00

D) $15.00

A) $16.67

B) $18.33

C) $20.00

D) $15.00

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

33

ftere are currently 20 community property states in the United States.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

34

fte following statements about reporting dividends on the estate tax return are all true, except:

A) A dividend "check in the mail" on the date of death is still a "check in the mail" six months later if alternate valuation is elected.

B) A dividend receivable is disclosed as a separate asset if the decedent died on or after the record date.

C) If the decedent died on or after the ex-dividend date, but prior to the record date, there is no dividend receivable on the return, but the dividend is added back to the ex-dividend price.

D) If the decedent died on or after the declaration date, the dividend is "income in respect of a decedent."

A) A dividend "check in the mail" on the date of death is still a "check in the mail" six months later if alternate valuation is elected.

B) A dividend receivable is disclosed as a separate asset if the decedent died on or after the record date.

C) If the decedent died on or after the ex-dividend date, but prior to the record date, there is no dividend receivable on the return, but the dividend is added back to the ex-dividend price.

D) If the decedent died on or after the declaration date, the dividend is "income in respect of a decedent."

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

35

fte following statements about "Qualified Terminable Interest Property" (QTIP) trusts are true, except:

A) fte QTIP trust is a "simple" trust and anyone, including a charity, may be the remainderman.

B) A QTIP trust may not be implemented prior to the grantor's death.

C) Only the grantor's spouse may be the income beneficiary, but may refuse to accept the bequest and elect against the will.

D) If a trust otherwise qualifies, QTIP treatment may be elected for an undivided portion of the trust, such as 78 percent.

A) fte QTIP trust is a "simple" trust and anyone, including a charity, may be the remainderman.

B) A QTIP trust may not be implemented prior to the grantor's death.

C) Only the grantor's spouse may be the income beneficiary, but may refuse to accept the bequest and elect against the will.

D) If a trust otherwise qualifies, QTIP treatment may be elected for an undivided portion of the trust, such as 78 percent.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

36

All the following items are includible in the gross estate of the decedent, John Palmer, except:

A) Gift tax paid on a gift made by John two years before his death

B) fte proceeds of life insurance on John's life where all incidents of ownership were transferred to an irrevocable trust 18 months prior to his death

C) fte present value of a joint and survivorship annuity purchased by John's wife, Frieda

D) Property subject to John's testamentary general power of appointment

A) Gift tax paid on a gift made by John two years before his death

B) fte proceeds of life insurance on John's life where all incidents of ownership were transferred to an irrevocable trust 18 months prior to his death

C) fte present value of a joint and survivorship annuity purchased by John's wife, Frieda

D) Property subject to John's testamentary general power of appointment

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

37

Crummey trusts represent an exception to the gift tax's present interest rule.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

38

General powers of appointment that are limited by ascertainable standards do not bring property into the Estate Tax Return.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

39

Brandon Kingsley died in 2012. fte tentative estate tax is $700,000. Brandon also paid $25,000 in gift taxes on post-1976 gifts. fte estate tax payable is:

A) $0

B) $700,000

C) $675,000

D) $150,000

A) $0

B) $700,000

C) $675,000

D) $150,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

40

fte following statements regarding the estate tax return, Form 706, are true, except:

A) It must be filed if the gross estate of a decedent who died in 2012 exceeded $5,120,000 even if no tax is due.

B) fte return is due nine months after death even if the alternate valuation date is used.

C) fte IRS generally has three years to audit the return.

D) For simple estates the short form, Form 706A, may be used.

A) It must be filed if the gross estate of a decedent who died in 2012 exceeded $5,120,000 even if no tax is due.

B) fte return is due nine months after death even if the alternate valuation date is used.

C) fte IRS generally has three years to audit the return.

D) For simple estates the short form, Form 706A, may be used.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

41

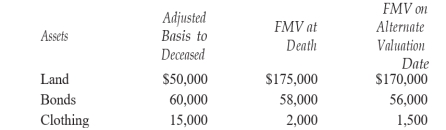

Dale Davidson's estate includes the following assets:  fte executor elects the alternative valuation date. What is the amount included in Mr. Davidson's estate?

fte executor elects the alternative valuation date. What is the amount included in Mr. Davidson's estate?

A) $125,000

B) $235,000

C) $227,500

D) None of the above

fte executor elects the alternative valuation date. What is the amount included in Mr. Davidson's estate?

fte executor elects the alternative valuation date. What is the amount included in Mr. Davidson's estate?A) $125,000

B) $235,000

C) $227,500

D) None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is not deductible in arriving at the taxable estate?

A) Administration expenses.

B) Casualty losses.

C) Adjusted taxable gifts after 1976.

D) All of the above.

A) Administration expenses.

B) Casualty losses.

C) Adjusted taxable gifts after 1976.

D) All of the above.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

43

Assume that John Henry died on July 1, 2012 and that sales of Video Corporation stock that he owned occurred four trading days before his death and two trading days after his death. Also, assume that the mean sales prices were $15 and $20, respectively, and that Mr. Henry owned 1,000 shares at date of death. What would be the fair market value?

A) $15.00

B) $20.00

C) $16.67

D) $18.33

A) $15.00

B) $20.00

C) $16.67

D) $18.33

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

44

fte following statements about the $13,000 gift tax exclusion are true, except:

A) A donor may receive two exclusions if the donor's spouse consents to gift-splitting.

B) It is not available for gifts of future interest.

C) More than one exclusion may be available to one donor in one year on the transfer of one asset to a trust.

D) fte marital deduction is available without regard to whether an exclusion is available.

A) A donor may receive two exclusions if the donor's spouse consents to gift-splitting.

B) It is not available for gifts of future interest.

C) More than one exclusion may be available to one donor in one year on the transfer of one asset to a trust.

D) fte marital deduction is available without regard to whether an exclusion is available.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

45

John Henry died during the current year, and he left a gross estate of $5.2 million. His will left $300,000 to the First Methodist church, $800,000 cash outright to his wife, $1,000,000 in a QTIP trust, and the balance in a residuary trust for his two kids. How much of a marital deduction will John Henry's estate receive?

A) $800,000

B) $2,1000,000

C) $0

D) $1,800,000

A) $800,000

B) $2,1000,000

C) $0

D) $1,800,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

46

Ed Milam, a resident of Mississippi, died during the current year. From the items listed below, what amount of allowable deductions can be subtracted from the gross estate?

A) $73,500

B) $103,500

C) $74,500

D) $78,500

A) $73,500

B) $103,500

C) $74,500

D) $78,500

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

47

In many cases, a gift tax return is due even if no gift tax is payable. ftis is true in the following situations, except:

A) A gift of $13,001 to an organization not qualifying for the gift tax charitable contribution deduction.

B) A gift of a future interest to donor's spouse, actuarially valued at $2 million.

C) A split gift of $18,000 by parents to their child.

D) A gift of a future interest worth $13 to a nephew.

A) A gift of $13,001 to an organization not qualifying for the gift tax charitable contribution deduction.

B) A gift of a future interest to donor's spouse, actuarially valued at $2 million.

C) A split gift of $18,000 by parents to their child.

D) A gift of a future interest worth $13 to a nephew.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

48

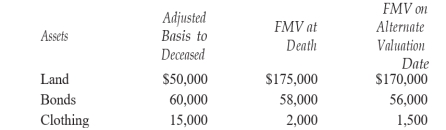

Dale Davidson's estate includes the following assets:  Assume the executor elects to value the estate at the date of death. What is the amount included in Mr. Davidson's estate?

Assume the executor elects to value the estate at the date of death. What is the amount included in Mr. Davidson's estate?

A) $125,000

B) $235,000

C) $227,500

D) None of the above

Assume the executor elects to value the estate at the date of death. What is the amount included in Mr. Davidson's estate?

Assume the executor elects to value the estate at the date of death. What is the amount included in Mr. Davidson's estate?A) $125,000

B) $235,000

C) $227,500

D) None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

49

During the current year, Joseph Horton made the following gifts: $15,000 to the local church

$13,000 to his son, Sam

$2,000 to Scrags Community College for Sam's tuition fte gift tax return would show the following:

A) Gross gifts of $30,000 less one $13,000 exclusion and a charitable deduction of $15,000.

B) Nothing, since none is due.

C) Gross gifts of $25,000, less two $13,000 exclusions, and a $5,000 charitable deduction.

D) A gross gift of $15,000, less a $13,000 exclusion and a $5,000 charitable deduction, for a net gift of zero.

$13,000 to his son, Sam

$2,000 to Scrags Community College for Sam's tuition fte gift tax return would show the following:

A) Gross gifts of $30,000 less one $13,000 exclusion and a charitable deduction of $15,000.

B) Nothing, since none is due.

C) Gross gifts of $25,000, less two $13,000 exclusions, and a $5,000 charitable deduction.

D) A gross gift of $15,000, less a $13,000 exclusion and a $5,000 charitable deduction, for a net gift of zero.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following are general powers of appointment?

A) Power to appoint to self.

B) Power to appoint to powerholder's creditors.

C) Power to appoint to creditors of powerholder's estate.

D) All of the above

A) Power to appoint to self.

B) Power to appoint to powerholder's creditors.

C) Power to appoint to creditors of powerholder's estate.

D) All of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following transactions constitute gifts for tax purposes?

A) A payment of $22,000 to cover the expenses of a 22-year-old daughter's wedding.

B) A gift of $100,000 to a political organization.

C) A gratuitous transfer to a revocable trust of $1 million, with a life estate to the grantor's sister, with remainder to a grandchild.

D) A year-end bonus of $15,000 to the vice-president of finance from the majority shareholder.

A) A payment of $22,000 to cover the expenses of a 22-year-old daughter's wedding.

B) A gift of $100,000 to a political organization.

C) A gratuitous transfer to a revocable trust of $1 million, with a life estate to the grantor's sister, with remainder to a grandchild.

D) A year-end bonus of $15,000 to the vice-president of finance from the majority shareholder.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

52

fte following are all true statements about gift-splitting, except:

A) Both spouses must be U.S. citizens or residents at the time of the gift, not necessarily the whole year.

B) fte election, once made, may only be revoked up to the due date of the gift tax return.

C) If the gifted property is owned by the spouses as tenants by the entirety, a gift-splitting election is redundant.

D) fte spouses, if not married at the time of the gift, must be married by the end of the calendar year.

A) Both spouses must be U.S. citizens or residents at the time of the gift, not necessarily the whole year.

B) fte election, once made, may only be revoked up to the due date of the gift tax return.

C) If the gifted property is owned by the spouses as tenants by the entirety, a gift-splitting election is redundant.

D) fte spouses, if not married at the time of the gift, must be married by the end of the calendar year.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

53

John Marigold's estate incurred the following payments during administration: (1.) Charitable contributions of $15,000 (2.) Funeral expenses of $4,000 (3.) Mortgage payments of $5,000 (4.) Attorney's fees of $10,000

Which of the above amounts offer the executor an option to deduct the payments?

A) (1), (2), (3), and (4)

B) (1) and (2)

C) (1) and (3)

D) (4)

Which of the above amounts offer the executor an option to deduct the payments?

A) (1), (2), (3), and (4)

B) (1) and (2)

C) (1) and (3)

D) (4)

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

54

Which statement is incorrect

A) fte current annual exclusion from gift tax is $13,000 per donee per year, indexed for inflation after 1998.

B) If the Estate tax exemption is not used at the death of H, H's wife can use the credit.

C) In 2012, the estate tax exemption is $3.5 million.

D) All of the above.

A) fte current annual exclusion from gift tax is $13,000 per donee per year, indexed for inflation after 1998.

B) If the Estate tax exemption is not used at the death of H, H's wife can use the credit.

C) In 2012, the estate tax exemption is $3.5 million.

D) All of the above.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

55

fte following statements about the gift tax are correct, except:

A) No donative intent is necessary to find a taxable gift.

B) It is difficult to find gifts in an employment situation.

C) A gift tax return is due if all gifts made during the year are to qualified charities.

D) A gift may result from the lapse of a general power of appointment.

A) No donative intent is necessary to find a taxable gift.

B) It is difficult to find gifts in an employment situation.

C) A gift tax return is due if all gifts made during the year are to qualified charities.

D) A gift may result from the lapse of a general power of appointment.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following statements is true under current law:

A) All gifts made within three years of the decedent's death are brought back into the estate and taxed.

B) fte "three-year" rule no longer applies to any lifetime gifts.

C) fte "three-year" rule now applies mainly to gifts of life insurance.

D) All of the above.

A) All gifts made within three years of the decedent's death are brought back into the estate and taxed.

B) fte "three-year" rule no longer applies to any lifetime gifts.

C) fte "three-year" rule now applies mainly to gifts of life insurance.

D) All of the above.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck