Deck 14: Accounting for Health Care Organizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/46

Play

Full screen (f)

Deck 14: Accounting for Health Care Organizations

1

All three kinds of organizations may be health care providers-private or investor-owned hospitals, governmental hospitals, or nonprofit.

True

2

Nonprofit and investor-owned hospitals follow Financial Accounting Standards Board standards while governmental hospitals are required to follow standards issued by the Governmental Accounting Standards Board.

True

3

Financial reporting by nonprofit hospitals focuses on three classes of net assets-restricted, unrestricted, and endowments.

False

4

Nonprofit hospitals provide two operating statements-one a typical operating statement reports only on unrestricted net assets, the other reports changes in the two required net asset classes.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

5

Governmental hospitals that meet the definition of an enterprise fund must present four financial statements-a statement of position, a statement of changes in net position, a statement of changes in cash flows, and a budgetary comparison statement.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

6

Hospitals sometimes work with third-party payers who pay an interim rate based on a percentage of the hospital's established rates but also have the right to adjust their payments later-or retrospectively.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

7

Nonprofit hospitals must base all their patient service revenue recognition on contracts with patients, whether those contracts are written or unwritten.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

8

Nonprofit hospitals recognize patient service revenue at their gross (established) rates, even though they don't expect to be able to collect those amounts.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

9

Once a governmental or nonprofit hospital decides that its patient meets the definition of a charity care case, they are no longer permitted to report the fees that are charged for the services provided to that patient as revenue.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

10

Hospitals that enter into capitation fee agreements, such as with HMOs, recognize patient service revenues in the same manner (giving consideration to contractual and implied concessions) as for all other patient service revenues.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

11

When a governmental hospital receives donations of supplies, such as of syringes, it should recognize contribution revenue equal to the amount the contributor paid for the supplies.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

12

When a donor contributes cash with "no strings attached," this means the hospital should report the contribution as revenue right away.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

13

If a dietician in the community donates her time to the local nonprofit hospital to help it create better menus for its food service, that nonprofit hospital should report her services as contributed services revenue equal to the fair value of her services and the same amount as an expense.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

14

Some nonprofits hospitals report "assets limited as to use" when specific resources are restricted by a contract (such as with a lender) or when the nonprofit's governing body has set aside resources for a specific purpose.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

15

Nonprofit hospitals may receive a variety of contributions that impose donor restrictions, including limitations on the period during which the hospital may use the resources.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

16

When governmental hospitals receive contributions that include eligibility requirements, the hospital only recognizes revenue when it has met those eligibility requirements. If the government receives cash, it reports the cash as a liability until the eligibility requirements are met.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

17

Both governmental and nonprofit hospitals must report their investments in debt and equity securities at their fair value.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

18

Both governmental and nonprofit hospitals must report a liability for medical malpractice claims once it is probable that the claim will have to be paid and the amount is known.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

19

When a governmental hospital that meets the definition of an enterprise fund purchases a building, it must report the entire cost of the building as a capital expenditure.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

20

Both governmental and nonprofit hospitals are required to be present a statement of cash flows, but the statements presented for nonprofit hospitals are different from those presented by governmental hospitals.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

21

Nonprofit hospitals are required to include a performance indicator in their operating statements called "Excess of revenue over expenses," that excludes unrealized gains and losses on investments and net assets released from restrictions.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

22

Nonprofit hospitals are required to present two operating statements. The second statement-a statement of changes in net assets-reports on both changes in net assets without donor restrictions and in net assets with donor restrictions.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

23

Governmental hospitals are required to distinguish between operating and nonoperating revenue and expenses but not between changes in net assets with donor restrictions and net assets without donor restrictions.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

24

Governmental hospitals are required to report their net position in five categories-current, noncurrent, restricted, unrestricted, and net investment in capital assets.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

25

In which fund category are governmental hospitals generally reported?

A) Governmental funds

B) Enterprise funds

C) Fiduciary funds

D) Restricted funds

A) Governmental funds

B) Enterprise funds

C) Fiduciary funds

D) Restricted funds

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

26

Regardless of ownership, most hospitals' revenues come from third-party payers. These third parties include:

A) Public (governmental) payers, such as Medicare and Medicaid

B) Private insurance companies

C) Health maintenance organizations (HMOs)

D) All of the above

A) Public (governmental) payers, such as Medicare and Medicaid

B) Private insurance companies

C) Health maintenance organizations (HMOs)

D) All of the above

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

27

The difference between a nonprofit's hospital's established billing rate and the amount paid by a third-party payer is referred to as:

A) A Medicaid allowance

B) A capitation agreement

C) A charity allowance

D) As an explicit or implicit concession depending on circumstances

A) A Medicaid allowance

B) A capitation agreement

C) A charity allowance

D) As an explicit or implicit concession depending on circumstances

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

28

How do nonprofit hospitals calculate "patient service revenue," on their operating statements?

A) Based on each contract's transaction price-the estimated amount of consideration a nonprofit hospital believes to be probable of receipt.

B) Gross billings at established rates; less explicit and implicit price concessions

C) Gross billings at established rates; less estimated bad debts (uncollectible amounts)

D) Based on each contract's transaction price-the estimated amount of estimated bad debt

A) Based on each contract's transaction price-the estimated amount of consideration a nonprofit hospital believes to be probable of receipt.

B) Gross billings at established rates; less explicit and implicit price concessions

C) Gross billings at established rates; less estimated bad debts (uncollectible amounts)

D) Based on each contract's transaction price-the estimated amount of estimated bad debt

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

29

A nonprofit hospital had gross patient billings at established rates of $115 million in 2018. The hospital was subject to contractual price adjustments of $45 million and $5 million of its 2018 services were determined to be charity care. The hospital also has a policy of providing care before determining whether the patient meets charity care thresholds. In 2018, the hospital provided $8 million of services to people not expected to be able to pay at established rates. The hospital reduced these billings by 50%. How much is the hospital's 2018 patient service revenue?

A) $70 million

B) $65 million

C) $61 million

D) $45 million

A) $70 million

B) $65 million

C) $61 million

D) $45 million

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

30

How do governmental hospitals calculate "net patient service revenue," on their operating statements?

A) Gross billings at established rates; minus contractual adjustments, charity care, and similar items that the hospital does not expect to collect

B) Gross billings at established rates; minus contractual adjustments, charity care, and a provision for uncollectible accounts

C) Gross billings at established rates; minus any amounts that the hospital does not expect to collect; plus revenue from capitation premiums

D) Gross billings at established rates; revenue from capitation premiums; and any other revenue directly attributable to patient services such as special charges for TV

A) Gross billings at established rates; minus contractual adjustments, charity care, and similar items that the hospital does not expect to collect

B) Gross billings at established rates; minus contractual adjustments, charity care, and a provision for uncollectible accounts

C) Gross billings at established rates; minus any amounts that the hospital does not expect to collect; plus revenue from capitation premiums

D) Gross billings at established rates; revenue from capitation premiums; and any other revenue directly attributable to patient services such as special charges for TV

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

31

A nonprofit hospital had gross patient billings of $43 million, contractual adjustments of $8 million and charity care of $1,500,000 for 2018. In addition, the hospital also revised its estimate of bad debts for all 2018 accounts by $1,000,000. How much patient service revenue should the hospital report in 2018.

A) $43 million

B) $35 million

C) $33.5 million

D) $32.5 million

A) $43 million

B) $35 million

C) $33.5 million

D) $32.5 million

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

32

The required reporting for bad debts (amounts not likely to be collected) varies between governmental and nonprofit hospitals in the following way:

A) Bad debts are reported as an adjustment of revenue, not as an expense, by governmental hospitals; nonprofits report bad debt expense in limited circumstances

B) Nonprofit hospitals do not calculate bad debts

C) Nonprofit hospitals report bad debt expense but only once it has been 12 months since it provided the services

D) Governmental hospitals report bad debts as charity care, which is only disclosed in the notes to financial statements

A) Bad debts are reported as an adjustment of revenue, not as an expense, by governmental hospitals; nonprofits report bad debt expense in limited circumstances

B) Nonprofit hospitals do not calculate bad debts

C) Nonprofit hospitals report bad debt expense but only once it has been 12 months since it provided the services

D) Governmental hospitals report bad debts as charity care, which is only disclosed in the notes to financial statements

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

33

Differences between a nonprofit hospital's established rates and amounts negotiated with third-party payers are referred to as:

A) Explicit concessions

B) Unrecovered costs

C) Charity care

D) Implicit concessions

A) Explicit concessions

B) Unrecovered costs

C) Charity care

D) Implicit concessions

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

34

All hospitals are required to report detailed information in the notes to financial statements about the charity care they provide. Required information includes:

A) Dollar amount of charity care provided calculated using the hospital's established billing rates

B) Dollar amount of charity care provided calculated using the hospital's Medicaid rate

C) Dollar amount of charity care provided based on the hospital's direct and indirect costs of providing that care

D) Dollar amount less any resources the hospital received to subsidize charity care, including gifts (contributions) and grants.

A) Dollar amount of charity care provided calculated using the hospital's established billing rates

B) Dollar amount of charity care provided calculated using the hospital's Medicaid rate

C) Dollar amount of charity care provided based on the hospital's direct and indirect costs of providing that care

D) Dollar amount less any resources the hospital received to subsidize charity care, including gifts (contributions) and grants.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

35

A hospital invested $780,000 in equity securities in March 2018. When it prepared its financial statements at year-end, the securities had a fair value of $802,000. How should the hospital report the securities in its balance sheet at year end?

A) Report the securities at cost ($780,000).

B) Report the securities at cost ($780,000) and show the fair value ($802,000) parenthetically next to the caption "Investments"

C) Report the securities at cost ($780,000) and show the fair value ($802,000) in the notes to the financial statements.

D) Report the securities at the fair value ($802,000)

A) Report the securities at cost ($780,000).

B) Report the securities at cost ($780,000) and show the fair value ($802,000) parenthetically next to the caption "Investments"

C) Report the securities at cost ($780,000) and show the fair value ($802,000) in the notes to the financial statements.

D) Report the securities at the fair value ($802,000)

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

36

A nonprofit hospital purchased an equity security for $150,000 on September 2018. When it prepared its 2018 financial statements, the security had a fair value of $145,000. It sold the security for $160,000 in 2019. How would the sale of the security in 2019 be reported by the nonprofit hospital in its 2019 statement of operations?

A) No effect

B) As a realized gain of $10,000 included in excess of revenues over expenses and as an increase in net unrealized gains and losses on investments of $5,000 after excess of revenues over expenses.

C) As a realized gain of $15,000

D) An increase of $160,000

A) No effect

B) As a realized gain of $10,000 included in excess of revenues over expenses and as an increase in net unrealized gains and losses on investments of $5,000 after excess of revenues over expenses.

C) As a realized gain of $15,000

D) An increase of $160,000

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

37

Catlett County Hospital, a governmental hospital, has its financial statement audit done by a local CPA firm. In 2018, the CPA firm announced that it would no longer charge for the audit. How is the County Hospital required to report the donated audit in 2019, assuming that it would have been billed $20,000 for the audit and that the cost incurred by the CPA firm is estimated at $11,000?

A) Report contributed service revenue of $20,000 and audit expense of $11,000

B) Report contributed service revenue of $0 and audit expense of $0

C) Report contributed service of $20,000 and audit expense of $20,000

D) Report contributed service revenue of $11,000 and audit expense of $11,000

A) Report contributed service revenue of $20,000 and audit expense of $11,000

B) Report contributed service revenue of $0 and audit expense of $0

C) Report contributed service of $20,000 and audit expense of $20,000

D) Report contributed service revenue of $11,000 and audit expense of $11,000

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

38

A group of fine dining restaurants in town get together and agree to provide their leftover, unprepared fresh food to the City Hospital for use in its food service operations. The City Hospital estimates that the fair value of the food received during the year was $22,000. How should City Hospital report the donated food?

A) As revenue equal to the fair value of the food when it is received ($22,000 over the course of the year)

B) The fair value of the donated food should be disclosed in the Hospital's notes to financial statements

C) As revenue equal to the amount it estimates the restaurants paid for the food

D) None of the above

A) As revenue equal to the fair value of the food when it is received ($22,000 over the course of the year)

B) The fair value of the donated food should be disclosed in the Hospital's notes to financial statements

C) As revenue equal to the amount it estimates the restaurants paid for the food

D) None of the above

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

39

A nonprofit hospital, the Ruth Clark Hospital established a fundraising Foundation at the beginning of its calendar year. By the end of the year, the Foundation had raised $750,000 in cash-$600,000 of which was restricted by donors to acquire a new building and $150,000 of which was unrestricted. How should the Ruth Clark Hospital report its interest in the Hospital Foundation and the contributions it received at the end of the first year?

A) As Cash of $750,000, Gains without donor restrictions of $150,000, and Gains with donor restrictions of $750,000

B) As Interest in Hospital Foundation of $750,000, Gains without donor restrictions-change in interest in net assets of Hospital Foundation of $150,000, and Gains with donor restrictions-change in net assets of Hospital foundation restricted to capital acquisitions of $600,000

C) It should not report the contributions; the Hospital Foundation is a separate entity

D) As Cash of $750,000, Net assets without donor restrictions of $150,000, and Net assets with donor restrictions of $600,000

A) As Cash of $750,000, Gains without donor restrictions of $150,000, and Gains with donor restrictions of $750,000

B) As Interest in Hospital Foundation of $750,000, Gains without donor restrictions-change in interest in net assets of Hospital Foundation of $150,000, and Gains with donor restrictions-change in net assets of Hospital foundation restricted to capital acquisitions of $600,000

C) It should not report the contributions; the Hospital Foundation is a separate entity

D) As Cash of $750,000, Net assets without donor restrictions of $150,000, and Net assets with donor restrictions of $600,000

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

40

A nonprofit hospital's trustees designate $600,000 of the hospital's net assets without donor restrictions for the future acquisition of a new hospital wing. The trustees tell the hospital comptroller to purchase a separate certificate of deposit for it. How should the hospital record and report this investment?

A) Report the investment as "assets limited as to use" and report $600,000 as net assets without donor restrictions-board designated

B) Report the investment as "assets limited as to use," and report $600,000 of net assets as restricted net assets

C) Report the investment as "assets limited as to use," and report $600,000 as board-designated net assets

D) Report the investment as "restricted" investments and report $600,000 of net assets as restricted net assets

A) Report the investment as "assets limited as to use" and report $600,000 as net assets without donor restrictions-board designated

B) Report the investment as "assets limited as to use," and report $600,000 of net assets as restricted net assets

C) Report the investment as "assets limited as to use," and report $600,000 as board-designated net assets

D) Report the investment as "restricted" investments and report $600,000 of net assets as restricted net assets

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

41

Under what circumstances do nonprofit hospitals sometimes present a fifth financial statement?

A) When they need to report on budget versus actual financial results

B) To report expenses by function and when they have not done so in their statement of operations

C) To show details of charity care

D) To report on the cash basis of accounting

A) When they need to report on budget versus actual financial results

B) To report expenses by function and when they have not done so in their statement of operations

C) To show details of charity care

D) To report on the cash basis of accounting

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

42

A governmental hospital has about 30 outstanding medical malpractice claims when it prepares its 2018 financial statements. It does not carry third-party insurance. The total amount claimed on these claims is $2,000,000. Historically, most of these claims are settled out-of-court for about 20 percent of the amount claimed. Some of claims were filed before 2018 and some were filed in 2018. It takes an average of three years to settle them. What is the appropriate method of handling this situation on the financial statements?

A) Do not report anything either on the face or in the notes to the statements

B) Do not report anything on the face of the statements; but in the notes, state that claims were received, insurance is not carried, and it takes about three years to settle claims; say nothing about the amount of the claims or the potential loss

C) Develop a best estimate of the probable loss (about $400,000), based on past experience, and report a liability for that amount on the balance sheet

D) Report a liability of $2,000,000 on the balance sheet; and state in the notes that the liability may be lower if the hospital is successful in defending itself

A) Do not report anything either on the face or in the notes to the statements

B) Do not report anything on the face of the statements; but in the notes, state that claims were received, insurance is not carried, and it takes about three years to settle claims; say nothing about the amount of the claims or the potential loss

C) Develop a best estimate of the probable loss (about $400,000), based on past experience, and report a liability for that amount on the balance sheet

D) Report a liability of $2,000,000 on the balance sheet; and state in the notes that the liability may be lower if the hospital is successful in defending itself

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

43

What categories of net assets are required to be presented in a nonprofit entity's balance sheet?

A) Three-net assets without donor restrictions, net assets with donor restrictions, and net assets with board designations

B) Two-net assets released from restrictions and net assets with restrictions

C) Two-net assets without donor restrictions and net assets with donor restrictions

D) Three-restricted, unrestricted, and net investment in capital assets.

A) Three-net assets without donor restrictions, net assets with donor restrictions, and net assets with board designations

B) Two-net assets released from restrictions and net assets with restrictions

C) Two-net assets without donor restrictions and net assets with donor restrictions

D) Three-restricted, unrestricted, and net investment in capital assets.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

44

Prepare journal entries to account for the following transactions for Cort Hospital, a governmental hospital that meets the definition of an Enterprise Fund. Also, compute the net patient service revenue calculation that would be reported on the face of the Hospital's statement of operations.

a. Cort provided services to patients during the year, billing a total of $59,500,000 at its established rates.

b. Included in the services provided in transaction a. were the following: (1) charity cases for which it did not expect to be paid amounting to $2,100,000; (2) contractual adjustments amounting to $15,000,000 based on negotiations with third-party payers, (3) implicit price adjustments for self-pay patients of $2,000,000 and, (4) estimated uncollectible amounts of $500,000.

c. Cort collected $36,000,000 from direct-pay and third-party payers.

d. At year-end, Cort analyzed the costs incurred under its arrangements with a third-party payer, and estimated that it would need to refund $250,000 to that third-party after submission and audit of its cost report to the third party.

a. Cort provided services to patients during the year, billing a total of $59,500,000 at its established rates.

b. Included in the services provided in transaction a. were the following: (1) charity cases for which it did not expect to be paid amounting to $2,100,000; (2) contractual adjustments amounting to $15,000,000 based on negotiations with third-party payers, (3) implicit price adjustments for self-pay patients of $2,000,000 and, (4) estimated uncollectible amounts of $500,000.

c. Cort collected $36,000,000 from direct-pay and third-party payers.

d. At year-end, Cort analyzed the costs incurred under its arrangements with a third-party payer, and estimated that it would need to refund $250,000 to that third-party after submission and audit of its cost report to the third party.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

45

Lucas Community Hospital is a nonprofit hospital. Prepare journal entries to record the following transactions and events:

a. Third-parties and direct-pay patients were billed $4,200,000 at the hospital's established billing rates.

b. The billings in transaction a. included the following:

(1) Services provided to charity care patients totaled $170,000

(2) Services were provided to patients covered by third-party payers with whom contractual adjustments had been negotiated. The difference between the hospital's established rates and the contractual rates was $1,000,000.

c. The hospital collected $2,200,000 from its billings for patient services.

d. The hospital received $800,000 in fees under capitation arrangements with HMOs.

e. Salaries paid in cash during the period were as follows:

f. The hospital used $100,000 of its idle cash to purchase equity securities

g. During the period, the hospital received the following contributions:

(1) Richard & Pryor, a local pharmaceutical manufacturer, donated $40,000 of drugs to the hospital. The hospital placed the drugs in its inventory.

(2) Several high students voluntarily carried food to hospital patients during weekends. If the hospital had to pay for these services, it would have cost the hospital $5,000.

h. In providing care to its patients, the hospital used drugs amounting to $25,000.

i. The hospital received parking lot fees in the amount of $20,000.

j. Before preparing its annual financial statements, the hospital considered the following:

(1) The hospital estimated that $90,000 of its billings to individual direct pay patients would not be collected

(2) The hospital recorded depreciation expenses of $100,000.

(3) The fair value of the securities purchased in f., above, was $98,000.

(4) A hospital patient filed a malpractice claim against the hospital for $50,000, claiming the hospital food made him sick. Hospital attorneys believe the claim was without merit and that the hospital would prevail if the claim went to trial.

a. Third-parties and direct-pay patients were billed $4,200,000 at the hospital's established billing rates.

b. The billings in transaction a. included the following:

(1) Services provided to charity care patients totaled $170,000

(2) Services were provided to patients covered by third-party payers with whom contractual adjustments had been negotiated. The difference between the hospital's established rates and the contractual rates was $1,000,000.

c. The hospital collected $2,200,000 from its billings for patient services.

d. The hospital received $800,000 in fees under capitation arrangements with HMOs.

e. Salaries paid in cash during the period were as follows:

f. The hospital used $100,000 of its idle cash to purchase equity securities

g. During the period, the hospital received the following contributions:

(1) Richard & Pryor, a local pharmaceutical manufacturer, donated $40,000 of drugs to the hospital. The hospital placed the drugs in its inventory.

(2) Several high students voluntarily carried food to hospital patients during weekends. If the hospital had to pay for these services, it would have cost the hospital $5,000.

h. In providing care to its patients, the hospital used drugs amounting to $25,000.

i. The hospital received parking lot fees in the amount of $20,000.

j. Before preparing its annual financial statements, the hospital considered the following:

(1) The hospital estimated that $90,000 of its billings to individual direct pay patients would not be collected

(2) The hospital recorded depreciation expenses of $100,000.

(3) The fair value of the securities purchased in f., above, was $98,000.

(4) A hospital patient filed a malpractice claim against the hospital for $50,000, claiming the hospital food made him sick. Hospital attorneys believe the claim was without merit and that the hospital would prevail if the claim went to trial.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

46

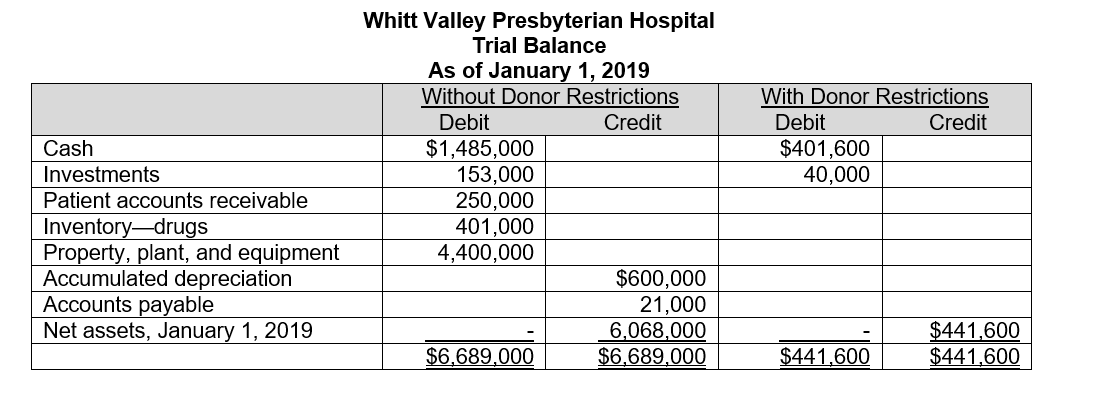

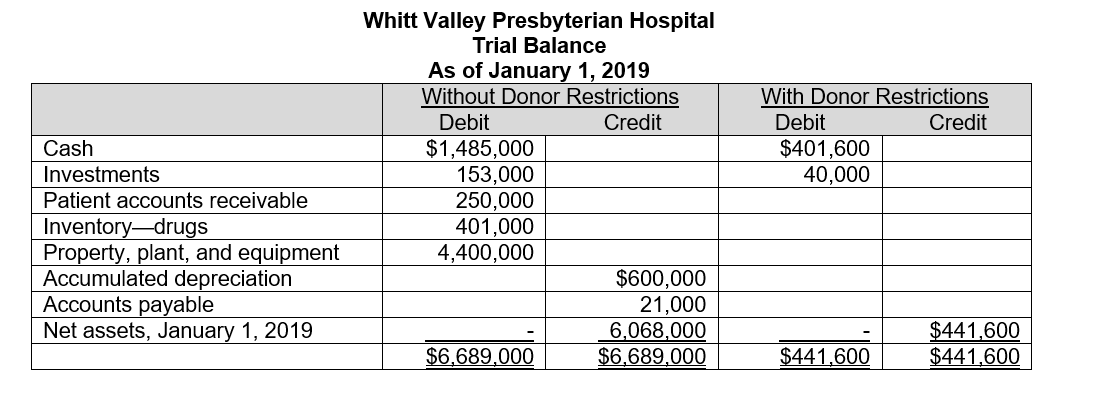

Whitt Valley Presbyterian Hospital is a nonprofit initial care facility. For the hospital's calendar year ending December 31, 2019, prepare (I) journal entries to record the transactions listed in a. through n. below, (II) a trial balance based on your entries and the beginning balances listed at o. below, and (III) a Statement of Operations and a Statement of Changes in Net Assets for the hospital.

a. Third-parties payers and direct-pay patients were billed $6,500,000 at the hospital's established billing rates

b. The hospital determined that certain of its patients qualified for charity care and that it would not seek to collect $950,000 at established billing rates from direct-pay patients

c. The hospital estimated contractual adjustments for the year of $1,600,000

d. The hospital originally estimated uncollectible amounts from direct-pay patients to be $250,000 (recall that original estimated uncollectible amounts reduce revenue; only estimates specific to an individual patient are reported as bad debt expense).

e. The hospital received capitation premiums of $2,500,000. It estimated that the cost of providing this care was $1,800,000

f. The hospital received payments from third-party payers and direct-pay patients totaling $3,500,000

g. The hospital received contributions of $1,100,000 that were restricted by donors for building a new urgent care wing

h. The hospital paid salaries and wages of $4,500,000 in cash; these amounts are reported as patient care expense

i. The fair value of investments required to be held in perpetuity increased by $25,000

j. The hospital received cash from interest and dividend income of $10,000 on investments without donor restrictions

k. The hospital used $1,375,000 of net assets with donor restrictions to construct a new urgent care wing, consistent with the restrictions created by the donors

l. The hospital reported depreciation expense of $475,000

m. The hospital used drug inventories of $365,000

n. The hospital incurred other operating costs for patient care of $275,000 on credit

o. The hospital's beginning of the year trial balance at January 1, 2019 was as follows:

a. Third-parties payers and direct-pay patients were billed $6,500,000 at the hospital's established billing rates

b. The hospital determined that certain of its patients qualified for charity care and that it would not seek to collect $950,000 at established billing rates from direct-pay patients

c. The hospital estimated contractual adjustments for the year of $1,600,000

d. The hospital originally estimated uncollectible amounts from direct-pay patients to be $250,000 (recall that original estimated uncollectible amounts reduce revenue; only estimates specific to an individual patient are reported as bad debt expense).

e. The hospital received capitation premiums of $2,500,000. It estimated that the cost of providing this care was $1,800,000

f. The hospital received payments from third-party payers and direct-pay patients totaling $3,500,000

g. The hospital received contributions of $1,100,000 that were restricted by donors for building a new urgent care wing

h. The hospital paid salaries and wages of $4,500,000 in cash; these amounts are reported as patient care expense

i. The fair value of investments required to be held in perpetuity increased by $25,000

j. The hospital received cash from interest and dividend income of $10,000 on investments without donor restrictions

k. The hospital used $1,375,000 of net assets with donor restrictions to construct a new urgent care wing, consistent with the restrictions created by the donors

l. The hospital reported depreciation expense of $475,000

m. The hospital used drug inventories of $365,000

n. The hospital incurred other operating costs for patient care of $275,000 on credit

o. The hospital's beginning of the year trial balance at January 1, 2019 was as follows:

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck