Deck 2: The Time Value of Money and Net Present Value

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/65

Play

Full screen (f)

Deck 2: The Time Value of Money and Net Present Value

1

You purchased a share of stock for $58.00. At the end of a quarter, the stock paid a dividend of $0.75, and you sold it for $63.00 right after receiving the dividend.

Refer to the information above. What was your dividend yield? Round your answer to the nearest tenth of a percent.

A)1.2%

B)8.6%

C)1.3%

D)none of the above

Refer to the information above. What was your dividend yield? Round your answer to the nearest tenth of a percent.

A)1.2%

B)8.6%

C)1.3%

D)none of the above

1.3%

2

You purchased a bond for $1,000. At the end of a year, the bond paid interest of $90. You sold the bond for $950 after receiving the interest payment.

Refer to the information above. What was your capital gains yield? Round your answer to the nearest tenth of a percent.

A)9.5%

B)-0.1%

C)-5.0%

D)5.3%

Refer to the information above. What was your capital gains yield? Round your answer to the nearest tenth of a percent.

A)9.5%

B)-0.1%

C)-5.0%

D)5.3%

-5.0%

3

One hundred basis points equal

A)1%

B)10%

C)100%

D)$1

A)1%

B)10%

C)100%

D)$1

1%

4

If a bond trader indicates that the yield on a bond has increased by 50 basis points,

what is the percentage change in yield?

what is the percentage change in yield?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

5

What are the four assumptions that define a "perfect" market?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements is true?

A)All rates of return are just interest rates earned on an investment.

B)An interest rate is the rate of return on a loan.

C)An interest payment can have unlimited upside potential.

D)All of the above are true statements.

A)All rates of return are just interest rates earned on an investment.

B)An interest rate is the rate of return on a loan.

C)An interest payment can have unlimited upside potential.

D)All of the above are true statements.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

7

You purchased a share of stock for $58.00. At the end of a quarter, the stock paid a dividend of $0.75, and you sold it for $63.00 right after receiving the dividend.

Refer to the information above. What was your total rate of return on this investment? Round your answer to the nearest tenth of a percent.

A)8.6%

B)7.2%

C)10.9%

D)9.9%

Refer to the information above. What was your total rate of return on this investment? Round your answer to the nearest tenth of a percent.

A)8.6%

B)7.2%

C)10.9%

D)9.9%

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

8

Suppose you deposit $1,000 today in an account that pays 5% interest at the end of each year. If you make no withdrawals, what is the balance in your account at the end of four years?

Round your answer to the nearest dollar.

A)$1,200

B)$1,216

C)$1,020

D)$1,050

Round your answer to the nearest dollar.

A)$1,200

B)$1,216

C)$1,020

D)$1,050

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

9

The Federal Reserve announced that it would lower the discount rate from 4.75% to 4.5%. This represents a decrease of

A)25 basis points

B)250 basis points

C)2.5 basis points

D)0.25 basis points

A)25 basis points

B)250 basis points

C)2.5 basis points

D)0.25 basis points

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

10

You purchased a bond for $1,000. At the end of a year, the bond paid interest of $90. You sold the bond for $950 after receiving the interest payment.

Refer to the information above. What was your total rate of return on this investment? Round your answer to the nearest tenth of a percent.

A)-5.0%

B)14.7%

C)9.5%

D)4.0%

Refer to the information above. What was your total rate of return on this investment? Round your answer to the nearest tenth of a percent.

A)-5.0%

B)14.7%

C)9.5%

D)4.0%

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is a necessary condition of a perfect market?

A)no risk

B)no taxes

C)no inflation

D)All of the above are necessary conditions for a market to be perfect.

A)no risk

B)no taxes

C)no inflation

D)All of the above are necessary conditions for a market to be perfect.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

12

You purchased a bond for $1,000. At the end of a year, the bond paid interest of $90. You sold the bond for $950 after receiving the interest payment.

Refer to the information above. What was your coupon yield ? Round your answer to the nearest tenth of a percent.

A)9.5%

B)9 basis points

C)9.0%

D)Both B and C are correct.

Refer to the information above. What was your coupon yield ? Round your answer to the nearest tenth of a percent.

A)9.5%

B)9 basis points

C)9.0%

D)Both B and C are correct.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

13

You purchased a share of stock for $58.00. At the end of a quarter, the stock paid a dividend of $0.75, and you sold it for $63.00 right after receiving the dividend.

Refer to the information above. What was your capital gains yield? Round your answer to the nearest tenth of a percent.

A)9.9%

B)8.6%

C)9.3%

D)9.2%

Refer to the information above. What was your capital gains yield? Round your answer to the nearest tenth of a percent.

A)9.9%

B)8.6%

C)9.3%

D)9.2%

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

14

You purchased a house for $330,000 cash one year ago. You can sell it today for $277,000. What rate of return did you earn on this investment? Round your answer to the nearest tenth

Of a percent.

A)19.1%

B)83.9%

C)-16.1%

D)none of the above

Of a percent.

A)19.1%

B)83.9%

C)-16.1%

D)none of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

15

Your newborn daughter has received a total of $2,500 in cash from various friends and relatives. If you deposit this money for her in an investment that returns an average return of

12% a year, how much will she have accumulated on her 21st birthday, to the nearest dollar?

A)$180,121

B)$204,247

C)$24,116

D)$27,010

12% a year, how much will she have accumulated on her 21st birthday, to the nearest dollar?

A)$180,121

B)$204,247

C)$24,116

D)$27,010

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

16

You have deposited $5,000 in an account that pays 5% interest each year. How much will you have in the account at the end of six years? Round your answer to the nearest dollar.

A)$6,500

B)$6,700

C)$6,381

D)none of the above

A)$6,500

B)$6,700

C)$6,381

D)none of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is not a necessary condition of a perfect market?

A)no taxes

B)no information differences among investors

C)no risk

D)no transaction costs

A)no taxes

B)no information differences among investors

C)no risk

D)no transaction costs

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

18

You purchased a stock for $60.00. At the end of one quarter, the stock paid a $0.30

dividend and was selling for $63.00. Calculate your total holding period return and

indicate how much was dividend yield and how much was capital gain yield.

dividend and was selling for $63.00. Calculate your total holding period return and

indicate how much was dividend yield and how much was capital gain yield.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

19

You invested $10,000 in a zero-coupon bond. The bond was worth $10,750 at the end of the year. What

Rate of return did you earn on this investment? Round your answer to the nearest tenth of a

Percent.

A)1.1%

B)9.3%

C)10.8%

D)7.5%

Rate of return did you earn on this investment? Round your answer to the nearest tenth of a

Percent.

A)1.1%

B)9.3%

C)10.8%

D)7.5%

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

20

What is the difference between an interest payment and a noninterest payment as

defined in the chapter?

defined in the chapter?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

21

Margaret Bodner opened a savings account for her new-born niece with $2,000. The

account pays 4% interest a year. How much will the account have in it when her niece

turns 20?

account pays 4% interest a year. How much will the account have in it when her niece

turns 20?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

22

Suppose you deposit $1,000 today in an account that pays interest at an annual rate of 5%. What will be the balance in the account at the end of two years if you withdraw only the

Interest paid on the interest at that time?

A)$1,100

B)$1,000

C)$1,103

D)$1,050

Interest paid on the interest at that time?

A)$1,100

B)$1,000

C)$1,103

D)$1,050

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

23

If interest is compounded daily, then

A)the annual percentage rate (APR)is greater than the effective annual rate (AER).

B)the investor will earn less interest than if interest were compounded monthly instead.

C)the annual percentage rate (APR)is lower than the effective annual rate (AER).

D)the annual percentage rate (APR)is equal to the effective annual rate (AER).

A)the annual percentage rate (APR)is greater than the effective annual rate (AER).

B)the investor will earn less interest than if interest were compounded monthly instead.

C)the annual percentage rate (APR)is lower than the effective annual rate (AER).

D)the annual percentage rate (APR)is equal to the effective annual rate (AER).

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

24

If you deposit $20,000 today in a bank account at a quoted rate of 12%, compounded quarterly, how much will be in the account in five years if you make no withdrawals? Round your

Answer to the nearest dollar.

A)$36,122

B)$21,020

C)$35,247

D)none of the above

Answer to the nearest dollar.

A)$36,122

B)$21,020

C)$35,247

D)none of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

25

A gallon of gasoline cost $0.39 during the summer of 1968 and $3.50 in the summer of 2008. To the nearest tenth of a percent, this is an average annual increase of

A)5.6%.

B)7.8%.

C)3.1%.

D)31.9%.

A)5.6%.

B)7.8%.

C)3.1%.

D)31.9%.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

26

A mutual fund reported the following quarterly returns: 2%, -5%, 4%, 1%. To the nearest tenth of a percent, this represents an annual return of

A)3.0%.

B)1.8%.

C)2.0%.

D)1.2%.

A)3.0%.

B)1.8%.

C)2.0%.

D)1.2%.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

27

The Monumental Returns Investment Company is offering you an investment that promises you $1,000 at the end of ten years if you invest $500 today. What average annual rate of return

Does this investment promise? Round your answer to the nearest tenth of a percent.

A)100.0%

B)10.3%

C)20.0%

D)7.2%

Does this investment promise? Round your answer to the nearest tenth of a percent.

A)100.0%

B)10.3%

C)20.0%

D)7.2%

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

28

How long will it take for a $1,000 investment to grow to $3,000 if the interest rate per year is 8%, and interest is paid only at the end of each year?

A)13 years

B)15 years

C)14 years

D)12 years

A)13 years

B)15 years

C)14 years

D)12 years

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

29

If you deposit $20,000 today in an account at a quoted rate of 16% a year, compounded semiannually, how much will you have in the account at the end of five years if you make no

Withdrawals?

A)$29,386

B)$43,822

C)$42,007

D)none of the above

Withdrawals?

A)$29,386

B)$43,822

C)$42,007

D)none of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

30

An investment earned 12% in one year. This represents an average monthly return of

A)100 basis points.

B)95 basis points.

C)9 basis points.

D)1 basis point.

A)100 basis points.

B)95 basis points.

C)9 basis points.

D)1 basis point.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

31

How long will it take to triple your investment if the interest rate per year is 9%, and interest is paid only at the end of each year?

A)13 years

B)15 years

C)11 years

D)17 years

A)13 years

B)15 years

C)11 years

D)17 years

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

32

If you had deposited $1.00 in a bank account at an annual rate of 2% at the beginning of 1929, how much would you have in the account at the end of 2008, assuming the interest rate

Remained constant?

A)$160.00

B)$47.79

C)$4.88

D)$81.60

Remained constant?

A)$160.00

B)$47.79

C)$4.88

D)$81.60

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

33

If $100 is deposited into an account that earns a quoted rate of 16%, compounded quarterly, for five years, how much will be in the account at the end of the 5th year? Round your answer to

The nearest dollar.

A)$219

B)$216

C)$210

D)$190

The nearest dollar.

A)$219

B)$216

C)$210

D)$190

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

34

You invested $1,000 in a mutual fund at the beginning of the year. The fund reported the following quarterly returns during the year: -5%, 5%, 4%, and 8%. How much will you have

In your account at the end of the year, assuming you made no additional deposits or

Withdrawals? Ignore any fees and round your answer to the nearest dollar.

A)$1,112

B)$1,030

C)$1,120

D)none of the above

In your account at the end of the year, assuming you made no additional deposits or

Withdrawals? Ignore any fees and round your answer to the nearest dollar.

A)$1,112

B)$1,030

C)$1,120

D)none of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

35

If you deposit $1,000 today in a bank account that pays 4%, compounded quarterly, how much will you have in ten years?

A)$1,040.60

B)$1,104.62

C)$1,460.24

D)$1,488.86

A)$1,040.60

B)$1,104.62

C)$1,460.24

D)$1,488.86

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

36

Suppose you deposit $1,000 today in an account that pays 5% interest at the end of each year. If you withdraw one half of the year's interest at the end of each year, what is the balance in

Your account after your third withdrawal? Round your answer to the nearest dollar.

A)$1,050

B)$1,077

C)$1,000

D)$1,216

Your account after your third withdrawal? Round your answer to the nearest dollar.

A)$1,050

B)$1,077

C)$1,000

D)$1,216

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

37

In which of the following accounts would you prefer to invest your money?

A)one that pays 4.5%, compounded annually

B)one that pays 4%, compounded daily

C)one that pays 4.25%, compounded monthly

D)one that pays 4.75%, compounded quarterly

A)one that pays 4.5%, compounded annually

B)one that pays 4%, compounded daily

C)one that pays 4.25%, compounded monthly

D)one that pays 4.75%, compounded quarterly

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

38

Sam refuses to retire until his retirement account has a balance of at least $1 million. The account currently has a balance of $500,000, and earns a rate of 9%, compounded monthly. If

Sam does not plan to make any more deposits into his account, how long will he have to wait

Until he retires?

A)15.2 years

B)7.8 years

C)9.4 years

D)12.1 years

Sam does not plan to make any more deposits into his account, how long will he have to wait

Until he retires?

A)15.2 years

B)7.8 years

C)9.4 years

D)12.1 years

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

39

The TriValley Corporation has a 3-month loan of $30,000. At the end of three months, the firm must repay the $30,000 plus $675 in interest. What is the effective annual rate on this loan?

A)30.6%

B)6.9%

C)9.3%

D)13.1%

A)30.6%

B)6.9%

C)9.3%

D)13.1%

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following loan terms would result in the lowest annual cost?

A)4% compounded annually

B)4%, compounded monthly

C)4%, compounded quarterly

D)4%, compounded daily

A)4% compounded annually

B)4%, compounded monthly

C)4%, compounded quarterly

D)4%, compounded daily

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

41

If the cost of capital is 8% per year, what is the discount factor for a cash flow occurring in 4 years?

A)0.7350

B)1.3605

C)1.0800

D)0.9259

A)0.7350

B)1.3605

C)1.0800

D)0.9259

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

42

Three years ago, Karen deposited $25,000 in an account that paid 8% annually. Today,

she transferred the funds in that account to an account that will pay her 10% annually.

How much will she have in her account three years from now?

she transferred the funds in that account to an account that will pay her 10% annually.

How much will she have in her account three years from now?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

43

You want to set aside some money today in order to present your son with a $3,000 trip upon his graduation from high school in seven years. If your opportunity cost of capital is 10% per

Year, how much do you need to set aside? Round your answer to the nearest dollar.

A)$471

B)$1,233

C)$1,539

D)$4,843

Year, how much do you need to set aside? Round your answer to the nearest dollar.

A)$471

B)$1,233

C)$1,539

D)$4,843

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

44

When your first child is born, you open an account for him with $5,000. If this account

will earn a compound average annual rate of 12%, is it possible for your child to

become a millionaire in his lifetime?

will earn a compound average annual rate of 12%, is it possible for your child to

become a millionaire in his lifetime?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

45

How much must you deposit in a bank account today to have $1,000 at the end of 5 years if the bank quotes a rate of 5%, compounded daily? Assume a 365-day year and round your answer

To the nearest dollar.

A)$779

B)$951

C)$784

D)$884

To the nearest dollar.

A)$779

B)$951

C)$784

D)$884

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

46

A bond that promises to pay $5,000 at the end of 12 months is selling for $4,695 today. What is its implied yield? Round your answer to the nearest tenth of a percent.

A)6.5%

B)9.0%

C)6.1%

D)9.4%

A)6.5%

B)9.0%

C)6.1%

D)9.4%

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

47

A zero-coupon bond promises to pay $1,000 in ten years. The appropriate annual effective interest rate for the 10-year period is a constant 6%. Rounded to the nearest dollar, the current

Price of the bond is

A)$943.

B)$747.

C)$558.

D)$1,000.

Price of the bond is

A)$943.

B)$747.

C)$558.

D)$1,000.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

48

How much must you deposit in an account today in order to have $1,000 in your account at the end of two years if you can earn 6.5% per year on your money? Round your answer to the

Nearest dollar.

A)$939

B)$914

C)$885

D)$882

Nearest dollar.

A)$939

B)$914

C)$885

D)$882

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

49

A project will cost $50,000 initially, and is expected to return $25,000 in years 1 and 2, -$20,000 in year 3, and $25,000 in years 4 and 5. Calculate the project's NPV if the appropriate cost of

Capital is 20%. Round your answer to the nearest dollar.

A)+$28,010

B)-$1,276

C)-$2,247

D)+$21,872

Capital is 20%. Round your answer to the nearest dollar.

A)+$28,010

B)-$1,276

C)-$2,247

D)+$21,872

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

50

Which is the better deal: a deposit of one penny today in an account that will offer a

daily return of 100% for one month (i.e., the value of the account is doubled every day

for 30 days)or a lump sum of $10 million to be received thirty days from today?

daily return of 100% for one month (i.e., the value of the account is doubled every day

for 30 days)or a lump sum of $10 million to be received thirty days from today?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

51

A Treasury bill promises to pay $10,000 at the end of 3 months. If its annual

percentage yield (APY)is 4%, what is its current market price?

percentage yield (APY)is 4%, what is its current market price?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

52

Suppose you are shopping for a loan, and three different institutions quote the same

interest rate. However, the first institution uses monthly compounding, the second

compounds interest quarterly, and the third uses semiannual compounding. Which

loan is the best deal? Why?

interest rate. However, the first institution uses monthly compounding, the second

compounds interest quarterly, and the third uses semiannual compounding. Which

loan is the best deal? Why?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

53

Consider two investment opportunities. Investment 1 pays interest at the rate of 12%

per year, compounded annually while Investment 2 pays interest at the rate of 11.5% a

year, compounded daily. Assuming a 365-day year, which investment provides the

better return?

per year, compounded annually while Investment 2 pays interest at the rate of 11.5% a

year, compounded daily. Assuming a 365-day year, which investment provides the

better return?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

54

A project will cost $1,000 initially, and is expected to return $500 in year 1, $400 in year 2, $300 in year 3, $100 in year 4, and nothing thereafter. What is the project's NPV if the appropriate

Cost of capital is 10%? Round your answer to the nearest dollar.

A)+$182

B)+$79

C)+$1,079

D)none of the above

Cost of capital is 10%? Round your answer to the nearest dollar.

A)+$182

B)+$79

C)+$1,079

D)none of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

55

A certain project will cost a firm $5,000 today. The project is not expected to produce any cash flows until the second year, at which point it is expected to produce $6,200. No other cash

Flows are anticipated. If the appropriate cost of capital is 15%, what is this project's NPV?

Round your answer to the nearest dollar.

A)+$391

B)+$5,836

C)-$312

D)-$1,852

Flows are anticipated. If the appropriate cost of capital is 15%, what is this project's NPV?

Round your answer to the nearest dollar.

A)+$391

B)+$5,836

C)-$312

D)-$1,852

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

56

You paid $713 last year for a zero-coupon bond that promised to pay you $1,000 at the end of 5 years. Rather than hold it for the remaining four years, you have decided to sell it today. The

Prevailing effective annual interest rate is 9%. To the nearest dollar, what price do you expect

To get for your bond?

A)$763

B)$708

C)$777

D)This cannot be determined with the information provided.

Prevailing effective annual interest rate is 9%. To the nearest dollar, what price do you expect

To get for your bond?

A)$763

B)$708

C)$777

D)This cannot be determined with the information provided.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

57

You purchased a zero-coupon bond last week for $499. The bond promised to pay $1,000 in ten years. Since your purchase, prevailing interest rates have increased by 50 basis points. If

You assume no other changes have occurred that would affect your bond's price, which of the

Following statements is necessarily true?

A)The value of your investment has decreased to about $476.

B)The value of your investment has decreased to about $449.

C)The value of your investment has increased to about $549.

D)The value of your investment has stayed the same since this is a zero-coupon bond.

You assume no other changes have occurred that would affect your bond's price, which of the

Following statements is necessarily true?

A)The value of your investment has decreased to about $476.

B)The value of your investment has decreased to about $449.

C)The value of your investment has increased to about $549.

D)The value of your investment has stayed the same since this is a zero-coupon bond.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

58

How much would you have to deposit in your newborn child's account today in order

to make him a millionaire at age 36 if the account will earn an average annual rate of

10%?

to make him a millionaire at age 36 if the account will earn an average annual rate of

10%?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

59

A certain project will cost $50,000 and is expected to produce cash flows of $15,563 for the next seven years. The appropriate cost of capital is 15%. Calculate the project's NPV, rounding

Your answer to the nearest dollar.

A)+$58,941

B)+$14,748

C)-$36,467

D)+$64,748

Your answer to the nearest dollar.

A)+$58,941

B)+$14,748

C)-$36,467

D)+$64,748

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements is true?

A)There is no necessary connection between a firm's growth rate and the rate of return you should expect to earn by investing in the firm.

B)Given the same expected cash flows, a firm that has a lower cost of capital will sell for a lower price than a firm that has a higher cost of capital.

C)It is always better to invest in a high-growth firm since it will offer a higher return on your investment dollars.

D)Slower growing firms are the better choice for long-term investing since they are "slow but steady" whereas the high-growth firms typically have only one or two good years after

Which they tend to earn less than the slower-growth firms.

A)There is no necessary connection between a firm's growth rate and the rate of return you should expect to earn by investing in the firm.

B)Given the same expected cash flows, a firm that has a lower cost of capital will sell for a lower price than a firm that has a higher cost of capital.

C)It is always better to invest in a high-growth firm since it will offer a higher return on your investment dollars.

D)Slower growing firms are the better choice for long-term investing since they are "slow but steady" whereas the high-growth firms typically have only one or two good years after

Which they tend to earn less than the slower-growth firms.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

61

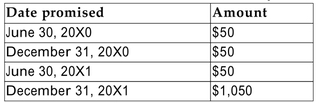

An investment will cost $1,000 on January 1, 20X0 and will offer the following payouts:  What is the NPV of this investment if alternative investments offer an APR of 6%? Round your answer to the nearest dollar.

What is the NPV of this investment if alternative investments offer an APR of 6%? Round your answer to the nearest dollar.

A)+$30

B)+$74

C)-$35

D)-$23

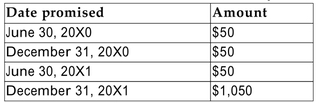

What is the NPV of this investment if alternative investments offer an APR of 6%? Round your answer to the nearest dollar.

What is the NPV of this investment if alternative investments offer an APR of 6%? Round your answer to the nearest dollar.A)+$30

B)+$74

C)-$35

D)-$23

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

62

You have an investment opportunity that will cost $1,000 today and promises cash flows of $25 in 6 months, $25 in 12 months, $25 in 18 months, and $1,025 at the end of two years. If you

Could earn an APR of 6% on alternative investments, what is this investment's net present

Value? Round your answer to the nearest dollar.

A)+$981

B)-$19

C)+$18

D)-$121

Could earn an APR of 6% on alternative investments, what is this investment's net present

Value? Round your answer to the nearest dollar.

A)+$981

B)-$19

C)+$18

D)-$121

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

63

Pepe has won a sweepstakes and can choose between two payment options: $1 million

today or ten $125,000 payments, with the first payment to occur today. If Pepe can

earn interest at a risk-free annual rate of 5%, which is the better deal?

today or ten $125,000 payments, with the first payment to occur today. If Pepe can

earn interest at a risk-free annual rate of 5%, which is the better deal?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

64

Project Hush is expected is expected to generate net cash flows of $8,200 a year for

three years. If the appropriate cost of capital is 10%, what is the maximum amount the

Lullaby Company should be willing to invest in this project?

three years. If the appropriate cost of capital is 10%, what is the maximum amount the

Lullaby Company should be willing to invest in this project?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

65

A project will cost $3,000 today and is expected to return $2,000 over the next two

years. If the appropriate cost of capital is 15%, should this project be undertaken?

Why?

years. If the appropriate cost of capital is 15%, should this project be undertaken?

Why?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck