Deck 31: Financial Distress

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/22

Play

Full screen (f)

Deck 31: Financial Distress

1

The management of Schroeder Books has proposed to reorganize the company. The proposal is based on a going-concern value of $2.3 million. The proposed financial structure is $500,000 in new mortgage debt, $300,000 in subordinated debt and $1,500,000 in new equity. All creditors, both secured and unsecured, are owed $3 million dollars. Secured creditors have a mortgage lien for $2,000,000 on the book bindery. The corporate tax rate is 34%. How much should the unsecured creditors receive?

A) $300,000

B) $500,000

C) $1,000,000

D) $2,300,000

A) $300,000

B) $500,000

C) $1,000,000

D) $2,300,000

$1,000,000

2

The management of Magic Mobile Homes has proposed to reorganize the firm. The proposal is based on a going-concern value of $2.0 million. The proposed financial structure is $750,000 in new mortgage debt, $250,000 in subordinated debt and $1,000,000 in new equity. All creditors, both secured and unsecured, are owed $2.5 million dollars. Secured creditors have a mortgage lien for $1,500,000 on the factory. The corporate tax rate is 34%. How much should the unsecured creditors receive?

A) $1,000,000

B) $500,000

C) $750,000

D) $667,000

A) $1,000,000

B) $500,000

C) $750,000

D) $667,000

$1,000,000

3

The management of Magic Mobile Homes has proposed to reorganize the firm. The proposal is based on a going-concern value of $2.0 million. The proposed financial structure is $750,000 in new mortgage debt, $250,000 in subordinated debt and $1,000,000 in new equity. All creditors, both secured and unsecured, are owed $2.5 million dollars. Secured creditors have a mortgage lien for $1,500,000 on the factory. The corporate tax rate is 34%. What will the equity holders receive if they had 5 million shares with a par value of $0.50 each?

A) $1,000,000

B) $583,333

C) $35,714

D) $0

A) $1,000,000

B) $583,333

C) $35,714

D) $0

$0

4

Financial distress can be best described by which of the following situations in which the firm is forced to take corrective action?

A) Cash payments are delayed to creditors.

B) The market value of the stock declines by 50%.

C) The firm's operating cash flows are insufficient to pay current obligations.

D) Cash distributions are eliminated because the board of directors considers the surplus account to be low.

A) Cash payments are delayed to creditors.

B) The market value of the stock declines by 50%.

C) The firm's operating cash flows are insufficient to pay current obligations.

D) Cash distributions are eliminated because the board of directors considers the surplus account to be low.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

5

Magic Mobile Homes is to be liquidated. All creditors, both secured and unsecured, are owed $2.0 million dollars. Administrative costs of liquidation and wages payments are expected to be $500,000. A sale of assets is expected to bring $1.8 million after all costs and taxes. Secured creditors have a mortgage lien for $1,200,000 on the factory which will be liquidated for $900,000 out of the sale proceeds. The corporate tax rate is 34%. How much and what percentage of their claim will the unsecured creditors receive, in total?

A) $290,909; 36.36%

B) $300,000; 37.50%

C) $600,000; 75.00%

D) $100,000; 12.50%

A) $290,909; 36.36%

B) $300,000; 37.50%

C) $600,000; 75.00%

D) $100,000; 12.50%

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

6

The management of Magic Mobile Homes has proposed to reorganize the firm. The proposal is based on a going-concern value of $2.0 million. The proposed financial structure is $750,000 in new mortgage debt, $250,000 in subordinated debt and $1,000,000 in new equity. All creditors, both secured and unsecured, are owed $2.5 million dollars. Secured creditors have a mortgage lien for $1,500,000 on the factory. The corporate tax rate is 34%. How much should the secured creditors receive?

A) $1,000,000

B) $1,500,000

C) $1,250,000

D) $1,333,333

A) $1,000,000

B) $1,500,000

C) $1,250,000

D) $1,333,333

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

7

Insolvency can be defined as:

A) not having cash.

B) being illiquid.

C) an inability to pay one's debts.

D) an inability to increase one's debts.

E) the present value of payments being less than assets.

A) not having cash.

B) being illiquid.

C) an inability to pay one's debts.

D) an inability to increase one's debts.

E) the present value of payments being less than assets.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

8

What is the correct priority of the following claims, once a corporation is determined to be bankrupt?

A) Administrative expenses, wages claims not exceeding $2,000, government tax claims, debtholder and then equity holder claims.

B) Administrative expenses, wages claims not exceeding $2,000, government tax claims, equity holder and then debtholder claims.

C) All wage claims, administrative expenses, debtholder claims, government tax claims and equity holder claims.

D) All wage claims, administrative expenses, debtholder claims, equity holder claims and government tax claims.

A) Administrative expenses, wages claims not exceeding $2,000, government tax claims, debtholder and then equity holder claims.

B) Administrative expenses, wages claims not exceeding $2,000, government tax claims, equity holder and then debtholder claims.

C) All wage claims, administrative expenses, debtholder claims, government tax claims and equity holder claims.

D) All wage claims, administrative expenses, debtholder claims, equity holder claims and government tax claims.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

9

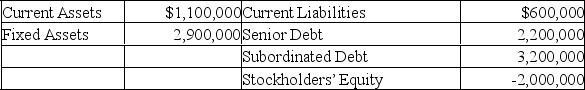

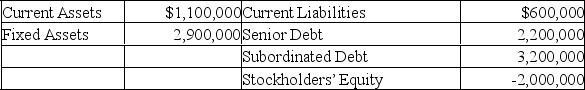

The Steel Pony Company a maker of all-terrain recreational vehicles is having financial difficulties due to high interest payments. The estimated "going concern" value if Steel Pony is $4.0 million. The statement of financial position of the firm is as shown:

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

10

One of the various events which typically occurs around the period of financial distress for a firm is:

A) continued earning losses.

B) steady growth.

C) dividend reductions.

D) dividend increases.

A) continued earning losses.

B) steady growth.

C) dividend reductions.

D) dividend increases.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

11

The management of Schroeder Books has proposed to reorganize the company. The proposal is based on a going-concern value of $2.3 million. The proposed financial structure is $500,000 in new mortgage debt, $300,000 in subordinated debt and $1,500,000 in new equity. All creditors, both secured and unsecured, are owed $3 million dollars. Secured creditors have a mortgage lien for $2,000,000 on the book bindery. The corporate tax rate is 34%. How much should the secured creditors receive?

A) $1,500,000

B) $2,000,000

C) $2,300,000

D) $3,000,000

A) $1,500,000

B) $2,000,000

C) $2,300,000

D) $3,000,000

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

12

Bankruptcy reorganizations are used by management to:

A) forestall the inevitable liquidation in all cases.

B) provide time to turn the business around.

C) allow the courts' time to set up an administrative structure.

A) forestall the inevitable liquidation in all cases.

B) provide time to turn the business around.

C) allow the courts' time to set up an administrative structure.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

13

Most firms in financial distress do not fail or cease to exist. In fact, many firms can actually benefit from financial distress by:

A) re-evaluating their core operations and restructuring their assets.

B) selectively ceasing payment on some of their outstanding debts.

C) filing for bankruptcy.

D) liquidating.

E) increasing their debt load.

A) re-evaluating their core operations and restructuring their assets.

B) selectively ceasing payment on some of their outstanding debts.

C) filing for bankruptcy.

D) liquidating.

E) increasing their debt load.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

14

Whether bankruptcy is entered either voluntarily or involuntarily, the major difference by CCCA and Bankruptcy and Insolvency Act is:

A) that liquidation occurs in CCCA but reorganization is the objective under Bankruptcy and Insolvency Act.

B) that there is no priority of claims under Chapter CCCA.

C) that liquidation occurs in Bankruptcy and Insolvency Act but reorganization is the objective under CCCA.

D) that no lawyers fees are necessary under Bankruptcy and Insolvency Act.

A) that liquidation occurs in CCCA but reorganization is the objective under Bankruptcy and Insolvency Act.

B) that there is no priority of claims under Chapter CCCA.

C) that liquidation occurs in Bankruptcy and Insolvency Act but reorganization is the objective under CCCA.

D) that no lawyers fees are necessary under Bankruptcy and Insolvency Act.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

15

A corporation is adjudged bankrupt. When do the shareholders receive any payment?

A) After the trustee liquidates the assets and pays the administrative expenses, the shareholders are paid before the creditors.

B) After the trustee liquidates the assets, the administrative expenses and secured creditors are paid, then the unsecured creditors, and, then the shareholders divide any remainder.

C) After the trustee liquidates the assets, the shareholders are paid, next the administrative expenses, the secured creditors, and then the unsecured creditors divide any remainder.

D) After the trustee liquidates the assets, the shareholders are paid first because they are the owners of the firm and have the principal stake.

A) After the trustee liquidates the assets and pays the administrative expenses, the shareholders are paid before the creditors.

B) After the trustee liquidates the assets, the administrative expenses and secured creditors are paid, then the unsecured creditors, and, then the shareholders divide any remainder.

C) After the trustee liquidates the assets, the shareholders are paid, next the administrative expenses, the secured creditors, and then the unsecured creditors divide any remainder.

D) After the trustee liquidates the assets, the shareholders are paid first because they are the owners of the firm and have the principal stake.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

16

A firm that has a series of negative earnings, sales declines and workforce reductions is likely to head:

A) a change in management.

B) a merger.

C) a financial distress.

D) a new financing.

A) a change in management.

B) a merger.

C) a financial distress.

D) a new financing.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements about private workouts of financial distress is NOT true?

A) Senior debt is replaced with junior debt.

B) Debt may be replaced by equity.

C) Private workouts account for about three quarters of all reorganizations.

D) Top management is dismissed or take pay reduction many times.

A) Senior debt is replaced with junior debt.

B) Debt may be replaced by equity.

C) Private workouts account for about three quarters of all reorganizations.

D) Top management is dismissed or take pay reduction many times.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

18

Stock-based insolvency is a(an):

A) income statement measurement.

B) balance sheet measurement.

C) book value measurement.

D) income statement and balance sheet measurement.

A) income statement measurement.

B) balance sheet measurement.

C) book value measurement.

D) income statement and balance sheet measurement.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

19

The management of Schroeder Books has proposed to reorganize the company. The proposal is based on a going-concern value of $2.3 million. The proposed financial structure is $500,000 in new mortgage debt, $300,000 in subordinated debt and $1,500,000 in new equity. All creditors, both secured and unsecured, are owed $3 million dollars. Secured creditors have a mortgage lien for $2,000,000 on the book bindery. The corporate tax rate is 34%. What will the equity holders receive if they had 5 million shares with a par value of $0.50 each?

A) $0

B) $35,714

C) $583,333

D) $1,000,000

A) $0

B) $35,714

C) $583,333

D) $1,000,000

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

20

Magic Mobile Homes is to be liquidated. All creditors, both secured and unsecured, are owed $2.0 million dollars. Administrative costs of liquidation and wages payments are expected to be $500,000. A sale of assets is expected to bring $1.8 million after all costs and taxes. Secured creditors have a mortgage lien for $1,200,000 on the factory which will be liquidated for $900,000 out of the sale proceeds. The corporate tax rate is 34%. How much and what percentage of their claim will the secured creditors receive, in total?

A) $1,200,000; 100.00%

B) $1,009,091; 84.10%

C) $900,000.00; 75.00%

D) $981,818; 81.82%

A) $1,200,000; 100.00%

B) $1,009,091; 84.10%

C) $900,000.00; 75.00%

D) $981,818; 81.82%

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

21

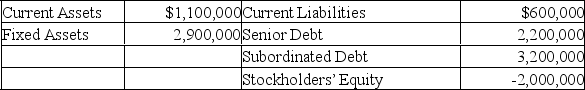

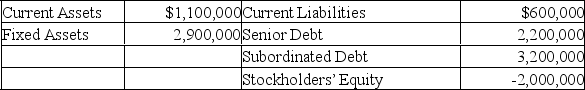

The Steel Pony Company a maker of all-terrain recreational vehicles is having financial difficulties due to high interest payments. The estimated "going concern" value if Steel Pony is $4.0 million. The statement of financial position of the firm is as shown:

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

22

There are a number of ways firms can deal with financial distress. Identify at least 5 of these.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck