Deck 3: Income or Loss From an Office or Employment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/108

Play

Full screen (f)

Deck 3: Income or Loss From an Office or Employment

1

Explain how a bonus arrangement can be used to defer the taxes paid by an employee.

The ability to use a bonus arrangement to defer tax on employment income is based on the fact that, while business income is accrual based, employment income is on a cash basis. This means that the business can deduct the bonus at the time a commitment is made to make the payment, but the employee will not be taxed on it until it is received. If the bonus is declared in one year and paid in the following year, this provides a one year deferral to the employee. Note, however, the bonus must be paid within 180 days of the year end of the employer. If it is not paid within this period, the employer will not be able to deduct the bonus until it is paid.

2

Because of the formula used to calculate the taxable benefit when an employer owned vehicle is provided to an employee, the amount of the benefit can exceed the value of the vehicle. Explain this statement.

The formula requires a benefit of 2 percent of the cost of the vehicle per month of use. This benefit continues, without regard to the length of time the car is used by the employee. At this rate, after 50 months, the taxable benefit is equal to the value of the vehicle [(2%)(50)= 100%]. If the vehicle is used for more than 50 months, the amount of the benefit will exceed 100 percent of the cost of the vehicle.

3

Under what circumstances is an individual entitled to a deduction equal to one-half of the employment income inclusion resulting from exercising or selling stock options?

If the issuing corporation is a publicly traded Canadian company, the deduction is only available when the option price is equal to or greater than the fair market value of the shares at the time the options were issued.

If the issuing corporation is a Canadian controlled private corporation, the deduction is available if the shares are held for two years, without regard to whether the option price was above or below the fair market value of the shares at the time the options were issued.

However, if the shares are not held for two years, the availability of the deduction is subject to the same condition that is applicable to public companies. That is, the option price must be equal to or greater than the fair market value of the shares at the time they were issued.

If the issuing corporation is a Canadian controlled private corporation, the deduction is available if the shares are held for two years, without regard to whether the option price was above or below the fair market value of the shares at the time the options were issued.

However, if the shares are not held for two years, the availability of the deduction is subject to the same condition that is applicable to public companies. That is, the option price must be equal to or greater than the fair market value of the shares at the time they were issued.

4

Tax planning considerations are very significant in deciding the kinds of benefits that will be provided to employees. Explain why salary payments are considered the basic bench- mark with which other types of employee compensation will be compared.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

5

What is the difference between an allowance and a reimbursement?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

6

For tax purposes, an employee who receives an option on his employer's stock that is not in-the-money will not have an employment income inclusion at the time the option is received. Do you agree with this treatment? Explain your conclusion.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

7

Employment income is the salary, wages, and other remuneration, including gratuities, that are receivable by an individual during the year.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

8

The tax consequences of being classified as an employee rather than as an independent contractor can be significant. As a result, it is not uncommon to find controversy and, in some cases, litigation resulting from the need to make this distinction. Explain the importance, from the point of view of an employee, of the distinction between being classified as an employee versus being classified as a self-employed independent contractor.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

9

Many employees maintain a work space in their home. Describe the kinds of home related costs that can be deducted by an employee.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

10

An employee may be paid a monthly amount for using his own automobile in employment related activities. Alternatively, he may be paid a reasonable amount based on the number of kilometers driven. From the point of view of both the employer and the employee, explain the tax treatment that will be given to these two alternatives.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

11

Briefly explain the tax consequences resulting from being a member of an employer sponsored group disability insurance plan.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

12

List the factors that will have to be considered in determining whether a particular low interest or interest free loan is an effective form of employee compensation.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

13

One of the advantages of being an independent contractor rather than an employee is that you do not have to make CPP contributions.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

14

London Wholesalers employs over 50 full time salespeople, all of whom are provided with a company car. While the cars are used primarily for business purposes, all of the sales staff drive them at least 20,000 kilometers per year for personal reasons. As controller of the Company you are aware that there is tax legislation in effect which can create substantial taxable benefits that could accrue to these salespeople because they have the use of a company car.

Indicate some of the ways in which the Company and the sales staff might legitimately reduce the amount of the taxable benefit associated with having the use of a company car.

Indicate some of the ways in which the Company and the sales staff might legitimately reduce the amount of the taxable benefit associated with having the use of a company car.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

15

Briefly described the advantages to an employer of hiring independent contractors, as opposed to hiring employees.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

16

The number of deductions that can be made in computing employment income is fairly limited. Further, certain types of expenses must meet specified conditions in order to be eligible for deduction. Indicate the conditions that must be met in order for a salesperson to deduct expenses in computing employment income. In addition, Indicate the conditions that must be met in order for travel costs to be deducted in computing employment income.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

17

Briefly describe the calculation of the taxable benefit that is assessed on loans to employees that are not considered to be housing loans.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

18

List and briefly describe the major factors that will be considered in determining whether an individual is working as an employee or as an independent contractor.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

19

List two types of employee benefits that involve tax deferral and two types of benefits that involve tax avoidance.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

20

If properly constructed, bonus arrangements can result in tax deferral for employees.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

21

Payments by employers to private health care plans are not taxable benefits and any benefits received under such plans are tax free.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

22

Which one of the following benefits received from an employer would NOT result in a taxable benefit to the employee?

A)An allowance of 45 cents per kilometer for driving on employer business.

B)An interest free loan used to acquire shares of the employer.

C)Employer paid life insurance premiums for $20,000 of employee coverage.

D)Use of the employer's vehicle which is used 95% for employment purposes.

A)An allowance of 45 cents per kilometer for driving on employer business.

B)An interest free loan used to acquire shares of the employer.

C)Employer paid life insurance premiums for $20,000 of employee coverage.

D)Use of the employer's vehicle which is used 95% for employment purposes.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is a taxable benefit?

A)Payment of the tuition for an employee taking a course that will benefit the employer.

B)A $350 VISA gift card given as a Christmas present to all employees.

C)A 15 percent discount on the employer's merchandise, available to all employees.

D)Low priced meals in the company cafeteria where the prices are approximately equal to the cost of the meals.

A)Payment of the tuition for an employee taking a course that will benefit the employer.

B)A $350 VISA gift card given as a Christmas present to all employees.

C)A 15 percent discount on the employer's merchandise, available to all employees.

D)Low priced meals in the company cafeteria where the prices are approximately equal to the cost of the meals.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

24

An employee has been offered a choice of an increase in salary of $100,000 or a combination of salary and other benefits with a cost to the employer of $100,000. Assuming that the employee would buy the listed benefits with his own funds if they were not provided in the benefits package, which of the following packages would be the most advantageous from a tax perspective?

A)A dental plan plus a leased automobile that would be used only for personal travel by the employee.

B)Life insurance plus a leased automobile that would be used only for personal travel by the employee.

C)Salary plus life insurance.

D)Salary only.

A)A dental plan plus a leased automobile that would be used only for personal travel by the employee.

B)Life insurance plus a leased automobile that would be used only for personal travel by the employee.

C)Salary plus life insurance.

D)Salary only.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is NOT a tax-free benefit for the employee when it is provided by an employer?

A)Premiums for private health care plans.

B)A gift of a digital camera for an employee's wedding.

C)Employer reimbursement for the cost of tools required to perform work.

D)Employer contributions to a registered pension plan.

A)Premiums for private health care plans.

B)A gift of a digital camera for an employee's wedding.

C)Employer reimbursement for the cost of tools required to perform work.

D)Employer contributions to a registered pension plan.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

26

Indicate which of the following benefits provided by an employer is NOT considered part of employment income.

A)Reimbursement of moving expenses.

B)Travel expenses of the employee's spouse.

C)Payments resulting from wage loss replacement plans.

D)Premiums paid by an employer on life insurance policies.

E)Individual premiums under provincial hospitalization plans.

A)Reimbursement of moving expenses.

B)Travel expenses of the employee's spouse.

C)Payments resulting from wage loss replacement plans.

D)Premiums paid by an employer on life insurance policies.

E)Individual premiums under provincial hospitalization plans.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

27

She pays her employer $1,000 on September 30 to decrease the loan. Her taxable benefit from the loan is $180 for the year.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

28

Payments by employers of premiums on life insurance for employees are not taxable benefits.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

29

Indicate which of the following benefits provided by an employer is considered part of employment income.

A)Subsidized meals provided in employer facilities.

B)Low rent housing.

C)Premiums under private health services plans.

D)Uniforms and special clothing.

A)Subsidized meals provided in employer facilities.

B)Low rent housing.

C)Premiums under private health services plans.

D)Uniforms and special clothing.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following considerations is NOT relevant in the determination of whether an individual performing work is an employee or an independent contractor?

A)Opportunity for profit.

B)Hours per week spent at work site.

C)Ability to subcontract to others.

D)Ownership of tools.

A)Opportunity for profit.

B)Hours per week spent at work site.

C)Ability to subcontract to others.

D)Ownership of tools.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

31

With respect to employment related automobile costs and benefits, which of the following statements is correct?

A)When an employee is provided with an automobile that is purchased by the employer for $50,000, the taxable benefit to the employee will be based on the prescribed limit of $30,000.

B)An employee who uses his own vehicle for employment related activities cannot deduct any financing costs related to the acquisition of the car.

C)An employee who is provided with a vehicle owned by his employer can deduct capital cost allowance to the extent that the vehicle is used for employment related activities.

D)If an employee drives an employer provided vehicle for more than 20,004 kilometers of personal use during a year, there will be no reduction of the basic standby charge.

A)When an employee is provided with an automobile that is purchased by the employer for $50,000, the taxable benefit to the employee will be based on the prescribed limit of $30,000.

B)An employee who uses his own vehicle for employment related activities cannot deduct any financing costs related to the acquisition of the car.

C)An employee who is provided with a vehicle owned by his employer can deduct capital cost allowance to the extent that the vehicle is used for employment related activities.

D)If an employee drives an employer provided vehicle for more than 20,004 kilometers of personal use during a year, there will be no reduction of the basic standby charge.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

32

During 2020, Nellie Ward receives from her current employer: • A $400 gift certificate for online retailer Amazon.

• A $600 reclining easy chair for outstanding customer service during the year.

• A set of 4 coffee mugs with the employer's logo etched on the side. These mugs cost the employer $20.

• An Easter basket of gourmet treats valued at $245.

• A cash award of $300 in recognition of 10 years of service with the employer.

What is the amount that will be included in Nellie's 2020 Net Income For Tax Purposes due to the gifts?

A)$800.

B)$1,000.

C)$1,300.

D)$700.

• A $600 reclining easy chair for outstanding customer service during the year.

• A set of 4 coffee mugs with the employer's logo etched on the side. These mugs cost the employer $20.

• An Easter basket of gourmet treats valued at $245.

• A cash award of $300 in recognition of 10 years of service with the employer.

What is the amount that will be included in Nellie's 2020 Net Income For Tax Purposes due to the gifts?

A)$800.

B)$1,000.

C)$1,300.

D)$700.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following groups of factors are used by the courts in order to determine a taxpayer's status as an employee or a self-employed contractor?

A)Intent, control test, ownership of tools test, number of hours worked per week

B)Intent, ability to subcontract test, the type of work being undertaken, ownership of tools test

C)Intent, control test, ownership of tools test, opportunity for profit

D)Intent, ability to subcontract test, the location of the work site, opportunity for profit

A)Intent, control test, ownership of tools test, number of hours worked per week

B)Intent, ability to subcontract test, the type of work being undertaken, ownership of tools test

C)Intent, control test, ownership of tools test, opportunity for profit

D)Intent, ability to subcontract test, the location of the work site, opportunity for profit

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

34

The questions below relate to the following facts:

An employee is given a $10,000 interest free loan from her employer on January 1 to buy a car to be used for business trips. Due to a serious illness, she used the car for only nine months of the year. Assume that the prescribed rate is 2 percent for the entire year.

Her taxable benefit from the loan is $200 for the year.

An employee is given a $10,000 interest free loan from her employer on January 1 to buy a car to be used for business trips. Due to a serious illness, she used the car for only nine months of the year. Assume that the prescribed rate is 2 percent for the entire year.

Her taxable benefit from the loan is $200 for the year.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

35

When an employee pays all of the premiums for disability insurance coverage, the payments are not deductible and the benefits received are tax free.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

36

In calculating her minimum standby charge, the imputed interest from the loan is part of her operating costs.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is NOT a taxable benefit?

A)A cash Christmas gift to an employee from the employer. All the employees received a cash bonus of $150.

B)Payment of the tuition for an employee completing a general interest degree on a part-time basis.

C)A 20 percent discount on the employer's merchandise, available to all employees. The employer's mark-up is 50 percent.

D)Low rent housing provided by the employer.

A)A cash Christmas gift to an employee from the employer. All the employees received a cash bonus of $150.

B)Payment of the tuition for an employee completing a general interest degree on a part-time basis.

C)A 20 percent discount on the employer's merchandise, available to all employees. The employer's mark-up is 50 percent.

D)Low rent housing provided by the employer.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

38

Veronica mows lawns during the summer. In 2020 she was paid directly by homeowners for her work, in some case on the basis of the completed job, in other cases at an hourly rate. Her friend Jonathon does the same work. However, he is paid at an hourly rate by a lawn maintenance company. Which of the following statements is correct?

A)Veronica earns business income and Jonathon earns employment income. Veronica will be able to deduct more expenses than Jonathon.

B)Veronica and Jonathon both earn employment income.

C)Veronica earns business income and Jonathon earns employment income. Their deductible expenses will be the same.

D)Veronica and Jonathon both earn business income.

A)Veronica earns business income and Jonathon earns employment income. Veronica will be able to deduct more expenses than Jonathon.

B)Veronica and Jonathon both earn employment income.

C)Veronica earns business income and Jonathon earns employment income. Their deductible expenses will be the same.

D)Veronica and Jonathon both earn business income.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

39

Employers generally prefer contracting out as it avoids the cost of CPP and EI contributions.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

40

In which one of the following lists are ALL items relevant when computing net employment income?

A)Employee contributions to a registered pension plan; signing bonus on accepting employment; use of an employer-owned automobile.

B)Monthly automobile allowance; dental plan paid for by the employer; promotional cost incurred in selling the employer's products.

C)Subsidized meals in employer's facilities; life insurance paid by the employer; legal fees incurred to collect unpaid salary.

D)Tips and gratuities; dental insurance paid by the employer; exercise of options to purchase shares of the publicly traded employer.

A)Employee contributions to a registered pension plan; signing bonus on accepting employment; use of an employer-owned automobile.

B)Monthly automobile allowance; dental plan paid for by the employer; promotional cost incurred in selling the employer's products.

C)Subsidized meals in employer's facilities; life insurance paid by the employer; legal fees incurred to collect unpaid salary.

D)Tips and gratuities; dental insurance paid by the employer; exercise of options to purchase shares of the publicly traded employer.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

41

With respect to loans to employees, which of the following statements is correct?

A)If the rate on the loan is less than the market rate for similar types of debt, the employee will have a taxable benefit equal to the difference.

B)If the proceeds from the loan are invested in income producing assets, the interest benefit on the loan will be deductible in determining the employee's Net Income For Tax Purposes.

C)When the loan is to assist an employee with a home purchase, the taxable benefit must be calculated using each quarterly value for the prescribed rate.

D)The taxable benefit on an employee loan will not be altered by the amount of interest payments the employee makes to the employer.

A)If the rate on the loan is less than the market rate for similar types of debt, the employee will have a taxable benefit equal to the difference.

B)If the proceeds from the loan are invested in income producing assets, the interest benefit on the loan will be deductible in determining the employee's Net Income For Tax Purposes.

C)When the loan is to assist an employee with a home purchase, the taxable benefit must be calculated using each quarterly value for the prescribed rate.

D)The taxable benefit on an employee loan will not be altered by the amount of interest payments the employee makes to the employer.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

42

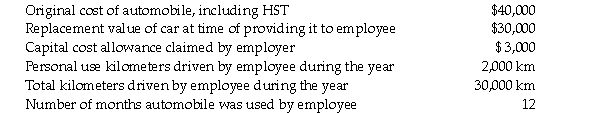

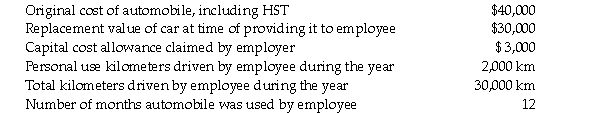

The following facts relate to an employer provided automobile.  Which one of the following amounts represents the employee's minimum standby charge in 2020?

Which one of the following amounts represents the employee's minimum standby charge in 2020?

A)$720.

B)$960.

C)$640.

D)$9,600.

Which one of the following amounts represents the employee's minimum standby charge in 2020?

Which one of the following amounts represents the employee's minimum standby charge in 2020?A)$720.

B)$960.

C)$640.

D)$9,600.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

43

With respect to the determination of net employment income, which of the following statements is correct?

A)If an allowance is included on an employee's T4, any expenses related to the allowance cannot be deducted for tax purposes.

B)One-half of reimbursed meals are taxable.

C)Reasonable vehicle allowances are not included in income.

D)All allowances are included in income, all reimbursements are not included in income.

A)If an allowance is included on an employee's T4, any expenses related to the allowance cannot be deducted for tax purposes.

B)One-half of reimbursed meals are taxable.

C)Reasonable vehicle allowances are not included in income.

D)All allowances are included in income, all reimbursements are not included in income.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

44

Omar is employed by Sansauto Corp. and uses his own car for employment activities. Which of the following may NOT be claimed as an employment expense deduction?

A)Gas (employment related portion)

B)Auto insurance (employment related portion)

C)Standby charge (employment related portion)

D)Oil change (employment related portion)

A)Gas (employment related portion)

B)Auto insurance (employment related portion)

C)Standby charge (employment related portion)

D)Oil change (employment related portion)

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

45

The questions below are based on the following information:

Scott Bicycle Manufacturing Ltd. (SBM)is a Canadian controlled private corporation. Brian Mills, one of SBM's employees, was granted stock options on January 15, 2017 for 10,000 shares at $3 per share. The fair market value on January 15, 2017 was $4 per share.

Brian exercised the stock options on September 30, 2017, when the fair market value was $6 per share. In June, 2020, Brian purchased a new home and sold the shares for $7 each.

What is the adjusted cost base to Brian of the SBM shares at the time of sale in June, 2020?

A)$30,000.

B)$45,000.

C)$60,000.

D)$70,000.

E)None of the above.

Scott Bicycle Manufacturing Ltd. (SBM)is a Canadian controlled private corporation. Brian Mills, one of SBM's employees, was granted stock options on January 15, 2017 for 10,000 shares at $3 per share. The fair market value on January 15, 2017 was $4 per share.

Brian exercised the stock options on September 30, 2017, when the fair market value was $6 per share. In June, 2020, Brian purchased a new home and sold the shares for $7 each.

What is the adjusted cost base to Brian of the SBM shares at the time of sale in June, 2020?

A)$30,000.

B)$45,000.

C)$60,000.

D)$70,000.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

46

Mr. Brown's employer provides him with an automobile for his personal use, and pays all operating costs for that vehicle. The vehicle, used by Mr. Brown throughout 2020, cost his employer $31,500, including GST of $1,500 (no provincial sales tax was charged on the vehicle purchase). Mr. Brown drove the vehicle 45,000 km during the year, of which 9,000 km were for personal purposes. His employer paid $7,750 in operating costs for the year. Mr. Brown paid nothing to his employer for the use of the vehicle. Which one of the following amounts represents the minimum taxable benefit that Mr. Brown must include in his employment income for the use of this vehicle in 2020?

A)$2,268.

B)$4,859.

C)$5,102.

D)$5,921.

A)$2,268.

B)$4,859.

C)$5,102.

D)$5,921.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

47

Ms. Joan Hanson is an employee of a Canadian controlled private corporation. During 2019, she receives options to purchase 500 shares of her employer's common stock at a price of $22 per share. At this time, the estimated per share value of the stock is $20.50. During 2020, she exercises all of these options. At this time, the estimated market value of the stock is $31.50 per share. On December 1, 2020, she sells the stock for $38.75 per share. The net effect of the 2020 transactions on her Taxable Income would be:

A)an increase of $1,812.50.

B)an increase of $2,375.00.

C)an increase of $4,187.50.

D)an increase of $4,750.00.

E)an increase of $6,562.50.

A)an increase of $1,812.50.

B)an increase of $2,375.00.

C)an increase of $4,187.50.

D)an increase of $4,750.00.

E)an increase of $6,562.50.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following statements with respect to stock options is correct?

A)If the option price for shares is less than the grant date market value of the shares, granting the options will create a taxable benefit for the grantee.

B)If shares in a Canadian controlled private corporation are acquired through the exercise of stock options, there will be a deduction equal to one-half of the employment income inclusion, provided the shares were held for at least two years.

C)When options to acquire the shares of a Canadian public corporation are exercised, there are no immediate tax consequences for the acquirer.

D)When shares in a Canadian controlled private corporation that have been acquired through the exercise of options are sold, any loss on the sale can be used to offset any income inclusion that results from the exercise of the options.

A)If the option price for shares is less than the grant date market value of the shares, granting the options will create a taxable benefit for the grantee.

B)If shares in a Canadian controlled private corporation are acquired through the exercise of stock options, there will be a deduction equal to one-half of the employment income inclusion, provided the shares were held for at least two years.

C)When options to acquire the shares of a Canadian public corporation are exercised, there are no immediate tax consequences for the acquirer.

D)When shares in a Canadian controlled private corporation that have been acquired through the exercise of options are sold, any loss on the sale can be used to offset any income inclusion that results from the exercise of the options.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

49

The questions below are based on the following information:

The cost of the car is $20,000 including HST. If the car is leased, the monthly lease payment is $500 including HST. The car is driven for a total of 26,000 km during 2020 and its operating costs for the year are $4,000.

Assume the car is leased. It is used by the employee for 11 months of the year. In the other month, he was required to return the car to his employer's premises. He drives it for personal purposes for a total of 6,000 km. The minimum taxable benefit is:

The cost of the car is $20,000 including HST. If the car is leased, the monthly lease payment is $500 including HST. The car is driven for a total of 26,000 km during 2020 and its operating costs for the year are $4,000.

Assume the car is leased. It is used by the employee for 11 months of the year. In the other month, he was required to return the car to his employer's premises. He drives it for personal purposes for a total of 6,000 km. The minimum taxable benefit is:

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

50

T. Adams commenced employment at Moana Sales Ltd. on February 1, 2020. He had lived in an apartment until May 2020, at which time he purchased a new house. Under the terms of his employment, he received a housing loan on May 1, 2020 of $80,000 at a rate of 2 percent. He pays the interest on the loan on a monthly basis. Assume the 2020 prescribed interest rates applicable to employee loans are as follows:  What is T. Adams' taxable benefit on the above loan for 2020?

What is T. Adams' taxable benefit on the above loan for 2020?

A)Nil.

B)$267.40.

C)$670.68.

D)$1,073.97.

E)$2,147.95.

What is T. Adams' taxable benefit on the above loan for 2020?

What is T. Adams' taxable benefit on the above loan for 2020?A)Nil.

B)$267.40.

C)$670.68.

D)$1,073.97.

E)$2,147.95.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

51

Sam borrowed $50,000 from her employer at an annual rate of 1% interest last year to cover her gambling debts. Assume that at the time the loan was made, the prescribed rate of interest was 3% and this rate has not changed. Sam is subject to a combined tax rate of 30 percent. What is the after tax cost of the loan to Sam for the current year?

A)$300

B)$500

C)$800

D)$1,500

A)$300

B)$500

C)$800

D)$1,500

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

52

The questions below are based on the following information:

Scott Bicycle Manufacturing Ltd. (SBM)is a Canadian controlled private corporation. Brian Mills, one of SBM's employees, was granted stock options on January 15, 2017 for 10,000 shares at $3 per share. The fair market value on January 15, 2017 was $4 per share.

Brian exercised the stock options on September 30, 2017, when the fair market value was $6 per share. In June, 2020, Brian purchased a new home and sold the shares for $7 each.

What is the effect of these facts on Brian's Taxable Income?

A)An increase of $15,000 in 2017

B)An increase of $15,000 in 2020.

C)An increase of $30,000 in 2017.

D)An increase of $20,000 in 2020.

E)None of the above.

Scott Bicycle Manufacturing Ltd. (SBM)is a Canadian controlled private corporation. Brian Mills, one of SBM's employees, was granted stock options on January 15, 2017 for 10,000 shares at $3 per share. The fair market value on January 15, 2017 was $4 per share.

Brian exercised the stock options on September 30, 2017, when the fair market value was $6 per share. In June, 2020, Brian purchased a new home and sold the shares for $7 each.

What is the effect of these facts on Brian's Taxable Income?

A)An increase of $15,000 in 2017

B)An increase of $15,000 in 2020.

C)An increase of $30,000 in 2017.

D)An increase of $20,000 in 2020.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

53

The questions below are based on the following information:

The cost of the car is $20,000 including HST. If the car is leased, the monthly lease payment is $500 including HST. The car is driven for a total of 26,000 km during 2020 and its operating costs for the year are $4,000.

Assume the car is purchased. It is used by the employee for 10 months of the year. In the other months, he was required to return the car to his employer's premises. He drives it for personal purposes for a total of 11,000 km. The minimum taxable benefit is:

The cost of the car is $20,000 including HST. If the car is leased, the monthly lease payment is $500 including HST. The car is driven for a total of 26,000 km during 2020 and its operating costs for the year are $4,000.

Assume the car is purchased. It is used by the employee for 10 months of the year. In the other months, he was required to return the car to his employer's premises. He drives it for personal purposes for a total of 11,000 km. The minimum taxable benefit is:

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

54

The questions below are based on the following information:

The cost of the car is $20,000 including HST. If the car is leased, the monthly lease payment is $500 including HST. The car is driven for a total of 26,000 km during 2020 and its operating costs for the year are $4,000.

Assume the car is leased. It is used by the employee for 11 months of the year. In the other month, he was required to return the car to his employer's premises. He drives it for personal purposes for a total of 7,500 km and reimburses the employer $1,100 ($100 per month)for the use of the car. The minimum taxable benefit is:

The cost of the car is $20,000 including HST. If the car is leased, the monthly lease payment is $500 including HST. The car is driven for a total of 26,000 km during 2020 and its operating costs for the year are $4,000.

Assume the car is leased. It is used by the employee for 11 months of the year. In the other month, he was required to return the car to his employer's premises. He drives it for personal purposes for a total of 7,500 km and reimburses the employer $1,100 ($100 per month)for the use of the car. The minimum taxable benefit is:

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements with respect to allowances is NOT correct?

A)An allowance from an employer to cover an employee's professional association dues will not be included in an employee's income.

B)Reimbursement by an employer of an employee's moving expenses will not be included in an employee's income.

C)Travel allowances provided by an employer are never included in an employee's income.

D)In general, employers prefer allowances to reimbursements.

A)An allowance from an employer to cover an employee's professional association dues will not be included in an employee's income.

B)Reimbursement by an employer of an employee's moving expenses will not be included in an employee's income.

C)Travel allowances provided by an employer are never included in an employee's income.

D)In general, employers prefer allowances to reimbursements.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

56

An employee of a public Canadian corporation receives an option to purchase 1,000 of her employer's common shares at $20 per share in July, 2019. At this time, the fair market value of the stock is $19 per share. In March, 2020, when the fair market value is $26 per share, she exercises the option and immediately sells the shares. By what amount do these transactions increase her Taxable Income?

A)$1,000 in 2019.

B)$3,000 in 2020.

C)$3,500 in 2020.

D)$6,000 in 2020.

A)$1,000 in 2019.

B)$3,000 in 2020.

C)$3,500 in 2020.

D)$6,000 in 2020.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following employee reimbursements would result in an increase in taxable income?

A)Housing loss reimbursement of $20,000

B)Moving costs reimbursement of $20,000

C)Travel expense reimbursement of $20,000

D)Employment related tuition reimbursement of $20,000

A)Housing loss reimbursement of $20,000

B)Moving costs reimbursement of $20,000

C)Travel expense reimbursement of $20,000

D)Employment related tuition reimbursement of $20,000

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

58

The questions below are based on the following information:

The cost of the car is $20,000 including HST. If the car is leased, the monthly lease payment is $500 including HST. The car is driven for a total of 26,000 km during 2020 and its operating costs for the year are $4,000.

Assume the car is purchased. It was used by an employee for the whole year. He drives it for personal purposes for a total of 9,000 km. The minimum taxable benefit is:

The cost of the car is $20,000 including HST. If the car is leased, the monthly lease payment is $500 including HST. The car is driven for a total of 26,000 km during 2020 and its operating costs for the year are $4,000.

Assume the car is purchased. It was used by an employee for the whole year. He drives it for personal purposes for a total of 9,000 km. The minimum taxable benefit is:

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following will be included in taxable income because it is NOT a "reasonable allowance"?

A)An allowance of $500, calculated as 2,000 kilometers at $0.25/km.

B)An allowance of $6,500, calculated as 10,000 kilometers at $0.65/km.

C)$750 allowance for employment related trip expenses (actual costs were $700).

D)$750 allowance for employment related trip expenses (actual costs were $800).

A)An allowance of $500, calculated as 2,000 kilometers at $0.25/km.

B)An allowance of $6,500, calculated as 10,000 kilometers at $0.65/km.

C)$750 allowance for employment related trip expenses (actual costs were $700).

D)$750 allowance for employment related trip expenses (actual costs were $800).

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

60

The questions below are based on the following information:

Mr. Morra commenced employment with Peoples Bank Ltd., a public corporation, on January 1, 2018. On December 31, 2018, he was granted options to purchase 500 shares of Peoples Bank Ltd. stock for $15 per share. The market value on December 31, 2018 was $16 per share.

Mr. Morra exercised his options on May 31, 2019, purchasing 500 shares for $15 per share when the market value was $17 per share. On September 1, 2020, Mr. Morra sold the shares for $24 each.

What is the effect of the above transactions on Mr. Morra's Taxable Income in 2019?

A)Nil.

B)An increase of $250.

C)An increase of $500.

D)An increase of $1,000.

Mr. Morra commenced employment with Peoples Bank Ltd., a public corporation, on January 1, 2018. On December 31, 2018, he was granted options to purchase 500 shares of Peoples Bank Ltd. stock for $15 per share. The market value on December 31, 2018 was $16 per share.

Mr. Morra exercised his options on May 31, 2019, purchasing 500 shares for $15 per share when the market value was $17 per share. On September 1, 2020, Mr. Morra sold the shares for $24 each.

What is the effect of the above transactions on Mr. Morra's Taxable Income in 2019?

A)Nil.

B)An increase of $250.

C)An increase of $500.

D)An increase of $1,000.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

61

During 2020, Mr. Sam Warren is provided with an automobile that is leased by his employer. The monthly lease payment is $791 per month. This figure includes $91 HST. During the year, the car is used by Mr. Warren for a total of 310 days. When he is not using the car, his employer requires that it be returned to their premises. During this period, he drives the car a total of 40,000 kilometers, 22,000 of which are employment related. Calculate Mr. Warren's minimum taxable benefit for the use of the automobile.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

62

The questions below are based on the following information:

Parminder is an employee of a public Canadian corporation. On April 1, 2019 she received options to purchase 5,000 shares of her employer's common stock at a price of $75 per share. She exercised her options and purchased 5,000 shares on November 1, 2019. She sold all of her shares on February 1, 2020. The market price of her employer's common stock was $74 per share on April 1, 2019; $79 per share on November 1, 2019 and $85 per share on February 1, 2020.

The effect on her 2020 tax return is:

A)increase in Net Income for Tax Purposes of $15,000; increase in Taxable Income of $15,000.

B)increase in Net Income for Tax Purposes of $30,000; increase in Taxable Income of $15,000.

C)increase in Net Income for Tax Purposes of $25,000; increase in Taxable Income of $25,000.

D)increase in Net Income for Tax Purposes of $50,000; increase in Taxable Income of $25,000.

Parminder is an employee of a public Canadian corporation. On April 1, 2019 she received options to purchase 5,000 shares of her employer's common stock at a price of $75 per share. She exercised her options and purchased 5,000 shares on November 1, 2019. She sold all of her shares on February 1, 2020. The market price of her employer's common stock was $74 per share on April 1, 2019; $79 per share on November 1, 2019 and $85 per share on February 1, 2020.

The effect on her 2020 tax return is:

A)increase in Net Income for Tax Purposes of $15,000; increase in Taxable Income of $15,000.

B)increase in Net Income for Tax Purposes of $30,000; increase in Taxable Income of $15,000.

C)increase in Net Income for Tax Purposes of $25,000; increase in Taxable Income of $25,000.

D)increase in Net Income for Tax Purposes of $50,000; increase in Taxable Income of $25,000.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

63

Mr. Rudy Jackson is required by his employer to use his own automobile in the course of his employment. To compensate him, he is paid an annual allowance of $4,200. During 2020, he drove his automobile a total of 26,720 kilometers, of which 8,150 were employment related. His total automobile costs for the year, including lease costs, are $8,623. What amounts will Mr. Jackson include and deduct from his 2020 employment income related to the use of his automobile?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

64

Mr. John Lamarche, as the result of an outstanding sales achievement within his organization, is awarded two airline tickets to Vancouver. His employer pays a travel agent $5,275, plus $264 in GST for the tickets. What is the amount of Mr. Lamarche's taxable benefit?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following statements about expense deductions for employees is NOT correct?

A)In order for an employee to deduct work space in the home costs it must be the place where that individual principally carries on his employment duties.

B)If an employee uses his own automobile to carry out his employment duties, he can deduct a pro rata share of the interest that he pays on a loan to finance the automobile.

C)In order to deduct travel costs, an employee must ordinarily be required to carry on his duties away from the employer's place of business.

D)If an employed salesperson who earns commission income acquires a cell phone, he cannot deduct CCA on this asset.

A)In order for an employee to deduct work space in the home costs it must be the place where that individual principally carries on his employment duties.

B)If an employee uses his own automobile to carry out his employment duties, he can deduct a pro rata share of the interest that he pays on a loan to finance the automobile.

C)In order to deduct travel costs, an employee must ordinarily be required to carry on his duties away from the employer's place of business.

D)If an employed salesperson who earns commission income acquires a cell phone, he cannot deduct CCA on this asset.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

66

Ms. Rhonda Jewel's employer provides her with an annual allowance of $6,500 per year to compensate her for the fact that she uses her own automobile for employment related activities. During 2020, she has total automobile related costs, including her monthly lease payments of $12,472. Her total milage is 42,000 kilometers, of which 18,000 kilometers were employment related. What amounts will Ms. Jewel include and deduct from her 2020 employment income related to the use of her own automobile?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

67

John Tertiak's employer sponsors a group disability plan for its employees. The plan provides periodic benefits that compensate for lost employment income. The annual premium on this plan is $3,200, with this cost being shared equally by the employer and the employee. Because John became disabled in January, 2020, he did not make any contribution for this year. In the years prior to 2020, John had total contributions of $16,000. During 2020, because of his disability, John receives benefit under the plan totaling $24,000. What amount will John include in his 2020 net employment income?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

68

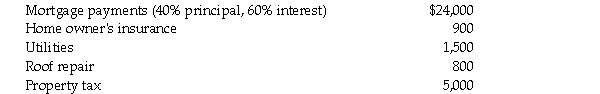

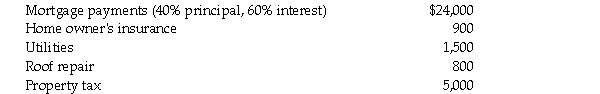

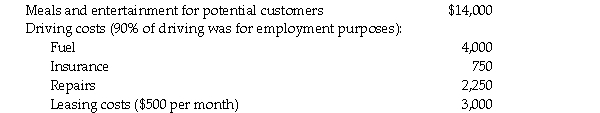

Nancy is employed by a large corporation as a sales representative. She is paid a salary of $70,000 during 2020. She is required to have a home office and uses the 375 square foot den in her 1,500 square foot house exclusively for this purpose. Total costs for 2020 were as follows:  As Nancy's compensation does not include any commissions, she is unable to use some of these costs as tax deductions. If instead, her compensation of $70,000 was in the form of commissions, she would be able to claim extra tax deductions of:

As Nancy's compensation does not include any commissions, she is unable to use some of these costs as tax deductions. If instead, her compensation of $70,000 was in the form of commissions, she would be able to claim extra tax deductions of:

A)$1,675.

B)$3,600.

C)$5,075.

D)$1,475.

As Nancy's compensation does not include any commissions, she is unable to use some of these costs as tax deductions. If instead, her compensation of $70,000 was in the form of commissions, she would be able to claim extra tax deductions of:

As Nancy's compensation does not include any commissions, she is unable to use some of these costs as tax deductions. If instead, her compensation of $70,000 was in the form of commissions, she would be able to claim extra tax deductions of:A)$1,675.

B)$3,600.

C)$5,075.

D)$1,475.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

69

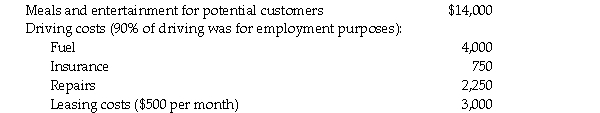

John secured employment as a commissioned salesman in July, 2020. In 2020, he received a base salary of $60,000, and $5,000 of commissions. A further $6,000 of commissions earned in December was paid to him in January, 2020. John worked away from the office negotiating sales contracts, and he is required to pay his own vehicle and promotional expenses. His employer has signed a Form T2200 certifying that require- ment, and certifying that no reimbursements are paid for any expenses John incurs to earn commissions. John incurred the following costs from July through December 2020:  What is the maximum deduction John may claim for employment expenses in 2020?

What is the maximum deduction John may claim for employment expenses in 2020?

A)$5,000.

B)$9,000.

C)$11,000.

D)$16,000.

What is the maximum deduction John may claim for employment expenses in 2020?

What is the maximum deduction John may claim for employment expenses in 2020?A)$5,000.

B)$9,000.

C)$11,000.

D)$16,000.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

70

Ms. Robin Nestor is provided with an automobile that is owned by her employer. The employer purchased the car in 2019 for $54,000, plus $7,020 in HST. During 2020, she drives the car a total of 72,000 kilometers, of which 67,000 kilometers were employment related. The automobile was used by Ms. Nestor for 268 days during 2020. When she was not using the automobile, her employer required that it be returned to their premises. Calculate Ms. Nestor's minimum taxable benefit for the use of the automobile.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

71

The questions below are based on the following information:

Parminder is an employee of a public Canadian corporation. On April 1, 2019 she received options to purchase 5,000 shares of her employer's common stock at a price of $75 per share. She exercised her options and purchased 5,000 shares on November 1, 2019. She sold all of her shares on February 1, 2020. The market price of her employer's common stock was $74 per share on April 1, 2019; $79 per share on November 1, 2019 and $85 per share on February 1, 2020.

The effect on her 2019 tax return is:

A)increase in Net Income for Tax Purposes of $12,500; increase in Taxable Income of $12,500.

B)increase in Net Income for Tax Purposes of $25,000; increase in Taxable Income of $12,500.

C)increase in Net Income for Tax Purposes of $10,000; increase in Taxable Income of $10,000.

D)increase in Net Income for Tax Purposes of $20,000; increase in Taxable Income of $10,000.

Parminder is an employee of a public Canadian corporation. On April 1, 2019 she received options to purchase 5,000 shares of her employer's common stock at a price of $75 per share. She exercised her options and purchased 5,000 shares on November 1, 2019. She sold all of her shares on February 1, 2020. The market price of her employer's common stock was $74 per share on April 1, 2019; $79 per share on November 1, 2019 and $85 per share on February 1, 2020.

The effect on her 2019 tax return is:

A)increase in Net Income for Tax Purposes of $12,500; increase in Taxable Income of $12,500.

B)increase in Net Income for Tax Purposes of $25,000; increase in Taxable Income of $12,500.

C)increase in Net Income for Tax Purposes of $10,000; increase in Taxable Income of $10,000.

D)increase in Net Income for Tax Purposes of $20,000; increase in Taxable Income of $10,000.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

72

Connely Ltd. has an August 31 year end. On August 31, 2020, it declares a bonus of $250,000 payable to Ms. Sara Connely, the founder of the Company. The bonus is payable on April 1, 2021. Describe the tax consequences of this bonus to both Connely Ltd. and Ms. Sara Connely.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following criteria is NOT necessary in order for a salesperson to deduct office costs?

A)Must pay own expenses.

B)Must carry on duties away from the employer's place of business.

C)Must not receive an expense allowance which has not been included in income.

D)Must receive all remuneration in commissions.

A)Must pay own expenses.

B)Must carry on duties away from the employer's place of business.

C)Must not receive an expense allowance which has not been included in income.

D)Must receive all remuneration in commissions.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

74

Ms. Sarah Wexler is provided with a car by her employer. It is leased by the employer for $728 per month, including $78 of HST. The lease payment also includes a payment of $50 per month to cover insuring the vehicle. During 2020, Ms. Wexler uses the car for 10 months. During the other 2 months, the employer requires that it be returned to their premises. She drives the car 76,000 kilometers during this period, of which 23,000 are for personal use. Calculate Ms. Wexler's minimum taxable benefit for the use of the automobile.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

75

Ms. Jessica Tremblay is a member of a group disability plan sponsored by her employer. The plan provides periodic benefits that compensate for lost employment income. In 2019, Ms. Tremblay was required to pay $324 in premiums. In 2020, Ms. Tremblay received benefits under the plan of $6,940. Ms. Tremblay's contributions to the plan for 2020 totalled $250. During 2020, her employer's share of the annual premium was $2,175. What amount will Ms. Tremblay include in her 2020 net employment income?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

76

Roger is employed by an Internet based corporation as a technical support representative and is paid a salary of $40,000 per year. He is required to work from home and uses the 200 square foot den in his 1,000 square foot apartment exclusively for this purpose. Total costs for 2020 were as follows:  Roger's maximum employment expense deduction for 2020 is:

Roger's maximum employment expense deduction for 2020 is:

A)$3,890.

B)$3,970.

C)$3,870.

D)$3,790.

Roger's maximum employment expense deduction for 2020 is:

Roger's maximum employment expense deduction for 2020 is:A)$3,890.

B)$3,970.

C)$3,870.

D)$3,790.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

77

Gail works for a Canadian public corporation. Three years ago she was offered an option to purchase 100 shares at $30 per share from her employer. The fair market value on that day was $33 per share. Gail exercised her option by purchasing 100 shares in the current year at a time the fair market value was $42 per share. She is still holding the shares. What is the effect on Gail's Net Income For Tax Purposes in the current year?

A)$1,200 increase

B)$900 increase

C)$600 increase

D)No effect.

A)$1,200 increase

B)$900 increase

C)$600 increase

D)No effect.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

78

Mr. Robert Rhodes is provided with an automobile that is owned by his employer. The car was acquired by the employer in 2018 for $63,000, plus $3,150 in GST. During 2020, it was used by Mr. Rhodes for 8 months. When not using the automobile, the employer required that Mr. Rhodes return it to their premises. His total milage in 2020 was 53,000 kilometers, of which 22,000 were employment related. Calculate Mr. Rhodes' minimum taxable benefit for the use of the automobile.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

79

The questions below are based on the following information:

Mr. Morra commenced employment with Peoples Bank Ltd., a public corporation, on January 1, 2018. On December 31, 2018, he was granted options to purchase 500 shares of Peoples Bank Ltd. stock for $15 per share. The market value on December 31, 2018 was $16 per share.

Mr. Morra exercised his options on May 31, 2019, purchasing 500 shares for $15 per share when the market value was $17 per share. On September 1, 2020, Mr. Morra sold the shares for $24 each.

What is the effect of the above transactions on Mr. Morra's Taxable Income in 2020?

A)Nil.

B)An increase of $1,750.

C)An increase of $2,750.

D)An increase of $3,500.

Mr. Morra commenced employment with Peoples Bank Ltd., a public corporation, on January 1, 2018. On December 31, 2018, he was granted options to purchase 500 shares of Peoples Bank Ltd. stock for $15 per share. The market value on December 31, 2018 was $16 per share.

Mr. Morra exercised his options on May 31, 2019, purchasing 500 shares for $15 per share when the market value was $17 per share. On September 1, 2020, Mr. Morra sold the shares for $24 each.

What is the effect of the above transactions on Mr. Morra's Taxable Income in 2020?

A)Nil.

B)An increase of $1,750.

C)An increase of $2,750.

D)An increase of $3,500.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

80

Brock Inc. has a taxation year that ends on September 30. On July 1, 2020 it declared a bonus of $100,000 payable to Stan Gable. The bonus will be paid on February 1, 2021. Describe the tax consequences of this bonus declaration and payment on both Stan Gable and Brock Inc.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck