Deck 13: From Financial Statements to Economic Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/63

Play

Full screen (f)

Deck 13: From Financial Statements to Economic Cash Flows

1

Which of the following is considered a long-term accrual?

A)accounts payable

B)depreciation

C)inventory

D)accounts receivable

A)accounts payable

B)depreciation

C)inventory

D)accounts receivable

depreciation

2

Which of the following financial statements provides a snapshot view of the firm at a given point in time?

A)income statement

B)balance sheet

C)cash flow statement

D)Both B and C.

A)income statement

B)balance sheet

C)cash flow statement

D)Both B and C.

balance sheet

3

The term that applies when an intangible asset, such as a patent, is expensed over time rather than fully expensed at the time of purchase is

A)goodwill write-down.

B)depletion.

C)depreciation.

D)amortization.

A)goodwill write-down.

B)depletion.

C)depreciation.

D)amortization.

amortization.

4

Assume a firm purchases a piece of equipment that costs $500,000 and will be depreciated using straight-line depreciation over 5 years for tax purposes. If the firm is in the 34%

Marginal tax bracket, what will its annual tax savings due to the depreciation be?

A)$330,000

B)$ 66,000

C)$ 34,000

D)$170,000

Marginal tax bracket, what will its annual tax savings due to the depreciation be?

A)$330,000

B)$ 66,000

C)$ 34,000

D)$170,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following are subtracted from sales in order to arrive at operating income? I. Cost of goods sold

II. Selling, general, and administrative expenses

III. Depreciation and amortization

IV. Interest expense

A)I, II, III, and IV

B)I, II, and III only

C)I only

D)I and II only

II. Selling, general, and administrative expenses

III. Depreciation and amortization

IV. Interest expense

A)I, II, III, and IV

B)I, II, and III only

C)I only

D)I and II only

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

6

The annual report of a firm is filed with the SEC in Form

A)10K

B)10Q

C)8K

D)1040A

A)10K

B)10Q

C)8K

D)1040A

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

7

Dupke Discount Office Supply Stores had sales of $12 million in 2007. Its cost of goods sold was $9 million, and it had selling, general, and administrative expenses of $1.1 million. The

Firm paid $100,000 in interest expense and $50,000 in dividends to its shareholders. For

Simplicity, assume a flat tax rate of 40%. Dupke's net income for 2007 was

A)$1.90 million.

B)$1.08 million.

C)$1.75 million.

D)$3.00 million.

Firm paid $100,000 in interest expense and $50,000 in dividends to its shareholders. For

Simplicity, assume a flat tax rate of 40%. Dupke's net income for 2007 was

A)$1.90 million.

B)$1.08 million.

C)$1.75 million.

D)$3.00 million.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following would not be considered a short-term accrual?

A)accounts payable

B)accounts receivable

C)pre-paid expenses

D)cash

A)accounts payable

B)accounts receivable

C)pre-paid expenses

D)cash

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

9

The Arc Corporation has a depreciation expense of $30,000 and is in the 25% marginal tax bracket. The depreciation provides a tax savings of

A)$30,000

B)$15,000

C)$7,500

D)$2,250

A)$30,000

B)$15,000

C)$7,500

D)$2,250

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following accounts will not be found on a firm's income statement?

A)deferred taxes

B)selling, general, and administrative expenses

C)depreciation expense

D)All of the above can be found on a firm's income statement.

A)deferred taxes

B)selling, general, and administrative expenses

C)depreciation expense

D)All of the above can be found on a firm's income statement.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

11

The Ace Dairy Corporation is considering the purchase of a new machine that will cost $91,000. The machine is expected to increase revenues by $27,000 a year and cash expenses by

$8,000. The machine will be depreciated using straight-line depreciation under IRS rules over

7 years. The firm pays taxes at a marginal rate of 40%. Calculate the incremental annual cash

Flows if Ace Dairy purchases the machine.

A)$16,600

B)$13,200

C)$3,600

D)$26,200

$8,000. The machine will be depreciated using straight-line depreciation under IRS rules over

7 years. The firm pays taxes at a marginal rate of 40%. Calculate the incremental annual cash

Flows if Ace Dairy purchases the machine.

A)$16,600

B)$13,200

C)$3,600

D)$26,200

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

12

A certain asset costs $147,000. It has a real physical life of 7 years and a 3-year life for accounting purposes. If straight-line depreciation is used, what depreciation expense will be

Recorded on the income statement that is provided to shareholders (i.e., the one that is

Prepared using GAAP?)

A)$36,750

B)$21,000

C)$49,000

D)$29,400

Recorded on the income statement that is provided to shareholders (i.e., the one that is

Prepared using GAAP?)

A)$36,750

B)$21,000

C)$49,000

D)$29,400

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

13

The most important financial statement from the viewpoint of a financial analyst is the

A)balance sheet

B)owners' equity statement

C)cash flow statement

D)income statement

A)balance sheet

B)owners' equity statement

C)cash flow statement

D)income statement

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

14

Calumet Cabinets Corporation had sales of $3.2 million in 2007. Its cost of goods sold was $1.4 million, and it had $1.3 million in selling, general, and administrative expenses. It paid interest

Of $50,000 and dividends to its shareholders of $10,000. For simplicity, assume a flat tax rate of

40%. The firm's operating profit in 2007 was

A)$0.35 million.

B)$1.8 million.

C)$0.50 million.

D)$0.45 million.

Of $50,000 and dividends to its shareholders of $10,000. For simplicity, assume a flat tax rate of

40%. The firm's operating profit in 2007 was

A)$0.35 million.

B)$1.8 million.

C)$0.50 million.

D)$0.45 million.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

15

The B. Bowden Company is evaluating the purchase of a new stadium, the B.B. Dome. The new stadium would cost Bowden $100,000,000 and would be depreciated for tax purposes

Using straight-line depreciation over 20 years. It is expected that the new stadium will

Increase revenues by $400,000,000 a year and cash expenses by $200,000,000 a year. Calculate

The incremental annual cash flows if B. Bowden undertakes the stadium project Assume a

Marginal tax rate of 35%.

A)$200,000,000

B)$ 97,500,000

C)$147,500,000

D)None of the above answers is correct.

Using straight-line depreciation over 20 years. It is expected that the new stadium will

Increase revenues by $400,000,000 a year and cash expenses by $200,000,000 a year. Calculate

The incremental annual cash flows if B. Bowden undertakes the stadium project Assume a

Marginal tax rate of 35%.

A)$200,000,000

B)$ 97,500,000

C)$147,500,000

D)None of the above answers is correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following needs to be done in order to convert net income to a number that is closer to cash flow?

A)subtract capital expenditures and the depreciation expense from net income

B)add capital expenditures to net income and subtract the depreciation expense from net income

C)subtract capital expenditures from net income and add the depreciation expense to net income

D)add back capital expenditures and the depreciation expense to net income

A)subtract capital expenditures and the depreciation expense from net income

B)add capital expenditures to net income and subtract the depreciation expense from net income

C)subtract capital expenditures from net income and add the depreciation expense to net income

D)add back capital expenditures and the depreciation expense to net income

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

17

A certain asset costs $84,000. It has a real physical life of 10 years, but it can be depreciated using straight-line depreciation over 7 years for tax accounting purposes. If a firm is in the

34% tax bracket, what will the tax savings from the depreciation be?

A)$7,920

B)$4,080

C)$2,856

D)$5,544

34% tax bracket, what will the tax savings from the depreciation be?

A)$7,920

B)$4,080

C)$2,856

D)$5,544

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is a short-term accrual?

A)capital expenditures

B)bad debt losses

C)depreciation

D)taxes payable

A)capital expenditures

B)bad debt losses

C)depreciation

D)taxes payable

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following accounts will not be found on a firm's balance sheet?

A)prepaid expenses

B)taxes payable

C)deferred taxes

D)depreciation expense

A)prepaid expenses

B)taxes payable

C)deferred taxes

D)depreciation expense

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

20

How is the cost of a machine treated differently by a financial analyst doing an NPV

analysis and an accountant preparing financial statements?

analysis and an accountant preparing financial statements?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

21

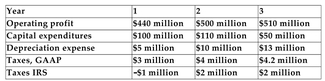

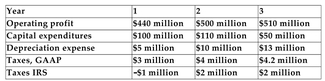

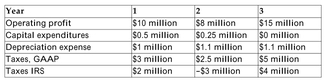

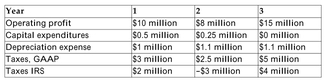

The following information is provided for a firm:

Refer to the information above. Calculate the firm's actual after-tax cash flow for year 2.

A)$378 million

B)$598 million

C)$596 million

D)$398 million

Refer to the information above. Calculate the firm's actual after-tax cash flow for year 2.

A)$378 million

B)$598 million

C)$596 million

D)$398 million

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

22

All else equal, if a firm invests an additional $100,000 in inventory during the year,

A)cash flow from investing activities will increase by $100,000.

B)cash flow from operating activities will decrease by $100,000.

C)cash flow from investing activities will decrease by $100,000.

D)cash flow from operating activities will increase by $100,000.

A)cash flow from investing activities will increase by $100,000.

B)cash flow from operating activities will decrease by $100,000.

C)cash flow from investing activities will decrease by $100,000.

D)cash flow from operating activities will increase by $100,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

23

Assume that an existing piece of equipment of a firm is being depreciated at $10,000 a year under current tax laws. The firm is considering replacing it with a new machine that will be

Depreciated at $15,000 a year. What will be the annual tax savings on the incremental

Depreciation provided by the new machine if the firm is in a 40% marginal tax bracket?

A)$3,000

B)$9,000

C)$2,000

D)$6,000

Depreciated at $15,000 a year. What will be the annual tax savings on the incremental

Depreciation provided by the new machine if the firm is in a 40% marginal tax bracket?

A)$3,000

B)$9,000

C)$2,000

D)$6,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

24

Assume your firm will consist of just one machine. The machine costs $126,000 and has a physical life of 10 years. Tax laws require that it be depreciated over 7 years, using straight-line depreciation. The machine produces $50,000 a year in sales and requires cash expenses of $15,000 a year. All sales are cash sales, and your firm's marginal tax rate is 40%. Your overall cost of capital is 14% a year, and this is the appropriate rate at which to discount both the before-tax project cash flows and the cash flows to Uncle Sam. Your firm has $80,000 of debt at an interest rate of 10% a year. Your first interest payment is due in year 1. Your last interest payment and the principal on the debt are due in year 10.

Refer to the information above. If you can assume perfect capital markets, what is the NPV of the levered ownership of the firm? Round your answer to the nearest dollar.

A)+$14,414

B)+$21,094

C)-$65,586

D)None of the above is correct.

Refer to the information above. If you can assume perfect capital markets, what is the NPV of the levered ownership of the firm? Round your answer to the nearest dollar.

A)+$14,414

B)+$21,094

C)-$65,586

D)None of the above is correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

25

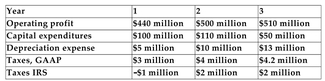

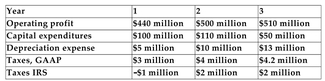

The following information is provided for a firm:

Refer to the information above. Calculate the firm's real after-tax cash flow for year 3.

A)$471 million

B)$542.8 million

C)$545 million

D)None of the above is correct.

Refer to the information above. Calculate the firm's real after-tax cash flow for year 3.

A)$471 million

B)$542.8 million

C)$545 million

D)None of the above is correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

26

Will the total GAAP depreciation at the end of a project equal the amount of

depreciation that is reported for tax purposes? If so, why is the difference in accounting

methods even an issue?

depreciation that is reported for tax purposes? If so, why is the difference in accounting

methods even an issue?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

27

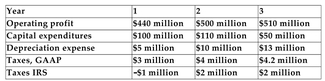

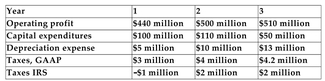

The following information is provided for a firm:

Refer to the information above. How much will the firm report in its deferred taxes liability account in year 2?

A)$6 million

B)$2 million

C)$4 million

D)None of the above is correct.

Refer to the information above. How much will the firm report in its deferred taxes liability account in year 2?

A)$6 million

B)$2 million

C)$4 million

D)None of the above is correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

28

True, False, or Uncertain: "Adding depreciation, depletion, and amortization back to

operating profit gives us EBITDA, which is the actual cash flow from operations of the

firm." Explain.

operating profit gives us EBITDA, which is the actual cash flow from operations of the

firm." Explain.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

29

In 2006, the Skeeter Corporation had deferred taxes of $348 on the liability side of its balance sheet. In 2007, the amount was $224. This means that Skeeter had a

A)cash outflow of $224 in 2007.

B)cash outflow of $124 in 2007.

C)cash inflow of $124 in 2007.

D)cash inflow of $224 in 2007.

A)cash outflow of $224 in 2007.

B)cash outflow of $124 in 2007.

C)cash inflow of $124 in 2007.

D)cash inflow of $224 in 2007.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is a correct adjustment to derive cash flow from the net income figure for a firm?

A)subtract an increase in inventory

B)add an increase in accounts receivable

C)subtract an increase in income taxes payable

D)add an increase in capital expenditures

A)subtract an increase in inventory

B)add an increase in accounts receivable

C)subtract an increase in income taxes payable

D)add an increase in capital expenditures

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is a correct adjustment to derive cash flow from the net income figure for a firm?

A)subtract any increase in accounts payable

B)subtract any decrease in accounts receivable

C)add any increase in accounts payable

D)add any increase in inventory

A)subtract any increase in accounts payable

B)subtract any decrease in accounts receivable

C)add any increase in accounts payable

D)add any increase in inventory

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following transactions is most likely to affect the deferred taxes account of a firm?

A)The firm delays its payments to its suppliers.

B)The firm sells goods on credit.

C)The firm experiences an extraordinary loss due to a natural disaster.

D)The firm uses one method of depreciation for reporting to shareholders and another for tax reporting.

A)The firm delays its payments to its suppliers.

B)The firm sells goods on credit.

C)The firm experiences an extraordinary loss due to a natural disaster.

D)The firm uses one method of depreciation for reporting to shareholders and another for tax reporting.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

33

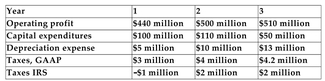

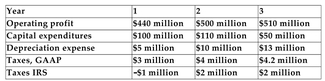

The following information is provided for a firm:

Refer to the information above. How much will the firm report in its deferred taxes liability account in year 3?

A)$6.2 million

B)$1.8 million

C)$8.2 million

D)$3.8 million

Refer to the information above. How much will the firm report in its deferred taxes liability account in year 3?

A)$6.2 million

B)$1.8 million

C)$8.2 million

D)$3.8 million

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is a correct adjustment to make when translating net income into cash flow?

A)add back any increase in accounts payable or other payables

B)add back any increase in accounts receivables or inventory

C)subtract any decrease in accounts payable or other payables

D)Both A and B are correct adjustments to make.

A)add back any increase in accounts payable or other payables

B)add back any increase in accounts receivables or inventory

C)subtract any decrease in accounts payable or other payables

D)Both A and B are correct adjustments to make.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

35

The following information is provided for a firm:  a. Calculate the amount of deferred taxes that the firm will report on its balance sheet

a. Calculate the amount of deferred taxes that the firm will report on its balance sheet

in years 2 and 3.

b. Calculate the real after-tax cash flows for the firm in years 2 and 3.

a. Calculate the amount of deferred taxes that the firm will report on its balance sheet

a. Calculate the amount of deferred taxes that the firm will report on its balance sheetin years 2 and 3.

b. Calculate the real after-tax cash flows for the firm in years 2 and 3.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

36

Given that depreciation is not an actual cash flow, why do financial analysts even

concern themselves with this number?

concern themselves with this number?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

37

The Trimark Corporation is considering replacing an existing machine that cost $125,000 three years ago with one that will cost $200,000 today. The existing machine is being depreciated for

Tax purposes over 5 years using straight-line depreciation. The new machine would be

Depreciated over 5 years using straight-line depreciation as well. Trimark pays taxes at a

Marginal rate of 40%. If Trimark buys the new machine, what will be the annual tax savings

From the incremental depreciation for each of the first five years?

A)$15,000 for the first two years and $40,000 for the last three years

B)$6,000 for the first two years and $16,000 for the last three years

C)$6,000 for all five years

D)$16,000 for all five years

Tax purposes over 5 years using straight-line depreciation. The new machine would be

Depreciated over 5 years using straight-line depreciation as well. Trimark pays taxes at a

Marginal rate of 40%. If Trimark buys the new machine, what will be the annual tax savings

From the incremental depreciation for each of the first five years?

A)$15,000 for the first two years and $40,000 for the last three years

B)$6,000 for the first two years and $16,000 for the last three years

C)$6,000 for all five years

D)$16,000 for all five years

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

38

Assume your firm will consist of just one machine. The machine costs $126,000 and has a physical life of 10 years. Tax laws require that it be depreciated over 7 years, using straight-line depreciation. The machine produces $50,000 a year in sales and requires cash expenses of $15,000 a year. All sales are cash sales, and your firm's marginal tax rate is 40%. Your overall cost of capital is 14% a year, and this is the appropriate rate at which to discount both the before-tax project cash flows and the cash flows to Uncle Sam. Your firm has $80,000 of debt at an interest rate of 10% a year. Your first interest payment is due in year 1. Your last interest payment and the principal on the debt are due in year 10.

Refer to the information above. Calculate the NPV of the project.

A)-$72,796

B)+$21,094

C)+$ 5,151

D)+$14,414

Refer to the information above. Calculate the NPV of the project.

A)-$72,796

B)+$21,094

C)+$ 5,151

D)+$14,414

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

39

Deferred taxes are

A)taxes that need never be paid due to a credit received from the federal government.

B)a current liability account.

C)taxes that must be paid within the next month.

D)none of the above.

A)taxes that need never be paid due to a credit received from the federal government.

B)a current liability account.

C)taxes that must be paid within the next month.

D)none of the above.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is not a net working capital account?

A)accounts receivable

B)accounts payable

C)cash

D)deferred taxes

A)accounts receivable

B)accounts payable

C)cash

D)deferred taxes

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

41

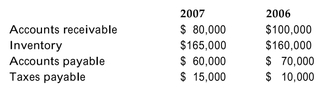

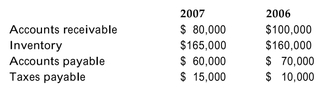

Felix Industries' 2007 annual report contained the following information:  What net effect did these accounts have on the firm's 2007 cash flow?

What net effect did these accounts have on the firm's 2007 cash flow?

A)decreased cash flow by $30,000

B)increased cash flow by $10,000

C)increased cash flow by $30,000

D)decreased cash flow by $10,000

What net effect did these accounts have on the firm's 2007 cash flow?

What net effect did these accounts have on the firm's 2007 cash flow?A)decreased cash flow by $30,000

B)increased cash flow by $10,000

C)increased cash flow by $30,000

D)decreased cash flow by $10,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

42

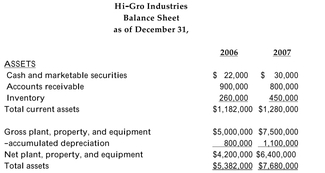

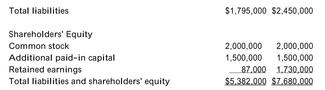

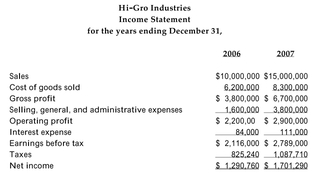

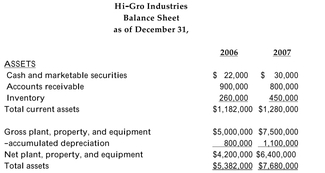

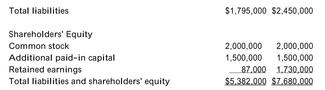

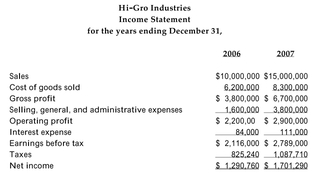

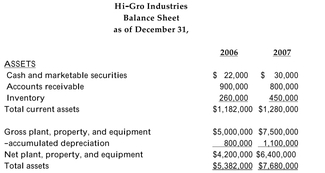

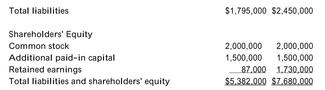

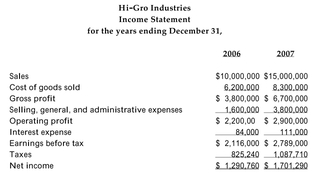

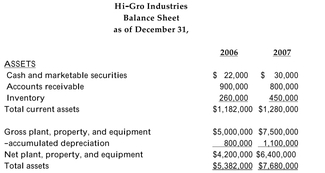

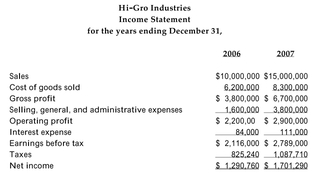

The 2006 and 2007 income statements and balance sheets for Hi-Gro Industries are provided below:

Assume that the difference in the gross plant, property, and equipment account reflects Hi-Gro's capital expenditures and that the change in its long-term debt account reflects its net issuance of debt. Assume, also, that the actual taxes paid in 2007 were $1,131,000.

Assume that the difference in the gross plant, property, and equipment account reflects Hi-Gro's capital expenditures and that the change in its long-term debt account reflects its net issuance of debt. Assume, also, that the actual taxes paid in 2007 were $1,131,000.

Refer to the information above. Calculate Hi-Gro's cash flow to levered equity shareholders.

A)+$134,000

B)-$1,167,000

C)-$1,056,000

D)+$23,000

Assume that the difference in the gross plant, property, and equipment account reflects Hi-Gro's capital expenditures and that the change in its long-term debt account reflects its net issuance of debt. Assume, also, that the actual taxes paid in 2007 were $1,131,000.

Assume that the difference in the gross plant, property, and equipment account reflects Hi-Gro's capital expenditures and that the change in its long-term debt account reflects its net issuance of debt. Assume, also, that the actual taxes paid in 2007 were $1,131,000.Refer to the information above. Calculate Hi-Gro's cash flow to levered equity shareholders.

A)+$134,000

B)-$1,167,000

C)-$1,056,000

D)+$23,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following actions can a firm take to make its cash flow look better in any given year?

A)increase its inventory

B)offer more liberal credit terms to its customers

C)delay payments to its suppliers

D)none of the above

A)increase its inventory

B)offer more liberal credit terms to its customers

C)delay payments to its suppliers

D)none of the above

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

44

The Morning Star News Agency reported an operating profit of $140,000 in 2007. Its depreciation expense was $13,000, and it invested $20,000 in new equipment during the year.

In addition, its accounts receivable increased by $10,000; its inventory increased by $5,000, its

Accounts payable increased by $8,000; and its taxes payable decreased by $3,000. If the firm

Paid taxes of $14,000 in 2007, what was its free cash flow?

A)$ 83,000

B)$109,000

C)$103,000

D)$129,000

In addition, its accounts receivable increased by $10,000; its inventory increased by $5,000, its

Accounts payable increased by $8,000; and its taxes payable decreased by $3,000. If the firm

Paid taxes of $14,000 in 2007, what was its free cash flow?

A)$ 83,000

B)$109,000

C)$103,000

D)$129,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

45

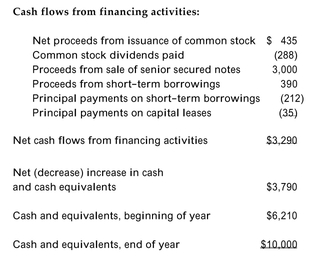

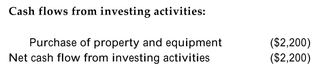

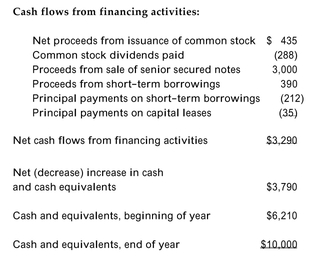

Jemco Corporation's 2007 Statement of Cash Flows is provided below:

Jemco had $9,200 in interest expense in 2007.

Jemco had $9,200 in interest expense in 2007.

Refer to the information above. Calculate Jemco's equity cash flow.

A)-$ 900

B)+$ 8,300

C)+$17,500

D)-$56,000

Jemco had $9,200 in interest expense in 2007.

Jemco had $9,200 in interest expense in 2007.Refer to the information above. Calculate Jemco's equity cash flow.

A)-$ 900

B)+$ 8,300

C)+$17,500

D)-$56,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

46

The Trinidad Tire Company reported an operating profit of $100,000 in 2007. Its depreciation expense was $20,000, and it invested $30,000 in new equipment during the year. In addition,

Its accounts receivable decreased by $3,000; its inventory decreased by $10,000; its accounts

Payable increased by $6,000; and its taxes payable decreased by $5,000. If the firm paid taxes

Of $10,000 in 2007, what was its free cash flow?

A)$66,000

B)$86,000

C)$26,000

D)$94,000

Its accounts receivable decreased by $3,000; its inventory decreased by $10,000; its accounts

Payable increased by $6,000; and its taxes payable decreased by $5,000. If the firm paid taxes

Of $10,000 in 2007, what was its free cash flow?

A)$66,000

B)$86,000

C)$26,000

D)$94,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

47

Jemco Corporation's 2007 Statement of Cash Flows is provided below:

Jemco had $9,200 in interest expense in 2007.

Jemco had $9,200 in interest expense in 2007.

Refer to the information above. Calculate Jemco's project cash flow.

A)+$ 8,300

B)+$17,500

C)-$56,000

D)-$26,700

Jemco had $9,200 in interest expense in 2007.

Jemco had $9,200 in interest expense in 2007.Refer to the information above. Calculate Jemco's project cash flow.

A)+$ 8,300

B)+$17,500

C)-$56,000

D)-$26,700

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

48

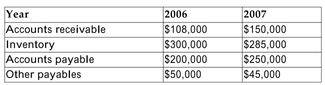

Jacobi Industries produced the following income statement in 2007:  Other financial data for the firm for 2006 and 2007 were as follows:

Other financial data for the firm for 2006 and 2007 were as follows:  Calculate Jacobi's free cash flow from operations for 2007.

Calculate Jacobi's free cash flow from operations for 2007.

A)$ 98,630

B)$ 66,430

C)$ 64,740

D)$100,620

Other financial data for the firm for 2006 and 2007 were as follows:

Other financial data for the firm for 2006 and 2007 were as follows:  Calculate Jacobi's free cash flow from operations for 2007.

Calculate Jacobi's free cash flow from operations for 2007.A)$ 98,630

B)$ 66,430

C)$ 64,740

D)$100,620

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

49

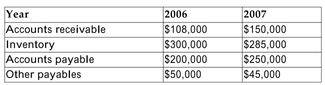

The Genetica Corporation produced the following income statement in 2007:  Other financial data for the firm for 2006 and 2007 were as follows:

Other financial data for the firm for 2006 and 2007 were as follows:  Calculate Genetica's free cash flow from operations for 2007.

Calculate Genetica's free cash flow from operations for 2007.

A)$1,080,000

B)$ 190,000

C)$ 410,000

D)$ 830,000

Other financial data for the firm for 2006 and 2007 were as follows:

Other financial data for the firm for 2006 and 2007 were as follows:  Calculate Genetica's free cash flow from operations for 2007.

Calculate Genetica's free cash flow from operations for 2007.A)$1,080,000

B)$ 190,000

C)$ 410,000

D)$ 830,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

50

What is the net effect on a firm's cash flow if its net working capital decreases from one

year to the next? Why does this make sense?

year to the next? Why does this make sense?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

51

A firm's annual report contains the following information:  What net effect did these accounts have on the cash flow of the firm in 2007?

What net effect did these accounts have on the cash flow of the firm in 2007?

What net effect did these accounts have on the cash flow of the firm in 2007?

What net effect did these accounts have on the cash flow of the firm in 2007?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

52

The Sinbad Corporation's 2007 annual report contained the following information:  What net effect did these accounts have on the firm's 2007 cash flow?

What net effect did these accounts have on the firm's 2007 cash flow?

A)decreased cash flow by $10,000

B)decreased cash flow by $12,000

C)increased cash flow by $12,000

D)increased cash flow by $10,000

What net effect did these accounts have on the firm's 2007 cash flow?

What net effect did these accounts have on the firm's 2007 cash flow?A)decreased cash flow by $10,000

B)decreased cash flow by $12,000

C)increased cash flow by $12,000

D)increased cash flow by $10,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

53

All else equal, if a firm reduces its accounts payable by $20,000 during the year,

A)cash flow from investing activities will increase by $20,000.

B)cash flow from operating activities will increase by $20,000.

C)cash flow from operating activities will decrease by $20,000.

D)cash flow from investing activities will decrease by $20,000.

A)cash flow from investing activities will increase by $20,000.

B)cash flow from operating activities will increase by $20,000.

C)cash flow from operating activities will decrease by $20,000.

D)cash flow from investing activities will decrease by $20,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following might be a warning sign that management is attempting to deceive investors when reporting a high cash flow?

A)a large increase in its accounts payable from one year to the next

B)a large increase in its depreciation expense from one year to the next

C)a large decrease in its accounts payable from one year to the next

D)a large decrease in its accounts receivable from one year to the next

A)a large increase in its accounts payable from one year to the next

B)a large increase in its depreciation expense from one year to the next

C)a large decrease in its accounts payable from one year to the next

D)a large decrease in its accounts receivable from one year to the next

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

55

When comparing two firms based on their short-term accrual-to-sales ratios, what

two things must you ensure are the same for both firms in order to make a valid

comparison?

two things must you ensure are the same for both firms in order to make a valid

comparison?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

56

The 2006 and 2007 income statements and balance sheets for Hi-Gro Industries are provided below:

Assume that the difference in the gross plant, property, and equipment account reflects Hi-Gro's capital expenditures and that the change in its long-term debt account reflects its net issuance of debt. Assume, also, that the actual taxes paid in 2007 were $1,131,000.

Assume that the difference in the gross plant, property, and equipment account reflects Hi-Gro's capital expenditures and that the change in its long-term debt account reflects its net issuance of debt. Assume, also, that the actual taxes paid in 2007 were $1,131,000.

Refer to the information above. Calculate Hi-Gro's free cash flow to both debt and equity investors (i.e., the project cash flows)for 2007.

A)+$339,000

B)-$461,000

C)+$399,000

D)-$643,000

Assume that the difference in the gross plant, property, and equipment account reflects Hi-Gro's capital expenditures and that the change in its long-term debt account reflects its net issuance of debt. Assume, also, that the actual taxes paid in 2007 were $1,131,000.

Assume that the difference in the gross plant, property, and equipment account reflects Hi-Gro's capital expenditures and that the change in its long-term debt account reflects its net issuance of debt. Assume, also, that the actual taxes paid in 2007 were $1,131,000.Refer to the information above. Calculate Hi-Gro's free cash flow to both debt and equity investors (i.e., the project cash flows)for 2007.

A)+$339,000

B)-$461,000

C)+$399,000

D)-$643,000

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

57

You are examining a firm's cash flow statement and see that a large part of its increase

in cash flow from operating activities for the year is due to a change in its accounts

payable from the previous year. What, specifically, does this mean?

in cash flow from operating activities for the year is due to a change in its accounts

payable from the previous year. What, specifically, does this mean?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

58

Dividend payments to shareholders is a

A)cash flow from operating activities

B)cash flow from financing activities

C)cash flow from investing activities

D)None of the above is correct.

A)cash flow from operating activities

B)cash flow from financing activities

C)cash flow from investing activities

D)None of the above is correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

59

A firm reported $400,000 in net income in 2007. The firm invested $50,000 in equipment during the year and reported a depreciation expense of $21,000. Its account receivable

Decreased by $10,000; its inventory increased by $8,000; its accounts payable increased by

$3,000; and its taxes payable decreased by $2,000. Calculate the firm's operating cash flow.

(Assume no other transactions affected the firm's 2007 cash flow.)

A)$330,000

B)$368,000

C)$374,000

D)None of the above is correct.

Decreased by $10,000; its inventory increased by $8,000; its accounts payable increased by

$3,000; and its taxes payable decreased by $2,000. Calculate the firm's operating cash flow.

(Assume no other transactions affected the firm's 2007 cash flow.)

A)$330,000

B)$368,000

C)$374,000

D)None of the above is correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

60

The Miners' Deli is considering the purchase of a new computer system for inventory control purposes. It is thought that better inventory management will save the firm $20,000 a year in

Cash expenses although it is not expected to have any effect on revenues. It is also expected

That the deli will be able to reduce its investment in inventory by $5,000 a year. No other net

Working capital accounts are expected to be affected. The system will cost $80,000 and will be

Depreciated using straight-line depreciation over 5 years for tax purposes. The firm pays taxes

At a marginal rate of 25%. What are the annual incremental cash flows for this project?

A)$14,000

B)$24,000

C)$19,000

D)None of the above answers is correct.

Cash expenses although it is not expected to have any effect on revenues. It is also expected

That the deli will be able to reduce its investment in inventory by $5,000 a year. No other net

Working capital accounts are expected to be affected. The system will cost $80,000 and will be

Depreciated using straight-line depreciation over 5 years for tax purposes. The firm pays taxes

At a marginal rate of 25%. What are the annual incremental cash flows for this project?

A)$14,000

B)$24,000

C)$19,000

D)None of the above answers is correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

61

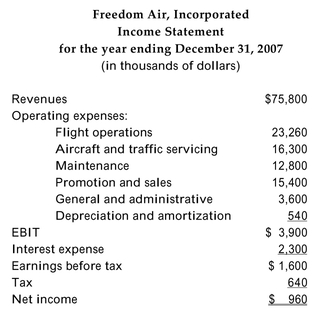

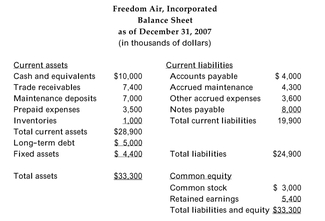

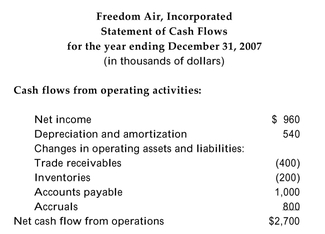

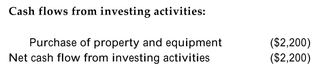

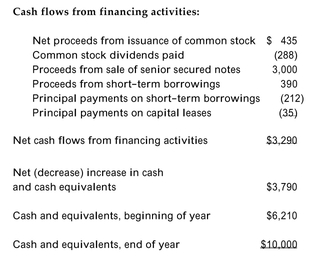

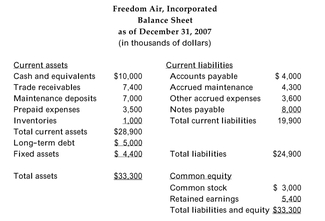

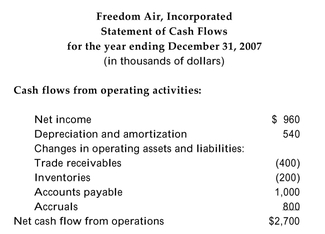

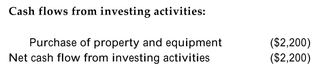

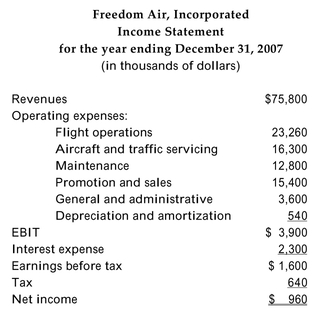

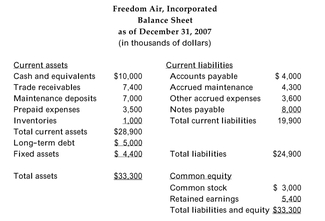

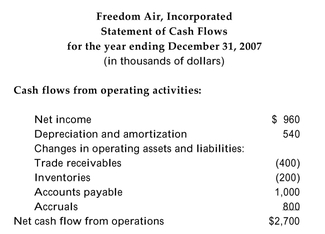

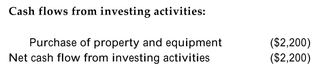

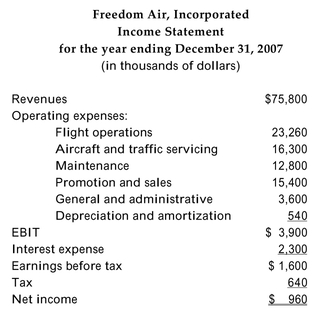

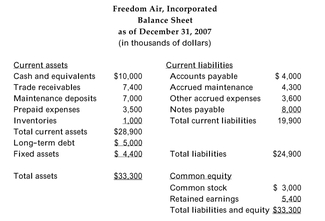

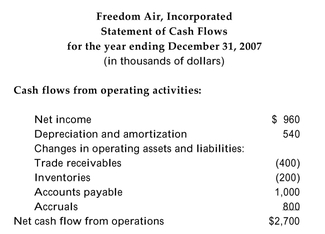

The 2007 financial statements for Freedom Air, Incorporated are provided below:

Refer to the information above. Use Freedom Air's financial statement information to

calculate the project cash flows (i.e., free cash flows)available to the debt and equity

investors.

Refer to the information above. Use Freedom Air's financial statement information to

calculate the project cash flows (i.e., free cash flows)available to the debt and equity

investors.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

62

The 2007 financial statements for Freedom Air, Incorporated are provided below:

Refer to the information above. Use Freedom Air's financial statement information to

calculate the cash flows available to levered equity shareholders.

Refer to the information above. Use Freedom Air's financial statement information to

calculate the cash flows available to levered equity shareholders.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

63

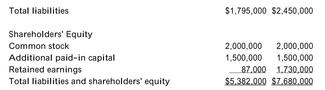

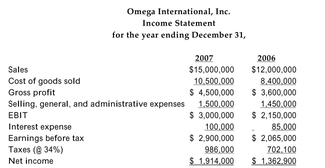

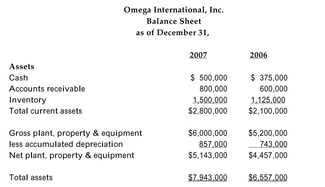

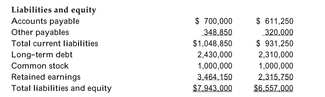

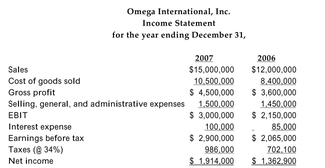

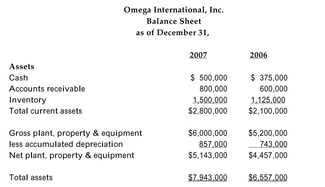

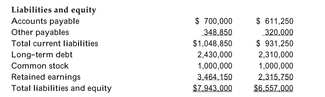

The 2006 and 2007 income statements and balance sheets of Omega International, Inc.

are provided below:

Assume that the change in the gross plant, property, and equipment account

Assume that the change in the gross plant, property, and equipment account

represents the capital expenditures of the firm in 2007 and that the actual taxes paid by

Omega in 2007 were $1,020,000. Calculate Omega's free cash flow for 2007.

are provided below:

Assume that the change in the gross plant, property, and equipment account

Assume that the change in the gross plant, property, and equipment accountrepresents the capital expenditures of the firm in 2007 and that the actual taxes paid by

Omega in 2007 were $1,020,000. Calculate Omega's free cash flow for 2007.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck