Deck 32: The Fed Model: Linking Interest Rates, Output, and Inflation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

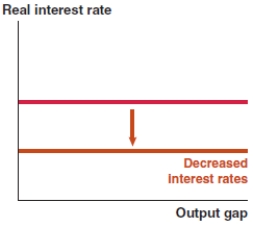

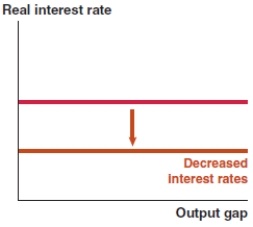

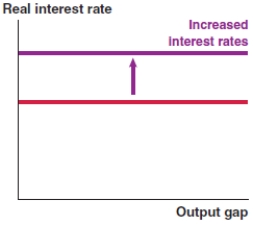

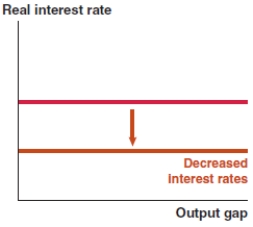

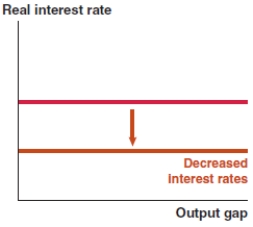

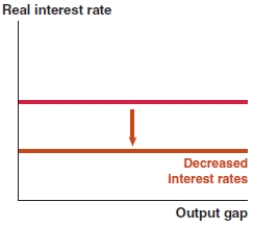

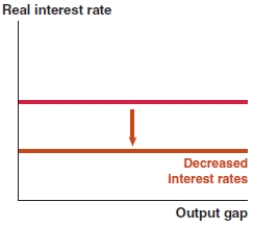

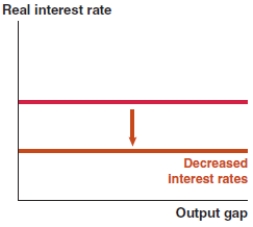

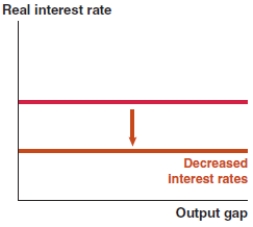

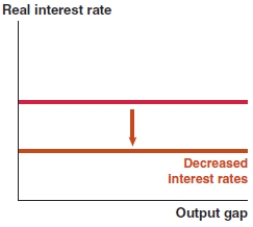

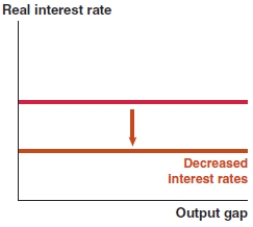

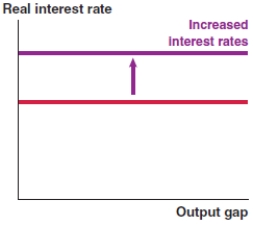

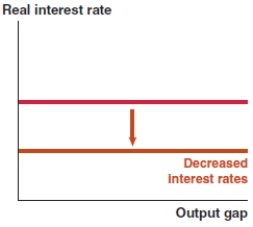

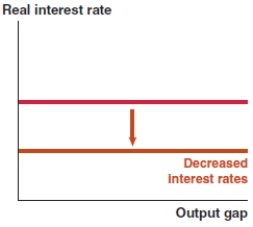

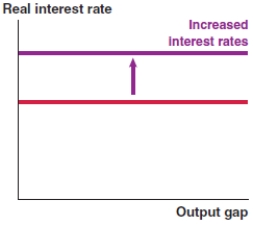

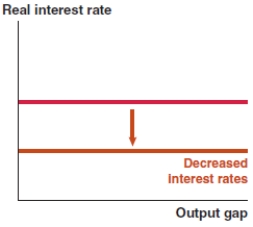

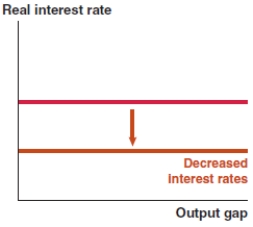

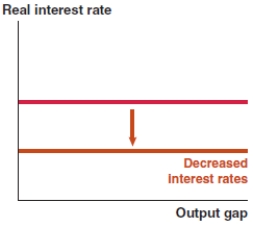

Question

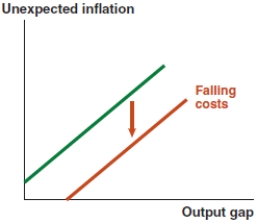

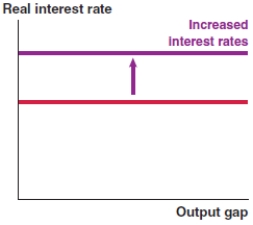

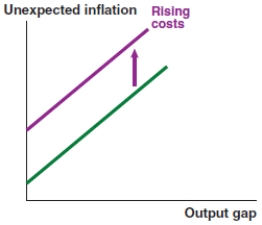

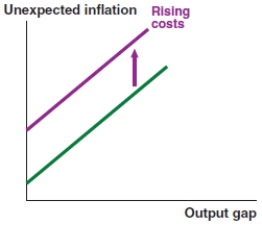

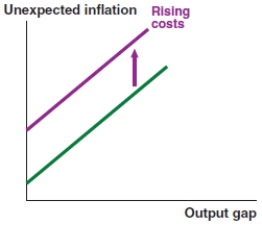

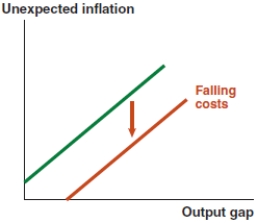

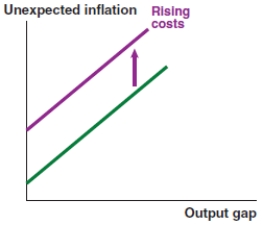

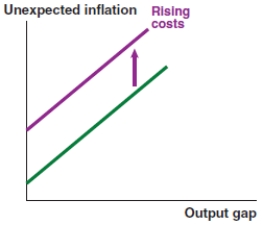

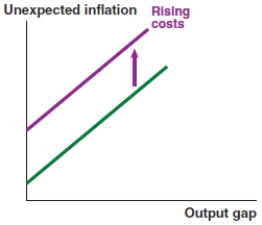

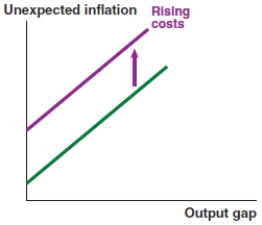

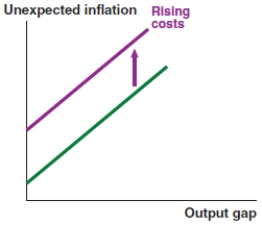

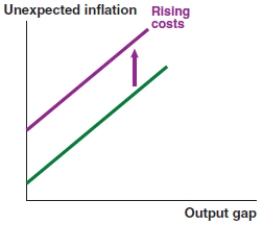

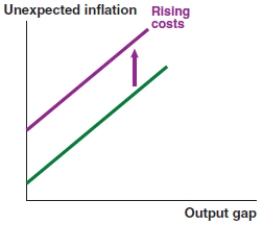

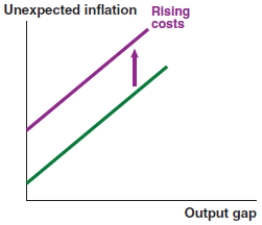

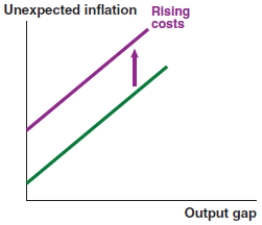

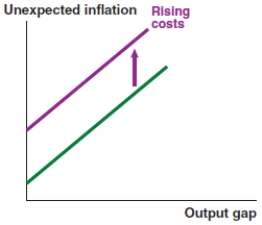

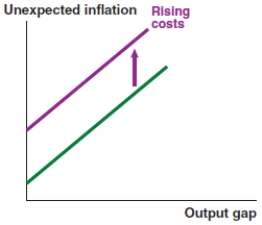

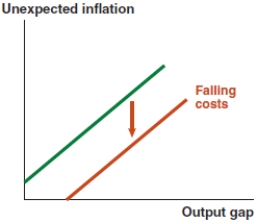

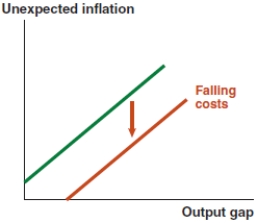

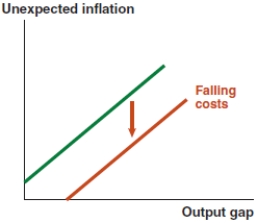

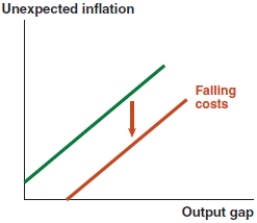

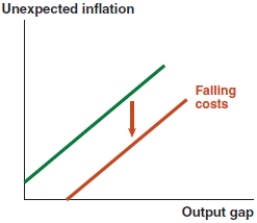

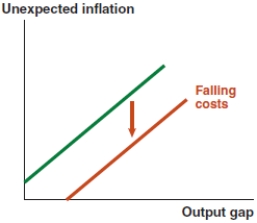

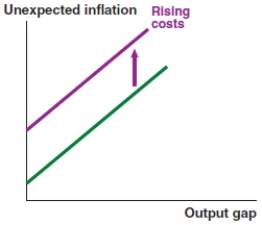

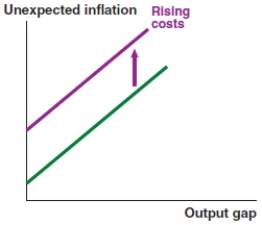

Question

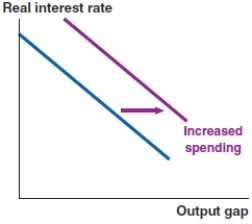

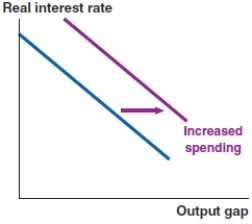

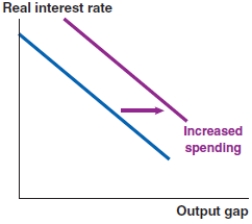

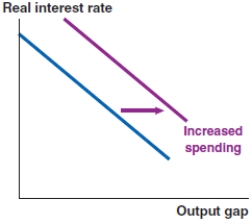

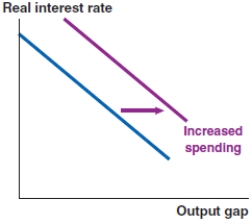

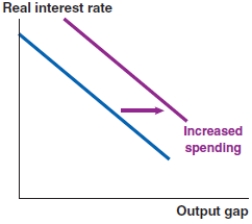

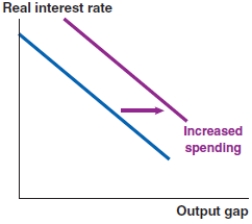

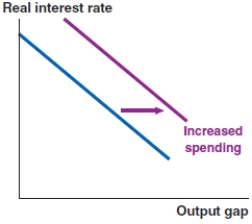

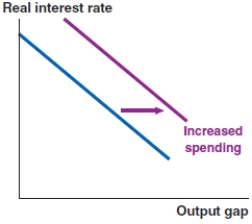

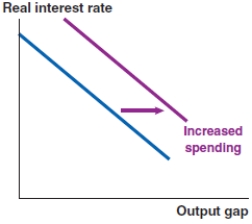

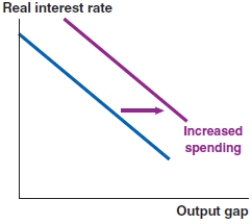

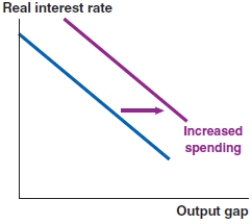

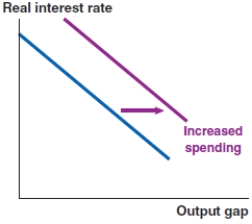

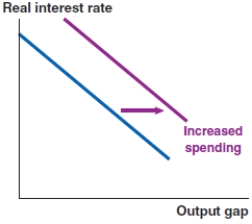

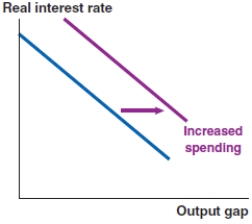

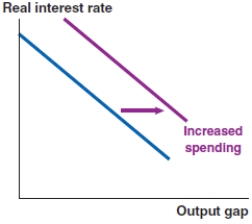

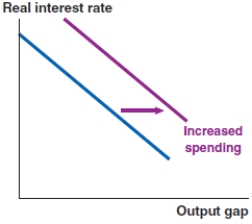

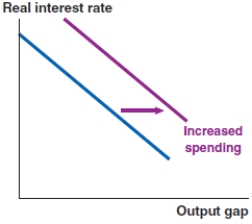

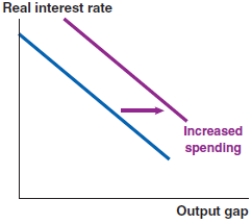

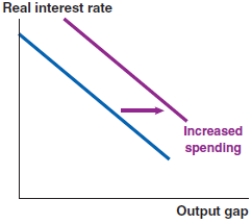

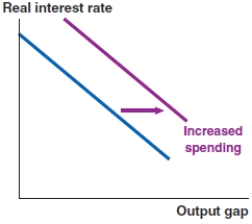

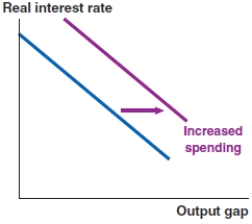

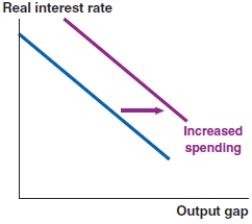

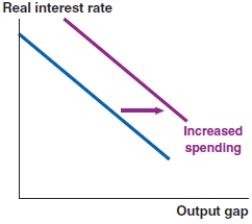

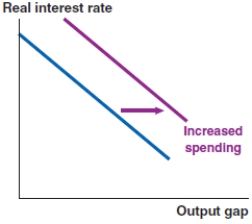

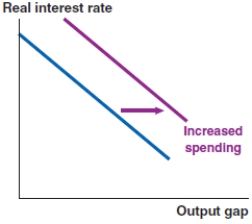

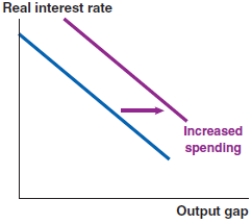

Question

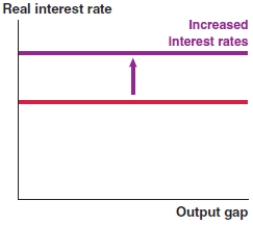

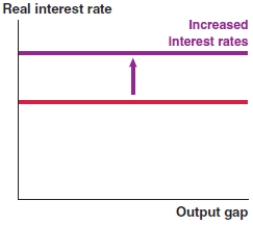

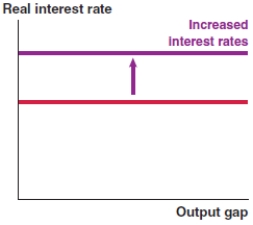

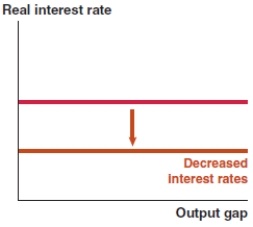

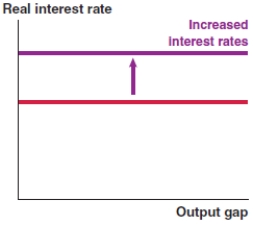

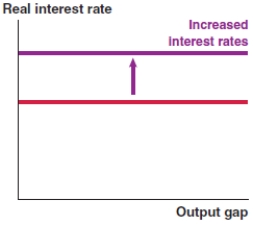

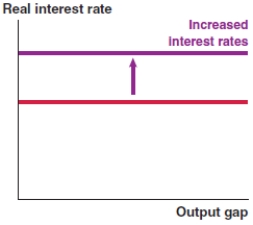

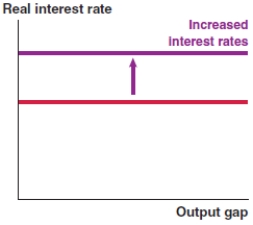

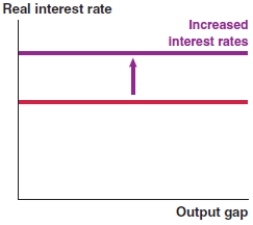

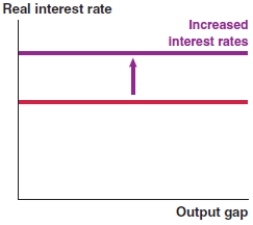

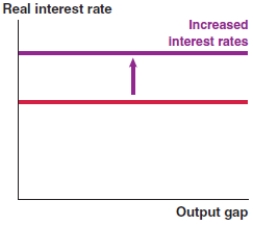

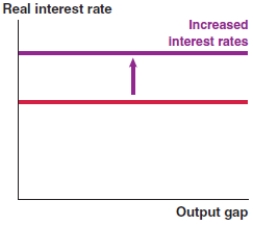

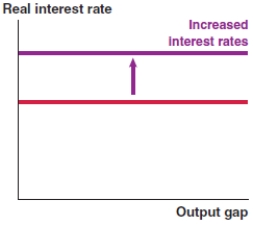

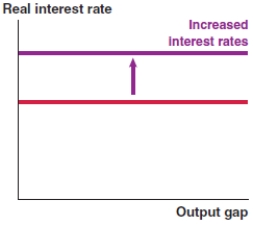

Question

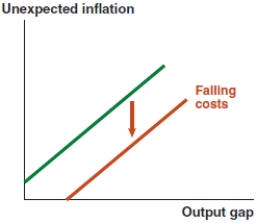

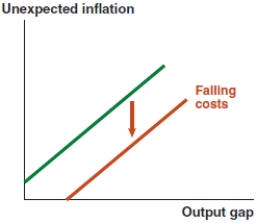

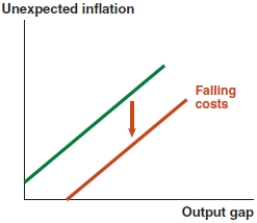

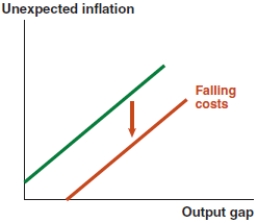

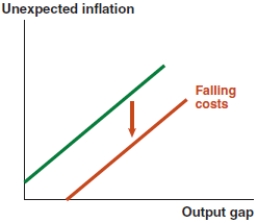

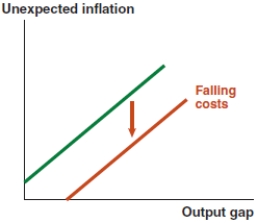

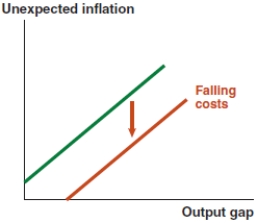

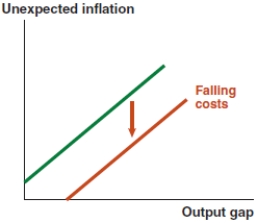

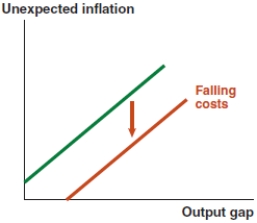

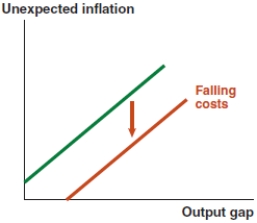

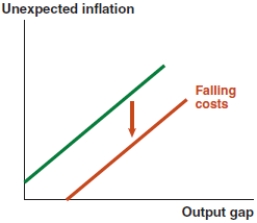

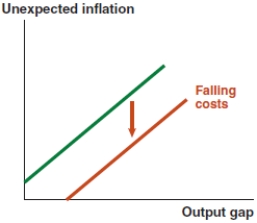

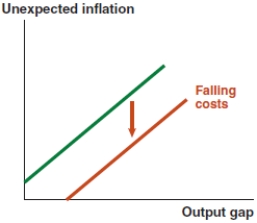

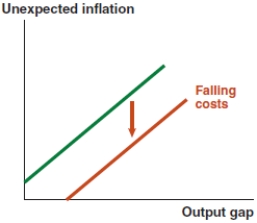

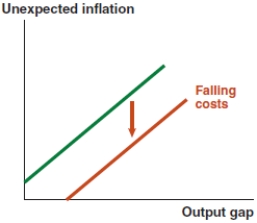

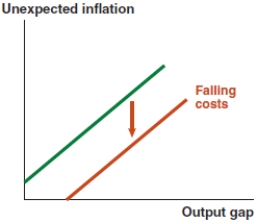

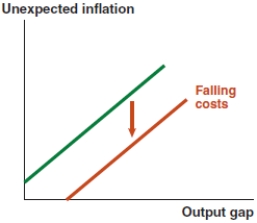

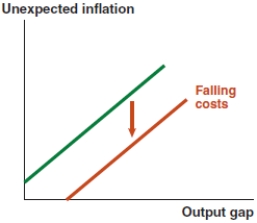

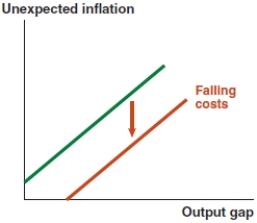

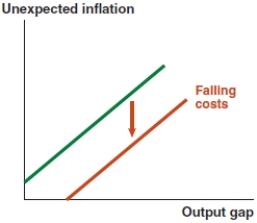

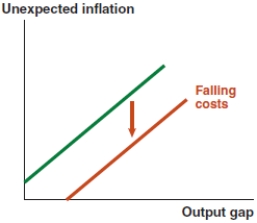

Question

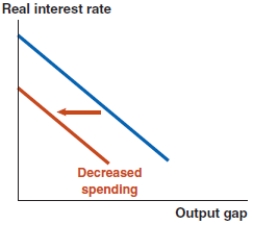

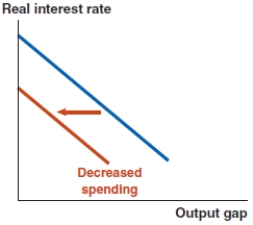

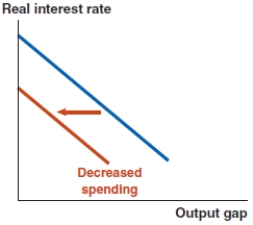

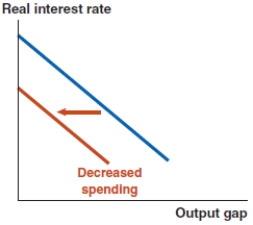

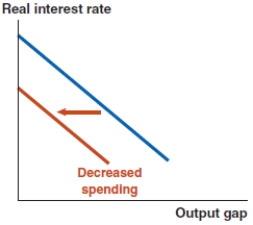

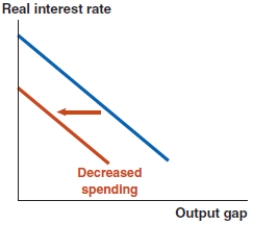

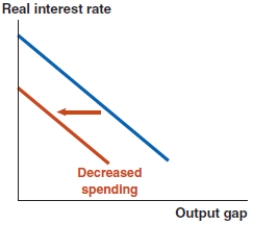

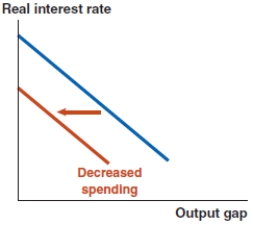

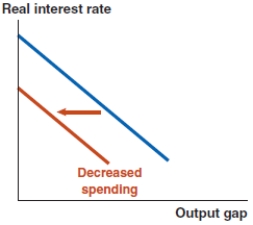

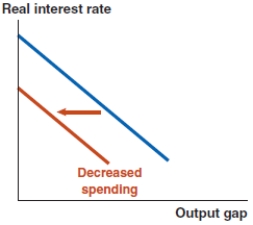

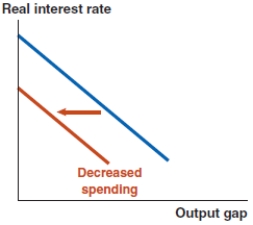

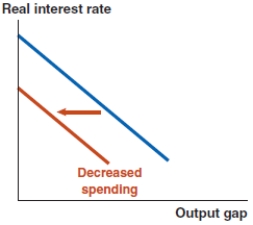

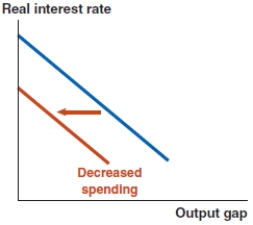

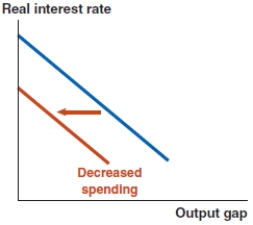

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

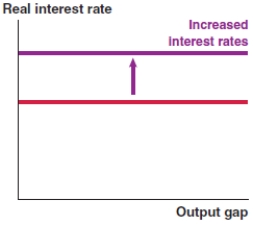

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/125

Play

Full screen (f)

Deck 32: The Fed Model: Linking Interest Rates, Output, and Inflation

1

The framework that the Federal Reserve uses to analyze, forecast, and adjust the economy is called:

A)the Fed model.

B)the real GDP model.

C)expansionary monetary policy.

D)contractionary monetary policy.

A)the Fed model.

B)the real GDP model.

C)expansionary monetary policy.

D)contractionary monetary policy.

A

2

The Fed model combines the _____ curve, the _____ curve, and the ____ curve to link interest rates, the output gap, and inflation.

A)IS; MP; Phillips

B)AD; AS; Phillips

C)dollar demand; dollar supply; AS

D)demand for loanable funds; supply of loanable funds; AD

A)IS; MP; Phillips

B)AD; AS; Phillips

C)dollar demand; dollar supply; AS

D)demand for loanable funds; supply of loanable funds; AD

A

3

In the IS-MP analysis in the Fed model, the MP curve shows you the:

A)potential GDP level in the economy.

B)output level in the economy.

C)current real interest rate.

D)price level in the economy.

A)potential GDP level in the economy.

B)output level in the economy.

C)current real interest rate.

D)price level in the economy.

C

4

In the IS-MP analysis in the Fed model, the risk-free rate rises in response to:

A)increased capital inflows.

B)adverse supply shocks.

C)fiscal policy.

D)monetary policy.

A)increased capital inflows.

B)adverse supply shocks.

C)fiscal policy.

D)monetary policy.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

5

In the IS-MP analysis in the Fed model, a rise in the risk-free rate shifts the:

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

6

In the IS-MP analysis in the Fed model, a decrease in the risk-free rate shifts the:

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

7

In the IS-MP analysis in the Fed model, if the Federal Reserve raises the federal funds rate, the:

A)IS curve shifts to the left.

B)IS curve shifts to the right.

C)MP curve shifts up.

D)MP curve shifts down.

A)IS curve shifts to the left.

B)IS curve shifts to the right.

C)MP curve shifts up.

D)MP curve shifts down.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

8

In the IS-MP analysis in the Fed model, if the Federal Reserve lowers the federal funds rate, the:

A)IS curve shifts to the left.

B)IS curve shifts to the right.

C)MP curve shifts up.

D)MP curve shifts down.

A)IS curve shifts to the left.

B)IS curve shifts to the right.

C)MP curve shifts up.

D)MP curve shifts down.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

9

In the IS-MP analysis in the Fed model, a decrease in the risk premium shifts the:

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

10

In the IS-MP analysis in the Fed model, a rise in the interest rate causes a:

A)movement to the left along the IS curve.

B)right shift of the IS curve.

C)left shift of the IS curve.

D)movement to the right along the IS curve.

A)movement to the left along the IS curve.

B)right shift of the IS curve.

C)left shift of the IS curve.

D)movement to the right along the IS curve.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

11

In the IS-MP analysis in the Fed model, a fall in the interest rate causes a:

A)right shift of the IS curve.

B)movement to the left along the IS curve.

C)left shift of the IS curve.

D)movement to the right along the IS curve.

A)right shift of the IS curve.

B)movement to the left along the IS curve.

C)left shift of the IS curve.

D)movement to the right along the IS curve.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

12

In the IS-MP analysis in the Fed model, the intersection of the IS and MP curves determines the:

A)equilibrium exchange rate.

B)output gap.

C)unemployment rate.

D)potential GDP.

A)equilibrium exchange rate.

B)output gap.

C)unemployment rate.

D)potential GDP.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

13

In the IS-MP analysis in the Fed model, a fall in government expenditure will shift the:

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

14

In the IS-MP analysis in the Fed model, a rise in government expenditure will shift the:

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

15

In the IS-MP analysis in the Fed model, a rise in investment will shift the:

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

16

In the IS-MP analysis in the Fed model, a fall in investment will shift the:

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

17

In the IS-MP analysis in the Fed model, expansionary fiscal policy will shift the:

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

18

In the IS-MP analysis in the Fed model, contractionary fiscal policy will shift the:

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

A)IS curve to the left.

B)IS curve to the right.

C)MP curve up.

D)MP curve down.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

19

In the IS-MP analysis in the Fed model, an increase in imports will shift the:

A)MP curve up.

B)MP curve down.

C)IS curve to the left.

D)IS curve to the right.

A)MP curve up.

B)MP curve down.

C)IS curve to the left.

D)IS curve to the right.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

20

In the IS-MP analysis in the Fed model, a decrease in imports will shift the:

A)MP curve up.

B)MP curve down.

C)IS curve to the left.

D)IS curve to the right.

A)MP curve up.

B)MP curve down.

C)IS curve to the left.

D)IS curve to the right.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

21

The Fed model links the IS, MP, and Phillips curves. In the IS-MP analysis, an increase in exports will shift the:

A)MP curve up.

B)MP curve down.

C)IS curve to the left.

D)IS curve to the right.

A)MP curve up.

B)MP curve down.

C)IS curve to the left.

D)IS curve to the right.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

22

In the IS-MP analysis in the Fed model, a decrease in exports will shift the:

A)MP curve up.

B)MP curve down.

C)IS curve to the left.

D)IS curve to the right.

A)MP curve up.

B)MP curve down.

C)IS curve to the left.

D)IS curve to the right.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

23

In the IS-MP analysis in the Fed model, an increase in net exports will shift the:

A)MP curve up.

B)MP curve down.

C)IS curve to the left.

D)IS curve to the right.

A)MP curve up.

B)MP curve down.

C)IS curve to the left.

D)IS curve to the right.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

24

In the IS-MP analysis in the Fed model, a decrease in net exports will shift the:

A)MP curve up.

B)MP curve down.

C)IS curve to the left.

D)IS curve to the right.

A)MP curve up.

B)MP curve down.

C)IS curve to the left.

D)IS curve to the right.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

25

When using the Fed model, the first step is to:

A)find the output gap.

B)assess inflation.

C)identify the shock and shift the curve.

D)increase the federal funds rate.

A)find the output gap.

B)assess inflation.

C)identify the shock and shift the curve.

D)increase the federal funds rate.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

26

Once you have identified the point of equilibrium in the IS-MP graph in the Fed model, the vertical axis will show you the:

A)actual inflation.

B)unexpected inflation.

C)output gap.

D)equilibrium real interest rate.

A)actual inflation.

B)unexpected inflation.

C)output gap.

D)equilibrium real interest rate.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

27

Once you have identified the point of equilibrium in the IS-MP graph in the Fed model, the horizontal axis will show you the:

A)actual inflation.

B)unexpected inflation.

C)output gap.

D)equilibrium real interest rate.

A)actual inflation.

B)unexpected inflation.

C)output gap.

D)equilibrium real interest rate.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

28

Once you have identified the output gap in the IS-MP graph in the Fed model, how would you connect to the Phillips curve?

A)Trace the inflation rate from the IS-MP model down to the same inflation rate in the Phillips curve.

B)Trace the real interest rate from the IS-MP model down to the same real interest rate in the Phillips curve.

C)Trace the unemployment rate from the IS-MP model down to the same unemployment gap in the Phillips curve.

D)Trace the output gap from the IS-MP model down to the same output gap in the Phillips curve.

A)Trace the inflation rate from the IS-MP model down to the same inflation rate in the Phillips curve.

B)Trace the real interest rate from the IS-MP model down to the same real interest rate in the Phillips curve.

C)Trace the unemployment rate from the IS-MP model down to the same unemployment gap in the Phillips curve.

D)Trace the output gap from the IS-MP model down to the same output gap in the Phillips curve.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

29

Once you have connected the output gaps from the IS-MP model and the Phillips curve, the next step is to identify the:

A)price level from the Phillips curve.

B)unexpected inflation from the Phillips curve.

C)potential GDP level.

D)unemployment rate from the labor market.

A)price level from the Phillips curve.

B)unexpected inflation from the Phillips curve.

C)potential GDP level.

D)unemployment rate from the labor market.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

30

Once you have identified the unexpected inflation from the Phillips curve:

A)add the nominal interest rate to arrive at the real interest rate.

B)equate it to the actual inflation rate.

C)add the expected inflation rate to get the actual inflation rate.

D)subtract the expected inflation rate to get the actual inflation rate.

A)add the nominal interest rate to arrive at the real interest rate.

B)equate it to the actual inflation rate.

C)add the expected inflation rate to get the actual inflation rate.

D)subtract the expected inflation rate to get the actual inflation rate.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

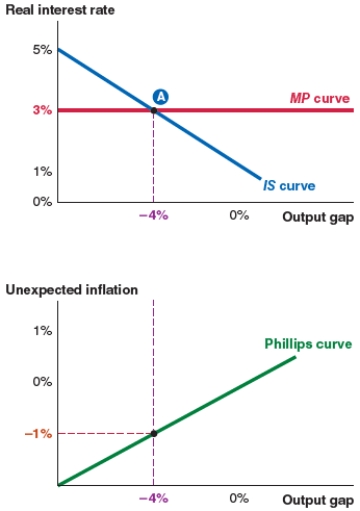

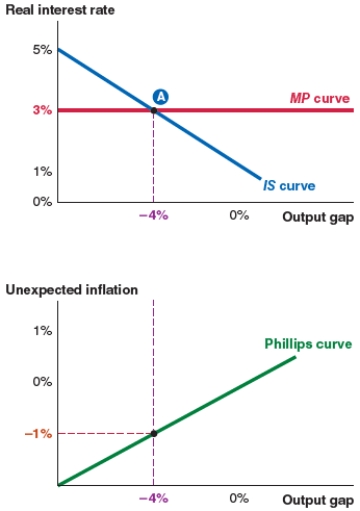

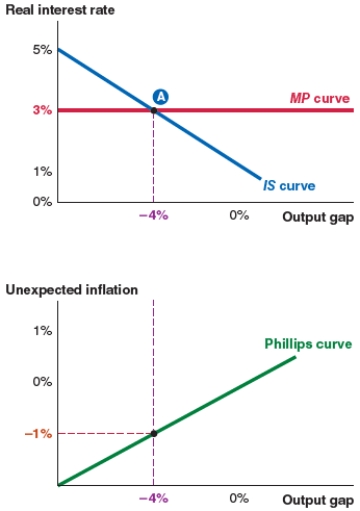

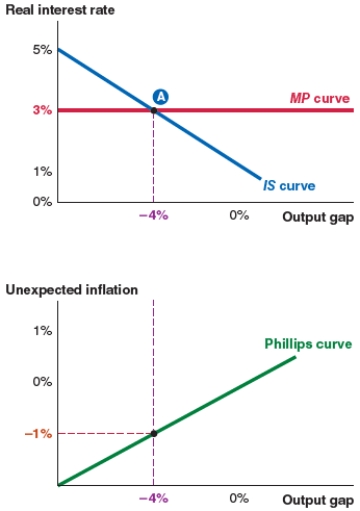

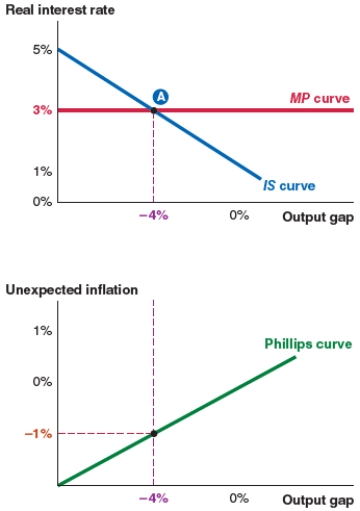

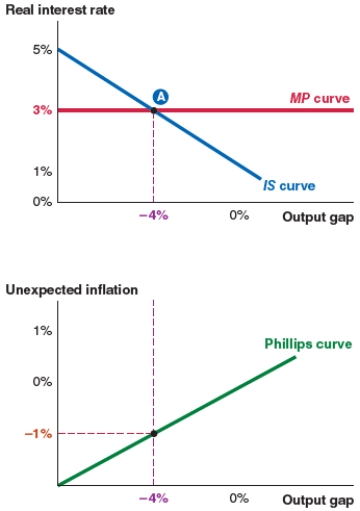

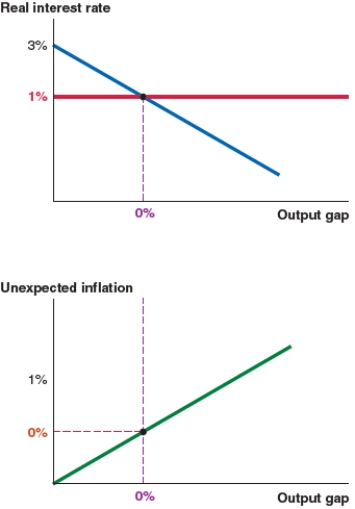

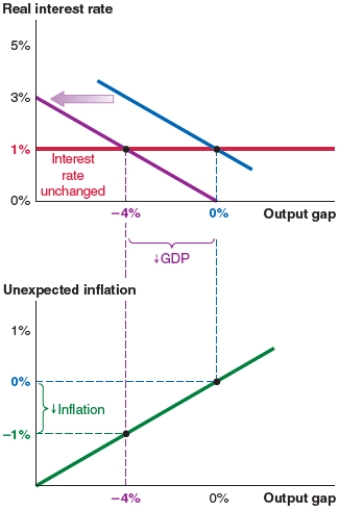

31

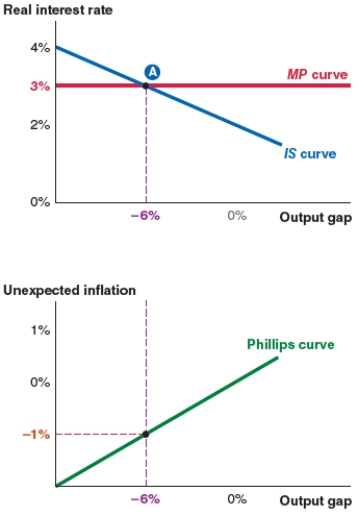

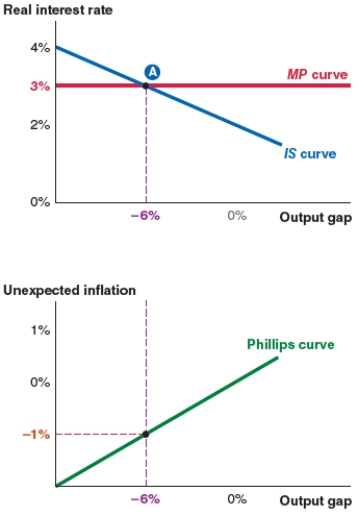

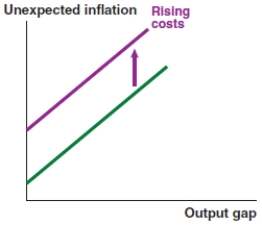

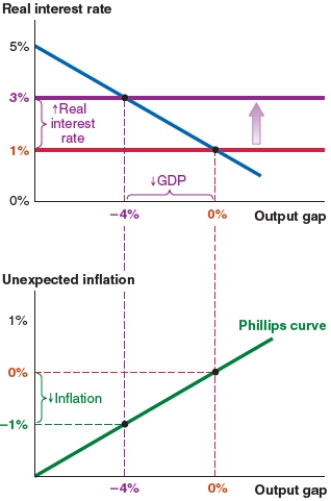

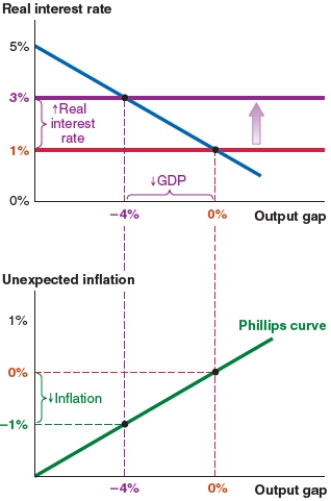

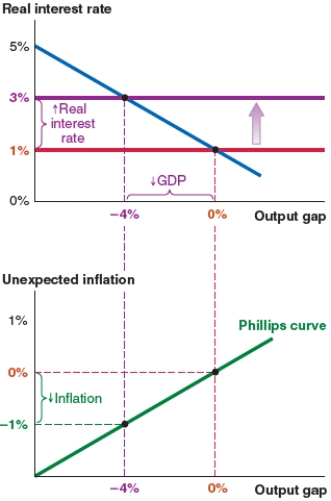

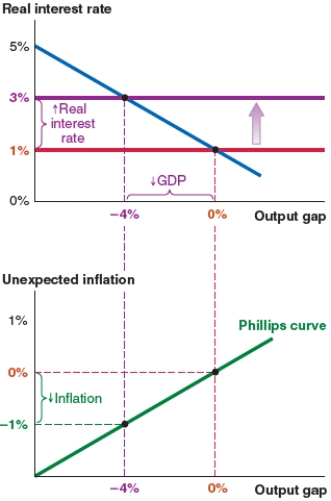

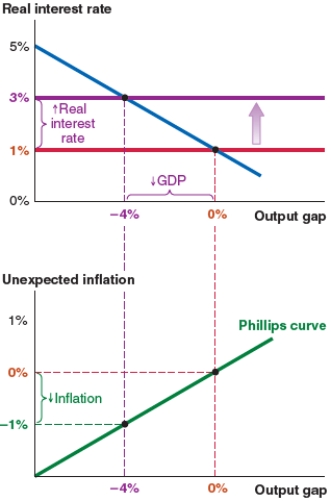

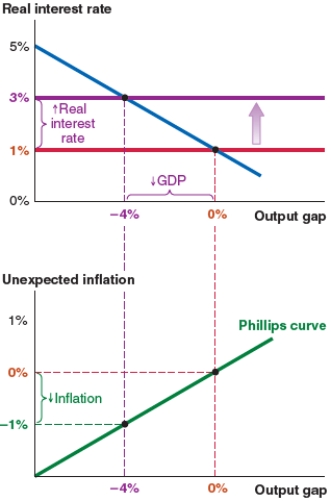

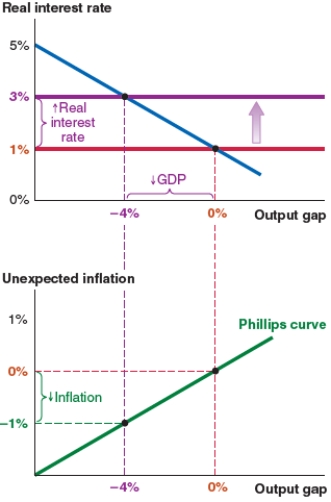

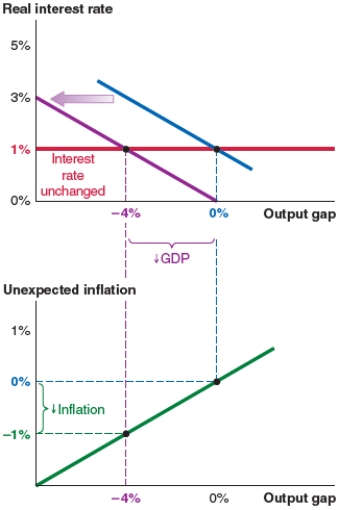

Take a look at the IS-MP-PC model shown here. If a spending shock causes the IS curve to shift right until the output gap is 0%, what will the new equilibrium real interest rate be?

A)5%.

B)3%.

C)-4%.

D)0%.

A)5%.

B)3%.

C)-4%.

D)0%.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

32

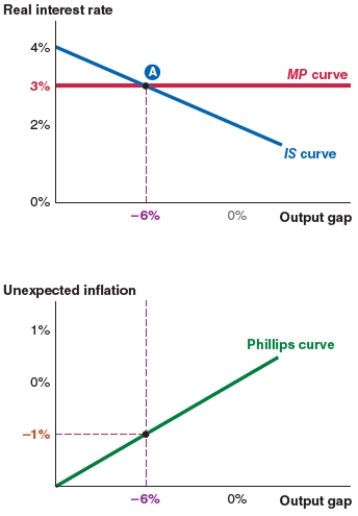

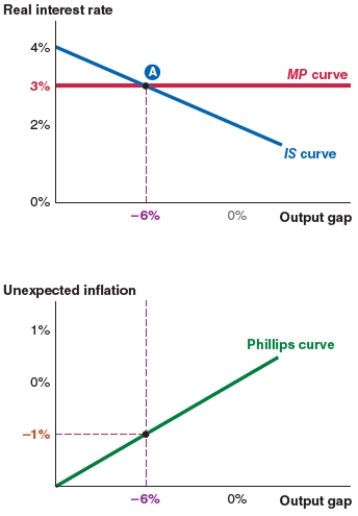

Take a look at the IS-MP-PC model shown here. The equilibrium real interest rate is:

A)5%.

B)3%.

C)-4%.

D)-1%.

A)5%.

B)3%.

C)-4%.

D)-1%.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

33

Take a look at the IS-MP-PC model shown here. At equilibrium, the output gap is:

A)5%.

B)3%.

C)-4%.

D)-1%.

A)5%.

B)3%.

C)-4%.

D)-1%.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

34

Take a look at the IS-MP-PC model shown here. At equilibrium, unexpected inflation is:

A)5%.

B)3%.

C)-4%.

D)-1%.

A)5%.

B)3%.

C)-4%.

D)-1%.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

35

Take a look at the IS-MP-PC model shown here. If the expected inflation rate is 2%, the actual inflation rate is:

A)1%.

B)-1%.

C)3%.

D)2%.

A)1%.

B)-1%.

C)3%.

D)2%.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

36

Take a look at the IS-MP-PC model shown here. If the expected inflation rate is 2.5%, the actual inflation rate is:

A)2.5%.

B)1.5%.

C)-1.5%.

D)-2.5%.

A)2.5%.

B)1.5%.

C)-1.5%.

D)-2.5%.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

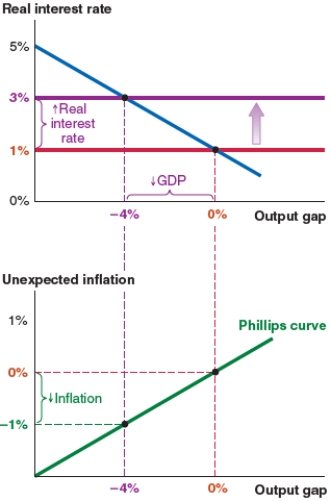

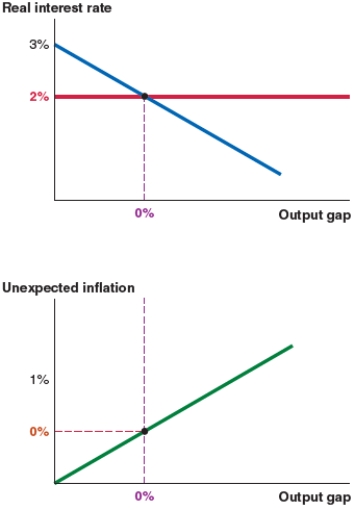

37

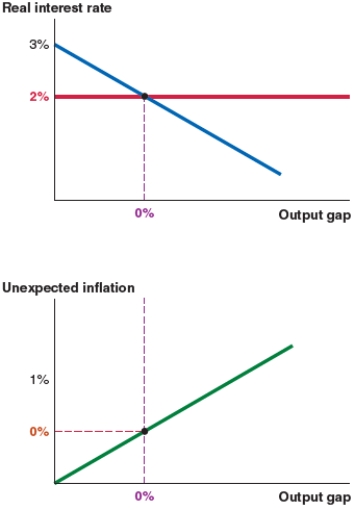

Take a look at the IS-MP-PC model shown here. The equilibrium real interest rate is:

A)4%.

B)3%.

C)2%.

D)-1%.

A)4%.

B)3%.

C)2%.

D)-1%.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

38

Take a look at the IS-MP-PC model shown here. At equilibrium, the output gap is:

A)4%.

B)3%.

C)-6%.

D)-1%.

A)4%.

B)3%.

C)-6%.

D)-1%.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

39

Take a look at the IS-MP-PC model shown here. If the expected inflation rate is 1.75%, the actual inflation rate is:

A)0.75%.

B)-0.75%.

C)1.75%.

D)2.75%.

A)0.75%.

B)-0.75%.

C)1.75%.

D)2.75%.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

40

If you see a newspaper headline that says "Oil prices rise sharply," this is an example of _____ shock.

A)a spending

B)an interest rate

C)a financial

D)a supply

A)a spending

B)an interest rate

C)a financial

D)a supply

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

41

If you see a newspaper headline that says "Consumer spending booms," this is an example of _____ shock.

A)a spending

B)an interest rate

C)a financial

D)a supply

A)a spending

B)an interest rate

C)a financial

D)a supply

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

42

If you see a newspaper headline that says "Consumer confidence falls as stock market plummets 1,500 points," this is an example of _____ shock.

A)a spending

B)an interest rate

C)a financial

D)a supply

A)a spending

B)an interest rate

C)a financial

D)a supply

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

43

If you see a newspaper headline that says "Steel prices rise sharply," this is an example of _____ shock.

A)a spending

B)an interest rate

C)a financial

D)a supply

A)a spending

B)an interest rate

C)a financial

D)a supply

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

44

If you see a newspaper headline that says "Banks shut doors - depositors scrambling to get their money back," this is an example of _____ shock.

A)a spending

B)an interest rate

C)a financial

D)a supply

A)a spending

B)an interest rate

C)a financial

D)a supply

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

45

If you see a newspaper headline that says "U.S. exports plunge," this is an example of _____ shock.

A)a spending

B)an interest rate

C)a financial

D)a supply

A)a spending

B)an interest rate

C)a financial

D)a supply

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

46

A spending shock is any change in:

A)aggregate expenditure at a given interest rate and level of income.

B)borrowing conditions that changes the real interest rate at which people can borrow.

C)production costs that leads suppliers to change the prices they charge at any given level of output.

D)potential GDP in the economy.

A)aggregate expenditure at a given interest rate and level of income.

B)borrowing conditions that changes the real interest rate at which people can borrow.

C)production costs that leads suppliers to change the prices they charge at any given level of output.

D)potential GDP in the economy.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

47

A financial shock is any change in:

A)aggregate expenditure, at a given interest rate and level of income.

B)borrowing conditions that changes the real interest rate at which people can borrow.

C)production costs that leads suppliers to change the prices they charge at any given level of output.

D)potential GDP in the economy.

A)aggregate expenditure, at a given interest rate and level of income.

B)borrowing conditions that changes the real interest rate at which people can borrow.

C)production costs that leads suppliers to change the prices they charge at any given level of output.

D)potential GDP in the economy.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

48

A supply shock is any change in:

A)aggregate expenditure at a given interest rate and level of income.

B)borrowing conditions that changes the real interest rate at which people can borrow.

C)production costs that leads suppliers to change the prices they charge at any given level of output.

D)potential GDP in the economy.

A)aggregate expenditure at a given interest rate and level of income.

B)borrowing conditions that changes the real interest rate at which people can borrow.

C)production costs that leads suppliers to change the prices they charge at any given level of output.

D)potential GDP in the economy.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

49

The first step in analyzing a macroeconomic shock is to:

A)assess inflation.

B)find the output gap.

C)identify the shock and shift the curve.

D)forecast future GDP growth.

A)assess inflation.

B)find the output gap.

C)identify the shock and shift the curve.

D)forecast future GDP growth.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

50

The second step in analyzing a macroeconomic shock is to:

A)assess inflation.

B)find the output gap.

C)identify the shock and shift the curve.

D)forecast future GDP growth.

A)assess inflation.

B)find the output gap.

C)identify the shock and shift the curve.

D)forecast future GDP growth.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

51

The third step in analyzing a macroeconomic shock is to:

A)assess inflation.

B)find the output gap.

C)identify the shock and shift the curve.

D)forecast future GDP growth.

A)assess inflation.

B)find the output gap.

C)identify the shock and shift the curve.

D)forecast future GDP growth.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

52

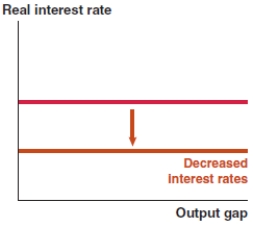

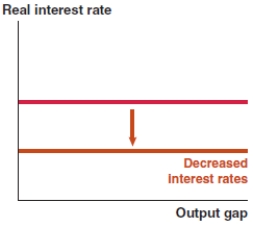

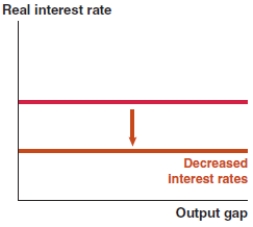

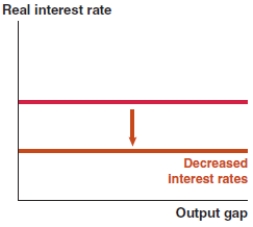

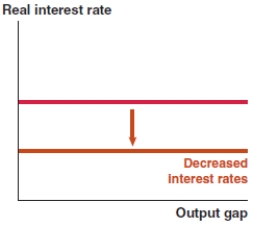

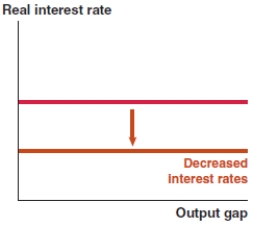

Which of the following graphs correctly represents a decrease in the risk premium on the MP curve?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

53

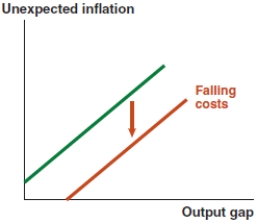

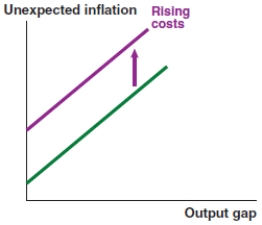

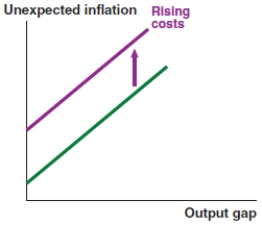

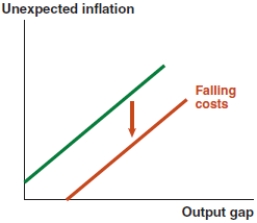

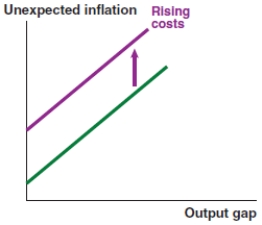

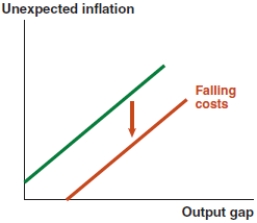

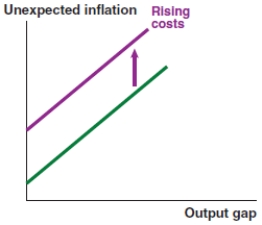

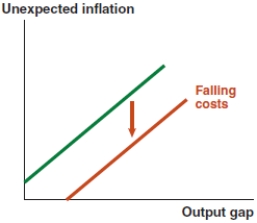

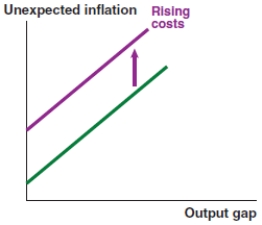

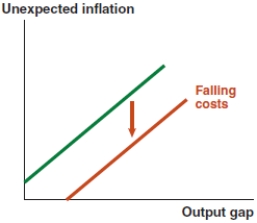

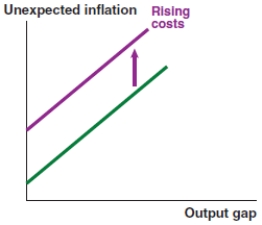

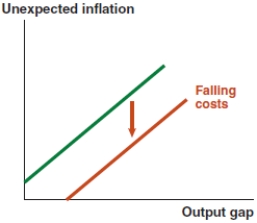

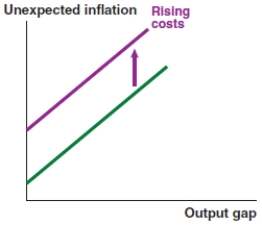

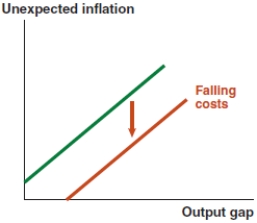

Which of the following graphs correctly represents a negative supply shock on the Phillips curve?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

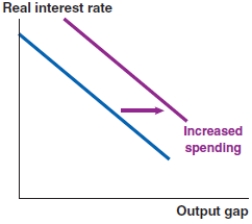

54

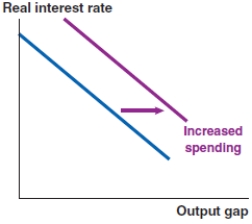

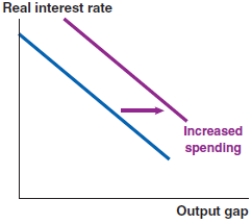

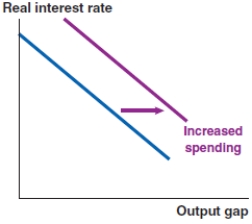

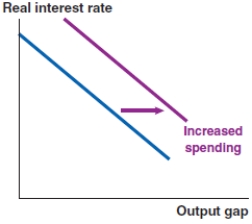

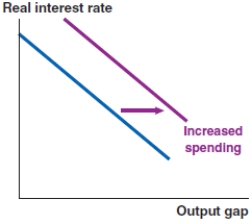

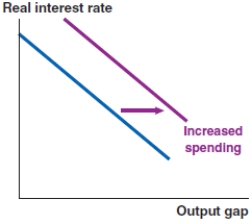

Which of the following graphs correctly represents a positive spending shock on the IS curve?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following graphs correctly represents an increase in the risk premium on the MP curve?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

56

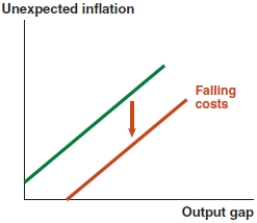

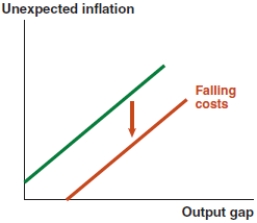

Which of the following graphs correctly represents a positive supply shock on the Phillips curve?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

57

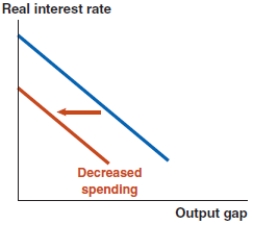

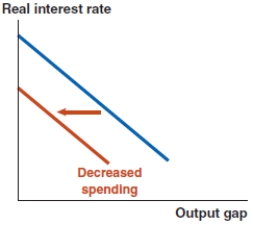

Which of the following graphs correctly represents a negative spending shock on the IS curve?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following graphs correctly represents the effect of increased consumer confidence and spending on the IS curve?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

59

If the government lowers corporate taxes, which of the following graphs correctly represents the effect on the IS curve?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

60

If the U.S. dollar appreciates, which of the following graphs correctly represents the effect on the IS curve?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

61

If the Canadian dollar depreciates, which of the following graphs correctly represents the effect on the IS curve in Canada?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

62

If the default risk rises in Greece, which of the following graphs correctly represents the effect on the MP curve in Greece?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following graphs correctly represents the effect on the MP curve if there is a rise in liquidity risk in the United States?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following graphs correctly represents the effect on the MP curve in Canada if mortgage rates decrease?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following graphs correctly represents the effect on the MP curve if lenders become less risk averse?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following graphs correctly represents the effect on the Phillips curve if there is widespread production technology improvement in Bangladesh?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following graphs correctly represents the effect on the Phillips curve in India if the Indian rupee depreciates?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following graphs correctly represents the effect on the Phillips curve in Ethiopia if the Ethiopian birr appreciates?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

69

In 2017, nearly 7.6% of Vietnamese imports were integrated circuits, which are used in the manufacture of electronics. If the price of integrated circuits rises significantly, what effect does this have on the Phillips curve in Vietnam?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

70

In 2017, nearly 3.5% of Vietnamese imports constituted of refined oil. If the price of oil rises significantly, what effect does this have on the Phillips curve in Vietnam?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

71

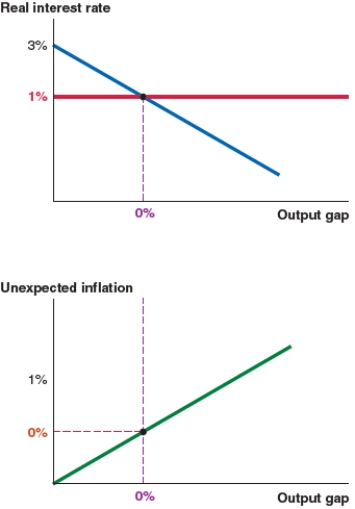

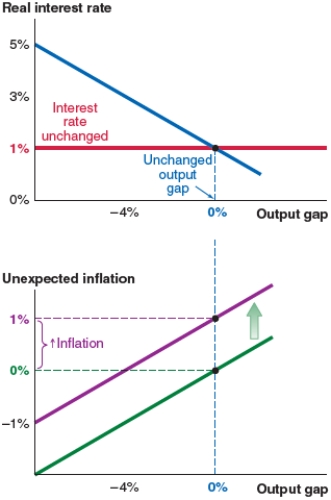

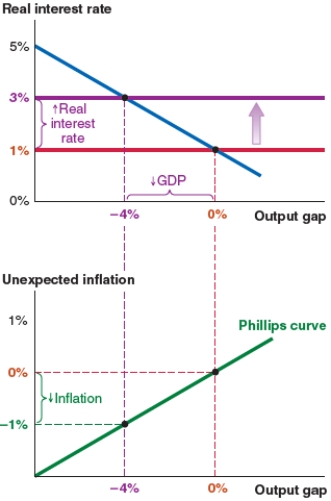

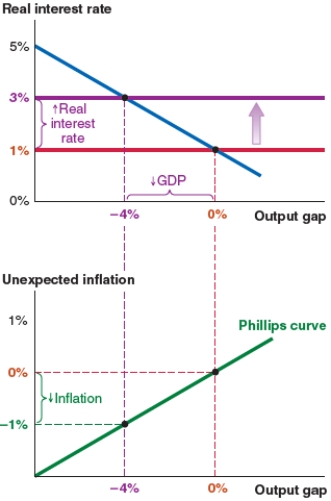

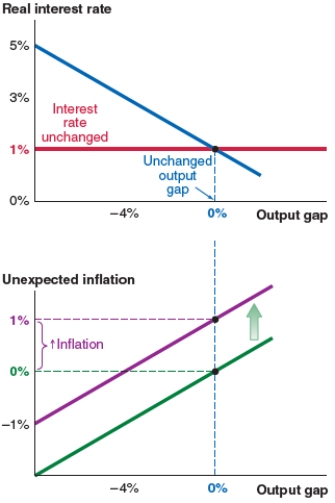

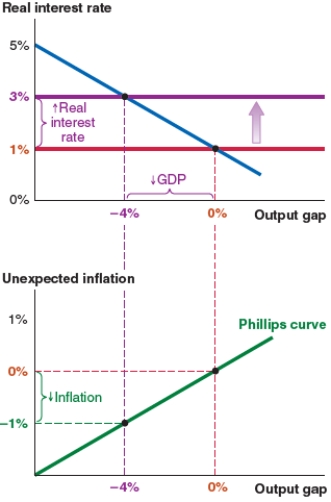

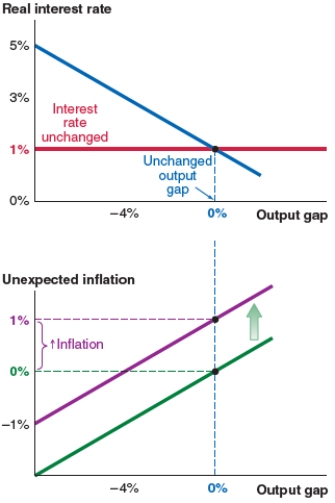

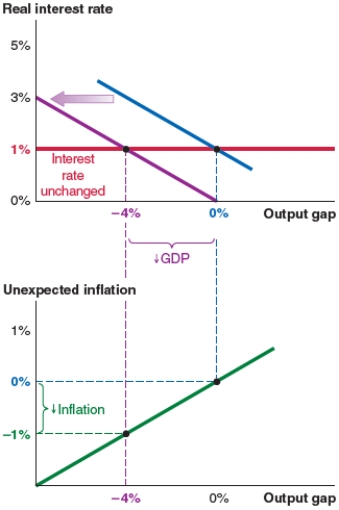

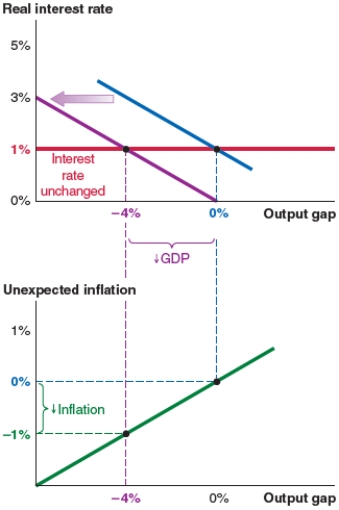

Assume that the economy starts at a 0% output gap. Now suppose that banks begin to fear the risk of default and the risk premium rises by 2%. Which of the following figures shows what happens in this scenario?

Figure A

Figure B

Figure C

Figure D

A)Figure A (no change)

B)Figure B (an upward shift of the MP curve and a new interest rate of 3%)

C)Figure C (a leftward shift of the IS curve and an output gap of -4%)

D)Figure D (an upward shift of the Phillips curve and 1% unexpected inflation)

Figure A

Figure B

Figure C

Figure D

A)Figure A (no change)

B)Figure B (an upward shift of the MP curve and a new interest rate of 3%)

C)Figure C (a leftward shift of the IS curve and an output gap of -4%)

D)Figure D (an upward shift of the Phillips curve and 1% unexpected inflation)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

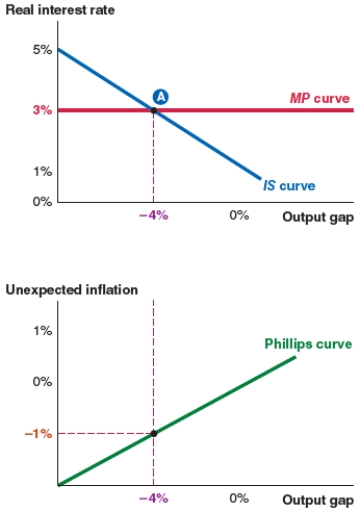

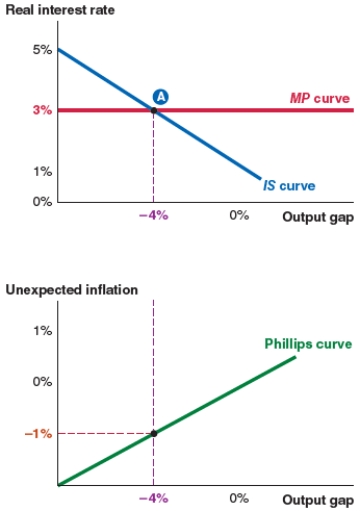

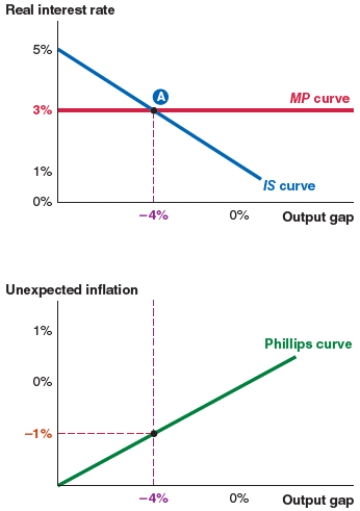

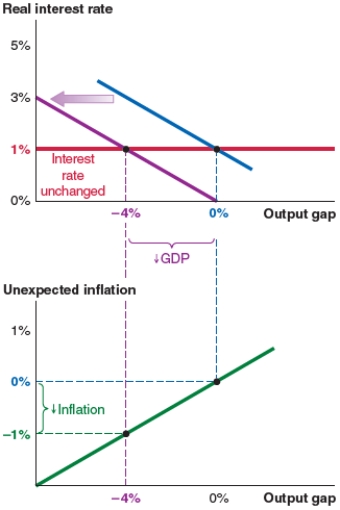

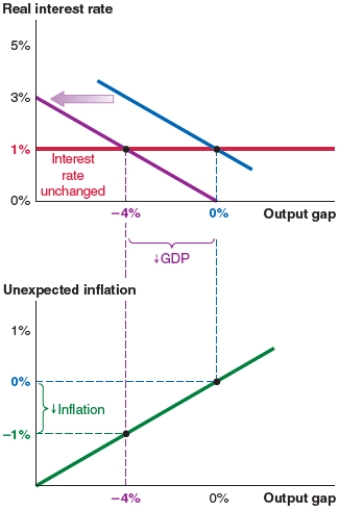

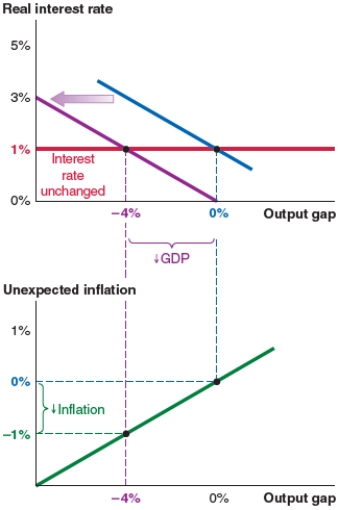

72

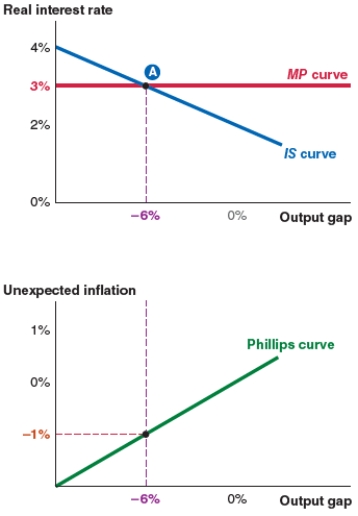

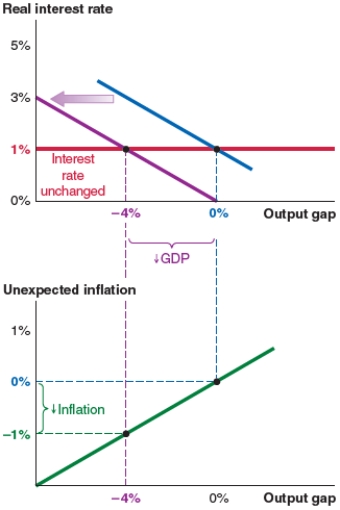

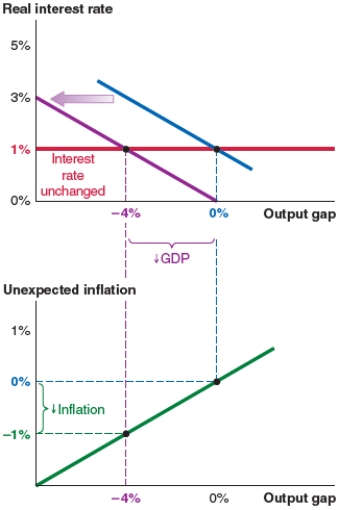

The economy shown here begins at a 0% output gap. A rise in the risk premium by 2% leads to:

A)a new real interest rate of 3%.

B)unexpected inflation of 1%.

C)a new output gap of 2%.

D)a new real interest rate of 0%.

A)a new real interest rate of 3%.

B)unexpected inflation of 1%.

C)a new output gap of 2%.

D)a new real interest rate of 0%.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

73

The economy shown here begins at a 0% output gap. A rise in the risk premium by 2% leads to:

A)unexpected inflation of 0%.

B)unexpected inflation of 1%.

C)a new output gap of -4%.

D)a new real interest rate of 1%.

A)unexpected inflation of 0%.

B)unexpected inflation of 1%.

C)a new output gap of -4%.

D)a new real interest rate of 1%.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

74

The economy shown here begins at a 0% output gap. A rise in the risk premium by 2% leads to:

A)unexpected inflation of 0%.

B)unexpected inflation of -1%.

C)a new output gap of 2%.

D)a new real interest rate of 1%.

A)unexpected inflation of 0%.

B)unexpected inflation of -1%.

C)a new output gap of 2%.

D)a new real interest rate of 1%.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

75

The economy shown here begins at a 0% output gap. Now suppose that banks begin to fear the risk of default and the risk premium rises by 2%. If inflation expectations remain unchanged, the actual inflation rate will be:

A)2% higher.

B)1% higher.

C)1% lower.

D)4% lower.

A)2% higher.

B)1% higher.

C)1% lower.

D)4% lower.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

76

You are an economic adviser using the Fed model to analyze the economy. What is the effect of a rise in the risk premium in the economy?

A)a rise in the real interest rate, falling output, and unexpected deflation

B)a rise in the real interest rate, rising output, and unexpected inflation

C)a fall in the real interest rate, falling output, and unexpected deflation

D)a fall in the real interest rate, rising output, and unexpected inflation

A)a rise in the real interest rate, falling output, and unexpected deflation

B)a rise in the real interest rate, rising output, and unexpected inflation

C)a fall in the real interest rate, falling output, and unexpected deflation

D)a fall in the real interest rate, rising output, and unexpected inflation

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

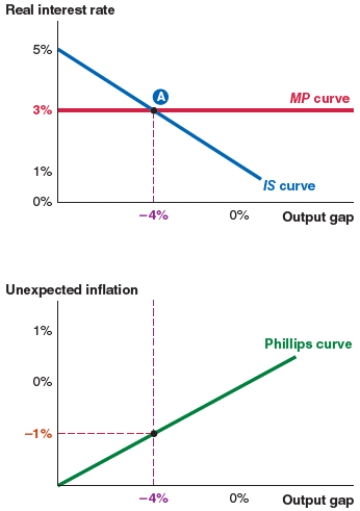

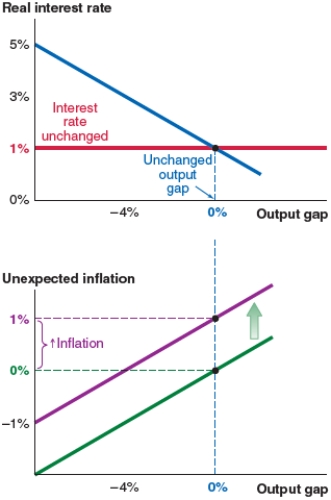

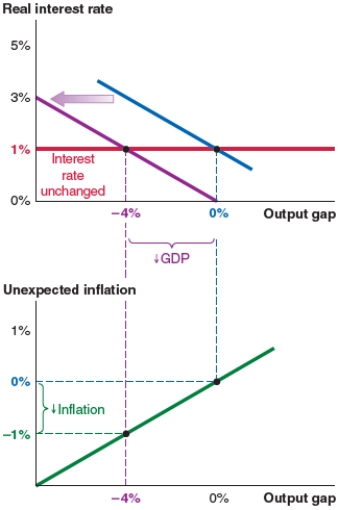

77

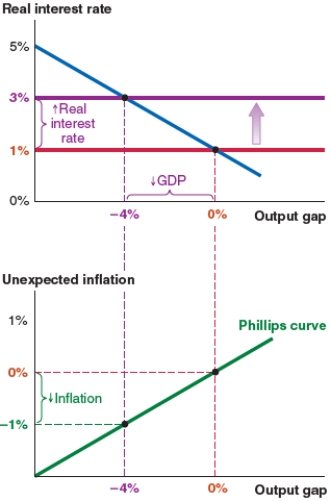

Assume that the economy starts at a 0% output gap. Now suppose that consumers fear a recession and reduce their spending. Based on this scenario, the economy experiences:

Figure A

Figure B

Figure C

Figure D

A) no change, as shown in Figure A.

B) an upward shift of the MP curve and a new interest rate of 3%, as shown in Figure B.

C) a leftward shift of the IS curve and an output gap of -4%, as shown in Figure C.

D) an upward shift of the Phillips curve and 1% unexpected inflation, as shown in Figure D.

Figure A

Figure B

Figure C

Figure D

A) no change, as shown in Figure A.

B) an upward shift of the MP curve and a new interest rate of 3%, as shown in Figure B.

C) a leftward shift of the IS curve and an output gap of -4%, as shown in Figure C.

D) an upward shift of the Phillips curve and 1% unexpected inflation, as shown in Figure D.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

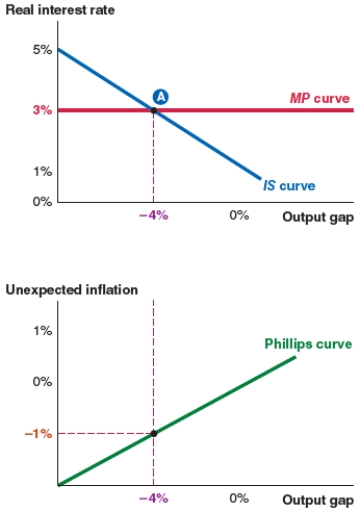

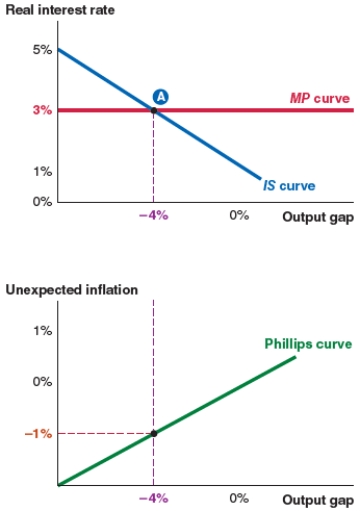

78

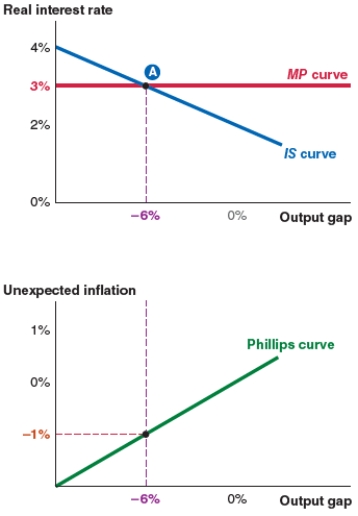

The economy shown here begins at a 0% output gap. Now suppose that consumers fear a recession and reduce their spending. This leads to:

A)a new real interest rate of 3%.

B)unexpected inflation of 1%.

C)a new output gap of -4%.

D)a new real interest rate of 0%.

A)a new real interest rate of 3%.

B)unexpected inflation of 1%.

C)a new output gap of -4%.

D)a new real interest rate of 0%.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

79

The economy shown here begins at a 0% output gap. Now suppose that consumers fear a recession and reduce their spending. This leads to:

A)a new real interest rate of 3%.

B)unexpected inflation of 1%.

C)a new output gap of 1%.

D)an unchanged interest rate.

A)a new real interest rate of 3%.

B)unexpected inflation of 1%.

C)a new output gap of 1%.

D)an unchanged interest rate.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

80

The economy shown here begins at a 0% output gap. Now suppose that consumers fear a recession and reduce their spending. This leads to:

A)unexpected inflation of 0%.

B)unexpected inflation of -1%.

C)a new output gap of 2%.

D)a new real interest rate of 3%.

A)unexpected inflation of 0%.

B)unexpected inflation of -1%.

C)a new output gap of 2%.

D)a new real interest rate of 3%.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck