Deck 11: Responsibility Accounting Systems

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

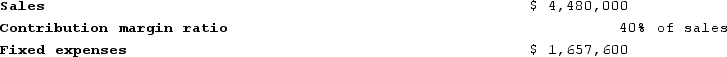

Question

Question

Question

Question

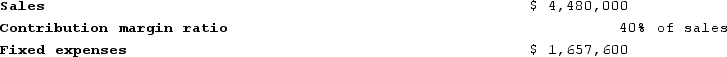

Question

Question

Question

Question

Question

Question

Question

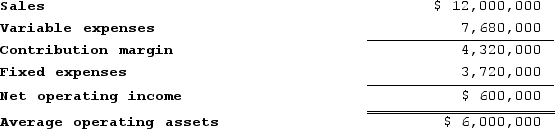

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

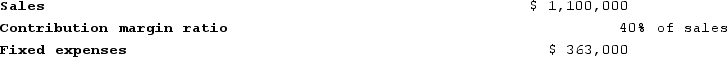

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/335

Play

Full screen (f)

Deck 11: Responsibility Accounting Systems

1

Under a responsibility accounting system, fewer expenses are charged against managers the higher one moves upward in an organization.

False

2

Residual income is the difference between net operating income and the product of average operating assets and the minimum rate of return.

True

3

Return on investment (ROI) and residual income are tools used to evaluate managerial performance in investment centers.

True

4

The selling division in a transfer pricing situation should want the transfer price to cover at least the full cost per unit plus the lost contribution margin per unit on outside sales.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

5

A change in sales has no effect on margin and turnover.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

6

A profit center is responsible for generating revenue, but it is not responsible for controlling costs.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

7

Residual income can be used most effectively in comparing the performance of divisions of different size.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

8

An advantage of using return on investment (ROI) to evaluate performance is that it encourages the manager to reduce the investment in operating assets as well as increase net operating income.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

9

If a company contains a number of investment centers of differing sizes, return on investment (ROI) should be used rather than residual income to rank the financial performance of the divisions.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

10

A cost center is a responsibility center.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

11

From the buying division's perspective, when a transferred item can be purchased from an outside supplier, the price charged by the outside supplier represents an upper bound on the charge that should be made on transfers between the selling and buying divisions.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

12

Residual income should be used to evaluate an investment center rather than a cost or profit center.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

13

Whenever the selling division must give up outside sales in order to sell internally, it has an opportunity cost that should be considered in setting the transfer price.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

14

The use of return on investment (ROI) as a performance measure may lead managers to reject a project that would be favorable for the company as a whole.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

15

Land held for possible plant expansion would be included as an operating asset when computing return on investment (ROI).

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

16

Suppose a company evaluates divisional performance using both return on investment (ROI) and residual income. The company's minimum required rate of return for the purposes of residual income calculations is 12%. If a division has a residual income of $6,000, then its return on investment is less than 12%.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

17

The basic objective of responsibility accounting is to charge each manager with those costs and/or revenues over which he has control.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

18

When used in return on investment (ROI) calculations, turnover equals sales divided by average operating assets.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

19

Net operating income is income before interest and taxes.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

20

All other things the same, an increase in unit sales will normally result in an increase in the return on investment.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

21

Setting transfer prices at full cost can lead to bad decisions because, among other reasons, full cost does not take into account opportunity costs.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

22

In service department cost allocations, sales dollars should be used as an allocation base whenever possible.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following would be considered an operating asset in return on investment computations?

A) Land being held for plant expansion.

B) Treasury stock.

C) Accounts receivable.

D) Common stock.

A) Land being held for plant expansion.

B) Treasury stock.

C) Accounts receivable.

D) Common stock.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

24

If transfer prices are to be based on cost, then the costs should be actual costs rather than standard costs.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

25

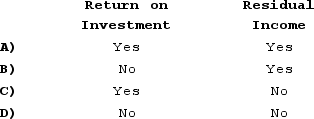

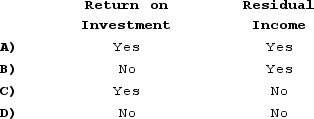

Which of the following performance measures will increase if inventory decreases and all else remains the same?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

26

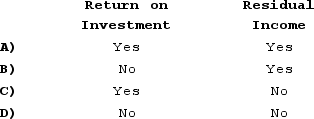

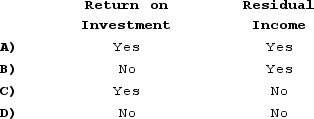

Which of the following segment performance measures will decrease if there is an increase in the interest expense for that segment?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following will not result in an increase in return on investment (ROI), assuming other factors remain the same?

A) A reduction in expenses.

B) An increase in net operating income.

C) An increase in operating assets.

D) An increase in sales.

A) A reduction in expenses.

B) An increase in net operating income.

C) An increase in operating assets.

D) An increase in sales.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

28

All other things equal, which of the following would increase a division's residual income?

A) Increase in expenses.

B) Decrease in average operating assets.

C) Increase in minimum required return.

D) Decrease in net operating income.

A) Increase in expenses.

B) Decrease in average operating assets.

C) Increase in minimum required return.

D) Decrease in net operating income.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

29

A segment of a business responsible for both revenues and expenses would be called:

A) a cost center.

B) an investment center.

C) a profit center.

D) residual income.

A) a cost center.

B) an investment center.

C) a profit center.

D) residual income.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

30

For performance evaluation purposes, the actual fixed costs of a service department should be charged to the departments that consume the service in proportion to the actual services provided to the consuming departments during the period.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

31

All charges for services computed using budgeted rather than actual rates should be removed from an operating department's performance report.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

32

The transfer price used for internal transfers between divisions of the same company cannot affect the divisions' reported profits.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

33

Some investment opportunities that should be accepted from the viewpoint of the entire company may be rejected by a manager who is evaluated on the basis of:

A) return on investment.

B) residual income.

C) contribution margin.

D) segment margin.

A) return on investment.

B) residual income.

C) contribution margin.

D) segment margin.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following would be an argument for using the gross cost of plant and equipment as part of operating assets in return on investment (ROI) computations?

A) It is consistent with the computation of net operating income, which includes depreciation as an operating expense.

B) It is consistent with the balance sheet presentation of plant and equipment.

C) It eliminates the age of equipment as a factor in return on investment (ROI) computations.

D) It discourages the replacement of old, worn-out equipment because of the dramatic, adverse effect on return on investment.

A) It is consistent with the computation of net operating income, which includes depreciation as an operating expense.

B) It is consistent with the balance sheet presentation of plant and equipment.

C) It eliminates the age of equipment as a factor in return on investment (ROI) computations.

D) It discourages the replacement of old, worn-out equipment because of the dramatic, adverse effect on return on investment.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following measures of performance encourages continued expansion by an investment center so long as it is able to earn a return in excess of the minimum required return on average operating assets?

A) return on investment

B) transfer pricing

C) the contribution approach

D) residual income

A) return on investment

B) transfer pricing

C) the contribution approach

D) residual income

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

36

Since sales dollars represents "ability to pay," it is superior to most other bases used for allocating or charging service department costs.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

37

For performance evaluation purposes, variable service department costs should be charged to operating departments in predetermined, lump-sum amounts.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

38

Whenever possible, service department costs should be separated into fixed and variable costs and charged separately to operating departments.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

39

For performance evaluation purposes, any variance over budgeted fixed costs in a service department should be the responsibility of the service department and should not be charged to the departments that use the service.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

40

When a dispute arises over a transfer price, top managers should intervene to keep divisional managers from making a costly mistake, even though the divisions are evaluated as profit centers.

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

41

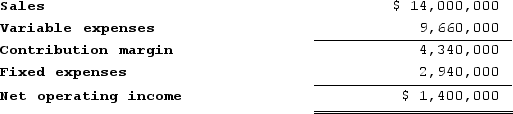

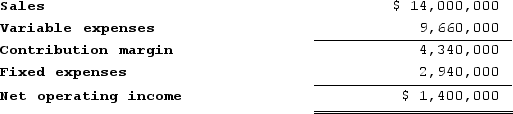

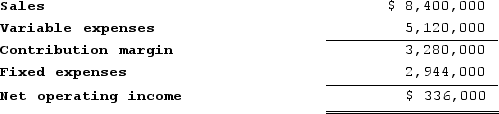

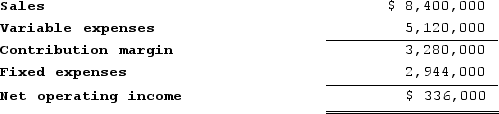

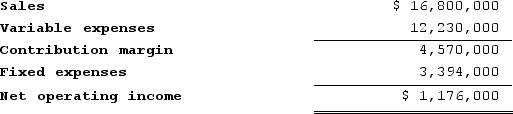

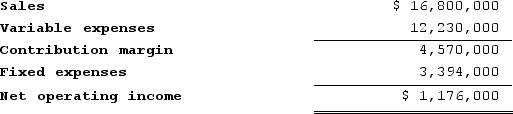

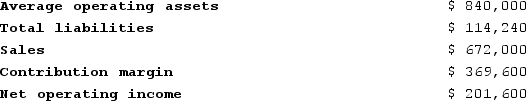

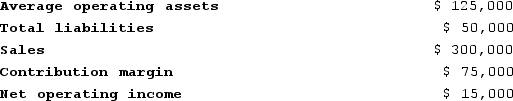

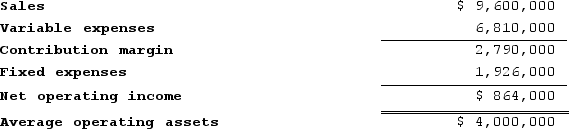

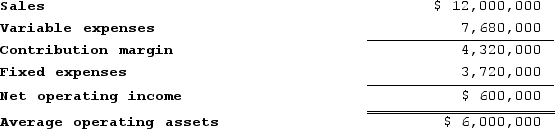

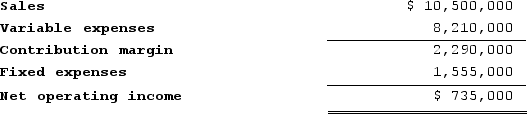

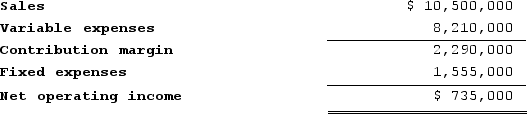

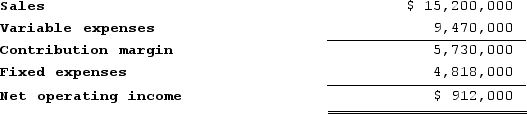

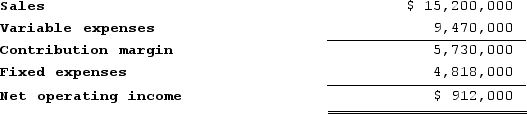

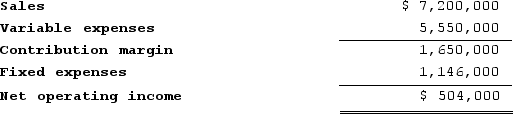

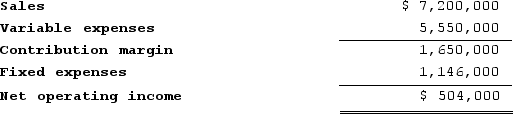

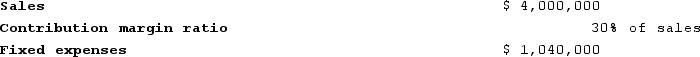

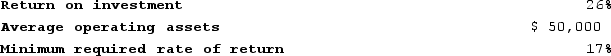

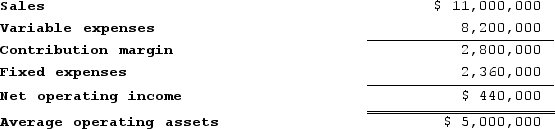

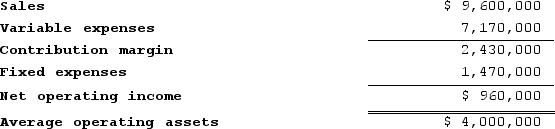

Leete Incorporated reported the following results from last year's operations:  Last year's margin was closest to:

Last year's margin was closest to:

A) 79.0%

B) 31.0%

C) 20.0%

D) 10.0%

Last year's margin was closest to:

Last year's margin was closest to:A) 79.0%

B) 31.0%

C) 20.0%

D) 10.0%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

42

The following information relates to last year's operations at the Legumes Division of Gervani Corporation:  What was the Legume Division's net operating income last year?

What was the Legume Division's net operating income last year?

A) $72,000

B) $52,500

C) $19,500

D) $24,000

What was the Legume Division's net operating income last year?

What was the Legume Division's net operating income last year?A) $72,000

B) $52,500

C) $19,500

D) $24,000

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

43

The following information relates to last year's operations at the Legumes Division of Gervani Corporation:  What was the Legume Division's net operating income last year?

What was the Legume Division's net operating income last year?

A) $108,000

B) $135,000

C) $36,000

D) $45,000

What was the Legume Division's net operating income last year?

What was the Legume Division's net operating income last year?A) $108,000

B) $135,000

C) $36,000

D) $45,000

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

44

BR Company has a contribution margin of 9%. Sales are $477,000, net operating income is $42,930, and average operating assets are $134,000. What is the company's return on investment (ROI)?

A) 3.6%

B) 9.0%

C) 32.0%

D) 0.3%

A) 3.6%

B) 9.0%

C) 32.0%

D) 0.3%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

45

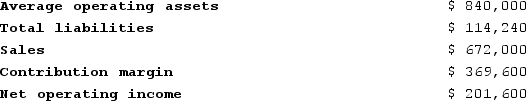

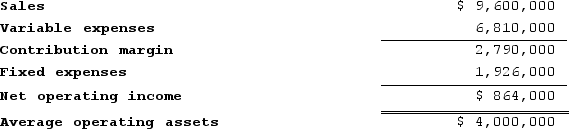

Tadman Incorporated reported the following results from last year's operations:  At the beginning of this year, the company has a $800,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $756,000, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

At the beginning of this year, the company has a $800,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $756,000, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

A) 1.0%

B) 3.0%

C) 5.0%

D) 3.8%

At the beginning of this year, the company has a $800,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $756,000, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

At the beginning of this year, the company has a $800,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $756,000, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:A) 1.0%

B) 3.0%

C) 5.0%

D) 3.8%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

46

Runyon Incorporated reported the following results from last year's operations:  The company's average operating assets were $7,000,000.Last year's turnover was closest to:

The company's average operating assets were $7,000,000.Last year's turnover was closest to:

A) 0.42

B) 14.29

C) 0.07

D) 2.40

The company's average operating assets were $7,000,000.Last year's turnover was closest to:

The company's average operating assets were $7,000,000.Last year's turnover was closest to:A) 0.42

B) 14.29

C) 0.07

D) 2.40

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

47

Verbeke Incorporated reported the following results from last year's operations:  Last year's turnover was closest to:

Last year's turnover was closest to:

A) 16.67

B) 0.06

C) 2.10

D) 0.48

Last year's turnover was closest to:

Last year's turnover was closest to:A) 16.67

B) 0.06

C) 2.10

D) 0.48

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

48

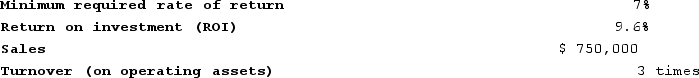

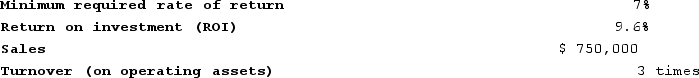

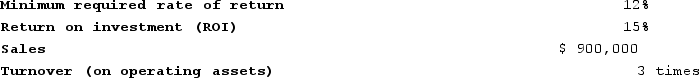

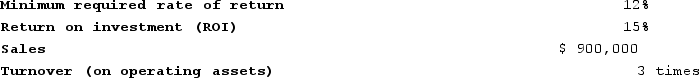

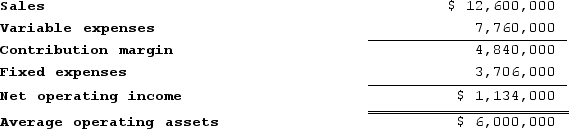

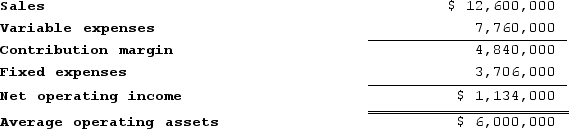

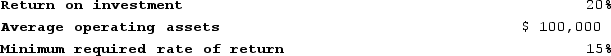

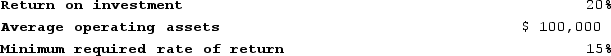

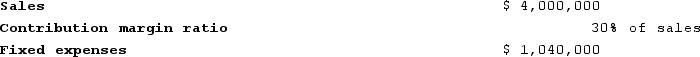

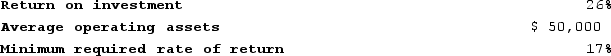

Given the following data:  Return on investment (ROI) is:

Return on investment (ROI) is:

A) 30.0%

B) 24.0%

C) 55.0%

D) 44.0%

Return on investment (ROI) is:

Return on investment (ROI) is:A) 30.0%

B) 24.0%

C) 55.0%

D) 44.0%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

49

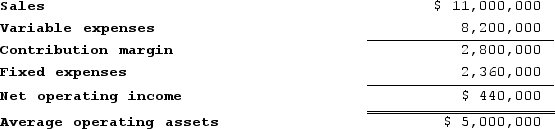

Nasser Incorporated reported the following results from last year's operations:  Last year's return on investment (ROI) was closest to:

Last year's return on investment (ROI) was closest to:

A) 9.0%

B) 47.6%

C) 18.9%

D) 80.7%

Last year's return on investment (ROI) was closest to:

Last year's return on investment (ROI) was closest to:A) 9.0%

B) 47.6%

C) 18.9%

D) 80.7%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

50

Given the following data:  Return on investment (ROI) is:

Return on investment (ROI) is:

A) 30%

B) 5%

C) 20%

D) 12%

Return on investment (ROI) is:

Return on investment (ROI) is:A) 30%

B) 5%

C) 20%

D) 12%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

51

Chiodini Incorporated has a $900,000 investment opportunity that involves sales of $2,430,000, fixed expenses of $1,044,900, and a contribution margin ratio of 50% of sales. The return on investment (ROI) for this year's investment opportunity considered alone is closest to:

A) 16.3%

B) 18.9%

C) 7.0%

D) 135.0%

A) 16.3%

B) 18.9%

C) 7.0%

D) 135.0%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

52

BR Company has a contribution margin of 40%. Sales are $312,500, net operating income is $25,000, and average operating assets are $200,000. What is the company's return on investment (ROI)?

A) 12.5%

B) 62.5%

C) 8.0%

D) 64.0%

A) 12.5%

B) 62.5%

C) 8.0%

D) 64.0%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

53

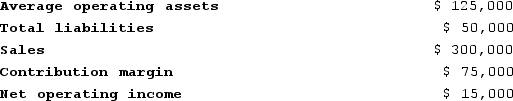

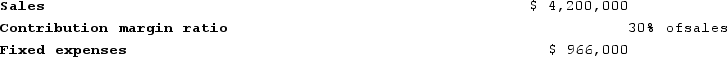

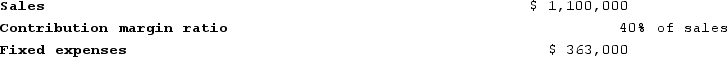

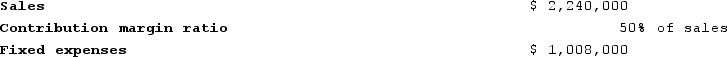

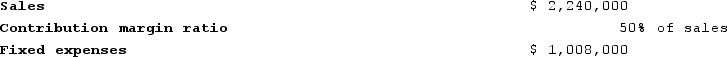

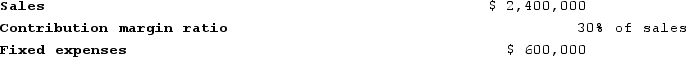

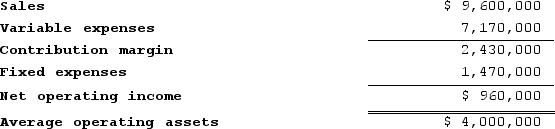

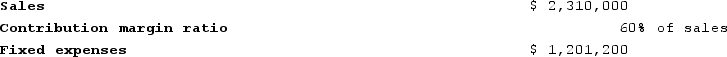

Cirone Incorporated reported the following results from last year's operations:  At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

A) 3.1%

B) 8.4%

C) 6.3%

D) 12.1%

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics: If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:A) 3.1%

B) 8.4%

C) 6.3%

D) 12.1%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

54

Youns Incorporated reported the following results from last year's operations:  The company's average operating assets were $5,000,000.At the beginning of this year, the company has a $1,400,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $616,000, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

The company's average operating assets were $5,000,000.At the beginning of this year, the company has a $1,400,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $616,000, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

A) 9.50

B) 1.64

C) 2.66

D) 2.08

The company's average operating assets were $5,000,000.At the beginning of this year, the company has a $1,400,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $616,000, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

The company's average operating assets were $5,000,000.At the beginning of this year, the company has a $1,400,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $616,000, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:A) 9.50

B) 1.64

C) 2.66

D) 2.08

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

55

Tennill Incorporated has a $1,400,000 investment opportunity with the following characteristics:  The return on investment (ROI) for this year's investment opportunity considered alone is closest to:

The return on investment (ROI) for this year's investment opportunity considered alone is closest to:

A) 8.1%

B) 128.0%

C) 3.0%

D) 9.6%

The return on investment (ROI) for this year's investment opportunity considered alone is closest to:

The return on investment (ROI) for this year's investment opportunity considered alone is closest to:A) 8.1%

B) 128.0%

C) 3.0%

D) 9.6%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

56

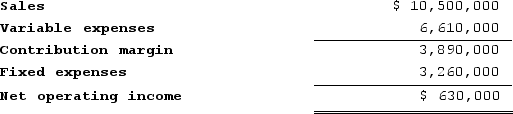

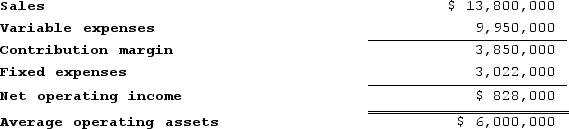

Condren Incorporated reported the following results from last year's operations:  At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined Return on investment (ROI) for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined Return on investment (ROI) for the entire company will be closest to:

A) 1.1%

B) 8.6%

C) 9.7%

D) 11.3%

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics: If the company pursues the investment opportunity and otherwise performs the same as last year, the combined Return on investment (ROI) for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined Return on investment (ROI) for the entire company will be closest to:A) 1.1%

B) 8.6%

C) 9.7%

D) 11.3%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

57

Selma Incorporated reported the following results from last year's operations:  Last year's margin was closest to:

Last year's margin was closest to:

A) 78.1%

B) 6.0%

C) 13.8%

D) 27.9%

Last year's margin was closest to:

Last year's margin was closest to:A) 78.1%

B) 6.0%

C) 13.8%

D) 27.9%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

58

Anguiano Incorporated reported the following results from last year's operations:  The company's average operating assets were $5,000,000. Last year's return on investment (ROI) was closest to:

The company's average operating assets were $5,000,000. Last year's return on investment (ROI) was closest to:

A) 7.0%

B) 14.7%

C) 45.8%

D) 47.6%

The company's average operating assets were $5,000,000. Last year's return on investment (ROI) was closest to:

The company's average operating assets were $5,000,000. Last year's return on investment (ROI) was closest to:A) 7.0%

B) 14.7%

C) 45.8%

D) 47.6%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

59

Last year a company had sales of $370,000, a turnover of 2.1, and a return on investment of 56.7%. The company's net operating income for the year was:

A) $109,890

B) $176,190

C) $99,900

D) $209,790

A) $109,890

B) $176,190

C) $99,900

D) $209,790

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

60

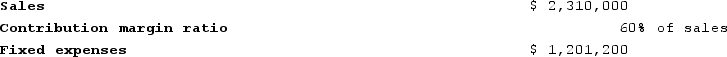

Othman Incorporated has a $800,000 investment opportunity with the following characteristics:  The margin for this investment opportunity is closest to:

The margin for this investment opportunity is closest to:

A) 50.0%

B) 45.0%

C) 5.0%

D) 55.0%

The margin for this investment opportunity is closest to:

The margin for this investment opportunity is closest to:A) 50.0%

B) 45.0%

C) 5.0%

D) 55.0%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

61

Boespflug Incorporated has a $1,000,000 investment opportunity that involves sales of $900,000, fixed expenses of $225,000, and a contribution margin ratio of 30% of sales. The margin for this investment opportunity is closest to:

A) 5.0%

B) 25.0%

C) 75.0%

D) 30.0%

A) 5.0%

B) 25.0%

C) 75.0%

D) 30.0%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

62

Largo Company recorded for the past year sales of $750,000 and average operating assets of $375,000. What is the margin that Largo Company needed to earn in order to achieve an return on investment (ROI) of 15%?

A) 2.00%

B) 15.00%

C) 9.99%

D) 7.50%

A) 2.00%

B) 15.00%

C) 9.99%

D) 7.50%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

63

Tallon Incorporated has a $1,200,000 investment opportunity that involves sales of $1,680,000, fixed expenses of $336,000, and a contribution margin ratio of 30% of sales. The turnover for this investment opportunity is closest to:

A) 1.40

B) 0.10

C) 10.00

D) 0.71

A) 1.40

B) 0.10

C) 10.00

D) 0.71

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

64

Largo Company recorded for the past year sales of $730,000 and average operating assets of $292,000. What is the margin that Largo Company needed to earn in order to achieve an return on investment (ROI) of 32.5%?

A) 32.50%

B) 2.50%

C) 3.08%

D) 13.00%

A) 32.50%

B) 2.50%

C) 3.08%

D) 13.00%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

65

Chavin Company had the following results during August: net operating income, $270,000; turnover, 9; and return on investment (ROI) 15%. Chavin Company's average operating assets were:

A) $30,000

B) $40,500

C) $2,430,000

D) $1,800,000

A) $30,000

B) $40,500

C) $2,430,000

D) $1,800,000

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

66

If net operating income is $70,000, average operating assets are $250,000, and the minimum required rate of return is 16%, what is the residual income?

A) $11,200

B) $40,000

C) $110,000

D) $30,000

A) $11,200

B) $40,000

C) $110,000

D) $30,000

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

67

Bungert Incorporated reported the following results from last year's operations:  The company's minimum required rate of return is 12% and its average operating assets were $8,000,000. Last year's residual income was closest to:

The company's minimum required rate of return is 12% and its average operating assets were $8,000,000. Last year's residual income was closest to:

A) $912,000

B) ($48,000)

C) $992,000

D) ($972,800)

The company's minimum required rate of return is 12% and its average operating assets were $8,000,000. Last year's residual income was closest to:

The company's minimum required rate of return is 12% and its average operating assets were $8,000,000. Last year's residual income was closest to:A) $912,000

B) ($48,000)

C) $992,000

D) ($972,800)

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

68

Chavin Company had the following results during August: net operating income, $220,000; turnover, 5; and return on investment (ROI) 25%. Chavin Company's average operating assets were:

A) $880,000

B) $44,000

C) $55,000

D) $1,100,000

A) $880,000

B) $44,000

C) $55,000

D) $1,100,000

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

69

The following data has been provided for a company's most recent year of operations:  The residual income for the year was closest to:

The residual income for the year was closest to:

A) $20,000

B) $3,000

C) $5,000

D) $15,000

The residual income for the year was closest to:

The residual income for the year was closest to:A) $20,000

B) $3,000

C) $5,000

D) $15,000

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

70

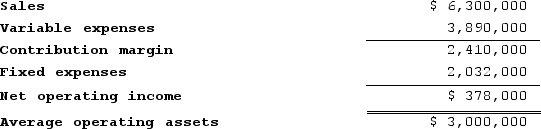

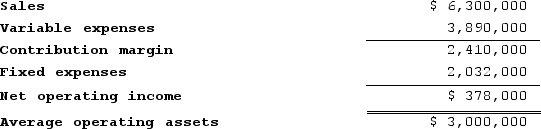

Salvey Incorporated reported the following results from last year's operations:  The company's average operating assets were $3,000,000.At the beginning of this year, the company has a $300,000 investment opportunity that involves sales of $480,000, fixed expenses of $100,800, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined return on investment (ROI) for the entire company will be closest to:

The company's average operating assets were $3,000,000.At the beginning of this year, the company has a $300,000 investment opportunity that involves sales of $480,000, fixed expenses of $100,800, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined return on investment (ROI) for the entire company will be closest to:

A) 16.6%

B) 1.3%

C) 18.2%

D) 15.3%

The company's average operating assets were $3,000,000.At the beginning of this year, the company has a $300,000 investment opportunity that involves sales of $480,000, fixed expenses of $100,800, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined return on investment (ROI) for the entire company will be closest to:

The company's average operating assets were $3,000,000.At the beginning of this year, the company has a $300,000 investment opportunity that involves sales of $480,000, fixed expenses of $100,800, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined return on investment (ROI) for the entire company will be closest to:A) 16.6%

B) 1.3%

C) 18.2%

D) 15.3%

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

71

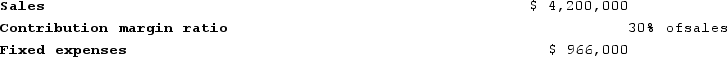

Lumsden Incorporated has a $1,200,000 investment opportunity with the following characteristics:  The company's minimum required rate of return is 7%. The residual income for this year's investment opportunity is closest to:

The company's minimum required rate of return is 7%. The residual income for this year's investment opportunity is closest to:

A) $120,000

B) $36,000

C) $0

D) $84,000

The company's minimum required rate of return is 7%. The residual income for this year's investment opportunity is closest to:

The company's minimum required rate of return is 7%. The residual income for this year's investment opportunity is closest to:A) $120,000

B) $36,000

C) $0

D) $84,000

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

72

Braymiller Incorporated has a $1,600,000 investment opportunity with the following characteristics:  The turnover for this investment opportunity is closest to:

The turnover for this investment opportunity is closest to:

A) 0.04

B) 0.40

C) 2.50

D) 25.00

The turnover for this investment opportunity is closest to:

The turnover for this investment opportunity is closest to:A) 0.04

B) 0.40

C) 2.50

D) 25.00

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

73

The following data has been provided for a company's most recent year of operations:  The residual income for the year was closest to:

The residual income for the year was closest to:

A) $4,500

B) $12,000

C) $8,000

D) $9,100

The residual income for the year was closest to:

The residual income for the year was closest to:A) $4,500

B) $12,000

C) $8,000

D) $9,100

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

74

Mike Corporation uses residual income to evaluate the performance of its divisions. The company's minimum required rate of return is 14%. In January, the Commercial Products Division had average operating assets of $970,000 and net operating income of $143,700. What was the Commercial Products Division's residual income in January?

A) $7,900

B) ($20,118)

C) $20,118

D) ($7,900)

A) $7,900

B) ($20,118)

C) $20,118

D) ($7,900)

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

75

Pankey Incorporated has a $700,000 investment opportunity that would involve sales of $1,050,000, a contribution margin ratio of 40% of sales, and fixed expenses of $325,500. The company's minimum required rate of return is 18%. The residual income for this year's investment opportunity is closest to:

A) ($31,500)

B) $0

C) $94,500

D) $126,000

A) ($31,500)

B) $0

C) $94,500

D) $126,000

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

76

Last year a company had sales of $600,000, a turnover of 3.6, and a return on investment of 18%. The company's net operating income for the year was:

A) $166,667

B) $108,000

C) $30,000

D) $15,000

A) $166,667

B) $108,000

C) $30,000

D) $15,000

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

77

In November, the Universal Solutions Division of Keaffaber Corporation had average operating assets of $480,000 and net operating income of $46,200. The company uses residual income, with a minimum required rate of return of 11%, to evaluate the performance of its divisions. What was the Universal Solutions Division's residual income in November?

A) ($6,600)

B) $5,082

C) $6,600

D) ($5,082)

A) ($6,600)

B) $5,082

C) $6,600

D) ($5,082)

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

78

If net operating income is $39,000, average operating assets are $351,000, and the minimum required rate of return is 10%, what is the residual income?

A) $42,900

B) $31,200

C) $3,900

D) $35,100

A) $42,900

B) $31,200

C) $3,900

D) $35,100

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

79

Worsell Incorporated reported the following results from last year's operations:  The company's minimum required rate of return is 10%. Last year's residual income was closest to:

The company's minimum required rate of return is 10%. Last year's residual income was closest to:

A) $440,000

B) $490,000

C) ($638,000)

D) ($60,000)

The company's minimum required rate of return is 10%. Last year's residual income was closest to:

The company's minimum required rate of return is 10%. Last year's residual income was closest to:A) $440,000

B) $490,000

C) ($638,000)

D) ($60,000)

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck

80

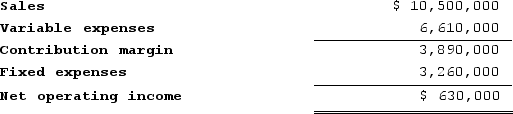

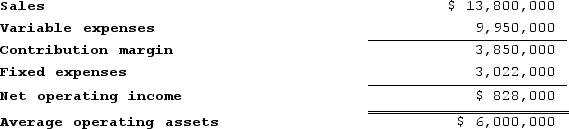

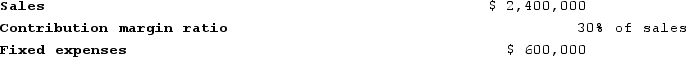

Canedo Incorporated reported the following results from last year's operations:  At the beginning of this year, the company has a $700,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $700,000 investment opportunity with the following characteristics:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

A) 2.98

B) 17.01

C) 2.53

D) 2.04

At the beginning of this year, the company has a $700,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $700,000 investment opportunity with the following characteristics: If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:A) 2.98

B) 17.01

C) 2.53

D) 2.04

Unlock Deck

Unlock for access to all 335 flashcards in this deck.

Unlock Deck

k this deck