Deck 5: Accounting for Inventories

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/169

Play

Full screen (f)

Deck 5: Accounting for Inventories

1

The LIFO cost flow method assigns the cost of the items purchased first to ending inventory.

True

2

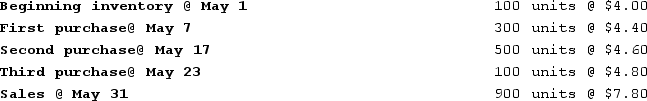

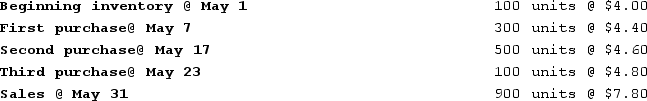

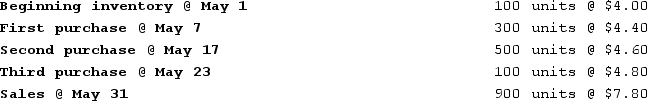

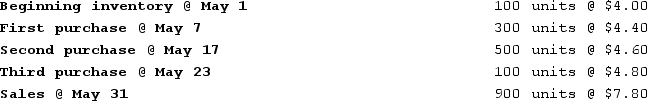

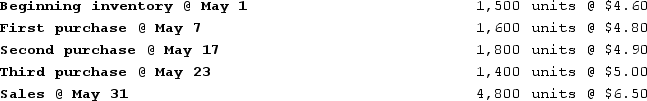

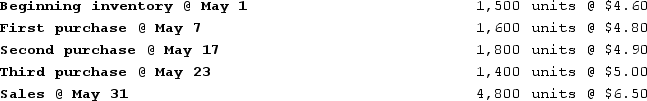

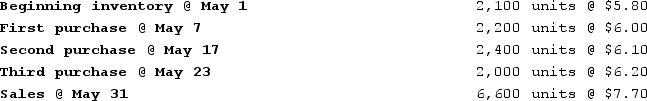

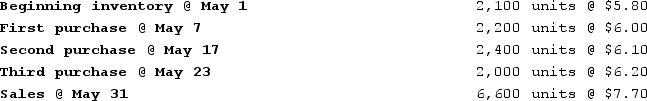

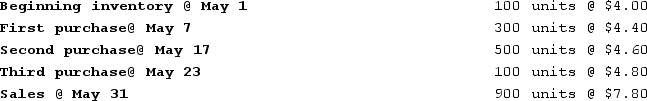

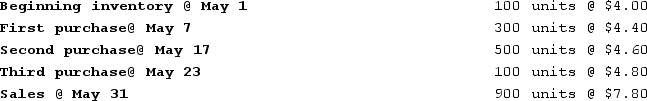

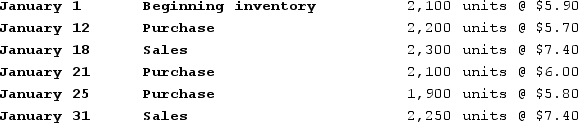

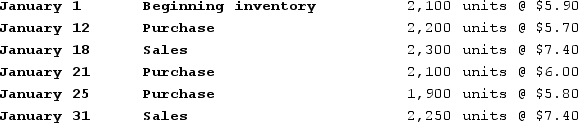

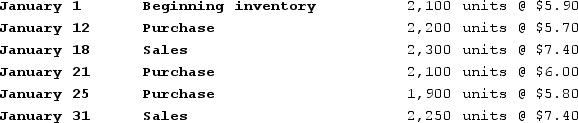

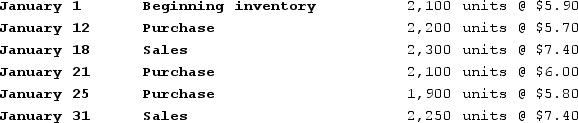

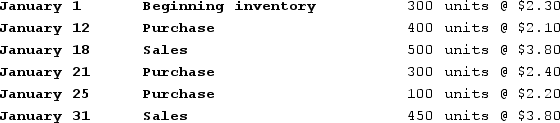

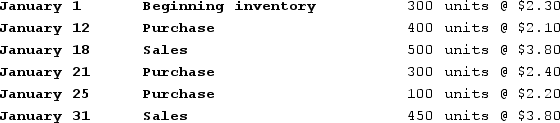

Singleton Company's perpetual inventory records included the following information:

False

3

During a period of rising inventory prices the LIFO cost flow method will result in higher total assets than FIFO.

False

4

During a period of declining prices, a company would report a lower gross margin using the FIFO cost flow method than with LIFO.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

5

A company uses a cost flow method (such as last-in, LIFO or FIFO)to allocate product costs between cost of goods sold and beginning inventory.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

6

Generally accepted accounting principles often allow companies to account for the same types of events in different ways.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

7

In most businesses, the physical flow of goods occurs on a FIFO basis, but a different cost flow method is allowed under generally accepted accounting principles.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

8

Singleton Company's perpetual inventory records included the following information:

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

9

During a period of rising inventory prices, the amount of ending inventory reported on the balance sheet will be lower using the LIFO cost flow method than with FIFO.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

10

Generally accepted accounting principles restrict or limit a company's freedom to change inventory cost flow methods from one year to the next.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

11

In a period of rising inventory prices, use of the FIFO cost flow method would cause a company to pay more income taxes than would use of LIFO.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

12

During a period of rising inventory prices, a company's cost of goods sold would be higher using the LIFO cost flow method than with FIFO.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

13

Singleton Company's perpetual inventory records included the following information:

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

14

If a company uses the FIFO cost flow method for its income tax return it must also use FIFO for financial reporting.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

15

Singleton Company's perpetual inventory records included the following information:

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

16

Singleton Company's perpetual inventory records included the following information:

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

17

A company's gross margin reported on the income statement is not affected by the inventory cost flow method it uses.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

18

The specific identification inventory method is not practical for companies that sell many low-priced, high turnover items.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

19

Generally accepted accounting principles do not allow the cost flow pattern for merchandise inventory to differ from the physical flow of merchandise within the business.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

20

Singleton Company's perpetual inventory records included the following information:

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

21

Warner Company purchased two units of a product for $36 and later purchased one more for $40. If the company uses the weighted average cost flow method, and it sold one unit of the product for $60, its gross margin would be $22.00.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

22

When prices are rising, which method of inventory, if any, will result in the lowest relative net cash outflow (including the effects of taxes, if any)?

A)LIFO.

B)FIFO.

C)Weighted average.

D)None of these; the choice of inventory methods does not affect cash flows.

A)LIFO.

B)FIFO.

C)Weighted average.

D)None of these; the choice of inventory methods does not affect cash flows.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

23

Warner Company purchased thirty-eight units of a product for $19 eachand later purchased nineteen more for $20.00. If the company uses the weighted average cost flow method, and it sold one unit of the product for $30, its gross margin would be $10.67.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

24

What happens when prices are falling?

A)LIFO will result in lower net income and a lower inventory valuation than will FIFO.

B)LIFO will result in lower net income and a higher inventory valuation than will FIFO.

C)LIFO will result in higher net income and a higher inventory valuation than will FIFO.

D)LIFO will result in higher net income and a lower inventory valuation than will FIFO.

A)LIFO will result in lower net income and a lower inventory valuation than will FIFO.

B)LIFO will result in lower net income and a higher inventory valuation than will FIFO.

C)LIFO will result in higher net income and a higher inventory valuation than will FIFO.

D)LIFO will result in higher net income and a lower inventory valuation than will FIFO.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

25

A discount merchandiser is likely to have a higher inventory turnover than more upscale stores with higher merchandise prices.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

26

International Financial Reporting Standards (IFRS)do not permit the use of the LIFO inventory cost flow method.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

27

The gross margin method of estimating inventory is not useful in detecting inventory fraud.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

28

Blake Company purchased two identical inventory items. The item purchased first cost $19.00, and the item purchased second cost $20.00. Blake sold one of the items for $34.00. Which of the following statements is true?

A)Ending inventory will be lower if Blake usesthe weighted-average rather than the FIFO inventory cost flow method.

B)Cost of goods sold will be higher if Blake uses the FIFO rather than the weighted-average inventory cost flow method.

C)The dollar amount assigned to ending inventory will be the same no matter which inventorycost flow method is used.

D)Gross margin will be higher if Blake uses LIFO rather than the FIFO inventory cost flow method.

A)Ending inventory will be lower if Blake usesthe weighted-average rather than the FIFO inventory cost flow method.

B)Cost of goods sold will be higher if Blake uses the FIFO rather than the weighted-average inventory cost flow method.

C)The dollar amount assigned to ending inventory will be the same no matter which inventorycost flow method is used.

D)Gross margin will be higher if Blake uses LIFO rather than the FIFO inventory cost flow method.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

29

If a company overstates its Inventory balance at the end of Year 1 due to an error, its Retained Earnings will also be overstated on the Year 1 balance sheet.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

30

The Internal Revenue Service allows a company to use LIFO for income tax purposes only if it also uses LIFO for financial reporting.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

31

A loss resulting from application of the lower-of-cost-or-market rule is included in cost of goods sold if the loss is material in amount.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

32

Which inventory costing method will produce an amount for cost of goods sold that is closest to current market value?

A)Weighted average

B)Specific identification

C)LIFO

D)FIFO

A)Weighted average

B)Specific identification

C)LIFO

D)FIFO

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

33

If prices are rising, which inventory cost flow method will produce the lowest amount of cost of goods sold?

A)LIFO.

B)FIFO.

C)Weighted average.

D)LIFO, FIFO, and the weighted-average inventory cost flow methods will all produce equal amounts of cost of goods sold.

A)LIFO.

B)FIFO.

C)Weighted average.

D)LIFO, FIFO, and the weighted-average inventory cost flow methods will all produce equal amounts of cost of goods sold.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

34

If a company uses the LIFO cost flow method, it is not required by generally accepted accounting principles to apply the lower-of-cost-or-market rule.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

35

If the replacement cost of inventory is greater than its historical cost, the increase in value does not affect the company's financial statements.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

36

When the cost of purchasing inventory is declining, which inventory cost flow method will produce the highest amount of cost of goods sold?

A)Weighted-average.

B)LIFO.

C)FIFO.

D)LIFO, FIFO, and weighted-average will all produce the same amount of cost of goods sold.

A)Weighted-average.

B)LIFO.

C)FIFO.

D)LIFO, FIFO, and weighted-average will all produce the same amount of cost of goods sold.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

37

Barker Company paid cash to purchase two identical inventory items. The first purchase cost $18.00 cash and the second cost $20.00 cash. Barker sold one inventory item for $30.00 cash. Based on this information alone, without considering the effect of income taxes, which of the following statements is correct?

A)Cash flow from operating activities is $11.00 assuming the weighted-average inventory cost flow method is used.

B)Cash flow from operating activities is $12.00 assuming the FIFO inventory cost flow method is used.

C)Cash flow from operating activities is $10.00 assuming the LIFO inventory cost flow method is used.

D)The amount of cash flow from operating activities is not affected by the inventory cost flow method chosen.

A)Cash flow from operating activities is $11.00 assuming the weighted-average inventory cost flow method is used.

B)Cash flow from operating activities is $12.00 assuming the FIFO inventory cost flow method is used.

C)Cash flow from operating activities is $10.00 assuming the LIFO inventory cost flow method is used.

D)The amount of cash flow from operating activities is not affected by the inventory cost flow method chosen.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

38

Blake Company purchased two identical inventory items. The item purchased first cost $16.00, and the item purchased second cost $18.00. Blake sold one of the items for $24.00. Which of the following statements is true?

A)Ending inventory will be lower if Blake uses the weighted-average rather than the FIFO inventory cost flow method.

B)Cost of goods sold will be higher if Blake uses the FIFO rather than the weighted-average inventory cost flow method.

C)The dollar amount assigned to ending inventory will be the same no matter which inventory cost flow method is used.

D)Gross margin will be higher if Blake uses LIFO rather than the FIFO inventory cost flow method.

A)Ending inventory will be lower if Blake uses the weighted-average rather than the FIFO inventory cost flow method.

B)Cost of goods sold will be higher if Blake uses the FIFO rather than the weighted-average inventory cost flow method.

C)The dollar amount assigned to ending inventory will be the same no matter which inventory cost flow method is used.

D)Gross margin will be higher if Blake uses LIFO rather than the FIFO inventory cost flow method.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

39

The cost flow method chosen by a company will impact its inventory turnover ratio.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

40

What happens when a company is operating in an inflationary environment?

A)The company's net income will be higher if it uses LIFO than if it uses FIFO.

B)The company's cost of goods sold will be lower if it uses LIFO as opposed to FIFO.

C)The company's net income will be the same regardless of whether LIFO or FIFO is used.

D)The company's assets will be lower if it uses LIFO as opposed to FIFO cost flow.

A)The company's net income will be higher if it uses LIFO than if it uses FIFO.

B)The company's cost of goods sold will be lower if it uses LIFO as opposed to FIFO.

C)The company's net income will be the same regardless of whether LIFO or FIFO is used.

D)The company's assets will be lower if it uses LIFO as opposed to FIFO cost flow.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

41

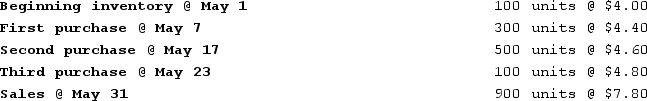

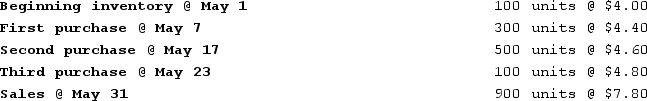

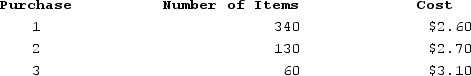

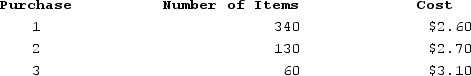

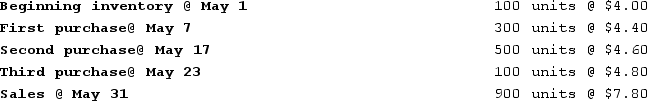

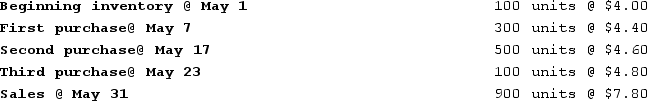

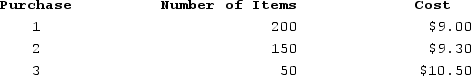

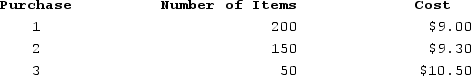

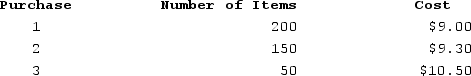

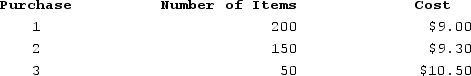

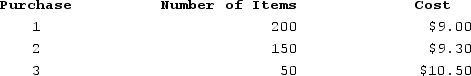

Glasgow Enterprises started the period with 80 units in beginning inventory that cost $1.90 each. During the period, the company purchased inventory items as follows:  Glasgow sold 265 units after purchase 3 for $7.80 each.

Glasgow sold 265 units after purchase 3 for $7.80 each.

What is Glasgow's cost of goods sold under FIFO?

A)$596

B)$504

C)$769

D)$687

Glasgow sold 265 units after purchase 3 for $7.80 each.

Glasgow sold 265 units after purchase 3 for $7.80 each.What is Glasgow's cost of goods sold under FIFO?

A)$596

B)$504

C)$769

D)$687

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

42

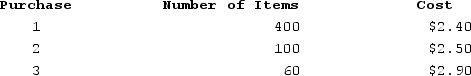

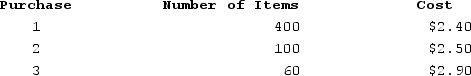

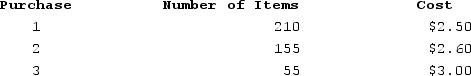

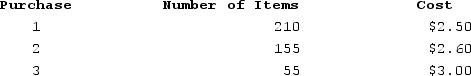

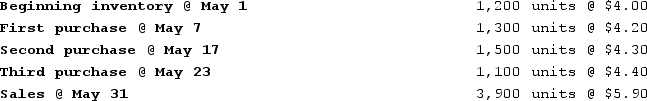

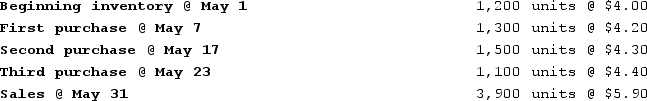

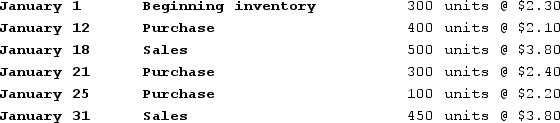

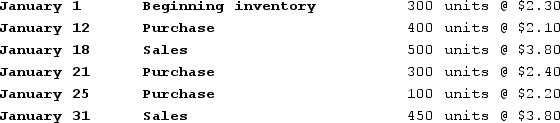

The inventory records for Radford Company reflected the following:  What is the amount of gross margin assuming the weighted-average inventory cost flow method?

What is the amount of gross margin assuming the weighted-average inventory cost flow method?

A)$3,015

B)$2,412

C)$1,314

D)$2,970

What is the amount of gross margin assuming the weighted-average inventory cost flow method?

What is the amount of gross margin assuming the weighted-average inventory cost flow method?A)$3,015

B)$2,412

C)$1,314

D)$2,970

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

43

Anton Company uses the perpetual inventory system and FIFO cost flow method. During the year, Anton purchased 1,080 units of inventory that cost $7 each and then purchased an additional 1,110 units of inventory that cost $9 each. If Anton sells 1,550 units of inventory, what is the amount of cost of goods sold?

A)$13,950

B)$11,790

C)$10,850

D)$14,260

A)$13,950

B)$11,790

C)$10,850

D)$14,260

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

44

Hoover Company purchased two identical inventory items. The item purchased first cost $33.00. The item purchased second cost $35.00. Then Hoover sold one of the inventory items for $62.00. Based on this information, which of the following statements is true?

A)The ending inventory is $35.00 if Hoover uses the LIFO cost flow method.

B)The gross margin is $28.00 if Hoover uses the weighted-average cost flow method.

C)The cost of goods sold is $35.00 if Hoover uses the FIFO cost flow method.

D)The cost of goods sold is $33.00 if Hoover uses the LIFO cost flow method.

A)The ending inventory is $35.00 if Hoover uses the LIFO cost flow method.

B)The gross margin is $28.00 if Hoover uses the weighted-average cost flow method.

C)The cost of goods sold is $35.00 if Hoover uses the FIFO cost flow method.

D)The cost of goods sold is $33.00 if Hoover uses the LIFO cost flow method.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

45

Glasgow Enterprises started the period with 80 units in beginning inventory that cost $2.10 each. During the period, the company purchased inventory items as follows:  Glasgow sold 360 units after purchase 3 for $8.40 each.

Glasgow sold 360 units after purchase 3 for $8.40 each.

What isGlasgow's ending inventory under LIFO?

A)$775

B)$675

C)$610

D)$525

Glasgow sold 360 units after purchase 3 for $8.40 each.

Glasgow sold 360 units after purchase 3 for $8.40 each.What isGlasgow's ending inventory under LIFO?

A)$775

B)$675

C)$610

D)$525

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

46

The inventory records for Radford Company reflected the following:  What is the amount of ending inventory assuming the FIFO cost flow method?

What is the amount of ending inventory assuming the FIFO cost flow method?

A)$6,440

B)$6,240

C)$6,160

D)$5,060

What is the amount of ending inventory assuming the FIFO cost flow method?

What is the amount of ending inventory assuming the FIFO cost flow method?A)$6,440

B)$6,240

C)$6,160

D)$5,060

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

47

The inventory records for Radford Company reflected the following:  What is the amount of gross margin assuming the FIFO cost flow method?

What is the amount of gross margin assuming the FIFO cost flow method?

A)$2,920

B)$3,420

C)$3,000

D)$4,020

What is the amount of gross margin assuming the FIFO cost flow method?

What is the amount of gross margin assuming the FIFO cost flow method?A)$2,920

B)$3,420

C)$3,000

D)$4,020

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

48

Hoover Company purchased two identical inventory items. The item purchased first cost $46.00. The item purchased second cost $51.75. Then Hoover sold one of the inventory items for $75. Based on this information, which of the following statements is true?

A)The ending inventory is $51.75 if Hoover uses the LIFO cost flow method.

B)The gross margin is $26.12 if Hoover uses the weighted-average cost flow method.

C)The cost of goods sold is $51.75 if Hoover uses the FIFO cost flow method.

D)The cost of goods sold is $46.00 if Hoover uses the LIFO cost flow method.

A)The ending inventory is $51.75 if Hoover uses the LIFO cost flow method.

B)The gross margin is $26.12 if Hoover uses the weighted-average cost flow method.

C)The cost of goods sold is $51.75 if Hoover uses the FIFO cost flow method.

D)The cost of goods sold is $46.00 if Hoover uses the LIFO cost flow method.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

49

The inventory records for Radford Company reflected the following:  What is the amount of cost of goods sold assuming the LIFO cost flow method?

What is the amount of cost of goods sold assuming the LIFO cost flow method?

A)$4,100

B)$4,320

C)$2,360

D)$3,600

What is the amount of cost of goods sold assuming the LIFO cost flow method?

What is the amount of cost of goods sold assuming the LIFO cost flow method?A)$4,100

B)$4,320

C)$2,360

D)$3,600

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

50

Glasgow Enterprises started the period with 80 units in beginning inventory that cost $2.00 each. During the period, the company purchased inventory items as follows:  Glasgow sold 230 units after purchase 3 for $8.10 each.

Glasgow sold 230 units after purchase 3 for $8.10 each.

What is Glasgow's ending inventory under weighted-average? (Round your intermediate computation to 2 decimal places.)

A)$678

B)$685

C)$577

D)$542

Glasgow sold 230 units after purchase 3 for $8.10 each.

Glasgow sold 230 units after purchase 3 for $8.10 each.What is Glasgow's ending inventory under weighted-average? (Round your intermediate computation to 2 decimal places.)

A)$678

B)$685

C)$577

D)$542

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

51

The inventory records for Radford Company reflected the following:  What is the amount of ending inventory assuming the FIFO cost flow method?

What is the amount of ending inventory assuming the FIFO cost flow method?

A)$480

B)$440

C)$400

D)$940

What is the amount of ending inventory assuming the FIFO cost flow method?

What is the amount of ending inventory assuming the FIFO cost flow method?A)$480

B)$440

C)$400

D)$940

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

52

The inventory records for Radford Company reflected the following:  What is the amount of cost of goods sold assuming the LIFO cost flow method?

What is the amount of cost of goods sold assuming the LIFO cost flow method?

A)$24,000

B)$23,500

C)$23,040

D)$22,080

What is the amount of cost of goods sold assuming the LIFO cost flow method?

What is the amount of cost of goods sold assuming the LIFO cost flow method?A)$24,000

B)$23,500

C)$23,040

D)$22,080

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

53

Glasgow Enterprises started the period with 80 units in beginning inventory that cost $7.50 each. During the period, the company purchased inventory items as follows:  Glasgow sold 220 units after purchase 3 for $17.00 each.

Glasgow sold 220 units after purchase 3 for $17.00 each.

What is Glasgow's cost of goods sold under FIFO?

A)$1,650

B)$1,860

C)$2,310

D)$2,100

Glasgow sold 220 units after purchase 3 for $17.00 each.

Glasgow sold 220 units after purchase 3 for $17.00 each.What is Glasgow's cost of goods sold under FIFO?

A)$1,650

B)$1,860

C)$2,310

D)$2,100

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

54

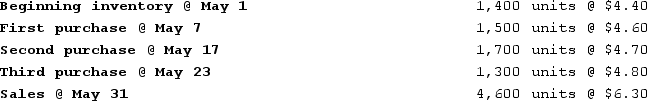

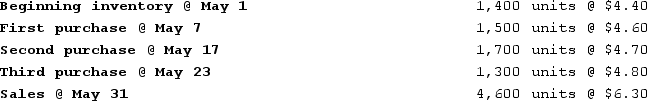

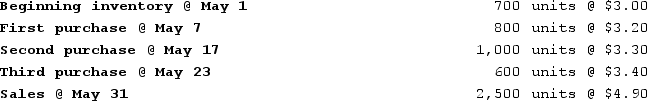

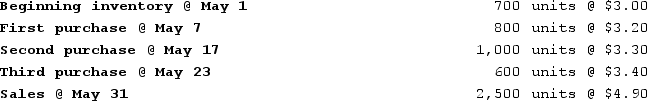

The inventory records for Radford Company reflected the following:  If the company uses the weighted-average inventory cost flow method, what is the average cost per unit (rounded)for May?

If the company uses the weighted-average inventory cost flow method, what is the average cost per unit (rounded)for May?

A)$6.03

B)$5.97

C)$6.10

D)$7.70

If the company uses the weighted-average inventory cost flow method, what is the average cost per unit (rounded)for May?

If the company uses the weighted-average inventory cost flow method, what is the average cost per unit (rounded)for May?A)$6.03

B)$5.97

C)$6.10

D)$7.70

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

55

Anton Company uses the perpetual inventory system and FIFO cost flow method. During the year, Anton purchased 400 units of inventory that cost $12.00 each and then purchased an additional 600 units of inventory that cost $16.00 each. If Anton sells 700 units of inventory, what is the amount of cost of goods sold?

A)$11,200

B)$10,400

C)$8,400

D)$9,600

A)$11,200

B)$10,400

C)$8,400

D)$9,600

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

56

Glasgow Enterprises started the period with 80 units in beginning inventory that cost $7.50 each. During the period, the company purchased inventory items as follows:  Glasgow sold 220 units after purchase 3 for $17.00 each.

Glasgow sold 220 units after purchase 3 for $17.00 each.

What is Glasgow's ending inventory under LIFO?

A)$2,730

B)$2,460

C)$2,220

D)$1,950

Glasgow sold 220 units after purchase 3 for $17.00 each.

Glasgow sold 220 units after purchase 3 for $17.00 each.What is Glasgow's ending inventory under LIFO?

A)$2,730

B)$2,460

C)$2,220

D)$1,950

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

57

The inventory records for Radford Company reflected the following:  If the company uses the weighted-average inventory cost flow method, what is the average cost per unit (rounded)for May?

If the company uses the weighted-average inventory cost flow method, what is the average cost per unit (rounded)for May?

A)$4.45

B)$4.50

C)$5.12

D)$6.34

If the company uses the weighted-average inventory cost flow method, what is the average cost per unit (rounded)for May?

If the company uses the weighted-average inventory cost flow method, what is the average cost per unit (rounded)for May?A)$4.45

B)$4.50

C)$5.12

D)$6.34

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

58

The inventory records for Radford Company reflected the following:  What is the amount of gross margin assuming the weighted-average inventory cost flow method? (Round your intermediate calculations to two decimal places.)

What is the amount of gross margin assuming the weighted-average inventory cost flow method? (Round your intermediate calculations to two decimal places.)

A)$6,513

B)$17,160

C)$5,850

D)$10,920

What is the amount of gross margin assuming the weighted-average inventory cost flow method? (Round your intermediate calculations to two decimal places.)

What is the amount of gross margin assuming the weighted-average inventory cost flow method? (Round your intermediate calculations to two decimal places.)A)$6,513

B)$17,160

C)$5,850

D)$10,920

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

59

Glasgow Enterprises started the period with 80 units in beginning inventory that cost $7.50 each. During the period, the company purchased inventory items as follows:  Glasgow sold 220 units after purchase 3 for $17.00 each.

Glasgow sold 220 units after purchase 3 for $17.00 each.

What is Glasgow's ending inventory under weighted-average (rounded)?

A)$2,361

B)$2,340

C)$1,980

D)$1,998

Glasgow sold 220 units after purchase 3 for $17.00 each.

Glasgow sold 220 units after purchase 3 for $17.00 each.What is Glasgow's ending inventory under weighted-average (rounded)?

A)$2,361

B)$2,340

C)$1,980

D)$1,998

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

60

The inventory records for Radford Company reflected the following:  What is the amount of gross margin assuming the FIFO cost flow method?

What is the amount of gross margin assuming the FIFO cost flow method?

A)$4,260

B)$5,260

C)$7,960

D)$4,290

What is the amount of gross margin assuming the FIFO cost flow method?

What is the amount of gross margin assuming the FIFO cost flow method?A)$4,260

B)$5,260

C)$7,960

D)$4,290

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

61

Koontz Company uses the perpetual inventory method and the weighted-average method. On January 1, Year 1, the company's first day of operations, Koontz purchased 400 units of inventory that cost $7.50 each. On January 10, Year 1, the company purchased an additional 600 units of inventory that cost $9.00 each. If the company sells 550 units of inventory, what is the amount of inventory that would appear on the balance sheet immediately following the sale?

A)$3,780

B)$4,738

C)$3,080

D)$3,713

A)$3,780

B)$4,738

C)$3,080

D)$3,713

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

62

Vargas Company uses the perpetual inventory system and the FIFO cost flow method. During the current year, Vargas purchased 400 units of inventory that cost $15.00 each. At a later date during the year, the company purchased an additional 800 units of inventory that cost $18.00 each. Vargas sold 500 units of inventory for $27.00. What is the amount of cost of goods sold that will appear on the current year's income statement?

A)$7,800

B)$6,000

C)$4,500

D)$5,700

A)$7,800

B)$6,000

C)$4,500

D)$5,700

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

63

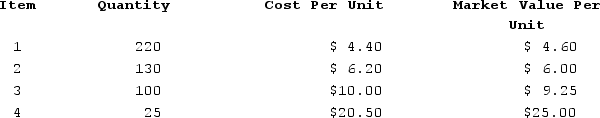

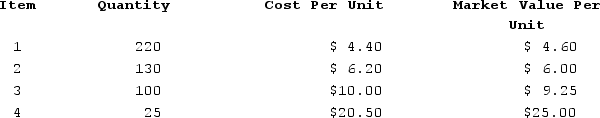

Rowan Company has four different categories of inventory. The quantity, cost, and market value for each of the inventory categories are as follows:  The company carries inventory at lower-of-cost-or-market applied to the entire stock of inventory in the aggregate. How would the implementation of the lower-of-cost-or-market rule impact the elements of the company's financial statements?

The company carries inventory at lower-of-cost-or-market applied to the entire stock of inventory in the aggregate. How would the implementation of the lower-of-cost-or-market rule impact the elements of the company's financial statements?

A)Increase total assets and stockholders' equity by $55.50.

B)Decrease total assets and stockholders' equity by $101.00.

C)Decrease total assets and stockholders' equity by $79.00.

D)Have no effect on total assets or stockholders' equity.

The company carries inventory at lower-of-cost-or-market applied to the entire stock of inventory in the aggregate. How would the implementation of the lower-of-cost-or-market rule impact the elements of the company's financial statements?

The company carries inventory at lower-of-cost-or-market applied to the entire stock of inventory in the aggregate. How would the implementation of the lower-of-cost-or-market rule impact the elements of the company's financial statements?A)Increase total assets and stockholders' equity by $55.50.

B)Decrease total assets and stockholders' equity by $101.00.

C)Decrease total assets and stockholders' equity by $79.00.

D)Have no effect on total assets or stockholders' equity.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

64

Melbourne Company uses the perpetual inventory system and LIFO cost flow method. Melbourne purchased 600 units of inventory that cost $2.75 each. At a later date, the company purchased an additional 700 units of inventory that cost $3.25 each. If the company sells 900 units of inventory, what amount of ending inventory will appear on a balance sheet prepared immediately after the sale?

A)$2,825

B)$1,200

C)$1,100

D)$1,300

A)$2,825

B)$1,200

C)$1,100

D)$1,300

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

65

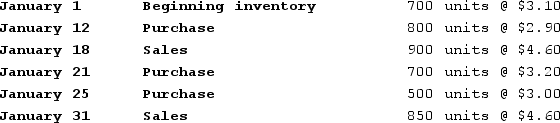

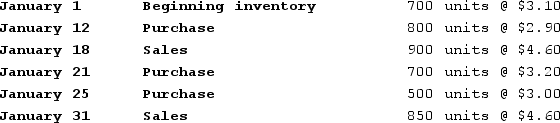

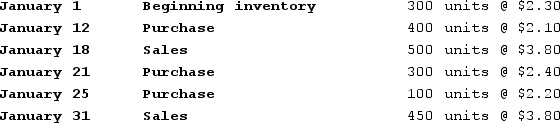

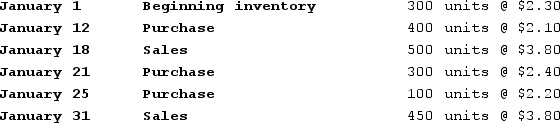

Chase Company uses the perpetual inventory method. The inventory records for Chase reflected the following information:  Assuming Chase uses a FIFO cost flow method, what is the ending inventory on January 31?

Assuming Chase uses a FIFO cost flow method, what is the ending inventory on January 31?

A)$1,705

B)$1,650

C)$2,940

D)$2,540

Assuming Chase uses a FIFO cost flow method, what is the ending inventory on January 31?

Assuming Chase uses a FIFO cost flow method, what is the ending inventory on January 31?A)$1,705

B)$1,650

C)$2,940

D)$2,540

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following businesses is most likely to use a specific identification cost flow method?

A)Car dealership

B)Grocery store

C)Hardware store

D)Roofing company

A)Car dealership

B)Grocery store

C)Hardware store

D)Roofing company

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

67

Poole Company purchased two identical inventory items. One of the items, purchased in January, cost $4.50. The other, purchased in February, cost $4.75. One of the items was sold in March at a selling price of $7.50. Poole uses LIFO. Which of the following statements is true?

A)The balance in ending inventory would be $4.75.

B)The amount of gross margin would be $2.75.

C)The amount of ending inventory would be $4.625.

D)The amount of cost of goods sold would be $4.50.

A)The balance in ending inventory would be $4.75.

B)The amount of gross margin would be $2.75.

C)The amount of ending inventory would be $4.625.

D)The amount of cost of goods sold would be $4.50.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

68

Stubbs Company uses the perpetual inventory method and the weighted-average cost flow method. On January 1, Year 2, Stubbs purchased 400 units of inventory that cost $8.00 each. On January 10, Year 2, the company purchased an additional 600 units of inventory that cost $9.00 each. If the company sells 700 units of inventory for $16.00 each, what is the amount of gross margin reported on the income statement?

A)$5,180

B)$5,250

C)$5,000

D)$6,020

A)$5,180

B)$5,250

C)$5,000

D)$6,020

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

69

Chase Company uses the perpetual inventory method. The inventory records for Chase reflected the following information:  Assuming Chase uses a FIFO cost flow method, what is the cost of goods sold for the sales transaction on January 31?

Assuming Chase uses a FIFO cost flow method, what is the cost of goods sold for the sales transaction on January 31?

A)$13,245

B)$12,900

C)$13,645

D)$22,120

Assuming Chase uses a FIFO cost flow method, what is the cost of goods sold for the sales transaction on January 31?

Assuming Chase uses a FIFO cost flow method, what is the cost of goods sold for the sales transaction on January 31?A)$13,245

B)$12,900

C)$13,645

D)$22,120

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

70

If a company is using the lower-of-cost-or-market rule and a write-down is required, how will that write-down affect the company's financial statements?

A)Net income will increase.

B)Gross margin will decrease.

C)Total assets will decrease.

D)Net income and total assets will both decrease.

A)Net income will increase.

B)Gross margin will decrease.

C)Total assets will decrease.

D)Net income and total assets will both decrease.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

71

Chase Company uses the perpetual inventory method. The inventory records for Chase reflected the following information:  Assuming Chase uses a LIFO cost flow method, what is the amount of cost of goods sold for the sales transaction on January 18?

Assuming Chase uses a LIFO cost flow method, what is the amount of cost of goods sold for the sales transaction on January 18?

A)$1,150

B)$1,050

C)$1,070

D)$1,130

Assuming Chase uses a LIFO cost flow method, what is the amount of cost of goods sold for the sales transaction on January 18?

Assuming Chase uses a LIFO cost flow method, what is the amount of cost of goods sold for the sales transaction on January 18?A)$1,150

B)$1,050

C)$1,070

D)$1,130

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

72

Stubbs Company uses the perpetual inventory method and the weighted-average cost flow method. On January 1, Year 2, Stubbs purchased 1,350 units of inventory that cost $11.50 each. On January 10, Year 2, the company purchased an additional 600 units of inventory that cost $7.00 each. If the company sells 1,500 units of inventory for $23 each, what is the amount of gross margin reported on the income statement? (Round your intermediate calculations to two decimal places.)

A)$35,525

B)$19,320

C)$41,600

D)$26,312

A)$35,525

B)$19,320

C)$41,600

D)$26,312

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

73

Vargas Company uses the perpetual inventory system and the FIFO cost flow method. During the current year, Vargas purchased 1,300 units of inventory that cost $14 each. At a later dateduring the year, the company purchased an additional 1,700 units of inventory that cost $15 each. Vargas sold 1,400 units of inventory for $18.What is the amount of cost of goods sold that will appear on the current year's income statement?

A)$5,500

B)$18,200

C)$4,200

D)$19,700

A)$5,500

B)$18,200

C)$4,200

D)$19,700

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

74

Koontz Company uses the perpetual inventory method and the weighted-average method. On January 1, Year 1, the company's first day of operations, Koontz purchased 1,150 units of inventory that cost $5.50 each. On January 10, Year 1, the company purchased an additional 1,400 units of inventory that cost $7.50 each. If the company sells 1,300 units of inventory, what is the amount of inventory that would appear on the balance sheet immediately following the sale? (Round your intermediate calculations to two decimal places.):

A)$8,580

B)$9,750

C)$8,250

D)$6,875

A)$8,580

B)$9,750

C)$8,250

D)$6,875

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

75

Chase Company uses the perpetual inventory method. The inventory records for Chase reflected the following information:  Assuming Chase uses a LIFO cost flow method, what is the amount of cost of goods sold for the sales transaction on January 18?

Assuming Chase uses a LIFO cost flow method, what is the amount of cost of goods sold for the sales transaction on January 18?

A)$13,570

B)$13,130

C)$13,110

D)$13,530

Assuming Chase uses a LIFO cost flow method, what is the amount of cost of goods sold for the sales transaction on January 18?

Assuming Chase uses a LIFO cost flow method, what is the amount of cost of goods sold for the sales transaction on January 18?A)$13,570

B)$13,130

C)$13,110

D)$13,530

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

76

Chase Company uses the perpetual inventory method. The inventory records for Chase reflected the following information:  Assuming Chase uses a first-in, first-out (FIFO)cost flow method, what is the cost of goods sold for the sales transaction on January 31?

Assuming Chase uses a first-in, first-out (FIFO)cost flow method, what is the cost of goods sold for the sales transaction on January 31?

A)$1,020

B)$1,005

C)$1,045

D)$340

Assuming Chase uses a first-in, first-out (FIFO)cost flow method, what is the cost of goods sold for the sales transaction on January 31?

Assuming Chase uses a first-in, first-out (FIFO)cost flow method, what is the cost of goods sold for the sales transaction on January 31?A)$1,020

B)$1,005

C)$1,045

D)$340

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

77

Poole Company purchased two identical inventory items. One of the items, purchased in January, cost $50. The other, purchased in February, cost $66. One of the items was sold in March at a selling price of $190. Poole uses LIFO. Which of the following statements is true?

A)The balance in ending inventory would be $66.

B)The amount of gross margin would be $124.

C)The amount of ending inventory would be $58.

D)The amount of cost of goods sold would be $50.

A)The balance in ending inventory would be $66.

B)The amount of gross margin would be $124.

C)The amount of ending inventory would be $58.

D)The amount of cost of goods sold would be $50.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

78

Chase Company uses the perpetual inventory method. The inventory records for Chase reflected the following information:  Assuming Chase uses a FIFO cost flow method, what is the ending inventory on January 31?

Assuming Chase uses a FIFO cost flow method, what is the ending inventory on January 31?

A)$345

B)$340

C)$330

D)$1,020

Assuming Chase uses a FIFO cost flow method, what is the ending inventory on January 31?

Assuming Chase uses a FIFO cost flow method, what is the ending inventory on January 31?A)$345

B)$340

C)$330

D)$1,020

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

79

Melbourne Company uses the perpetual inventory system and LIFO cost flow method. Melbourne purchased 500 units of inventory that cost $4.00 each. At a later date, the company purchased an additional 600 units of inventory that cost $5.00 each. If the company sells 800 units of inventory, what amount of ending inventory will appear on a balance sheet prepared immediately after the sale?

A)$3,800.

B)$1,350.

C)$1,500.

D)$1,200.

A)$3,800.

B)$1,350.

C)$1,500.

D)$1,200.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

80

The lower-of-cost-or-market rule can be applied to which of the following?

A)Major classes or categories of inventory

B)The entire stock of inventory in the aggregate

C)Each individual inventory item

D)All of these answer choices are correct.

A)Major classes or categories of inventory

B)The entire stock of inventory in the aggregate

C)Each individual inventory item

D)All of these answer choices are correct.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck