Deck 14: Thebasics of Finance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/170

Play

Full screen (f)

Deck 14: Thebasics of Finance

1

Moral hazard describes a scenario in which people behave:

A) morally and a negative consequence occurs.

B) in a riskier fashion or renege on agreements when they do not face the full consequences of their actions.

C) in a riskier fashion when they don't understand the consequences of their actions.

D) behave morally but end up in a dangerous situation.

A) morally and a negative consequence occurs.

B) in a riskier fashion or renege on agreements when they do not face the full consequences of their actions.

C) in a riskier fashion when they don't understand the consequences of their actions.

D) behave morally but end up in a dangerous situation.

in a riskier fashion or renege on agreements when they do not face the full consequences of their actions.

2

Banks act as:

A) organizers among firms in a specific market.

B) intermediaries between borrowers and savers.

C) informants to various buyers about prices and contracts.

D) negotiators for buyers.

A) organizers among firms in a specific market.

B) intermediaries between borrowers and savers.

C) informants to various buyers about prices and contracts.

D) negotiators for buyers.

intermediaries between borrowers and savers.

3

After the housing bubble popped in 2007, the U.S. government provided emergency funds that prevented banks from failing. Some argued this action caused:

A) moral hazard.

B) adverse selection.

C) adverse decisions.

D) moral consequence.

A) moral hazard.

B) adverse selection.

C) adverse decisions.

D) moral consequence.

moral hazard.

4

Which of the following exemplifies a buyer in a financial market?

A) A family buying a new house

B) A student saving money from a summer job for college

C) A corporation loaning money to other firms

D) A family putting money away for the future

A) A family buying a new house

B) A student saving money from a summer job for college

C) A corporation loaning money to other firms

D) A family putting money away for the future

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

5

In financial markets, buyers are people who:

A) want to spend money on something of value right now, but don't have cash on hand.

B) have cash on hand and are willing to let others use it, for a price.

C) want to spend money on something of value in the future, but don't know how to save for it.

D) have cash promised to them at some future date.

A) want to spend money on something of value right now, but don't have cash on hand.

B) have cash on hand and are willing to let others use it, for a price.

C) want to spend money on something of value in the future, but don't know how to save for it.

D) have cash promised to them at some future date.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

6

A local bank decides to expand and opens up new branches in neighboring states. This expansion allows it to:

A) further diversify risk.

B) decrease its reserve ratio.

C) provide less liquidity.

D) charge higher interest rates.

A) further diversify risk.

B) decrease its reserve ratio.

C) provide less liquidity.

D) charge higher interest rates.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

7

A financial market:

A) brings together savers and borrowers.

B) connects the government to those who need public services.

C) helps individuals keep track of the general price level.

D) gathers information about firms' profits.

A) brings together savers and borrowers.

B) connects the government to those who need public services.

C) helps individuals keep track of the general price level.

D) gathers information about firms' profits.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following are common economic problems caused by asymmetric information? I. Moral hazard

II) Public debt

III) Adverse selection

IV) Resource cost

A) I and II only

B) I and III only

C) III and IV only

D) I, II, III, and IV

II) Public debt

III) Adverse selection

IV) Resource cost

A) I and II only

B) I and III only

C) III and IV only

D) I, II, III, and IV

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

9

Adverse selection occurs when:

A) one participant in a transaction has more information than another, resulting in a bargaining dispute.

B) one participant in a negotiation selects the wrong strategy, resulting in an unfavourable outcome.

C) one participant in a transaction has more information than another, resulting in less frequent transactions.

D) neither participant in a transaction is willing to make an agreement because they don't have enough information.

A) one participant in a transaction has more information than another, resulting in a bargaining dispute.

B) one participant in a negotiation selects the wrong strategy, resulting in an unfavourable outcome.

C) one participant in a transaction has more information than another, resulting in less frequent transactions.

D) neither participant in a transaction is willing to make an agreement because they don't have enough information.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

10

The basic purpose of financial markets is to:

A) match people who want money to spend now with people who want to save their money for later.

B) buy and sell different currencies to make a profit.

C) sell commodities to firms as inputs.

D) trade stocks and bonds.

A) match people who want money to spend now with people who want to save their money for later.

B) buy and sell different currencies to make a profit.

C) sell commodities to firms as inputs.

D) trade stocks and bonds.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

11

In general, information asymmetries are _______ within financial markets.

A) common

B) not accounted for

C) uncommon

D) not easily accounted for

A) common

B) not accounted for

C) uncommon

D) not easily accounted for

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

12

In a financial market, people trade:

A) future claims on funds or goods.

B) current claims for future goods.

C) current goods for future funds.

D) future funds or goods for reduced current risk.

A) future claims on funds or goods.

B) current claims for future goods.

C) current goods for future funds.

D) future funds or goods for reduced current risk.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

13

Information asymmetries occur when:

A) one participant in a transaction has more information than another.

B) information isn't readily available to anyone involved in a transaction.

C) both participants in a transaction have equal information.

D) None of these are true.

A) one participant in a transaction has more information than another.

B) information isn't readily available to anyone involved in a transaction.

C) both participants in a transaction have equal information.

D) None of these are true.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

14

The development and heavy use of ATMs and debit cards increased:

A) reserve ratios.

B) liquidity.

C) interest rates.

D) risk.

A) reserve ratios.

B) liquidity.

C) interest rates.

D) risk.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following exemplifies a seller in a financial market?

A) An entrepreneur starting a new venture

B) A government financing public spending

C) An individual who has a savings account

D) A family buying a new minivan

A) An entrepreneur starting a new venture

B) A government financing public spending

C) An individual who has a savings account

D) A family buying a new minivan

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

16

Banks provide:

A) liquidity.

B) adverse selection.

C) moral hazard.

D) None of these are provided by banks.

A) liquidity.

B) adverse selection.

C) moral hazard.

D) None of these are provided by banks.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

17

Because a bank has a very large pool of buyers and savers, it can:

A) act as an intermediary between firms and government.

B) provide liquidity to some individuals that deposit funds.

C) diversify the risk of saving and borrowing for individuals.

D) act in the best interest of society by ensuring there is enough money for everyone.

A) act as an intermediary between firms and government.

B) provide liquidity to some individuals that deposit funds.

C) diversify the risk of saving and borrowing for individuals.

D) act in the best interest of society by ensuring there is enough money for everyone.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

18

Arpita decides to take up mountain biking after securing health insurance. Her choice is an example of:

A) moral hazard.

B) adverse selection.

C) adverse decisions.

D) moral consequence.

A) moral hazard.

B) adverse selection.

C) adverse decisions.

D) moral consequence.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

19

When shopping for a used car on the internet, Jonathan is faced with:

A) moral hazard.

B) adverse selection.

C) poor credit.

D) financial intermediaries.

A) moral hazard.

B) adverse selection.

C) poor credit.

D) financial intermediaries.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

20

In financial markets, sellers are people who:

A) have cash on hand and are willing to let others use it, for a price.

B) want to spend money on something of value right now, but don't have cash on hand.

C) want to spend money on something of value in the future, but don't know how to save for it.

D) have cash promised to them at some future date.

A) have cash on hand and are willing to let others use it, for a price.

B) want to spend money on something of value right now, but don't have cash on hand.

C) want to spend money on something of value in the future, but don't know how to save for it.

D) have cash promised to them at some future date.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

21

In the market for loanable funds, borrowing is like:

A) selling the right to use your money for a time.

B) buying the right to use someone else's money.

C) selling the right to use someone else's money.

D) buying the right to use your money for a time.

A) selling the right to use your money for a time.

B) buying the right to use someone else's money.

C) selling the right to use someone else's money.

D) buying the right to use your money for a time.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

22

Which type of institution is responsible for providing liquidity to the financial system?

A) Banks

B) Stock exchanges

C) Insurance companies

D) All of these institutions provide liquidity to the financial system.

A) Banks

B) Stock exchanges

C) Insurance companies

D) All of these institutions provide liquidity to the financial system.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

23

The price of borrowing is the:

A) equilibrium price.

B) interest rate.

C) transaction cost.

D) None of these are true.

A) equilibrium price.

B) interest rate.

C) transaction cost.

D) None of these are true.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

24

The supply of loanable funds comes from all the following except:

A) businesses.

B) individuals.

C) government.

D) borrowers.

A) businesses.

B) individuals.

C) government.

D) borrowers.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

25

Savings is considered the portion of income that is:

A) not immediately spent on the consumption of goods and services.

B) spent on productive inputs, such as factories, machinery, and inventories.

C) placed in an individual's savings account.

D) stored in any interest-bearing account.

A) not immediately spent on the consumption of goods and services.

B) spent on productive inputs, such as factories, machinery, and inventories.

C) placed in an individual's savings account.

D) stored in any interest-bearing account.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

26

What are the three main roles of financial markets?

A) Act as intermediaries between governments and firms, decrease liquidity, and diversify risk

B) Act as intermediaries between buyers and sellers, provide liquidity, and integrate risk

C) Act as intermediaries between governments and firms, provide liquidity, and integrate risk

D) Act as intermediaries between buyers and sellers, provide liquidity, and diversify risk

A) Act as intermediaries between governments and firms, decrease liquidity, and diversify risk

B) Act as intermediaries between buyers and sellers, provide liquidity, and integrate risk

C) Act as intermediaries between governments and firms, provide liquidity, and integrate risk

D) Act as intermediaries between buyers and sellers, provide liquidity, and diversify risk

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

27

Economists use the word investment to refer to the portion of income that is:

A) spent on productive inputs, such as factories, machinery, and inventories.

B) not immediately spent on the consumption of goods and services.

C) placed in an individual's savings account.

D) stored in any interest-bearing account.

A) spent on productive inputs, such as factories, machinery, and inventories.

B) not immediately spent on the consumption of goods and services.

C) placed in an individual's savings account.

D) stored in any interest-bearing account.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

28

Savings and investment are equal:

A) at equilibrium in the market for loanable funds.

B) when banks regulate their flow.

C) at the interest rate set by the Fed.

D) when banks operate according to government regulations.

A) at equilibrium in the market for loanable funds.

B) when banks regulate their flow.

C) at the interest rate set by the Fed.

D) when banks operate according to government regulations.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

29

In the market for loanable funds, saving is like:

A) selling the right to use your money for a time.

B) buying the right to use someone else's money.

C) selling the right to use someone else's money.

D) buying the right to use your money for a time.

A) selling the right to use your money for a time.

B) buying the right to use someone else's money.

C) selling the right to use someone else's money.

D) buying the right to use your money for a time.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

30

The quantity of savings that people are willing to supply depends on:

A) the price they will receive.

B) the amount they have left over after consumption.

C) their disposable income.

D) their age, since people tend to stop saving once they retire.

A) the price they will receive.

B) the amount they have left over after consumption.

C) their disposable income.

D) their age, since people tend to stop saving once they retire.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

31

The portion of income that is spent on productive inputs, such as factories, machinery, and inventories, is called:

A) investment.

B) savings.

C) consumption spending.

D) loanable funds.

A) investment.

B) savings.

C) consumption spending.

D) loanable funds.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

32

Savers supply funds to those who want to borrow for their investment spending needs in the:

A) market for loanable funds.

B) market for savings.

C) market for interest rates.

D) stock market.

A) market for loanable funds.

B) market for savings.

C) market for interest rates.

D) stock market.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

33

The demand for loanable funds comes from:

A) investment.

B) savings.

C) government-printed money.

D) household spending on nondurable goods.

A) investment.

B) savings.

C) government-printed money.

D) household spending on nondurable goods.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is not a scenario in which a bank could serve as an intermediary between borrowers and savers?

A) Tom takes out student loans to cover the cost of going to school to learn how to be a welder.

B) Danika takes a job with a salary that is greater than her living expenses, so she starts looking into different options for a 401(k).

C) Jan is hunting for an apartment close to work that costs about 30 percent of her take-home pay.

D) Chris is looking to buy a new car but does not have the cash on hand to pay for it outright.

A) Tom takes out student loans to cover the cost of going to school to learn how to be a welder.

B) Danika takes a job with a salary that is greater than her living expenses, so she starts looking into different options for a 401(k).

C) Jan is hunting for an apartment close to work that costs about 30 percent of her take-home pay.

D) Chris is looking to buy a new car but does not have the cash on hand to pay for it outright.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

35

The interest rate:

A) is the price of borrowing money for a specified period of time.

B) is expressed as a percentage per dollar borrowed and per unit of time.

C) determines the total amount that must be paid back on a loan.

D) All of these are true.

A) is the price of borrowing money for a specified period of time.

B) is expressed as a percentage per dollar borrowed and per unit of time.

C) determines the total amount that must be paid back on a loan.

D) All of these are true.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

36

In the market for loanable funds:

A) savers supply funds to those who want to borrow.

B) borrowers buy and sell loans.

C) savers interact to set the interest rate for loans.

D) borrowers supply funds to savers.

A) savers supply funds to those who want to borrow.

B) borrowers buy and sell loans.

C) savers interact to set the interest rate for loans.

D) borrowers supply funds to savers.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

37

The supply of loanable funds comes from:

A) savings.

B) investment.

C) borrowers.

D) taxes.

A) savings.

B) investment.

C) borrowers.

D) taxes.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

38

The portion of income that is not immediately spent on the consumption of goods and services is called:

A) savings.

B) the reserve requirement.

C) investment.

D) loanable funds.

A) savings.

B) the reserve requirement.

C) investment.

D) loanable funds.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

39

Banks act as an intermediary between savers and borrowers by determining the:

A) price at which the quantity of funds saved will be equal to the quantity invested.

B) quantity of funds that will be saved depending on the price.

C) quantity of funds that will be borrowed for any given quantity of savings.

D) price at which the quantity of funds saved will be more than enough for those who want to borrow.

A) price at which the quantity of funds saved will be equal to the quantity invested.

B) quantity of funds that will be saved depending on the price.

C) quantity of funds that will be borrowed for any given quantity of savings.

D) price at which the quantity of funds saved will be more than enough for those who want to borrow.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

40

Equilibrium in the market for loanable funds occurs:

A) at the interest rate set by the Fed.

B) at the price where quantity supplied is slightly greater than quantity demanded.

C) where the amount being borrowed equals the amount being saved.

D) where the amount being saved covers banks' required reserves.

A) at the interest rate set by the Fed.

B) at the price where quantity supplied is slightly greater than quantity demanded.

C) where the amount being borrowed equals the amount being saved.

D) where the amount being saved covers banks' required reserves.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

41

After taking out a one-year loan with an annual interest rate of 10 percent, Toben pays $3,300 back to the bank. The principal of the loan was _______ and the interest payment was _______.

A) $3,000; $300

B) $3,300; $300

C) $300; $3,300

D) $300; $3,000

A) $3,000; $300

B) $3,300; $300

C) $300; $3,300

D) $300; $3,000

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

42

John can take out a one-year loan of $1,000 at an annual interest rate of 10 percent. After calculating his return to be $200, John knows he will _______ if he takes out the loan.

A) make $100

B) lose $100

C) make $200

D) lose $200

A) make $100

B) lose $100

C) make $200

D) lose $200

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

43

The principal of a loan is the:

A) original amount of the loan.

B) set of rules and conditions borrowers agree to when taking out a loan.

C) set of rules and conditions savers agree to when agreeing to let someone borrow their money.

D) initial credit check conducted by the lender.

A) original amount of the loan.

B) set of rules and conditions borrowers agree to when taking out a loan.

C) set of rules and conditions savers agree to when agreeing to let someone borrow their money.

D) initial credit check conducted by the lender.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

44

If Riko takes out a one-year loan of $2,000 with a 10 percent annual interest rate, the price she will pay for borrowing is:

A) $2,000.

B) $2,200.

C) $200.

D) $2,400.

A) $2,000.

B) $2,200.

C) $200.

D) $2,400.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

45

If Howard takes out a one-year loan of $400 with a 5 percent annual interest rate, he will pay back a total of:

A) $400.

B) $440.

C) $420.

D) $20.

A) $400.

B) $440.

C) $420.

D) $20.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

46

If citizens expect to bear most of the burden for their own health care and retirement costs in the future, then we would expect the _______ loanable funds to be _______ than it would be if retirement benefits were expected.

A) demand for; greater

B) demand for; lesser

C) supply of; greater

D) supply; lesser

A) demand for; greater

B) demand for; lesser

C) supply of; greater

D) supply; lesser

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

47

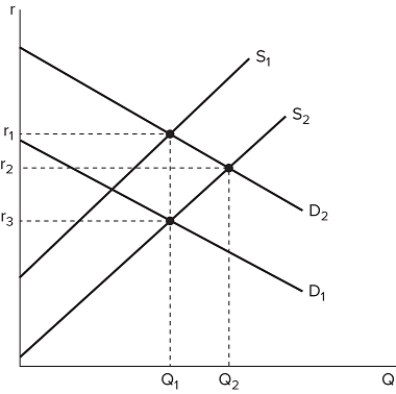

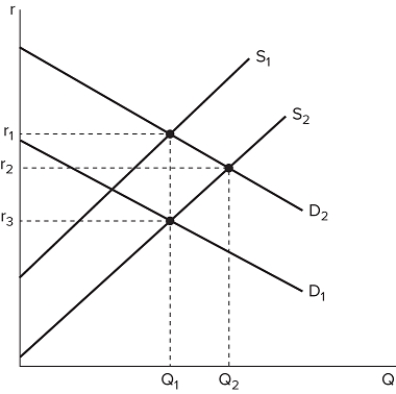

The graph shown displays the market for loanable funds in an economy.  If the quantity people want to save increases, at any given interest rate, a new equilibrium would occur at a _______ interest rate and a _______ equilibrium quantity of funds saved and invested.

If the quantity people want to save increases, at any given interest rate, a new equilibrium would occur at a _______ interest rate and a _______ equilibrium quantity of funds saved and invested.

A) lower; higher

B) higher; higher

C) lower; constant

D) higher; constant

If the quantity people want to save increases, at any given interest rate, a new equilibrium would occur at a _______ interest rate and a _______ equilibrium quantity of funds saved and invested.

If the quantity people want to save increases, at any given interest rate, a new equilibrium would occur at a _______ interest rate and a _______ equilibrium quantity of funds saved and invested.A) lower; higher

B) higher; higher

C) lower; constant

D) higher; constant

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

48

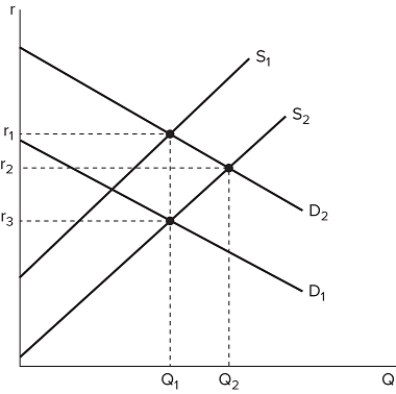

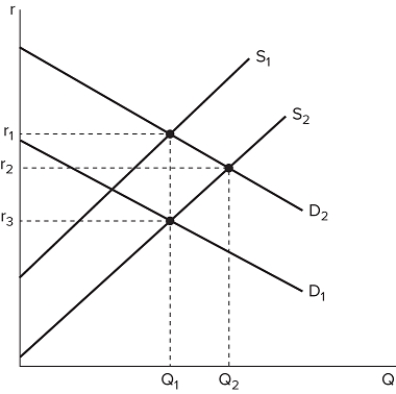

The graph shown displays the market for loanable funds in an economy.  Suppose investors become more optimistic that the economy will do well over the next decade. How will the market for loanable funds be affected?

Suppose investors become more optimistic that the economy will do well over the next decade. How will the market for loanable funds be affected?

A) Supply will shift to the right, from S1 to S2

B) Supply will shift to the left, from S2 to S1

C) Demand will shift to the right, from D1 to D2

D) Demand will shift to the left, from D2 to D1

Suppose investors become more optimistic that the economy will do well over the next decade. How will the market for loanable funds be affected?

Suppose investors become more optimistic that the economy will do well over the next decade. How will the market for loanable funds be affected?A) Supply will shift to the right, from S1 to S2

B) Supply will shift to the left, from S2 to S1

C) Demand will shift to the right, from D1 to D2

D) Demand will shift to the left, from D2 to D1

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

49

After taking out a one-year loan with an annual interest rate of 5 percent, Pranav pays $2,100 back to the bank. The principal of the loan was _______ and the interest payment was _______.

A) $2,000; $100

B) $2,100; $100

C) $100; $2,100

D) $100; $2,000

A) $2,000; $100

B) $2,100; $100

C) $100; $2,100

D) $100; $2,000

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

50

If the rate of return is lower than the cost of borrowing:

A) an investor will lose money after paying back the loan.

B) an investor should make the investment.

C) a borrower will make money after taking out the loan.

D) banks will offer more loans.

A) an investor will lose money after paying back the loan.

B) an investor should make the investment.

C) a borrower will make money after taking out the loan.

D) banks will offer more loans.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

51

In the market for loanable funds, the law of supply shows that more people will choose to _______ at _______ interest rates.

A) borrow; lower

B) save; lower

C) save; higher

D) borrow; higher

A) borrow; lower

B) save; lower

C) save; higher

D) borrow; higher

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

52

In the market for loanable funds, the demand curve:

A) represents savers.

B) is downward-sloping.

C) shows that more people will choose to save at higher interest rates.

D) represents the amount of debt-backed securities the government is willing to provide at each interest rate.

A) represents savers.

B) is downward-sloping.

C) shows that more people will choose to save at higher interest rates.

D) represents the amount of debt-backed securities the government is willing to provide at each interest rate.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

53

If the rate of return is higher than the cost of borrowing, the:

A) investor will lose money after paying back the loan.

B) investor will make money after paying back the loan.

C) saver will make less money than the borrower.

D) borrower will make more money than the saver.

A) investor will lose money after paying back the loan.

B) investor will make money after paying back the loan.

C) saver will make less money than the borrower.

D) borrower will make more money than the saver.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

54

In the market for loanable funds, the supply curve:

A) represents savers.

B) is downward-sloping.

C) shows that more people will choose to save at lower interest rates.

D) represents borrowers.

A) represents savers.

B) is downward-sloping.

C) shows that more people will choose to save at lower interest rates.

D) represents borrowers.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

55

Studies show that _______ households tend to save more of their income and that ____________ households save more out of tax cuts than others do.

A) richer; poorer

B) richer; richer

C) poorer; richer

D) poorer; poorer

A) richer; poorer

B) richer; richer

C) poorer; richer

D) poorer; poorer

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

56

Miguel takes out a one-year loan of $5,000 with a 10 percent annual interest rate. What is the principal?

A) $5,000

B) $5,500

C) $500

D) $1,000

A) $5,000

B) $5,500

C) $500

D) $1,000

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

57

Aisha can take out a one-year loan of $3,000 at an annual interest rate of 10 percent. After calculating her return to be $200, Aisha knows she will _______ if she takes out the loan.

A) lose $100

B) make $200

C) make $100

D) lose $200

A) lose $100

B) make $200

C) make $100

D) lose $200

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

58

Sarah can take out a one-year loan of $5,000 at an annual interest rate of 10 percent. After calculating her return to be $450, Sarah knows she will _______ if she takes out the loan.

A) make $450

B) lose $450

C) make $50

D) lose $50

A) make $450

B) lose $450

C) make $50

D) lose $50

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

59

In the market for loanable funds, the rate of return describes the:

A) expected profit a project will generate per dollar invested.

B) cost of borrowing.

C) interest rate on loans.

D) frequency with which reinvestment can occur.

A) expected profit a project will generate per dollar invested.

B) cost of borrowing.

C) interest rate on loans.

D) frequency with which reinvestment can occur.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

60

The fact that U.S. citizens expect to receive retirement benefits through Social Security and Medicare causes the _______ loanable funds to be _______ than it would be if these programs did not exist.

A) demand for; greater

B) demand for; lesser

C) supply of; greater

D) supply of; lesser

A) demand for; greater

B) demand for; lesser

C) supply of; greater

D) supply of; lesser

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

61

The _______ the length of a loan, and the _______ the risk of repayment, the higher the interest rate a bank will charge.

A) longer; higher

B) longer; lower

C) shorter; higher

D) shorter; lower

A) longer; higher

B) longer; lower

C) shorter; higher

D) shorter; lower

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

62

Why do lenders generally want a higher interest rate when loans stretch over a longer period?

A) The opportunity cost increases over time.

B) There's more uncertainty about potential future investment opportunities.

C) They want to be compensated for the inability to get their money back quickly.

D) All of these are true.

A) The opportunity cost increases over time.

B) There's more uncertainty about potential future investment opportunities.

C) They want to be compensated for the inability to get their money back quickly.

D) All of these are true.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

63

When a borrower fails to pay back a loan according to the agreed-upon terms, it is called:

A) credit risk.

B) default.

C) adverse selection.

D) asymmetric information.

A) credit risk.

B) default.

C) adverse selection.

D) asymmetric information.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

64

One of the reasons that interest rates vary for different type of loans is:

A) the length of time to repay the loan.

B) the amount of the loan.

C) government policy.

D) the exchange rate.

A) the length of time to repay the loan.

B) the amount of the loan.

C) government policy.

D) the exchange rate.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

65

The reduction in private borrowing caused by an increase in government borrowing is called:

A) the crowding out effect.

B) surplus investment.

C) the dissaving effect.

D) the savings effect.

A) the crowding out effect.

B) surplus investment.

C) the dissaving effect.

D) the savings effect.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

66

If a lender believes that a particular borrower might default, the lender will demand:

A) a higher interest rate, to make the risk worth taking.

B) more collateral, to ensure adequate compensation if the default occurs.

C) a longer term on the loan, to give the borrower more of a chance to repay.

D) that another bank is also involved in securing the loan.

A) a higher interest rate, to make the risk worth taking.

B) more collateral, to ensure adequate compensation if the default occurs.

C) a longer term on the loan, to give the borrower more of a chance to repay.

D) that another bank is also involved in securing the loan.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

67

Suppose an economy experiences an economic downturn. If expectations about the future don't change, at any given interest rate savings will _______ and the supply curve for loanable funds will shift to the _______.

A) decrease; left

B) increase; left

C) decrease; right

D) increase; right

A) decrease; left

B) increase; left

C) decrease; right

D) increase; right

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

68

A booming economy can make investors _______, shifting the _______ curve for loanable funds to the _______.

A) eager to borrow money; demand; right

B) eager to borrow money; supply; right

C) wary of future downturns; demand; left

D) wary of future downturns; supply; left

A) eager to borrow money; demand; right

B) eager to borrow money; supply; right

C) wary of future downturns; demand; left

D) wary of future downturns; supply; left

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

69

When people expect their income to fall in the future, they will be:

A) more inclined to save.

B) less inclined to save.

C) unaffected in their present choices.

D) Any of these could occur when income is expected to fall.

A) more inclined to save.

B) less inclined to save.

C) unaffected in their present choices.

D) Any of these could occur when income is expected to fall.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

70

When current economic conditions are poor, people are _______ inclined to save, and when future economic conditions are predicted to be poor people are _______ inclined to save.

A) less; more

B) less; less

C) more; more

D) more; less

A) less; more

B) less; less

C) more; more

D) more; less

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

71

As interest rates rise, there are fewer potential investments that will generate returns high enough to make the cost of paying back a loan worthwhile. This relationship is represented by the _______ in the market for loanable funds.

A) upward-sloping supply curve

B) downward-sloping supply curve

C) upward-sloping demand curve

D) downward-sloping demand curve

A) upward-sloping supply curve

B) downward-sloping supply curve

C) upward-sloping demand curve

D) downward-sloping demand curve

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

72

In 2006, before the Great Recession, the economy was booming and consumer demand was high. The good economic conditions caused the _______ for loanable funds to _______.

A) demand; increase

B) demand; decrease

C) supply; increase

D) supply; decrease

A) demand; increase

B) demand; decrease

C) supply; increase

D) supply; decrease

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

73

Crowding out is a reduction in _______ borrowing caused by an increase in _______ borrowing.

A) private; government

B) government; private

C) private; corporate

D) corporate; private

A) private; government

B) government; private

C) private; corporate

D) corporate; private

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

74

The following are all determinants of the supply of loanable funds except:

A) wealth.

B) expectations of future economic conditions.

C) social welfare policies.

D) the rate of return on investment.

A) wealth.

B) expectations of future economic conditions.

C) social welfare policies.

D) the rate of return on investment.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

75

Investment decisions are based on the trade-off between which two factors?

A) The potential profit that could be generated by investment and the cost of borrowing money to finance the investment

B) The interest rate that savers will earn and the interest rate that borrowers will have to pay

C) The future value of the loan and the present value of the loan

D) The potential profit that could be generated and the willingness of a lender to make the loan

A) The potential profit that could be generated by investment and the cost of borrowing money to finance the investment

B) The interest rate that savers will earn and the interest rate that borrowers will have to pay

C) The future value of the loan and the present value of the loan

D) The potential profit that could be generated and the willingness of a lender to make the loan

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

76

When the government runs a deficit, the cost of borrowing _______, which _______ private demand for loanable funds.

A) increases; decreases

B) decreases; decreases

C) increases; increases

D) decreases; increases

A) increases; decreases

B) decreases; decreases

C) increases; increases

D) decreases; increases

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

77

When the government borrows to finance excess spending, it causes the _______ loanable funds to _______.

A) demand for; increase

B) demand for; decrease

C) supply of; increase

D) supply of; decrease

A) demand for; increase

B) demand for; decrease

C) supply of; increase

D) supply of; decrease

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

78

A default happens when a:

A) borrower fails to pay back a loan according to the agreed-upon terms.

B) lender fails to earn a high-enough return on their investment.

C) bank fails to have enough cash on hand to give all depositors their money.

D) borrower pays back a loan early.

A) borrower fails to pay back a loan according to the agreed-upon terms.

B) lender fails to earn a high-enough return on their investment.

C) bank fails to have enough cash on hand to give all depositors their money.

D) borrower pays back a loan early.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

79

Good current economic conditions incentivize people to save _______, and a good outlook on future economic conditions incentivizes people to save _______.

A) more; less

B) more; more

C) less; more

D) less; less

A) more; less

B) more; more

C) less; more

D) less; less

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

80

The supply of loanable funds is determined by:

A) current economic conditions.

B) expected profit on an investment.

C) investors' confidence.

D) All of these are determinants of the supply of loanable funds.

A) current economic conditions.

B) expected profit on an investment.

C) investors' confidence.

D) All of these are determinants of the supply of loanable funds.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck