Deck 6: Supply, Demand and Government Policies

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

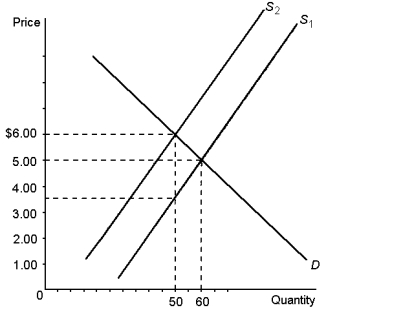

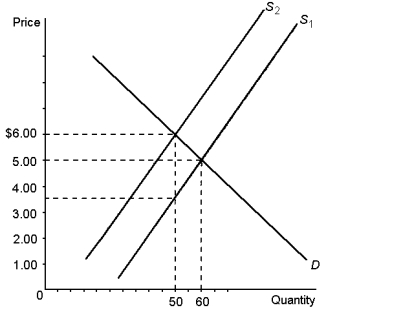

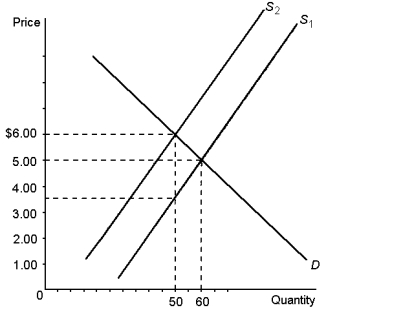

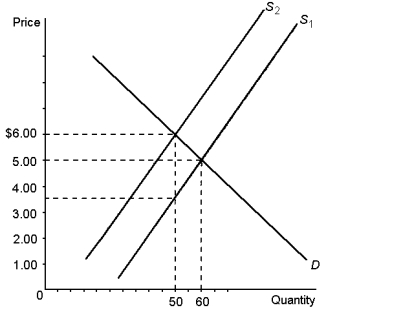

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

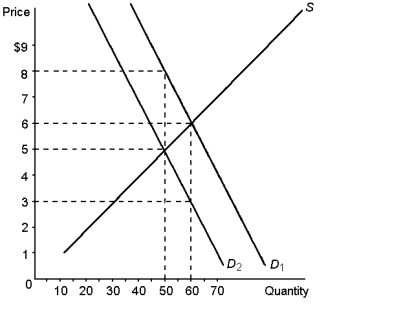

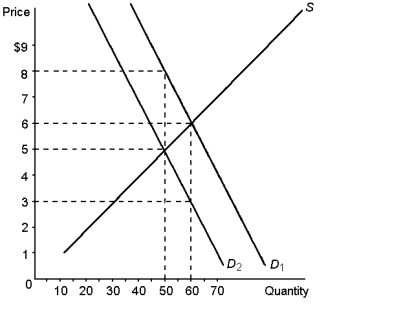

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/111

Play

Full screen (f)

Deck 6: Supply, Demand and Government Policies

1

A binding price floor in a competitive market will result in persistent shortages of a product.

False

2

Price controls are an effective way of allocating resources in an economy. For this reason there is widespread support for price controls among economists.

False

3

Taxes are employed by policy makers for two reasons. The first is to raise revenue. The second is to adjust market outcomes.

True

4

Suppose that the equilibrium wage rate in an industry is $10 per hour. The government then sets a minimum wage of $12 per hour. The result will be a surplus of labour supply.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

5

If a tax is imposed on the buyer of a product, the tax incidence will fall entirely on the buyer.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

6

Rent control reduces the incentive for landlords to properly maintain their properties.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

7

Market prices are an efficient and impersonal way to ration goods.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

8

A price floor is a legal minimum on the price of a good or service.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

9

Suppose a price floor on alcohol is set above the equilibrium price. This will increase the supply of alcohol, leading to an increase in sales of alcohol.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

10

Suppose the market equilibrium price for cigarettes is $20 before the government introduced a $22 price floor. This price floor will not be binding as it is above market price.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

11

If sellers of a product are required to pay a tax, the supply curve for the product will shift left by exactly the size of the tax.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

12

The effect of a tax on a product is always to reduce the total size of its market.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

13

Suppose a price ceiling is placed on rice. The price ceiling is set below the equilibrium price. This will result in the quantity demanded of rice exceeding the quantity supplied.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

14

Rent subsidies and wage subsidies are better than price controls at helping the poor because they have no costs associated with them.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

15

Common rationing mechanisms under price ceilings include waiting in long lines and biases of the sellers.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

16

Price controls often help those in need.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

17

Suppose the local government decides to implement rent controls. The housing shortage in the short run is likely to be less severe than the housing shortage in the long run.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

18

A binding price floor causes a surplus.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

19

Opponents of the minimum wage note that a high minimum wage creates unemployment, causes teenagers to drop out of school and prevents some unskilled workers from getting the on-the-job training that they need.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

20

If a tax is levied on a market, sellers will receive more for their goods and buyers will have to pay more for their purchases.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

21

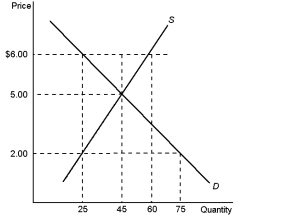

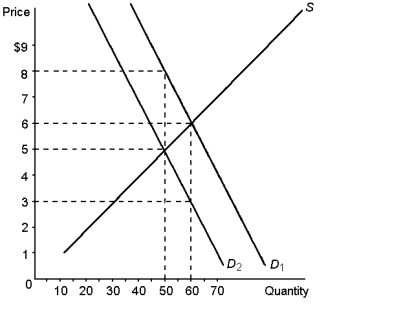

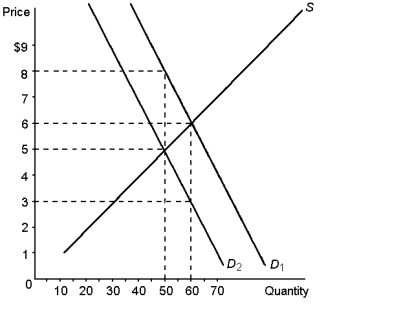

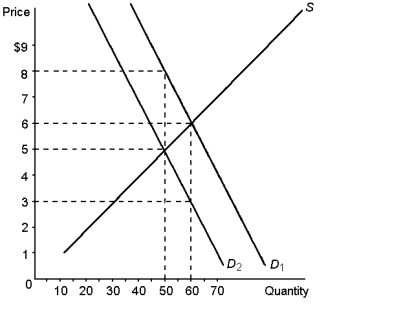

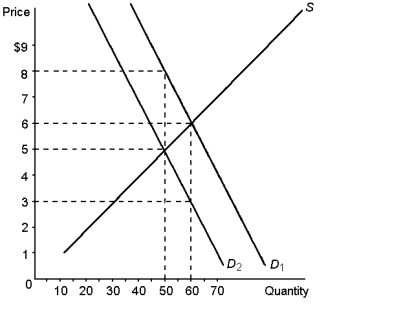

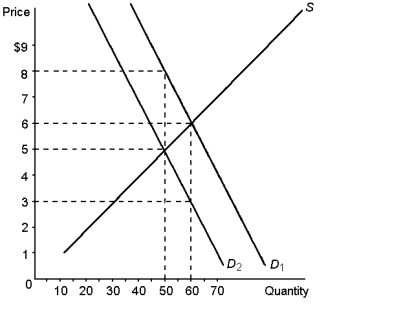

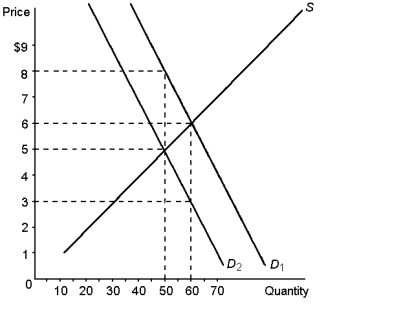

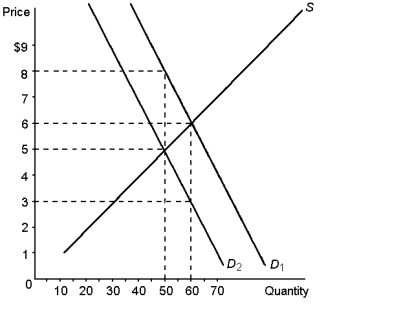

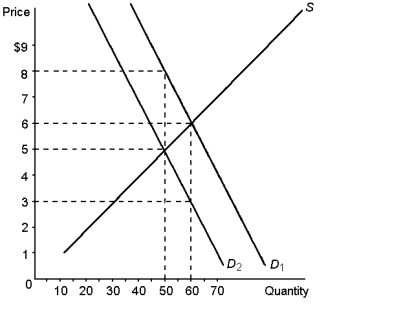

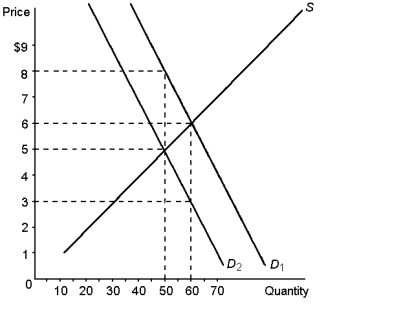

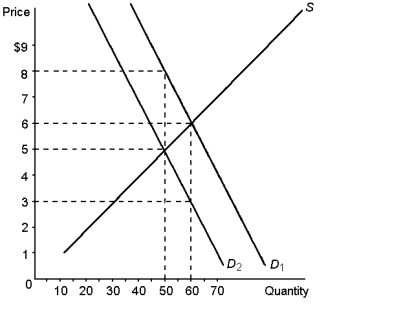

Graph 6-2

According to Graph 6-2, if the government imposes a binding price floor in this market at a price of $8.00, the result will be a:

A) shortage of 20 units

B) shortage of 40 units

C) surplus of 30 units

D) surplus of 40 units

According to Graph 6-2, if the government imposes a binding price floor in this market at a price of $8.00, the result will be a:

A) shortage of 20 units

B) shortage of 40 units

C) surplus of 30 units

D) surplus of 40 units

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

22

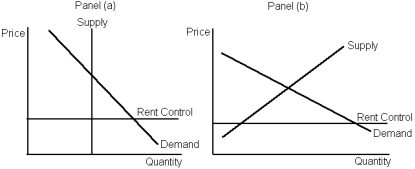

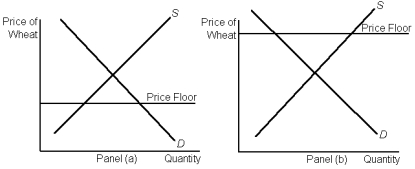

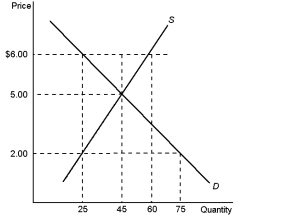

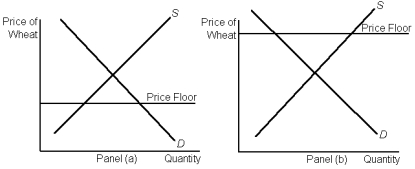

Graph 6-1

In Graph 6-1, a price ceiling that is not binding is shown in:

A) panel a

B) panel b

C) both panel a and panel b

D) neither panel a nor panel b

In Graph 6-1, a price ceiling that is not binding is shown in:

A) panel a

B) panel b

C) both panel a and panel b

D) neither panel a nor panel b

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

23

Most of the burden of a luxury tax falls on the middle-class workers who supply luxury goods, rather than on the rich who buy them.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

24

The benefits of the First Home Owners Grant scheme fall primarily to the sellers of housing.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

25

If supply is perfectly inelastic, then a subsidy paid to buyers of a good can never increase the size of the market.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

26

A tax on sellers will cause the equilibrium market price to rise, but the equilibrium quality sold will fall.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

27

Price controls are:

A) used to make markets less unfair

B) used to make markets more efficient

C) used to make markets more unfair

D) used to make markets less efficient

A) used to make markets less unfair

B) used to make markets more efficient

C) used to make markets more unfair

D) used to make markets less efficient

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

28

Graph 6-2

According to Graph 6-2, a binding price ceiling would exist at:

A) any price above $8.00

B) any price below $6.00

C) any price above $5.00

D) any price below $8.00

According to Graph 6-2, a binding price ceiling would exist at:

A) any price above $8.00

B) any price below $6.00

C) any price above $5.00

D) any price below $8.00

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

29

Graph 6-1

In which panel(s) in Graph 6-1 would there be a shortage for a good at the market price?

A) panel a

B) panel b

C) panel a and panel b

D) neither panel a nor panel b

In which panel(s) in Graph 6-1 would there be a shortage for a good at the market price?

A) panel a

B) panel b

C) panel a and panel b

D) neither panel a nor panel b

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

30

The incidence of a tax is determined by whether the tax is imposed on the seller or the buyer.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

31

Who pays the majority of a tax levied on a product depends on whether the tax is placed on the buyer or the seller.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

32

If demand is less elastic than supply, then the burden of a tax will fall more heavily upon sellers of a good.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

33

Suppliers of a good are likely to favor a binding:

A) price floor, as the quantity sold will be higher than in a competitive market

B) price floor, as the price received will be higher than in a competitive market

C) price ceiling, as the quantity demanded will be higher than in a competitive market

D) price ceiling, as the price received will be higher than in a competitive market

A) price floor, as the quantity sold will be higher than in a competitive market

B) price floor, as the price received will be higher than in a competitive market

C) price ceiling, as the quantity demanded will be higher than in a competitive market

D) price ceiling, as the price received will be higher than in a competitive market

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

34

If a price ceiling is binding:

A) the equilibrium price is above the ceiling and there will be a shortage

B) the equilibrium price is above the ceiling and there will be a surplus

C) the equilibrium price is below the ceiling and there will be a shortage

D) the equilibrium price is below the ceiling and there will be a surplus

A) the equilibrium price is above the ceiling and there will be a shortage

B) the equilibrium price is above the ceiling and there will be a surplus

C) the equilibrium price is below the ceiling and there will be a shortage

D) the equilibrium price is below the ceiling and there will be a surplus

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

35

A subsidy paid to suppliers of a good will grow a market.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

36

Domestic producers of natural gas would welcome being a signatory to the world price regime if it is set above the equilibrium, as they can export the surplus.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

37

Some developing countries have used price ceilings to keep rice cheap to assist the poor. At the ceiling price:

A) the quantity demanded will be greater than the quantity supplied and a shortage will result

B) the quantity demanded will be greater than the quantity supplied and a surplus will result

C) the quantity demanded will be less than the quantity supplied and a shortage will result

D) the quantity demanded will be less than the quantity supplied and a surplus will result

A) the quantity demanded will be greater than the quantity supplied and a shortage will result

B) the quantity demanded will be greater than the quantity supplied and a surplus will result

C) the quantity demanded will be less than the quantity supplied and a shortage will result

D) the quantity demanded will be less than the quantity supplied and a surplus will result

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

38

Lawmakers can decide whether the buyer or the seller must send a tax to the government, but they cannot legislate the true burden of a tax.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

39

A tax on sellers shifts the supply curve upward by exactly the size of the tax.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

40

A price ceiling that is not binding:

A) is a detriment to society

B) will cause a shortage

C) will cause a surplus

D) has no effect

A) is a detriment to society

B) will cause a shortage

C) will cause a surplus

D) has no effect

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

41

If the minimum wage is below the equilibrium wage:

A) the quantity demanded of labour will be greater than the quantity supplied

B) the quantity demanded of labour will equal the quantity supplied

C) the quantity demanded of labour will be less than the quantity supplied

D) anyone who wants a job at the minimum wage can find one

A) the quantity demanded of labour will be greater than the quantity supplied

B) the quantity demanded of labour will equal the quantity supplied

C) the quantity demanded of labour will be less than the quantity supplied

D) anyone who wants a job at the minimum wage can find one

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

42

Rent controls lead to:

A) a shortage of housing in the short run and a surplus of housing in the long run

B) a surplus of housing in the short run and a surplus of housing in the long run

C) a small shortage of housing in the short run and a large shortage of housing in the long run

D) a large shortage of housing in the short run and a small shortage of housing in the long run

A) a shortage of housing in the short run and a surplus of housing in the long run

B) a surplus of housing in the short run and a surplus of housing in the long run

C) a small shortage of housing in the short run and a large shortage of housing in the long run

D) a large shortage of housing in the short run and a small shortage of housing in the long run

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

43

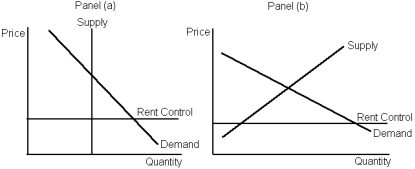

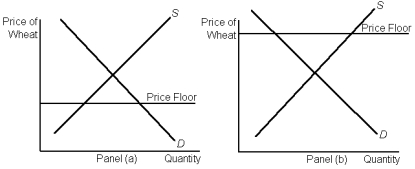

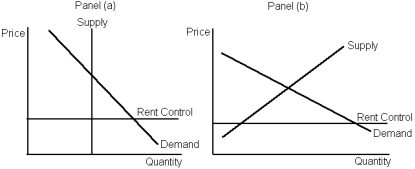

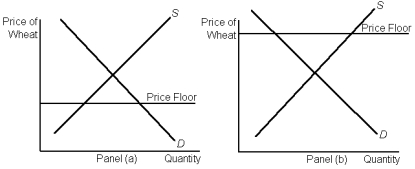

Graph 6-3

According to Graph 6-3, which panel(s) best represent(s) a binding rent control in the long run?

A) panel a

B) panel b

C) neither panel

D) both panels

According to Graph 6-3, which panel(s) best represent(s) a binding rent control in the long run?

A) panel a

B) panel b

C) neither panel

D) both panels

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

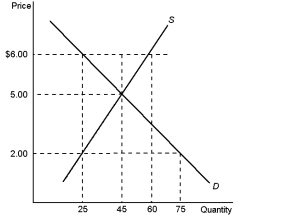

44

Graph 6-5

According to Graph 6-5, if the government imposes a binding price floor of $6.00 in this market, the result will be a:

A) surplus of 15

B) surplus of 35

C) shortage of 30

D) shortage of 50

According to Graph 6-5, if the government imposes a binding price floor of $6.00 in this market, the result will be a:

A) surplus of 15

B) surplus of 35

C) shortage of 30

D) shortage of 50

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

45

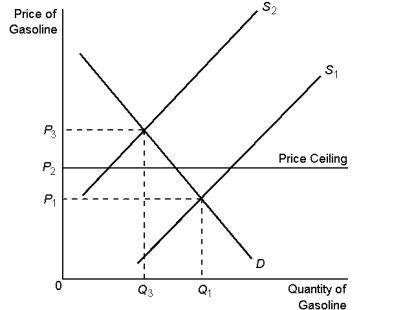

Graph 6-6

According to Graph 6-6, in panel a, at the actual price there will be:

A) a shortage of wheat

B) equilibrium in the market

C) a surplus of wheat

D) an excess demand for wheat

According to Graph 6-6, in panel a, at the actual price there will be:

A) a shortage of wheat

B) equilibrium in the market

C) a surplus of wheat

D) an excess demand for wheat

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

46

Minimum wage laws dictate the:

A) average price employers must pay for labour

B) highest price employers may pay for labour

C) lowest price employers may pay for labour

D) quality of labour which must be supplied

A) average price employers must pay for labour

B) highest price employers may pay for labour

C) lowest price employers may pay for labour

D) quality of labour which must be supplied

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is an example of a price-ceiling?

A) a minimum wage

B) a sales tax

C) none of the above

D) a rent control

A) a minimum wage

B) a sales tax

C) none of the above

D) a rent control

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

48

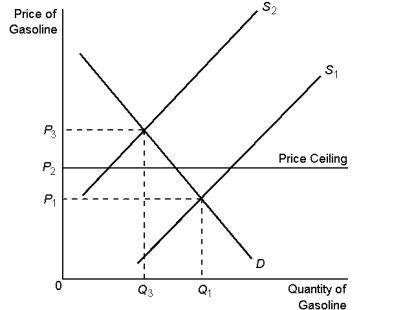

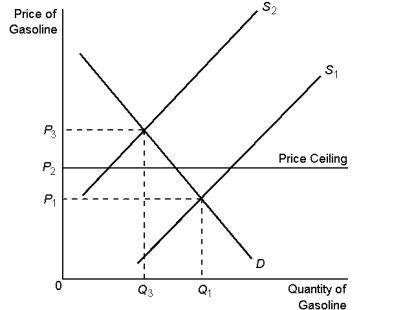

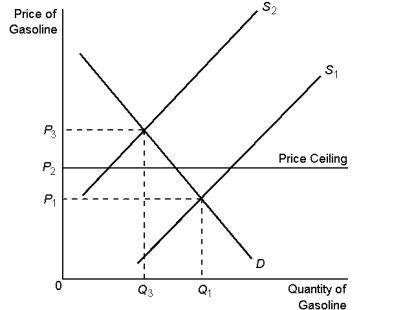

Graph 6-4

According to Graph 6-4, when the supply curve shifts from S1 to S2:

A) the new market quantity will be Q3

B) the new market quantity will be less than Q3

C) the new market quantity will be greater than Q3

D) there will be a surplus at the new market price of P2

According to Graph 6-4, when the supply curve shifts from S1 to S2:

A) the new market quantity will be Q3

B) the new market quantity will be less than Q3

C) the new market quantity will be greater than Q3

D) there will be a surplus at the new market price of P2

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is a correct statement about the labour market?

A) workers determine the supply of labour and firms determine the demand for labour

B) workers determine the demand for labour and firms determine the supply of labour

C) workers determine the supply of labour and government determines the demand for labour

D) government determines the supply of labour and firms determine the supply of labour

A) workers determine the supply of labour and firms determine the demand for labour

B) workers determine the demand for labour and firms determine the supply of labour

C) workers determine the supply of labour and government determines the demand for labour

D) government determines the supply of labour and firms determine the supply of labour

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

50

The justification for the minimum wage is to:

A) increase the jobs available for workers

B) reduce the jobs available for unskilled workers

C) ensure all workers get an adequate standard of living

D) provide benefits to middle-class part-time workers

A) increase the jobs available for workers

B) reduce the jobs available for unskilled workers

C) ensure all workers get an adequate standard of living

D) provide benefits to middle-class part-time workers

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

51

Suppose the equilibrium price of bananas is $5 and a price ceiling of $7 is implemented. This will result in:

A) a shortage, as the price ceiling is above the equilibrium price

B) a surplus, as the price ceiling is above the equilibrium price

C) no change in the quantity of bananas sold

D) a surplus, as the price ceiling is below the equilibrium price

A) a shortage, as the price ceiling is above the equilibrium price

B) a surplus, as the price ceiling is above the equilibrium price

C) no change in the quantity of bananas sold

D) a surplus, as the price ceiling is below the equilibrium price

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

52

The minimum wage has its greatest adverse impact on the market for:

A) the most experienced workers

B) the most skilled workers

C) engineers

D) teenage labour

A) the most experienced workers

B) the most skilled workers

C) engineers

D) teenage labour

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

53

A hot summer's day can lead to dramatic increases in the demand for electricity. Suppose the government decides a binding price ceiling is necessary so pensioners can continue to afford their power bills. The effect of this policy will be such that:

A) the quantity of electricity supplied will be unchanged

B) electricity producers will increase supply, leading to a decrease in price

C) electricity producers will supply less than demanded, leading to a shortage

D) demand will decrease, leading to a decrease in price

A) the quantity of electricity supplied will be unchanged

B) electricity producers will increase supply, leading to a decrease in price

C) electricity producers will supply less than demanded, leading to a shortage

D) demand will decrease, leading to a decrease in price

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

54

Graph 6-5

According to Graph 6-5, a binding price floor would exist at a price of:

A) $6.00

B) $5.00

C) $2.00

D) none of the above

According to Graph 6-5, a binding price floor would exist at a price of:

A) $6.00

B) $5.00

C) $2.00

D) none of the above

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

55

Graph 6-3

According to Graph 6-3, which panel(s) best represent(s) a binding rent control in the short run?

A) panel a

B) panel b

C) neither panel

D) both panels

According to Graph 6-3, which panel(s) best represent(s) a binding rent control in the short run?

A) panel a

B) panel b

C) neither panel

D) both panels

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

56

Water shortages caused by droughts can be lessened by:

A) allowing price to equate the demand and supply

B) restricting water usage of consumers

C) arresting anyone who wastes water

D) imposing tight price controls on water

A) allowing price to equate the demand and supply

B) restricting water usage of consumers

C) arresting anyone who wastes water

D) imposing tight price controls on water

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

57

After a natural disaster, a binding price ceiling on bottled water will lead to:

A) a shortage of bottled water

B) an increase in supply of bottled water

C) supplied surplus of bottled water

D) bottled water to be distributed more equitably

A) a shortage of bottled water

B) an increase in supply of bottled water

C) supplied surplus of bottled water

D) bottled water to be distributed more equitably

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

58

Graph 6-6

According to Graph 6-6, in panel b, at the actual price there will be:

A) cheaper wheat for consumers

B) equilibrium in the market

C) a surplus of wheat

D) rationing of demand with long waiting lines

According to Graph 6-6, in panel b, at the actual price there will be:

A) cheaper wheat for consumers

B) equilibrium in the market

C) a surplus of wheat

D) rationing of demand with long waiting lines

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

59

Workers with high levels of skill and experience are not affected by the minimum wage because:

A) they belong to unions

B) they are not legally guaranteed the minimum wage

C) they generally earn wages less than the minimum wage

D) their equilibrium wages are well above the minimum wage

A) they belong to unions

B) they are not legally guaranteed the minimum wage

C) they generally earn wages less than the minimum wage

D) their equilibrium wages are well above the minimum wage

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

60

Graph 6-4

According to Graph 6-4, when the supply curve for gasoline shifts from S1 to S2:

A) the price will increase to P3

B) a surplus will occur at the new market price of P2

C) the market price will stay at P1 due to the price ceiling

D) a shortage will occur at the price ceiling of P2

According to Graph 6-4, when the supply curve for gasoline shifts from S1 to S2:

A) the price will increase to P3

B) a surplus will occur at the new market price of P2

C) the market price will stay at P1 due to the price ceiling

D) a shortage will occur at the price ceiling of P2

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

61

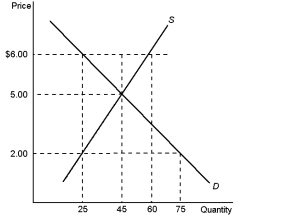

Graph 6-8

According to Graph 6-8, the price buyers will pay after the tax is imposed is:

A) $1.00

B) $3.50

C) $5.00

D) $6.00

According to Graph 6-8, the price buyers will pay after the tax is imposed is:

A) $1.00

B) $3.50

C) $5.00

D) $6.00

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

62

The term tax incidence refers to the:

A) division of income tax between high-income and low-income earners

B) level of tax levied on a buyer of a good

C) division of the tax burden between buyers and sellers

D) division of tax between federal and local government

A) division of income tax between high-income and low-income earners

B) level of tax levied on a buyer of a good

C) division of the tax burden between buyers and sellers

D) division of tax between federal and local government

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

63

If the government lowered the minimum wage, but this had no effect on unemployment, one possible explanation could be:

A) those who are already unemployed refuse to work for such a low wage

B) the equilibrium wage was already above the minimum wage

C) most of the unemployed are teenagers who don't require high wages

D) the equilibrium wage was below the minimum wage

A) those who are already unemployed refuse to work for such a low wage

B) the equilibrium wage was already above the minimum wage

C) most of the unemployed are teenagers who don't require high wages

D) the equilibrium wage was below the minimum wage

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is the most correct statement about price controls?

A) Price controls always help those they are designed to help.

B) Price controls never help those they are designed to help.

C) Price controls often hurt those they are designed to help.

D) Price controls always hurt those they are designed to help.

A) Price controls always help those they are designed to help.

B) Price controls never help those they are designed to help.

C) Price controls often hurt those they are designed to help.

D) Price controls always hurt those they are designed to help.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

65

Graph 6-8

According to Graph 6-8, the equilibrium price in the market before the tax is imposed is:

A) $1.00

B) $3.50

C) $5.00

D) $6.00

According to Graph 6-8, the equilibrium price in the market before the tax is imposed is:

A) $1.00

B) $3.50

C) $5.00

D) $6.00

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

66

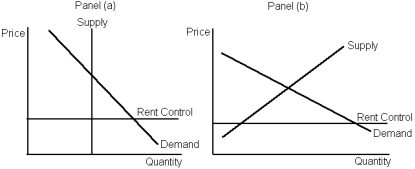

Graph 6-7

According to Graph 6-7, the price buyers will pay after the tax is imposed is:

A) $8.00

B) $6.00

C) $5.00

D) $3.50

According to Graph 6-7, the price buyers will pay after the tax is imposed is:

A) $8.00

B) $6.00

C) $5.00

D) $3.50

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

67

To fund new green energy research, suppose the government requires every buyer of a new car to pay a $100 tax. When compared to the pre-tax equilibrium, such a tax will:

A) make buyers $100 worse off without affecting sellers

B) make buyers $100 worse off, but make sellers better off

C) increase the price sellers receive for cars

D) make both buyers and sellers worse off, but we cannot say by how much without more information

A) make buyers $100 worse off without affecting sellers

B) make buyers $100 worse off, but make sellers better off

C) increase the price sellers receive for cars

D) make both buyers and sellers worse off, but we cannot say by how much without more information

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

68

A subsidy on the sellers of coffee:

A) increases the size of the coffee market

B) reduces the size of the coffee market

C) has no effect on the size of the coffee market

D) the benefit will accrue entirely to the sellers of coffee

A) increases the size of the coffee market

B) reduces the size of the coffee market

C) has no effect on the size of the coffee market

D) the benefit will accrue entirely to the sellers of coffee

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

69

Graph 6-7

According to Graph 6-7, the price sellers receive after the tax is imposed is:

A) $8.00

B) $6.00

C) $5.00

D) $3.50

According to Graph 6-7, the price sellers receive after the tax is imposed is:

A) $8.00

B) $6.00

C) $5.00

D) $3.50

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

70

If sellers are required to pay a $0.70 tax on each cup of coffee, the supply of coffee will shift:

A) right by $0.70 per cup

B) left by $0.70 per cup

C) up by $0.70 per cup

D) down by $0.70 per cup

A) right by $0.70 per cup

B) left by $0.70 per cup

C) up by $0.70 per cup

D) down by $0.70 per cup

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

71

Graph 6-7

According to Graph 6-7, the equilibrium price in the market before the tax is imposed is:

A) $8.00

B) $6.00

C) $5.00

D) $3.50

According to Graph 6-7, the equilibrium price in the market before the tax is imposed is:

A) $8.00

B) $6.00

C) $5.00

D) $3.50

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

72

A tax on the sellers of coffee will cause the price the buyer pays:

A) and the price the seller receives to rise

B) and the price the seller receives to fall

C) to rise and the price the seller receives to fall

D) to fall and the price the seller receives to rise

A) and the price the seller receives to rise

B) and the price the seller receives to fall

C) to rise and the price the seller receives to fall

D) to fall and the price the seller receives to rise

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

73

A tax paid by buyers of a good or service:

A) encourages market activity and decreases the price received by sellers

B) encourages market activity and increases the price paid by buyers

C) discourages market activity and decreases the price received by sellers

D) discourages market activity and increases the price received by sellers

A) encourages market activity and decreases the price received by sellers

B) encourages market activity and increases the price paid by buyers

C) discourages market activity and decreases the price received by sellers

D) discourages market activity and increases the price received by sellers

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

74

Which is the most correct statement about the benefits of a subsidy on toothbrushes?

A) buyers will receive most of the benefit of the subsidy

B) sellers will receive most of the benefit of the subsidy

C) buyers and sellers will share the benefits of the subsidy

D) the government enjoys the entire benefit of the subsidy

A) buyers will receive most of the benefit of the subsidy

B) sellers will receive most of the benefit of the subsidy

C) buyers and sellers will share the benefits of the subsidy

D) the government enjoys the entire benefit of the subsidy

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

75

A subsidy paid to the sellers of coffee will:

A) increase the equilibrium price of coffee and reduce the equilibrium quantity

B) reduce the equilibrium price of coffee and increase the equilibrium quantity

C) increase the equilibrium price of coffee and increase the equilibrium quantity

D) reduce the equilibrium price of coffee and reduce the equilibrium quantity

A) increase the equilibrium price of coffee and reduce the equilibrium quantity

B) reduce the equilibrium price of coffee and increase the equilibrium quantity

C) increase the equilibrium price of coffee and increase the equilibrium quantity

D) reduce the equilibrium price of coffee and reduce the equilibrium quantity

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

76

The initial effect of a tax on the sellers of a good is on:

A) the supply of that good

B) the demand for that good

C) both supply and demand

D) the price of the good

A) the supply of that good

B) the demand for that good

C) both supply and demand

D) the price of the good

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

77

Graph 6-7

According to Graph 6-7, the amount of the tax that sellers would pay would be:

A) $1.00

B) $1.50

C) $2.00

D) $3.00

According to Graph 6-7, the amount of the tax that sellers would pay would be:

A) $1.00

B) $1.50

C) $2.00

D) $3.00

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

78

The main reason policymakers use price controls is because:

A) they are better at coordinating economic activity than the free market

B) they believe that in some cases the market outcome is not fair

C) they need a reason to justify their jobs

D) all of the above is true

A) they are better at coordinating economic activity than the free market

B) they believe that in some cases the market outcome is not fair

C) they need a reason to justify their jobs

D) all of the above is true

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

79

Graph 6-7

According to Graph 6-7, the amount of the tax that buyers would pay would be:

A) $1.00

B) $1.50

C) $2.00

D) $3.00

According to Graph 6-7, the amount of the tax that buyers would pay would be:

A) $1.00

B) $1.50

C) $2.00

D) $3.00

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

80

Graph 6-7

According to Graph 6-7, the amount of the tax imposed in this market is:

A) $1.00

B) $1.50

C) $2.50

D) $3.00

According to Graph 6-7, the amount of the tax imposed in this market is:

A) $1.00

B) $1.50

C) $2.50

D) $3.00

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck