Deck 23: Options and Corporate Finance: Basic Concepts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/63

Play

Full screen (f)

Deck 23: Options and Corporate Finance: Basic Concepts

1

Which of the following statements is true?

A) Call options are issued by corporations and bought by investors.

B) Call options are issued by investors and bought by corporations.

C) Call options are issued by investors and bought by investors.

D) Put options are issued by corporations and bought by investors.

A) Call options are issued by corporations and bought by investors.

B) Call options are issued by investors and bought by corporations.

C) Call options are issued by investors and bought by investors.

D) Put options are issued by corporations and bought by investors.

Call options are issued by investors and bought by investors.

2

A stock has both a call and a put option outstanding. The exercise price was set equal to the stock price. If the option were to expire now what would be the minimum value of the call and the put respectively?

A) (ST - E); ³ 0.

B) 0; (ST - E).

C) <0; >0.

D) 0; 0.

E) (E - ST); (ST - E).

A) (ST - E); ³ 0.

B) 0; (ST - E).

C) <0; >0.

D) 0; 0.

E) (E - ST); (ST - E).

0; 0.

3

Which one of the following will cause the value of a call to decrease?

A) Lowering the exercise price.

B) Increasing the time to expiration.

C) Increasing the risk-free rate.

D) Lowering the risk level of the underlying security.

E) Increasing the stock price.

A) Lowering the exercise price.

B) Increasing the time to expiration.

C) Increasing the risk-free rate.

D) Lowering the risk level of the underlying security.

E) Increasing the stock price.

Lowering the risk level of the underlying security.

4

Which of the following statements is true?

A) Both call and put options are in the money if the stock price is above the exercise price.

B) Both call and put options are in the money if the stock price is below the exercise price.

C) Call options are in the money if the stock price is above the exercise price. Put options are in the money if the stock price is below the exercise price.

D) Call options are in the money if the stock price is below the exercise price. Put options are in the money if the stock price is above the exercise price.

A) Both call and put options are in the money if the stock price is above the exercise price.

B) Both call and put options are in the money if the stock price is below the exercise price.

C) Call options are in the money if the stock price is above the exercise price. Put options are in the money if the stock price is below the exercise price.

D) Call options are in the money if the stock price is below the exercise price. Put options are in the money if the stock price is above the exercise price.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

5

You can realize the same value as that derived from stock ownership if you:

A) sell a put option and invest at the risk-free rate of return.

B) buy a call option and write a put option on a stock and also borrow funds at the risk-free rate.

C) sell a put and buy a call on a stock as well as invest at the risk-free rate of return.

D) lend out funds at the risk-free rate of return and sell a put option on the stock.

A) sell a put option and invest at the risk-free rate of return.

B) buy a call option and write a put option on a stock and also borrow funds at the risk-free rate.

C) sell a put and buy a call on a stock as well as invest at the risk-free rate of return.

D) lend out funds at the risk-free rate of return and sell a put option on the stock.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

6

In general, an option gives the holder the right to exercise at the ______ price through the ______ date.

A) strike; inception.

B) American; inception.

C) European; expiration.

D) strike; expiration.

A) strike; inception.

B) American; inception.

C) European; expiration.

D) strike; expiration.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is not true concerning call option writers?

A) Writers promise to deliver shares if exercised by the buyer.

B) The writer has the option to sell shares but not an obligation.

C) The writer's liability is zero if the option expires out-of-the-money.

D) The writer receives a cash payment from the buyer at the time the option is purchased.

E) The writer has a loss if the market price rises substantially above the exercise price.

A) Writers promise to deliver shares if exercised by the buyer.

B) The writer has the option to sell shares but not an obligation.

C) The writer's liability is zero if the option expires out-of-the-money.

D) The writer receives a cash payment from the buyer at the time the option is purchased.

E) The writer has a loss if the market price rises substantially above the exercise price.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

8

A call gives the owner the right:

A) and the obligation to buy an asset at a given price.

B) and the obligation to sell an asset at a given price.

C) but not the obligation to buy an asset at a given price.

D) but not the obligation to sell an asset at a given price.

A) and the obligation to buy an asset at a given price.

B) and the obligation to sell an asset at a given price.

C) but not the obligation to buy an asset at a given price.

D) but not the obligation to sell an asset at a given price.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

9

Which one of the following statements correctly describes your situation as the owner of an American call option?

A) You are obligated to buy at a set price at any time up to and including the expiration date.

B) You have the right to sell at a set price at any time up to and including the expiration date.

C) You have the right to buy at a set price only on the expiration date.

D) You are obligated to sell at a set price if the option is exercised.

E) You have the right to buy at a set price at any time up to and including the expiration date.

A) You are obligated to buy at a set price at any time up to and including the expiration date.

B) You have the right to sell at a set price at any time up to and including the expiration date.

C) You have the right to buy at a set price only on the expiration date.

D) You are obligated to sell at a set price if the option is exercised.

E) You have the right to buy at a set price at any time up to and including the expiration date.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

10

An in-the-money put option is one that:

A) has an exercise price greater than the underlying stock price.

B) has an exercise price less than the underlying stock price.

C) has an exercise price equal to the underlying stock price.

D) should not be exercised at expiration.

E) should not be exercised at any time.

A) has an exercise price greater than the underlying stock price.

B) has an exercise price less than the underlying stock price.

C) has an exercise price equal to the underlying stock price.

D) should not be exercised at expiration.

E) should not be exercised at any time.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

11

Pay-off diagrams for a call options versus stock prices are called:

A) vertical tower diagrams.

B) hockey stick diagrams.

C) fulcrum diagrams.

D) cumulative frequency diagrams.

A) vertical tower diagrams.

B) hockey stick diagrams.

C) fulcrum diagrams.

D) cumulative frequency diagrams.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

12

You own a call option with time to expiration. The common stock is selling for $15 and your exercise price is $12, this option:

A) must be sold to the writer.

B) is in-the-money.

C) is out-of-the-money.

D) must be offset by a put.

A) must be sold to the writer.

B) is in-the-money.

C) is out-of-the-money.

D) must be offset by a put.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

13

The intrinsic value of a put is equal to the:

A) lesser of the strike price or the stock price.

B) lesser of the stock price minus the exercise price or zero.

C) lesser of the stock price or zero.

D) greater of the strike price minus the stock price or zero.

E) greater of the stock price minus the exercise price or zero.

A) lesser of the strike price or the stock price.

B) lesser of the stock price minus the exercise price or zero.

C) lesser of the stock price or zero.

D) greater of the strike price minus the stock price or zero.

E) greater of the stock price minus the exercise price or zero.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

14

An option that grants the right, but not the obligation, to sell shares of the underlying asset on a particular date at a specified price is called:

A) either an American or a European option.

B) an American call.

C) an American put.

D) a European put.

E) a European call.

A) either an American or a European option.

B) an American call.

C) an American put.

D) a European put.

E) a European call.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

15

Jeff opted to exercise his August option on August 10 and received $2,500 in exchange for his shares. Jeff must have owned a (an):

A) warrant.

B) American call.

C) American put.

D) European call.

A) warrant.

B) American call.

C) American put.

D) European call.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is true?

A) American options are options on securities of U.S. corporations, and the options are traded on American exchanges. European options are options on securities of U.S. corporations, but the options are traded on European exchanges.

B) American options are options on securities which are traded on American exchanges. European options, also traded on American exchanges, are options on European corporations.

C) American options give the holder the right to the dividend payment. European options do not.

D) American options may be exercised anytime up to expiration. European options may be exercised only at expiration.

A) American options are options on securities of U.S. corporations, and the options are traded on American exchanges. European options are options on securities of U.S. corporations, but the options are traded on European exchanges.

B) American options are options on securities which are traded on American exchanges. European options, also traded on American exchanges, are options on European corporations.

C) American options give the holder the right to the dividend payment. European options do not.

D) American options may be exercised anytime up to expiration. European options may be exercised only at expiration.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

17

The lowest value a call option can have is:

A) zero, because it is a limited liability instrument.

B) ST, because the basis of value is the stock price.

C) ST - 0, because it is a limited liability instrument.

D) X - ST, because the exercise price is the hurdle.

A) zero, because it is a limited liability instrument.

B) ST, because the basis of value is the stock price.

C) ST - 0, because it is a limited liability instrument.

D) X - ST, because the exercise price is the hurdle.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

18

The special contractual nature giving the owner the right to buy or sell an asset at a fixed price on or before a given date is the basis of:

A) a common stock.

B) a capital investment.

C) a futures.

D) an option.

A) a common stock.

B) a capital investment.

C) a futures.

D) an option.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

19

Which one of the following provides the option of selling a stock anytime during the option period at a specified price even if the market price of the stock declines to zero?

A) American call

B) European call

C) American put

D) European put

A) American call

B) European call

C) American put

D) European put

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

20

A trading opportunity that offers a riskless profit is called a(n):

A) put option.

B) call option.

C) market equilibrium.

D) arbitrage.

E) cross-hedge.

A) put option.

B) call option.

C) market equilibrium.

D) arbitrage.

E) cross-hedge.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

21

Calls on the King Co. closed trading at 2 5/8. You bought 3 call contracts at the close. The cost of 3 call options were:

A) $2.6255 plus brokerage fees, etc.

B) $7.875 plus brokerage fees, etc.

C) $262.50 plus brokerage fees, etc.

D) $787.50 plus brokerage fees, etc.

A) $2.6255 plus brokerage fees, etc.

B) $7.875 plus brokerage fees, etc.

C) $262.50 plus brokerage fees, etc.

D) $787.50 plus brokerage fees, etc.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

22

Tele-Tech Com has announced a large loss in their on-line services division causing the price of Tele-Tech Com stock to drop but the price volatility of the stock is not expected to drop. Which of the following correctly identifies the impact of these changes on the call option of Tele-Tech Com?

A) Both changes cause the price of the call option to decrease.

B) Both changes cause the price of the call option to increase.

C) The volatility normally will have a negative effect on the price of the call option while the lower price of the stock will cause the price of the call option to increase.

D) The volatility normally will have a positive effect on the price of the call option while the lower price of the stock will cause the price of the call option to decrease.

E) Volatility has no direct effect on the price of the call option while the lower price of the stock will cause the price of the call option to decrease.

A) Both changes cause the price of the call option to decrease.

B) Both changes cause the price of the call option to increase.

C) The volatility normally will have a negative effect on the price of the call option while the lower price of the stock will cause the price of the call option to increase.

D) The volatility normally will have a positive effect on the price of the call option while the lower price of the stock will cause the price of the call option to decrease.

E) Volatility has no direct effect on the price of the call option while the lower price of the stock will cause the price of the call option to decrease.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

23

A put gives the owner the right:

A) and the obligation to buy an asset at a given price.

B) and the obligation to sell an asset at a given price.

C) but not the obligation to buy an asset at a given price.

D) but not the obligation to sell an asset at a given price.

A) and the obligation to buy an asset at a given price.

B) and the obligation to sell an asset at a given price.

C) but not the obligation to buy an asset at a given price.

D) but not the obligation to sell an asset at a given price.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

24

A stock is selling for $31. There is a call option on the stock with an exercise price of $27. What is the approximate minimum value of the call option?

A) $0

B) $4

C) $27

D) $31

A) $0

B) $4

C) $27

D) $31

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

25

If the time to expiration of the underlying stock decreases, then the:

A) value of the put option will increase, but the value of the call option will decrease.

B) value of the put option will decrease, but the value of the call option will increase.

C) value of both the put and call option will increase.

D) value of both the put and call option will decrease.

E) value of both the put and call option will remain the same.

A) value of the put option will increase, but the value of the call option will decrease.

B) value of the put option will decrease, but the value of the call option will increase.

C) value of both the put and call option will increase.

D) value of both the put and call option will decrease.

E) value of both the put and call option will remain the same.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

26

Suppose a stock can be purchased for $8, a put option on the stock can be purchased for $1.50, and a call option on the stock can be written (i.e., sold) for $1.00. If holding these positions in combination can guarantee a payoff of $10 at the end of the year, then what must be the risk-free rate if no arbitrage opportunities exist?

A) 12.50%.

B) 5.50%.

C) 17.65%.

D) 33.33%.

E) 18.75%.

A) 12.50%.

B) 5.50%.

C) 17.65%.

D) 33.33%.

E) 18.75%.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

27

Tele-Tech Com announces a major expansion into internet services. This announcement causes the price of Tele-Tech Com stock to increase, but also causes an increase in price volatility of the stock. Which of the following correctly identifies the impact of these changes on the put option of Tele-Tech Com?

A) Both changes cause the price of the put option to decrease.

B) Both changes cause the price of the put option to increase.

C) The greater uncertainty will cause the price of the put option to decrease. The higher price of the stock will cause the price of the put option to increase.

D) The greater uncertainty will cause the price of the put option to increase. The higher price of the stock will cause the price of the put option to decrease.

E) The greater uncertainty has no direct effect on the price of the put option. The higher price of the stock will cause the price of the put option to decrease.

A) Both changes cause the price of the put option to decrease.

B) Both changes cause the price of the put option to increase.

C) The greater uncertainty will cause the price of the put option to decrease. The higher price of the stock will cause the price of the put option to increase.

D) The greater uncertainty will cause the price of the put option to increase. The higher price of the stock will cause the price of the put option to decrease.

E) The greater uncertainty has no direct effect on the price of the put option. The higher price of the stock will cause the price of the put option to decrease.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

28

The higher the exercise price:

A) the higher the call price.

B) the lower the call price.

C) has no effect on call price.

D) the higher the stock price.

E) the lower the stock price.

A) the higher the call price.

B) the lower the call price.

C) has no effect on call price.

D) the higher the stock price.

E) the lower the stock price.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

29

You hold a put option on a stock with a strike price of $23. The stock is selling for $25. What is the approximate minimum value of the put option?

A) $23

B) $25

C) $2

D) $0

A) $23

B) $25

C) $2

D) $0

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

30

Tele-Tech Com announces a major expansion into internet services. This announcement causes the price of Tele-Tech Com stock to increase, but also causes an increase in price volatility of the stock. Which of the following correctly identifies the impact of these changes on the call option of Tele-Tech Com?

A) Both changes cause the price of the call option to decrease.

B) Both changes cause the price of the call option to increase.

C) The greater uncertainty will cause the price of the call option to decrease. The higher price of the stock will cause the price of the call option to increase.

D) The greater uncertainty will cause the price of the call option to increase. The higher price of the stock will cause the price of the call option to decrease.

E) The greater uncertainty has no direct effect on the price of the call option. The higher price of the stock will cause the price of the call option to decrease.

A) Both changes cause the price of the call option to decrease.

B) Both changes cause the price of the call option to increase.

C) The greater uncertainty will cause the price of the call option to decrease. The higher price of the stock will cause the price of the call option to increase.

D) The greater uncertainty will cause the price of the call option to increase. The higher price of the stock will cause the price of the call option to decrease.

E) The greater uncertainty has no direct effect on the price of the call option. The higher price of the stock will cause the price of the call option to decrease.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

31

When reading option price quotes from the Wall Street Journal or National Post, a price of "-" indicates that:

A) the price is rapidly increasing.

B) the price is rapidly decreasing.

C) the option did not trade that day.

D) the price is in error and needs recalculation.

A) the price is rapidly increasing.

B) the price is rapidly decreasing.

C) the option did not trade that day.

D) the price is in error and needs recalculation.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

32

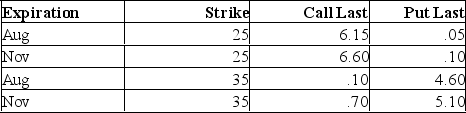

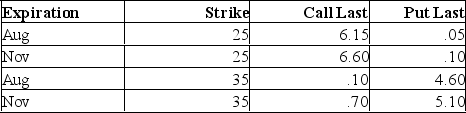

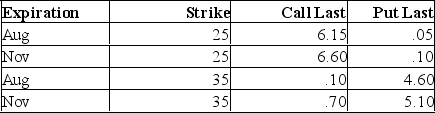

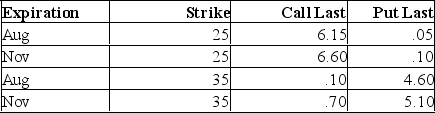

What is the intrinsic value of the August 25 call? KNJ (KNJ) Underlying stock price: 30.86

A) $0.10

B) $5.86

C) $6.15

D) $10.00

E) $25.00

A) $0.10

B) $5.86

C) $6.15

D) $10.00

E) $25.00

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

33

What is the cost of five November 25 call option contracts on KNJ stock given the following price quotes? KNJ (KNJ) Underlying stock price: 30.86

A) $615

B) $660

C) $2,500

D) $3,075

E) $3,300

A) $615

B) $660

C) $2,500

D) $3,075

E) $3,300

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

34

You own five put option contracts on XYZ stock with an exercise price of $25. What is the total intrinsic value of these contracts if XYZ stock is currently selling for $24.50 a share?

A) -$250

B) -$50

C) $0

D) $50

E) $250

A) -$250

B) -$50

C) $0

D) $50

E) $250

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

35

Tele-Tech Com has announced a large loss in their on-line services division causing the price of Tele-Tech Com stock to drop but the price volatility of the stock is not expected to drop. Which of the following correctly identifies the impact of these changes on the put option of Tele-Tech Com?

A) Both changes cause the price of the put option to decrease.

B) Both changes cause the price of the put option to increase.

C) The volatility normally will have a positive effect on the price of the put option, but the lower price of the stock will cause the price of the put option to increase.

D) The volatility normally will have a negative effect on the price of the put option while the lower price of the stock will cause the price of the put option to decrease.

E) Volatility has no direct effect on the price of the put option while the lower price of the stock will cause the price of the put option to decrease.

A) Both changes cause the price of the put option to decrease.

B) Both changes cause the price of the put option to increase.

C) The volatility normally will have a positive effect on the price of the put option, but the lower price of the stock will cause the price of the put option to increase.

D) The volatility normally will have a negative effect on the price of the put option while the lower price of the stock will cause the price of the put option to decrease.

E) Volatility has no direct effect on the price of the put option while the lower price of the stock will cause the price of the put option to decrease.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

36

Put-Call Parity can be used to show:

A) how far in-the-money put options can get.

B) how far in-the-money call options can get.

C) the precise relationship between put and call prices given equal exercise prices and equal expiration dates.

D) that the value of a call option is always twice that of a put given equal exercise prices and equal expiration dates.

E) that the value of a call option is always half that of a put given equal exercise prices and equal expiration dates.

A) how far in-the-money put options can get.

B) how far in-the-money call options can get.

C) the precise relationship between put and call prices given equal exercise prices and equal expiration dates.

D) that the value of a call option is always twice that of a put given equal exercise prices and equal expiration dates.

E) that the value of a call option is always half that of a put given equal exercise prices and equal expiration dates.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is true?

A) For both calls and puts an increase in the exercise price will cause an increase in the option price.

B) For both calls and puts an increase in the time to expiration will cause an increase in the option price.

C) For calls, but not for puts, an increase in the time to expiration will cause an increase in the option price.

D) For puts, but not for calls, an increase in the time to expiration will cause an increase in the option price.

A) For both calls and puts an increase in the exercise price will cause an increase in the option price.

B) For both calls and puts an increase in the time to expiration will cause an increase in the option price.

C) For calls, but not for puts, an increase in the time to expiration will cause an increase in the option price.

D) For puts, but not for calls, an increase in the time to expiration will cause an increase in the option price.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

38

The payoff diagram for a put with the same exercise price and premium as the call on the same underlying asset with the same maturity is:

A) the inverse of the call diagram along the put price.

B) unrelated to the call diagram no matter what the exercise price.

C) the mirror image of the call diagram around the exercise price.

D) exactly the same as the call diagram for the given exercise price.

A) the inverse of the call diagram along the put price.

B) unrelated to the call diagram no matter what the exercise price.

C) the mirror image of the call diagram around the exercise price.

D) exactly the same as the call diagram for the given exercise price.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

39

If the volatility of the underlying asset decreases, then the:

A) value of the put option will increase, but the value of the call option will decrease.

B) value of the put option will decrease, but the value of the call option will increase.

C) value of both the put and call option will increase.

D) value of both the put and call option will decrease.

E) value of both the put and call option will remain the same.

A) value of the put option will increase, but the value of the call option will decrease.

B) value of the put option will decrease, but the value of the call option will increase.

C) value of both the put and call option will increase.

D) value of both the put and call option will decrease.

E) value of both the put and call option will remain the same.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

40

The put option allows:

A) the holder to sell shares if desired and requires the put seller to buy the shares at a fixed price.

B) the put seller to sell shares and requires the holder to buy shares at a fixed price.

C) the holder to buy shares if desired and requires the put seller to sell the shares at a fixed price.

D) the put seller to sell shares and allows the holder to sell shares at a fixed price.

A) the holder to sell shares if desired and requires the put seller to buy the shares at a fixed price.

B) the put seller to sell shares and requires the holder to buy shares at a fixed price.

C) the holder to buy shares if desired and requires the put seller to sell the shares at a fixed price.

D) the put seller to sell shares and allows the holder to sell shares at a fixed price.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

41

Suppose a situation exists where you can purchase a share of stock for $25, purchase a put option on the stock for $3, and write a call option against the stock for $4. Also suppose that holding these three positions guarantees a payoff of $30 one year from today. If the risk free rate is 20%, does put-call parity hold? If not, then what new price of the put option would allow put-call parity to hold?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

42

The two state OPM is so named because:

A) there is only two specific outcomes in the future period.

B) the probability of price increase equals the probability of a price decrease.

C) only two interest rates are used.

D) only two arbitrage positions can be established.

A) there is only two specific outcomes in the future period.

B) the probability of price increase equals the probability of a price decrease.

C) only two interest rates are used.

D) only two arbitrage positions can be established.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

43

When a firm in financial distress accepts very risky projects, the stockholders benefit at the expense of the bondholders. In terms of option theory, the gain to the stockholders occurs because:

A) the stock is a put option on the firm's assets, and risky projects decrease the exercise price of the option.

B) the stock is a put option on the firm's assets, and risky projects increase the exercise price of the option.

C) the stock is a call option on the firm's assets, and risky projects increase the volatility of those assets.

D) the stock is a call option on the firm's assets, and risky projects decrease the volatility of those assets.

A) the stock is a put option on the firm's assets, and risky projects decrease the exercise price of the option.

B) the stock is a put option on the firm's assets, and risky projects increase the exercise price of the option.

C) the stock is a call option on the firm's assets, and risky projects increase the volatility of those assets.

D) the stock is a call option on the firm's assets, and risky projects decrease the volatility of those assets.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

44

The Federal Reserve Board decreases open-market purchases, which results in a general increase in interest rates. As a result, the price of Specific Car stock drops. Which of the following correctly describes the impact of these changes on the price of the call option for Specific Car stock?

A) Both changes cause the price of the call option to decrease.

B) Both changes cause the price of the call option to increase.

C) The higher interest rate will cause the price of the call option to decrease. The lower price of the stock will cause the price of the call option to increase.

D) The higher interest rate will cause the price of the call option to increase. The lower price of the stock will cause the price of the call option to decrease.

E) The higher interest rate has no direct effect on the price of the call option. The lower price of the stock will cause the price of the call option to decrease.

A) Both changes cause the price of the call option to decrease.

B) Both changes cause the price of the call option to increase.

C) The higher interest rate will cause the price of the call option to decrease. The lower price of the stock will cause the price of the call option to increase.

D) The higher interest rate will cause the price of the call option to increase. The lower price of the stock will cause the price of the call option to decrease.

E) The higher interest rate has no direct effect on the price of the call option. The lower price of the stock will cause the price of the call option to decrease.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

45

In terms of relating options to firm value, if the stockholders have a call option on the firm, what do the bondholders have?

A) In addition to owning the firm, they have written a call option against the firm whose exercise price equals the promised payment.

B) In addition to owning the firm, they have bought a call option against the firm whose exercise price equals the promised payment.

C) In addition to owning the firm, they have written a put option against the firm whose exercise price equals the promised payment.

D) In addition to owning the firm, they have bought a put option against the firm whose exercise price equals the promised payment.

A) In addition to owning the firm, they have written a call option against the firm whose exercise price equals the promised payment.

B) In addition to owning the firm, they have bought a call option against the firm whose exercise price equals the promised payment.

C) In addition to owning the firm, they have written a put option against the firm whose exercise price equals the promised payment.

D) In addition to owning the firm, they have bought a put option against the firm whose exercise price equals the promised payment.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

46

If a firm with risky debt outstanding pays a large cash distribution, the value of the bonds:

A) will be unaffected as payment is to the stockholders.

B) will increase because the value of the call options increases.

C) will increase because the value of the call option decreases.

D) will decrease because the value of the put option will decrease.

E) will decrease because the value of the put option will increase.

A) will be unaffected as payment is to the stockholders.

B) will increase because the value of the call options increases.

C) will increase because the value of the call option decreases.

D) will decrease because the value of the put option will decrease.

E) will decrease because the value of the put option will increase.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

47

In terms of relating options to the value of the firm, the equity of the firm can be viewed as:

A) a call option on the firm with the exercise price equal to the promised payments to the bondholders.

B) a call option on the firm with the exercise price equal to the firm's after-tax cash flow.

C) a put option on the firm with the exercise price equal to the promised payments to the bondholders.

D) a put option on the firm with an exercise price equal to the firm's after-tax cash flow.

A) a call option on the firm with the exercise price equal to the promised payments to the bondholders.

B) a call option on the firm with the exercise price equal to the firm's after-tax cash flow.

C) a put option on the firm with the exercise price equal to the promised payments to the bondholders.

D) a put option on the firm with an exercise price equal to the firm's after-tax cash flow.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

48

To compute the value of a put using the Black-Scholes option pricing model, you:

A) first have to apply the put-call parity relationship.

B) first have to compute the value of the put as if it is a call.

C) compute the value of an equivalent call and then subtract that value from one.

D) compute the value of an equivalent call and then subtract that value from the market price of the stock.

A) first have to apply the put-call parity relationship.

B) first have to compute the value of the put as if it is a call.

C) compute the value of an equivalent call and then subtract that value from one.

D) compute the value of an equivalent call and then subtract that value from the market price of the stock.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

49

The Black-Scholes OPM is dependent on which five parameters?

A) Stock price, exercise price, risk free rate, probability, and time to maturity.

B) Stock price, risk free rate, probability, time to maturity, and variance.

C) Stock price, risk free rate, probability, variance and exercise price.

D) Stock price, exercise price, risk free rate, variance and time to maturity.

E) Exercise price, probability, stock price, variance and time to maturity.

A) Stock price, exercise price, risk free rate, probability, and time to maturity.

B) Stock price, risk free rate, probability, time to maturity, and variance.

C) Stock price, risk free rate, probability, variance and exercise price.

D) Stock price, exercise price, risk free rate, variance and time to maturity.

E) Exercise price, probability, stock price, variance and time to maturity.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

50

Use the Black-Scholes model to determine the option price for the May 35 call for Nibblers as of April 18, 2015. The expiration date for this option is May 18, 2015. The annualized interest rate on a T-bill that matures that same day is 3.0%. Nibblers stock closed at 36. The historic variance for Nibblers is .25. Assume a 365 day year.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

51

Verma Violin Manufacturing Corporation has issued debt with $10 million of principal due. In terms of viewing the equity of the firm as a call option, what happens to the equity of the firm if the cashflow of the firm is less than $10 million?

A) The option is in-the-money and the stockholders earn the difference between the cash flow and the bondholder's promised payment.

B) The option is in-the-money and the bondholders earn the entire cash flow.

C) The option is out-of-the-money, the stockholders walk away, and the bondholders receive the entire cash flow.

D) The option is out-of-the-money, and the stockholders make up the difference so that the bondholders receive full payment.

A) The option is in-the-money and the stockholders earn the difference between the cash flow and the bondholder's promised payment.

B) The option is in-the-money and the bondholders earn the entire cash flow.

C) The option is out-of-the-money, the stockholders walk away, and the bondholders receive the entire cash flow.

D) The option is out-of-the-money, and the stockholders make up the difference so that the bondholders receive full payment.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

52

Verma Violin Manufacturing Corporation has issued debt with $10 million of principal due. In terms of viewing the equity of the firm as a call option, what happens to the equity of the firm if the cash flow of the firm is greater than $10 million?

A) The option is in-the-money and the stockholders earn the difference between the cash flow and the bondholder's promised payment.

B) The option is in-the-money and the bondholders earn the entire cash flow.

C) The option is out-of-the-money, the stockholders walk away, and the bondholders receive the entire cash flow.

D) The option is out-of-the-money, and the stockholders make up the difference so that the bondholders receive full payment.

A) The option is in-the-money and the stockholders earn the difference between the cash flow and the bondholder's promised payment.

B) The option is in-the-money and the bondholders earn the entire cash flow.

C) The option is out-of-the-money, the stockholders walk away, and the bondholders receive the entire cash flow.

D) The option is out-of-the-money, and the stockholders make up the difference so that the bondholders receive full payment.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

53

You own stock in a firm that has a pure discount loan due in six months. The loan has a face value of $50,000. The assets of the firm are currently worth $62,000. The stockholders in this firm basically own a _____ option on the assets of the firm with a strike price of ______

A) put; $62,000.

B) put; $50,000.

C) warrant; $62,000.

D) call; $62,000.

E) call; $50,000.

A) put; $62,000.

B) put; $50,000.

C) warrant; $62,000.

D) call; $62,000.

E) call; $50,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

54

In relating stockholder value in terms of put options, the stockholders own the firm, they owe promised payments to the bondholders, and they have bought a put on the firm's assets with an exercise price equal to the promised payment to the bondholders. If the firm's cash flow is greater than these promised payments:

A) the put is out-of-the-money, is not exercised, and the stockholders retain ownership.

B) the put is out-of-the-money, is exercised, and the stockholders retain ownership.

C) the put is in-the-money, is exercised, and the stockholders walk away from their promise to the bondholders.

D) the put is in-the-money, is exercised, and the stockholders retain ownership.

A) the put is out-of-the-money, is not exercised, and the stockholders retain ownership.

B) the put is out-of-the-money, is exercised, and the stockholders retain ownership.

C) the put is in-the-money, is exercised, and the stockholders walk away from their promise to the bondholders.

D) the put is in-the-money, is exercised, and the stockholders retain ownership.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

55

Explain how the value of a firm can be viewed as an option. How can the call and put views be resolved?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

56

In relating stockholder value in terms of put options, the stockholders own the firm, they owe promised payments to the bondholders, and they have bought a put on the firm's assets with an exercise price equal to the promised payment to the bondholders. If the firm's cash flow is less than these promised payments:

A) the put is out-of-the-money, is not exercised, and the stockholders retain ownership.

B) the put is out-of-the-money, is exercised, and the stockholders retain ownership.

C) the put is in-the-money, is exercised, and the stockholders walk away from their promise to the bondholders.

D) the put is in-the-money, is exercised, and the stockholders retain ownership.

A) the put is out-of-the-money, is not exercised, and the stockholders retain ownership.

B) the put is out-of-the-money, is exercised, and the stockholders retain ownership.

C) the put is in-the-money, is exercised, and the stockholders walk away from their promise to the bondholders.

D) the put is in-the-money, is exercised, and the stockholders retain ownership.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

57

You have entered into a call option contract for 1 period. The stock is selling for $28, you borrowed $12 at 8% and the delta is 0.6. What is the value of the call?

A) $8.89

B) $4.80

C) $5.69

D) $9.60

A) $8.89

B) $4.80

C) $5.69

D) $9.60

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

58

Use the Black-Scholes model to determine the option price for a call option which will expire in one year. The strike price is $17.50, the stock pays no dividends and has a current market price of $20.00. The volatility of the stock has resulted in an annualized standard deviation of 10%. The interest rate on a T-bill that matures in one year is 7%.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

59

Options can be used to explain how the choice of a project can determine investor value. Options are also useful in evaluating alternatives open within a project choice, such as investing now or delaying. Give an example of how options can be used in investment timing.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

60

An insight gained by bringing the theory of options into standard capital budgeting analysis is:

A) independent projects with positive NPVs should very often be rejected.

B) independent projects with negative NPVs should very often be accepted.

C) projects, as call options, can be more valuable if the decision to start up the project is delayed until relevant information is released.

D) projects, as call options, can be less valuable if the decision to start up the project is delayed until relevant information is released.

A) independent projects with positive NPVs should very often be rejected.

B) independent projects with negative NPVs should very often be accepted.

C) projects, as call options, can be more valuable if the decision to start up the project is delayed until relevant information is released.

D) projects, as call options, can be less valuable if the decision to start up the project is delayed until relevant information is released.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

61

Suppose your wealthy Aunt Minnie has asked you to manage her large stock portfolio. You would like to buy and/or sell options on many of the stocks she owns. Describe the types of options you would buy or sell, as well as your rationale, given the following circumstances:

a. Aunt Minnie owns 10,000 shares of IBM common stock. You believe it is going to fall in price, but she won't let you sell it because her late husband told her never to let it go. How do you protect her from the impending price decline?

b. Your analysis suggests that the common stock of Jet-Electro is poised to increase in value sharply over the next year. Aunt Minnie doesn't want to buy any of the stock, but does want you to use options to profit if the price rises. What do you do?

c. Although Aunt Minnie doesn't want you to sell any of the stocks she owns, she would like you to use options to generate a little extra income.

How might you do this?

a. Aunt Minnie owns 10,000 shares of IBM common stock. You believe it is going to fall in price, but she won't let you sell it because her late husband told her never to let it go. How do you protect her from the impending price decline?

b. Your analysis suggests that the common stock of Jet-Electro is poised to increase in value sharply over the next year. Aunt Minnie doesn't want to buy any of the stock, but does want you to use options to profit if the price rises. What do you do?

c. Although Aunt Minnie doesn't want you to sell any of the stocks she owns, she would like you to use options to generate a little extra income.

How might you do this?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

62

Explain the rationale behind the statement that equity is a call option on the firm's assets. When would a shareholder allow the call to expire?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

63

What are the upper and lower bounds of an American call option? Explain what would happen in each case if the bound was violated.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck