Deck 2: The Balance Sheet

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/123

Play

Full screen (f)

Deck 2: The Balance Sheet

1

The asset that results from the payment of expenses in advance is

A) short term investments.

B) prepaid expenses.

C) accounts receivable.

D) inventory.

A) short term investments.

B) prepaid expenses.

C) accounts receivable.

D) inventory.

prepaid expenses.

2

The dominating criteria by which accounting information can be judged is that of

A) freedom from bias.

B) comparability.

C) timeliness.

D) usefulness for decision making.

A) freedom from bias.

B) comparability.

C) timeliness.

D) usefulness for decision making.

usefulness for decision making.

3

Abe Cox is the sole owner and manager of Cox Auto Repair Shop. In 20X1, Cox purchased a new automobile for personal use and continued to use an old truck in the business. Which of the following fundamentals prevents Cox from recording the cost of the new automobile as an asset to the business?

A) Separate-entity assumption

B) Revenue principle

C) Full disclosure

D) Historical cost principle

A) Separate-entity assumption

B) Revenue principle

C) Full disclosure

D) Historical cost principle

Separate-entity assumption

4

How are goods, which are purchased for sale later, recorded in the ?nancial statements

A) as prepaid expenses.

B) as cost of goods sold.

C) as inventory.

D) as operating expenses.

A) as prepaid expenses.

B) as cost of goods sold.

C) as inventory.

D) as operating expenses.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following defines assets?

A) Probable future economic benefits owned by an entity as a result of past transactions.

B) Possible future economic benefits owed by an entity as a result of past transactions.

C) Probable future economic benefits owned by an entity as a result of future transactions.

D) Possible future economic benefits owed by an entity as a result of future transactions.

A) Probable future economic benefits owned by an entity as a result of past transactions.

B) Possible future economic benefits owed by an entity as a result of past transactions.

C) Probable future economic benefits owned by an entity as a result of future transactions.

D) Possible future economic benefits owed by an entity as a result of future transactions.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

6

The assumption that a business enterprise will not be liquidated or sold in the near future is known as the

A) monetary unit assumption.

B) economic entity assumption.

C) going concern assumption.

D) conservatism assumption.

A) monetary unit assumption.

B) economic entity assumption.

C) going concern assumption.

D) conservatism assumption.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

7

During the lifetime of an entity, accountants produce ?nancial statements at arbitrary points in time in accordance with which accounting concept?

A) Periodicity

B) Cost/bene?t relationship

C) Comparability

D) Monetary unit assumption

A) Periodicity

B) Cost/bene?t relationship

C) Comparability

D) Monetary unit assumption

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following defines shareholders' equity?

A) Probable debts or obligations of an entity as a result of past transactions which will be paid with assets or services.

B) Assets plus liabilities.

C) Probable future economic benefits owned by an entity as a result of past transactions.

D) The financing provided by the owners and the operations of a business.

A) Probable debts or obligations of an entity as a result of past transactions which will be paid with assets or services.

B) Assets plus liabilities.

C) Probable future economic benefits owned by an entity as a result of past transactions.

D) The financing provided by the owners and the operations of a business.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

9

The asset that results when a customer buys goods or services on credit is

A) notes receivable.

B) accounts payable.

C) Cash.

D) accounts receivable.

A) notes receivable.

B) accounts payable.

C) Cash.

D) accounts receivable.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

10

Where would we report changes in shareholders' equity caused by operating activities?

A) In the retained earnings account.

B) In a contributed capital account.

C) In a liability account.

D) In an asset account.

A) In the retained earnings account.

B) In a contributed capital account.

C) In a liability account.

D) In an asset account.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

11

It is assumed that the activities of Petro Canada Corporation can be distinguished from those of Imperial Oil Limited because of the

A) continuity assumption.

B) separate-entity assumption.

C) unit-of-measure assumption.

D) periodicity assumption.

A) continuity assumption.

B) separate-entity assumption.

C) unit-of-measure assumption.

D) periodicity assumption.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

12

The continuity assumption is inappropriate when

A) the business is just starting up.

B) liquidation appears likely.

C) fair values are higher than costs.

D) the business is organized as a proprietorship.

A) the business is just starting up.

B) liquidation appears likely.

C) fair values are higher than costs.

D) the business is organized as a proprietorship.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

13

Accounting information is considered to be relevant when it

A) can be depended on to represent the economic conditions and events that it is intended to represent.

B) is capable of making a difference in a decision.

C) is understandable by reasonably informed users of accounting information.

D) is veri?able and neutral.

A) can be depended on to represent the economic conditions and events that it is intended to represent.

B) is capable of making a difference in a decision.

C) is understandable by reasonably informed users of accounting information.

D) is veri?able and neutral.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

14

Shareholders' equity

A) is equal to liabilities and retained earnings.

B) includes retained earnings and contributed capital.

C) is shown on the income statement.

D) is usually equal to cash on hand.

A) is equal to liabilities and retained earnings.

B) includes retained earnings and contributed capital.

C) is shown on the income statement.

D) is usually equal to cash on hand.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

15

Liabilities are generally classi?ed on a statement of ?nancial position as

A) small liabilities and large liabilities.

B) present liabilities and future liabilities.

C) tangible liabilities and intangible liabilities.

D) current liabilities and non-current liabilities.

A) small liabilities and large liabilities.

B) present liabilities and future liabilities.

C) tangible liabilities and intangible liabilities.

D) current liabilities and non-current liabilities.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

16

The main objective of financial reporting is to:

A) compare a company's performance with its competitors.

B) meet the needs of all potential users.

C) provide information that is useful to individuals making investment and credit decisions.

D) provide information that will be used by a company's managers for product pricing decisions.

A) compare a company's performance with its competitors.

B) meet the needs of all potential users.

C) provide information that is useful to individuals making investment and credit decisions.

D) provide information that will be used by a company's managers for product pricing decisions.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following defines liabilities?

A) Possible debts or obligations of an entity as a result of future transactions which will be paid with assets or services.

B) Possible debts or obligations of an entity as a result of past transactions which will be paid with assets or services.

C) Probable debts or obligations of an entity as a result of future transactions which will be paid with assets or services.

D) Probable debts or obligations of an entity as a result of past transactions which will be paid with assets or services.

A) Possible debts or obligations of an entity as a result of future transactions which will be paid with assets or services.

B) Possible debts or obligations of an entity as a result of past transactions which will be paid with assets or services.

C) Probable debts or obligations of an entity as a result of future transactions which will be paid with assets or services.

D) Probable debts or obligations of an entity as a result of past transactions which will be paid with assets or services.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

18

Which one of the following is not a qualitative characteristic of useful accounting information?

A) Relevance

B) Faithful representation

C) Materiality

D) Comparability

A) Relevance

B) Faithful representation

C) Materiality

D) Comparability

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

19

If Golden Company owed Eye Company $500, where would Golden Company re?ect this?

A) Statement of ?nancial position.

B) Income statement.

C) Statement of cash ?ows

D) Statement of changes in equity.

A) Statement of ?nancial position.

B) Income statement.

C) Statement of cash ?ows

D) Statement of changes in equity.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

20

The adoption of International Financial Reporting Standards can be viewed as an application of which of the following quality enhancing characteristics?

A) Timeliness

B) Representational faithfulness

C) Veri?ability

D) Comparability

A) Timeliness

B) Representational faithfulness

C) Veri?ability

D) Comparability

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

21

Which one of the following represents the expanded basic accounting equation?

A) Assets = Liabilities + Contributed capital + Retained Earnings + Revenues - Expenses - Dividends

B) Assets + Liabilities = Dividends + Expenses + Contributed capital + Revenues

C) Assets - Liabilities - Dividends = Contributed capital + Revenues - Expenses

D) Assets = Revenues + Expenses - Liabilities

A) Assets = Liabilities + Contributed capital + Retained Earnings + Revenues - Expenses - Dividends

B) Assets + Liabilities = Dividends + Expenses + Contributed capital + Revenues

C) Assets - Liabilities - Dividends = Contributed capital + Revenues - Expenses

D) Assets = Revenues + Expenses - Liabilities

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

22

The purchase of an asset on credit

A) increases assets and shareholders' equity.

B) increases assets and liabilities.

C) decreases assets and increases liabilities.

D) has no effect on total assets.

A) increases assets and shareholders' equity.

B) increases assets and liabilities.

C) decreases assets and increases liabilities.

D) has no effect on total assets.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

23

If total liabilities decreased by $14,000, and shareholders' equity increased by $6,000 during the same period, then the amount and direction (increase or decrease) of the period's change in total assets is a(n)

A) $20,000 increase.

B) $8,000 decrease.

C) $8,000 increase.

D) $14,000 increase.

A) $20,000 increase.

B) $8,000 decrease.

C) $8,000 increase.

D) $14,000 increase.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

24

The collection of a trade receivable from a customer would do which of the following?

A) Increase liabilities.

B) Decrease liabilities.

C) Not affect liabilities.

D) Decrease shareholders' equity.

A) Increase liabilities.

B) Decrease liabilities.

C) Not affect liabilities.

D) Decrease shareholders' equity.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following transactions will cause both the left and right side of the equation to increase?

A) We collect cash from a customer who owed us money

B) We pay a supplier for inventory we previously bought on account

C) We borrow money from the bank

D) We purchase equipment for cash

A) We collect cash from a customer who owed us money

B) We pay a supplier for inventory we previously bought on account

C) We borrow money from the bank

D) We purchase equipment for cash

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

26

The payment of a liability

A) decreases assets and shareholders' equity.

B) increases assets and decreases liabilities.

C) decreases assets and increases liabilities.

D) decreases assets and liabilities.

A) decreases assets and shareholders' equity.

B) increases assets and decreases liabilities.

C) decreases assets and increases liabilities.

D) decreases assets and liabilities.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

27

The following amounts are reported in the ledger of Bowers Company: What is the balance in the contributed capital account?

A) $7,000 credit.

B) $8,000 debit.

C) $12,000 credit.

D) $12,000 debit.

A) $7,000 credit.

B) $8,000 debit.

C) $12,000 credit.

D) $12,000 debit.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

28

When a new business is just starting up, which of the following must be done ?rst?

A) Generate positive cash ?ow through successful operations.

B) Acquire the assets both long-lived and short-lived so they can operate.

C) Acquire ?nancing from issuance of shares and borrowing from creditors.

D) These activities all occur simultaneously not sequentially.

A) Generate positive cash ?ow through successful operations.

B) Acquire the assets both long-lived and short-lived so they can operate.

C) Acquire ?nancing from issuance of shares and borrowing from creditors.

D) These activities all occur simultaneously not sequentially.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is least likely to have a liability called Deferred Revenue?

A) An insurance company

B) A retailer

C) A magazine subscription company

D) A university or college

A) An insurance company

B) A retailer

C) A magazine subscription company

D) A university or college

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following will not result in recording a transaction?

A) Signing a contract to have an outside cleaning service clean o?ces nightly.

B) Paying our employees their wages.

C) Selling shares to investors.

D) Buying equipment and agreeing to pay a note payable and interest at the end of a year.

A) Signing a contract to have an outside cleaning service clean o?ces nightly.

B) Paying our employees their wages.

C) Selling shares to investors.

D) Buying equipment and agreeing to pay a note payable and interest at the end of a year.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following liability accounts is usually not satis?ed by payment of cash?

A) Trade payables.

B) Unearned revenues.

C) Taxes payable.

D) Short-term borrowings.

A) Trade payables.

B) Unearned revenues.

C) Taxes payable.

D) Short-term borrowings.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

32

The purchase of an asset on credit

A) increases assets and shareholders' equity.

B) increases assets and liabilities.

C) decreases assets and increases liabilities.

D) has no effect on total assets.

A) increases assets and shareholders' equity.

B) increases assets and liabilities.

C) decreases assets and increases liabilities.

D) has no effect on total assets.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

33

Winsome Inc. reports total assets and total liabilities of $225,000 and $100,000, respectively, at the end of its first year of business. The company earned $75,000 during the first year and distributed $30,000 in dividends. What was the corporation's contributed capital?

A) $125,000

B) $95,000

C) $80,000

D) $50,000

A) $125,000

B) $95,000

C) $80,000

D) $50,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is not considered an asset?

A) Equipment

B) Dividends

C) Accounts receivable

D) Inventory

A) Equipment

B) Dividends

C) Accounts receivable

D) Inventory

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

35

An account is a part of the ?nancial information system and is described by all except which one of the following?

A) An account has a debit and credit side

B) An account consists of three parts

C) An account has a title

D) An account is a source document

A) An account has a debit and credit side

B) An account consists of three parts

C) An account has a title

D) An account is a source document

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

36

Collection of a $600 accounts receivable

A) increases an asset $600; decreases a liability $600.

B) decreases a liability $600; increases shareholders' equity $600.

C) decreases an asset $600; decreases a liability $600.

D) has no effect on total assets.

A) increases an asset $600; decreases a liability $600.

B) decreases a liability $600; increases shareholders' equity $600.

C) decreases an asset $600; decreases a liability $600.

D) has no effect on total assets.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

37

Assume a company's January 1, 20X1, financial position was: Assets, $40,000 and Liabilities, $15,000. During January 20X1, the company completed the following transactions: (a) paid on a note payable, $4,000 (no interest); (b) collected trade receivables, $4,000; (c) paid trade payables, $2,000; and (d) purchased a truck, $1,000 cash, and $8,000 notes payable. What is the company's January 31, 20X1 financial position?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

38

On a classi?ed balance sheet, prepaid expenses are classi?ed as

A) a current liability.

B) property, plant, and equipment.

C) a current asset.

D) a long-term investment.

A) a current liability.

B) property, plant, and equipment.

C) a current asset.

D) a long-term investment.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

39

When a company buys equipment for $60,000 and pays for one third in cash and the other two thirds is ?nanced by a note payable, which of the following are the effects on the accounting equation?

A) Cash decreases by $60,000.

B) Equipment increases by $20,000.

C) Liabilities increase by $40,000.

D) Total assets increase by $60,000.

A) Cash decreases by $60,000.

B) Equipment increases by $20,000.

C) Liabilities increase by $40,000.

D) Total assets increase by $60,000.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

40

Accounting systems should record

A) all economic events.

B) events that result in a change in assets, liabilities, or shareholders' equity items.

C) only events that involve cash.

D) items of interest to the shareholders.

A) all economic events.

B) events that result in a change in assets, liabilities, or shareholders' equity items.

C) only events that involve cash.

D) items of interest to the shareholders.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

41

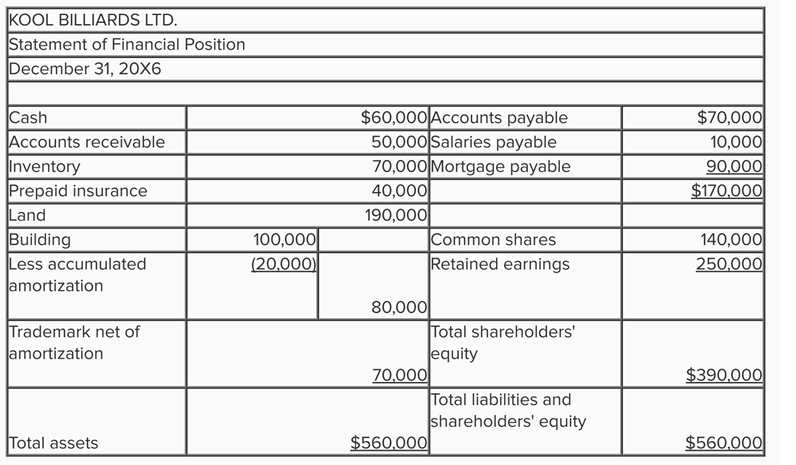

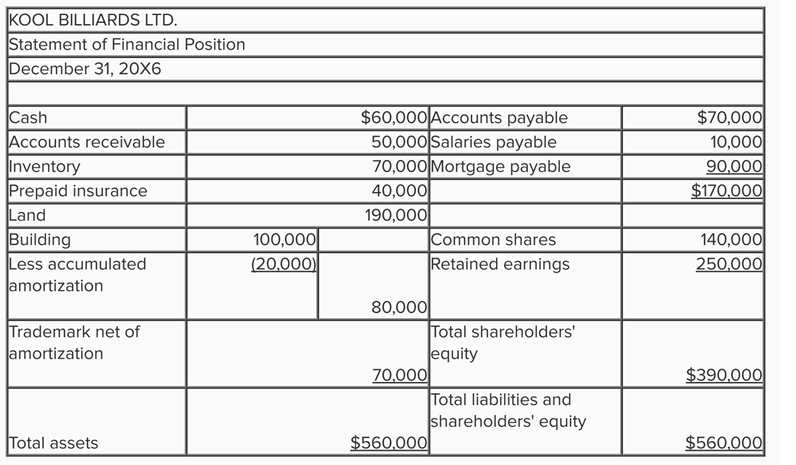

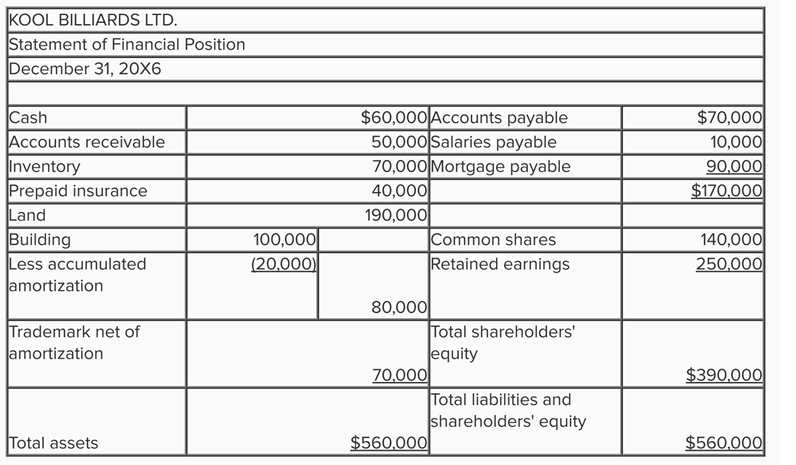

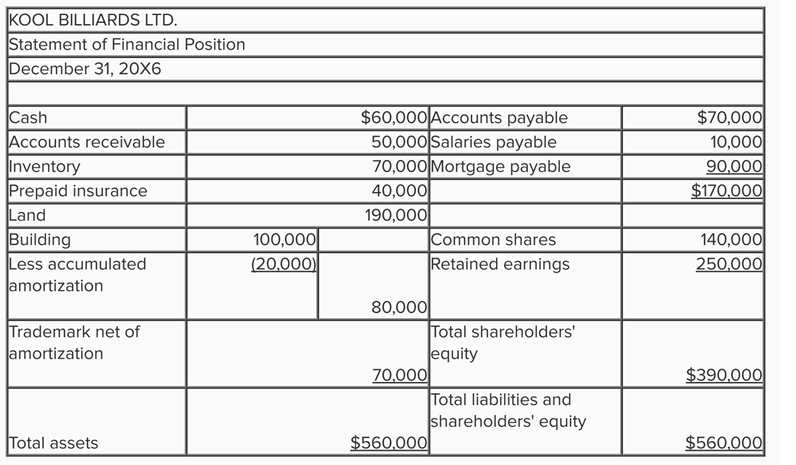

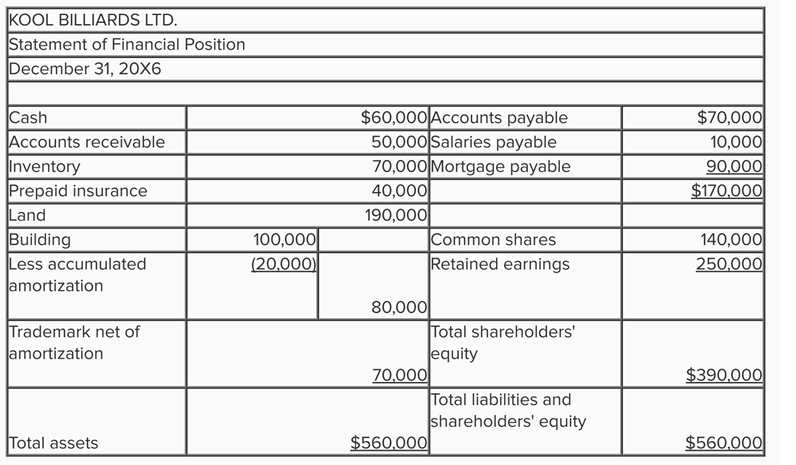

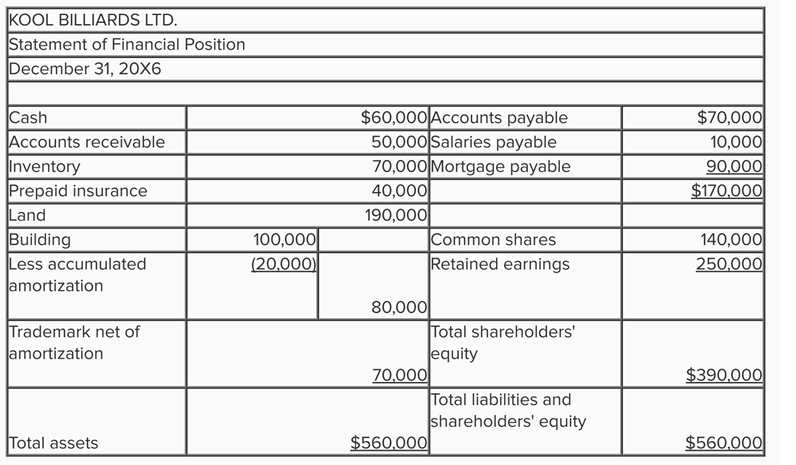

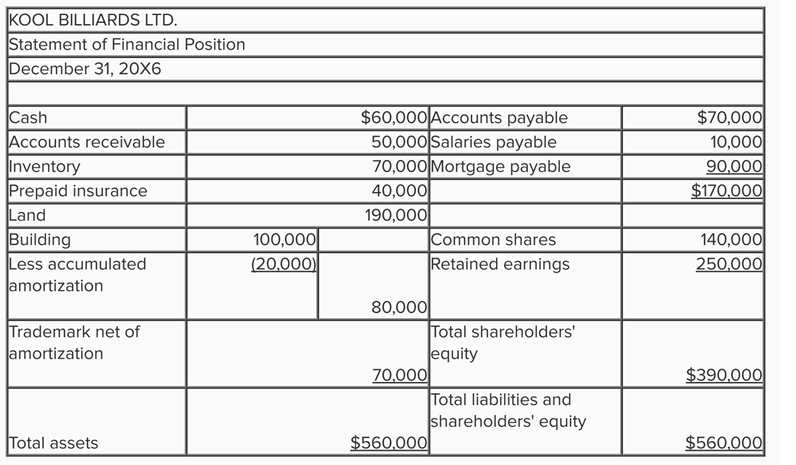

-The total dollar amount of assets to be classified as investments is

A) $0

B) $150,000

C) $100,000

D) $180,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

42

The trade payables account has a beginning balance of $1,000 and we purchased $3,000 of inventory on credit during the month. The ending balance was $800. How much did we pay our creditors during the month?

A) $2,800

B) $3,000

C) $3,200

D) $4,800

A) $2,800

B) $3,000

C) $3,200

D) $4,800

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

43

A T account is

A) a way of depicting the basic form of an account.

B) a special account used instead of a journal.

C) a special account used instead of a trial balance.

D) is the actual account form used in real accounting systems.

A) a way of depicting the basic form of an account.

B) a special account used instead of a journal.

C) a special account used instead of a trial balance.

D) is the actual account form used in real accounting systems.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

44

The classi?cation and normal balance of the dividend account is

A) revenue with a credit balance.

B) an expense with a debit balance.

C) a liability with a credit balance.

D) shareholders' equity with a debit balance.

A) revenue with a credit balance.

B) an expense with a debit balance.

C) a liability with a credit balance.

D) shareholders' equity with a debit balance.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

45

-The total dollar amount of assets to be classified as current assets is

A) $270,000

B) $220,000

C) $190,000

D) $170,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

46

-The total amount of working capital is

A) $140,000

B) $370,000

C) $40,000

D) $60,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

47

Assets normally show

A) credit balances.

B) debit balances.

C) debit and credit balances.

D) debit or credit balances.

A) credit balances.

B) debit balances.

C) debit and credit balances.

D) debit or credit balances.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

48

If total liabilities increased by $25,000 and shareholders' equity increased by $5,000 during a period of time, then total assets must change by what amount and direction during that same period?

A) $20,000 decrease

B) $25,000 increase

C) $30,000 increase

D) $20,000 increase

A) $20,000 decrease

B) $25,000 increase

C) $30,000 increase

D) $20,000 increase

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

49

Salida Company paid a note payable of $10,000 (interest had previously been paid). This transaction should be recorded as follows on the payment date.

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements is true?

A) The normal balance is always on the side of the T account that is decreasing.

B) The normal balance is always on the side of the T account that is increasing

C) The normal balance is always on the debit side of the T account.

D) The normal balance is always on the credit side of the T account.

A) The normal balance is always on the side of the T account that is decreasing.

B) The normal balance is always on the side of the T account that is increasing

C) The normal balance is always on the debit side of the T account.

D) The normal balance is always on the credit side of the T account.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

51

-Long-term liabilities total

A) $90,000

B) $170,000

C) $390,000

D) $560,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

52

-The total dollar amount of assets to be classified as property, plant, and equipment is

A) $80,000

B) $340,000

C) $270,000

D) $190,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

53

When recording transactions in T-account format, we must add an additional step to the transaction analysis process. Which of the following is the additional step?

A) Determine what accounts and elements in the equation are affected by the transaction.

B) Determine if the affected accounts are increased or decreased by the transaction.

C) We must have equal debits and credits once the entry is recorded in the accounts.

D) The accounting equation must remain in balance after each transaction.

A) Determine what accounts and elements in the equation are affected by the transaction.

B) Determine if the affected accounts are increased or decreased by the transaction.

C) We must have equal debits and credits once the entry is recorded in the accounts.

D) The accounting equation must remain in balance after each transaction.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

54

In the ?rst month of operations, the total of the debit entries to the cash account amounted to $1,900 and the total of the credit entries to the cash account amounted to $1,500. The cash account has a

A) $500 credit balance.

B) $900 debit balance.

C) $400 debit balance.

D) $400 credit balance.

A) $500 credit balance.

B) $900 debit balance.

C) $400 debit balance.

D) $400 credit balance.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

55

The best interpretation of the word credit is the

A) offset side of an account.

B) increase side of an account.

C) right side of an account.

D) decrease side of an account.

A) offset side of an account.

B) increase side of an account.

C) right side of an account.

D) decrease side of an account.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

56

Jet Corporation was organized on March 1, 20X2. Jet Corporation issued shares to each of the six owners who paid in a total of $3,000 cash. On the basis of transaction analysis, the following entry should be recorded in the accounts (dr = debit and cr = credit)

A) Cash (dr), $3,000; Revenue (cr), $3,000.

B) Cash (cr), $3,000; Shareholders' equity (dr), $3,000.

C) Cash (dr), $3,000; Contributed capital (cr), $3,000.

D) Cash (cr), $3,000; Contributed capital (dr), $3,000.

A) Cash (dr), $3,000; Revenue (cr), $3,000.

B) Cash (cr), $3,000; Shareholders' equity (dr), $3,000.

C) Cash (dr), $3,000; Contributed capital (cr), $3,000.

D) Cash (cr), $3,000; Contributed capital (dr), $3,000.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

57

-The current ratio is:

A) 1.75 to 1

B) 1.50 to 1

C) 3.25 to 1

D) 2.75 to 1

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

58

A new company signed a lease for o?ce space during their ?rst month of business. At that time, they paid a total of $16,000 for ?rst and last months' rent. At the end of the ?rst month, the effect on the ?nancial statements would be:

A) $14,000 rent expense

B) $8,000 rent expense and $8,000 prepaid rent

C) $14,000 prepaid rent

D) Nothing is recorded because the company has not made any sales yet

A) $14,000 rent expense

B) $8,000 rent expense and $8,000 prepaid rent

C) $14,000 prepaid rent

D) Nothing is recorded because the company has not made any sales yet

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

59

An accountant has debited an asset account for $500 and credited a revenue account for $1,000. What can be done to complete the recording of the transaction?

A) Nothing further must be done.

B) Debit a shareholders' equity account for $500.

C) Debit another asset account for $500.

D) Credit a different asset account for $500.

A) Nothing further must be done.

B) Debit a shareholders' equity account for $500.

C) Debit another asset account for $500.

D) Credit a different asset account for $500.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

60

Borrowing $100,000 of cash from First National Bank, signing a note to be paid, would do which of the following?

A) Increase cash by a credit.

B) Increase notes payable by a debit.

C) Increase notes payable by a credit.

D) Decrease cash by a debit.

A) Increase cash by a credit.

B) Increase notes payable by a debit.

C) Increase notes payable by a credit.

D) Decrease cash by a debit.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following expenses has no effect on the cash ?ow of a ?rm?

A) Salaries expense

B) Interest expense

C) Depreciation expense

D) Cost of goods sold

A) Salaries expense

B) Interest expense

C) Depreciation expense

D) Cost of goods sold

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

62

The unit-of-measure assumption states that financial information is reported in the national monetary unit.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

63

The basic system of recording transactions has withstood the test of time, and has been in use for more than 500 years.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following would be an example of a ?nancing transaction?

A) Purchasing equipment for cash.

B) Buying inventory from a supplier on credit.

C) Selling shares to investors for cash.

D) Buying inventory from a supplier for cash.

A) Purchasing equipment for cash.

B) Buying inventory from a supplier on credit.

C) Selling shares to investors for cash.

D) Buying inventory from a supplier for cash.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following would cause an inflow of cash?

A) Payment of a long-term mortgage.

B) Sale of an asset for cash at less than its book value.

C) Payment of accounts payable.

D) Purchase of inventory for debt.

A) Payment of a long-term mortgage.

B) Sale of an asset for cash at less than its book value.

C) Payment of accounts payable.

D) Purchase of inventory for debt.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

66

Assets are economic resources controlled by an entity as a result of past transactions or events and for which future economic benefits may be obtained.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

67

An individual accounting record for a specific asset, liability or shareholders' equity item is called an account.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

68

The amount shown on the statement of financial position as shareholders' equity represents the current market value of the owners' residual claim against the company.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

69

Three of the four basic assumptions that underlie accounting measurement and reporting relate to the statement of financial position.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

70

Cash and supplies are both classified as current assets.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

71

Financing activities involve

A) lending money.

B) acquiring investments.

C) issuing shares.

D) acquiring long-lived assets.

A) lending money.

B) acquiring investments.

C) issuing shares.

D) acquiring long-lived assets.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

72

-Earnings retained for use in the business are

A) $80,000

B) $390,000

C) $250,000

D) $60,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

73

The separate-entity assumption assumes a stable monetary unit (not affected by inflation or deflation).

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

74

Investing activities include

A) collecting the principal on loans made.

B) obtaining cash from creditors.

C) obtaining capital from owners.

D) repaying money previously borrowed.

A) collecting the principal on loans made.

B) obtaining cash from creditors.

C) obtaining capital from owners.

D) repaying money previously borrowed.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

75

Liability accounts are reported on the statement of financial position.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

76

Faithful representation means information must be free from material error, neutral and complete.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

77

A weakness of the current ratio is

A) the dificulty of the calculation.

B) that it doesn't take the composition of the current assets into account.

C) that it is rarely used by sophisticated analysts.

D) that it can be expressed as a percentage, as a rate, or as a proportion.

A) the dificulty of the calculation.

B) that it doesn't take the composition of the current assets into account.

C) that it is rarely used by sophisticated analysts.

D) that it can be expressed as a percentage, as a rate, or as a proportion.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

78

If you trade your computer plus cash for a new car, the cost of the new car is equal to the cash paid plus the market value of the computer.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

79

Dow Construction Company reports a net use of cash for investing activities of $1.2 million and a net source of cash provided by financing of $.8 million. What was the effect on the cash balance?

A) To cause the balance to increase by $.8 million.

B) To cause the balance to decrease by $.4 million.

C) To cause the balance to increase by $.4 million.

D) Undeterminable because the beginning cash balance was not given.

A) To cause the balance to increase by $.8 million.

B) To cause the balance to decrease by $.4 million.

C) To cause the balance to increase by $.4 million.

D) Undeterminable because the beginning cash balance was not given.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

80

Qualitative characteristics of accounting information are not part of the conceptual framework of accounting.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck