Deck 14: The Statement of Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 14: The Statement of Cash Flows

1

Which of the following is NOT a financing cash flow?

A) Dividends received

B) Issue of shares

C) Borrowing $10 000 from the bank

D) Share buybacks

A) Dividends received

B) Issue of shares

C) Borrowing $10 000 from the bank

D) Share buybacks

A

2

Which of the following is classified under cash flow from operations?

A) Dividend paid

B) Purchase of office equipment for cash

C) Sale of office equipment

D) Income taxes paid

A) Dividend paid

B) Purchase of office equipment for cash

C) Sale of office equipment

D) Income taxes paid

D

3

Which of the following is a financing activity?

A) Repayment of loan by other entity

B) Share buyback

C) Discount received

D) Discount allowed

A) Repayment of loan by other entity

B) Share buyback

C) Discount received

D) Discount allowed

B

4

Which of the following is NOT classified as an investing activity?

A) Purchase of plant and equipment

B) Sale of plant and equipment

C) Issue of shares

D) Purchase of shares in another company

A) Purchase of plant and equipment

B) Sale of plant and equipment

C) Issue of shares

D) Purchase of shares in another company

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

During the year, Penso Ltd received $50 000 from its customers, $5000 for the sale of a motor vehicle and $20 000 for the issue of shares. It paid $27 000 to suppliers and employees, $3000 for income tax and $50 000 for new machinery. In addition, it paid out $12 000 to redeem bonds. Its cash balance at the commencement of the year was $22 000. What were the cash flows from investing activities?

A) $8000

B) $45 000

C) ($45 000)

D) ($48 000)

A) $8000

B) $45 000

C) ($45 000)

D) ($48 000)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

During the year, Penso Ltd received $50 000 from its customers, $5000 for the sale of a motor vehicle and $20 000 for the issue of shares. It paid $27 000 to suppliers and employees, $3000 for income tax and $50 000 for new machinery. In addition, it paid out $12 000 to redeem bonds. Its cash balance at the commencement of the year was $22 000. What were the cash flows from operating activities?

A) $25 000

B) $23 000

C) ($17 000)

D) $20 000

A) $25 000

B) $23 000

C) ($17 000)

D) $20 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following cannot be classified under cash flow from operations?

A) Interest received

B) Dividends received

C) Interest paid

D) Dividends paid

A) Interest received

B) Dividends received

C) Interest paid

D) Dividends paid

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following does NOT involve a cash flow in 2016?

A) Payment in 2016 of insurance for 2017

B) Purchase of inventory in 2016, to be paid in 2017

C) Borrowing from the bank in 2016, to be repaid in 2018

D) Cash sales in 2016

A) Payment in 2016 of insurance for 2017

B) Purchase of inventory in 2016, to be paid in 2017

C) Borrowing from the bank in 2016, to be repaid in 2018

D) Cash sales in 2016

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is NOT an operating cash flow?

A) Cash sales

B) Payment of wages

C) Dividends paid

D) Interest paid

A) Cash sales

B) Payment of wages

C) Dividends paid

D) Interest paid

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is NOT classified as an investing activity?

A) Purchase of shares in BHP

B) Purchase of motor vehicle

C) Making a loan to another entity

D) Obtaining a loan from another entity

A) Purchase of shares in BHP

B) Purchase of motor vehicle

C) Making a loan to another entity

D) Obtaining a loan from another entity

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is NOT a financing cash flow?

A) Dividends received

B) Issue of shares

C) The borrowing of $10 000 from the bank

D) Share buybacks

A) Dividends received

B) Issue of shares

C) The borrowing of $10 000 from the bank

D) Share buybacks

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is NOT classified as a financing activity?

A) Issue of shares

B) Dividend payments

C) Sale of equipment

D) Borrowing from a finance company

A) Issue of shares

B) Dividend payments

C) Sale of equipment

D) Borrowing from a finance company

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is an operating cash flow?

A) Issue of shares

B) Purchase of equipment

C) Repayment of a loan

D) Receipt of cash from accounts receivable

A) Issue of shares

B) Purchase of equipment

C) Repayment of a loan

D) Receipt of cash from accounts receivable

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is NOT an example of financing cash flows?

A) Repayment of borrowings

B) Purchase of another entity

C) Proceeds from borrowings

D) Issue of shares

A) Repayment of borrowings

B) Purchase of another entity

C) Proceeds from borrowings

D) Issue of shares

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

What effect does increasing depreciation expense have on cash flows?

A) It increases operating cash flows.

B) It decreases operating cash flows.

C) It decreases investing cash flows.

D) It has no effect.

A) It increases operating cash flows.

B) It decreases operating cash flows.

C) It decreases investing cash flows.

D) It has no effect.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

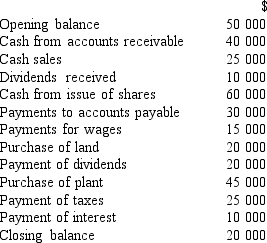

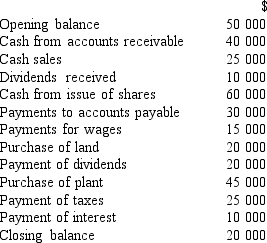

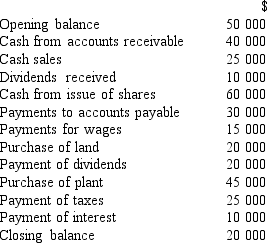

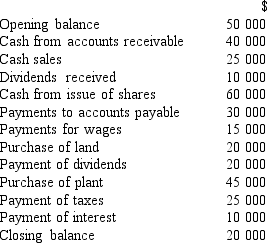

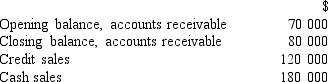

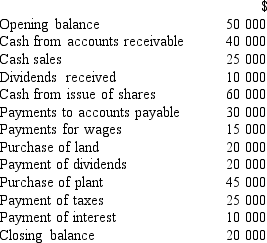

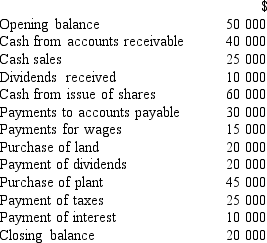

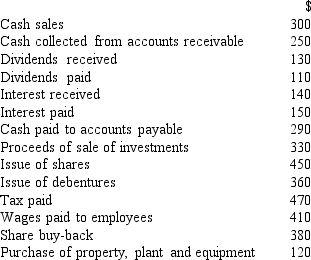

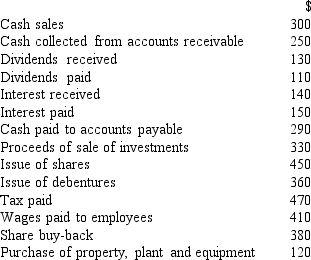

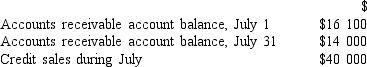

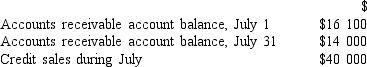

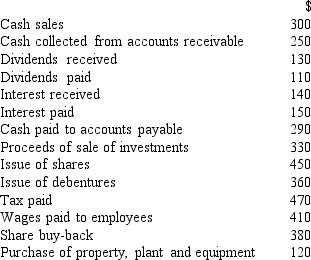

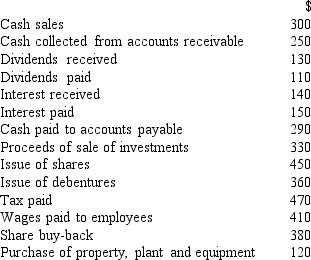

A summary of the entries in the Cash ledger account of Staple Ltd for the month of January was as follows:

What were the receipts from customers of Staple Ltd?

A) $25 000

B) $40 000

C) $65 000

D) $135 000

What were the receipts from customers of Staple Ltd?

A) $25 000

B) $40 000

C) $65 000

D) $135 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

During the year, Penso Ltd received $50 000 from its customers, $5000 for the sale of a motor vehicle and $20 000 for the issue of shares. It paid $27 000 to suppliers and employees, $3000 for income tax and $50 000 for new machinery. In addition, it paid out $12 000 to redeem bonds. Its cash balance at the commencement of the year was $22 000. What were the cash flows from financing activities?

A) $20 000

B) $8000

C) ($12 000)

D) ($28 000)

A) $20 000

B) $8000

C) ($12 000)

D) ($28 000)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following transactions does NOT involve a cash flow?

A) Prepayment of insurance

B) Issue of shares

C) Accrual of waged expense

D) Revenue received in advance

A) Prepayment of insurance

B) Issue of shares

C) Accrual of waged expense

D) Revenue received in advance

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

A summary of the entries in the Cash ledger account of Staple Ltd for the month of January was as follows:

What were the payments to suppliers and employees of Staple Ltd?

A) $45 000

B) $55 000

C) $80 000

D) $30 000

What were the payments to suppliers and employees of Staple Ltd?

A) $45 000

B) $55 000

C) $80 000

D) $30 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is NOT an investing cash flow?

A) Proceeds from the sale of equipment

B) Purchase of shares on the stock market

C) Purchase of another company

D) Repayment of debentures

A) Proceeds from the sale of equipment

B) Purchase of shares on the stock market

C) Purchase of another company

D) Repayment of debentures

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

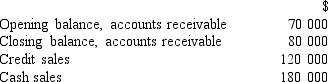

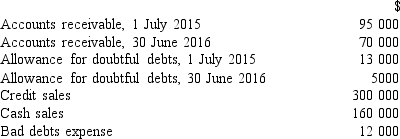

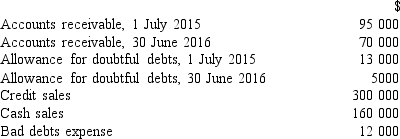

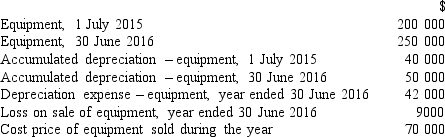

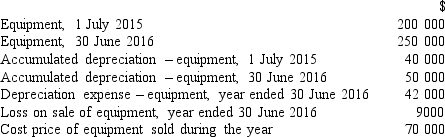

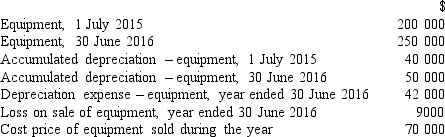

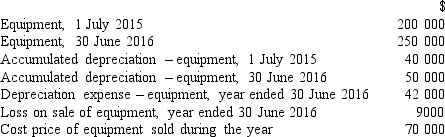

Given the following information for the year ended 30 June 2016:

What was the amount of cash received from customers?

A) $110 000

B) $180 000

C) $290 000

D) $310 000

What was the amount of cash received from customers?

A) $110 000

B) $180 000

C) $290 000

D) $310 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

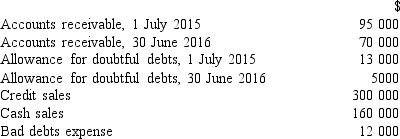

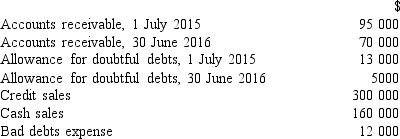

The following information is taken from the accounts of Birmingham Ltd for year ended 30 June 2016.

What was the amount of cash received from customers?

A) $305 000

B) $465 000

C) $485 000

D) None of the answers provided

What was the amount of cash received from customers?

A) $305 000

B) $465 000

C) $485 000

D) None of the answers provided

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

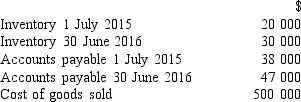

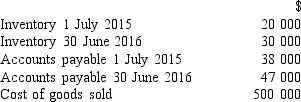

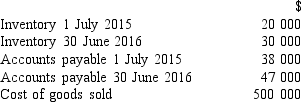

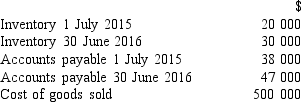

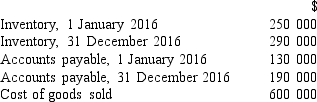

Use the information below to answer the following question.

The amount of cash paid to suppliers during the year was:

A) $10 000.

B) $501 000.

C) $510 000.

D) $519 000.

The amount of cash paid to suppliers during the year was:

A) $10 000.

B) $501 000.

C) $510 000.

D) $519 000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

If a gain of $70 000 is incurred in selling equipment that has a book value of $250 000, the total amount reported in the cash flows from the investing activities section of the statement of cash flows is:

A) $70 000.

B) $220 000.

C) $320 000.

D) $270 000.

A) $70 000.

B) $220 000.

C) $320 000.

D) $270 000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

Marion Company had these transactions during the first month of the new accounting period:

Sold merchandise for $9000 on credit; its cost was $5000 and it was purchased and paid for last year

Collected $3000 from an account receivable

Borrowed $10 000 from the bank

Paid dividends of $500

Using the above information, Marion would report net cash flow from operating activities for the new period as:

A) $2500.

B) $3000.

C) $8000.

D) none of the answers provided.

Sold merchandise for $9000 on credit; its cost was $5000 and it was purchased and paid for last year

Collected $3000 from an account receivable

Borrowed $10 000 from the bank

Paid dividends of $500

Using the above information, Marion would report net cash flow from operating activities for the new period as:

A) $2500.

B) $3000.

C) $8000.

D) none of the answers provided.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

Use the information below to answer the following question.

The amount of inventory purchased during the year was:

A) $490 000.

B) $500 000.

C) $510 000.

D) $520 000.

The amount of inventory purchased during the year was:

A) $490 000.

B) $500 000.

C) $510 000.

D) $520 000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

The cost of goods sold during the year was $50 000. Inventories were $11 500 and $9500 at the beginning and end of the year, respectively. Accounts payable were $5000 and $4000 at the beginning and end of the year, respectively. Using the direct method of reporting cash flows from operating activities, cash payments to accounts payable would total:

A) $49 000.

B) $47 000.

C) $51 000.

D) $53 000.

A) $49 000.

B) $47 000.

C) $51 000.

D) $53 000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

A summary of the entries in the Cash ledger account of Staple Ltd for the month of January was as follows:

What was the cash flow from financing activities of Staple Ltd?

A) $60 000

B) $40 000

C) ($20 000)

D) $20 000

What was the cash flow from financing activities of Staple Ltd?

A) $60 000

B) $40 000

C) ($20 000)

D) $20 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

Income tax expense was $200 000 for the year. Income tax payable was $20 000 at the beginning and $30 000 at the end of the year. Cash payment for income tax reported on the cash flow statement using the direct method is:

A) $200 000.

B) $190 000.

C) $220 000.

D) $230 000.

A) $200 000.

B) $190 000.

C) $220 000.

D) $230 000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

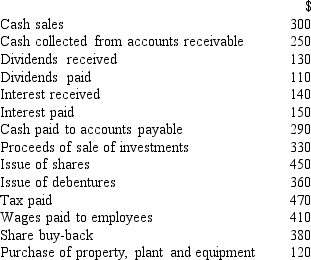

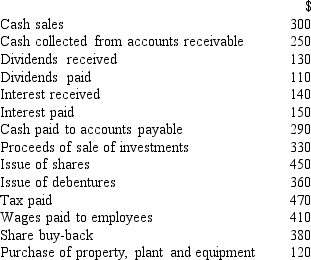

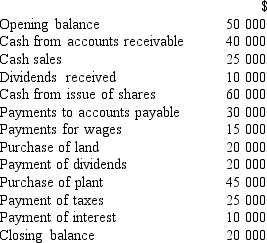

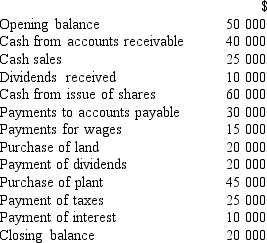

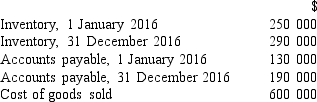

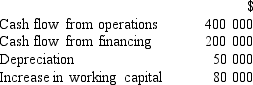

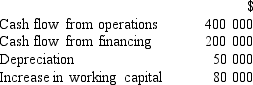

Use the information below to answer the following question.

What was the cash flow from financing activities?

A) $320

B) $430

C) ($40)

D) $700

What was the cash flow from financing activities?

A) $320

B) $430

C) ($40)

D) $700

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

Use the information below to answer the following question.

What was the cash flow from investing activities?

A) $570

B) $210

C) ($290)

D) ($330)

What was the cash flow from investing activities?

A) $570

B) $210

C) ($290)

D) ($330)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

The net profit reported on the income statement for the current year was $50 000. Depreciation on property, plant and equipment was $31 000. What is the amount of cash flows from operating activities that would appear on the statement of cash flows prepared using the indirect method?

A) $19 000

B) $49 000

C) $81 000

D) $80 000

A) $19 000

B) $49 000

C) $81 000

D) $80 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

A summary of the entries in the Cash ledger account of Staple Ltd for the month of January was as follows:

What was the cash flow from investing activities of Staple Ltd?

A) ($5000)

B) ($45 000)

C) ($65 000)

D) ($55 000)

What was the cash flow from investing activities of Staple Ltd?

A) ($5000)

B) ($45 000)

C) ($65 000)

D) ($55 000)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

The following information is taken from the accounts of Birmingham Ltd for year ended 30 June 2016.

What was the value of debts written off as irrecoverable during the year?

A) $5000

B) $8000

C) $12 000

D) $20 000

What was the value of debts written off as irrecoverable during the year?

A) $5000

B) $8000

C) $12 000

D) $20 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

Assume zero opening balances for all balance sheet accounts.

Credit sales of $100 000, of which $80 000 was received at year end

Paid wages of $40 000

Depreciation expenses was $8000

Net profit and cash flow from operations are respectively?

A) $32 000; $40 000

B) $52 000; $32 000

C) $52 000; $40 000

D) None of the answers provided

Credit sales of $100 000, of which $80 000 was received at year end

Paid wages of $40 000

Depreciation expenses was $8000

Net profit and cash flow from operations are respectively?

A) $32 000; $40 000

B) $52 000; $32 000

C) $52 000; $40 000

D) None of the answers provided

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

Determine the cash received from customers on account during July, based on the following data.

A) $37 900

B) $40 000

C) $42 100

D) $26 000

A) $37 900

B) $40 000

C) $42 100

D) $26 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

Use the information below to answer the following question.

What was the cash flow from operating activities?

A) ($90)

B) ($350)

C) ($610)

D) ($500)

What was the cash flow from operating activities?

A) ($90)

B) ($350)

C) ($610)

D) ($500)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

Given the following information, what was the amount paid to suppliers during the year?

A) $700 000

B) $580 000

C) $540 000

D) $240 000

A) $700 000

B) $580 000

C) $540 000

D) $240 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

The opening and closing balances of accounts receivable were $200 000 and $270 000 respectively. Sales on credit were $200 000. What was the amount of cash received from customers?

A) $130 000

B) $200 000

C) $270 000

D) $300 000

A) $130 000

B) $200 000

C) $270 000

D) $300 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

The prepaid insurance account showed an opening balance of $22 000 and a closing balance of $25 000. Insurance expense was $67 000. What was the cash payment for insurance?

A) $64 000

B) $67 000

C) $70 000

D) $45 000

A) $64 000

B) $67 000

C) $70 000

D) $45 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

The income tax payable account showed an opening balance of $62 000 and a closing balance of $75 000. Income tax expense was $68 000. What was the income tax paid?

A) $55 000

B) $68 000

C) $81 000

D) $62 000

A) $55 000

B) $68 000

C) $81 000

D) $62 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

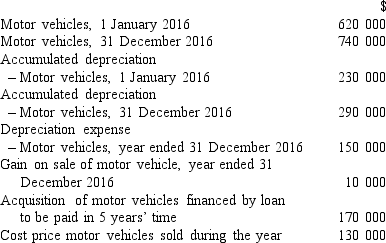

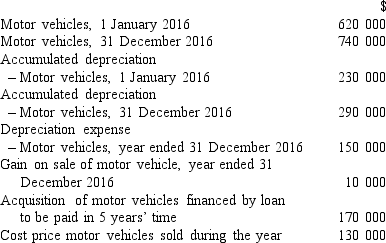

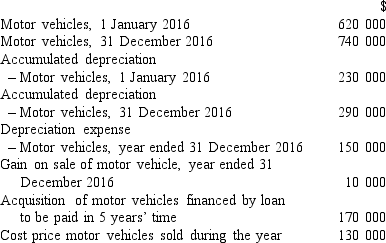

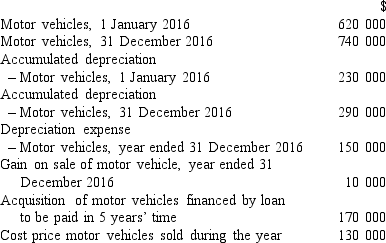

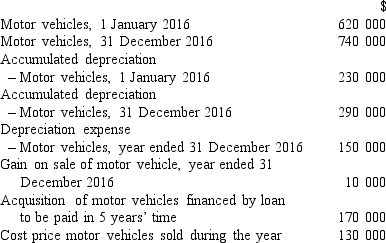

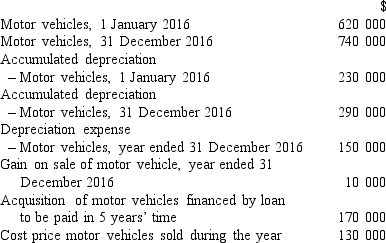

The following information is taken from the accounts of Ray Ltd.

What was the value of motor vehicles purchased for cash?

A) $140 000

B) $190 000

C) $250 000

D) $80 000

What was the value of motor vehicles purchased for cash?

A) $140 000

B) $190 000

C) $250 000

D) $80 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

The following information is taken from the accounts of Ray Ltd.

What were the proceeds from sale of motor vehicles?

A) $30 000

B) $40 000

C) $50 000

D) $140 000

What were the proceeds from sale of motor vehicles?

A) $30 000

B) $40 000

C) $50 000

D) $140 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

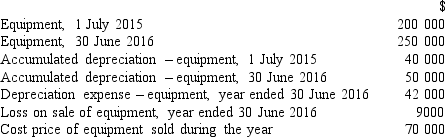

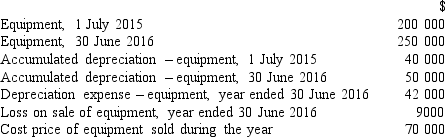

The following information is taken from the accounts of Spratt Ltd.

What were the proceeds from the sale of plant?

A) $9000

B) $19 000

C) $29 000

D) $47 000

What were the proceeds from the sale of plant?

A) $9000

B) $19 000

C) $29 000

D) $47 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

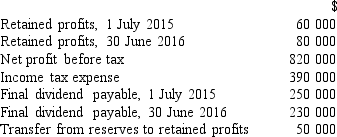

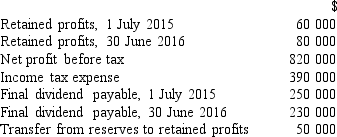

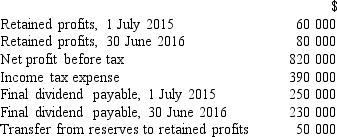

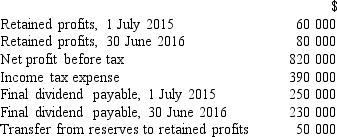

The following information is taken from the financial statements of Cyrus Ltd for the year ended 30 June 2016.

Dividends of $100 000 were declared during the year, and the balances in the dividends payable account at the beginning and end of the year were $15 000 and $25 000 respectively. What amount would be reported as payment of dividends in the cash flows from the financing activities section of the statement of cash flows?

A) $90 000

B) $25 000

C) $100 000

D) $110 000

Dividends of $100 000 were declared during the year, and the balances in the dividends payable account at the beginning and end of the year were $15 000 and $25 000 respectively. What amount would be reported as payment of dividends in the cash flows from the financing activities section of the statement of cash flows?

A) $90 000

B) $25 000

C) $100 000

D) $110 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

The following information is taken from the accounts of Spratt Ltd.

What was the accumulated depreciation on plant sold during the year?

A) $32 000

B) $42 000

C) $52 000

D) $40 000

What was the accumulated depreciation on plant sold during the year?

A) $32 000

B) $42 000

C) $52 000

D) $40 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

Using the following information, calculate net operating profit after tax.

A) $270 000

B) $430 000

C) $530 000

D) None of the answers provided

A) $270 000

B) $430 000

C) $530 000

D) None of the answers provided

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

The following information is taken from the accounts of Ray Ltd.

What was the accumulated depreciation on motor vehicles sold during the year?

A) $90 000

B) $150 000

C) $210 000

D) $80 000

What was the accumulated depreciation on motor vehicles sold during the year?

A) $90 000

B) $150 000

C) $210 000

D) $80 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

The following information is taken from the accounts of Spratt Ltd.

What was the value of plant purchased?

A) $20 000

B) $70 000

C) $88 000

D) $120 000

What was the value of plant purchased?

A) $20 000

B) $70 000

C) $88 000

D) $120 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

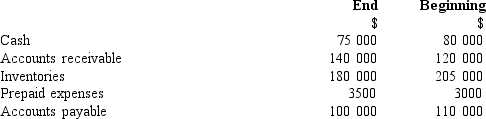

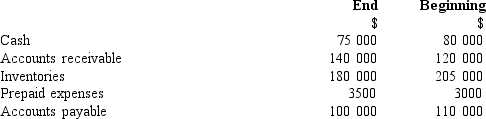

The net profit reported on the income statement for the current year was $100 000. Depreciation recorded on property, plant and equipment was $60 000. Balances of current asset and current liability accounts at the end and at the beginning of the year are listed below.

What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?

A) $94 000

B) $109 500

C) $154 500

D) $155 500

What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?

A) $94 000

B) $109 500

C) $154 500

D) $155 500

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is NOT added back to net income to obtain cash flow from operations?

A) Depreciation

B) Gain on sale of investment

C) Decrease in accounts receivable

D) Increase in accounts payable

A) Depreciation

B) Gain on sale of investment

C) Decrease in accounts receivable

D) Increase in accounts payable

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

Income tax expense was $200 000 for the year. Income tax payable was $20 000 at the beginning and $30 000 at the end of the year. Cash payment for income tax reported on the cash flow statement using the direct method is:

A) $200 000.

B) $190 000.

C) $220 000.

D) $230 000.

A) $200 000.

B) $190 000.

C) $220 000.

D) $230 000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

The wages payable account showed an opening balance of $27 000 and a closing balance of $42 000. Wages expense was $590 000. What was the cash payment for wages?

A) $575 000

B) $590 000

C) $605 000

D) $632 000

A) $575 000

B) $590 000

C) $605 000

D) $632 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements about the indirect method of presenting cash flow from operations is NOT true?

A) The direct and indirect methods give the same cash flow from operations.

B) Australian companies do not need to report information about the indirect method.

C) Depreciation expense is added back to operating profit in the indirect method.

D) Decreases in accounts payable are deducted from operating profit in the indirect method.

A) The direct and indirect methods give the same cash flow from operations.

B) Australian companies do not need to report information about the indirect method.

C) Depreciation expense is added back to operating profit in the indirect method.

D) Decreases in accounts payable are deducted from operating profit in the indirect method.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

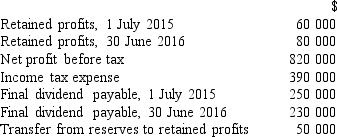

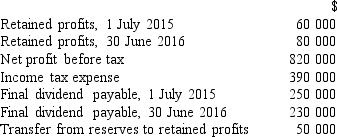

The following information is taken from the financial statements of Cyrus Ltd for the year ended 30 June 2016.

What was the amount of interim dividend paid during the year?

A) $620 000

B) $460 000

C) $230 000

D) $210 000

What was the amount of interim dividend paid during the year?

A) $620 000

B) $460 000

C) $230 000

D) $210 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

The following information is taken from the financial statements of Cyrus Ltd for the year ended 30 June 2016.

What were the total dividends paid during the year?

A) $250 000

B) $460 000

C) $480 000

D) $230 000

What were the total dividends paid during the year?

A) $250 000

B) $460 000

C) $480 000

D) $230 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

The retained profits of Franko Ltd at the beginning of the year were $270 000 and at the end of the year $320 000. Net profit after tax for the year was $510 000. During the year, $100 000 was transferred to general reserve. The proposed final dividend at the beginning of the year was $200 000 and at the end of the year $250 000. What was the amount of interim dividend paid during the year?

A) $110 000

B) $160 000

C) $260 000

D) $360 000

A) $110 000

B) $160 000

C) $260 000

D) $360 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

The net operating profit of Patrick Ltd was $31 000. Depreciation expense was $10 000 and gain on sale of equipment was $2000. Accounts receivable increased by $15 000 and inventory decreased by $7000. Accounts payable decreased by $8000. What was the cash flow from operations?

A) $47 000

B) $39 000

C) $25 000

D) $23 000

A) $47 000

B) $39 000

C) $25 000

D) $23 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

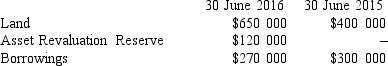

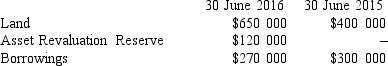

Consecutive balance sheets of Crow Ltd showed the following balances:

During the year ended 30 June 2016, land was revalued upwards by $120 000, and $80 000 was borrowed to acquire land. What was the value of land purchased for cash?

A) $50 000

B) $130 000

C) $170 000

D) $250 000

During the year ended 30 June 2016, land was revalued upwards by $120 000, and $80 000 was borrowed to acquire land. What was the value of land purchased for cash?

A) $50 000

B) $130 000

C) $170 000

D) $250 000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

Shippers Ltd made a net operating loss of $42 000. Depreciation expense was $80 000 and loss on sale of vessels was $170 000. Accounts receivable increased by $65 000 and inventory decreased by $18 000. Accounts payable increased by $160 000 and expenses payable decreased by $1000. What was the cash flow from operations?

A) $404 000

B) $320 000

C) ($20 000)

D) None of the answers provided

A) $404 000

B) $320 000

C) ($20 000)

D) None of the answers provided

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck