Deck 27: Short-Term Finance and Planning

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/51

Play

Full screen (f)

Deck 27: Short-Term Finance and Planning

1

A fraction of the available credit on a loan agreement deposited by the borrower with the bank in a low or non-interest-bearing account is called a:

A) compensating balance.

B) cleanup loan.

C) letter of credit.

D) line of credit.

A) compensating balance.

B) cleanup loan.

C) letter of credit.

D) line of credit.

compensating balance.

2

Cash flow from operations equals:

A) net income minus change in net working capital.

B) net income minus depreciation.

C) net income minus taxes.

D) net income plus change in net working capital.

E) net income plus depreciation.

A) net income minus change in net working capital.

B) net income minus depreciation.

C) net income minus taxes.

D) net income plus change in net working capital.

E) net income plus depreciation.

net income plus depreciation.

3

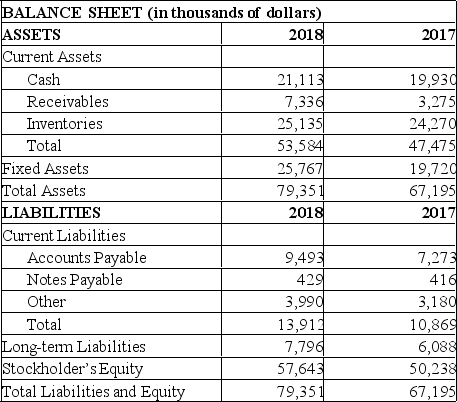

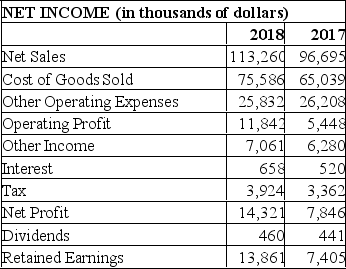

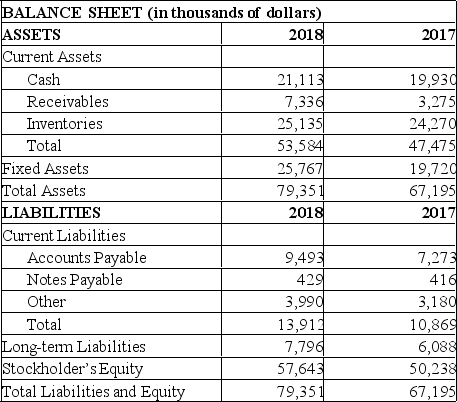

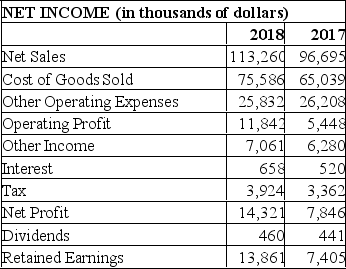

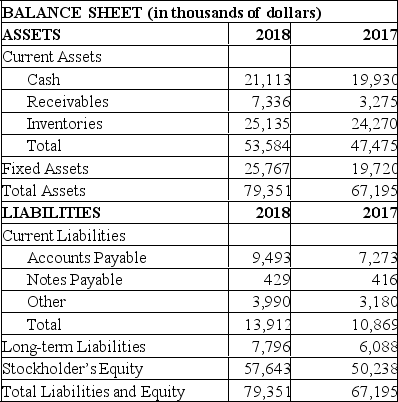

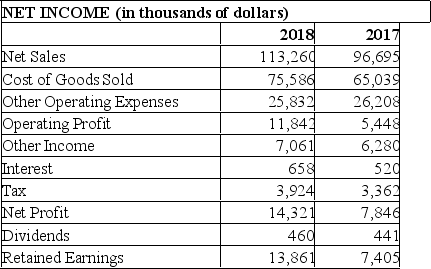

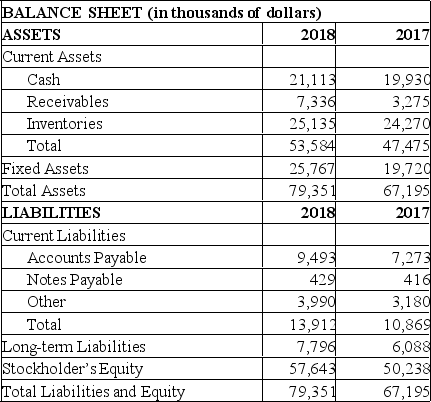

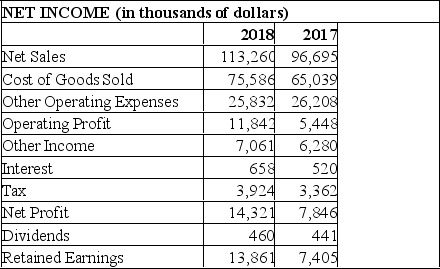

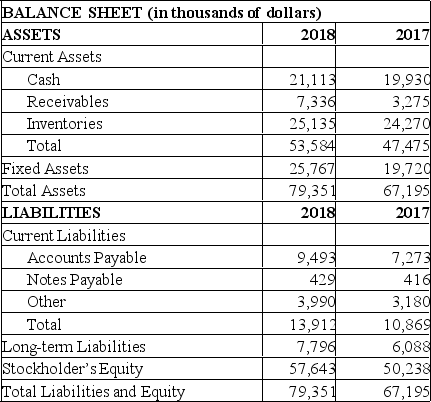

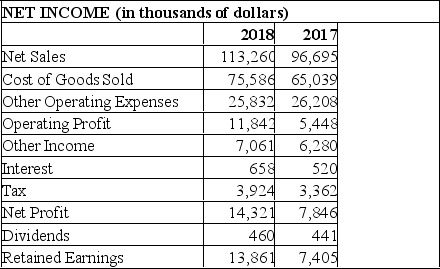

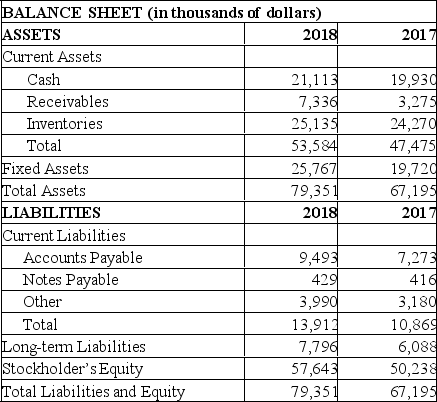

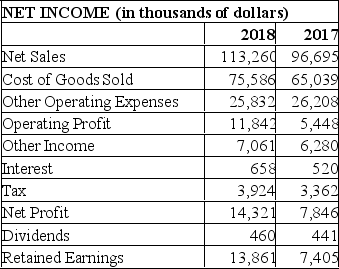

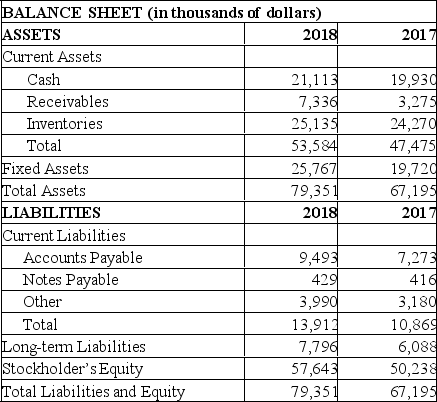

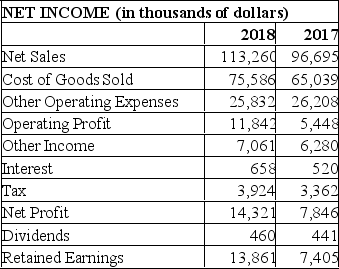

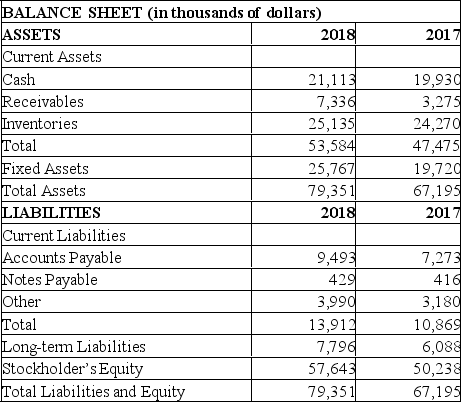

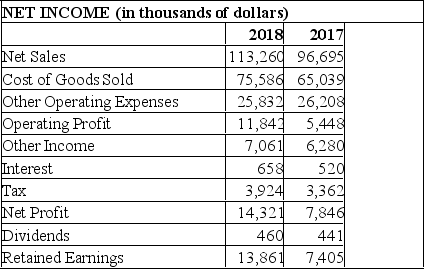

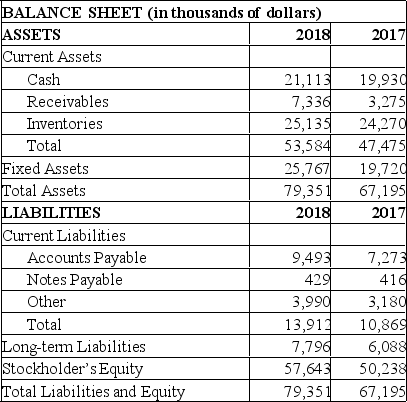

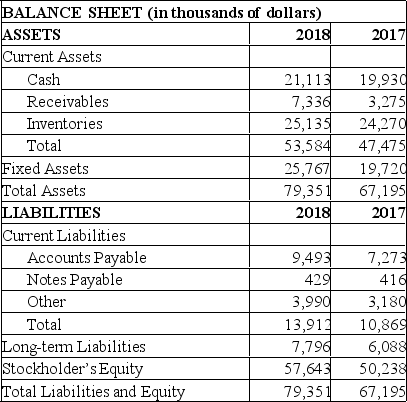

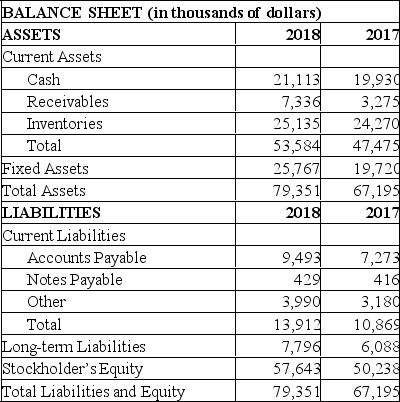

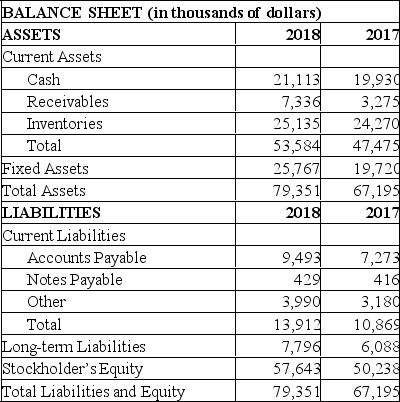

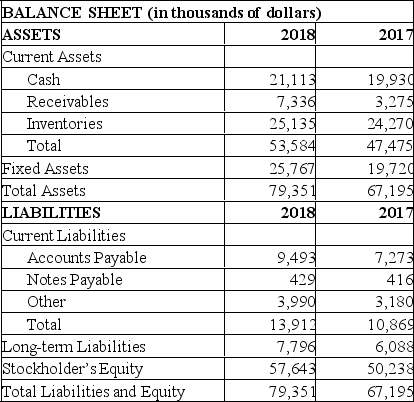

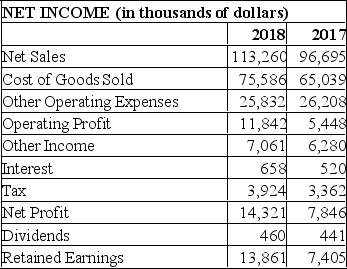

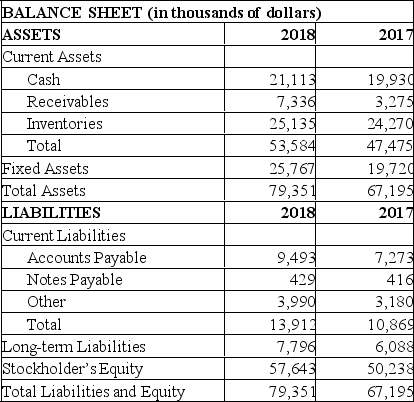

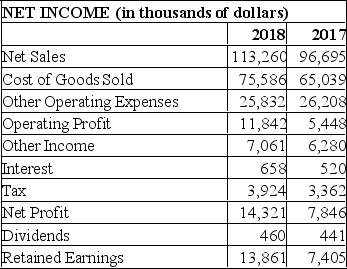

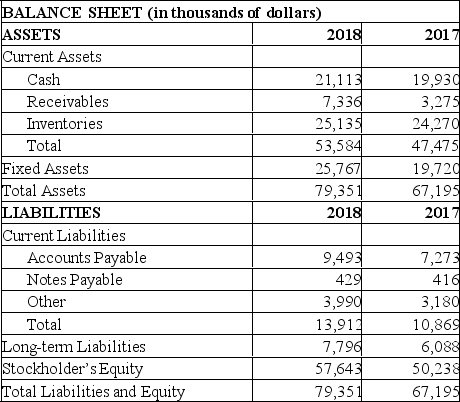

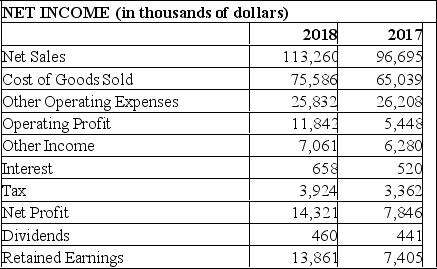

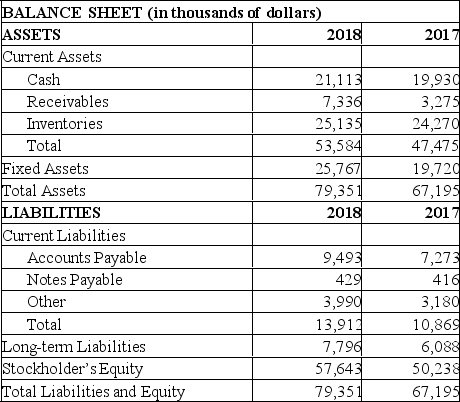

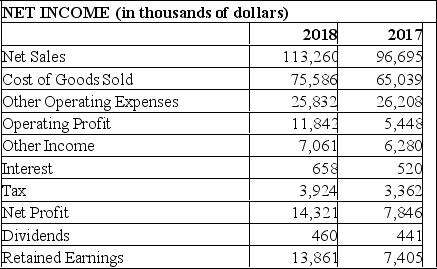

StarrKnight Corporation's statement of financial position and Income Statement as shown below:

(all sales and purchases are credit)

(all sales and purchases are credit)

The inventory turnover ratio for 2018 is (use average inventory):

A) 2.96.

B) 3.06.

C) 3.17.

D) 5.87.

E) 6.01.

(all sales and purchases are credit)

(all sales and purchases are credit)The inventory turnover ratio for 2018 is (use average inventory):

A) 2.96.

B) 3.06.

C) 3.17.

D) 5.87.

E) 6.01.

3.06.

4

StarrKnight Corporation's statement of financial position and Income Statement as shown below:

(all sales and purchases are credit)

(all sales and purchases are credit)

The average inventory in 2018 is (in thousands of dollar):

A) $12,567.50.

B) $12,883.50.

C) $23,837.50.

D) $24,702.50.

E) $25,567.50.

(all sales and purchases are credit)

(all sales and purchases are credit)The average inventory in 2018 is (in thousands of dollar):

A) $12,567.50.

B) $12,883.50.

C) $23,837.50.

D) $24,702.50.

E) $25,567.50.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is not included in current assets?

A) Accounts receivable.

B) Accrued wages.

C) Cash.

D) Inventories.

A) Accounts receivable.

B) Accrued wages.

C) Cash.

D) Inventories.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

6

The inventory turnover for the Sneeky Company is 8 times and its day's sales outstanding is 55. The average payables deferral period (or turnover) is 7.5. What is the cash cycle for Sneeky given a 365-day year.

A) 149.29 days.

B) 51.96 days.

C) 58.04 days.

D) 115.00 days.

A) 149.29 days.

B) 51.96 days.

C) 58.04 days.

D) 115.00 days.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

7

If the average accounts receivable that a firm holds decreases without any decrease in credit sales, the operating cycle will:

A) stay the same because of no sales change.

B) stay the same because cash collections are sooner and it will affect the cash cycle only.

C) decreases because days sales outstanding decreases.

D) stay the same because accounts receivable are not in the operating cycle.

A) stay the same because of no sales change.

B) stay the same because cash collections are sooner and it will affect the cash cycle only.

C) decreases because days sales outstanding decreases.

D) stay the same because accounts receivable are not in the operating cycle.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following would not be a short-run operating activity or decision?

A) Buying raw materials with cash or bank loan.

B) Selling product on credit.

C) Increasing inventory safety stock.

D) Investing a new process machine.

A) Buying raw materials with cash or bank loan.

B) Selling product on credit.

C) Increasing inventory safety stock.

D) Investing a new process machine.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

9

The definition of cash in terms of other statement of financial position items is:

A) long term debt minus equity minus net working capital (excluding cash) minus fixed assets.

B) long term debt minus equity plus net working capital (excluding cash) minus fixed assets.

C) long term debt minus equity plus net working capital(excluding cash) plus fixed assets.

D) long term debt plus equity minus net working capital(excluding cash) minus fixed assets.

E) long term debt plus equity minus net working capital(excluding cash) plus.

A) long term debt minus equity minus net working capital (excluding cash) minus fixed assets.

B) long term debt minus equity plus net working capital (excluding cash) minus fixed assets.

C) long term debt minus equity plus net working capital(excluding cash) plus fixed assets.

D) long term debt plus equity minus net working capital(excluding cash) minus fixed assets.

E) long term debt plus equity minus net working capital(excluding cash) plus.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

10

Net working capital is defined as:

A) the current assets in a business.

B) the difference between current assets and current liabilities.

C) the present value of short-term cash flows.

D) the difference between all assets and liabilities.

A) the current assets in a business.

B) the difference between current assets and current liabilities.

C) the present value of short-term cash flows.

D) the difference between all assets and liabilities.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements is not true?

A) Net working capital is the difference between short-term assets and short term liabilities.

B) Short-term financing deals with the management of short-term liabilities and short-term assets.

C) Short-term financing is concerned with determining reasonable amounts of cash to hold, which customers should get credit and others related issues.

D) Net working capital does not utilize the concept of present value since all flows are short-term.

A) Net working capital is the difference between short-term assets and short term liabilities.

B) Short-term financing deals with the management of short-term liabilities and short-term assets.

C) Short-term financing is concerned with determining reasonable amounts of cash to hold, which customers should get credit and others related issues.

D) Net working capital does not utilize the concept of present value since all flows are short-term.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

12

The cash cycle is defined as the time between:

A) the arrival of inventory in stock and when the cash is collected from receivables.

B) selling the product and posting the accounts receivable.

C) selling the product and collecting the accounts receivable.

D) cash disbursements and cash collection.

E) the arrival of inventory and cash collection.

A) the arrival of inventory in stock and when the cash is collected from receivables.

B) selling the product and posting the accounts receivable.

C) selling the product and collecting the accounts receivable.

D) cash disbursements and cash collection.

E) the arrival of inventory and cash collection.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is not included in current liabilities?

A) Accounts payable

B) Prepaid insurance

C) Accrued wages

D) Taxes

E) Notes payable

A) Accounts payable

B) Prepaid insurance

C) Accrued wages

D) Taxes

E) Notes payable

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

14

Sources of cash do not include:

A) increases in net income.

B) increases in depreciation.

C) decreases in accounts payable.

D) increases in notes payable.

E) increases in taxes payable.

A) increases in net income.

B) increases in depreciation.

C) decreases in accounts payable.

D) increases in notes payable.

E) increases in taxes payable.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

15

Flexible short term financial policies are not characterized by:

A) liberal credit policies.

B) large amounts of inventory held.

C) quick delivery services for customers.

D) high levels of production stoppages.

A) liberal credit policies.

B) large amounts of inventory held.

C) quick delivery services for customers.

D) high levels of production stoppages.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

16

The inventory turnover for the Sneeky Company is 8 times and its day's sales outstanding is 55. What is the operating cycle for Sneeky given a 365-day year.

A) 63.00

B) 6.86

C) 100.63

D) 46.98

A) 63.00

B) 6.86

C) 100.63

D) 46.98

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

17

Which one of the following will decrease the net working capital of a firm? Assume that the current ratio is greater than 1.0.

A) Selling inventory at a profit.

B) Collecting an accounts receivable.

C) Paying a payment on a long-term debt.

D) Selling a fixed asset for book value.

A) Selling inventory at a profit.

B) Collecting an accounts receivable.

C) Paying a payment on a long-term debt.

D) Selling a fixed asset for book value.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

18

A firm currently has a 36 day cash cycle. Assume that the firm changes its operations such that it decreases its receivables period by 4 days, increases its inventory period by 1 day and decreases its payables period by 2 days. What will the length of the cash cycle be after these changes?

A) 31 days

B) 33 days

C) 35 days

D) 37 days

E) 38 days

A) 31 days

B) 33 days

C) 35 days

D) 37 days

E) 38 days

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

19

Assets are classified as current or long term based on:

A) age of the asset.

B) whether the asset is a physical good or not.

C) the liquidity of the asset.

D) whether the asset is based on fair market value or not.

A) age of the asset.

B) whether the asset is a physical good or not.

C) the liquidity of the asset.

D) whether the asset is based on fair market value or not.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

20

If the use of supplier financing decreases and is replaced by cash financing for the same level of business activity, the cash cycle will:

A) increase because days in payables decrease.

B) stay the same because the change is only on the operating cycle.

C) decrease because days in payables decrease.

D) stay the same because business activity does not change.

E) stay the same because cash is used for payment.

A) increase because days in payables decrease.

B) stay the same because the change is only on the operating cycle.

C) decrease because days in payables decrease.

D) stay the same because business activity does not change.

E) stay the same because cash is used for payment.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

21

The forecast of cash receipts and disbursements for the next planning period is called a:

A) pro forma income statement.

B) statement of cash flows.

C) cash budget.

D) receivables analysis.

E) credit analysis.

A) pro forma income statement.

B) statement of cash flows.

C) cash budget.

D) receivables analysis.

E) credit analysis.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

22

ABC Manufacturing historically produced products that were held in inventory until they could be sold to a customer. The firm is now changing its policy and only producing a product when it receives an actual order from a customer. All else equal, this change will:

A) increase the operating cycle.

B) lengthen the accounts receivable period.

C) shorten the accounts payable period.

D) decrease the cash cycle.

E) decrease the inventory turnover rate.

A) increase the operating cycle.

B) lengthen the accounts receivable period.

C) shorten the accounts payable period.

D) decrease the cash cycle.

E) decrease the inventory turnover rate.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

23

Managing current assets involves a trade-off between two types of costs. These costs are:

A) carrying costs and opportunity costs.

B) shortage costs and cash-out costs.

C) cash-out costs and stock-out costs.

D) carrying costs and shortage costs.

A) carrying costs and opportunity costs.

B) shortage costs and cash-out costs.

C) cash-out costs and stock-out costs.

D) carrying costs and shortage costs.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

24

The Impromptu Party Company has estimated all their cash inflows and outflows for the coming quarter. The quarterly income statement indicates a strong profit but the cash budget indicates a problem with operations giving a shortfall in the cash balance. Why might there be a problem and how might it be solved?

A) cash inflows are too large and they will need to invest in marketable securities.

B) cash inflows and outflows are not synchronized with outflows occurring before the inflows. They should arrange a line of credit with the bank.

C) quarterly taxes are making the company unprofitable and siphoning of all the cash. They need to charge more expenses to reduce taxes.

D) the company has too many loans outstanding requiring several different payments. They should a new long-term loan and consolidate all the others.

A) cash inflows are too large and they will need to invest in marketable securities.

B) cash inflows and outflows are not synchronized with outflows occurring before the inflows. They should arrange a line of credit with the bank.

C) quarterly taxes are making the company unprofitable and siphoning of all the cash. They need to charge more expenses to reduce taxes.

D) the company has too many loans outstanding requiring several different payments. They should a new long-term loan and consolidate all the others.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

25

Firms that use maturity hedging as a guide to financing policy:

A) try to hedge with futures contracts.

B) hold excess cash balances to reduce risk.

C) will finance long term assets with long term financing.

D) rely on government policy to keep interest rates low.

A) try to hedge with futures contracts.

B) hold excess cash balances to reduce risk.

C) will finance long term assets with long term financing.

D) rely on government policy to keep interest rates low.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

26

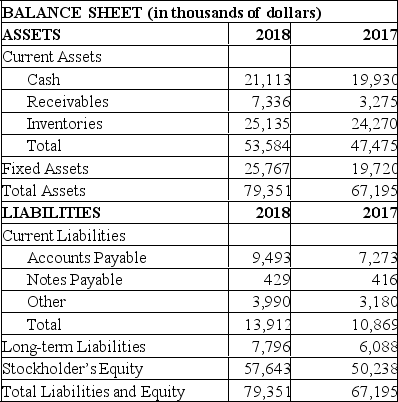

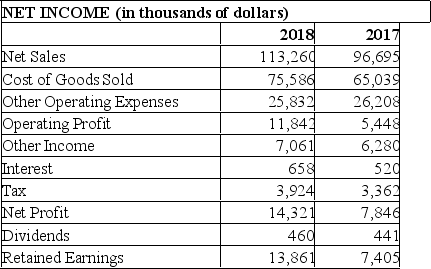

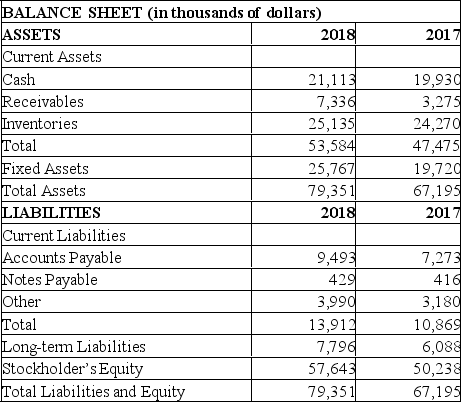

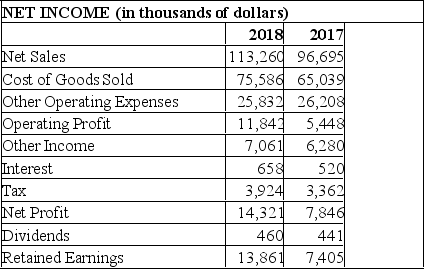

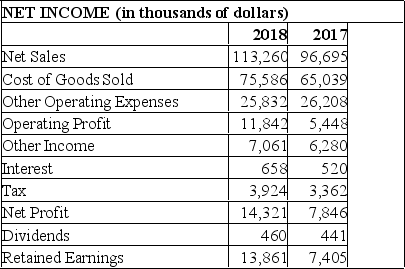

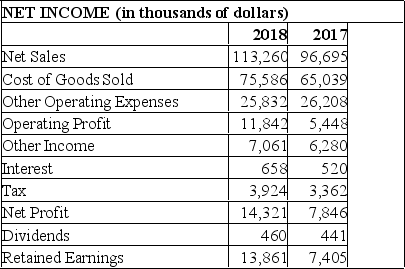

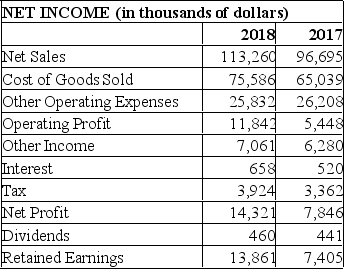

StarrKnight Corporation's statement of financial position and Income Statement as shown below:

(all sales and purchases are credit)

(all sales and purchases are credit)

The cash cycle for 2018 is:

A) 140.27 days.

B) 50.71 days.

C) 94.55 days.

D) 81.65 days.

E) 98.74 days.

(all sales and purchases are credit)

(all sales and purchases are credit)The cash cycle for 2018 is:

A) 140.27 days.

B) 50.71 days.

C) 94.55 days.

D) 81.65 days.

E) 98.74 days.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

27

StarrKnight Corporation's statement of financial position and Income Statement as shown below:

(all sales and purchases are credit)

(all sales and purchases are credit)

The average collection period for 2018 is (use average accounts receivable):

A) 10.56 days.

B) 12.36 days.

C) 23.66 days.

D) 17.10 days.

E) 126.74 days.

(all sales and purchases are credit)

(all sales and purchases are credit)The average collection period for 2018 is (use average accounts receivable):

A) 10.56 days.

B) 12.36 days.

C) 23.66 days.

D) 17.10 days.

E) 126.74 days.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

28

StarrKnight Corporation's statement of financial position and Income Statement as shown below:

(all sales and purchases are credit)

(all sales and purchases are credit)

The operating cycle for 2018 is:

A) 187.37 days.

B) 85.84 days.

C) 127.50 days.

D) 135.04 days.

E) 133.87 days.

(all sales and purchases are credit)

(all sales and purchases are credit)The operating cycle for 2018 is:

A) 187.37 days.

B) 85.84 days.

C) 127.50 days.

D) 135.04 days.

E) 133.87 days.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

29

StarrKnight Corporation's statement of financial position and Income Statement as shown below:

(all sales and purchases are credit)

(all sales and purchases are credit)

The accounts payable deferred period for 2018 is (use average payables):

A) 10.39.

B) 9.02.

C) 8.94.

D) 7.96.

E) 7.75.

(all sales and purchases are credit)

(all sales and purchases are credit)The accounts payable deferred period for 2018 is (use average payables):

A) 10.39.

B) 9.02.

C) 8.94.

D) 7.96.

E) 7.75.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

30

StarrKnight Corporation's statement of financial position and Income Statement as shown below:

(all sales and purchases are credit)

(all sales and purchases are credit)

The accounts receivable turnover ratio for 2018 is (use average accounts receivable):

A) 2.88.

B) 21.35.

C) 15.43.

D) 29.53.

E) 34.58.

(all sales and purchases are credit)

(all sales and purchases are credit)The accounts receivable turnover ratio for 2018 is (use average accounts receivable):

A) 2.88.

B) 21.35.

C) 15.43.

D) 29.53.

E) 34.58.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements is not true?

A) A flexible policy toward total asset requirement involves cash surplus.

B) A flexible policy toward total asset requirement involves a permanent need for short-term borrowing.

C) A restrictive policy toward total asset requirement involves a large investment in net working capital.

D) Maturity hedging seeks to avoid financing long-term assets with short-term borrowing.

E) Usually, long-term borrowing costs are lower than short-term borrowing costs.

A) A flexible policy toward total asset requirement involves cash surplus.

B) A flexible policy toward total asset requirement involves a permanent need for short-term borrowing.

C) A restrictive policy toward total asset requirement involves a large investment in net working capital.

D) Maturity hedging seeks to avoid financing long-term assets with short-term borrowing.

E) Usually, long-term borrowing costs are lower than short-term borrowing costs.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

32

StarrKnight Corporation's statement of financial position and Income Statement as shown below:

(all sales and purchases are credit)

(all sales and purchases are credit)

The inventory period for 2018 is (use average inventory):

A) 60.73 days.

B) 62.18 days.

C) 115.14 days.

D) 123.31 days.

E) 119.3 days.

(all sales and purchases are credit)

(all sales and purchases are credit)The inventory period for 2018 is (use average inventory):

A) 60.73 days.

B) 62.18 days.

C) 115.14 days.

D) 123.31 days.

E) 119.3 days.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

33

StarrKnight Corporation's statement of financial position and Income Statement as shown below:

(all sales and purchases are credit)

(all sales and purchases are credit)

The days in payable for 2018 is (use average payables):

A) 47.10 days.

B) 40.48 days.

C) 45.85 days.

D) 40.82 days.

E) 35.13 days.

(all sales and purchases are credit)

(all sales and purchases are credit)The days in payable for 2018 is (use average payables):

A) 47.10 days.

B) 40.48 days.

C) 45.85 days.

D) 40.82 days.

E) 35.13 days.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

34

The minimum total cost of holding current assets occurs at the:

A) intersection of the carrying costs and shortage costs curves.

B) intersection of the marginal cost and average variable costs curves.

C) minimum for both the carrying costs and shortage costs curve.

D) minimum of the average variable cost curve.

A) intersection of the carrying costs and shortage costs curves.

B) intersection of the marginal cost and average variable costs curves.

C) minimum for both the carrying costs and shortage costs curve.

D) minimum of the average variable cost curve.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

35

A flexible short-term financial policy:

A) increases the likelihood that a firm will face financial distress.

B) incurs an opportunity cost due to the rate of return that applies to short-term assets.

C) advocates a smaller investment in net working capital than a restrictive policy does.

D) increases the probability that a firm will earn high returns on all of its assets.

E) utilizes short-term financing to fund all of the firm's assets.

A) increases the likelihood that a firm will face financial distress.

B) incurs an opportunity cost due to the rate of return that applies to short-term assets.

C) advocates a smaller investment in net working capital than a restrictive policy does.

D) increases the probability that a firm will earn high returns on all of its assets.

E) utilizes short-term financing to fund all of the firm's assets.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

36

Which one of the following will decrease the operating cycle?

A) Paying accounts payable faster.

B) Discontinuing the discount given for early payment of an accounts receivable.

C) Decreasing the inventory turnover rate.

D) Collecting accounts receivable faster.

E) Increasing the accounts payable turnover rate.

A) Paying accounts payable faster.

B) Discontinuing the discount given for early payment of an accounts receivable.

C) Decreasing the inventory turnover rate.

D) Collecting accounts receivable faster.

E) Increasing the accounts payable turnover rate.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

37

Costs that fall with increases in the level of investment in current assets are called:

A) current asset costs.

B) fixed costs.

C) flexible costs.

D) liquid capital costs.

E) shortage costs.

A) current asset costs.

B) fixed costs.

C) flexible costs.

D) liquid capital costs.

E) shortage costs.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

38

Costs that rise with increases in the level of investment in current assets are called:

A) capital costs.

B) carrying costs.

C) commitment costs.

D) liquid capital costs.

E) short-term capital costs.

A) capital costs.

B) carrying costs.

C) commitment costs.

D) liquid capital costs.

E) short-term capital costs.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

39

In an "ideal" economy:

A) cash is zero.

B) long-term debt is zero.

C) net working capital could be zero.

D) short-term debt is zero.

A) cash is zero.

B) long-term debt is zero.

C) net working capital could be zero.

D) short-term debt is zero.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

40

The two kinds of shortage costs are:

A) commitment costs and costs related to safety reserves.

B) commitment costs and costs related to supply factors.

C) commitment costs and order costs.

D) order costs and costs related to safety reserves.

E) order costs and costs related to supply factors.

A) commitment costs and costs related to safety reserves.

B) commitment costs and costs related to supply factors.

C) commitment costs and order costs.

D) order costs and costs related to safety reserves.

E) order costs and costs related to supply factors.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

41

A. What is the cash cycle for White Bluffs, Inc. if all sales are credit sales.

B. If you knew that Accounts Payables were $4884 last year, what effect would this have on your estimate of the cash cycle. Show and explain why.

A. See answer for question 52 for Days in Inventory and Receivables.

Accounts Payables Turnover = CGS/Accounts Payables = 28461/2754 = 10.334.

Days in Payables = 365/10.334 = 35.32.

Cash Cycle = 124.39 - 35.32 = 89.07.

B. Average Accounts Payable = (4884 + 2754)/2 = 3819.

Accounts Payable Turnover = 28461/3819 = 7.452

Days in Accounts Payable = 365/7452 = 48.98.

Cash Cycle = 124.39 - 48.98 = 75.41.

- Cash Cycle would be lower, which is better because White Bluffs has greater use of trade financing.

B. If you knew that Accounts Payables were $4884 last year, what effect would this have on your estimate of the cash cycle. Show and explain why.

A. See answer for question 52 for Days in Inventory and Receivables.

Accounts Payables Turnover = CGS/Accounts Payables = 28461/2754 = 10.334.

Days in Payables = 365/10.334 = 35.32.

Cash Cycle = 124.39 - 35.32 = 89.07.

B. Average Accounts Payable = (4884 + 2754)/2 = 3819.

Accounts Payable Turnover = 28461/3819 = 7.452

Days in Accounts Payable = 365/7452 = 48.98.

Cash Cycle = 124.39 - 48.98 = 75.41.

- Cash Cycle would be lower, which is better because White Bluffs has greater use of trade financing.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

42

Compensating balances:

A) are used to finance inventories.

B) earn high rates of interest for the firm.

C) are ordered monthly (or quarterly) following forecasts based on cash budget analysis to compensate for shortfalls.

D) increase the effective interest earned by banks on credit lines.

E) require a commitment fee.

A) are used to finance inventories.

B) earn high rates of interest for the firm.

C) are ordered monthly (or quarterly) following forecasts based on cash budget analysis to compensate for shortfalls.

D) increase the effective interest earned by banks on credit lines.

E) require a commitment fee.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

43

A. What is the operating cycle for White Bluffs, Inc. if all sales are on credit?

B. If you knew that Accounts Receivables were $3,250 the prior year, what effect would this have on your estimate of the operating cycle. Show and explain why.

A. Inventory Turnover = CGS/Inventory = 28461/7280 = 3.909.

Days in Inventory = 365/3.909 = 93.37 days.

Accounts Receivable Turnover = Sales/A/R = 44,466/3779 = 11.767.

Days in Receivables = 365/11.767 = 31.02.

Operating Cycle = Days in Inventory + Days in Receivable = 93.37 + 31.02 = 124.39.

B. Average Accounts Receivable = 3779 + 3250/2 = 3514.50

A/R Turnover = 44,466/3514.50 = 12.652.

Days in Receivables = 365/12.652 = 28.85.

Operating Cycle = 93.37 + 28.85 = 122.22.

- Operating Cycle falls because of a smaller average tied up in receivables to generate sales.

B. If you knew that Accounts Receivables were $3,250 the prior year, what effect would this have on your estimate of the operating cycle. Show and explain why.

A. Inventory Turnover = CGS/Inventory = 28461/7280 = 3.909.

Days in Inventory = 365/3.909 = 93.37 days.

Accounts Receivable Turnover = Sales/A/R = 44,466/3779 = 11.767.

Days in Receivables = 365/11.767 = 31.02.

Operating Cycle = Days in Inventory + Days in Receivable = 93.37 + 31.02 = 124.39.

B. Average Accounts Receivable = 3779 + 3250/2 = 3514.50

A/R Turnover = 44,466/3514.50 = 12.652.

Days in Receivables = 365/12.652 = 28.85.

Operating Cycle = 93.37 + 28.85 = 122.22.

- Operating Cycle falls because of a smaller average tied up in receivables to generate sales.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

44

In a loan arranged through the assignment of accounts receivable the lender:

A) accepts the actual receivable to be collected.

B) has a lien on the receivables and recourse to the borrower.

C) assumes full risk of default.

D) All of these are correct.

A) accepts the actual receivable to be collected.

B) has a lien on the receivables and recourse to the borrower.

C) assumes full risk of default.

D) All of these are correct.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

45

A firm borrows $7 million through a credit line and is required to keep $350,000 as a compensating balance. The credit line carries a 11% interest rate. Calculate the effective interest rate on the loan if it is repaid after 1 year.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

46

The three basic forms of inventory loans include:

A) blanket inventory lien, field warehouse financing, and line of credit.

B) blanket inventory lien, line of credit, and trust receipt.

C) blanket inventory lien, field warehouse financing, and trust receipt.

D) field warehouse financing, line of credit, and trust receipt.

A) blanket inventory lien, field warehouse financing, and line of credit.

B) blanket inventory lien, line of credit, and trust receipt.

C) blanket inventory lien, field warehouse financing, and trust receipt.

D) field warehouse financing, line of credit, and trust receipt.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

47

Firms hold cash, in part, to satisfy compensating balances. Compensating balances are:

A) cash balances held at the firm in excess of its transactions needs.

B) cash balances held at the firm that are below that of its transactions needs.

C) cash balances held at the firm in excess of its cash inflows.

D) cash balances held at commercial banks to pay implicitly for bank services.

A) cash balances held at the firm in excess of its transactions needs.

B) cash balances held at the firm that are below that of its transactions needs.

C) cash balances held at the firm in excess of its cash inflows.

D) cash balances held at commercial banks to pay implicitly for bank services.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

48

It has been argued that if one could perfectly synchronize a firm's cash inflows and outflows, short-term financial planning would be unnecessary. Do you agree? What actions can the firm's financial decision-makers take to reduce the degree of asynchronization? Why should this be a concern?

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

49

A firm that is buying something from a supplier may effectively arrange for the bank to pay the outstanding bill using a:

A) banker's acceptance.

B) certificate of deposit.

C) letter of payment.

D) forward option.

A) banker's acceptance.

B) certificate of deposit.

C) letter of payment.

D) forward option.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

50

The most common way to finance a temporary cash deficit is the use of:

A) banker's acceptances.

B) call options.

C) commercial paper.

D) unsecured bank loans.

A) banker's acceptances.

B) call options.

C) commercial paper.

D) unsecured bank loans.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

51

Restrictive short-term financial policies regarding current asset management include three basic actions. List and briefly describe each action.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck