Deck 15: Administrative Procedures

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/103

Play

Full screen (f)

Deck 15: Administrative Procedures

1

The IRS provides advice concerning an issue that arises during an audit by issuing

A)a revenue ruling.

B)an audit memorandum.

C)a technical advice memorandum.

D)a private letter ruling.

A)a revenue ruling.

B)an audit memorandum.

C)a technical advice memorandum.

D)a private letter ruling.

C

2

Identify which of the following statements is false.

A)A Technical Advice Memorandum may be requested by an IRS auditor if the transaction in question involves an especially complex tax issue.

B)If the taxpayer being audited does not concur with the proposed assessment, the Service is required to send the taxpayer a 30-day letter detailing the proposed changes and the available appeals process.

C)During the audit process, if the taxpayer concurs with the assessment of tax by the IRS and signs Form 870 (Waiver of Restrictions on Assessment and Collection of Deficiency in Tax), then the taxpayer is precluded from filing a refund suit.

D)Interest on a deficiency accrues from the due date of the return through the payment date.

A)A Technical Advice Memorandum may be requested by an IRS auditor if the transaction in question involves an especially complex tax issue.

B)If the taxpayer being audited does not concur with the proposed assessment, the Service is required to send the taxpayer a 30-day letter detailing the proposed changes and the available appeals process.

C)During the audit process, if the taxpayer concurs with the assessment of tax by the IRS and signs Form 870 (Waiver of Restrictions on Assessment and Collection of Deficiency in Tax), then the taxpayer is precluded from filing a refund suit.

D)Interest on a deficiency accrues from the due date of the return through the payment date.

C

3

The IRS will issue a 90-day letter (a Statutory Notice of Deficiency)if the taxpayer does not file a protest letter within 30 days of the date of the 30-day letter.

True

4

The program specifically designed to identify returns with a high potential for a deficiency assessment is the

A)TCMP.

B)DIF program.

C)instant audit program.

D)1040 program.

A)TCMP.

B)DIF program.

C)instant audit program.

D)1040 program.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

5

Identify which of the following statements is false.

A)In general, the taxpayer has the burden of proof in Tax Court cases. However, the IRS has the burden of proof for issues raised after the issuance of the 90-day letter.

B)A taxpayer may want to avoid using the Tax Court to litigate an issue because decisions from this court cannot be appealed.

C)The Tax Court can be used to litigate a tax issue without first paying the tax assessment.

D)In order to litigate in the Tax Court, a petition must be filed within 90 days of the issuance of a notice of deficiency.

A)In general, the taxpayer has the burden of proof in Tax Court cases. However, the IRS has the burden of proof for issues raised after the issuance of the 90-day letter.

B)A taxpayer may want to avoid using the Tax Court to litigate an issue because decisions from this court cannot be appealed.

C)The Tax Court can be used to litigate a tax issue without first paying the tax assessment.

D)In order to litigate in the Tax Court, a petition must be filed within 90 days of the issuance of a notice of deficiency.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

6

A taxpayer will receive a 30-day letter

A)to notify him that the return was selected for audit.

B)after a response to the 90-day letter with a protest.

C)only if the taxpayer does not sign Form 870.

D)only if the taxpayer is more than 30 days late in filing the tax return.

A)to notify him that the return was selected for audit.

B)after a response to the 90-day letter with a protest.

C)only if the taxpayer does not sign Form 870.

D)only if the taxpayer is more than 30 days late in filing the tax return.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

7

Identify which of the following statements is false.

A)Appeals officers usually have the operating authority to settle disputes with taxpayers based on the "hazards of litigation."

B)When an appeals officer is dealing with an "appeals coordinated issue," he has the authority to settle with the taxpayer based on the "hazards of litigation."

C)A Technical Advice Memorandum may be requested by an IRS auditor if the transaction in question involves an especially complex tax issue.

D)If the taxpayer and the appeals officer fail to reach agreement, the IRS issues a 90-day letter.

A)Appeals officers usually have the operating authority to settle disputes with taxpayers based on the "hazards of litigation."

B)When an appeals officer is dealing with an "appeals coordinated issue," he has the authority to settle with the taxpayer based on the "hazards of litigation."

C)A Technical Advice Memorandum may be requested by an IRS auditor if the transaction in question involves an especially complex tax issue.

D)If the taxpayer and the appeals officer fail to reach agreement, the IRS issues a 90-day letter.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

8

The Internal Revenue Service is part of the

A)Congress.

B)Treasury Department.

C)Federal Bureau of Investigation.

D)U)S. Customs Department.

A)Congress.

B)Treasury Department.

C)Federal Bureau of Investigation.

D)U)S. Customs Department.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

9

Identify which of the following statements is true.

A)If a taxpayer has been audited in at least one of the two previous years on the same item and the earlier audit did not result in any additional tax owed, the taxpayer may qualify for the special audit relief rule.

B)A taxpayer can request and always receive an exemption from an audit by the IRS if his return was audited in at least one of the two previous years and the previous audit did not result in any change to his tax liability.

C)The signing of Form 870 allows the taxpayer to wait for 30 interest-free days after the billing date to pay the tax.

D)All of the above are true.

A)If a taxpayer has been audited in at least one of the two previous years on the same item and the earlier audit did not result in any additional tax owed, the taxpayer may qualify for the special audit relief rule.

B)A taxpayer can request and always receive an exemption from an audit by the IRS if his return was audited in at least one of the two previous years and the previous audit did not result in any change to his tax liability.

C)The signing of Form 870 allows the taxpayer to wait for 30 interest-free days after the billing date to pay the tax.

D)All of the above are true.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

10

In order to appeal to the Appeals Division, a taxpayer must submit a protest letter to the IRS

A)if an office audit is involved.

B)as a response to receiving a 30-day letter.

C)in a field audit involving an assessment of taxes, interest, and penalties in excess of $25,000.

D)if a TCMP audit is involved.

A)if an office audit is involved.

B)as a response to receiving a 30-day letter.

C)in a field audit involving an assessment of taxes, interest, and penalties in excess of $25,000.

D)if a TCMP audit is involved.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

11

How long does a taxpayer have to file a petition with the U.S. Tax Court following the date of the Statutory Notice of Deficiency?

A)90 days

B)three months

C)180 days

D)30 days

A)90 days

B)three months

C)180 days

D)30 days

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

12

Explain how the Internal Revenue Service is organized to be efficient and client-oriented.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

13

The majority of the individual tax returns that are audited are selected under the DIF program.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

14

Identify which of the following statements is true.

A)Form 870-AD is used if the taxpayer and IRS representative agree to a lesser tax liability than that originally proposed by the Service.

B)Signing of Form 870-AD by the taxpayer does not generally preclude the subsequent filing of a refund claim.

C)The IRS will issue a 90-day letter (a Statutory Notice of Deficiency)if the taxpayer does not file a protest letter within 10 days of the date of the 30-day letter.

D)All of the above are false.

A)Form 870-AD is used if the taxpayer and IRS representative agree to a lesser tax liability than that originally proposed by the Service.

B)Signing of Form 870-AD by the taxpayer does not generally preclude the subsequent filing of a refund claim.

C)The IRS will issue a 90-day letter (a Statutory Notice of Deficiency)if the taxpayer does not file a protest letter within 10 days of the date of the 30-day letter.

D)All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

15

Identify which of the following statements is true.

A)The 90-day letter offers the taxpayer the choice of paying the tax assessed or filing a petition refuting the tax assessment with the Tax Court.

B)A taxpayer can choose to initiate tax litigation in a U.S. district court, the Tax Court, or a Court of Appeals.

C)The IRS cannot raise a new tax issue after issuance of the Statutory Notice of Deficiency (90-day letter).

D)All of the above are false.

A)The 90-day letter offers the taxpayer the choice of paying the tax assessed or filing a petition refuting the tax assessment with the Tax Court.

B)A taxpayer can choose to initiate tax litigation in a U.S. district court, the Tax Court, or a Court of Appeals.

C)The IRS cannot raise a new tax issue after issuance of the Statutory Notice of Deficiency (90-day letter).

D)All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

16

The court in which the taxpayer does not have to pay the tax and then litigate for a refund is the

A)U)S. Court of Federal Claims.

B)Federal district court.

C)Tax Court.

D)all of the above

A)U)S. Court of Federal Claims.

B)Federal district court.

C)Tax Court.

D)all of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

17

If the taxpayer has credible evidence, the IRS bears the burden of proof in a tax dispute.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

18

Identify which of the following statements is false.

A)If the phrase "Entered under Rule 155" appears at the end of the Tax Court's opinion, the litigating parties must jointly determine the additional tax due.

B)A taxpayer does not have to pay the tax assessment before filing suit in a U.S. district court or the U.S. Court of Federal Claims.

C)Either the taxpayer or the government can appeal the decision of a court of original jurisdiction to the next higher court with the potential for a final ruling from the U.S. Supreme Court if a writ of certiorari is granted.

D)All of the above are false.

A)If the phrase "Entered under Rule 155" appears at the end of the Tax Court's opinion, the litigating parties must jointly determine the additional tax due.

B)A taxpayer does not have to pay the tax assessment before filing suit in a U.S. district court or the U.S. Court of Federal Claims.

C)Either the taxpayer or the government can appeal the decision of a court of original jurisdiction to the next higher court with the potential for a final ruling from the U.S. Supreme Court if a writ of certiorari is granted.

D)All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

19

The 90-day letter (Statutory Notice of Deficiency)gives the taxpayer 90 days to file a petition with the Tax Court or to pay the disputed tax.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

20

Identify which of the following statements is false.

A)The majority of the individual tax returns that are audited are selected under the DIF program.

B)The TCMP audit program has been temporarily suspended by the IRS and replaced in part by lifestyle audits.

C)The IRS is authorized to pay a reward to individuals who provide information resulting in increased collections.

D)All of the above are false.

A)The majority of the individual tax returns that are audited are selected under the DIF program.

B)The TCMP audit program has been temporarily suspended by the IRS and replaced in part by lifestyle audits.

C)The IRS is authorized to pay a reward to individuals who provide information resulting in increased collections.

D)All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

21

Identify which of the following statements is false.

A)So-called private letter rulings are made public after confidential information is eliminated.

B)A letter ruling is a written statement issued to a taxpayer by the IRS that interprets and applies the tax laws to that taxpayer's specific set of facts.

C)Only the taxpayer can appeal the decision of a court of original jurisdiction to the next higher court.

D)If the Supreme Court decides to hear a case, it grants certiorari.

A)So-called private letter rulings are made public after confidential information is eliminated.

B)A letter ruling is a written statement issued to a taxpayer by the IRS that interprets and applies the tax laws to that taxpayer's specific set of facts.

C)Only the taxpayer can appeal the decision of a court of original jurisdiction to the next higher court.

D)If the Supreme Court decides to hear a case, it grants certiorari.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following items can be omitted from a taxpayer's request for a ruling?

A)names, addresses, and taxpayer identification numbers of all interested parties

B)a detailed explanation of the transaction

C)the particular conclusion desired by the taxpayer

D)the location of the IRS district office that has examination jurisdiction

A)names, addresses, and taxpayer identification numbers of all interested parties

B)a detailed explanation of the transaction

C)the particular conclusion desired by the taxpayer

D)the location of the IRS district office that has examination jurisdiction

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

23

Explain the four conditions that must be met in civil cases for the burden of proving any factual issue relevant to the determination of taxpayer liability to rest with the IRS.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

24

Identify which of the following statements is false.

A)The IRS will not issue a ruling on the topic of whether compensation is reasonable.

B)Tax returns for all taxpayers must be filed on or before the fifteenth day of the fourth month following the year-end.

C)A corporation must file a tax return even if it has no gross income.

D)Extensions of time for filing tax returns may be obtained.

A)The IRS will not issue a ruling on the topic of whether compensation is reasonable.

B)Tax returns for all taxpayers must be filed on or before the fifteenth day of the fourth month following the year-end.

C)A corporation must file a tax return even if it has no gross income.

D)Extensions of time for filing tax returns may be obtained.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

25

Explain one of the two exceptions to imposing interest from the original due date of the tax return until the date the tax deficiency is paid.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

26

Identify which of the following statements is false.

A)The IRS issues annually a revenue procedure that prescribes how a letter ruling should be requested and the information to be contained in the ruling request.

B)The request for a ruling may contain a suggested conclusion (or answer)that the taxpayer proposes that the IRS adopt in the described situation.

C)As a practical consideration, taxpayers always find it preferable to obtain an advance ruling on questionable tax situations.

D)Third parties may not cite private letter rulings as authority for the tax consequences of their transactions.

A)The IRS issues annually a revenue procedure that prescribes how a letter ruling should be requested and the information to be contained in the ruling request.

B)The request for a ruling may contain a suggested conclusion (or answer)that the taxpayer proposes that the IRS adopt in the described situation.

C)As a practical consideration, taxpayers always find it preferable to obtain an advance ruling on questionable tax situations.

D)Third parties may not cite private letter rulings as authority for the tax consequences of their transactions.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

27

The IRS will issue a ruling

A)on prospective transactions only.

B)only if regulations have been issued on the subject.

C)on a completed transaction for which a return has been filed.

D)to clarify the tax treatment of a transaction.

A)on prospective transactions only.

B)only if regulations have been issued on the subject.

C)on a completed transaction for which a return has been filed.

D)to clarify the tax treatment of a transaction.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

28

The "automatic" extension period for filing an individual return is seven months.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

29

Identify which of the following statements is false.

A)In addition to interest, taxpayers may be subject to penalties for failure to file on time and failure to pay taxes by the due date for the return.

B)The failure-to-file penalty is levied against taxpayers who do not file a return by its due date at a rate of 5% per month (or fraction of a month)with a maximum additional penalty of 25%.

C)The failure-to-pay penalty is imposed at a rate of 5% per month (or fraction of a month)with a maximum penalty of 25%.

D)A different interest rate is charged to corporate and noncorporate taxpayers.

A)In addition to interest, taxpayers may be subject to penalties for failure to file on time and failure to pay taxes by the due date for the return.

B)The failure-to-file penalty is levied against taxpayers who do not file a return by its due date at a rate of 5% per month (or fraction of a month)with a maximum additional penalty of 25%.

C)The failure-to-pay penalty is imposed at a rate of 5% per month (or fraction of a month)with a maximum penalty of 25%.

D)A different interest rate is charged to corporate and noncorporate taxpayers.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

30

A letter ruling is a written determination that interprets and applies the tax laws to the taxpayer's specific set of facts.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

31

Identify which of the following statements is true.

A)A partnership is not required to file a return if the partnership has no income for the year.

B)The "automatic" extension period for filing an individual return is five months.

C)Individuals and calendar year-end corporations may obtain six-month extensions for paying taxes and filing their returns for the taxable year by filing the appropriate extension requests.

D)All of the above are false.

A)A partnership is not required to file a return if the partnership has no income for the year.

B)The "automatic" extension period for filing an individual return is five months.

C)Individuals and calendar year-end corporations may obtain six-month extensions for paying taxes and filing their returns for the taxable year by filing the appropriate extension requests.

D)All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

32

If a return's due date is extended, a taxpayer

A)also extends the period in which to pay taxes without interest.

B)still should pay the tax by the original return due date.

C)has 30 days following the original due date to pay estimated taxes without penalty.

D)has 30 days following the original due date to pay estimated taxes without interest.

A)also extends the period in which to pay taxes without interest.

B)still should pay the tax by the original return due date.

C)has 30 days following the original due date to pay estimated taxes without penalty.

D)has 30 days following the original due date to pay estimated taxes without interest.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

33

The maximum failure to file penalty is a total of 25% of the underpayment.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

34

Identify which of the following statements is false.

A)Interest is imposed on any tax not paid by the due date of the return (determined without regard to extensions).

B)Interest is charged on underpayments, or paid on overpayments, at a rate of three percentage points higher than the federal short-term rate.

C)Interest on underpayments is calculated using daily compounding and covers a time period from the original due date of the return until the date of payment.

D)Any tax not paid by the due date for the return is subject to an interest charge.

A)Interest is imposed on any tax not paid by the due date of the return (determined without regard to extensions).

B)Interest is charged on underpayments, or paid on overpayments, at a rate of three percentage points higher than the federal short-term rate.

C)Interest on underpayments is calculated using daily compounding and covers a time period from the original due date of the return until the date of payment.

D)Any tax not paid by the due date for the return is subject to an interest charge.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

35

An automatic extension of time from the regular filing date for an individual tax return may be received, without giving the IRS a reason, for

A)2 months.

B)3 months.

C)4 months.

D)6 months.

A)2 months.

B)3 months.

C)4 months.

D)6 months.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

36

A calendar-year individual taxpayer files last year's income tax return on July 1 of the current year. No extension was requested, and there is not a reasonable cause for the late filing. The return shows a balance due of $800 of tax. The late filing penalty is

A)$0.

B)$40.

C)$80.

D)$120.

A)$0.

B)$40.

C)$80.

D)$120.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

37

A calendar-year individual taxpayer files last year's income tax return on October 17 of the current year. No extension was requested, and there is not a reasonable cause for the late filing. The return shows a balance due of $1,500 of tax. The late filing penalty is

A)$0.

B)$75.

C)$375.

D)$450.

A)$0.

B)$75.

C)$375.

D)$450.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

38

A taxpayer who fails to file and fails to pay taxes is subject to a combined 5% monthly penalty on the underpayment.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

39

In which of the situations below will a taxpayer not be assessed interest on the tax remitted?

A)An extension is obtained and the tax is paid within the extension period.

B)A timely return is filed but the taxpayer must delay payment of the taxes.

C)The return is audited and additional tax is owed.

D)None of the above situations.

A)An extension is obtained and the tax is paid within the extension period.

B)A timely return is filed but the taxpayer must delay payment of the taxes.

C)The return is audited and additional tax is owed.

D)None of the above situations.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

40

Which one of the following statements about letter rulings is false?

A)If a taxpayer requests and pays for a ruling, the IRS must respond to his request by issuing a ruling.

B)A ruling is a response to a taxpayer's specific set of facts.

C)Rulings become public information.

D)The IRS issues revenue procedures periodically, which prescribe the information that must be supplied with a ruling request.

A)If a taxpayer requests and pays for a ruling, the IRS must respond to his request by issuing a ruling.

B)A ruling is a response to a taxpayer's specific set of facts.

C)Rulings become public information.

D)The IRS issues revenue procedures periodically, which prescribe the information that must be supplied with a ruling request.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

41

Gerald requests an extension for filing his last year's individual income tax return. His tax liability is $10,000, of which $8,000 was withheld, leaving a balance due of $2,000 when he files on August 1 of the current year. His penalty for failure to pay the tax on time is

A)$0.

B)$40.

C)$300.

D)$400.

A)$0.

B)$40.

C)$300.

D)$400.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

42

On July 25 of the following year, Joy files her current calendar-year tax return without having requested an extension. On October 8, she pays the amount due. The tax shown on her return is $25,000. Her current-year withholding tax is $20,000. Joy pays no estimated taxes and does not claim any tax credits on her current year return. Calculate the penalties that the IRS is likely to assess. Ignore the penalty for underpayment of estimated taxes. Assume she did not commit fraud.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

43

The taxes shown on Kate's tax returns for 2017 and 2018 were $6,000 and $9,000, respectively. Kate's withholding tax for 2018 was $7,000 and she paid no estimated taxes. Kate filed her 2018 return on April 3, 2019, but she did not have sufficient funds to pay the balance due. She pays the $2,000 balance due on June 19, 2019. Kate's AGI for 2018 did not exceed $150,000. Calculate the penalties Kate owes on her 2018 tax return.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

44

On August 13 of the following year, Joy files her current calendar-year tax return and pays the amount due without having requested an extension. The tax shown on her return is $25,000. Her current-year withholding tax is $15,000. Joy pays no estimated taxes and does not claim any tax credits on her current-year return. Will Joy owe interest, and if so, on what amount and for how many days?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

45

Pete has reported a tax liability of $3,500 on his two years ago. Last year his withholding was $3,800. He did not last year's return until June of this year. What penalties does Pete owe?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

46

A substantial understatement of tax liability involves which of the following?

A)understatement of tax exceeding the greater of 10% of tax required to be shown on the return or $5,000 for individuals

B)underpayment of tax exceeding the greater of 15% of the tax required to be shown on the return or $5,000 for individuals

C)underpayment of tax exceeding the lesser of 25% of the tax required to be shown on the return or $5,000 for individuals

D)$10,000 or more difference between the amount shown on the return and the correct amount due

A)understatement of tax exceeding the greater of 10% of tax required to be shown on the return or $5,000 for individuals

B)underpayment of tax exceeding the greater of 15% of the tax required to be shown on the return or $5,000 for individuals

C)underpayment of tax exceeding the lesser of 25% of the tax required to be shown on the return or $5,000 for individuals

D)$10,000 or more difference between the amount shown on the return and the correct amount due

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

47

A taxpayer's return is audited and additional taxes are assessed. The IRS also asserts that a negligence penalty should be assessed. The taxpayer concurs with the additional $15,000 tax liability; $7,000 of this amount is attributable to negligence. What is the amount of the penalty for negligence?

A)$700

B)$1,400

C)$5,600

D)$1,750

A)$700

B)$1,400

C)$5,600

D)$1,750

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

48

Paul's tax liability for last year was $30,000. Paul projects that his tax for this year will be $40,000. Paul is self-employed and, thus, will have no withholding. His AGI for last year did not exceed $150,000. How much estimated tax should Paul pay for this year to avoid the penalty for underpayment of estimated taxes?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

49

Lucy files her current-year individual income tax return on August 5 of the following year, without having requested an extension. Her total tax is $10,000. Lucy pays $7,500 in a timely manner and the $2,500 balance when she files the return. Lucy did not engage in fraud and has no reasonable cause for late filing and late payment. Compute Lucy's penalties.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

50

A $500 penalty for each instance of failing to comply with the due diligence requirements for determining eligibility applies to which of the following?

A)Head of Household

B)Hope and Lifetime Learning Credit

C)Child Tax Credit and Earned Income Tax Credit

D)All of the above

A)Head of Household

B)Hope and Lifetime Learning Credit

C)Child Tax Credit and Earned Income Tax Credit

D)All of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

51

A taxpayer can automatically escape the penalty for underpayment of taxes by

A)owing less than $1,000 in taxes over and above the taxes withheld from wages.

B)owing taxes in the previous year.

C)having a casualty loss.

D)none of the above

A)owing less than $1,000 in taxes over and above the taxes withheld from wages.

B)owing taxes in the previous year.

C)having a casualty loss.

D)none of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

52

Identify which of the following statements is true.

A)The failure-to-pay penalty is waived if the additional tax due with the filing of the extended return does not exceed 15% of the tax owed for the year.

B)If both the failure-to-file and the failure-to-pay penalties are owed, the taxpayer will incur a maximum addition to tax of 5.5% per month.

C)Individuals having substantial income from sources not subject to regular withholding generally should make quarterly estimated tax payments to the IRS.

D)All of the above are false.

A)The failure-to-pay penalty is waived if the additional tax due with the filing of the extended return does not exceed 15% of the tax owed for the year.

B)If both the failure-to-file and the failure-to-pay penalties are owed, the taxpayer will incur a maximum addition to tax of 5.5% per month.

C)Individuals having substantial income from sources not subject to regular withholding generally should make quarterly estimated tax payments to the IRS.

D)All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

53

If Brad files his last year's individual tax return on July 5 of the current year after having requested an extension, what is the amount of his failure-to-pay penalty if his total tax is $10,000 and he paid $9,500 through timely withholding and $500 with the return?

A)$0

B)$6

C)$60

D)none of the above

A)$0

B)$6

C)$60

D)none of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

54

Jeff's tax liability for last year was $30,000. Jeff projects that his tax for this year will be only $25,000. Jeff is self-employed and, thus, will have no withholding. His AGI for last year did not exceed $150,000. How much estimated tax, at a minimum, should Jeff pay for this year to avoid the penalty for underpayment of estimated taxes? How would your answer change if his income exceeded last year's due to a large capital gain at the end of the year?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is not a reason for relief from the substantial understatement penalty?

A)disclosure of the relevant facts pertaining to the questionable tax return position

B)substantial authority for the tax return position

C)reliance on a tax return preparer

D)reasonable cause and a good faith effort to comply with the tax law

A)disclosure of the relevant facts pertaining to the questionable tax return position

B)substantial authority for the tax return position

C)reliance on a tax return preparer

D)reasonable cause and a good faith effort to comply with the tax law

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

56

On August 13 of the following year, Joy files her current calendar-year tax return and pays the amount due without having requested an extension. The tax shown on her return is $25,000. Her current-year withholding tax is $15,000. Joy pays no estimated taxes and does not claim any tax credits on her current-year return. Calculate the penalties that the IRS is likely to assess. Ignore the penalty for underpayment of estimated taxes. Assume she did not commit fraud.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

57

Billy, a calendar-year taxpayer, files his current year individual tax return on August 17 of the following year without having requested an extension. His return reports an amount due of $5,000. Billy pays this amount on November 23 of the following year. What are Billy's penalties for his failure to file and his failure to pay his tax on time? Assume Billy did not commit fraud.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

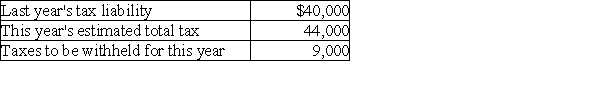

58

Your client wants to avoid any penalty for underpayment of estimated taxes by making timely deposits. Determine the amount of the minimum quarterly estimated tax payments required to avoid the penalty. Assume your client's adjusted gross income last year was $140,000.

A)$7,650

B)$7,750

C)$8,750

D)$11,000

A)$7,650

B)$7,750

C)$8,750

D)$11,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

59

On July 25 of the following year, Joy files her current calendar-year tax return. She had requested extensions as required. On October 8, she pays the amount due. The tax shown on her return is $22,000. Her current-year withholding tax is $21,000. Joy pays no estimated taxes and does not claim any tax credits on her current-year return. Calculate the penalties that the IRS is likely to assess. Ignore the penalty for underpayment of estimated taxes. Assume she did not commit fraud.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

60

On July 25 of the following year, Joy files her current calendar-year tax return without having requested an extension. On October 8, she pays the amount due. The tax shown on her return is $25,000. Her current-year withholding tax is $20,000. Joy pays no estimated taxes and does not claim any tax credits on her current-year return. Assume she did not commit fraud. Will Joy owe interest, and if so, on what amount and for how many days?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

61

A six-year statute of limitation rule applies if the taxpayer

A)understates taxable income by 25%.

B)understates AGI by 25%.

C)understates gross income by 25%.

D)none of the above

A)understates taxable income by 25%.

B)understates AGI by 25%.

C)understates gross income by 25%.

D)none of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

62

What is the requirement for a substantial understatement of tax for individuals?

A)The understatement exceeds 10% of the tax required to be shown on the return.

B)The understatement exceeds $5,000.

C)The understatement exceeds the lesser of 10% of the tax required to be shown on the return or $5,000.

D)The understatement exceeds the greater of 10% of the tax required to be shown on the return or $5,000.

A)The understatement exceeds 10% of the tax required to be shown on the return.

B)The understatement exceeds $5,000.

C)The understatement exceeds the lesser of 10% of the tax required to be shown on the return or $5,000.

D)The understatement exceeds the greater of 10% of the tax required to be shown on the return or $5,000.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

63

The IRS audited the tax returns of Dan Jackson, a gifted painter. The IRS contends for several years, Jackson received $500,000 for his paintings, but reported non cash payments of $75,000. Jackson attributed the shortfall to his receipt of cash at art fairs and street fairs. He allegedly concealed the cash payments in separate bank accounts unbeknownst to his CPA. What tax compliance issues regarding the alleged underreporting are pertinent to the CPA?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

64

The statute of limitations is unlimited for a tax return that is never filed.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

65

Identify which of the following statements is true.

A)An individual taxpayer may be subject to a penalty for underpayment of estimated taxes if his balance of tax due when he files is $500.

B)A penalty for substantial understatement will potentially be assessed on an individual if the underpayment of tax exceeds the greater of 15% of the tax shown on the return or $5,000.

C)Substantial authority exists for a position that is supported by a decision rendered by the Court of Appeals for the taxpayer's own circuit.

D)All of the above are true.

A)An individual taxpayer may be subject to a penalty for underpayment of estimated taxes if his balance of tax due when he files is $500.

B)A penalty for substantial understatement will potentially be assessed on an individual if the underpayment of tax exceeds the greater of 15% of the tax shown on the return or $5,000.

C)Substantial authority exists for a position that is supported by a decision rendered by the Court of Appeals for the taxpayer's own circuit.

D)All of the above are true.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

66

The statute of limitations, which stipulates the time frame within which either the government or the taxpayer may request a redetermination of tax due, usually expires 6 years after the date on which the return is filed.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

67

You are preparing the tax return for Agre Corporation, which has sales of $50 million. Agre made a $2 million expenditure for which the appropriate tax treatment, deductible or capitalizable, is a gray area. The corporation's Chief Financial Officer wants you to deduct the expenditure. What tax compliance issues should you consider in deciding whether to deduct the expenditure?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

68

What is the difference between the burden of proof for civil and criminal fraud?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

69

Steve files his return on April 1 and pays the entire amount of tax for the year at that time, $5,000. He is audited and pays the deficiency of $1,500 two years later. The maximum amount Steve may file a claim for refund for eighteen months later is

A)$6,500.

B)$5,000.

C)$1,500.

D)some other amount.

A)$6,500.

B)$5,000.

C)$1,500.

D)some other amount.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

70

Identify which of the following statements is false.

A)If fraud is asserted in a tax transaction, the burden of proof falls on the IRS.

B)The civil fraud penalty consists of 75% of the tax underpayment attributable to fraud plus 25% of the interest payable on the portion of the underpayment resulting from the fraud.

C)The government must prove its case "beyond a reasonable doubt" in order for the court or jury to convict a taxpayer of criminal fraud.

D)The fraud penalty can be imposed with respect to income, gift, and estate tax returns.

A)If fraud is asserted in a tax transaction, the burden of proof falls on the IRS.

B)The civil fraud penalty consists of 75% of the tax underpayment attributable to fraud plus 25% of the interest payable on the portion of the underpayment resulting from the fraud.

C)The government must prove its case "beyond a reasonable doubt" in order for the court or jury to convict a taxpayer of criminal fraud.

D)The fraud penalty can be imposed with respect to income, gift, and estate tax returns.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

71

Linda's individual tax return for the current year is subject to an IRS audit. The IRS assesses a $10,000 deficiency, $4,000 of which is due to Linda's negligence. What is Linda's negligence penalty?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

72

Identify which of the following statements is true.

A)The statute of limitations, which stipulates the time frame within which either the government or the taxpayer may request a redetermination of tax due, usually expires six years after the date on which the return is filed.

B)The statute of limitations limits the time during which a taxpayer may claim a refund of an overpayment of tax.

C)If a taxpayer omits from gross income an amount in excess of 25% of the gross income shown on his return, the statute of limitations is five years.

D)All of the above are true.

A)The statute of limitations, which stipulates the time frame within which either the government or the taxpayer may request a redetermination of tax due, usually expires six years after the date on which the return is filed.

B)The statute of limitations limits the time during which a taxpayer may claim a refund of an overpayment of tax.

C)If a taxpayer omits from gross income an amount in excess of 25% of the gross income shown on his return, the statute of limitations is five years.

D)All of the above are true.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

73

Richard recently won a popular television reality show and its one million dollar prize. However, he omitted the prize money from his tax return for the year. What penalties can the IRS assess?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

74

How does a taxpayer determine if "substantial authority" exists for a tax treatment the taxpayer desires to adopt?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

75

Terry files his return on March 31. The return shows taxes of $6,000, and Terry pays this entire amount when he files his return. By what time must he file a claim of refund?

A)the later of two years from the return filing or three years from the date the tax is paid

B)the later of three years from the return due date or two years from the date the tax is paid

C)two years from the payment of tax date, if the IRS mails a notice of deficiency in the third year following the due date of the return

D)four years from the payment of tax date, if the IRS mails a notice of deficiency

A)the later of two years from the return filing or three years from the date the tax is paid

B)the later of three years from the return due date or two years from the date the tax is paid

C)two years from the payment of tax date, if the IRS mails a notice of deficiency in the third year following the due date of the return

D)four years from the payment of tax date, if the IRS mails a notice of deficiency

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

76

Identify which of the following statements is true.

A)If a taxpayer fails to file a return, the statute of limitations is extended to 10 years.

B)If a couple files a joint return but only one spouse had income, only the spouse with income is responsible for paying any tax due.

C)Joint and several liability means that each spouse is potentially liable for the full amount of tax due.

D)All of the above are false.

A)If a taxpayer fails to file a return, the statute of limitations is extended to 10 years.

B)If a couple files a joint return but only one spouse had income, only the spouse with income is responsible for paying any tax due.

C)Joint and several liability means that each spouse is potentially liable for the full amount of tax due.

D)All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

77

Pablo, a bachelor, owes $80,000 of additional taxes, all due to fraud. What is the amount of the civil fraud penalty? What criminal fraud penalty might be imposed under Sec. 7201?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

78

On April 15, 2018, a married couple filed their joint 2017 tax return showing gross income of $120,000. Their return was prepared by a professional tax preparer who mistakenly omitted $45,000 of income, which the preparer in good faith considered to be nontaxable. No information with regard to this omitted income was disclosed on the return or attached statements. By what date must the IRS assert a notice of deficiency before the statute of limitations expires?

A)April 15, 2024

B)December 31, 2018

C)April 15, 2021

D)December 31, 2024

A)April 15, 2024

B)December 31, 2018

C)April 15, 2021

D)December 31, 2024

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

79

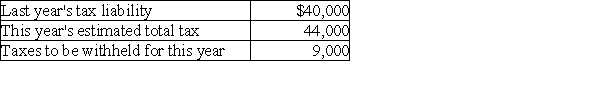

Latka Novatny gave you the following information to use in the preparation of his current year's tax return:  In addition, he received $40,000 from a relative for whom he had worked previously. You have researched whether the $40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classifying it as a gift. What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

In addition, he received $40,000 from a relative for whom he had worked previously. You have researched whether the $40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classifying it as a gift. What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

In addition, he received $40,000 from a relative for whom he had worked previously. You have researched whether the $40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classifying it as a gift. What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

In addition, he received $40,000 from a relative for whom he had worked previously. You have researched whether the $40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classifying it as a gift. What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

80

The IRS audits Kiara's current-year individual return and determines that, among other errors, she negligently did not report dividend income of $10,000. The deficiency with respect to the dividends is $2,800. The IRS argues for an additional $12,000 deficiency for various other errors that do not involve negligence. What is Kiara's negligence penalty for the $14,800 in deficiencies?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck