Deck 9: The Capital Asset Pricing Model

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/64

Play

Full screen (f)

Deck 9: The Capital Asset Pricing Model

1

The risk-free rate is 5%, and the expected return on the market is 13%. A publicly-traded bond promises a rate of return of 9%; the expected return on this bond is 8%. What is the

Bond's implied beta?

A)2.667

B)0.375

C)3.000

D)0.500

Bond's implied beta?

A)2.667

B)0.375

C)3.000

D)0.500

0.375

2

The equity premium is 8.8% and the risk-free rate is 4.6%. What is the expected return on the market portfolio?

A)10.4%

B)13.4%

C)9.6%

D)4.2%

A)10.4%

B)13.4%

C)9.6%

D)4.2%

13.4%

3

The relevant risk-free rate is 5%, and the equity premium has averaged 9% in recent years. Your project has an estimated beta of 1.12. What rate of return should you require on this

Project? Round your answer to the nearest tenth of a percent.

A)14.6%

B)5.1%

C)15.1%

D)9.5%

Project? Round your answer to the nearest tenth of a percent.

A)14.6%

B)5.1%

C)15.1%

D)9.5%

15.1%

4

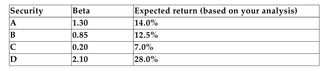

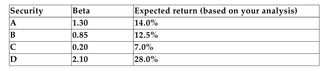

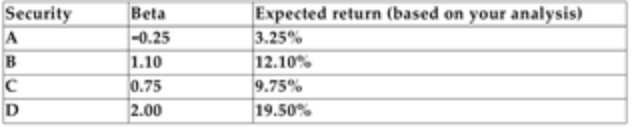

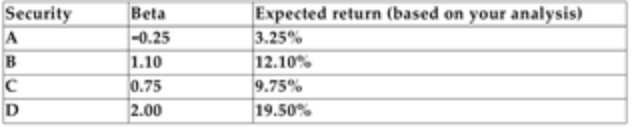

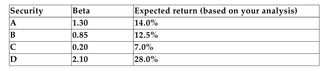

You have analyzed the following four securities and have estimated each security's beta and what you expect each security to return next year. The expected return on the market portfolio is 13%, and the relevant risk-free rate is 5.5%.

Refer to the information above. Based on your analysis, which of the securities is correctly priced?

A)Security C

B)Security D

C)Security B

D)Security A

Refer to the information above. Based on your analysis, which of the securities is correctly priced?

A)Security C

B)Security D

C)Security B

D)Security A

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

5

The risk-free rate is 4.2%, and the expected return on the market is 10%. A publicly-traded bond promises to return 8%. The expected return on the bond investment is 5.5%. What is the

Bond's implied beta?

A)0.22

B)1.38

C)0.73

D)0.45

Bond's implied beta?

A)0.22

B)1.38

C)0.73

D)0.45

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

6

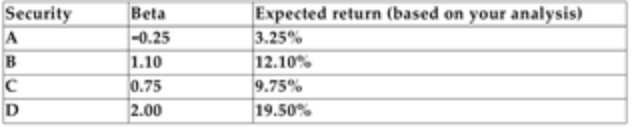

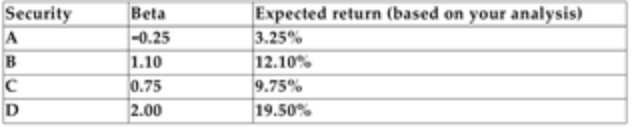

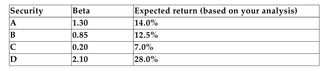

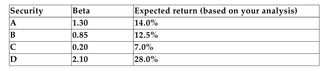

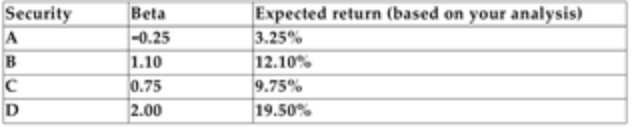

You have analyzed the following four securities and have estimated each security's beta and what you expect each security to return next year. The expected return on the market portfolio is 12%, and the relevant risk-free rate is 5%.

Refer to the information above. Based on your analysis, which of the securities is correctly priced?

A)Security A

B)Security B

C)Security D

D)Security C

Refer to the information above. Based on your analysis, which of the securities is correctly priced?

A)Security A

B)Security B

C)Security D

D)Security C

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

7

In addition to perfect markets, what are the underlying assumptions of the Capital

Asset Pricing Model (CAPM)?

Asset Pricing Model (CAPM)?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements is true?

A)Assets with higher levels of market risk will sell for higher prices.

B)Assets with higher levels of market risk will have lower expected rates of return.

C)Assets with lower levels of market risk will have higher expected rates of return.

D)Assets with lower levels of market risk will sell for higher prices.

A)Assets with higher levels of market risk will sell for higher prices.

B)Assets with higher levels of market risk will have lower expected rates of return.

C)Assets with lower levels of market risk will have higher expected rates of return.

D)Assets with lower levels of market risk will sell for higher prices.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

9

You have analyzed the following four securities and have estimated each security's beta and what you expect each security to return next year. The expected return on the market portfolio is 12%, and the relevant risk-free rate is 5%.

Refer to the information above. Based on your analysis, which of the securities is (are) underpriced?

A)Security A and Security D

B)Security B and Security C

C)Security D

D)Security A

Refer to the information above. Based on your analysis, which of the securities is (are) underpriced?

A)Security A and Security D

B)Security B and Security C

C)Security D

D)Security A

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is not an input to the capital asset pricing model?

A)standard deviation

B)beta

C)risk-free rate

D)expected return on the market portfolio

A)standard deviation

B)beta

C)risk-free rate

D)expected return on the market portfolio

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

11

A project has a market beta of 1.4. The risk-free rate is 5%, and the equity premium is 7.6%. Your firm should undertake this project only if it returns

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

12

Your project has a beta of 1.8. The risk-free rate is 5.3%, and the expected return on the market is 12%. What minimum rate of return should you require on this project? Round your answer

To the nearest tenth of a percent.

A)15.4%

B)16.9%

C)12.1%

D)none of the above

To the nearest tenth of a percent.

A)15.4%

B)16.9%

C)12.1%

D)none of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

13

You have $5,000 invested in Security M, $3,000 invested in Security L, and $2,000 invested in Security P. Security M has a beta of 0.85; Security L has a beta of 1.50; and Security P has a beta

Of 1.90. The relevant risk-free rate is 7%, and the expected return on the market portfolio is

18%. What is the expected return on your portfolio? Round your answer to the nearest tenth

Of a percent.

A)20.8%

B)18.0%

C)29.6%

D)6.8%

Of 1.90. The relevant risk-free rate is 7%, and the expected return on the market portfolio is

18%. What is the expected return on your portfolio? Round your answer to the nearest tenth

Of a percent.

A)20.8%

B)18.0%

C)29.6%

D)6.8%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

14

You have analyzed the following four securities and have estimated each security's beta and what you expect each security to return next year. The expected return on the market portfolio is 13%, and the relevant risk-free rate is 5.5%.

Refer to the information above. Based on your analysis, which of the securities is overpriced?

A)Security B

B)Security C

C)Security A

D)Security D

Refer to the information above. Based on your analysis, which of the securities is overpriced?

A)Security B

B)Security C

C)Security A

D)Security D

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

15

You have analyzed the following four securities and have estimated each security's beta and what you expect each security to return next year. The expected return on the market portfolio is 13%, and the relevant risk-free rate is 5.5%.

Refer to the information above. Based on your analysis, which securities is (are)underpriced?

A)Security B and Security D

B)Security A and Security D

C)Security A only

D)Security B only

Refer to the information above. Based on your analysis, which securities is (are)underpriced?

A)Security B and Security D

B)Security A and Security D

C)Security A only

D)Security B only

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

16

The expected return on the market portfolio is 12%, and the relevant risk-free rate is 4.2%. What is the equity premium?

A)17.8%

B)16.2%

C)7.8%

D)8.6%

A)17.8%

B)16.2%

C)7.8%

D)8.6%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is not one of the underlying assumptions of the Capital Asset Pricing Model (CAPM)?

A)All investors hold well-diversified portfolios.

B)We live in a world of perfect capital markets.

C)All investors face the same, single-period, time horizon.

D)All of the above are assumptions underlying CAPM.

A)All investors hold well-diversified portfolios.

B)We live in a world of perfect capital markets.

C)All investors face the same, single-period, time horizon.

D)All of the above are assumptions underlying CAPM.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

18

You have analyzed the following four securities and have estimated each security's beta and what you expect each security to return next year. The expected return on the market portfolio is 12%, and the relevant risk-free rate is 5%.

Refer to the information above. Based on your analysis, which of the securities is (are) overpriced?

A)Security A only

B)Security B and Security D

C)Security B and Security C

D)Security D only

Refer to the information above. Based on your analysis, which of the securities is (are) overpriced?

A)Security A only

B)Security B and Security D

C)Security B and Security C

D)Security D only

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

19

Security A is expected to return 12% according to CAPM; Security B is expected to return 15% according to CAPM. Which of the following statements is (are)true?

A)Security A must have a higher degree of total risk than Security B.

B)Security B must have a higher degree of market risk than Security A.

C)Security B is a better investment than Security A since it offers a higher return.

D)Both A and C are true.

A)Security A must have a higher degree of total risk than Security B.

B)Security B must have a higher degree of market risk than Security A.

C)Security B is a better investment than Security A since it offers a higher return.

D)Both A and C are true.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

20

In the CAPM world, investors measure the risk of a project that your firm chooses to undertake by its

A)variance.

B)covariance with other projects in which your firm invests.

C)market beta.

D)standard deviation.

A)variance.

B)covariance with other projects in which your firm invests.

C)market beta.

D)standard deviation.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

21

A zero-coupon bond has a beta of 0.15 and promises to pay $5,000 next year with a probability of 96%, $1,000 with a probability of 2%, and there is a 2% probability of total default. One-year Treasury securities are yielding 4%, and the expected return on the market is 10%.

Refer to the information above. What is the risk premium for this bond investment?

A)3.9%

B)4.0%

C)5.3%

D)0.9%

Refer to the information above. What is the risk premium for this bond investment?

A)3.9%

B)4.0%

C)5.3%

D)0.9%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

22

When evaluating a project, the chance of default is captured by

A)discounting the expected cash flows of the project at the equity premium.

B)calculating the expected cash flows of the project.

C)using the expected return on the market as the discount rate.

D)using the CAPM expected rate of return as the discount rate.

A)discounting the expected cash flows of the project at the equity premium.

B)calculating the expected cash flows of the project.

C)using the expected return on the market as the discount rate.

D)using the CAPM expected rate of return as the discount rate.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

23

The Security Market Line depicts the relationship between a security's

A)expected return and market beta.

B)expected return and total risk.

C)price and market beta.

D)price and standard deviation.

A)expected return and market beta.

B)expected return and total risk.

C)price and market beta.

D)price and standard deviation.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

24

A zero-coupon bond has a beta of 0.1 and promises to pay $1,000 next year with a probability of 98%. If the bond defaults, it will pay nothing. One-year Treasury securities are yielding 5%, and the equity premium is 7%.

Refer to the information above. What is the risk premium for this bond investment?

A)5.0%

B)2.9%

C)0.7%

D)5.7%

Refer to the information above. What is the risk premium for this bond investment?

A)5.0%

B)2.9%

C)0.7%

D)5.7%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

25

Your firm is considering a project that is expected to produce a single cash flow of $2,000 next year. The market beta of the project is 2.2. The equity premium is expected to be 6%, and the

Risk-free rate is 3.8%. What is the maximum amount your firm should be willing to invest in

This project? Round your answer to the nearest dollar.

A)$1,709

B)$1,639

C)$1,841

D)$2,000

Risk-free rate is 3.8%. What is the maximum amount your firm should be willing to invest in

This project? Round your answer to the nearest dollar.

A)$1,709

B)$1,639

C)$1,841

D)$2,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

26

A zero-coupon bond has a beta of 0.1 and promises to pay $1,000 next year with a probability of 98%. If the bond defaults, it will pay nothing. One-year Treasury securities are yielding 5%, and the equity premium is 7%.

Refer to the information above. What is the fair market value of the bond?

A)$927.15

B)$980.00

C)$946.07

D)$950.57

Refer to the information above. What is the fair market value of the bond?

A)$927.15

B)$980.00

C)$946.07

D)$950.57

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

27

A zero-coupon bond has a beta of 0.1 and promises to pay $1,000 next year with a probability of 98%. If the bond defaults, it will pay nothing. One-year Treasury securities are yielding 5%, and the equity premium is 7%.

Refer to the information above. What is the promised rate of return on this bond? Round your answer to the nearest tenth of a percent.

A)7.9%

B)2.0%

C)5.7%

D)5.2%

Refer to the information above. What is the promised rate of return on this bond? Round your answer to the nearest tenth of a percent.

A)7.9%

B)2.0%

C)5.7%

D)5.2%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

28

A zero-coupon bond has a beta of 0.15 and promises to pay $5,000 next year with a probability of 96%, $1,000 with a probability of 2%, and there is a 2% probability of total default. One-year Treasury securities are yielding 4%, and the expected return on the market is 10%.

Refer to the information above. What is the time premium for this bond investment?

A)5.3%

B)4.0%

C)6.0%

D)5.4%

Refer to the information above. What is the time premium for this bond investment?

A)5.3%

B)4.0%

C)6.0%

D)5.4%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

29

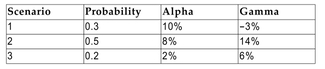

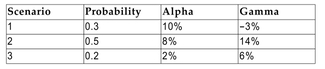

Consider the following information regarding Project Alpha and Project Gamma:  a. What is the expected return on Project Alpha?

a. What is the expected return on Project Alpha?

b. What is the expected return on Project Gamma?

c. If the relevant risk-free rate is 3.5% and the expected return on the market is 11%,

what is the CAPM expected return on Project Alpha if its estimated beta is 0.5?

d. Using the same assumptions as in part (c), what is the CAPM expected return on

Project Gamma if its estimated beta is 0.8?

e. Based on your previous calculations, in which project would you recommend your

firm invest? Why?

a. What is the expected return on Project Alpha?

a. What is the expected return on Project Alpha?b. What is the expected return on Project Gamma?

c. If the relevant risk-free rate is 3.5% and the expected return on the market is 11%,

what is the CAPM expected return on Project Alpha if its estimated beta is 0.5?

d. Using the same assumptions as in part (c), what is the CAPM expected return on

Project Gamma if its estimated beta is 0.8?

e. Based on your previous calculations, in which project would you recommend your

firm invest? Why?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

30

The slope of the Security Market Line is equal to

A)the equity premium.

B)beta.

C)the risk-free interest rate.

D)none of the above

A)the equity premium.

B)beta.

C)the risk-free interest rate.

D)none of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

31

The stock of Tartan Corporation paid a dividend of $2.00 this year. Dividends are expected to grow at the constant rate of 8% indefinitely. The expected return on the market is 11%, and the

Risk-free rate is 4%. The equity premium is expected to remain constant for the foreseeable

Future. If the beta of the stock is 0.8, what is the maximum price you should pay for a share of

Tartan Corporation, according to CAPM?

A)$135.00

B)$41.67

C)$45.00

D)$125.00

Risk-free rate is 4%. The equity premium is expected to remain constant for the foreseeable

Future. If the beta of the stock is 0.8, what is the maximum price you should pay for a share of

Tartan Corporation, according to CAPM?

A)$135.00

B)$41.67

C)$45.00

D)$125.00

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

32

The risk-free rate is 4.5%, and the expected return on the market is 11%. The equation of the security market line is

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

33

The slope of the security market line is indicative of

A)the level of investor risk aversion.

B)the current level of inflation.

C)the current, relevant risk-free rate.

D)the risk of the individual security or portfolio of securities being evaluated.

A)the level of investor risk aversion.

B)the current level of inflation.

C)the current, relevant risk-free rate.

D)the risk of the individual security or portfolio of securities being evaluated.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

34

A zero-coupon bond has a beta of 0.1 and promises to pay $1,000 next year with a probability of 98%. If the bond defaults, it will pay nothing. One-year Treasury securities are yielding 5%, and the equity premium is 7%.

Refer to the information above. What is the time premium for this bond investment?

A)0.7%

B)5.0%

C)2.9%

D)5.7%

Refer to the information above. What is the time premium for this bond investment?

A)0.7%

B)5.0%

C)2.9%

D)5.7%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

35

A zero-coupon bond has a beta of 0.1 and promises to pay $1,000 next year with a probability of 98%. If the bond defaults, it will pay nothing. One-year Treasury securities are yielding 5%, and the equity premium is 7%.

Refer to the information above. What is the default premium on this bond?

A)5.7%

B)7.9%

C)0.7%

D)2.2%

Refer to the information above. What is the default premium on this bond?

A)5.7%

B)7.9%

C)0.7%

D)2.2%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

36

A zero-coupon bond has a beta of 0.15 and promises to pay $5,000 next year with a probability of 96%, $1,000 with a probability of 2%, and there is a 2% probability of total default. One-year Treasury securities are yielding 4%, and the expected return on the market is 10%.

Refer to the information above. What is the promised rate of return on this bond investment? Round your answer to the nearest tenth of a percent.

A)8.8%

B)6.0%

C)9.3%

D)5.4%

Refer to the information above. What is the promised rate of return on this bond investment? Round your answer to the nearest tenth of a percent.

A)8.8%

B)6.0%

C)9.3%

D)5.4%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

37

You invest in 200 shares of Canso Corporation, which sells for $20 a share and has an

expected return of 12% with a standard deviation of 3% and a beta of 1.1, and 600

shares of Darnit Corporation, which sells for $10 a share and has an expected return of

18% with a standard deviation of 5% and a beta of 1.3.

a. What is the expected return of your portfolio?

b. What is the beta of your portfolio?

c. If the relevant risk-free rate is 5% and the equity premium is 8.5%, what is the

minimum rate of return you should require on your investment in this portfolio?

d. Is your portfolio overpriced, underpriced, or correctly priced? Explain.

expected return of 12% with a standard deviation of 3% and a beta of 1.1, and 600

shares of Darnit Corporation, which sells for $10 a share and has an expected return of

18% with a standard deviation of 5% and a beta of 1.3.

a. What is the expected return of your portfolio?

b. What is the beta of your portfolio?

c. If the relevant risk-free rate is 5% and the equity premium is 8.5%, what is the

minimum rate of return you should require on your investment in this portfolio?

d. Is your portfolio overpriced, underpriced, or correctly priced? Explain.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

38

A zero-coupon bond has a beta of 0.15 and promises to pay $5,000 next year with a probability of 96%, $1,000 with a probability of 2%, and there is a 2% probability of total default. One-year Treasury securities are yielding 4%, and the expected return on the market is 10%.

Refer to the information above. What is the fair market value of this bond investment?

A)$4,717.98

B)$4,594.85

C)$4,547.17

D)$4,820.00

Refer to the information above. What is the fair market value of this bond investment?

A)$4,717.98

B)$4,594.85

C)$4,547.17

D)$4,820.00

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

39

The CAPM expected rate of return is equal to the

A)time premium plus the default premium.

B)default premium plus the expected risk premium.

C)time premium plus the expected risk premium.

D)time premium plus the default premium plus the expected risk premium.

A)time premium plus the default premium.

B)default premium plus the expected risk premium.

C)time premium plus the expected risk premium.

D)time premium plus the default premium plus the expected risk premium.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

40

The stock of the Delta Corporation has a beta of 1.9. The stock recently paid an annual dividend of $1.60, and dividends are expected to grow at a rate of 10% indefinitely. The equity

Premium has averaged 8% in recent years, and it is expected to remain at this level for the

Foreseeable future. The relevant risk-free rate is 5%. What is the maximum price you should

Pay for a share of the Delta Corporation, according to CAPM?

A)$32.00

B)$15.69

C)$17.25

D)none of the above

Premium has averaged 8% in recent years, and it is expected to remain at this level for the

Foreseeable future. The relevant risk-free rate is 5%. What is the maximum price you should

Pay for a share of the Delta Corporation, according to CAPM?

A)$32.00

B)$15.69

C)$17.25

D)none of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

41

When using CAPM to determine a benchmark return against which to compare a project's IRR, you should

A)use the yield on a three-month Treasury security as your risk-free rate.

B)use the yield on a Treasury security that most closely matches the duration of your project as your risk-free rate.

C)use the yield on a ten-year Treasury security as your risk-free rate.

D)use the yield on a one-year Treasury security as your risk-free rate.

A)use the yield on a three-month Treasury security as your risk-free rate.

B)use the yield on a Treasury security that most closely matches the duration of your project as your risk-free rate.

C)use the yield on a ten-year Treasury security as your risk-free rate.

D)use the yield on a one-year Treasury security as your risk-free rate.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements is true?

A)The CAPM will provide a reasonably good cost of capital estimate in many corporate scenarios.

B)Most corporate CFOs used alternative models to the CAPM when estimating their projects' costs of capital.

C)The CAPM provides the most accurate results when it is used to determine which financial investments are best to undertake at any given point in time.

D)The CAPM will provide a cost of capital that is accurate to the hundredth of a percent.

A)The CAPM will provide a reasonably good cost of capital estimate in many corporate scenarios.

B)Most corporate CFOs used alternative models to the CAPM when estimating their projects' costs of capital.

C)The CAPM provides the most accurate results when it is used to determine which financial investments are best to undertake at any given point in time.

D)The CAPM will provide a cost of capital that is accurate to the hundredth of a percent.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

43

A zero-coupon bond has a beta of 0.15 and promises to pay $5,000 next year with a probability of 96%, $1,000 with a probability of 2%, and there is a 2% probability of total default. One-year Treasury securities are yielding 4%, and the expected return on the market is 10%.

Refer to the information above. What is the default premium for this bond investment?

A)3.9%

B)4.8%

C)8.8%

D)none of the above

Refer to the information above. What is the default premium for this bond investment?

A)3.9%

B)4.8%

C)8.8%

D)none of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

44

Your parents have informed you that they plan to reward you for your academic achievements with $10,000 when you graduate next year. The risk-free rate is 4%, and the expected return

On the market is 9%, with a standard deviation of 18%. What is the present value of this gift if

You assume that your future cash flow is independent of the return on the market? Round

Your answer to the nearest dollar.

A)$9,615

B)$8,850

C)$9,174

D)$9,467

On the market is 9%, with a standard deviation of 18%. What is the present value of this gift if

You assume that your future cash flow is independent of the return on the market? Round

Your answer to the nearest dollar.

A)$9,615

B)$8,850

C)$9,174

D)$9,467

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

45

A corporate bond promises to pay $5,000 next year with a probability of 97%. If the

bond instead defaults, the bondholders will receive nothing. The beta of the bond is

0.2, the risk-free rate is 5.5%, and the expected return on the market is 11%. Calculate

the bond's promised rate of return and indicate how much of it is time premium,

default premium, and risk premium.

bond instead defaults, the bondholders will receive nothing. The beta of the bond is

0.2, the risk-free rate is 5.5%, and the expected return on the market is 11%. Calculate

the bond's promised rate of return and indicate how much of it is time premium,

default premium, and risk premium.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

46

True, False, or Uncertain: CAPM provides us with a promised rate of return for an

asset. Explain.

asset. Explain.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

47

A project has an asset beta of 0.70. The expected return on the market is 18%, and the relevant risk-free rate is 7%. The project's required rate of return is

A)14.7%.

B)10.5%.

C)24.5%.

D)19.6%.

A)14.7%.

B)10.5%.

C)24.5%.

D)19.6%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

48

The philosophical method of estimating equity premiums suggests that equity premiums range from about

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

49

The most difficult CAPM input to estimate is the

A)market beta of the project.

B)risk-free interest rate.

C)standard deviation.

D)equity premium.

A)market beta of the project.

B)risk-free interest rate.

C)standard deviation.

D)equity premium.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

50

The empirical evidence suggests that

A)growth stocks tend to outperform value stocks when their relative market risks are considered.

B)small stocks tend to outperform large stocks when their relative market risks are considered.

C)CAPM reliably predicts a security's returns 96% of the time.

D)all of the above statements are true.

A)growth stocks tend to outperform value stocks when their relative market risks are considered.

B)small stocks tend to outperform large stocks when their relative market risks are considered.

C)CAPM reliably predicts a security's returns 96% of the time.

D)all of the above statements are true.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

51

Proponents of the bubble view believe that when using historical averages to estimate an equity premium,

A)the average should be based on the last 10 to 15 years of historical data only since earlier data is no longer descriptive of current conditions, e.g., bubbles.

B)the average should be calculated using data from the earliest recorded point in time in order to ensure that any temporary bubbles are smoothed out.

C)the equity premium will be lower after recent market surges.

D)the equity premium will be higher after recent market surges.

A)the average should be based on the last 10 to 15 years of historical data only since earlier data is no longer descriptive of current conditions, e.g., bubbles.

B)the average should be calculated using data from the earliest recorded point in time in order to ensure that any temporary bubbles are smoothed out.

C)the equity premium will be lower after recent market surges.

D)the equity premium will be higher after recent market surges.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

52

A project's asset beta is 1.15 and the relevant risk-free rate is 6%. The equity premium is expected to be 9%. The cost of capital for the project is

A)23.25%.

B)16.35%

C)9.45%.

D)unable to be determined without knowing the amount of debt that will be used to finance the project.

A)23.25%.

B)16.35%

C)9.45%.

D)unable to be determined without knowing the amount of debt that will be used to finance the project.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements regarding estimating an equity premium is false?

A)The S&P 500 Index is commonly used to proxy for the market portfolio when using historical data to estimate an equity premium.

B)If you are evaluating long-term projects, you should use the yield on a long-term Treasury bond as the risk-free rate in the equity premium equation.

C)You should estimate an equity premium for each project you are evaluating.

D)All of the above are true statements.

A)The S&P 500 Index is commonly used to proxy for the market portfolio when using historical data to estimate an equity premium.

B)If you are evaluating long-term projects, you should use the yield on a long-term Treasury bond as the risk-free rate in the equity premium equation.

C)You should estimate an equity premium for each project you are evaluating.

D)All of the above are true statements.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

54

The Bookworm Company is currently financed with $10,000 in debt and $40,000

equity. The market beta of its equity is 1.7. The market beta of its debt is zero since the

company has more than enough cash reserves to pay off its debt completely. The

equity premium is 6%, and the relevant risk-free rate is 4%. What will stockholders in

the company require as a minimum rate of return on their investment? What

minimum rate of return should Bookworm require on projects that it undertakes?

equity. The market beta of its equity is 1.7. The market beta of its debt is zero since the

company has more than enough cash reserves to pay off its debt completely. The

equity premium is 6%, and the relevant risk-free rate is 4%. What will stockholders in

the company require as a minimum rate of return on their investment? What

minimum rate of return should Bookworm require on projects that it undertakes?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements regarding errors in the CAPM inputs is (are)true?

A)Errors in equity premium estimates tend to be large and have a significant influence on the resultant hurdle rates.

B)Errors in the risk-free rate tend to be insignificant.

C)Errors in market-beta estimates tend to be modest.

D)All of the above statements are true.

A)Errors in equity premium estimates tend to be large and have a significant influence on the resultant hurdle rates.

B)Errors in the risk-free rate tend to be insignificant.

C)Errors in market-beta estimates tend to be modest.

D)All of the above statements are true.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

56

How is the probability of default incorporated in an NPV analysis?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

57

The market value of a firm's equity is $26 million and the market value of its debt is $16 million. The equity beta is 0.85 and the beta of the firm's debt is 0.0. What is the firm's asset

Beta? Round your answer to the nearest hundredth.

A)1.03

B)0.80

C)0.53

D)0.73

Beta? Round your answer to the nearest hundredth.

A)1.03

B)0.80

C)0.53

D)0.73

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

58

What does the empirical evidence suggest about the usefulness of the Capital Asset

Pricing Model? Discuss briefly.

Pricing Model? Discuss briefly.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is not an advantage of the certainty-equivalent approach to determining the NPV of a project?

A)It allows the decision maker to incorporate preferences for risk.

B)It is easier to interpret the net present value when the certainty equivalent method is used.

C)It separates the time value of money from the risk of the project.

D)All of the above are advantages of the certainty-equivalent approach.

A)It allows the decision maker to incorporate preferences for risk.

B)It is easier to interpret the net present value when the certainty equivalent method is used.

C)It separates the time value of money from the risk of the project.

D)All of the above are advantages of the certainty-equivalent approach.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

60

The equity beta of a firm that is financed with 40% debt and 60% equity is 1.6. The beta of the debt is 0.1. The expected return on the market is 10%, and the risk-free rate is 5%. What rate

Of return should this firm require on its projects?

A)5.5%

B)13.0%

C)10.0%

D)15.0%

Of return should this firm require on its projects?

A)5.5%

B)13.0%

C)10.0%

D)15.0%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following comparisons of the Capital Asset Pricing Model (CAPM)and the Arbitrage Pricing Model (APT)is (are)true?

A)CAPM bases the expected return on an asset on one factor--the market portfolio; the APT bases the expected return on a number of economic factors.

B)CAPM is based on the theory that an asset's returns should compensate the investor for the risk of the investment. Risk is not factored into the APT.

C)While CAPM requires a number of estimates, the APT factors and their values are known with certainty.

D)All of the above statements are true.

A)CAPM bases the expected return on an asset on one factor--the market portfolio; the APT bases the expected return on a number of economic factors.

B)CAPM is based on the theory that an asset's returns should compensate the investor for the risk of the investment. Risk is not factored into the APT.

C)While CAPM requires a number of estimates, the APT factors and their values are known with certainty.

D)All of the above statements are true.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

62

What is the definition of the efficient frontier? Describe the locus of points of the

efficient frontier when we assume the existence of a risk-free asset.

efficient frontier when we assume the existence of a risk-free asset.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following statements is (are)false?

A)If the market portfolio is the tangency portfolio, then the relationship between risk and return is best described as parabolic.

B)If two mean-variance efficient portfolios are combined, the result is a mean-variance efficient portfolio.

C)All mean-variance efficient portfolios are combinations of the market portfolio and the risk-free asset.

D)All of the above are true statements.

A)If the market portfolio is the tangency portfolio, then the relationship between risk and return is best described as parabolic.

B)If two mean-variance efficient portfolios are combined, the result is a mean-variance efficient portfolio.

C)All mean-variance efficient portfolios are combinations of the market portfolio and the risk-free asset.

D)All of the above are true statements.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

64

Assume you have a 2-factor APT model. Factor 1 is GDP growth, with an expected

value of 3.5%. Factor 2 is the percentage change in unemployment, with an expected

value of -2%. The following factor sensitivities have been calculated for Project X: = 3.0;

= 3.0;  unemployment = -0.1. The risk-free rate is 4%. What does APT indicate

unemployment = -0.1. The risk-free rate is 4%. What does APT indicate

you should require as a return on Project X?

value of 3.5%. Factor 2 is the percentage change in unemployment, with an expected

value of -2%. The following factor sensitivities have been calculated for Project X:

= 3.0;

= 3.0;  unemployment = -0.1. The risk-free rate is 4%. What does APT indicate

unemployment = -0.1. The risk-free rate is 4%. What does APT indicateyou should require as a return on Project X?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck