Deck 10: Risk and Return: Lessons From Market History

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/51

Play

Full screen (f)

Deck 10: Risk and Return: Lessons From Market History

1

Which one of the following is a correct statement concerning risk premium?

A) The greater the volatility of returns, the greater the risk premium.

B) The lower the volatility of returns, the greater the risk premium.

C) The lower the average rate of return, the greater the risk premium.

D) The risk premium is not correlated to the average rate of return.

A) The greater the volatility of returns, the greater the risk premium.

B) The lower the volatility of returns, the greater the risk premium.

C) The lower the average rate of return, the greater the risk premium.

D) The risk premium is not correlated to the average rate of return.

The greater the volatility of returns, the greater the risk premium.

2

Kids Toy Co. has had total returns over the past five years of 0%, 7%, -2%, 10%, and 12%. What was the mean return on this stock and its variability in percent return?

A) 6.75%; 6.15%.

B) 5.40%; 6.15%.

C) 6.75%; 6.33%.

D) 5.40%; 5.50%.

A) 6.75%; 6.15%.

B) 5.40%; 6.15%.

C) 6.75%; 6.33%.

D) 5.40%; 5.50%.

5.40%; 6.15%.

3

A capital gain occurs when:

A) the selling price is less than the purchase price.

B) the purchase price is less than the selling price.

C) there is no dividend paid.

D) there is no income component of return.

A) the selling price is less than the purchase price.

B) the purchase price is less than the selling price.

C) there is no dividend paid.

D) there is no income component of return.

the purchase price is less than the selling price.

4

The capital gains yield plus the dividend yield on a security is called the:

A) geometric return.

B) average period return.

C) current yield.

D) total return.

A) geometric return.

B) average period return.

C) current yield.

D) total return.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

5

You bought 100 shares of stock at $20 each. At the end of the year, you received a total of $400 in dividends, and your stock was worth $2,500 total. What was total dollar capital gain and total dollar return?

A) $400; $500.

B) $400; $900.

C) $500; $900.

D) $900; $2,500.

A) $400; $500.

B) $400; $900.

C) $500; $900.

D) $900; $2,500.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

6

On January 1, 2013 Westman Fuji sold for $40 and on January 1, 2014 Westman Fuji sold for $39.50. During 2013 Westman Fuji paid four quarterly dividends of $1.50. Fuji's dividend yield is:

A) 2.53%.

B) 3.75%.

C) 15.00%.

D) 15.19%.

A) 2.53%.

B) 3.75%.

C) 15.00%.

D) 15.19%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

7

You bought 100 shares of stock at $20 each. At the end of the year, you received a total of $400 in dividends, and your stock was worth $2,500 total. What was your percentage rate of return?

A) 20%

B) 25%

C) 45%

D) 125%

E) 145%

A) 20%

B) 25%

C) 45%

D) 125%

E) 145%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

8

Capital market history shows us that a correct ordering of the average arithmetic mean return for asset classes, from lowest to highest, is:

A) Corporate bonds, Treasury bills, small-company stocks, and large-company stocks.

B) U.S. Treasury bills, small-company stocks, large-company stocks, and government bonds.

C) Government bonds, Treasury bills, large-company stocks, and small-company stocks.

D) Treasury bills, government bonds, corporate bonds, and large-company stocks.

E) Treasury bills, long-term government bonds, intermediate-term government bonds, small-company stock.

A) Corporate bonds, Treasury bills, small-company stocks, and large-company stocks.

B) U.S. Treasury bills, small-company stocks, large-company stocks, and government bonds.

C) Government bonds, Treasury bills, large-company stocks, and small-company stocks.

D) Treasury bills, government bonds, corporate bonds, and large-company stocks.

E) Treasury bills, long-term government bonds, intermediate-term government bonds, small-company stock.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

9

Excelsior shares are currently selling for $25.00 each. You bought 200 shares one year ago at $24 and received dividend payments of $1.50 per share. What was your percentage capital gain this year?

A) 10.42%

B) 4.17%

C) 6.25%

D) 110.42%

E) 104.67%

A) 10.42%

B) 4.17%

C) 6.25%

D) 110.42%

E) 104.67%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

10

A year ago, you purchased 300 shares of IXC Technologies, Inc. stock at a price of $9.03 per share. The stock pays an annual dividend of $.10 per share. Today, you sold all of your shares for $28.14 per share. What is your total dollar return on this investment?

A) $5,703

B) $5,733

C) $5,753

D) $5,763

E) $5,853

A) $5,703

B) $5,733

C) $5,753

D) $5,763

E) $5,853

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

11

A year ago, you purchased 500 shares of New Tech stock at a price of $49.03 per share. The stock pays an annual dividend of $.10 per share. Today, you sold all of your shares for $58.14 per share. What is your total dollar return on this investment?

A) $4,755

B) $4,733

C) $4,753

D) $4,605

E) $4,853

A) $4,755

B) $4,733

C) $4,753

D) $4,605

E) $4,853

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

12

The Zolo Co. just declared that it is increasing its annual dividend from $1.00 per share to $1.25 per share. If the stock price remains constant, then:

A) the capital gains yield will decrease.

B) the capital gains yield will increase.

C) the dividend yield will increase.

D) the dividend yield will also remain constant.

E) neither the capital gains yield nor the dividend yield will change.

A) the capital gains yield will decrease.

B) the capital gains yield will increase.

C) the dividend yield will increase.

D) the dividend yield will also remain constant.

E) neither the capital gains yield nor the dividend yield will change.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

13

Six months ago, you purchased 100 shares of stock in ABC Co. at a price of $43.89 a share. ABC stock pays a quarterly dividend of $.10 a share. Today, you sold all of your shares for $45.13 per share. What is the total amount of your capital gains on this investment?

A) $1.24

B) $1.64

C) $40.00

D) $124.00

E) $164.00

A) $1.24

B) $1.64

C) $40.00

D) $124.00

E) $164.00

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

14

The expected return on a security in the market context is:

A) a negative function of execs security risk.

B) a positive function of the beta.

C) a negative function of the beta.

D) a positive function of the excess security risk.

E) independent of beta.

A) a negative function of execs security risk.

B) a positive function of the beta.

C) a negative function of the beta.

D) a positive function of the excess security risk.

E) independent of beta.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

15

You just sold 200 shares of XYZ Inc. stock at a price of $38.75 a share. Last year you paid $41.50 a share to buy this stock. Over the course of the year, you received dividends totaling $1.64 per share. What is your capital gain on this investment?

A) -$550

B) -$222

C) -$3

D) $550

E) $878

A) -$550

B) -$222

C) -$3

D) $550

E) $878

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

16

Capital gains are defined as:

A) the change in the firm's dividend payout over year.

B) assets sold at prices greater than their purchasing price.

C) assets sold at prices less than their purchasing price.

D) taxes collected by Federal but not by State governments.

A) the change in the firm's dividend payout over year.

B) assets sold at prices greater than their purchasing price.

C) assets sold at prices less than their purchasing price.

D) taxes collected by Federal but not by State governments.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

17

Excelsior share are currently selling for $25.00 each. You bought 200 shares one year ago at $24 and received dividend payments of $1.50 per share. What was your percentage rate of return?

A) 10.42%

B) 4.17%

C) 6.25%

D) 110.42%

E) 104.67%

A) 10.42%

B) 4.17%

C) 6.25%

D) 110.42%

E) 104.67%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

18

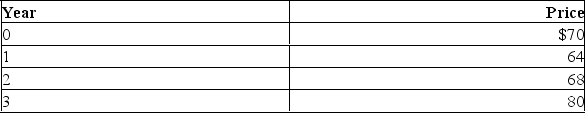

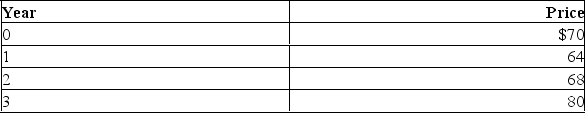

The prices for IMB over the last 3 years are given below. Assuming no dividends were paid, what was the 3-year holding period return?

A) 17.65%.

B) 5.11%.

C) 14.29%.

D) -8.57%.

A) 17.65%.

B) 5.11%.

C) 14.29%.

D) -8.57%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

19

You bought 100 shares of stock at $20 each. At the end of the year, you received a total of $400 in dividends, and your stock was worth $2,500 total. What was your total dollar return?

A) $900.

B) $500.

C) $400.

D) $2,500.

A) $900.

B) $500.

C) $400.

D) $2,500.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

20

Which one of the following statements concerning the standard deviation is correct?

A) The standard deviation is a measure of total return.

B) The higher the standard deviation, the higher the expected return.

C) The standard deviation varies in direct relation to increases in dividend yield.

D) The higher the standard deviation, the lower the risk.

E) The lower the standard deviation, the less certain the rate of return in any one given year.

A) The standard deviation is a measure of total return.

B) The higher the standard deviation, the higher the expected return.

C) The standard deviation varies in direct relation to increases in dividend yield.

D) The higher the standard deviation, the lower the risk.

E) The lower the standard deviation, the less certain the rate of return in any one given year.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

21

If the average return on common stocks was 13.3%, the average Treasury bill rate was 3.8%, and the average inflation rate was 3.2% what would be the expected nominal and approximate real market return for common stocks if the Treasury bill rate is expected to be 5.5% and the inflation rate is 4.1%?

A) 9.5%, 13.6%.

B) 13.6%, 9.5%.

C) 15.90%, 10.9%.

D) 14.6%, 9.1%.

A) 9.5%, 13.6%.

B) 13.6%, 9.5%.

C) 15.90%, 10.9%.

D) 14.6%, 9.1%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

22

The total annual returns on common stocks averaged 13.3% from 1957 to 2003. Small company stocks averaged 10.64%, long-term bonds averaged 8.96%, while Treasury Bills averaged 6.8%. What was the average risk premium earned by long-term Bonds, and small company stocks respectively?

A) 9.5%; 1.8%

B) 4.4%; 11.9%

C) 2.16%; 3.84%

D) 1.8%; 13.3%

A) 9.5%; 1.8%

B) 4.4%; 11.9%

C) 2.16%; 3.84%

D) 1.8%; 13.3%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

23

Kids Toy Co. has had total returns over the past five years of 0%, 7%, -2%, 10%, and 12%. What is the percentage change in wealth over the five years

A) 29%

B) 27%

C) 5.8%

D) 5.4%

A) 29%

B) 27%

C) 5.8%

D) 5.4%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

24

If the expected return on the market is 16%, then using the historical risk premium of 8.5%, the current risk-free rate is:

A) 4.5%.

B) 7.5%.

C) 10.0%.

D) 10.5%.

E) 12.5%.

A) 4.5%.

B) 7.5%.

C) 10.0%.

D) 10.5%.

E) 12.5%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

25

The market portfolio of common stocks earned 14.7% last year. Treasury bills earned 5.7% on average last year. The average inflation rate was 4.0%. What was the real return on equities?

A) 5.0%.

B) 9.0%.

C) 9.7%.

D) 10.7%.

E) 12.6%.

A) 5.0%.

B) 9.0%.

C) 9.7%.

D) 10.7%.

E) 12.6%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

26

The Alpha stock you bought for $26.75 a year ago is now selling for $32.50. Alpha also paid you $2.25 in dividends. What would your dollar return be from this stock?

A) $7.75

B) $8.00

C) $8.25

D) $5.75

A) $7.75

B) $8.00

C) $8.25

D) $5.75

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

27

The market portfolio of common stocks earned 20.4% last year. Treasury bills earned 5.3% on average last year. The average inflation rate was 2.5%. What was the equity risk premium?

A) 12.6%

B) 22.9%

C) 25.7%

D) 15.1%

E) 23.2%

A) 12.6%

B) 22.9%

C) 25.7%

D) 15.1%

E) 23.2%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

28

A security has an expected return of 10% and a standard deviation of.03. If the security is normally distributed, then about 68% of the time, the security return will be

A) between 10% and 13%.

B) between 7% and 10%.

C) between 7% and 13%.

D) between 4% and 10%.

E) between 13% and 16%.

A) between 10% and 13%.

B) between 7% and 10%.

C) between 7% and 13%.

D) between 4% and 10%.

E) between 13% and 16%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

29

Capital market history shows us that the average return relationship between securities where:

A) lowest return is inflation, then corporate bonds, Treasuries, small company stocks, to highest return all common stocks.

B) lowest return is Treasury bills, inflation, small company stocks, highest return all common stocks.

C) lowest return is Treasury bills, corporate bonds, government bonds, all common stocks, highest small company stocks.

D) lowest return is Treasury bills, government bonds, corporate bonds, all common stocks, highest small company stocks.

A) lowest return is inflation, then corporate bonds, Treasuries, small company stocks, to highest return all common stocks.

B) lowest return is Treasury bills, inflation, small company stocks, highest return all common stocks.

C) lowest return is Treasury bills, corporate bonds, government bonds, all common stocks, highest small company stocks.

D) lowest return is Treasury bills, government bonds, corporate bonds, all common stocks, highest small company stocks.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

30

The return pattern on your favorite stock has been 5%, 8%, -12%, 15%, 21% over the last five years. What is your average return and total change in wealth per year over the period?

A) 4.5%, 6.5%

B) 15%, 21%

C) 7.4%, 6.8%

D) 9.2%, 8.6%

A) 4.5%, 6.5%

B) 15%, 21%

C) 7.4%, 6.8%

D) 9.2%, 8.6%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

31

If you were to estimate the expected return on the market portfolio, you would need to know or estimate:

A) the beta of the portfolio, the risk-free rate, and the level of the market over the next year.

B) the risk-free rate and beta of the portfolio.

C) the historical risk premium and the risk free rate.

D) the level of the market over the next year, the risk-free rate, and the historical risk premium.

A) the beta of the portfolio, the risk-free rate, and the level of the market over the next year.

B) the risk-free rate and beta of the portfolio.

C) the historical risk premium and the risk free rate.

D) the level of the market over the next year, the risk-free rate, and the historical risk premium.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose you own a risky asset with an expected return of 12% and a standard deviation of 20%. If the returns are normally distributed, the approximate probability of receiving a return greater than 72%, or less than -48% is:

A) greater than 99%

B) greater than 95%

C) less than 5%

D) less than 1%

A) greater than 99%

B) greater than 95%

C) less than 5%

D) less than 1%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

33

Suppose you own a risky asset with an expected return of 12% and a standard deviation of 20%. If the returns are normally distributed, the approximate probability of receiving a return greater than 32% is:

A) 0.67.

B) 0.33.

C) 0.05.

D) 0.02.

E) 0.16.

A) 0.67.

B) 0.33.

C) 0.05.

D) 0.02.

E) 0.16.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

34

You have a sample of returns observations for the Malta Stock Fund. The 4 returns are 0.0725, 0.056, 0.125, 0.010. What is the average return and variance of these returns?

A) 6.50%, 0.0017.

B) 6.60%, 0.0023.

C) 26.35%, 0.0067.

D) 8.80%, 0.0017.

A) 6.50%, 0.0017.

B) 6.60%, 0.0023.

C) 26.35%, 0.0067.

D) 8.80%, 0.0017.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

35

The normal distribution is a theoretical distribution for a population. The distribution can be used to estimate how risky a cash flow or return is. If the mean is 12% and the standard deviation is 22.6%, what is the range of possible returns for a 2 standard deviation change and what percentage of all observations would fall within 2 standard deviations?

A) 24%, 68%.

B) 24%, 96%.

C) 90%, 68%.

D) 90%, 96%.

A) 24%, 68%.

B) 24%, 96%.

C) 90%, 68%.

D) 90%, 96%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

36

The return on your portfolio over the last 5 years were -5%, 20%, 0%, 10% and 5%. What was the standard deviation of your return? What is your best guess as to next year's return?

A) 2.74%; 6.00%.

B) 5.31%; 5.65%.

C) 9.62%; 6.00%.

D) 9.62%; 15.00%.

E) 12.70%; 20.00%.

A) 2.74%; 6.00%.

B) 5.31%; 5.65%.

C) 9.62%; 6.00%.

D) 9.62%; 15.00%.

E) 12.70%; 20.00%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

37

The market portfolio of common stocks earned 20.4% last year. Treasury bills earned 5.3% on average last year. The average inflation rate was 2.5%. What was the real return on T-Bills?

A) 2.8%.

B) 5.3%

C) 7.8%

D) 3.9%

A) 2.8%.

B) 5.3%

C) 7.8%

D) 3.9%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

38

Last year you bought some Alpha stock for $26.75 a share. It is currently selling for $32.50. You received a dividend of $2.25 during the year. What is your total rate of return?

A) 30%

B) 21%

C) 8.5%

D) 12%

A) 30%

B) 21%

C) 8.5%

D) 12%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

39

The market portfolio of common stocks earned 14.7% last year. Treasury bills earned 5.7% on average last year. The average inflation rate was 4.0%. What was the real risk premium on equities?

A) 5.0%.

B) 9.0%.

C) 6.5%.

D) 12.2%.

E) 18.7%.

A) 5.0%.

B) 9.0%.

C) 6.5%.

D) 12.2%.

E) 18.7%.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

40

The long term inflation rate average was 3.2% and you invested in long term corporate bonds over the same period which earned 6.1%. What was the average risk premium you earned and your precise rate of return?

A) 2.9%; -2.9%

B) 9.3%; 10.3%

C) 2.9%; 2.81%

D) cannot be determined

A) 2.9%; -2.9%

B) 9.3%; 10.3%

C) 2.9%; 2.81%

D) cannot be determined

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

41

Explain why a financial manager of a large company should use the standard deviation as the measure of risk to determine the discount rate?

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

42

Estimates using the arithmetic average will probably tend to _____ values over the long-term while estimates using the geometric average will probably tend to _____ values over the short-term.

A) overestimate; overestimate

B) overestimate; underestimate

C) underestimate; overestimate

D) underestimate; underestimate

E) accurately; accurately

A) overestimate; overestimate

B) overestimate; underestimate

C) underestimate; overestimate

D) underestimate; underestimate

E) accurately; accurately

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

43

The returns on your portfolio over the last 5 years were -5%, 20%, 0%, 10% and 5%. What is the arithmetic average return?

A) 5.0%

B) 6.0%

C) 7.5%

D) 8.0%

E) 10.0%

A) 5.0%

B) 6.0%

C) 7.5%

D) 8.0%

E) 10.0%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

44

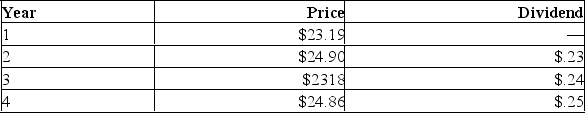

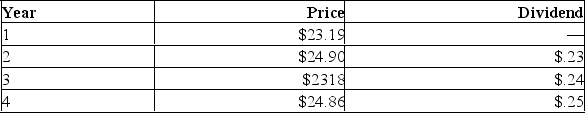

A stock had the following prices and dividends. What is the geometric average return on this stock?

A) 3.0%

B) 3.3%

C) 3.6%

D) 3.8%

E) 4.0%

A) 3.0%

B) 3.3%

C) 3.6%

D) 3.8%

E) 4.0%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

45

Little John Industries sold for $1.90 on January 1 and ended the year at a price of $2.50. In addition, the stock paid dividends of $0.20 per share. Calculate Little John's dividend yield, capital gain yield, and total rate of return for the year.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

46

A stock has returns of 3%, 18%, -24%, and 16% for the past four years. Based on this information, what is the 95% probability range for any one given year?

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

47

You earned a total return of -5% on NoDotCom this year, earned -40% last year, and earned 30% two years ago. Calculate both the three-year holding period return and the average three year return.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

48

List 2 shortcomings of using value at risk (VaR) as a risk management tool.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

49

A stock had returns of 8%, 14%, and 2% for the past three years. Based on these returns, what is the probability that this stock will earn at least 20% in any one given year?

A) 0.5%

B) 1.0%

C) 2.3%

D) 5.0%

E) 16.0%

A) 0.5%

B) 1.0%

C) 2.3%

D) 5.0%

E) 16.0%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

50

The average compound return earned per year over a multi-year period is called the _____ average return.

A) arithmetic

B) standard

C) variant

D) geometric

E) real

A) arithmetic

B) standard

C) variant

D) geometric

E) real

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

51

Suppose you are the risk manager of a bank with a trading portfolio of $1 billion. You have just received the latest information about the portfolio allocations made by the trading branch of your bank, who tell you that the portfolio will earn a premium return of 23% over the risk free rate in one year. You have carried out an independent analysis, and find that the return on your portfolio over the next ten days is normally distributed with a mean of 0.77% and a standard deviation of 5%. Find the ten day 1% value at risk for this portfolio.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck