Deck 17: Interim Period Reporting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

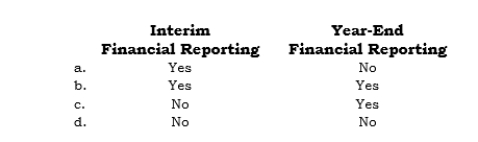

Question

Question

Question

Question

Question

Question

Question

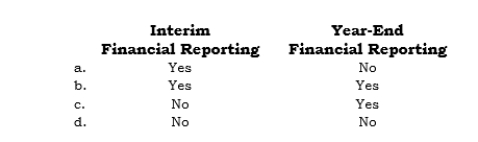

Question

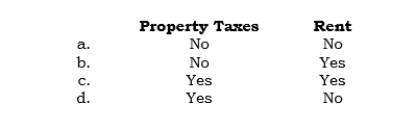

Question

Question

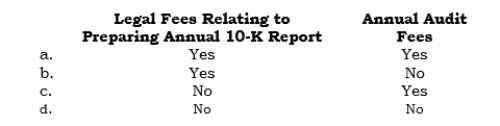

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/49

Play

Full screen (f)

Deck 17: Interim Period Reporting

1

In interim reporting, the approach that treats each interim period independently of all other periods is the ______________________________________ view.

discrete

2

In interim reporting, an interim period is considered a part of an annual period under the ___________________________view.

integral

3

In interim reporting, APB Opinion No. 28 prescribes the use of the_____________ _____________________________ view for income taxes.

integral

4

In interim reporting, APB Opinion No. 28 prescribes the use of the ______________ ______________________ view for extraordinary items.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

5

In interim reporting, changes in accounting estimates are to be accounted for on a(n) ______________________________________ basis.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

6

In interim reporting, changes in accounting principles that are made in other than the first interim reporting quarter are to be accounted for ________________________________________.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

7

In interim reporting, APB Opinion No. 28 essentially prescribes the use of the _______________________________ view for revenues.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

8

Under APB Opinion No. 28, declines in market prices of inventory at interim dates that can be reasonably expected to be restored by the end of the annual period ___________________________________ be recognized at an interim date.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

9

Under APB Opinion No. 28, planned volume or capacity variances that are expected to be absorbed by the end of the annual period ______________________ ______________________ be deferred at interim reporting dates.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

10

Under APB Opinion No. 28, certain costs and expenses (other than product costs) that clearly benefit more than one interim period ______________________________ be allocated among interim periods benefited.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

11

Quarterly financial reporting is a requirement under GAAP as promulgated by the FASB and its predecessor organizations.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

12

The inclusion of quarterly financial data in the annual report to stockholders is voluntary for publicly owned companies.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

13

The objective of interim reporting is to use the same accounting principles and practices used in preparing annual financial statements.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

14

Under the discrete view, an interim period is viewed as a self-contained segment of history that must stand on its own, just as an annual period must stand on its own.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

15

Under the integral view, the function of accounting is deemed to be that of recording transactions and events as they occur.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

16

Under the discrete view, the period of time for which results of operations are being determined should not influence how such transactions and events should be reported.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

17

Under APB Opinion No. 28, accounting for revenues in interim periods is done using a discrete approach.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

18

Under APB Opinion No. 28, market declines at interim dates pertaining to inventory are to be allocated to interim periods based on an estimate of time expired, benefit received, or activity associated with the periods.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

19

Under APB Opinion No. 28, unplanned capacity variances arising at an interim date should not be deferred at interim reporting dates.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

20

Under APB Opinion No. 28, certain expenditures (other than product costs) that clearly benefit more than one interim period are required to be allocated among interim periods benefitted.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

21

Under APB Opinion No. 28, the manner of computing income taxes for interim periods is primarily a discrete approach.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

22

Under APB Opinion No. 28, extraordinary items must be reported in the interim period in which they occur.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

23

Under APB Opinion No. 28, changes in accounting estimates are required to be accounted for in the first interim reporting period.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

24

Under APB Opinion No. 28, either a condensed or a complete income statement is to be included in interim financial reports.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

25

Certified public accountants of publicly owned companies are required to review interim financial reports prior to their release.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

26

_____ Under the discrete view,

A) Accounting procedures are used that result in reasonably constant operating profit margin throughout the year.

B) An interim period is viewed as an essential part of an annual period.

C) The period of time for which results of operations are being determined does not influence how such transactions and events are reported.

D) An interim period cannot stand on its own.

E) None of the above.

A) Accounting procedures are used that result in reasonably constant operating profit margin throughout the year.

B) An interim period is viewed as an essential part of an annual period.

C) The period of time for which results of operations are being determined does not influence how such transactions and events are reported.

D) An interim period cannot stand on its own.

E) None of the above.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

27

_____ Under the integral view,

A) Accounting procedures are used that result in reasonably constant operating profit margins throughout the year.

B) An interim period is viewed as a self-contained segment of history that must stand on its own.

C) Events and transactions are recorded as they occur.

D) The period of time for which results of operations are being determined does not influence how such transactions and events are reported.

E) None of the above.

A) Accounting procedures are used that result in reasonably constant operating profit margins throughout the year.

B) An interim period is viewed as a self-contained segment of history that must stand on its own.

C) Events and transactions are recorded as they occur.

D) The period of time for which results of operations are being determined does not influence how such transactions and events are reported.

E) None of the above.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

28

_____ Under APB Opinion No. 28, the approach taken to interim reporting was the

A) Discrete view.

B) Integral view.

C) Combination discrete-integral view.

D) Going-concern view.

E) Current-value view.

A) Discrete view.

B) Integral view.

C) Combination discrete-integral view.

D) Going-concern view.

E) Current-value view.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

29

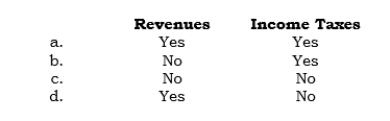

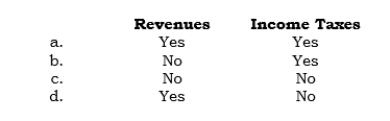

_____ Under APB Opinion No. 28, the following items are accounted for under the discrete view:

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

30

_____ Under APB Opinion No. 28,

A) Physical inventories must be taken at the end of each interim quarter.

B) When LIFO base period inventories are liquidated at an interim date but are expected to be replaced by the end of the annual period, cost of goods sold for the interim period are not to include the cost of replacing the liquidated LIFO base.

C) Market price declines at interim dates pertaining to inventories that are not temporary need not be recognized at the interim date.

D) Volume or capacity variances of inventoriable-type costs cannot be deferred at interim reporting dates.

E) None of the above.

A) Physical inventories must be taken at the end of each interim quarter.

B) When LIFO base period inventories are liquidated at an interim date but are expected to be replaced by the end of the annual period, cost of goods sold for the interim period are not to include the cost of replacing the liquidated LIFO base.

C) Market price declines at interim dates pertaining to inventories that are not temporary need not be recognized at the interim date.

D) Volume or capacity variances of inventoriable-type costs cannot be deferred at interim reporting dates.

E) None of the above.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

31

_____ Under APB Opinion No. 28,

A) Temporary declines in inventory market prices need not be recognized at interim reporting dates.

B) Temporary declines in inventory market prices are to be recognized at interim reporting dates.

C) Temporary and nontemporary declines in inventory market prices are to be recognized at interim reporting dates.

D) If inventory losses from nontemporary market declines are recognized at an interim date, any subsequent recoveries cannot be recognized.

E) None of the above.

A) Temporary declines in inventory market prices need not be recognized at interim reporting dates.

B) Temporary declines in inventory market prices are to be recognized at interim reporting dates.

C) Temporary and nontemporary declines in inventory market prices are to be recognized at interim reporting dates.

D) If inventory losses from nontemporary market declines are recognized at an interim date, any subsequent recoveries cannot be recognized.

E) None of the above.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

32

_____ Under APB Opinion No. 28, the cumulative effect of a change in the income tax rate occurring after the first interim reporting period is to be reported

A) In the first interim reporting period by restating the results of the first interim reporting period.

B) In the interim reporting period in which the change occurs.

C) On a prospective basis over the current and remaining interim periods.

D) On a prospective basis over the remaining interim periods.

E) Not at all if the change is expected to be temporary. f. None of the above.

A) In the first interim reporting period by restating the results of the first interim reporting period.

B) In the interim reporting period in which the change occurs.

C) On a prospective basis over the current and remaining interim periods.

D) On a prospective basis over the remaining interim periods.

E) Not at all if the change is expected to be temporary. f. None of the above.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

33

_____ Under APB Opinion No. 28, interim financial reports are to include, as a minimum,

A) A condensed income statement.

B) A complete income statement.

C) Comparative income statements.

D) Specified income statement items.

E) None of the above.

A) A condensed income statement.

B) A complete income statement.

C) Comparative income statements.

D) Specified income statement items.

E) None of the above.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

34

_____ Interim financial reports issued by publicly owned companies

A) Are required to be audited before they are released.

B) Are required to be reviewed by auditors before their release.

C) Do not have to be reviewed or audited by auditors prior to their release.

D) Are required to be reviewed by auditors if they are 10-Q quarterly reports being filed with the SEC.

E) None of the above.

A) Are required to be audited before they are released.

B) Are required to be reviewed by auditors before their release.

C) Do not have to be reviewed or audited by auditors prior to their release.

D) Are required to be reviewed by auditors if they are 10-Q quarterly reports being filed with the SEC.

E) None of the above.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

35

_____ For interim financial reporting, an inventory loss from a market decline in the second quarter that is not expected to be restored in the fiscal year should be recognized as a loss

A) In the fourth quarter.

B) Proportionately in each of the second, third, and fourth quarters.

C) Proportionately in each of the first, second, third, and fourth quarters.

D) In the second quarter.

A) In the fourth quarter.

B) Proportionately in each of the second, third, and fourth quarters.

C) Proportionately in each of the first, second, third, and fourth quarters.

D) In the second quarter.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

36

_____ For external reporting purposes, it is appropriate to use estimated gross profit rate to determine the cost of sales for

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

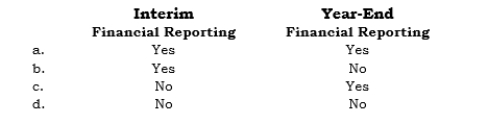

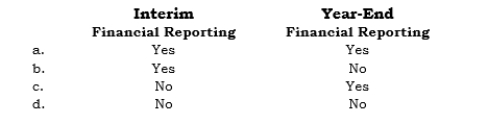

37

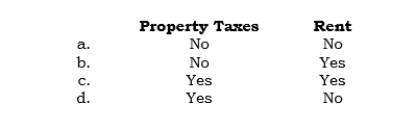

_____ Property taxes may be accrued or deferred to provide an appropriate cost in each period for

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

38

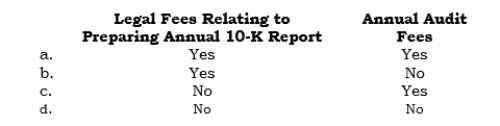

_____ For interim financial reporting, which of the following may be accrued or deferred to provide an appropriate cost in each period?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

39

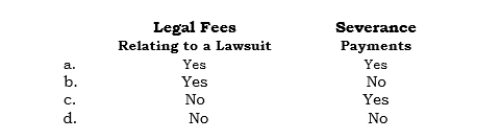

_____ For interim financial reporting, which of the following items may be prorated over each of the quarters instead of being expensed in the quarter in which incurred or paid?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

40

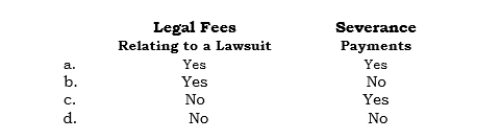

______ For interim financial reporting, which of the following items may be prorated over each of the quarters instead of being expensed in the quarter in which incurred or paid?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

41

______ In August 2006, Intex spent $150,000 on an advertising campaign for subscriptions to the magazine it sells on getting ready for the skiing season. There are only two issues: one in October and one in November. The magazine is sold on a subscription basis, and the subscriptions started in October 2006. Assuming that Intex's fiscal year ends on 3/31/05, what amount of expense should be included in Intex's quarterly income statement for the three months ended 12/31/06?

A) $37,500

B) $50,000

C) $75,000

D) $150,000

E) $ -0-

A) $37,500

B) $50,000

C) $75,000

D) $150,000

E) $ -0-

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

42

_____ In January 2006, Nollex paid property taxes of $20,000 covering the calendar year 2006. Also in January 2006, Nollex estimated tht its year-end bonuses to factory workers would be $80,000 for 2006. In Nollex's quarterly income statement for the three months ended 3/31/06, what is the total amount of expense relating to these two items that should be reported?

A) $25,000

B) $20,000

C) $5,000

D) $ -0-

A) $25,000

B) $20,000

C) $5,000

D) $ -0-

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

43

_____ Dobbco is subject to a 10% state corporate income tax rate and a 40% federal income tax rate. For 2006, Dobbco expects to have federal research and development credits of $60,000. Dobbco's estimated pretax income for 2006 is $2,000,000. What is Dobbco's combined estimated income tax rate for 2006 that it would use for calculating the income tax expense for the first quarter of 2006?

A) 40%

B) 43%

C) 47%

D) 48.5%

E) 50%

A) 40%

B) 43%

C) 47%

D) 48.5%

E) 50%

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

44

______ Cableco estimated its annual effective income tax rate to be 40% at the end of its first quarterly interim period for 2006. At the end of the third quarter for 2006, Cableco revised its estimated annual effective income tax rate to be 36%. Cableco had pretax income of $1,000,000 for each of the first three quarters and expects earnings for the fourth quarter to be $2,000,000. What amount should be reported for income tax expense for the third quarter in the third quarter interim report?

A) $280,000

B) $320,000

C) $360,000

D) $400,000

E) None of the above.

A) $280,000

B) $320,000

C) $360,000

D) $400,000

E) None of the above.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

45

_____ Cableco estimated its annual effective income tax rate to be 40% at the end of its first quarterly interim period for 2006. At the end of the third quarter for 2006, Cableco revised its estimated annual effective income tax rate to be 36%. Cableco had pretax income of $1,000,000 for each of the first three quarters and expects earnings for the fourth quarter to be $2,000,000. What amount should be reported for income tax expense in the third quarter interim report for the year-to-date (nine month) results?

A) $1,080,000

B) $1,120,000

C) $1,160,000

D) $1,200,000

E) None of the above.

A) $1,080,000

B) $1,120,000

C) $1,160,000

D) $1,200,000

E) None of the above.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

46

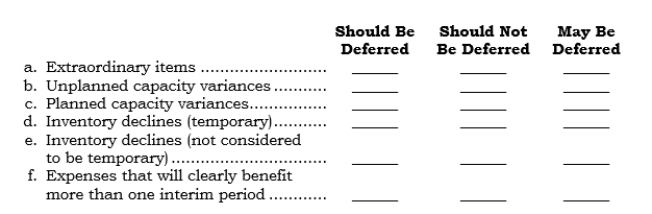

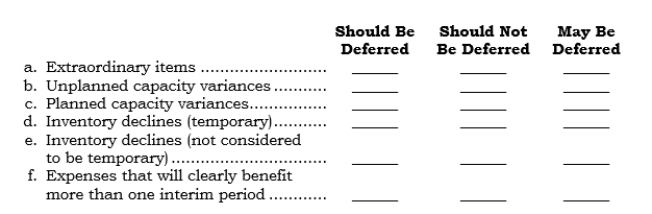

For each of the following items, indicate the proper accounting treatment to be followed under APB Opinion No. 28 by placing an X in the appropriate column.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

47

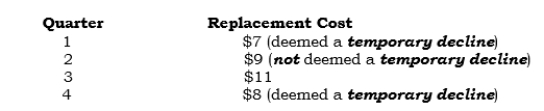

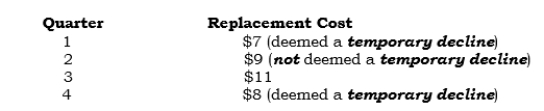

Temporex had 1,000 units of an item on hand at the beginning of 2006, which were valued at their acquisition cost of $10 per unit. No additional purchases of this item occurred during 2006. For simplicity, assume that no sales of this item were made in 2006. The replacement cost (assumed to be market) at the end of each quarter follows:

Required:

Required:

Determine the charge or credit, if any, to be made to earnings for each quarter of 2006.

Required:

Required:Determine the charge or credit, if any, to be made to earnings for each quarter of 2006.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

48

Quartex had pretax income for its first interim reporting quarter of $200,000. Estimated pretax income for the remainder of the year is $800,000. The federal income tax rate is 40%, and the state income tax rate is 10%. Federal research and development tax credits are expected to total $40,000 for the year.

Required:

a. Compute the estimated annual income tax rate for the year.

b. Compute the income tax expense to be reported in the first quarter.

Required:

a. Compute the estimated annual income tax rate for the year.

b. Compute the income tax expense to be reported in the first quarter.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

49

Quadrox estimated its annual effective income tax rate to be 45% at the end of its first quarterly interim period for 2006. It had pretax income of $400,000 for its first quarterly interim period for 2006. At the end of the second quarter of 2006, the company estimated its annual effective income tax rate to be 40%. The company had pretax income of $300,000 for its second quarterly interim period of 2006.

Required:

Compute the amount of income tax expense to be reported for the second quarterly interim period and for the year to date.

Required:

Compute the amount of income tax expense to be reported for the second quarterly interim period and for the year to date.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck