Deck 13: Accounting for Nonprofit Organizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/59

Play

Full screen (f)

Deck 13: Accounting for Nonprofit Organizations

1

The four types of nonprofits discussed in Chapter 13 are voluntary health and welfare organizations, health care organizations, colleges, and other nonprofits.

True

2

All nonprofits are organized to benefit the public.

False

3

Nonprofits receive significant amounts of contributions, operate for purposes other than to generate a profit, lack shareholders or owners.

True

4

The purpose of nonprofit financial reporting is to provide information that meets the needs of donors, members, creditors, and other resource providers.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

5

Nonprofits are not required to present a cash flow statement as part of their financial reports prepared in accordance with generally accepted accounting principles (GAAP).

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

6

Nonprofits must report their net assets in one of two required categories-net assets with donor restrictions and net assets without donor restrictions.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

7

Nonprofits must report all their expenses as decreases in net assets without donor restrictions.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

8

Nonprofit entities must present their assets and liabilities in order of relative liquidity in their statements of financial position / balance sheets.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

9

Nonprofits should report contributions received without limitations on their use in their statements of activities as revenues or gains without donor restrictions.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

10

Of the two types of temporary restrictions placed on contributions-purpose-type restrictions and time restrictions-only one should be reported as restricted contributions.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

11

Nonprofits must recognize donated food that they will use in their operations at fair value.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

12

Before it can report spending restricted contributions to pay for program expenses, a nonprofit must reclassify net assets with donor restrictions to net assets without donor restrictions.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

13

Unconditional promises to give represent assets to nonprofits because all the nonprofit has to do is ask for them or wait for them to be paid.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

14

Nonprofit entities that receive conditional promises to give money (ones that depend on some future event to happen) should report them as deferred revenue.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

15

When people contribute services that a nonprofit would have to pay a professional for if not donated, the nonprofit should report those services as revenues equal to the fair value of donated services.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

16

Historical artifacts that are donated to a nonprofit always should be reported at their fair value.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

17

Nonprofits are required to report contributed investments, such as bonds, at their fair value at the time they are contributed.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

18

At the end of each year, a nonprofit entity should report all of its investments at their fair value on that date, even if the investments were purchased, not contributed.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

19

When a donor establishes a split interest agreement with a nonprofit, the nonprofit receives a partial interest in the agreement but not the whole trust arrangement.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

20

All revenue transactions reported by nonprofits are exchange transactions.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

21

Nonprofits should report expenses that represent supporting activities in one of three classes; one of those is classes is fundraising expenses.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

22

When nonprofits use funds for internal reporting purposes, they generally use four common fund types-unrestricted current, restricted current, endowment, and plant funds.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is not a characteristic of a nonprofit, as defined by the Financial Accounting Standards Board (FASB)?

A) Nonprofits receive significant contributions from resource providers who do not expect to receive benefits in return

B) Nonprofits do not have defined ownership interests, such as stock that can be sold on a securities exchange

C) Nonprofits can sometimes issue tax-exempt debt

D) Nonprofits operated for a purpose other than to make a profit

A) Nonprofits receive significant contributions from resource providers who do not expect to receive benefits in return

B) Nonprofits do not have defined ownership interests, such as stock that can be sold on a securities exchange

C) Nonprofits can sometimes issue tax-exempt debt

D) Nonprofits operated for a purpose other than to make a profit

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

24

One big category of nonprofit entities is voluntary health and welfare organizations (VHWOs). These nonprofits receive their resources primarily from:

A) Donations from the general public

B) Governmental agencies

C) Charges for services they provide

D) All of the above

A) Donations from the general public

B) Governmental agencies

C) Charges for services they provide

D) All of the above

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following organizations establish accounting and financial reporting requirements for nonprofit entities?

A) The Federal Accounting Standards Advisory Board

B) The Governmental Accounting Standards Board

C) The American Institute of CPAs

D) The Financial Accounting Standards Board

A) The Federal Accounting Standards Advisory Board

B) The Governmental Accounting Standards Board

C) The American Institute of CPAs

D) The Financial Accounting Standards Board

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

26

When a nonprofit entity's net assets are presented as net assets with donor restrictions, who has imposed the restrictions?

A) The entity's board of trustees

B) Donors

C) The bondholders

D) Government regulators

A) The entity's board of trustees

B) Donors

C) The bondholders

D) Government regulators

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

27

Under which of the following circumstances would a nonprofit's net assets be presented as net assets with donor restrictions?

A) Donors impose stipulations on the use of resources that expire with the passage of time or that can be fulfilled by actions of the organization

B) The entity's board of directors stipulates that resources must be held intact in perpetuity, but that the income from the gift may be used for any purpose desired by the organization's trustees

C) The entity's board of directors requires that unrestricted resources be set aside for a specific purpose

D) The bank lending money to the nonprofit requires a percentage of maximum debt service to be set aside in a sinking fund

A) Donors impose stipulations on the use of resources that expire with the passage of time or that can be fulfilled by actions of the organization

B) The entity's board of directors stipulates that resources must be held intact in perpetuity, but that the income from the gift may be used for any purpose desired by the organization's trustees

C) The entity's board of directors requires that unrestricted resources be set aside for a specific purpose

D) The bank lending money to the nonprofit requires a percentage of maximum debt service to be set aside in a sinking fund

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

28

The FASB requires nonprofits to report net assets in which categories?

A) Current and noncurrent

B) Net assets without donor restrictions and net assets with donor restrictions

C) Net assets in endowment funds and net assets with board designations

D) Net assets with donor restrictions and net assets with non-donor contractual restrictions

A) Current and noncurrent

B) Net assets without donor restrictions and net assets with donor restrictions

C) Net assets in endowment funds and net assets with board designations

D) Net assets with donor restrictions and net assets with non-donor contractual restrictions

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

29

Nonprofit entities establish endowments when a donor contributes assets and makes certain specifications, including what?

A) The types of securities in which the contributed assets must be invested

B) How earnings and gains from investing those assets must be used.

C) That the nonprofit's board of trustees should decide how to use the contributed assets

D) That the nonprofit can keep the contributed assets until they become underwater

A) The types of securities in which the contributed assets must be invested

B) How earnings and gains from investing those assets must be used.

C) That the nonprofit's board of trustees should decide how to use the contributed assets

D) That the nonprofit can keep the contributed assets until they become underwater

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

30

The Board of Trustees of Building Lives, Inc., a nonprofit entity that provides support services for homeless men, votes to set aside $100,000 toward purchasing a fitness center for their clients at some time in the future. How should Building Lives report these assets?

A) As board-designated funds, a component of net assets with donor restrictions

B) As restricted assets

C) As board-designated funds, a component of net assets without donor restrictions

D) As noncurrent assets

A) As board-designated funds, a component of net assets with donor restrictions

B) As restricted assets

C) As board-designated funds, a component of net assets without donor restrictions

D) As noncurrent assets

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

31

A nonprofit arts organization receives a $40,000 gift from a donor who specifies that the gift must be used only to take disabled persons to the theater. How should the entity report the $40,000 gift in the net asset section of its statement of financial position?

A) As net assets with donor restrictions

B) As net assets with contractual restrictions

C) As net assets without donor restrictions

D) As net assets available for spending

A) As net assets with donor restrictions

B) As net assets with contractual restrictions

C) As net assets without donor restrictions

D) As net assets available for spending

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

32

Donor restrictions play an important role in how assets should be classified in a nonprofit's statement of financial position. What additional information may a nonprofit provide about the liquidity of its assets and liabilities?

A) Classifying assets as current and noncurrent in the same way that companies do

B) Sequencing assets based on their nearness to cash and liabilities based on their nearness to use of cash

C) Disclosing information about liquidity, maturity, and restrictions on use in the notes to financial statements

D) All of the above

A) Classifying assets as current and noncurrent in the same way that companies do

B) Sequencing assets based on their nearness to cash and liabilities based on their nearness to use of cash

C) Disclosing information about liquidity, maturity, and restrictions on use in the notes to financial statements

D) All of the above

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

33

Nonprofits must report expenses by program, which is any activity directly related to the organization's purpose. Which of the following is true about nonprofit programs?

A) Most nonprofits have programs for fundraising

B) Most nonprofits are involved in several programs

C) Only donor-restricted contributions can be used for program expenses

D) Programs expenses may never include management and general activity expenses.

A) Most nonprofits have programs for fundraising

B) Most nonprofits are involved in several programs

C) Only donor-restricted contributions can be used for program expenses

D) Programs expenses may never include management and general activity expenses.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

34

Nonprofits are required to prepare their cash flows statement using three categories of cash receipts and cash payments. What are these three categories?

A) Operating, investing, and financing activities

B) Operating, with donor restrictions, and without donor restrictions

C) Operating, investing, and capital and noncapital financing activities

D) Operating, restricted, and board-designated

A) Operating, investing, and financing activities

B) Operating, with donor restrictions, and without donor restrictions

C) Operating, investing, and capital and noncapital financing activities

D) Operating, restricted, and board-designated

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

35

GAAP require nonprofits to report their expenses by nature and function in one location. What may nonprofits use as "one location"?

A) A schedule in the notes to the financial statements

B) The face of their statement of activities

C) A separate financial statement called a statement of functional expenses

D) All of the above

A) A schedule in the notes to the financial statements

B) The face of their statement of activities

C) A separate financial statement called a statement of functional expenses

D) All of the above

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

36

The Aurora Fund received equipment having a cost of $65,000 and a fair value of $50,000 as a gift. The donor states that the Fund should decide how to best use the gift. How should the gift be reported in the Aurora Fund's financial statements?

A) As an asset measured at fair value and as revenues without donor restrictions

B) As an asset measured at fair value and as revenues with donor restrictions

C) As a footnote only, because gifts of equipment are not be reported on the face of financial

Statements

D) As an asset at the amount the donor paid for it and as revenue without donor restrictions

A) As an asset measured at fair value and as revenues without donor restrictions

B) As an asset measured at fair value and as revenues with donor restrictions

C) As a footnote only, because gifts of equipment are not be reported on the face of financial

Statements

D) As an asset at the amount the donor paid for it and as revenue without donor restrictions

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

37

The Chessie Fund received $100,000 in cash in 2018 with the stipulation that it be used to acquire a building that can be used to provide elderly housing. The Fund estimates that it will not have enough money to buy the building it has in mind until sometime in 2020. How should the gift be reported in the Fund's financial statements in 2018?

A) As cash and as contribution revenue-support without donor restrictions

B) As cash and as contribution revenue-support with donor restrictions

C) As a footnote only, until a building that meets the donor's specifications can be purchased

D) As cash and deferred revenue until a building that meets the donor's specifications can be purchased

A) As cash and as contribution revenue-support without donor restrictions

B) As cash and as contribution revenue-support with donor restrictions

C) As a footnote only, until a building that meets the donor's specifications can be purchased

D) As cash and deferred revenue until a building that meets the donor's specifications can be purchased

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

38

The Geneva Fund received $50,000 in cash in 2018. The donor requires the gift be used in 2018. How should the gift be reported in the Geneva Fund's 2018 financial statements?

A) As cash and as contribution revenue-support without donor restrictions

B) As cash and as contribution revenue-support with donor restrictions

C) As a footnote only, until the time restriction is met

D) As either a or b, provided the nonprofit does so consistently

A) As cash and as contribution revenue-support without donor restrictions

B) As cash and as contribution revenue-support with donor restrictions

C) As a footnote only, until the time restriction is met

D) As either a or b, provided the nonprofit does so consistently

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

39

The Victoria Fund, a child welfare fund, received $50,000 in cash in 2018. The donor requires the gift be held in perpetuity and that the income from investing this money may be used for its program of promoting adoption of young girls. How should the gift be reported in the Victoria Fund's financial statements?

A) As cash and as contribution revenue-support without donor restrictions

B) As cash and as contribution revenue-support with donor restrictions

C) As a footnote only, until the time restriction is met

D) As either a or b, provided the nonprofit does so consistently

A) As cash and as contribution revenue-support without donor restrictions

B) As cash and as contribution revenue-support with donor restrictions

C) As a footnote only, until the time restriction is met

D) As either a or b, provided the nonprofit does so consistently

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

40

The Turtle Island Singers receive three gifts during the year 2018: (a) $3,000, which may be used for any purpose at any time; (b) $5,000, which must be used for a special concert given in a nursing home; and (c) $1,000, which may be used for any purpose, but only in the year 2019. When it receives the gifts, how should the entity classify them:

A) $3,000 as contribution revenue-support without donor restrictions and $6,000 as contribution revenue-support with donor restrictions

B) $4,000 as contribution revenue-support without donor restrictions and $5,000 as contribution revenue-support with donor restrictions

C) $8,000 as contribution revenue-support without donor restrictions and $1,000 as contribution revenue-support with donor restrictions

D) $9,000 as contribution revenue-support without donor restrictions

A) $3,000 as contribution revenue-support without donor restrictions and $6,000 as contribution revenue-support with donor restrictions

B) $4,000 as contribution revenue-support without donor restrictions and $5,000 as contribution revenue-support with donor restrictions

C) $8,000 as contribution revenue-support without donor restrictions and $1,000 as contribution revenue-support with donor restrictions

D) $9,000 as contribution revenue-support without donor restrictions

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

41

A nonprofit entity conducts a special fundraising campaign at the end of fiscal year 2018, and specifies that it will use the money for its 2019 general operations. It receives pledges totaling $200,000. Based on past experience, the entity expects to receive $150,000 in cash. How should the entity report these events?

A) Recognize the entire amount pledged as contribution revenue-support without donor restrictions in 2018

B) Recognize the amount pledged (net of a $50,000 allowance for estimated uncollectibles) as contribution revenue-support without donor restrictions in 2018

C) Recognize the amount pledged (net of a $50,000 allowance for estimated uncollectibles) as contribution revenue-support without donor restrictions in 2018; and report the 2019 expenses as changes in support with donor restrictions in 2019

D) Recognize the amount pledged (net of a $50,000 allowance for estimated uncollectibles) as contribution revenue-support with donor restrictions in 2018; and reclassify the net assets as unrestricted at the beginning of 2019

A) Recognize the entire amount pledged as contribution revenue-support without donor restrictions in 2018

B) Recognize the amount pledged (net of a $50,000 allowance for estimated uncollectibles) as contribution revenue-support without donor restrictions in 2018

C) Recognize the amount pledged (net of a $50,000 allowance for estimated uncollectibles) as contribution revenue-support without donor restrictions in 2018; and report the 2019 expenses as changes in support with donor restrictions in 2019

D) Recognize the amount pledged (net of a $50,000 allowance for estimated uncollectibles) as contribution revenue-support with donor restrictions in 2018; and reclassify the net assets as unrestricted at the beginning of 2019

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

42

A nonprofit organization receives a pledge from a donor in fiscal 2018. The terms of the pledge are such that the organization will receive a large cash contribution in fiscal 2022. At what value should the pledge be reported in the organization's 2018 statement of financial position?

A) Fair value

B) Compound value

C) Marginal value

D) Discounted present value

A) Fair value

B) Compound value

C) Marginal value

D) Discounted present value

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

43

A donor had previously donated $2,000 to a nonprofit entity, stipulating that the gift must be used to finance the annual Fall Harvest festival. The festival is held and the gift is used for the stipulated purpose. Which of the following best describes the effect of the journal entries needed to record the expense resulting from use of the gift?

A) An expense is reported in the net assets with donor restrictions column of the statement of activities.

B) An expense is reported in the net assets without donor restrictions column of the statement of activities.

C) A journal entry is made to reclassify $2,000 of net assets with donor restrictions to net assets without donor restrictions because the purpose for which the contribution was made has been fulfilled. An additional entry records the expense in the net assets without donor restrictions column of the statement of activities.

D) The expense is netted against support with donor restrictions.

A) An expense is reported in the net assets with donor restrictions column of the statement of activities.

B) An expense is reported in the net assets without donor restrictions column of the statement of activities.

C) A journal entry is made to reclassify $2,000 of net assets with donor restrictions to net assets without donor restrictions because the purpose for which the contribution was made has been fulfilled. An additional entry records the expense in the net assets without donor restrictions column of the statement of activities.

D) The expense is netted against support with donor restrictions.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

44

At the statement of financial position date, a nonprofit has an investment in equity securities, the fair value of which is greater than the amount at which the investment was initially recorded. What adjustment, if any, is needed?

A) No adjustment is needed.

B) The increase should be recorded as a gain in net assets without donor restrictions.

C) The increase should be recorded as a gain in net assets with donor restrictions.

D) The increase should be recorded as an unrealized gain in the same net asset class in which the investment is reported.

A) No adjustment is needed.

B) The increase should be recorded as a gain in net assets without donor restrictions.

C) The increase should be recorded as a gain in net assets with donor restrictions.

D) The increase should be recorded as an unrealized gain in the same net asset class in which the investment is reported.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

45

On March 1, 2018, a nonprofit organization received a donation of securities worth $4,500. When it prepared its financial statements at December 31, 2018, the securities had a fair value of $5,200. When it sold the securities on June 30, 2019, it received $4,600. The entity's accounting procedures call for reporting all unrealized and realized gains and losses in a single account. How should it record its gains and losses in 2018 and 2019?

A) No change in 2018; a gain of $100 in 2019

B) A gain of $100 in 2018; no change in 2019

C) A gain of $700 in 2018; a loss of $600 in 2019

D) No change in 2018; a loss of $600 in 2019

A) No change in 2018; a gain of $100 in 2019

B) A gain of $100 in 2018; no change in 2019

C) A gain of $700 in 2018; a loss of $600 in 2019

D) No change in 2018; a loss of $600 in 2019

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

46

Dave Hall did some estate planning recently and decided to establish a trust for his favorite museum, the National Baseball Hall of Fame. He put $6 million into a revocable charitable remainder trust whereby all income from the trust would go to his children until the youngest reaches age 35. At that time, the remaining trust assets would be contributed to the Hall of Fame. An actuary for the trust estimated, based on the current ages of Hall's children, that $3.2 million could be contributed to the Hall of Fame. How should the Hall of Fame report this arrangement when it learns of the trust?

A) It should record nothing now. It should record the fair value of the assets only when it receives them.

B) It should record $3.2 million as contributions receivable and as contribution revenue with restrictions

C) It should disclose the anticipated $3.2 million contribution in the notes to its financial statements

D) It should record $3.2 million as contributions receivable and as a refundable advance

A) It should record nothing now. It should record the fair value of the assets only when it receives them.

B) It should record $3.2 million as contributions receivable and as contribution revenue with restrictions

C) It should disclose the anticipated $3.2 million contribution in the notes to its financial statements

D) It should record $3.2 million as contributions receivable and as a refundable advance

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

47

The Sutton Hoo Foundation holds $32,000,000 fair value in debt and equity securities as a result of a permanently restricted contribution it received in a previous year. During 2018, the Foundation has a net gain of $2 million and $880,000 of interest and dividend income on those investments. If the donor specified that investment income from the contribution should be used support historical research for the years 300-1100 AD, how should the Foundation, whose focus is on European history from 100 to 1800 AD, classify this income?

A) It should report investment income-support with donor restrictions.

B) It should report investment income-support without donor restrictions

C) It should add the investment income to the investments in restricted contribution.

D) It should report both the gain and the investment income as support with donor restrictions.

A) It should report investment income-support with donor restrictions.

B) It should report investment income-support without donor restrictions

C) It should add the investment income to the investments in restricted contribution.

D) It should report both the gain and the investment income as support with donor restrictions.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

48

The Beowulf Fund has extensive investments resulting from contributions that are restricted in perpetuity. Given that the Fund must disclose the data used (inputs) to measure the fair value of its investments using the FASB's three-level fair value hierarchy, in what level should the fund report its investments in equity securities that it obtained from the December 31st Wall Street Journal?

A) As Level 1, consisting of equity securities traded in active markets

B) As Level 2, consisting of inputs other than quoted market prices

C) As Level 3, consisting of unobservable inputs

D) None of the above; investments in equity securities are excluded from this required disclosure

A) As Level 1, consisting of equity securities traded in active markets

B) As Level 2, consisting of inputs other than quoted market prices

C) As Level 3, consisting of unobservable inputs

D) None of the above; investments in equity securities are excluded from this required disclosure

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

49

A large portion of our study of nonprofits has focused on reporting contributions and donor-imposed restrictions on net assets. However, nonprofits also engage in "exchange transactions." Which of the following is the best description of an exchange transaction?

A) A substantial payment made so that two seats in a newly constructed theatre would bear the donor's (patron's) name

B) College tuition paid by local Better Business Bureau for a qualifying student

C) College tuition paid by a student's parents who borrowed the money on a home equity loan

D) A state grant to a college to cover operating expenses.

A) A substantial payment made so that two seats in a newly constructed theatre would bear the donor's (patron's) name

B) College tuition paid by local Better Business Bureau for a qualifying student

C) College tuition paid by a student's parents who borrowed the money on a home equity loan

D) A state grant to a college to cover operating expenses.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

50

FASB revenue recognition requirements require nonprofits to apply five steps to each type of exchange contract to determine when to recognize revenue. The first 4 steps are (1) identify the contract with the customer, (2) identify the performance obligations in the contract, (3) determine the transaction price, and (4) allocate the transaction price to the performance obligations in the contract. What is the 5th step?

A) Recognize revenue when it is probable that the customer will pay for the goods or services

B) Recognize revenue when (or as) the entity satisfies the related performance obligation

C) Recognize revenue when the customer pays the bill

D) Recognize revenue when the nonprofit prepares an invoice for the service

A) Recognize revenue when it is probable that the customer will pay for the goods or services

B) Recognize revenue when (or as) the entity satisfies the related performance obligation

C) Recognize revenue when the customer pays the bill

D) Recognize revenue when the nonprofit prepares an invoice for the service

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

51

The Trent Baisley Bird Watching Club charges membership dues to finance its activities. These dues are $300 per year but the only direct benefit to the club members is a monthly newsletter listing regional citings and bird-watching tips. The newsletter has a fair value of $85 per year. What portion of the $300 member dues should be reported as an exchange transaction and what portion should be reported as contribution revenue?

A) The entire $300 should be reported as contribution revenue-support without donor restrictions

B) $215 should be reported as contribution revenue-support without donor restrictions; the rest should be reported as magazine subscription revenue-an exchange transaction

C) The entire $300 should be reported as an exchange transaction-membership dues

D) The Club should report $215 as contribution revenue-support with donor restrictions; the rest should be reported as magazine subscription revenue-an exchange transaction

A) The entire $300 should be reported as contribution revenue-support without donor restrictions

B) $215 should be reported as contribution revenue-support without donor restrictions; the rest should be reported as magazine subscription revenue-an exchange transaction

C) The entire $300 should be reported as an exchange transaction-membership dues

D) The Club should report $215 as contribution revenue-support with donor restrictions; the rest should be reported as magazine subscription revenue-an exchange transaction

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

52

The FASB requires nonprofits to provide information about the availability of its financial assets to meet cash needs for general expenditures within one year of the statement of financial position date. What information is required to be presented or disclosed?

A) The unused balances of all lines of credit available to the nonprofit

B) The nonprofit's financial assets available within one year of the financial position date for general expenditure

C) The amount of pledges receivable that the nonprofits expects will be available to pay for general expenditures of the current year

D) The portion of long-term debt that is due to be paid in the current period

A) The unused balances of all lines of credit available to the nonprofit

B) The nonprofit's financial assets available within one year of the financial position date for general expenditure

C) The amount of pledges receivable that the nonprofits expects will be available to pay for general expenditures of the current year

D) The portion of long-term debt that is due to be paid in the current period

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

53

A nonprofit university uses fund accounting for internal purposes. It maintains a Plant Fund to account financial resources to be used for capital asset acquisitions as well as land, building, and equipment it uses in its operations. In its external financial reporting, how should the university classify the net assets that it reports in its Plant Fund?

A) All net assets should be classified as net assets without donor restrictions

B) All net assets should be classified as net assets with donor restrictions

C) All net assets should be classified as net assets held for capital purposes

D) Net assets arising from resources set aside by the governing board should be classified as net assets without donor restrictions; net assets arising from contributions restricted to capital asset acquisitions should be classified as net assets with donor restrictions

A) All net assets should be classified as net assets without donor restrictions

B) All net assets should be classified as net assets with donor restrictions

C) All net assets should be classified as net assets held for capital purposes

D) Net assets arising from resources set aside by the governing board should be classified as net assets without donor restrictions; net assets arising from contributions restricted to capital asset acquisitions should be classified as net assets with donor restrictions

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

54

A nonprofit university uses fund accounting. The university's governing board decides to set aside $500,000 in a separate fund called the Student Performance Quasi-Endowment Fund, the income of which will be used to finance a long-term study on the career paths of the university's graduates. In which net asset classification of the university's statement of financial position would the net assets in this fund be reported?

A) Net assets without donor restrictions

B) Net assets with board designations

C) Net assets without donor restrictions-board-designated for research

D) Endowment funds

A) Net assets without donor restrictions

B) Net assets with board designations

C) Net assets without donor restrictions-board-designated for research

D) Endowment funds

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

55

The following transactions pertain to the activities of the Whitt Shakespeare Company (WSC), a nonprofit entity. For each transaction, state which classification of net assets is affected: net assets with donor restrictions or net asset without donor restrictions. In addition, state the fund in which the transaction would be recorded, if the WSC were using fund accounting for internal record-keeping purposes. (Note: Transactions may require more than one net asset classification and more than one fund.)

a. WSC receives a cash donation of $5,000, which must be used for a specific performance to be attended only by disadvantaged youths.

b. WSC gives the performance referred to in transaction a.

c. WSC conducts its annual fundraising campaign at the beginning of the year and raises $50,000 to help meet its regular program and other expenses.

d. The state council on the arts gives WSC a grant of $20,000, to be used only for specific performances during the same year for senior citizens who reside in government-supported housing.

e. Cort Beynon donates $16,000, stipulating that, starting next year, the resources should be used to help meet its regular program and administrative expenses, at the rate of $4,000 a year.

f. Jace Beynon donates $20,000, to be placed in a fund that will be maintained in perpetuity.

a. WSC receives a cash donation of $5,000, which must be used for a specific performance to be attended only by disadvantaged youths.

b. WSC gives the performance referred to in transaction a.

c. WSC conducts its annual fundraising campaign at the beginning of the year and raises $50,000 to help meet its regular program and other expenses.

d. The state council on the arts gives WSC a grant of $20,000, to be used only for specific performances during the same year for senior citizens who reside in government-supported housing.

e. Cort Beynon donates $16,000, stipulating that, starting next year, the resources should be used to help meet its regular program and administrative expenses, at the rate of $4,000 a year.

f. Jace Beynon donates $20,000, to be placed in a fund that will be maintained in perpetuity.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

56

Prepare journal entries to record the following transactions of Weatherford Teen Foundation, Inc. (WTFI), a nonprofit entity that provides counseling, training, and other programs for young people. WTFI accounts for all transactions in a single fund, recording them so as to distinguish between net assets with donor restrictions and net assets without donor restrictions as required for financial reporting purposes.

a. WTFI receives pledges of $150,000 to help finance its activities for the year. WTFI expects that it will ultimately receive 90% of these pledges in cash.

b. During the year, WTFI receives cash of $130,000 against the pledges and writes off $10,000 of the pledges as uncollectible.

c. WTFI incurs the following program expenses, financed by its unrestricted revenues:

(1) Counseling programs, $40,000

(2) Training programs, $50,000

d. WTFI has a contract with the county in which it is located to administer a youth recreation program. It incurs $20,000 of expenses under the program, and sends an invoice to the county for that amount.

e. Carole Burgess donates $5,000, stipulating that WTFI must use her gift to obtain the services of a well-known country singer for a special concert.

f. WTFI gives the concert referred to in e. WTFI pays $5,000 to the country singer, and charges the expense to Recreation programs.

g. David Bean, a local attorney, donates 10 hours of his time to WTFI drawing up legal contracts. Mr. Bean also donates 20 hours coaching softball for the youths. He normally charges $200 an hour for his legal services. WTFI would have hired an attorney and a coach to do this work if Mr. Bean had not volunteered his time.

h. Mary Catlett donates common stock to WTFI, stipulating that the stock must be used during WTFI's next fiscal year for any programs WTFI wishes to undertake. At the time of the gift, the stock has a fair value of $10,000.

i. When WTFI closes its books at year-end, the stock gift from Ms. Catlett has a fair value of $11,000.

a. WTFI receives pledges of $150,000 to help finance its activities for the year. WTFI expects that it will ultimately receive 90% of these pledges in cash.

b. During the year, WTFI receives cash of $130,000 against the pledges and writes off $10,000 of the pledges as uncollectible.

c. WTFI incurs the following program expenses, financed by its unrestricted revenues:

(1) Counseling programs, $40,000

(2) Training programs, $50,000

d. WTFI has a contract with the county in which it is located to administer a youth recreation program. It incurs $20,000 of expenses under the program, and sends an invoice to the county for that amount.

e. Carole Burgess donates $5,000, stipulating that WTFI must use her gift to obtain the services of a well-known country singer for a special concert.

f. WTFI gives the concert referred to in e. WTFI pays $5,000 to the country singer, and charges the expense to Recreation programs.

g. David Bean, a local attorney, donates 10 hours of his time to WTFI drawing up legal contracts. Mr. Bean also donates 20 hours coaching softball for the youths. He normally charges $200 an hour for his legal services. WTFI would have hired an attorney and a coach to do this work if Mr. Bean had not volunteered his time.

h. Mary Catlett donates common stock to WTFI, stipulating that the stock must be used during WTFI's next fiscal year for any programs WTFI wishes to undertake. At the time of the gift, the stock has a fair value of $10,000.

i. When WTFI closes its books at year-end, the stock gift from Ms. Catlett has a fair value of $11,000.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

57

Inner City Compassion, Inc. (ICC) solicits donations to provide shelter and counseling to abused children and adults. It also sponsors research into the causes of abuse. ICC accounts for all transactions in a single fund, recording them so as to distinguish between net assets with donor restrictions and net assets without donor restrictions as required for financial reporting purposes.

Prepare journal entries to record the following transactions.

a. ICC receives cash contributions of $150,000 and pledges of $100,000, to be used for any purpose approved by the trustees. Based on past experience, the trustees expect to collect 90% of the pledges.

b. ICC receives the following donations in cash, each for certain specific purposes:

(1) $25,000, which must be used only for sheltering abused wives;

(2) $100,000, the principal of which (and all investment gains or losses) must be held in perpetuity; and the income must be used only for research purposes; and

(3) $50,000, which must be used (together with any income its investment generates) for acquisition of buildings and equipment.

c. ICC invests the $100,000 contribution from transaction b(2) in equity securities.

d. ICC collects $87,000 in cash from the pledges made in transaction a. and writes off the remaining $13,000 of pledges as uncollectible.

e. ICC spends $30,000 in cash on the youth counseling program.

f. ICC spends $20,000 of the donation received in b(1) for sheltering abused wives.

g. At year-end, the $100,000 investment in transaction c. has a fair value of $104,000.

h. E. Falk, a professional psychiatrist, donates 20 days of her time in counseling youth under an ICC program. Had she not donated time, ICC would have spent $800 a day for these services.

i. K. Schermann sends ICC a letter, stating that he will make a cash donation next year of $25,000, provided ICC raises at least $50,000 in next-year's fundraising campaign.

j. B. Shaw sends ICC $5,000, stipulating that it must be used for next year's programs.

k. Dividends of $2,000 are received on the investments in transaction c. [See also b(2).]

Prepare journal entries to record the following transactions.

a. ICC receives cash contributions of $150,000 and pledges of $100,000, to be used for any purpose approved by the trustees. Based on past experience, the trustees expect to collect 90% of the pledges.

b. ICC receives the following donations in cash, each for certain specific purposes:

(1) $25,000, which must be used only for sheltering abused wives;

(2) $100,000, the principal of which (and all investment gains or losses) must be held in perpetuity; and the income must be used only for research purposes; and

(3) $50,000, which must be used (together with any income its investment generates) for acquisition of buildings and equipment.

c. ICC invests the $100,000 contribution from transaction b(2) in equity securities.

d. ICC collects $87,000 in cash from the pledges made in transaction a. and writes off the remaining $13,000 of pledges as uncollectible.

e. ICC spends $30,000 in cash on the youth counseling program.

f. ICC spends $20,000 of the donation received in b(1) for sheltering abused wives.

g. At year-end, the $100,000 investment in transaction c. has a fair value of $104,000.

h. E. Falk, a professional psychiatrist, donates 20 days of her time in counseling youth under an ICC program. Had she not donated time, ICC would have spent $800 a day for these services.

i. K. Schermann sends ICC a letter, stating that he will make a cash donation next year of $25,000, provided ICC raises at least $50,000 in next-year's fundraising campaign.

j. B. Shaw sends ICC $5,000, stipulating that it must be used for next year's programs.

k. Dividends of $2,000 are received on the investments in transaction c. [See also b(2).]

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

58

Kenyan Children Matter, Inc., a small nonprofit entity devoted to providing for primary school costs for underprivileged or orphaned children, prepares a brochure about its programs. The brochure showcases the children it currently supports, discusses how it accomplishes its programs, and the type of costs it incurs. It also discusses the AIDS epidemic as the reason why so many children are orphaned in Kenya. The brochure encourages readers to sponsor individual children. It distributes the brochures in U.S. churches and private schools. The cost of the producing the four-page brochure is $3,000. KCM estimates that a third of the cost of the brochure should be allocated to its programs and two thirds to fundraising.

KCM also incurs other expenses in 2018, as listed below.

i. Pays the annual costs for a boarding school for 20 Kenyan children at $800 each

ii. Pays $30,000 for tuition for its students who continue to live at home

iii. Pays for a visiting nurse to conduct annual health checks for its students totaling $6,000

iv. Pays the $10,000 annual salary for a social worker to monitor the home situations of children it supports but who are not placed in boarding schools

v. Pays $5,000 for a U.S. CPA firm to maintain KCM's books and to process contributions.

vi. Pays $2,000 for another CPA firm to prepare its IRS Form 990

vii. Pays $3,000 to buy backpacks and supplies in Kenya for its students

viii. Pays $5,000 "stipend" to its president for overseeing KCM's programs

ix. Pays $10,000 to cover the costs of its president to make a 6-day trip to Kenya to accompany 15 of its best contributors (who pay their own travel costs) to Kenya to meet some of KCM's students. After some discussion, KCM's CPA firm agrees with the nonprofit's conclusion that 90% of this cost should be reported as program expenses and the remainder as management and general expenses

Required:

(a) Prepare a schedule of KCM's costs for the year, using three columns: Program expenses, Management and General expenses, and Fundraising expenses.

(b) If KCM reports its operating results to a national charity rating organization, what percentages of its expenses would it report for programs expenses, administrative expenses, and fundraising expenses?

KCM also incurs other expenses in 2018, as listed below.

i. Pays the annual costs for a boarding school for 20 Kenyan children at $800 each

ii. Pays $30,000 for tuition for its students who continue to live at home

iii. Pays for a visiting nurse to conduct annual health checks for its students totaling $6,000

iv. Pays the $10,000 annual salary for a social worker to monitor the home situations of children it supports but who are not placed in boarding schools

v. Pays $5,000 for a U.S. CPA firm to maintain KCM's books and to process contributions.

vi. Pays $2,000 for another CPA firm to prepare its IRS Form 990

vii. Pays $3,000 to buy backpacks and supplies in Kenya for its students

viii. Pays $5,000 "stipend" to its president for overseeing KCM's programs

ix. Pays $10,000 to cover the costs of its president to make a 6-day trip to Kenya to accompany 15 of its best contributors (who pay their own travel costs) to Kenya to meet some of KCM's students. After some discussion, KCM's CPA firm agrees with the nonprofit's conclusion that 90% of this cost should be reported as program expenses and the remainder as management and general expenses

Required:

(a) Prepare a schedule of KCM's costs for the year, using three columns: Program expenses, Management and General expenses, and Fundraising expenses.

(b) If KCM reports its operating results to a national charity rating organization, what percentages of its expenses would it report for programs expenses, administrative expenses, and fundraising expenses?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

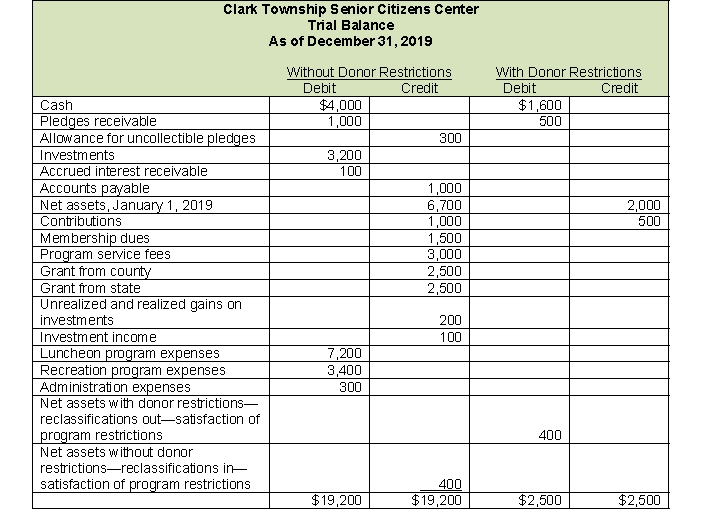

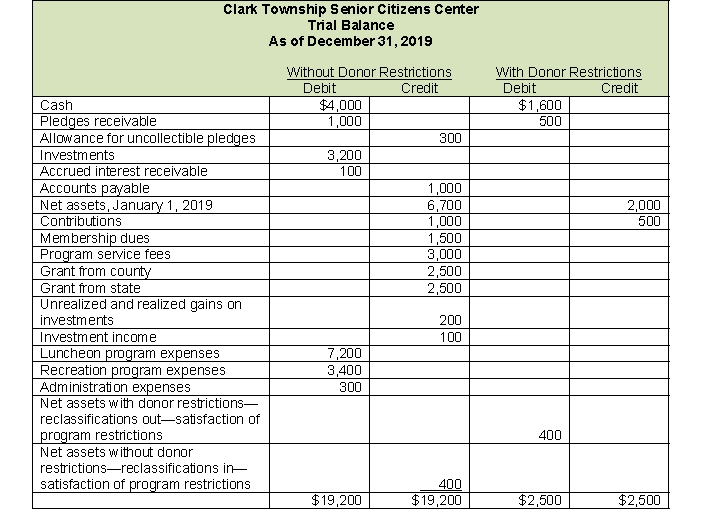

59

Following are the preclosing trial balances of Clark Township Senior Citizens Center as of December 31, 2019. Prepare a statement of financial position and a statement of activities for the Center at and for the year ended December 31, 2019.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck