Deck 11: Analysis of Financial Statements and Financial Condition

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/52

Play

Full screen (f)

Deck 11: Analysis of Financial Statements and Financial Condition

1

Management's financial flexibility is greater if a government's resources are relatively liquid and the level of unrestricted net position is relatively high.

True

2

Separating revenues by sources helps a government determine whether resources obtained during the year are sufficient to cover the costs of services provided during the year.

False

3

Analyzing the details of other financing sources reported in the statement of revenues, expenditures, and changes in fund balance may provide clues as to whether a government is facing financial stress.

True

4

The notes to the financial statements provide 10-year financial trends that are useful in analyzing the financial condition of a government.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

5

All else being equal, a government that has a high funded ratio for its pension and contributes the full actuarially determined contributions to its pension plan is in better fiscal health than a government with a low funded ratio that does not make the full actuarially determined contribution to the plan.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

6

Analyzing financial data can be enhanced by using ratios, per capita information, percentage change information, and common-size statements.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

7

Time series analysis involves relating one data element to another to produce an indicator of a particular characteristic.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

8

A quick ratio of less than one generally is considered to be a negative factor when analyzing a government's General Fund.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

9

A general rule of thumb for the number of days of cash that a government should have on hand is 100 days.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

10

The following are receivable collection efficiency ratios for governments: property tax collection rate, days' revenue in receivables, and number of days' cash on hand.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

11

The GFOA recommends that general-purpose governments have a financial policy that calls for the General Fund unrestricted fund balance (the total of unassigned, assigned, and committed) to be no less than two months of regular general fund operating revenues or regular General Fund operating expenditures.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

12

Common measures of a general purpose government's debt and debt service burdens are: debt burden, debt service burden, and debt principal payback.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

13

Debt burden can be defined as net outstanding tax-supported debt divided by the full value of taxable real property. All else equal, a bond-rating agency considers a higher debt burden to be better.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

14

A government's debt service burden is the portion of its revenues that is consumed by the annual payment of principal and interest on long-term debt and interest on short-term debt. All else equal, a lower debt service burden is considered to be better.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

15

The funded ratio for a pension plan is the pension plan's fiduciary net position divided by the net pension liability.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

16

Based on historical norms, a pension plan with a funded ratio of 90 percent is consider to have above average funding.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

17

Financial condition analysis primarily provides information about a government's financial position.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

18

To assess the financial condition of a government, an analyst needs to consider only the financial statements of a government.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

19

Analysts consider a gradually growing population with above average education as positive factors when analyzing a city.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

20

Credit-rating agencies provide an independent, objective, assessment of the creditworthiness of a municipality's debt obligations.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is the most significant item of information that a financial analyst might obtain by reviewing the statement of revenues, expenses, and changes in net position?

A) Whether the resources obtained during the year were sufficient to cover the cost of providing services

B) Whether services provided were sufficient for the government's constituencies

C) The current financial condition of a government

D) The current status of a government's assets and liabilities

A) Whether the resources obtained during the year were sufficient to cover the cost of providing services

B) Whether services provided were sufficient for the government's constituencies

C) The current financial condition of a government

D) The current status of a government's assets and liabilities

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is the most logical reason why the financial analyst needs to be aware of the property tax calendar, available in the notes to the financial statements?

A) It may help explain why the government needed to borrow long-term, as well as the size of government's capital expenditures.

B) It may help explain why the government needed to borrow short-term, as well as the size of year-end cash balances and deferred inflows of resources.

C) It may explain why the government's property tax collection practices were inefficient.

D) It may help explain why the government tends to raise more property tax revenue than the reference group.

A) It may help explain why the government needed to borrow long-term, as well as the size of government's capital expenditures.

B) It may help explain why the government needed to borrow short-term, as well as the size of year-end cash balances and deferred inflows of resources.

C) It may explain why the government's property tax collection practices were inefficient.

D) It may help explain why the government tends to raise more property tax revenue than the reference group.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

23

How does the use of ratios help the financial analyst?

A) They are a necessary first step in developing per capita information

B) They help the analyst assess trends for the government itself and for comparing the trends with those with other governments

C) They simplify financial analysis by reducing the number of items to be analyzed

D) They show the dollar amount of change from one year to another for each item of revenue and expense, both for the entity studied and the reference group

A) They are a necessary first step in developing per capita information

B) They help the analyst assess trends for the government itself and for comparing the trends with those with other governments

C) They simplify financial analysis by reducing the number of items to be analyzed

D) They show the dollar amount of change from one year to another for each item of revenue and expense, both for the entity studied and the reference group

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is a cash equivalent?

A) Assets, such as prepaid insurance or supplies inventories, that are consumed in the ordinary course of operations

B) Short-term liquid investments readily convertible to cash and so close to maturity (having an original maturity of 3 or less months) that there is little risk of loss of value

C) Any asset that is likely to be received in time to pay outstanding year-end payables, such as taxes receivable from taxpayers who have of history of timely payment

D) Investments in equity securities that have paid dividends for at least the past 25 consecutive years

A) Assets, such as prepaid insurance or supplies inventories, that are consumed in the ordinary course of operations

B) Short-term liquid investments readily convertible to cash and so close to maturity (having an original maturity of 3 or less months) that there is little risk of loss of value

C) Any asset that is likely to be received in time to pay outstanding year-end payables, such as taxes receivable from taxpayers who have of history of timely payment

D) Investments in equity securities that have paid dividends for at least the past 25 consecutive years

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

25

Leo Village provides water to its residents. It accounts for this business-type activity in an enterprise fund. Use the following information, as appropriate, to compute Leo Village's number of days' cash on hand: Cash - $2,000,000; Cash equivalents - $1,000,000; Short-term investments $400,000; Accounts receivable - $500,000; Operating expenses other than depreciation - $6,000,000; Operating expenses - depreciation $1,000,000.

A) 237

B) 203

C) 207

D) 177

A) 237

B) 203

C) 207

D) 177

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

26

Use the following information, as appropriate, to compute Leo Village's quick ratio for its General Fund: Cash - $2,000,000; Cash equivalents - $1,000,000; Short-term investments $400,000; Property taxes receivable - $500,000; Inventory - $420,000; Current liabilities - $2,800,000; Operating expenses other than depreciation - $6,000,000; Operating expenses - depreciation $1,000,000

A) 1.5

B) 1.4

C) 1.2

D) 1.1

A) 1.5

B) 1.4

C) 1.2

D) 1.1

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

27

The village of Indian Point collected $11,350,000 of property taxes during calendar year 2019. Of that amount $11,220,000 pertained to the tax levy for 2019; the other $130,000 represented collections of prior year tax delinquencies. The real property tax levy for 2019 was $11,920,000. What is Indian Point's property tax collection rate for 2019?

A) 105%

B) 99%

C) 95%

D) 94%

A) 105%

B) 99%

C) 95%

D) 94%

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

28

Winter Snow City operates on a calendar-year basis. Its property tax calendar is structured so that all taxes not received by October 31 are delinquent. Winter Snow therefore likes to measure its property tax efficiency by calculating its property tax receivable rate. Which of the following information elements are needed to make this calculation?

A) Property tax receivables, assessed value of property

B) Property tax receivables, property tax revenues

C) Property tax revenues, fair value of property

D) Current-year property taxes collected, current-year property tax levy

A) Property tax receivables, assessed value of property

B) Property tax receivables, property tax revenues

C) Property tax revenues, fair value of property

D) Current-year property taxes collected, current-year property tax levy

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

29

The following information comes from a governmental hospital's financial statements: Net patient accounts receivable - $3.5 million; Net revenue from patient services - $11 million. What is the hospital's days' revenue in receivables (rounded to nearest whole day)?

A) 3

B) 106

C) 116

D) 1,147

A) 3

B) 106

C) 116

D) 1,147

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

30

Mustang Village had unassigned fund balance of $4,200,000; assigned fund balance of $1,400,000, restricted fund balance of $2,200,000, and nonspendable fund balance of $800,000 at the end of its current fiscal year. The assigned fund balance is not appropriated to balance next year's budget. Mustang Village had total revenues in its General Fund of $28,000,000 and total expenditures to $27,800,000. It also has recurring transfers in of $1,800,000 from its Electric Utility Enterprise Fund. What is Mustang Village's budgetary cushion for its General Fund for the current year?

A) 31%

B) 29%

C) 26%

D) 20%

E) 19%

A) 31%

B) 29%

C) 26%

D) 20%

E) 19%

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

31

Why is it important for the financial analyst to be concerned with the details of the numerator when calculating a government's operating margin?

A) The numerator may be artificially overstated because of the failure to finance various expenditures and the inclusion of "one-shot" revenues

B) The numerator may be artificially overstated because of the inclusion of recurring transfers in

C) The numerator may be artificially understated because of the inclusion of recurring transfers out

D) The entity may have a policy of annually financing a small portion of its capital asset acquisitions through the General Fund

A) The numerator may be artificially overstated because of the failure to finance various expenditures and the inclusion of "one-shot" revenues

B) The numerator may be artificially overstated because of the inclusion of recurring transfers in

C) The numerator may be artificially understated because of the inclusion of recurring transfers out

D) The entity may have a policy of annually financing a small portion of its capital asset acquisitions through the General Fund

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

32

A city's current year total revenues in its General Fund was $34,000,000. The General Fund receives an annual transfer in from its Water and Sewer Enterprise Fund of $2,000,000. The General Fund also has an annual transfer out to the Debt Service Fund of $1,000,000 to help pay for principal and interest on bonds and a one-time transfer out to the Capital Projects Fund of $2,500,000. The city's net change in fund balance in its General Fund was a positive $900,000. What is the city's operating margin for its General Fund?

A) 2.8%

B) 2.7%

C) 2.6%

D) 2.5%

A) 2.8%

B) 2.7%

C) 2.6%

D) 2.5%

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

33

A tobacco company agrees to pay a state $1 billion a year over the next ten years to settle the state's claim that the tobacco had harmed the health of its citizens. The state "sells" the future revenue stream to a consortium of banks for the present value of the $10 billion, and deposits the cash in its General Fund to balance its current-year budget. How should the financial condition analyst view this financial arrangement?

A) The analyst should ignore it, provided the state has classified the revenues as an extraordinary item in its operating statement

B) The analyst should ignore it because the present value of the future revenue stream is equivalent to the revenue stream itself

C) The analyst should assess the effect of the revenue as a "one-shot" item that balanced the current year's budget, but that might leave a gap in future year budgets

D) The analyst should assess the effect of the arrangement on the auditor's report, the notes to the financial statements, and Management's Discussion and Analysis.

A) The analyst should ignore it, provided the state has classified the revenues as an extraordinary item in its operating statement

B) The analyst should ignore it because the present value of the future revenue stream is equivalent to the revenue stream itself

C) The analyst should assess the effect of the revenue as a "one-shot" item that balanced the current year's budget, but that might leave a gap in future year budgets

D) The analyst should assess the effect of the arrangement on the auditor's report, the notes to the financial statements, and Management's Discussion and Analysis.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following provides the best explanation of the purpose of calculating a government's debt service burden?

A) The greater the portion of revenues consumed by debt service, the less flexibility there is to issue additional debt and to meet operating expenditure needs.

B) The greater the portion of revenues consumed by debt service, the more likely it is that government is spending excessively on infrastructure assets.

C) The greater the portion of revenues consumed by debt service, the more likely it is that the government is "backloading" its debt service payments.

D) The greater the portion of revenues consumed by debt service, the more likely it is that the government will raise tax rates in the near future.

A) The greater the portion of revenues consumed by debt service, the less flexibility there is to issue additional debt and to meet operating expenditure needs.

B) The greater the portion of revenues consumed by debt service, the more likely it is that government is spending excessively on infrastructure assets.

C) The greater the portion of revenues consumed by debt service, the more likely it is that the government is "backloading" its debt service payments.

D) The greater the portion of revenues consumed by debt service, the more likely it is that the government will raise tax rates in the near future.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

35

A village's legal debt limit is $20 million. Its net outstanding tax-supported debt is $12 million. The village also has debt of $2 million that is backed by the revenues generated from its Water and Sewer Enterprise Fund. The village's population is 20,000. What is the village's debt burden per capita?

A) $1,100

B) $1,000

C) $600

D) $100

A) $1,100

B) $1,000

C) $600

D) $100

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

36

How does knowledge of the rate of payback of debt principal help the analyst in assessing a governmental entity's financial position?

A) It is a determinant of the entity's operating efficiency

B) It is a helpful substitute for the long-term debt to equity ratio

C) It is a useful indicator of financial flexibility and fiscal stress

D) It helps to explain the debt service funded ratio

A) It is a determinant of the entity's operating efficiency

B) It is a helpful substitute for the long-term debt to equity ratio

C) It is a useful indicator of financial flexibility and fiscal stress

D) It helps to explain the debt service funded ratio

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

37

What can a financial analyst learn from computing the debt service coverage of a governmental business-type activity?

A) The number of times the debt service is covered by the activity's excess of revenues over expenses

B) The excess of the total net assets over the activity's outstanding long-term debt

C) The number of times the debt service is covered by the activity's current assets

D) The number of times the debt service is covered by the activity's outstanding long-term debt

A) The number of times the debt service is covered by the activity's excess of revenues over expenses

B) The excess of the total net assets over the activity's outstanding long-term debt

C) The number of times the debt service is covered by the activity's current assets

D) The number of times the debt service is covered by the activity's outstanding long-term debt

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

38

At December 31, 2020, the Yorktown pension fund's plan fiduciary net position was $12 million. Its total pension liability at that time was $16 million. For the year ended December 31, 2020, its pension fund had paid $3 million in pension benefits. Yorktown's salaries for the year were $18 million. What was Yorktown's funded ratio?

A) 67%

B) 75%

C) 89%

D) 400%

A) 67%

B) 75%

C) 89%

D) 400%

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

39

At December 31, 2020, a city had $8 million in its General Fund that the city council had assigned to pay for OPEB retiree healthcare benefits. Its total OPEB liability at that time was $12 million. For the year ended December 31, 2020, it had paid $1 million in retiree healthcare costs. The city's salaries for the year were $20 million. What was the city's funded ratio?

A) 0%

B) 67%

C) 75%

D) 150%

A) 0%

B) 67%

C) 75%

D) 150%

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements regarding the funding of governmental pension plans is not true?

A) As a general rule, a funded ratio below 60 percent is considered to be "weak."

B) As a general rule, a funded ratio of 80 percent indicates that a pension plan to be reasonably funded.

C) Financial analysts should look to see if the government uses a high earnings rate assumption on plan investments because the higher the earnings assumption, the more likely it is that the plan will be well funded.

D) The GASB requires the funded ratio be reported as required supplementary information for each of the past 10 years.

A) As a general rule, a funded ratio below 60 percent is considered to be "weak."

B) As a general rule, a funded ratio of 80 percent indicates that a pension plan to be reasonably funded.

C) Financial analysts should look to see if the government uses a high earnings rate assumption on plan investments because the higher the earnings assumption, the more likely it is that the plan will be well funded.

D) The GASB requires the funded ratio be reported as required supplementary information for each of the past 10 years.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements regarding the funded status of public pension plans is false?

A) In general, the funded status of public pension plans improved between 2001 and 2015.

B) The 2010 Public Funding Survey found that pension plan funding declined between 2001 and 2009.

C) The funded status of a government's pension plan depends on the commitment of the government to finance the plan.

D) A government that consistently underfinances its pension plans may be at risk of serious financial stress.

A) In general, the funded status of public pension plans improved between 2001 and 2015.

B) The 2010 Public Funding Survey found that pension plan funding declined between 2001 and 2009.

C) The funded status of a government's pension plan depends on the commitment of the government to finance the plan.

D) A government that consistently underfinances its pension plans may be at risk of serious financial stress.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

42

What is the purpose of analyzing a government's financial condition?

A) To reach conclusions about the ability of the government to meet its payroll and pay its creditors in the following year

B) To enable an independent auditor to express a "clean opinion" on the government's financial statements for the year under audit

C) To draw inferences about the future ability of the government to meet its financial obligations as they come due and to provide services at a reasonable level to its individual and corporate citizens

D) To enable the government's management to complete the Management's Discussion and Analysis section of the annual financial report

A) To reach conclusions about the ability of the government to meet its payroll and pay its creditors in the following year

B) To enable an independent auditor to express a "clean opinion" on the government's financial statements for the year under audit

C) To draw inferences about the future ability of the government to meet its financial obligations as they come due and to provide services at a reasonable level to its individual and corporate citizens

D) To enable the government's management to complete the Management's Discussion and Analysis section of the annual financial report

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following factors and data sets require consideration in analyzing a government's financial condition: (a) the government's financial statements; (b) economic data, such as median household income and poverty rates; (c) demographic data, such as population trends; (d) managerial and administrative skills; (e) political will; (f) level and quality of service delivery to the citizenry?

A) Items (a), (b), and (c)

B) Items (a), (b), (c), and (d)

C) Items (a), (b), (c), (d), and (f)

D) All six items

A) Items (a), (b), and (c)

B) Items (a), (b), (c), and (d)

C) Items (a), (b), (c), (d), and (f)

D) All six items

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

44

Financial condition analysis is conducted for many reasons including:

A) By credit agencies to provide an objective assessment of the creditworthiness of state and local debt obligations.

B) By credit enhancers to assess the creditworthiness of debt obligations to decide whether to insure the payments of a government's debt service.

C) By state and oversight agencies to gather financial information from local governments in the state as part of their fiscal oversight responsibilities.

D) All of the above.

A) By credit agencies to provide an objective assessment of the creditworthiness of state and local debt obligations.

B) By credit enhancers to assess the creditworthiness of debt obligations to decide whether to insure the payments of a government's debt service.

C) By state and oversight agencies to gather financial information from local governments in the state as part of their fiscal oversight responsibilities.

D) All of the above.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

45

Calculate and then make an assessment based on the liquidity indicators (quick ratio and number of days' cash on hand) for a small village in New York State based on the following facts, drawn from the village's 2017 General Fund financial statements and from the State's Fiscal Stress Monitoring System.

a. Balance sheet data: Cash and equivalents - $4,730,000; Short-term investments $971,000; Current liabilities - $1,898,000

b. Statement of revenues, expenditures, and changes in fund balance data: Total expenditures - $15,524,000; Transfers out - $2,972,000

c. Assessment criteria: New York State's Fiscal Monitoring System assigns negative points in its rating scheme unless the government's quick ratio is greater than 100 percent and its cash and investments on hand covers at least 45 days of expenditures.

a. Balance sheet data: Cash and equivalents - $4,730,000; Short-term investments $971,000; Current liabilities - $1,898,000

b. Statement of revenues, expenditures, and changes in fund balance data: Total expenditures - $15,524,000; Transfers out - $2,972,000

c. Assessment criteria: New York State's Fiscal Monitoring System assigns negative points in its rating scheme unless the government's quick ratio is greater than 100 percent and its cash and investments on hand covers at least 45 days of expenditures.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

46

Calculate the Plains Regional Hospital's days' revenue in receivables and assess Plains Regional Hospital's accounts receivable collection efficiency based on the following set of facts:

a. Days' revenue in patient accounts receivable at December 31, 2019, for Plains Regional Hospital - 76 days

b. Extracts from Plains Regional Hospital's calendar year 2020 financial statements:

Net patient accounts receivable, $16.4 million

Net patient service revenue, $75 million

c. Assessment criteria: Days' revenue in patient accounts receivable at December 31, 2020 for hospitals of comparable size - 65 days

a. Days' revenue in patient accounts receivable at December 31, 2019, for Plains Regional Hospital - 76 days

b. Extracts from Plains Regional Hospital's calendar year 2020 financial statements:

Net patient accounts receivable, $16.4 million

Net patient service revenue, $75 million

c. Assessment criteria: Days' revenue in patient accounts receivable at December 31, 2020 for hospitals of comparable size - 65 days

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

47

The following data affecting the calculation of a small village's budget solvency and operating results indicators were obtained from the village's 2017 General Fund financial statements. Calculate the budgetary cushion and the operating margin and assess the results based on guidance established by the Government Finance Officers Association and New York's Fiscal Stress Monitoring System.

a. Balance sheet data: The village's fund balance is $9,456,000, consisting of: Nonspendable - $217,000; Restricted - $1,882,000; Assigned - $887,000; and Unassigned - $6,470,000

b. Statement, of revenues, expenditures, and changes in fund balance data: Net change in fund balance - $592,000; Total revenues - $19,001,000; Recurring transfers in - $50,000

c. Assessment criteria: The GFOA recommends that the total of unassigned, assigned, and committed fund balance of the General Fund should be no less than two months of regular General Fund operating revenues or regular General Fund operating expenditures. New York State's Fiscal Monitoring System assigns negative points in its rating scheme unless the government's assigned and unassigned fund balance in the General Fund is more than 10 percent of General Fund expenditures plus transfers out. (Note: When making the assessment in this problem, assume the village's revenues plus recurring transfers in are the same as expenditures plus transfers out.)

a. Balance sheet data: The village's fund balance is $9,456,000, consisting of: Nonspendable - $217,000; Restricted - $1,882,000; Assigned - $887,000; and Unassigned - $6,470,000

b. Statement, of revenues, expenditures, and changes in fund balance data: Net change in fund balance - $592,000; Total revenues - $19,001,000; Recurring transfers in - $50,000

c. Assessment criteria: The GFOA recommends that the total of unassigned, assigned, and committed fund balance of the General Fund should be no less than two months of regular General Fund operating revenues or regular General Fund operating expenditures. New York State's Fiscal Monitoring System assigns negative points in its rating scheme unless the government's assigned and unassigned fund balance in the General Fund is more than 10 percent of General Fund expenditures plus transfers out. (Note: When making the assessment in this problem, assume the village's revenues plus recurring transfers in are the same as expenditures plus transfers out.)

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

48

The following data is extracted from the General Fund and Debt Service Fund columns of the Town of Gold Hill's governmental funds statement of revenues, expenditures, and changes in fund balances for the year ended December 31, 2019. (Interfund transfers were eliminated in aggregating data.)

EThe governmental activities column of the Town of Gold Hill's statement of net position shows general obligation bonds payable of $96,900,000. The statistical tables in the Town's comprehensive annual financial report shows that its population is 230,600 and that the full value of its taxable real property for 2019 is $6,737,000,000.

Required:

a. Compute the Town of Gold Hill's debt service burden.

b. Compute the Town of Gold Hill's debt burden, using per capita debt and debt as a percentage of the full value of taxable real property.

c. Assess these burdens in light of the following data for a reference group of municipalities within the same state as the Town of Gold Hill: debt service burden - 4.6%; debt per capita - $370; debt as a percent of full value of taxable real property - 1.02%.

EThe governmental activities column of the Town of Gold Hill's statement of net position shows general obligation bonds payable of $96,900,000. The statistical tables in the Town's comprehensive annual financial report shows that its population is 230,600 and that the full value of its taxable real property for 2019 is $6,737,000,000.

Required:

a. Compute the Town of Gold Hill's debt service burden.

b. Compute the Town of Gold Hill's debt burden, using per capita debt and debt as a percentage of the full value of taxable real property.

c. Assess these burdens in light of the following data for a reference group of municipalities within the same state as the Town of Gold Hill: debt service burden - 4.6%; debt per capita - $370; debt as a percent of full value of taxable real property - 1.02%.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

49

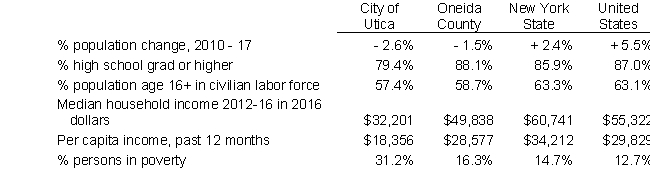

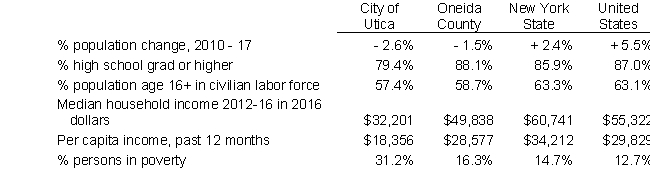

The following information is taken from QuickFacts at the Bureau of the Census website (accessed June 2018). The City of Utica is the county seat of Oneida County in New York State. Your assignment is to draw inferences regarding the strength of the economic and demographic environment of the City of Utica, using Oneida, New York State and United States data as reference groups, as an aid in assessing the financial condition of Utica.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

50

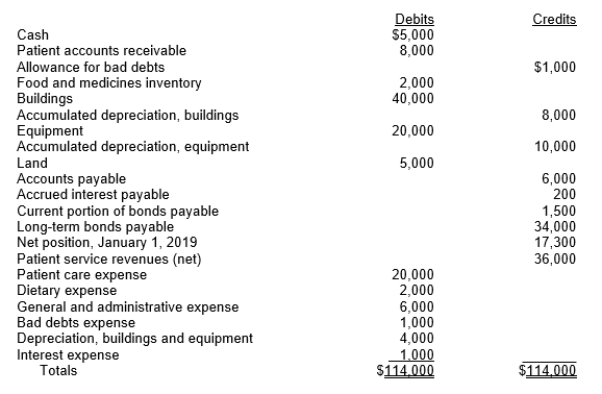

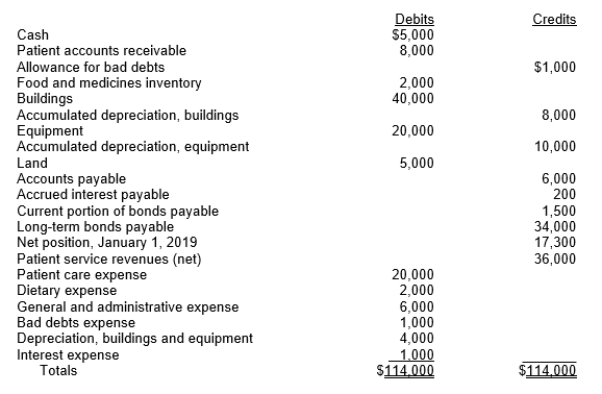

Following is a trial balance (with 000 omitted for simplification) showing the accounts of Beta Hospital at December 31, 2019. Using the information from the trial balance, answer the following questions. Show all calculations.

a. What is number of days' cash on hand?

b. What is the number of days of revenue in net patient accounts receivable?

c. How much is the excess of revenues over expenses?

d. What is the operating margin?

e. What is the long-term debt-to-equity ratio at year-end?

f. What is the interest coverage (times interest earned)?

a. What is number of days' cash on hand?

b. What is the number of days of revenue in net patient accounts receivable?

c. How much is the excess of revenues over expenses?

d. What is the operating margin?

e. What is the long-term debt-to-equity ratio at year-end?

f. What is the interest coverage (times interest earned)?

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

51

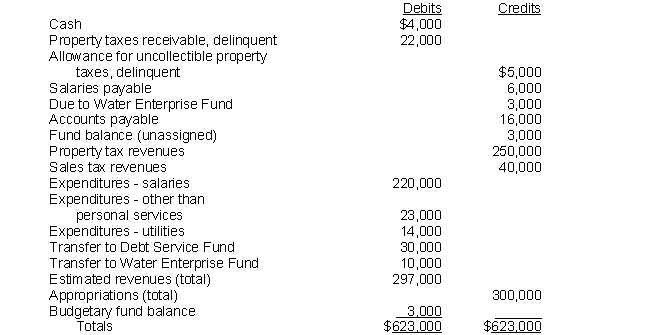

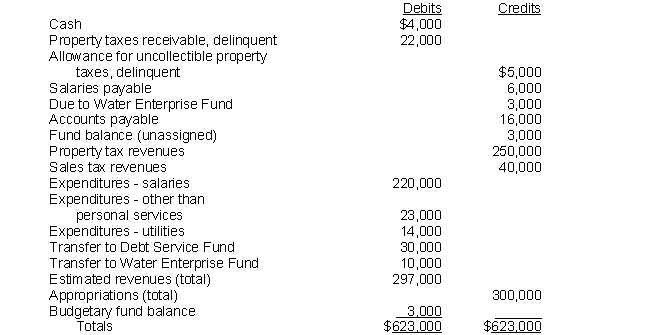

Following is a pre-closing trial balance of a village's General Fund at December 31, 2019. The amount shown as Fund balance (unassigned) has not changed since the year started. The amount shown as appropriations includes the amounts appropriated for transfers. Property tax invoices are mailed out on January 10 and are due to be paid on February 10. Property owners that have not paid their taxes are classified as delinquent on March 10.  Required:

Required:

Based on the information contained in the foregoing trial balance, answer the following questions.

a. When the budget was adopted, what budgetary results did the village anticipate? (Assume the budgetary amounts shown in the trial balance represent the budget as originally adopted by the village.)

b. What were the results of operations for the year? Did the fund balance increase or decrease as a result of the year's activities, and by how much? How much will the amount of the unassigned fund balance be after the books are closed?

c. Based on your analysis of the data, what appears to be the major cause (or causes) of the difference between the anticipated and the actual operating results?

d. Discuss possible reasons for the transfers to the Debt Service Fund and the Water Enterprise Fund.

e. Discuss several possible reasons for the amount shown as Due to Water Enterprise Fund.

f. Assess the financial condition of the village based on the information given in the problem. Include a discussion of the village's quick ratio, number of days' cash on hand, and budgetary cushion in developing your conclusion.

Required:

Required:Based on the information contained in the foregoing trial balance, answer the following questions.

a. When the budget was adopted, what budgetary results did the village anticipate? (Assume the budgetary amounts shown in the trial balance represent the budget as originally adopted by the village.)

b. What were the results of operations for the year? Did the fund balance increase or decrease as a result of the year's activities, and by how much? How much will the amount of the unassigned fund balance be after the books are closed?

c. Based on your analysis of the data, what appears to be the major cause (or causes) of the difference between the anticipated and the actual operating results?

d. Discuss possible reasons for the transfers to the Debt Service Fund and the Water Enterprise Fund.

e. Discuss several possible reasons for the amount shown as Due to Water Enterprise Fund.

f. Assess the financial condition of the village based on the information given in the problem. Include a discussion of the village's quick ratio, number of days' cash on hand, and budgetary cushion in developing your conclusion.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

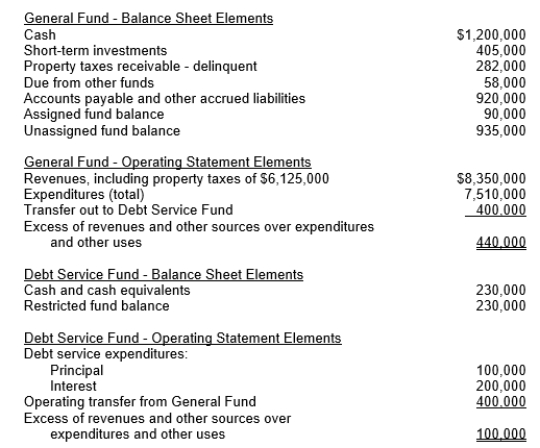

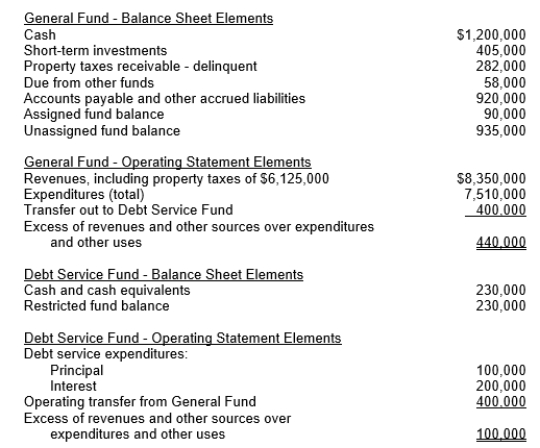

52

The following data comes from the 2020 financial statements of the Village of Matthews. Although presented in summarized format, the balance sheet debits and credits are equal and the operating statement information is complete.  Required: Calculate the following ratios for the Village of Matthews:

Required: Calculate the following ratios for the Village of Matthews:

a. Number of days' cash on hand - General Fund

b. Quick ratio - General Fund

c. Property tax receivable delinquency rate

d. Budgetary cushion for the General Fund (Assume all assigned fund balance is available.)

e. Debt service burden

f. Excess of revenues and other sources over expenditures and other uses, as a percentage of revenues - Combined, General Fund and Debt Service Fund (Hint: The transfers out and in cancel each other. Therefore, use the revenues for the denominator.)

g. Assess the liquidity of the Village of Matthews, based on the standard that the General Fund's number of days' cash on hand should be no less than 45 (and that 60 is more desirable) and that the quick ratio should be at least 1.

Required: Calculate the following ratios for the Village of Matthews:

Required: Calculate the following ratios for the Village of Matthews: a. Number of days' cash on hand - General Fund

b. Quick ratio - General Fund

c. Property tax receivable delinquency rate

d. Budgetary cushion for the General Fund (Assume all assigned fund balance is available.)

e. Debt service burden

f. Excess of revenues and other sources over expenditures and other uses, as a percentage of revenues - Combined, General Fund and Debt Service Fund (Hint: The transfers out and in cancel each other. Therefore, use the revenues for the denominator.)

g. Assess the liquidity of the Village of Matthews, based on the standard that the General Fund's number of days' cash on hand should be no less than 45 (and that 60 is more desirable) and that the quick ratio should be at least 1.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck