Deck 16: Rollovers Under Section 85

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/85

Play

Full screen (f)

Deck 16: Rollovers Under Section 85

1

A Section 85 rollover can result in an ITA 15(1)shareholder benefit to the transferor. Explain how this benefit can arise.

An ITA 15(1)shareholder benefit will arise in a Section 85(1)rollover if the transferor takes back total consideration that has a fair market value that exceeds the fair market value of the assets that he has transferred.

2

In deciding on the elected value to be used in an ITA 85 rollover, there are general rules that are applicable to all assets. Briefly describe these rules.

The general rules applicable to the elected value in a Section 85 rollover can be described as follows:

Ceiling Value - Fair market value of the asset transferred to the corporation.

Floor Value - The floor value will be equal to the greater of:

• the fair market value of the non-share consideration (boot)given to the transferor in return for the assets transferred; and

• the tax values (adjusted cost base or UCC)of the assets transferred.

Ceiling Value - Fair market value of the asset transferred to the corporation.

Floor Value - The floor value will be equal to the greater of:

• the fair market value of the non-share consideration (boot)given to the transferor in return for the assets transferred; and

• the tax values (adjusted cost base or UCC)of the assets transferred.

3

When an individual transfers a non-depreciable capital asset to an affiliated person, any resulting capital loss is disallowed. Give three examples of affiliated persons.

Affiliated persons are defined in the text as follows:

A. An individual is affiliated to another individual only if that individual is his spouse or common-law partner.

B. A corporation is affiliated with:

1. a person who controls the corporation;

2. each member of an affiliated group of persons who controls the corporation; and

3. the spouse or common-law partner of a person listed in (1)or (2).

C. Two corporations are affiliated if:

1. each corporation is controlled by a person, and the person by whom one corporation is controlled is affiliated with the person by whom the other corporation is controlled;

2. one corporation is controlled by a person, the other corporation is controlled by a group of persons, and each member of that group is affiliated with that person; or

3. each corporation is controlled by a group of persons, and each member of each group is affiliated with at least one member of the other group.

The required three examples can be selected from examples presented in this definition (e.g., an individual and his spouse).

A. An individual is affiliated to another individual only if that individual is his spouse or common-law partner.

B. A corporation is affiliated with:

1. a person who controls the corporation;

2. each member of an affiliated group of persons who controls the corporation; and

3. the spouse or common-law partner of a person listed in (1)or (2).

C. Two corporations are affiliated if:

1. each corporation is controlled by a person, and the person by whom one corporation is controlled is affiliated with the person by whom the other corporation is controlled;

2. one corporation is controlled by a person, the other corporation is controlled by a group of persons, and each member of that group is affiliated with that person; or

3. each corporation is controlled by a group of persons, and each member of each group is affiliated with at least one member of the other group.

The required three examples can be selected from examples presented in this definition (e.g., an individual and his spouse).

4

What is boot? What is its significance in the application of ITA 85(1)?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

5

In the absence of ITA 85(1), tax considerations could make it difficult to incorporate an existing unincorporated business. Briefly explain the basis for this statement.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

6

An individual wishes to transfer the assets of an unincorporated business to a corporation using ITA 85. He wishes to remove the maximum amount of cash from the corporation without incurring current taxation. In addition to cash, he will receive common shares in the new company. What values should he elect for the transfer of the assets? If he elects these values and removes the maximum amount of tax free cash, what will be the PUC and adjusted cost base of the common shares?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

7

Identify the entities that can serve as transferors in an ITA 85 rollover.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

8

In general, when there has been a transfer of assets under ITA 85, a PUC reduction is required. Explain briefly how the amount of this PUC reduction is calculated.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

9

When a taxpayer transfers a business using the provisions of ITA 85, he is generally advised not to list accounts receivable among the assets that are included in the election. What is the basis for this advice?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

10

When assets are transferred to a corporation using ITA 85, the transferor can take back as consideration a combination of common shares, preferred shares, and non-share consideration. Briefly explain how the total adjusted cost base of the consideration received would be determined, and how it would be allocated to each type of consideration received by the transferor.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

11

Section 85 of the Income Tax Act allows the rollover of many types of assets to a corporation at elected values, a procedure that can avoid taxes being incurred at the time of the transfer. There are, however, certain categories of assets that are ineligible for this rollover provision. Indicate which categories of assets are ineligible for rollover under the provisions of Section 85. Briefly explain the reasons for these exclusions.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

12

Mr. Lawson, who is a resident of the United States, owns a number of rental properties in various cities throughout Canada. Having reached age 65, he would like to see these properties transferred to his children. However, he does not have sufficient cash to pay the taxes that would accrue if he simply gave the property to his children. He is somewhat aware of the provisions of Section 85 of the Canadian Income Tax Act, and is considering transferring the properties to a U.S. corporation in which his children would hold the residual equity shares. Advise Mr. Lawson as to the soundness of his plan.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

13

When ITA 85(1)is being used, careful consideration must be given to the price that is elected for the transfer. Briefly explain the importance of this transfer value.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

14

In some applications of ITA 85, some amount of PUC may be left after the required PUC reduction. If more than one class of shares have been issued as part of the rollover, how is the remaining PUC allocated to the multiple classes of shares?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

15

When a taxpayer is transferring depreciable assets under the provisions of ITA 85, he may elect a value that will result in a capital gain. If this is the case, how will the transferee's capital cost for CCA purposes be determined?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

16

In making an election under ITA 85, it is important that all of the assets that are to be transferred are listed in the election form. Why is this the case?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

17

A Section 85 rollover can result in a gift to a related person. Explain how this can arise. In addition, indicate the tax consequences to both the transferor and the individual who benefits from the gift.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

18

When a depreciable property is transferred to a corporation using the provisions of ITA 85, the elected value will usually be the UCC of the property. In these circumstances, the transferee is required to retain the original capital cost of the asset, with the difference between the capital cost and the UCC being treated as deemed CCA. What is the reason for this rule?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

19

Why does the Income Tax Act provide a special ordering rule for the transfer of depreciable assets under ITA 85?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

20

One of the most useful types of tax planning available to individuals with large amounts of income is income splitting. In implementing an income splitting arrangement, one of the most useful techniques is to have the individual transfer assets to a corporation under the provisions of Section 85 of the Income Tax Act. However, if such a transfer is not carefully designed, the full objectives of the income splitting plan may not be achieved. What steps must be taken to ensure that transfers of property under Section 85 do, in fact, achieve the desired income splitting goals?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

21

In an ITA 85(1)rollover, any required PUC reduction will be allocated first to preferred shares issues, with any remaining balance allocated to common shares issued.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

22

The elected value in a Section 85(1)rollover can never be above the fair market value of the non-share consideration.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

23

In a Section 85(1)rollover, the elected value serves as proceeds of disposition for the property given up, the adjusted cost base of the property received from the corporation and the tax cost of the property received by the corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements fully describes a transferor or transferee under the provisions of ITA 85(1)and (2)?

A)A transferee must be a corporation or trust.

B)A transferee must be a Canadian corporation.

C)A transferor must be an individual or a corporation.

D)Only individuals are permitted to be transferors under ITA 85(1).

A)A transferee must be a corporation or trust.

B)A transferee must be a Canadian corporation.

C)A transferor must be an individual or a corporation.

D)Only individuals are permitted to be transferors under ITA 85(1).

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

25

In the context of ITA 85(1)rollovers, the term "boot" refers to any consideration received by the transferor other than common shares.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

26

In an ITA 85(1)rollover, consideration for the transferor can only include debt and common shares.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following scenarios would be most appropriate for a Section 85 rollover?

A)A shareholder of a corporation wishes to transfer property with a fair market value of $150,000 and a tax cost of $100,000 to his corporation.

B)A shareholder of a corporation wishes to transfer property with a fair market value of $100,000 and a tax cost of $150,000 to his corporation.

C)A shareholder of a corporation wishes to transfer property with a fair market value of $150,000 and a tax cost of $100,000 from his corporation.

D)A shareholder of a corporation wishes to transfer property with a fair market value of $100,000 and a tax cost of $150,000 from his corporation.

A)A shareholder of a corporation wishes to transfer property with a fair market value of $150,000 and a tax cost of $100,000 to his corporation.

B)A shareholder of a corporation wishes to transfer property with a fair market value of $100,000 and a tax cost of $150,000 to his corporation.

C)A shareholder of a corporation wishes to transfer property with a fair market value of $150,000 and a tax cost of $100,000 from his corporation.

D)A shareholder of a corporation wishes to transfer property with a fair market value of $100,000 and a tax cost of $150,000 from his corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

28

The elected transfer price in an ITA 85(1)rollover can never be below the amount of non-share consideration received.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

29

The taxpayer who is the transferor in an ITA 85(1)rollover must receive at least one share of the transferee corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following would be considered part of the boot received by a transferor in an ITA 85(1)rollover?

A)Common shares of the transferee.

B)Redeemable preferred shares of the transferee.

C)Non-redeemable preferred shares of the transferee.

D)The assumption of transferor debt by the transferee.

A)Common shares of the transferee.

B)Redeemable preferred shares of the transferee.

C)Non-redeemable preferred shares of the transferee.

D)The assumption of transferor debt by the transferee.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

31

For an individual, the only "affiliated person" is the individual's spouse or common-law partner.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

32

What is the objective of the legislation contained in ITA 55(2), the capital gains stripping rules?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

33

When a depreciable asset is transferred in an ITA 85(1)rollover, the transferor may elect a value in excess of the capital cost of the asset. For the transferee corporation, the elected value will be the capital cost for CCA purposes.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

34

For purposes of ITA 85(1), eligible property includes real property owned by a non-resident person and used in the year in a business carried on by that person in Canada.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

35

If an asset is transferred in an ITA 85 rollover at an elected value that results in a capital gain to the transferor, the cost to the transferee for CCA purposes will be the transferor's cost, plus one-half of the excess of the elected value over the transferor's cost.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

36

There is only one requirement specified in ITA 85(1)with respect to the consideration that the corporation must give the transferor in exchange for property transferred to the corporation. What is it?

A)The consideration given to the transferor must include shares of the corporation.

B)The consideration given to the transferor must include cash equal to the tax value of the property transferred to the corporation.

C)The consideration given to the transferor must include cash equal to the fair market value of the property transferred to the corporation.

D)The consideration given to the transferor can only include cash and shares of the corporation.

A)The consideration given to the transferor must include shares of the corporation.

B)The consideration given to the transferor must include cash equal to the tax value of the property transferred to the corporation.

C)The consideration given to the transferor must include cash equal to the fair market value of the property transferred to the corporation.

D)The consideration given to the transferor can only include cash and shares of the corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following assets CANNOT be transferred to a corporation under the provisions of ITA 85(1)?

A)Real property owned by a non-resident person and used in the year in a business carried on by that person in Canada.

B)Canadian Resource Property.

C)Eligible Capital Property.

D)Prepayments.

A)Real property owned by a non-resident person and used in the year in a business carried on by that person in Canada.

B)Canadian Resource Property.

C)Eligible Capital Property.

D)Prepayments.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

38

What is the objective of the legislation contained in ITA 84.1, the dividend stripping rules?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following would NOT be considered part of the boot received by a transferor in an ITA 85(1)rollover?

A)Bonds issued by the new corporation.

B)Redeemable preferred shares of the transferee.

C)The assumption of transferor debt by the transferee.

D)A non-interest bearing note issued by the new corporation.

A)Bonds issued by the new corporation.

B)Redeemable preferred shares of the transferee.

C)The assumption of transferor debt by the transferee.

D)A non-interest bearing note issued by the new corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

40

ITA 85(1)can only be used to transfer an unincorporated business to a new corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

41

Meng Zheng wishes to transfer a piece of machinery to a corporation using ITA 85(1). This machinery is currently used to produce income. It has a capital cost of $250,000, a UCC balance of $58,000 and a fair market value of $50,000. Which of the following statements is correct?

A)Section 85(1)does not apply. The terminal loss will be denied permanently if the property is transferred to the corporation.

B)This proposed transfer can be completed using ITA 85(1). As an alternative, the property could be transferred to the corporation by selling it at fair market value, in which case the terminal loss will be deductible in the year of transfer.

C)Section 85(1)does not apply. The proceeds of the disposition are deemed to be the UCC amount, thereby disallowing the terminal loss.

D)This proposed transfer can be completed using ITA 85(1). The terminal loss will be deductible to the transferor as long as the corporation continues to use the machinery to produce income.

A)Section 85(1)does not apply. The terminal loss will be denied permanently if the property is transferred to the corporation.

B)This proposed transfer can be completed using ITA 85(1). As an alternative, the property could be transferred to the corporation by selling it at fair market value, in which case the terminal loss will be deductible in the year of transfer.

C)Section 85(1)does not apply. The proceeds of the disposition are deemed to be the UCC amount, thereby disallowing the terminal loss.

D)This proposed transfer can be completed using ITA 85(1). The terminal loss will be deductible to the transferor as long as the corporation continues to use the machinery to produce income.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

42

Eric Lehnserr owns 100 percent of Magnus Products Ltd. The shares were originally issued in 1982 for $20,000. In 1986, they were acquired by Eric's father for $25,000. In 2002, Eric's father died and left the shares to Eric. At that time, they were deemed to have been disposed of for $100,000. On the terminal return for Eric's father, a capital gain of $75,000 was reported, and tax was paid on the taxable capital gain of $37,500. Eric wishes to transfer the shares, now valued at $250,000, to a holding corporation owned by himself, electing under Section 85(1)of the Income Tax Act. Magnus Products Ltd. has never paid dividends of any kind. Which one of the following amounts represents the minimum possible elected amount under Section 85(1), ignoring the impact of consideration received?

A)$20,000.

B)$25,000.

C)$100,000.

D)$250,000.

A)$20,000.

B)$25,000.

C)$100,000.

D)$250,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

43

Jason transferred a piece of land he held personally to a corporation in which he owned all of the shares using the provisions of ITA 85. The adjusted cost base of the land was $60,000 and it had a fair market value of $120,000 at the time of the transfer. In order to utilize a capital loss, Jason elected a transfer price of $105,000. What is the adjusted cost base of the land to the corporation?

A)$60,000

B)$82,500

C)$105,000

D)$120,000

A)$60,000

B)$82,500

C)$105,000

D)$120,000

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

44

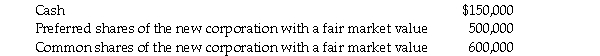

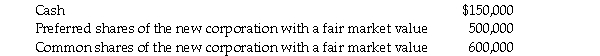

Daniel Kwok transfers his business assets to a corporation and elects a value of $678,000 for the assets transferred. These assets have a fair market value of $1,250,000. Daniel receives the following consideration:  How will the elected value be allocated between: the non-share consideration, the preferred shares issued, and the common stock issued?

How will the elected value be allocated between: the non-share consideration, the preferred shares issued, and the common stock issued?

A)$150,000; $0; $528,000

B)$150,000; $500,000; $28,000

C)$150,000; $528,000; $0

D)$150,000; $264,000; $264,000

How will the elected value be allocated between: the non-share consideration, the preferred shares issued, and the common stock issued?

How will the elected value be allocated between: the non-share consideration, the preferred shares issued, and the common stock issued?A)$150,000; $0; $528,000

B)$150,000; $500,000; $28,000

C)$150,000; $528,000; $0

D)$150,000; $264,000; $264,000

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

45

Mary Hanson is holding 1,000 shares of Hanson Operations. They have an adjusted cost base and Paid Up Capital of $20,000. Their current fair market value is equal to $200,000. Electing under ITA 85 in a manner that will maximize tax deferral, the shares are transferred to Hanson Holdings Inc., in return for $8,000 in cash and 250 Hanson Holdings shares with a fair market value of $192,000. The Paid Up Capital of the Hanson Holdings shares will be:

A)$12,000.

B)$20,000.

C)$192,000.

D)$200,000.

A)$12,000.

B)$20,000.

C)$192,000.

D)$200,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

46

Mr. Fingula transfers property to a corporation owned by his daughter. In which of the following situations do the indirect gift rules apply?

A)The property is transferred to the corporation at an elected amount that is equal to the fair market value of the asset and the consideration.

B)The property has a fair market value that exceeds the greater of the fair market value of the consideration received and the elected value.

C)The property has a fair market value that is less than the greater of the fair market value of the consideration received and the elected value.

D)The property is transferred to the corporation at an elected amount that is less than the fair market value and Mr. Fingula receives consideration equal to the fair market value.

A)The property is transferred to the corporation at an elected amount that is equal to the fair market value of the asset and the consideration.

B)The property has a fair market value that exceeds the greater of the fair market value of the consideration received and the elected value.

C)The property has a fair market value that is less than the greater of the fair market value of the consideration received and the elected value.

D)The property is transferred to the corporation at an elected amount that is less than the fair market value and Mr. Fingula receives consideration equal to the fair market value.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

47

Noor Ali transfers shares in Ali Manufacturing Inc. to Ali Holdings Ltd., a corporation which she controls. The shares have an adjusted cost base of $35,000 and a fair market value of $5,000. Noor elects to transfer these shares under Section 85 at an elected value of $5,000. The $30,000 capital loss on this transfer:

A)will be disallowed and kept in the tax records of the transferor to be recognized when the corporation is subject to an acquisition of control or is wound up.

B)will be disallowed and allocated to the ACB of the shares in the tax records of Ali Holdings Ltd.

C)will be deductible to the transferor as the transferor is an individual.

D)will be deductible to the transferee as the transferor is an individual.

A)will be disallowed and kept in the tax records of the transferor to be recognized when the corporation is subject to an acquisition of control or is wound up.

B)will be disallowed and allocated to the ACB of the shares in the tax records of Ali Holdings Ltd.

C)will be deductible to the transferor as the transferor is an individual.

D)will be deductible to the transferee as the transferor is an individual.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

48

Myron Cohen owns a retail store that he is currently operating as a proprietorship. In transferring the assets of this business to a corporation under the provisions of ITA 85(1), the elected value for the depreciable asset swill be more than their UCC but less than their capital cost. This will result in:

A)a capital gain.

B)a terminal loss.

C)recapture of CCA.

D)a capital loss and recapture of CCA.

A)a capital gain.

B)a terminal loss.

C)recapture of CCA.

D)a capital loss and recapture of CCA.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

49

Ali Manufacturing Inc. owns shares in Ali Holdings Inc, which it will transfer to Family Holdings Ltd. using Section 85. The shares have an adjusted cost base of $35,000 and a fair market value of $5,000, and an elected transfer price of $5,000 is used. The $30,000 capital loss on this transfer:

A)will be disallowed and kept in the tax records of the transferor to be recognized when the corporation is subject to an acquisition of control or is wound up.

B)will be disallowed with no opportunity to deduct the loss in the future.

C)will be allocated to the ACB of the shares in the tax records of Family Holdings Ltd., as the transferor is a corporation.

D)will be carried forward as a net capital loss in the records of Family Holdings Ltd., and will be deductible in a future year against any capital gains that are earned by that corporation.

A)will be disallowed and kept in the tax records of the transferor to be recognized when the corporation is subject to an acquisition of control or is wound up.

B)will be disallowed with no opportunity to deduct the loss in the future.

C)will be allocated to the ACB of the shares in the tax records of Family Holdings Ltd., as the transferor is a corporation.

D)will be carried forward as a net capital loss in the records of Family Holdings Ltd., and will be deductible in a future year against any capital gains that are earned by that corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

50

Using the provisions of Section 85(1), Marion transferred a piece of land she held personally to a corporation in which she owned all of the shares. The adjusted cost base of the land was $150,000 and it had a fair market value of $225,000. In order to utilize a $25,000 capital loss, she elected a value of $175,000. What is the adjusted cost base of the land to the corporation?

A)$175,000.

B)$150,000.

C)$225,000.

D)$162,500

A)$175,000.

B)$150,000.

C)$225,000.

D)$162,500

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

51

Bridget transferred a piece of land she held personally to her wholly owned corporation using the provisions of ITA 85. The land had an adjusted cost base of $150,000 and a fair market value of $250,000 at the time of transfer. The property was mortgaged for $50,000. As consideration for the transfer, Bridget received cash of $200,000 and preferred shares with a legal stated capital of $10,000. The corporation assumed the mortgage. Which one of the following is the elected transfer price (first)and the adjusted cost base of the preferred shares (second)?

A)$250,000 and Nil

B)$250,000 and $240,000

C)$260,000 and $50,000

D)$150,000 and Nil

A)$250,000 and Nil

B)$250,000 and $240,000

C)$260,000 and $50,000

D)$150,000 and Nil

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

52

Mr. Santaguida wishes to transfer his proprietorship to a corporation. The proprietorship does not have a balance in Class 14.1. However, you are recommending that he transfer goodwill at an elected value of $1. Why?

A)It is a requirement of ITA 85(1)to transfer goodwill at an elected value of $1 in every rollover that is completed.

B)The general rules for transfer price elections for eligible capital property set the minimum transfer price for assets such as goodwill at a value of $1.

C)The amount of $1 is the fair market value of the goodwill since it is not carried on the balance sheet.

D)To ensure the goodwill is included in the election, and also ensure that the transfer of goodwill is not considered a gift.

A)It is a requirement of ITA 85(1)to transfer goodwill at an elected value of $1 in every rollover that is completed.

B)The general rules for transfer price elections for eligible capital property set the minimum transfer price for assets such as goodwill at a value of $1.

C)The amount of $1 is the fair market value of the goodwill since it is not carried on the balance sheet.

D)To ensure the goodwill is included in the election, and also ensure that the transfer of goodwill is not considered a gift.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

53

Barry Hicks owns a building with a capital cost of $200,000, a UCC balance of $150,000, and a fair market value of $600,000. This property is transferred to a corporation under the provisions of ITA 85(1). The corporation assumes the $50,000 mortgage on the building. In return for the building, Barry receives a promissory note for $40,000 and preferred shares with a fair market value of $510,000. If Barry elects a value that will maximize tax deferral, the adjusted cost base of the preferred shares is:

A)nil.

B)$60,000.

C)$110,000.

D)$600,000.

A)nil.

B)$60,000.

C)$110,000.

D)$600,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

54

In transferring a business to a corporation, accounts receivable can be transferred using either ITA 22 or ITA 85(1), but not both. One advantage of using ITA 22 is:

A)the vendor will be able to deduct a capital loss.

B)the acquiring corporation will be able to deduct a bad debts reserve after the transfer.

C)the vendor will not have to add back to income any previously deducted reserve.

D)the vendor will have a loss that may be considered superficial.

A)the vendor will be able to deduct a capital loss.

B)the acquiring corporation will be able to deduct a bad debts reserve after the transfer.

C)the vendor will not have to add back to income any previously deducted reserve.

D)the vendor will have a loss that may be considered superficial.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

55

Mayumi Tajima transfers a depreciable asset to a CCPC in which she is the only shareholder. The asset has a cost of $100,000 and a UCC of $64,000. Mayumi will elect a transfer price equal to the fair market value of the asset which is $150,000. This transfer will result in:

A)a taxable capital gain of $43,000 with the capital cost of the asset to the transferee being $150,000.

B)a taxable capital gain of $25,000, recapture of $36,000 and the capital cost of the asset to the transferee will be $100,000.

C)a taxable capital gain of $25,000, recapture of $36,000 and the capital cost of the asset to the transferee will be $150,000.

D)a taxable capital gain of $25,000, recapture of $36,000 and the capital cost of the asset to the transferee will be $125,000.

A)a taxable capital gain of $43,000 with the capital cost of the asset to the transferee being $150,000.

B)a taxable capital gain of $25,000, recapture of $36,000 and the capital cost of the asset to the transferee will be $100,000.

C)a taxable capital gain of $25,000, recapture of $36,000 and the capital cost of the asset to the transferee will be $150,000.

D)a taxable capital gain of $25,000, recapture of $36,000 and the capital cost of the asset to the transferee will be $125,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

56

Mary Battle transfers a depreciable capital property with a fair market value of $100,000, a capital cost of $85,000, and a UCC of $47,500 to Battle Ltd. In consideration she receives cash of $60,000 and shares with a fair market value of $40,000, for a total value of $100,000. Using the provisions of Section 85 for the transfer, she elects a value of $90,000. Which of the following statements is correct?

A)Mary will have to report a capital gain of $5,000 and no recapture of CCA.

B)Because she is using Section 85, she does not have to report any income.

C)Mary will have to report recapture of CCA of $47,500.

D)Mary will have to report a capital gain of $5,000 and recapture of CCA of $37,500.

A)Mary will have to report a capital gain of $5,000 and no recapture of CCA.

B)Because she is using Section 85, she does not have to report any income.

C)Mary will have to report recapture of CCA of $47,500.

D)Mary will have to report a capital gain of $5,000 and recapture of CCA of $37,500.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

57

Under the provisions of ITA 85(1), Jason transferred a piece of land he held personally to a corporation in which he owned all of the shares. The adjusted cost base of the land was $120,000 and, at the time of the transfer, it had a fair market value of $390,000. The transfer took place at an elected value of $120,000. As consideration, Jason received a promissory note for $60,000, preferred shares with a fair market value of $210,000, and common shares with a fair market value of $120,000. Which one of the following is the adjusted cost base of the preferred shares (first)and the adjusted cost base of the common shares (second)?

A)Nil and $60,000.

B)$60,000 and Nil.

C)$38,181 and $21,819.

D)$210,000 and $120,000.

A)Nil and $60,000.

B)$60,000 and Nil.

C)$38,181 and $21,819.

D)$210,000 and $120,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

58

The general rules for transfer prices establish a range for the elected transfer price under ITA 85(1). Which of the following statements accurately describes the ceiling value?

A)The fair market value of the share consideration given to the transferor.

B)The fair market value of the non-share consideration given to the transferor.

C)The fair market value of the assets transferred to the corporation.

D)The fair market value of the share and non-share consideration given to the transferor.

A)The fair market value of the share consideration given to the transferor.

B)The fair market value of the non-share consideration given to the transferor.

C)The fair market value of the assets transferred to the corporation.

D)The fair market value of the share and non-share consideration given to the transferor.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

59

Under the provisions of ITA 85(1), Marx Stanislawski transfers a depreciable asset to a corporation in which he is the only shareholder. The asset has a fair market value of $500,000, a capital cost of $320,000 and a UCC of $180,000. Marx elects a transfer price of $180,000. As consideration, he receives cash of $140,000, and common shares with a legal stated capital of $360,000. What is the required PUC reduction for the common shares?

A)$320,000.

B)$220,000.

C)$180,000.

D)$40,000.

A)$320,000.

B)$220,000.

C)$180,000.

D)$40,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

60

Harold Warren incorporated Warren Enterprises Ltd. at the beginning of the current year. In addition to a $100,000 cash contribution, Harold contributed assets with a total tax value of $100,000 and a total fair market value of $150,000. In return, he receives 25,000 voting shares in the new corporation. If he elects a value that will result in minimum current Tax Payable, the adjusted cost base of the voting shares will be:

A)$100,000.

B)$150,000.

C)$200,000.

D)$250,000.

A)$100,000.

B)$150,000.

C)$200,000.

D)$250,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

61

Christine Rue transfers a non-depreciable capital property to a corporation, using the provisions of ITA 85. The property has a fair market value of $342,000 and an adjusted cost base of $111,000. She uses an elected value of $111,000. As consideration she receives:

• Cash of $21,000.

• Preferred shares with a fair market value of $50,000.

• Common shares with a fair market value of $271,000.

Indicate the adjusted cost base and the PUC of the preferred and common shares that were issued to Christine.

• Cash of $21,000.

• Preferred shares with a fair market value of $50,000.

• Common shares with a fair market value of $271,000.

Indicate the adjusted cost base and the PUC of the preferred and common shares that were issued to Christine.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

62

Ms. Helen Nasser has two depreciable assets - a Class 1 building and a Class 8 piece of equipment. The assets are to be transferred to a corporation using ITA 85. Relevant information on the assets is as follows:  What is the possible range of values that can be elected for the two properties? If, in each case, she elects the lowest possible value, what are the tax consequences for Ms. Nasser?

What is the possible range of values that can be elected for the two properties? If, in each case, she elects the lowest possible value, what are the tax consequences for Ms. Nasser?

What is the possible range of values that can be elected for the two properties? If, in each case, she elects the lowest possible value, what are the tax consequences for Ms. Nasser?

What is the possible range of values that can be elected for the two properties? If, in each case, she elects the lowest possible value, what are the tax consequences for Ms. Nasser?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

63

The use of ITA 85(1)to transfer property to a corporation would result in a benefit to a shareholder under ITA 15(1)in a situation where:

A)the fair market value of the property transferred is less than the consideration received.

B)a capital gain is triggered on the transfer resulting in taxable income to the transferor.

C)the elected value is received entirely in the form of non-share consideration.

D)the fair market value of the property transferred is greater than the consideration received.

A)the fair market value of the property transferred is less than the consideration received.

B)a capital gain is triggered on the transfer resulting in taxable income to the transferor.

C)the elected value is received entirely in the form of non-share consideration.

D)the fair market value of the property transferred is greater than the consideration received.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

64

Karl Young owns a non-depreciable capital asset with an adjusted cost base of $220,000 and a fair market value of $460,000. He intends to transfer the property to a corporation under the provisions of ITA 85, using an elected value of $220,000. As consideration he will receive a note for $110,000, preferred shares with a fair market value of $90,000, and common shares with a fair market value of $260,000. Indicate the adjusted cost base of the individual items of consideration received by Karl.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

65

Using ITA 85, Ms. Robyn Tunney transfers non-depreciable capital property to a corporation at an elected value of $91,200. The property has an adjusted cost base of $91,200 and a fair market value of $187,200. As consideration, she receives a note for $66,400, preferred shares with a fair market value and legal stated capital of $77,600, and common shares with a fair market value and legal stated capital of $43,200. Indicate the adjusted cost base and the PUC of the preferred and common shares that were issued to Ms. Tunney.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

66

Ms. Bimo transfers a non-depreciable capital property to a corporation in which all of the common shares are owned by her son. The property has a fair market value of $150,000 and an adjusted cost base of $35,000. Ms. Bimo transfers the property using an elected amount of $35,000 and the corporation issues her a note payable in the amount of $35,000 and preferred shares with a fair market value of $100,000. The ITA 85(1)excess amount (i.e. indirect gift)is:

A)$15,000.

B)$115,000.

C)$100,000.

D)$35,000.

A)$15,000.

B)$115,000.

C)$100,000.

D)$35,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements involving ITA 85 rollovers with excess consideration is correct?

A)Only one-half of the shareholder benefit under ITA 15(1)will be included in Net Income For Tax Purposes.

B)The amount of the shareholder benefit under ITA 15(1)will be added to the adjusted cost base of the consideration received by the transferor.

C)The amount of the shareholder benefit under ITA 15(1)will be added to the adjusted cost base of the shares received by the transferor.

D)The amount of the shareholder benefit under ITA 15(1)will be added to the PUC of the consideration received by the transferor.

A)Only one-half of the shareholder benefit under ITA 15(1)will be included in Net Income For Tax Purposes.

B)The amount of the shareholder benefit under ITA 15(1)will be added to the adjusted cost base of the consideration received by the transferor.

C)The amount of the shareholder benefit under ITA 15(1)will be added to the adjusted cost base of the shares received by the transferor.

D)The amount of the shareholder benefit under ITA 15(1)will be added to the PUC of the consideration received by the transferor.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

68

Jack Wild owns a depreciable property with a capital cost of $120,000 and a fair market value of $180,000. It is the only asset in its CCA class and the UCC balance for the class is $98,000. He uses ITA 85 to transfer this property to a new corporation at an elected value of $160,000. In return for the property, he receives a note for $160,000, in addition to common shares with a fair market value of $20,000.

What are the tax implications of this transaction for both Jack Wild and the transferee corporation? Include in your answer the adjusted cost base and PUC of the shares.

What are the tax implications of this transaction for both Jack Wild and the transferee corporation? Include in your answer the adjusted cost base and PUC of the shares.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

69

Parent Co. owns 100 percent of the shares of Son Co. They have a fair market value of $950,000, and an adjusted cost base of $75,000. Son Co. has safe income of $60,000. In order to complete a sale of Son Co. to Unrelated Co., an arm's length corporation, Son Co. borrows $875,000 from a bank, and uses the funds to pay a dividend to Parent Co. As a result, the fair market value of the Son Co. shares drops to $75,000. At this point, the shares are sold to Unrelated Co. for $75,000. Under these circumstances, the tax consequences for Parent Co. are:

A)a taxable capital gain of $437,500 and no dividends.

B)dividend income of $875,000 and no capital gains.

C)a taxable capital gain of $437,500 and a dividend of $875,000.

D)a taxable capital gain of $ 407,500 and a dividend of $60,000.

A)a taxable capital gain of $437,500 and no dividends.

B)dividend income of $875,000 and no capital gains.

C)a taxable capital gain of $437,500 and a dividend of $875,000.

D)a taxable capital gain of $ 407,500 and a dividend of $60,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following conditions is NOT required for ITA 84.1 (dividend stripping rules)to be applicable?

A)The shares that are disposed of must have been held as capital property.

B)The subject corporation must be associated with the purchaser corporation after the disposition of the shares.

C)The share disposition must be made to a corporation with which the taxpayer does not deal at arm's length.

D)The taxpayer who disposes of the shares must be a Canadian resident.

A)The shares that are disposed of must have been held as capital property.

B)The subject corporation must be associated with the purchaser corporation after the disposition of the shares.

C)The share disposition must be made to a corporation with which the taxpayer does not deal at arm's length.

D)The taxpayer who disposes of the shares must be a Canadian resident.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

71

Bruno owns 75 percent of the common shares of a corporation. His adult daughter owns the remaining 25 percent. During the current year, Bruno transferred shares from his investment portfolio that had an adjusted cost base of $55,000 to the corporation. These shares had a fair market value of $85,000 at the time of transfer and Bruno elected to transfer them at $55,000 under the provisions of ITA 85. As consideration for the transfer, he received a promissory note for $55,000 and preferred shares with a fair market value of $20,000. Which one of the following is the elected transfer price (first)and the adjusted cost base of the preferred shares (second)?

A)$55,000 and $20,000

B)$55,000 and $30,000

C)$65,000 and $20,000

D)$65,000 and Nil

A)$55,000 and $20,000

B)$55,000 and $30,000

C)$65,000 and $20,000

D)$65,000 and Nil

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

72

Samuel Rosen establishes a new corporation, arranging to have all of its common shares issued to his adult daughter for cash of $500. Mr. Rosen then transfers, using ITA 85, non-depreciable capital property with an adjusted cost base of $67,500 and an estimated fair market value of $87,750. The transfer is made at an elected value of $67,500. As consideration for this property, the corporation gives Mr. Rosen a note for $67,500 and preferred stock with a fair market value and a legal stated capital of $20,250. A CRA reassessment of this transaction determines that the actual fair market value of the property transferred is $100,000. Mr. Rosen reluctantly accepts this value.

After the reassessment, Mr. Rosen and his daughter sell their shares for their fair market value.

Describe the tax consequences of these transactions for both Mr. Rosen and his daughter. How would these tax consequences differ if Mr. Rosen had simply sold the non-depreciable capital property for its post-reassessment fair market value of $100,000?

After the reassessment, Mr. Rosen and his daughter sell their shares for their fair market value.

Describe the tax consequences of these transactions for both Mr. Rosen and his daughter. How would these tax consequences differ if Mr. Rosen had simply sold the non-depreciable capital property for its post-reassessment fair market value of $100,000?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

73

Jean Hill, a Canadian resident, transfers 100 percent of the shares in Hill Inc. to a new company, Jean Ltd. The Hill Inc. shares have an adjusted cost base and PUC of $100,000, and a fair market value of $1,000,000. The transfer is made under the provisions of ITA 85 at an elected value of $850,000. Ms. Hill receives cash of $850,000 and retractable preferred shares with a fair market value of $150,000. What are the immediate tax consequences to Ms. Hill, resulting from this transfer?

A)A capital gain of $900,000.

B)An ITA 84.1(1)deemed dividend of $750,000 and no capital gain.

C)An ITA 84.1(1)deemed dividend of $750,000, plus a capital gain of $150,000.

D)A capital gain of $750,000.

A)A capital gain of $900,000.

B)An ITA 84.1(1)deemed dividend of $750,000 and no capital gain.

C)An ITA 84.1(1)deemed dividend of $750,000, plus a capital gain of $150,000.

D)A capital gain of $750,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

74

Natasha Pulski's unincorporated business has inventories with a fair market value of $47,000 and a tax cost of $55,000. In addition, it has land with a fair market value of $275,000 and a tax cost of $83,000. She intends to transfer these assets to a new corporation, taking back $47,000 in cash for the inventories and $122,000 in cash for the land. If she uses Section 85(1)for the transfer, what is the possible range of values that can be elected for the two properties? If, in each case, she elects the lowest possible value, what are the tax consequences for Ms. Pulski?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

75

Joan Barkin is going to transfer the depreciable assets of her unincorporated business to a corporation in which she will be the sole shareholder. Relevant information on the assets is as follows:  Joan would like to defer as much current taxation as possible. At what value should she transfer each of the assets? Justify your conclusions. If she elects that value, what are the tax consequences for Joan in each case?

Joan would like to defer as much current taxation as possible. At what value should she transfer each of the assets? Justify your conclusions. If she elects that value, what are the tax consequences for Joan in each case?

Joan would like to defer as much current taxation as possible. At what value should she transfer each of the assets? Justify your conclusions. If she elects that value, what are the tax consequences for Joan in each case?

Joan would like to defer as much current taxation as possible. At what value should she transfer each of the assets? Justify your conclusions. If she elects that value, what are the tax consequences for Joan in each case?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

76

Natalie Bushkin's unincorporated business has land with a fair market value of $322,000 and an adjusted cost base of $147,000. In addition, the business has inventories with a fair market value of $23,000 and a tax cost of $25,000. She intends to transfer these assets to a new corporation, taking back $160,000 in cash for the land and $23,000 in cash for the inventories. If she uses Section 85(1)for the transfer, what is the possible range of values that can be elected for the two properties? If, in each case, she elects the lowest possible value, what are the tax consequences for Natalie?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

77

Derek Blunt wishes to transfer a non-depreciable capital property to a corporation that is owned by his adult daughter. The corporation is a new corporation, established with an investment of $100 in cash. Derek's daughter holds all of the common shares in this new corporation.

At the time of its transfer to the corporation, the non-depreciable capital property has an adjusted cost base of $250,000 and an estimated fair market value of $400,000. The transfer is made at an elected value of $250,000, with Derek receiving the corporation's note for $250,000, as well as preferred shares with a legal stated capital and fair market value of $150,000. A CRA reassessment of this transaction determines that the actual fair market value of the property transferred is $475,000. Mr. Blunt reluctantly accepts this value.

After the reassessment, Derek and his daughter both sell their shares in the new corporation for their fair market value.

Describe the tax consequences of these transactions for both Mr. Blunt and his daughter. How would these tax consequences differ if Mr. Blunt had simply sold the non-depreciable capital property for its post-reassessment fair market value of $475,000?

At the time of its transfer to the corporation, the non-depreciable capital property has an adjusted cost base of $250,000 and an estimated fair market value of $400,000. The transfer is made at an elected value of $250,000, with Derek receiving the corporation's note for $250,000, as well as preferred shares with a legal stated capital and fair market value of $150,000. A CRA reassessment of this transaction determines that the actual fair market value of the property transferred is $475,000. Mr. Blunt reluctantly accepts this value.

After the reassessment, Derek and his daughter both sell their shares in the new corporation for their fair market value.

Describe the tax consequences of these transactions for both Mr. Blunt and his daughter. How would these tax consequences differ if Mr. Blunt had simply sold the non-depreciable capital property for its post-reassessment fair market value of $475,000?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

78

Darlene Saunders has operated an unincorporated business for over 10 years. The business has been very successful and has now reached a point where it is producing more income than she requires for her personal needs. Given this, she would like to transfer the business to a new corporation, using the provisions of ITA 85(1).

On January 5, 2020, the transfer date, the tangible assets of the business have tax values of $375,000. Their fair market value is $1,190,000. In addition, because of the success of the business, it is estimated that the business has goodwill of $320,000. At the transaction date, liabilities total $115,000.

The elected value for the transfer will be equal to the tax values of $375,000. The corporation will assume the $115,000 in liabilities that are on the books of the business. In addition, Darlene will receive:

• New debt of $85,000.

• Preferred shares with a fair market value of $100,000.

• Common shares with a fair market value of $1,210,000.

Any dividends paid by the corporation will be non-eligible.

Required: Determine the following:

1. The adjusted cost base of each type of consideration received by Darlene.

2. The paid up capital of each type of share issued by the new corporation.

3. The tax consequences to Darlene of the new preferred shares being redeemed at their fair market value immediately.

On January 5, 2020, the transfer date, the tangible assets of the business have tax values of $375,000. Their fair market value is $1,190,000. In addition, because of the success of the business, it is estimated that the business has goodwill of $320,000. At the transaction date, liabilities total $115,000.

The elected value for the transfer will be equal to the tax values of $375,000. The corporation will assume the $115,000 in liabilities that are on the books of the business. In addition, Darlene will receive:

• New debt of $85,000.

• Preferred shares with a fair market value of $100,000.

• Common shares with a fair market value of $1,210,000.

Any dividends paid by the corporation will be non-eligible.

Required: Determine the following:

1. The adjusted cost base of each type of consideration received by Darlene.

2. The paid up capital of each type of share issued by the new corporation.

3. The tax consequences to Darlene of the new preferred shares being redeemed at their fair market value immediately.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

79

Using ITA 85, Tom Leung transfers non-depreciable capital property to a corporation at an elected value of $86,800. The property has an adjusted cost base of $86,800 and a fair market value of $246,400. As consideration, he receives a note for $71,400, preferred shares with a fair market value of $74,200, and common shares with a fair market value of $100,800. Indicate the adjusted cost base of the individual items of consideration received by Mr. Leung.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following conditions is NOT required for ITA 55(2)(capital gains stripping rules)to apply?

A)There is a disposition of shares by a corporation to an arm's length party.

B)The corporation that has disposed of the shares has received dividends that are deductible under ITA 112(1).

C)One of the purposes of the dividend received by the corporation was to significantly reduce a capital gain on the disposition of shares.

D)The corporation selling the shares must be a private company.

A)There is a disposition of shares by a corporation to an arm's length party.

B)The corporation that has disposed of the shares has received dividends that are deductible under ITA 112(1).

C)One of the purposes of the dividend received by the corporation was to significantly reduce a capital gain on the disposition of shares.

D)The corporation selling the shares must be a private company.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck