Deck 26: Derivatives and Hedging Risk

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/50

Play

Full screen (f)

Deck 26: Derivatives and Hedging Risk

1

Derivatives can be used to either hedge or speculate. These actions:

A) increase risk in both cases.

B) decrease risk in both cases.

C) spread or minimize risk in both cases.

D) offsets risk by hedging and increase risk by speculating.

E) offset risks by speculating and increase risk by hedging.

A) increase risk in both cases.

B) decrease risk in both cases.

C) spread or minimize risk in both cases.

D) offsets risk by hedging and increase risk by speculating.

E) offset risks by speculating and increase risk by hedging.

offsets risk by hedging and increase risk by speculating.

2

A futures contract on gold states that buyers and sellers agree to make or take delivery of an ounce of gold for $400 per ounce. The contract expires in 3 months. The current price of gold is $350 per ounce. If the price of gold rises and continues to rise by $1 every day over the 3 month period, then when the contract is settled, the buyer will _____ and the seller will ____.

A) lose; gain

B) gain; lose

C) gain; break even

D) gain; gain

E) lose; lose

A) lose; gain

B) gain; lose

C) gain; break even

D) gain; gain

E) lose; lose

gain; lose

3

The main difference between a forward contract and a cash transaction is:

A) only the cash transaction creates an obligation to perform.

B) a forward is performed at a later date while the cash transaction is performed immediately.

C) only one involves a deliverable instrument.

D) neither allows for hedging.

A) only the cash transaction creates an obligation to perform.

B) a forward is performed at a later date while the cash transaction is performed immediately.

C) only one involves a deliverable instrument.

D) neither allows for hedging.

a forward is performed at a later date while the cash transaction is performed immediately.

4

Suppose you agree to purchase one ounce of gold for $984 any time over the next month. The current price of gold is $970. The spot price of gold then falls to $960 the next day. If the agreement is represented by a futures contract marking to market on a daily basis as the price changes, what is your cash flow at the end of the next business day?

A) $10

B) $5

C) $0

D) -$5

E) -$10

A) $10

B) $5

C) $0

D) -$5

E) -$10

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

5

The buyer of a forward contract:

A) will be taking delivery of the good(s) today at today's price.

B) will be making delivery of the good(s) at a later date at that date's price.

C) will be making delivery of the good(s) today at today's price.

D) will be taking delivery of the good(s) at a later date at pre-specified price.

A) will be taking delivery of the good(s) today at today's price.

B) will be making delivery of the good(s) at a later date at that date's price.

C) will be making delivery of the good(s) today at today's price.

D) will be taking delivery of the good(s) at a later date at pre-specified price.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

6

Two key features of futures contracts that make them more in demand than forward contracts are:

A) futures are traded on exchanges and must be marked to the market.

B) futures contracts allow flexibility in delivery dates and provide a liquid market for netting positions.

C) futures are marked to the market and allow delivery flexibility.

D) futures are traded in liquid markets and are marked to the market.

A) futures are traded on exchanges and must be marked to the market.

B) futures contracts allow flexibility in delivery dates and provide a liquid market for netting positions.

C) futures are marked to the market and allow delivery flexibility.

D) futures are traded in liquid markets and are marked to the market.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

7

If rates in the market fall between now and one month from now, the mortgage banker:

A) loses as the mortgages are sold at a discount.

B) gains as the mortgages are sold at a discount.

C) loses as the mortgages are sold at a premium.

D) gains as the mortgages are sold at a premium.

A) loses as the mortgages are sold at a discount.

B) gains as the mortgages are sold at a discount.

C) loses as the mortgages are sold at a premium.

D) gains as the mortgages are sold at a premium.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

8

You have taken a short position in a futures contract on corn at $2.60 per bushel. Over the next 5 days the contract settled at 2.52, 2.57, 2.62, 2.68, 2.70. Before you can reverse your position in the futures market on the fifth day you are notified to accept delivery. What will you receive on delivery and what is the net amount you receive in total?

A) $2.60; $2.70

B) $2.70; -$0.10

C) $2.70; $2.60

D) $2.60; $0.10

E) $2.60; -$0.10

A) $2.60; $2.70

B) $2.70; -$0.10

C) $2.70; $2.60

D) $2.60; $0.10

E) $2.60; -$0.10

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

9

Suppose you agree to purchase one-ounce of gold for $382 any time over the next month. The current price of gold is $380. The spot price of gold then falls to $377 the next day. If the agreement is represented by a futures contract marking to market on a daily basis as the price changes, what is your cash flow at the end of the business on the next day?

A) $0.00.

B) $3.00.

C) $5.00.

D) -$3.00.

E) -$5.00.

A) $0.00.

B) $3.00.

C) $5.00.

D) -$3.00.

E) -$5.00.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

10

You have taken a short position in a futures contract on corn at $2.60 per bushel. Over the next 5 days the contract settled at 2.52, 2.57, 2.62, 2.68, 2.70. You then decide to reverse your position in the futures market on the fifth day at close. What is the net amount you receive at the end of 5 days?

A) $2.70

B) $2.60

C) $2.80

D) $0.00

A) $2.70

B) $2.60

C) $2.80

D) $0.00

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

11

In the practical use of credit default swaps, there:

A) is no organized exchange or template for the agreement.

B) is an organized exchange or template for the agreement.

C) are laws making them illegal in Canada.

D) are limits to the amount of borrowing of both parties.

A) is no organized exchange or template for the agreement.

B) is an organized exchange or template for the agreement.

C) are laws making them illegal in Canada.

D) are limits to the amount of borrowing of both parties.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

12

On March 1, you contract to take delivery of 1 ounce of gold for $495. The agreement is good for any day up to April 1. Throughout March, the price of gold hit a low of $425 and hit a high of $535. The price settled on March 31 at $505, and on April 1st you settle your futures agreement at that price. Your net cash flow is:

A) -$30.

B) -$20.

C) -$15.

D) $10.

E) $20.

A) -$30.

B) -$20.

C) -$15.

D) $10.

E) $20.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

13

A forward contract is described by:

A) agreeing today to buy a product at a later date at a price to be set in the future.

B) agreeing today to buy a product today at its current price.

C) agreeing today to buy a product at a later date at a price set today.

D) agreeing today to buy a product if and only if its price rises above the exercise price today at its current price.

A) agreeing today to buy a product at a later date at a price to be set in the future.

B) agreeing today to buy a product today at its current price.

C) agreeing today to buy a product at a later date at a price set today.

D) agreeing today to buy a product if and only if its price rises above the exercise price today at its current price.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

14

A derivative is a financial instrument whose value is determined by:

A) a regulatory body such as the FTC.

B) a primitive or underlying asset.

C) hedging a risk.

D) hedging a speculation.

A) a regulatory body such as the FTC.

B) a primitive or underlying asset.

C) hedging a risk.

D) hedging a speculation.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

15

If the producer of a product has entered into a fixed price sale agreement for that output, the producer faces:

A) a nice steady profit because the output price is fixed.

B) an uncertain profit if the input prices are volatile. This risk can be reduced by a short hedge.

C) an uncertain profit if the input prices are volatile. This risk can be reduced by a long hedge.

D) a modest profit if the input prices are stable. This risk can be reduced by a long hedge.

E) a modest profit if the input prices are stable. This risk can be reduced by a short hedge.

A) a nice steady profit because the output price is fixed.

B) an uncertain profit if the input prices are volatile. This risk can be reduced by a short hedge.

C) an uncertain profit if the input prices are volatile. This risk can be reduced by a long hedge.

D) a modest profit if the input prices are stable. This risk can be reduced by a long hedge.

E) a modest profit if the input prices are stable. This risk can be reduced by a short hedge.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

16

There are always _________ counterparties in a credit default swap.

A) zero

B) one

C) two

D) three

A) zero

B) one

C) two

D) three

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

17

You hold a forward contract to take delivery of Government of Canada bonds in 9 months. If the entire term structure of interest rates shifts down over the 9-month period, the value of the forward contract will have _____ on the date of delivery.

A) risen

B) fallen

C) not changed

D) either risen or fallen, depending on the maturity of the T-bond

E) collapsed

A) risen

B) fallen

C) not changed

D) either risen or fallen, depending on the maturity of the T-bond

E) collapsed

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

18

If you bought a futures contract for $2.60 per bushel and the contract ended at $2.70 after several days of trading of $2.52, $2.57, $2.62, $2.68, and $2.70. What would the mark to market sequence be?

A) -.08, .05, .05, .06, .02

B) .08, -.05, -.05, -.06, -.02

C) .08, .03, -.02, -.06, -.10

D) -.08, -.03, .02, .06, .10

E) .10

A) -.08, .05, .05, .06, .02

B) .08, -.05, -.05, -.06, -.02

C) .08, .03, -.02, -.06, -.10

D) -.08, -.03, .02, .06, .10

E) .10

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

19

Credit default swaps:

A) will pay the holder the LIBOR interest rate.

B) pay the borrower the LIBOR interest rate.

C) are like insurance against a loss of value if the firm defaults on a bond.

D) limit the amount of borrowing of all parties in the credit default swap.

A) will pay the holder the LIBOR interest rate.

B) pay the borrower the LIBOR interest rate.

C) are like insurance against a loss of value if the firm defaults on a bond.

D) limit the amount of borrowing of all parties in the credit default swap.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

20

On March 1, you contract to take delivery of 1 ounce of gold for $415. The agreement is good for any day up to April 1. Throughout March, the price of gold hit a low of $385 and hit a high of $435. The price settled on March 31 at $420, and on April 1st you settle your futures agreement at that price. Your net cash flow is:

A) -$30.00.

B) $20.00.

C) $5.00.

D) -$15.00.

E) -$20.00.

A) -$30.00.

B) $20.00.

C) $5.00.

D) -$15.00.

E) -$20.00.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

21

Duration of a coupon paying bond with same maturity is:

A) equal to its number of payments.

B) less than a zero coupon bond.

C) equal to the zero coupon bond.

D) equal to its maturity.

A) equal to its number of payments.

B) less than a zero coupon bond.

C) equal to the zero coupon bond.

D) equal to its maturity.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

22

In percentage terms, higher coupon bonds experience a _______ price change compared with lower coupon bonds of the same maturity given a change in yield to maturity.

A) greater

B) smaller

C) similar

D) smaller or greater

A) greater

B) smaller

C) similar

D) smaller or greater

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

23

A set of bonds all have the same maturity. Which one has the least percentage price changes for given shifts in interest rates:

A) zero coupon bonds.

B) high coupon bonds.

C) low coupon bonds.

D) pure discount bonds.

A) zero coupon bonds.

B) high coupon bonds.

C) low coupon bonds.

D) pure discount bonds.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

24

Comparing long-term bonds with short-term bonds, long-term bonds are _____ volatile and therefore experience _____ price change compared with short-term bonds for the same interest rate shift.

A) less; less

B) less; more

C) more; more

D) more; less

E) more; the same

A) less; less

B) less; more

C) more; more

D) more; less

E) more; the same

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

25

The duration of a 2 year annual 10% bond that is selling for par is:

A) 2.00 years

B) 1.00 years

C) 1.91 years

D) 2.09 years

A) 2.00 years

B) 1.00 years

C) 1.91 years

D) 2.09 years

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

26

If a financial institution has equated the dollar effects of interest rate risk on the assets with the dollar effects on the liabilities, it has engaged in:

A) a long hedge.

B) a short hedge.

C) a protected swap.

D) immunizing interest rate risk.

A) a long hedge.

B) a short hedge.

C) a protected swap.

D) immunizing interest rate risk.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

27

LIBOR stands for:

A) Luasanne Interest Basis Offered Rate

B) Libido Over Redline.

C) London Interbank Offered Rate.

D) London Interagency Overt Rate.

A) Luasanne Interest Basis Offered Rate

B) Libido Over Redline.

C) London Interbank Offered Rate.

D) London Interagency Overt Rate.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

28

Duration is a measure of:

A) the yield to maturity of a bond.

B) the coupon yield of a bond.

C) the price of a bond.

D) the effective maturity of a bond.

A) the yield to maturity of a bond.

B) the coupon yield of a bond.

C) the price of a bond.

D) the effective maturity of a bond.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

29

To protect against interest rate risk, the mortgage banker should:

A) buy futures, as this position will hedge loses if rates rise.

B) sell futures, as this position will hedge losses if rates rise.

C) sell futures, as this position will add to his gains if rates rise.

D) buy futures, as this position will add to his gains if rates rise.

A) buy futures, as this position will hedge loses if rates rise.

B) sell futures, as this position will hedge losses if rates rise.

C) sell futures, as this position will add to his gains if rates rise.

D) buy futures, as this position will add to his gains if rates rise.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

30

A bond manager who wishes to hold the bond with the greatest potential volatility would wise to hold:

A) short-term, high-coupon bonds.

B) long-term, low-coupon bonds.

C) long-term, zero-coupon bonds.

D) short-term, zero-coupon bonds.

E) short-term, low-coupon bonds.

A) short-term, high-coupon bonds.

B) long-term, low-coupon bonds.

C) long-term, zero-coupon bonds.

D) short-term, zero-coupon bonds.

E) short-term, low-coupon bonds.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

31

A pure discount bond pays:

A) no coupons, therefore its duration equal to its maturity.

B) discounted coupons, therefore its duration is greater than its maturity.

C) level coupons, therefore its duration is equal to its maturity.

D) declining coupons, therefore its duration is less than its maturity.

A) no coupons, therefore its duration equal to its maturity.

B) discounted coupons, therefore its duration is greater than its maturity.

C) level coupons, therefore its duration is equal to its maturity.

D) declining coupons, therefore its duration is less than its maturity.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

32

Calculate the duration of a 4-year $1,000 face value bond, which pays 8% coupons annually throughout maturity and has a yield to maturity of 9%.

A) 3.29 years

B) 3.58 years

C) 3.69 years

D) 3.89 years

E) 4.00 years

A) 3.29 years

B) 3.58 years

C) 3.69 years

D) 3.89 years

E) 4.00 years

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

33

A mortgage banker had made loan commitments for $10 million in 3 months. How many contracts on Treasury bonds futures must the banker write or buy?

A) Go short 10.

B) Go short 100.

C) Go long 10.

D) Go long 100.

A) Go short 10.

B) Go short 100.

C) Go long 10.

D) Go long 100.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

34

Duration of a pure discount bond:

A) is equal to its half-life.

B) is less than a zero coupon bond.

C) is equal to the liabilities hedged.

D) equal to its maturity.

A) is equal to its half-life.

B) is less than a zero coupon bond.

C) is equal to the liabilities hedged.

D) equal to its maturity.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

35

Interest rate and currency swaps allow one party to exchange a:

A) floating interest rate or currency value for a fixed interest or value over the contract term.

B) fixed interest rate or currency value for a lower fixed value over the contract term.

C) floating interest rate or currency value for a lower floating value over the contract term.

D) a fixed interest rate position for a currency position over the contract term.

A) floating interest rate or currency value for a fixed interest or value over the contract term.

B) fixed interest rate or currency value for a lower fixed value over the contract term.

C) floating interest rate or currency value for a lower floating value over the contract term.

D) a fixed interest rate position for a currency position over the contract term.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

36

The duration of a 15 year zero coupon bond priced at $182.70 is:

A) 15 years.

B) 2.74 years.

C) 17.74 years.

D) Cannot determine without the interest rate.

A) 15 years.

B) 2.74 years.

C) 17.74 years.

D) Cannot determine without the interest rate.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

37

A bank has a $50 million mortgage bond risk position which it hedges in the Treasury bond futures markets at the Chicago Board of Trade. Approximately how many contracts are needed to be held in the hedge?

A) 5 contracts.

B) 50 contracts.

C) 500 contracts.

D) 5,000 contracts.

E) 50,000 contracts.

A) 5 contracts.

B) 50 contracts.

C) 500 contracts.

D) 5,000 contracts.

E) 50,000 contracts.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

38

A financial institution can hedge its interest rate risk by:

A) matching the duration of its assets to the duration of its liabilities.

B) setting the duration of its assets equal to half that of the duration of its liabilities.

C) match the duration of its assets weighted by the market value of its assets with the duration of its liabilities weighted by the market value of its liabilities.

D) setting the duration of its assets weighted by the market value of its assets to one half that of the duration of the liabilities weighted by the market value of the liabilities.

A) matching the duration of its assets to the duration of its liabilities.

B) setting the duration of its assets equal to half that of the duration of its liabilities.

C) match the duration of its assets weighted by the market value of its assets with the duration of its liabilities weighted by the market value of its liabilities.

D) setting the duration of its assets weighted by the market value of its assets to one half that of the duration of the liabilities weighted by the market value of the liabilities.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

39

A financial institution has equity equal to one-tenth of its assets. If its asset duration is currently equal to its liability duration, then to immunize, the firm needs to:

A) decrease the duration of its assets.

B) increase the duration of its assets.

C) decrease the duration of its liabilities.

D) do nothing, i.e., keep the duration of its liabilities equal to the duration of its assets.

A) decrease the duration of its assets.

B) increase the duration of its assets.

C) decrease the duration of its liabilities.

D) do nothing, i.e., keep the duration of its liabilities equal to the duration of its assets.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

40

Hedging in the futures markets can reduce all risk if:

A) price movements in both the cash and futures markets are perfectly correlated.

B) price movements in both the cash and futures markets have zero correlation.

C) price movements in both the cash and futures markets are less than perfectly correlated.

D) the hedge is a short hedge, but not a long hedge.

E) the hedge is a long hedge, but not a short hedge.

A) price movements in both the cash and futures markets are perfectly correlated.

B) price movements in both the cash and futures markets have zero correlation.

C) price movements in both the cash and futures markets are less than perfectly correlated.

D) the hedge is a short hedge, but not a long hedge.

E) the hedge is a long hedge, but not a short hedge.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

41

A Treasury Note with a maturity of 2 years pays interest semi-annually on a 9 percent annual coupon rate. The $1,000 face value is returned at maturity. If the effective annual yield for all maturities is 7 percent annually, what is the current price of the Treasury Note?

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

42

An inverse floater and a super-inverse floater are more valuable to a purchaser if:

A) interest rates stay the same.

B) interest rates fall.

C) interest rates rise.

D) if held for a long time.

A) interest rates stay the same.

B) interest rates fall.

C) interest rates rise.

D) if held for a long time.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

43

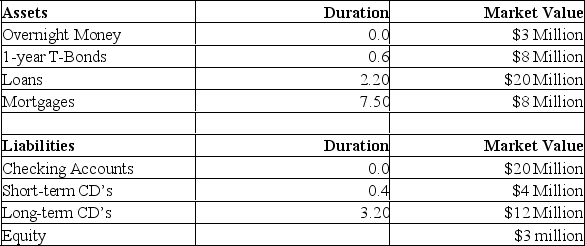

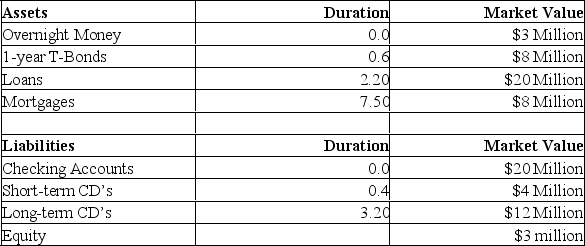

What new asset duration will immunize the statement of financial position if the duration of the liabilities are 1.111?

What new asset duration will immunize the statement of financial position if the duration of the liabilities are 1.111?

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

44

Duration is defined as the weighted average time to maturity of a financial instrument. Explain how this knowledge can help protect against interest rate risk.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

45

Calculate the duration of a 7-year $1,000 zero-coupon bond with a current price of $399.63 and a yield to maturity of 14%.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

46

The futures markets are labeled as pure speculation and even gambling. Why is this an inaccurate portrayal of the markets function.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

47

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

48

Calculate the duration of a 4-year $1,000 face value bond, which pays 8% coupons annually throughout maturity and has a yield to maturity of 9%.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

49

If a firm sells a floor at 6% this will:

A) will pay the holder the LIBOR interest below the 6%.

B) pay the firm 6% on their purchase.

C) will pay the holder the LIBOR interest above 6%.

D) limit the amount of borrowing to 6% of assets.

A) will pay the holder the LIBOR interest below the 6%.

B) pay the firm 6% on their purchase.

C) will pay the holder the LIBOR interest above 6%.

D) limit the amount of borrowing to 6% of assets.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

50

If a firm purchases a cap at 10% this will:

A) limit the amount of borrowing to 10% of assets.

B) pay the firm 10% on their purchase.

C) pay the holder the LIBOR interest above 10%.

D) pay the holder the LIBOR interest below the 10%.

A) limit the amount of borrowing to 10% of assets.

B) pay the firm 10% on their purchase.

C) pay the holder the LIBOR interest above 10%.

D) pay the holder the LIBOR interest below the 10%.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck