Deck 14: The Valuation of Fixed-Income Securities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/64

Play

Full screen (f)

Deck 14: The Valuation of Fixed-Income Securities

1

If investors expect interest rates to decline, they are also expecting bond prices to rise.

True

2

An investor may expect a bond to be called if its current yield exceeds the yield to maturity.

True

3

A call penalty is a payment made to the firm to encourage early retirement of the bond.

False

4

A call feature will have no impact on the value of a bond if interest rates rise.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

5

If interest rates have fallen, a firm may prefer to repurchase the bonds on the market instead of calling and redeeming them.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

6

If a bond sells for a discount, the yield to maturity exceeds the current yield.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

7

The prices of low coupon bonds tend to fluctuate more than the prices of high coupon bonds.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

8

If a $1,000 bond with a 7 percent coupon were to sell for $978, the current interest rate exceeds 7 percent.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

9

A few bonds called "perpetuals" never mature.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

10

If a bond sells for a premium, the current yield exceeds the yield to maturity.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

11

Most bonds pay interest semi-annually.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

12

The value of a bond depends on the amount of principal, when it matures, and the interest it pays.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

13

As interest rates increase, the prices of existing bonds increase.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

14

A bond is more likely to be called after interest rates have fallen.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

15

Bonds that are callable often have a call penalty.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

16

If interest rates increase, a bond may be called.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

17

If bond prices rise, the yield to maturity declines.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

18

The current yield exceeds the yield to maturity if interest rates fall.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

19

If a $1,000 bond has a coupon of 8 percent and matures after eight years, the price of the bond will exceed $1,000 if the current interest rate is 9 percent.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

20

If bond prices were to decline, the current yield would increase.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

21

Preferred stock pays a fixed amount of interest.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

22

If interest rates decline after a bond is issued and the investor reinvests the interest payment, the realized yield exceeds the yield to maturity.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

23

Since preferred stock pays a fixed dividend, it is often valued as if it were a bond.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

24

The prices of zero coupon bonds fluctuate less than bonds with large coupons.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

25

The spread (the basis points)between the yields on AAA-rated bonds and B-rated bonds tends to rise when yields increase.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

26

If a bond pays $90 interest annually, matures after ten years, and costs $1,100, the current yield is

A)8.2 percent

B)10.1 percent

C)9.0 percent

D)9.6 percent

A)8.2 percent

B)10.1 percent

C)9.0 percent

D)9.6 percent

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

27

If preferred stock is subject to mandatory retirement, its price is more volatile than preferred stock without the retirement feature.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

28

The value of a bond depends on

1. the coupon rate

2. the terms of the indenture

3. the maturity date

A)1 and 2

B)1 and 3

C)2 and 3

D)all of the above

1. the coupon rate

2. the terms of the indenture

3. the maturity date

A)1 and 2

B)1 and 3

C)2 and 3

D)all of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

29

If investors expect interest rates to rise, they should sell preferred stock and buy bonds.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

30

The smaller a bond's coupon implies a longer duration.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

31

The term and duration of a bond are equal for zero coupon bonds.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

32

If a $1,000 bond costs $1,000 and pays $50 interest,

1. the current yield is 5 percent

2. the yield to maturity is 5 percent

3. the bond is selling for par

A)1 and 2

B)1 and 3

C)2 and 3

D)all of the above

1. the current yield is 5 percent

2. the yield to maturity is 5 percent

3. the bond is selling for par

A)1 and 2

B)1 and 3

C)2 and 3

D)all of the above

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

33

The market price of preferred stock moves directly with changes in interest rates.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

34

From the viewpoint of the investor, preferred stock is riskier than bonds issued by the same firm.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

35

The concept of duration stresses when a bond will make its payments to bondholders.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

36

The smaller the duration, the more volatile the bond's price.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

37

A conservative investor will prefer a bond with a smaller duration even though it may have a longer term to maturity.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

38

The prices of twenty-year bonds tend to fluctuate less than bonds with five years to maturity.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

39

If a 7 percent, $1,000 bond matures after ten years and current interest rates are 9 percent, the current price of the bond should not be

1. $1,000

2. $872

3. $1,140

A)1 and 2

B)1 and 3

C)2 and 3

D)only 2

1. $1,000

2. $872

3. $1,140

A)1 and 2

B)1 and 3

C)2 and 3

D)only 2

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

40

Matching a bond's duration with the time the funds are needed reduces reinvestment risk.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

41

The current yield on a long-term bond is the

A)coupon interest divided by the price of the bond

B)coupon

C)interest paid, adjusted for price changes

D)going rate of interest

A)coupon interest divided by the price of the bond

B)coupon

C)interest paid, adjusted for price changes

D)going rate of interest

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

42

The concept of duration considers

A)the timing of interest payments

B)the timing of principal repayment

C)the current rate of interest

D)the timing of both interest and principal repayment

A)the timing of interest payments

B)the timing of principal repayment

C)the current rate of interest

D)the timing of both interest and principal repayment

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

43

The yield to call

A)is important if interest rates have fallen

B)is important if interest rates have risen

C)equals the yield to maturity

D)equals the current yield

A)is important if interest rates have fallen

B)is important if interest rates have risen

C)equals the yield to maturity

D)equals the current yield

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

44

A high-yield bond has the following terms:

Principal amount $1,000

Annual interest paid $100

Maturity 10 years

a. What is the bond's price if comparable debt yields 12 percent?

b. What would be the price if comparable debt yields 12 percent and the bond matures after five years?

c. What are the current yields and yields to maturity in a and b?

d. What would be the bond's price in a and b if interest rates declined to 9 percent?

e. What are the current yield and yield to maturity in d?

f. What two generalizations may be drawn from the above price changes?

Principal amount $1,000

Annual interest paid $100

Maturity 10 years

a. What is the bond's price if comparable debt yields 12 percent?

b. What would be the price if comparable debt yields 12 percent and the bond matures after five years?

c. What are the current yields and yields to maturity in a and b?

d. What would be the bond's price in a and b if interest rates declined to 9 percent?

e. What are the current yield and yield to maturity in d?

f. What two generalizations may be drawn from the above price changes?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

45

Preferred stock and long-term bonds are similar because

A)they both have voting power

B)interest and dividend payments are fixed

C)interest and dividend payments are legal obligations

D)interest and dividend payments are tax-deductible expenses

A)they both have voting power

B)interest and dividend payments are fixed

C)interest and dividend payments are legal obligations

D)interest and dividend payments are tax-deductible expenses

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

46

If interest rates in general were to fall,

1. the prices of existing bonds would rise

2. the prices of existing bonds would fall

3. yields to maturity would rise

4. yields to maturity would fall

A)1 and 3

B)1 and 4

C)2 and 3

D)2 and 4

1. the prices of existing bonds would rise

2. the prices of existing bonds would fall

3. yields to maturity would rise

4. yields to maturity would fall

A)1 and 3

B)1 and 4

C)2 and 3

D)2 and 4

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

47

Buying a bond with a duration equal to when the funds are needed

A)reduces reinvestment rate risk

B)increases impact of higher interest rates

C)reduces the impact of default

D)increases the bond's yield

A)reduces reinvestment rate risk

B)increases impact of higher interest rates

C)reduces the impact of default

D)increases the bond's yield

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

48

A bond's call feature may be exercised if

1. the yield to maturity exceeds the current yield

2. the yield to maturity is less than the current yield

3. interest rates have risen

4. interest rates have fallen

A)1 and 3

B)1 and 4

C)2 and 3

D)2 and 4

1. the yield to maturity exceeds the current yield

2. the yield to maturity is less than the current yield

3. interest rates have risen

4. interest rates have fallen

A)1 and 3

B)1 and 4

C)2 and 3

D)2 and 4

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

49

While bond prices fluctuate,

A)yields are constant

B)coupons are constant

C)the spread between yields is constant

D)short-term bond prices fluctuate more

A)yields are constant

B)coupons are constant

C)the spread between yields is constant

D)short-term bond prices fluctuate more

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

50

If a $100 par value preferred stock pays an annual dividend of $5 and comparable yields are 10 percent, the price of this preferred stock will be

A)$100

B)$75

C)$50

D)$25

A)$100

B)$75

C)$50

D)$25

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

51

a. What is the value (i.e., price)of the following preferred stocks if the comparable yield is 10 percent?

MN Inc. $6 preferred stock, $100 par

ST Inc. $6 preferred stock, $100 par and the stock is to be retired after twenty years

b. What is the current yield offered by each preferred stock?

c. Why are the prices of these preferred stocks different even though they both pay the same dividend?

MN Inc. $6 preferred stock, $100 par

ST Inc. $6 preferred stock, $100 par and the stock is to be retired after twenty years

b. What is the current yield offered by each preferred stock?

c. Why are the prices of these preferred stocks different even though they both pay the same dividend?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

52

An individual may purchase preferred stock

1. in anticipation of lower interest rates

2. in anticipation of higher interest rates

3. to receive a flow of tax-free income

4. to receive a flow of income

A)1 and 3

B)1 and 4

C)2 and 3

D)2 and 4

1. in anticipation of lower interest rates

2. in anticipation of higher interest rates

3. to receive a flow of tax-free income

4. to receive a flow of income

A)1 and 3

B)1 and 4

C)2 and 3

D)2 and 4

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

53

If an investor were to anticipate that interest rates were going to fall, that individual should

A)take no action

B)buy bonds

C)sell bonds

D)acquire money market securities

A)take no action

B)buy bonds

C)sell bonds

D)acquire money market securities

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

54

A bond with a 5 percent coupon ($50 a year)that matures after eight years is selling for $779. What is the yield to maturity?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

55

A bond has the following terms:

Annual interest $100

Term 15 years

Principal $1,000

a. What is the current price of the bond if comparable yields are 7 percent?

b. What are the current yield and yield to maturity given the price of the bond in the previous question?

c. If you expect the bond to be called at the end of the year, what would be the maximum price you should pay for the bond?

d. Is there a reason to expect that the bond will be called?

Annual interest $100

Term 15 years

Principal $1,000

a. What is the current price of the bond if comparable yields are 7 percent?

b. What are the current yield and yield to maturity given the price of the bond in the previous question?

c. If you expect the bond to be called at the end of the year, what would be the maximum price you should pay for the bond?

d. Is there a reason to expect that the bond will be called?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

56

If interest rates rise, the price of preferred stock

A)rises

B)falls

C)is not affected

D)rises or falls

A)rises

B)falls

C)is not affected

D)rises or falls

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

57

Preferred stock generally pays

A)a variable dividend

B)a fixed dividend

C)a stock dividend

D)no dividend

A)a variable dividend

B)a fixed dividend

C)a stock dividend

D)no dividend

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

58

If a bond is selling for a premium,

A)the yield to maturity exceeds the current yield

B)the current yield exceeds the yield to maturity

C)the current yield has risen

D)the bond cannot be called

A)the yield to maturity exceeds the current yield

B)the current yield exceeds the yield to maturity

C)the current yield has risen

D)the bond cannot be called

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

59

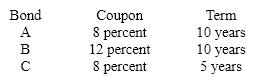

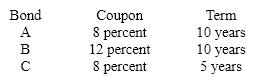

Compute the durations of the following bonds and rank them on the basis of their price volatility. Assume that the current rate of interest is 8 percent.

Confirm your ranking by calculating the percentage change in the price of each bond when interest rates rise from 8 to 12 percent.

Confirm your ranking by calculating the percentage change in the price of each bond when interest rates rise from 8 to 12 percent.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

60

If a preferred stock pays an annual $4.50 dividend, what should be the price of the stock if comparable yields are 10 percent? What would be the loss if yields rose to 12 percent?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

61

You purchase a high-yield, junk bond for $1,000 that pays $140 annually. After buying the bond, yields decline and you are able to reinvest the interest at only 9 percent. You reinvest all the interest payments. How much will you have when the bond is retired after twelve years? What was the annual return you earned on this investment?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

62

Junk Corp.'s high-yield bond has the following features:

Principal $1,000

Coupon 10%

Maturity 5 years

Special features: Company may extend the life of the bond to 10 years

a. If interest rates are currently 12 percent on comparable high-yield securities and are not expected to change, what is the price of this bond?

b. If interest rates are currently 9 percent on comparable high-yield securities and are not expected to change, what is the price of this bond?

c. If interest rates are currently 9 percent on comparable high-yield securities but the investor has no forecast as to future rates, what is the possible range of prices for this bond?

Principal $1,000

Coupon 10%

Maturity 5 years

Special features: Company may extend the life of the bond to 10 years

a. If interest rates are currently 12 percent on comparable high-yield securities and are not expected to change, what is the price of this bond?

b. If interest rates are currently 9 percent on comparable high-yield securities and are not expected to change, what is the price of this bond?

c. If interest rates are currently 9 percent on comparable high-yield securities but the investor has no forecast as to future rates, what is the possible range of prices for this bond?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

63

If you purchase a $5 preferred stock for $40 a share, what is the current yield? If you anticipate that yields will decline to 10 percent, what will be the anticipated capital gain on this investment?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

64

An investor buys a $1,000, 20 year 7 percent (interest paid semiannually)bond at par. After five years have passed, interest rates are 10 percent. How much did the investor lose on the purchase of the bond?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck