Deck 5: General and Special Revenue Funds Continued

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/62

Play

Full screen (f)

Deck 5: General and Special Revenue Funds Continued

1

Governmental-type funds report on financial assets, capital assets, and near-term liabilities.

False

2

The complete governmental fund accounting equation is: Financial Assets + Deferred Outflows of Resources Near-term Liabilities + Deferred Inflows of Resources + Fund Balance

True

3

Unmatured long-term debt arising from the issuance of general obligation bonds is not reported in governmental-type funds, but noncurrent liabilities associated with compensated absences or claims and judgments are reported in governmental-type funds.

False

4

In the General Fund, property tax revenues are recognized in the fiscal period for which the tax is levied, if the taxes are measurable and available.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

5

In the General Fund, property taxes collected in the period before the taxes are levied are reported as revenue.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

6

If property taxes levied for the current fiscal year are not collected until after the first 60 days of the next fiscal year, they should be reported as deferred inflows of resources in the current fiscal year balance sheet. (Assume this is accounted for in the General Fund.)

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

7

A government levies property taxes for general government activities of $800,000 for the current year and it expects to not be able to collect $80,000 of the property taxes. The government should credit Revenues-property taxes for $800,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

8

Derived tax revenues (such as sales taxes or personal income taxes) reported in governmental-type funds are recognized in the period the underlying exchange occurs if the resources are measurable and available.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

9

GASB standards require that grant recipients recognize revenues in governmental-type funds in the period that all applicable eligibility requirements are met.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

10

A city receives a grant with only a time requirement that is accounted for in a Special Revenue Fund. The city receives $200,000 in the current fiscal year, but the grant proceeds cannot be used until the next fiscal year. The city would recognize $200,000 as intergovernmental grant revenues in the next fiscal year.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

11

A school district is the recipient of an expenditure-driven grant of $40,000 from the state that is to pay for teacher training on new technologies. The school district spends the $40,000 for the teacher training in the current fiscal year but does not receive the $40,000 until the fourth day of the school district's next fiscal year. The school district should report $40,000 as intergovernmental grant revenue in its current fiscal year-end statement of revenues, expenditures, and changes in fund balance for its Special Revenue Fund.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

12

In governmental-type funds, salaries not paid at year-end are reported as expenditures along with the related liability.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

13

Governments recognize expenditures and liabilities for compensated absences in governmental-type funds when the employee earns the benefits-regardless of when the benefits are paid.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

14

An interfund reimbursement occurs when a fund provides cash to another fund without equivalent flows of assets in return and without a requirement of repayment.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

15

An interfund loan occurs when one fund lends cash to another fund with a requirement for repayment.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

16

When a fund repays another fund for expenditures or expenses initially paid by for by a fund other than the one that should have paid for the transaction, it is referred to as interfund services provided and used.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

17

The General Fund receives $5,000 from the sale of equipment that originally cost $4,000 and had accumulated depreciation associated with it of $3,000. The government should report a $4,000 on sale of equipment in the General Fund.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

18

The GASB allows two methods of accounting for inventories in governmental-type funds-the consumption method and the purchases method.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

19

Under the consumption method of accounting for inventories, a debit is made to Supplies inventory and a credit is made to Nonspendable fund balance if year-end inventory is greater than the beginning of the year inventory in governmental-type funds.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

20

The financial statements required for the General Fund or a Special Revenue Fund are a balance sheet and a statement of revenues, expenditures, and changes in fund balance.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

21

Unmatured long-term liabilities are not reported in the General Fund balance sheet even though the liabilities may ultimately be paid from resources in the General Fund.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

22

Unassigned fund balance is the residual classification for the General Fund and Special Revenue Funds.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

23

Governmental-type funds have five fund balance classifications: nonspendable fund balance, restricted fund balance, committed fund balance, assigned fund balance, and unassigned fund balance.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

24

Any fund balance in a governmental-type fund other than the General Fund that is not classified as nonspendable, restricted, or committed should be classified as assigned.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

25

The measurement focus used by governmental-type funds measure:

A) Capital resources

B) Financial resources

C) Financial resources and capital resources

D) Economic resources

A) Capital resources

B) Financial resources

C) Financial resources and capital resources

D) Economic resources

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

26

In the absence of an explicit requirement to do otherwise, a government should:

A) Record an expenditure in a governmental-type fund only when cash is paid for a good or service.

B) Accrue a liability in a governmental-type fund in the period in which the government orders a good or service.

C) Accrue a liability in a governmental-type fund in the period in which the government incurs a liability.

D) Record an expenditure in a governmental-type fund when the usefulness of an asset has expired.

A) Record an expenditure in a governmental-type fund only when cash is paid for a good or service.

B) Accrue a liability in a governmental-type fund in the period in which the government orders a good or service.

C) Accrue a liability in a governmental-type fund in the period in which the government incurs a liability.

D) Record an expenditure in a governmental-type fund when the usefulness of an asset has expired.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

27

The governmental fund balance sheet equation includes the following elements:

A) Financial assets, near-term liabilities, deferred inflows of resources, and fund balance.

B) Financial assets, long-term liabilities, deferred outflows of resources, and fund balance.

C) Financial assets, capital assets, near-term liabilities, and long-term liabilities.

D) Deferred outflows of resources, deferred inflows of resources, intangible assets, and fund balance.

A) Financial assets, near-term liabilities, deferred inflows of resources, and fund balance.

B) Financial assets, long-term liabilities, deferred outflows of resources, and fund balance.

C) Financial assets, capital assets, near-term liabilities, and long-term liabilities.

D) Deferred outflows of resources, deferred inflows of resources, intangible assets, and fund balance.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

28

Deferred inflows are a government's:

A) Revenues that are recognized in the current reporting period.

B) Expenditures that will be recognized in a future reporting period.

C) Acquisition of net assets that are applicable to a future reporting period.

D) Consumption of net assets that is applicable to a future reporting period.

A) Revenues that are recognized in the current reporting period.

B) Expenditures that will be recognized in a future reporting period.

C) Acquisition of net assets that are applicable to a future reporting period.

D) Consumption of net assets that is applicable to a future reporting period.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

29

Deferred property tax revenues are a:

A) Financial asset

B) Near-term liability

C) Deferred outflows of resources

D) Deferred inflows of resources

A) Financial asset

B) Near-term liability

C) Deferred outflows of resources

D) Deferred inflows of resources

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

30

On the first day of its fiscal year (January 1, 2019), a town recorded General Fund property tax receivables of $600,000. By year-end (December 31), taxpayers had paid a total $575,000. Based on previous experience, the town expected to collect the $25,000 of delinquent taxes as follows: $10,000 in January and February of 2020 and $15,000 between March 5th and August 30th of 2020. How much should the town report as property tax revenue in its General Fund statements for the year 2019?

A) $585,000

B) $600,000

C) $590,000

D) $575,000

A) $585,000

B) $600,000

C) $590,000

D) $575,000

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

31

On January 1, 2019, a city recorded General Fund property tax revenues of $750,000 but made no provision for uncollectible receivables or tax refunds. During the year, it collected property taxes of $720,000, wrote off $4,000 as uncollectible, and made tax refunds of $3,000. At year-end, the city finance director concluded that $10,000 of the delinquent taxes would be collected in January and February of 2020, $12,000 would be collected later in 2020, and $1,000 would need to be written off as uncollectible. How much should the city report as property tax revenue in its General Fund financial statements for the year 2019?

A) $720,000

B) $730,000

C) $742,000

D) $713,000

A) $720,000

B) $730,000

C) $742,000

D) $713,000

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

32

On January 1, 2019, a city recorded General Fund property tax revenues of $750,000 but made no provision for uncollectible receivables or tax refunds. During the year, it collected property taxes of $720,000, wrote off $4,000 as uncollectible, and made tax refunds of $3,000. At year-end, the city finance director concluded that $10,000 of the delinquent taxes would be collected in January and February of 2020, $12,000 would be collected later in 2020, and $1,000 would need to be written off as uncollectible. How much should the city report as Deferred revenues-property taxes in its General Fund financial statements for the year 2019?

A) $26,000

B) $22,000

C) $12,000

D) $10,000

A) $26,000

B) $22,000

C) $12,000

D) $10,000

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

33

A state collects sales taxes for a city. During calendar year 2019 the state remits $1,000,000 to the city for sales taxes collected for the city. On January 30, 2020, the state sends the city $300,000 for sales taxes collected in the fourth quarter of 2019. On March 1, 2020, the state sends the city $60,000 for sales taxes applicable to 2019 but sent in by late filers. The city has a stated policy of treating sales taxes as "available" if received by March 30 of the year after the applicable sales tax year. Based on the foregoing information only, how much should the city recognize as sales tax revenues in its financial statements for the year ended December 31, 2019?

A) $1,000,000

B) $1,060,000

C) $1,300,000

D) $1,360,000

A) $1,000,000

B) $1,060,000

C) $1,300,000

D) $1,360,000

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

34

During its 2019 fiscal year, a city receives a grant from the state to hire a police officer who is to educate young people about the dangers of using illegal drugs. The grant is for $60,000. The only requirement is that the city hire the police officer. The city hires the police officer and will receive the grant proceeds from the state during its 2019 fiscal year and the proceeds are considered available at the time of hire. How should the city report the grant in its Special Revenue Fund when it hires the police officer?

a.

b.

c.

d. No entry should be reported until the cash is received from the state.

a.

b.

c.

d. No entry should be reported until the cash is received from the state.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

35

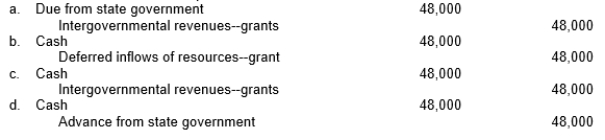

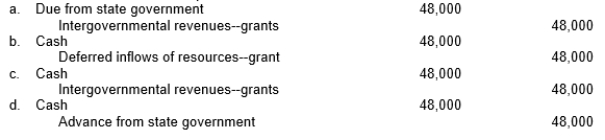

During its 2019 fiscal year, a city receives a grant from the state to hire a police officer who is to educate young people about the dangers of using illegal drugs. The grant is for up to $48,000 and must be spent by the city's 2022 fiscal year. The state pays the $48,000 grant proceeds to the city during the city's fiscal year 2019. The only requirement is that the city hire and pay the salary of the police officer. The city hires the police officer on the last day of its 2019 fiscal year, but the police officer did not work in fiscal year 2019. How should the city report the grant proceeds received from the state in its Special Revenue Fund?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

36

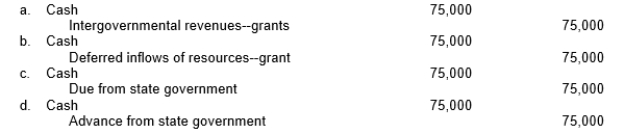

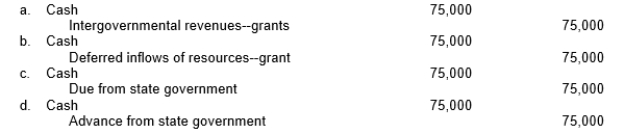

During its 2019 fiscal year, a city receives a grant from the state to use on a worthy city project as determined by the city council. No other eligibility requirements exist, but the state requires that the grant proceeds not be spent before the city's 2020 fiscal year. The city council decides to hire a police officer who is to educate young people about the dangers of using illegal drugs. The grant is for $75,000. The state pays the city $75,000 for the grant during its 2019 fiscal year. How should the city report the receipt of the grant proceeds from the state in its Special Revenue Fund?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

37

A town's garbage trucks accidentally sideswiped two parked automobiles in the fiscal year ended December 31, 2019. One case was settled for $3,000 in 2019, and the town expects to pay that claim in January 2020. In the other case, the claimant originally demanded $15,000. The town attorney thinks they can settle the claim for $10,000, but it probably will take two years to settle the case. What amount should the town report as a claims liability on the General Fund's December 31, 2019 balance sheet?

A) $0

B) $3,000

C) $13,000

D) $18,000

A) $0

B) $3,000

C) $13,000

D) $18,000

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

38

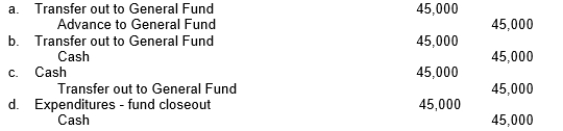

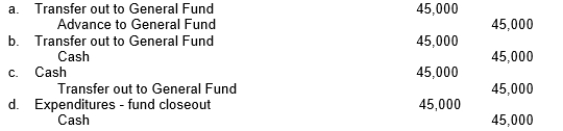

The city council decides to close the Library Special Revenue fund and send its remaining resources ($45,000 cash) to the General Fund. What journal entry should the Library Special Revenue Fund make?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

39

A city paid $40,000 for police cars with the expectation that they would have a useful life of 4 years. After 3 years, the city sold the cars for $3,000. How should the city account for the sale in the General Fund?

a.

b.

c.

d.

a.

b.

c.

d.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

40

A city uses General Fund resources to purchase a police car costing $40,000. How should the city account for the purchase in the General Fund?

a.

b.

c.

d.

a.

b.

c.

d.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

41

The GASB allows which of the following method(s) to account for inventories and prepayments?

A) Only the purchases method

B) Only the modified method

C) Only the consumption method

D) Purchases method and consumption method

E) Purchases method and modified method

A) Only the purchases method

B) Only the modified method

C) Only the consumption method

D) Purchases method and consumption method

E) Purchases method and modified method

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

42

A city uses the purchases method of accounting for supplies in the General Fund. How should the General Fund record a purchase of supplies?

A) Debit Supplies inventory and credit Expenditures-supplies

B) Debit Supplies inventory and credit Vouchers payable

C) Debit Expenditures-supplies and credit Vouchers payable

D) Debit Supplies inventory and credit Nonspendable fund balance

A) Debit Supplies inventory and credit Expenditures-supplies

B) Debit Supplies inventory and credit Vouchers payable

C) Debit Expenditures-supplies and credit Vouchers payable

D) Debit Supplies inventory and credit Nonspendable fund balance

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

43

A city uses the consumption method of accounting for supplies in the General Fund. How should the General Fund record a purchase of supplies?

A) Debit Supplies inventory and credit Expenditures-supplies

B) Debit Supplies inventory and credit Vouchers payable

C) Debit Expenditures-supplies and credit Vouchers payable

D) Debit Supplies inventory and credit Nonspendable fund balance

A) Debit Supplies inventory and credit Expenditures-supplies

B) Debit Supplies inventory and credit Vouchers payable

C) Debit Expenditures-supplies and credit Vouchers payable

D) Debit Supplies inventory and credit Nonspendable fund balance

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

44

The statement of revenues, expenditures, and changes in fund balance for Special Revenue Funds includes which of the following major sections?

A) Revenues

B) Expenditures

C) Other financing sources and uses

D) All of the above

E) Both a. and b.

A) Revenues

B) Expenditures

C) Other financing sources and uses

D) All of the above

E) Both a. and b.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

45

Revenues in governmental-type funds may best be defined as:

A) Increases in overall economic resources of a government.

B) Increases in net assets of a fund.

C) Increases in fund financial resources other than from interfund transfers and the proceeds of debt.

D) Increases in fund economic resources other than from interfund transfers and the proceeds of debt.

A) Increases in overall economic resources of a government.

B) Increases in net assets of a fund.

C) Increases in fund financial resources other than from interfund transfers and the proceeds of debt.

D) Increases in fund economic resources other than from interfund transfers and the proceeds of debt.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

46

Other financing sources in governmental-type funds may be defined as:

A) Increases in net assets of the government as a whole.

B) Increases in assets of a fund that generally do not increase the net assets of the government as a whole.

C) Increases in fund financial resources other than from interfund transfers and the proceeds of debt.

D) Increases in fund economic resources other than from interfund transfers and the proceeds of debt.

A) Increases in net assets of the government as a whole.

B) Increases in assets of a fund that generally do not increase the net assets of the government as a whole.

C) Increases in fund financial resources other than from interfund transfers and the proceeds of debt.

D) Increases in fund economic resources other than from interfund transfers and the proceeds of debt.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

47

A county has $3,650,000 of outstanding encumbrances related to unassigned resources at year-end, December 31, 2019. It expects to accept delivery on all orders in 2020. How should the county handle the outstanding encumbrances in its General Fund balance sheet at December 31, 2019?

A) It should report encumbrances as if they were expenditures and liabilities of the year 2019

B) It should close the open encumbrances and show them as part of unassigned fund balance

C) It should close the open encumbrances and show them as part of assigned fund balance

D) It should close the open encumbrances and make no adjustments to fund balance

A) It should report encumbrances as if they were expenditures and liabilities of the year 2019

B) It should close the open encumbrances and show them as part of unassigned fund balance

C) It should close the open encumbrances and show them as part of assigned fund balance

D) It should close the open encumbrances and make no adjustments to fund balance

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

48

The City of Mayville had total fund balance in its General Fund of $200,000 on December 31, 2019. The City of Maysville's General Fund balance sheet for its December 31, 2019 year end shows inventory of $28,000 and prepaid rent of $10,000. The City also had $60,000 of outstanding encumbrances related to unassigned resources in its General Fund at year-end. In December 2019, a grantor provided the City with $42,000 that must be used to pay musicians who perform in the City's series of summer concerts in the park during 2020. How much should the City report as assigned fund balance in its General Fund on December 31, 2019?

A) $28,000

B) $38,000

C) $42,000

D) $60,000

E) $98,000

A) $28,000

B) $38,000

C) $42,000

D) $60,000

E) $98,000

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

49

The City of Mayville had total fund balance in its General Fund of $200,000 on December 31, 2019. The City of Maysville's General Fund balance sheet for its December 31, 2019 year end shows inventory of $28,000 and prepaid rent of $10,000. The City also had $60,000 of outstanding encumbrances in its General Fund at year-end. In December 2019, a grantor provided the City with $42,000 that must be used to pay musicians who perform in the City's series of summer concerts in the park during 2020. How much should the city report as nonspendable fund balance in its General Fund on December 31, 2019?

A) $10,000

B) $28,000

C) $38,000

D) $42,000

E) $60,000

A) $10,000

B) $28,000

C) $38,000

D) $42,000

E) $60,000

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

50

The City of Mayville had total fund balance in its General Fund of $200,000 on December 31, 2019. The City of Maysville's General Fund balance sheet for its December 31, 2019 year end shows inventory of $28,000 and prepaid rent of $10,000. The City also had $60,000 of outstanding encumbrances in its General Fund at year-end. In December 2019, a grantor provided the City with $42,000 that must be used to buy musical instruments for the City's youth orchestra. No instruments had been purchased at year-end. How much should the City report as restricted fund balance in its General Fund on December 31, 2019?

A) $28,000

B) $38,000

C) $42,000

D) $60,000

E) $102,000

A) $28,000

B) $38,000

C) $42,000

D) $60,000

E) $102,000

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

51

The City of Mayville had total fund balance in its General Fund of $200,000 on December 31, 2019. The City of Maysville's General Fund balance sheet for its December 31, 2019 year end shows inventory of $28,000 and prepaid rent of $10,000. The City also had $60,000 of outstanding encumbrances in its General Fund at year-end. In December 2019, a grantor provided the City with $42,000 that must be used to buy musical instruments for the City's youth orchestra. No instruments had been purchased at year-end. How much should the City report as unassigned fund balance in its General Fund on December 31, 2019?

A) $38,000

B) $60,000

C) $80,000

D) $102,000

E) $120,000

A) $38,000

B) $60,000

C) $80,000

D) $102,000

E) $120,000

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

52

Prepare entries to record the following transactions and events related to Dominguez County's property taxes for the year beginning January 1, 2019:

a. To raise property tax revenues of $940,000, the County sends bills to property owners totaling $950,000. This will provide $10,000 for uncollectible taxes and refunds.

b. Shortly after receiving his $5,000 tax bill, Harold appeals his assessment. His tax bill is reduced by $1,000. He then pays the remaining $4,000 that is due.

c. Dominguez County receives $900,000 in cash from taxpayers (other than Harold) who make timely payment on their taxes.

d. Brown's home is destroyed by fire. He declares bankruptcy and the County writes off his $3,000 tax bill as uncollectible.

e. C. Blacke and D. Wight, who received bills totaling $8,000, are unable to pay on time. The County bills them $300 for interest. They subsequently pay the taxes plus interest. (Do not make an adjustment for delinquent taxes receivable for C. Blacke and D. Wight as this entry is only made at year-end.)

f. At year-end, the County declares all unpaid property taxes to be delinquent. Interest and penalties amounting to $1,500 is assessed against the delinquent taxpayers and is considered available.

g. The County decides to increase its allowance for uncollectible taxes by $1,000.

a. To raise property tax revenues of $940,000, the County sends bills to property owners totaling $950,000. This will provide $10,000 for uncollectible taxes and refunds.

b. Shortly after receiving his $5,000 tax bill, Harold appeals his assessment. His tax bill is reduced by $1,000. He then pays the remaining $4,000 that is due.

c. Dominguez County receives $900,000 in cash from taxpayers (other than Harold) who make timely payment on their taxes.

d. Brown's home is destroyed by fire. He declares bankruptcy and the County writes off his $3,000 tax bill as uncollectible.

e. C. Blacke and D. Wight, who received bills totaling $8,000, are unable to pay on time. The County bills them $300 for interest. They subsequently pay the taxes plus interest. (Do not make an adjustment for delinquent taxes receivable for C. Blacke and D. Wight as this entry is only made at year-end.)

f. At year-end, the County declares all unpaid property taxes to be delinquent. Interest and penalties amounting to $1,500 is assessed against the delinquent taxpayers and is considered available.

g. The County decides to increase its allowance for uncollectible taxes by $1,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

53

In its General Fund balance sheet at December 31, 2019, Marathon City reported Property taxes receivable of $40,000, deferred property tax revenues of $15,000, and an allowance for uncollectible taxes of $0. At the start of the year 2020, Marathon City made the following journal entry to record its property tax levy:

During the year 2020, the city collected all the property taxes receivable outstanding at December 31, 2019. It also collected $920,000 of the receivables recognized at the beginning of 2020 and wrote off $6,000 of receivables against the allowance account. On December 31, 2020, the Marathon City finance director made the following determinations regarding the property taxes outstanding at that date:

a. All outstanding property taxes would be collected, so there was no need for the allowance for uncollectible property taxes.

b. The City would collect about $15,000 of the outstanding property taxes receivable during the first 60 days of 2021 and the remainder during the latter part of 2021.

Required: Calculate how much property tax revenues Marathon City should recognize in 2020.

During the year 2020, the city collected all the property taxes receivable outstanding at December 31, 2019. It also collected $920,000 of the receivables recognized at the beginning of 2020 and wrote off $6,000 of receivables against the allowance account. On December 31, 2020, the Marathon City finance director made the following determinations regarding the property taxes outstanding at that date:

a. All outstanding property taxes would be collected, so there was no need for the allowance for uncollectible property taxes.

b. The City would collect about $15,000 of the outstanding property taxes receivable during the first 60 days of 2021 and the remainder during the latter part of 2021.

Required: Calculate how much property tax revenues Marathon City should recognize in 2020.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

54

Prepare entries to record the following transactions and events related to Colfax County's tax revenues for the year beginning January 1, 2019:

a. To raise property tax revenue of $800,000, the County bills its property owners a total of $802,000, providing $2,000 for uncollectible and refundable taxes.

b. During the year, taxpayers pay a total of $750,000 in property taxes.

c. E. Bloodworth declares bankruptcy, owing the County $2,000 in property taxes. The County writes off the unpaid amount as uncollectible.

d. At year-end, the County declares all unpaid property taxes to be delinquent.

e. To prepare financial statements for the year, the County comptroller estimates that Colfax will receive $20,000 in delinquent 2019 property taxes before the end of February, 2020. The other delinquent taxes will trickle in later in 2020.

a. To raise property tax revenue of $800,000, the County bills its property owners a total of $802,000, providing $2,000 for uncollectible and refundable taxes.

b. During the year, taxpayers pay a total of $750,000 in property taxes.

c. E. Bloodworth declares bankruptcy, owing the County $2,000 in property taxes. The County writes off the unpaid amount as uncollectible.

d. At year-end, the County declares all unpaid property taxes to be delinquent.

e. To prepare financial statements for the year, the County comptroller estimates that Colfax will receive $20,000 in delinquent 2019 property taxes before the end of February, 2020. The other delinquent taxes will trickle in later in 2020.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

55

Prepare entries to record the following transactions and events related to Colfax County's tax revenues in its General Fund for the year beginning January 1, 2019:

a. The state collects sales taxes on behalf of Colfax County. It sends the County $150,000 for sales taxes collected during the year.

b. To prepare financial statements for the year, the County comptroller determines that the state will remit $10,000 to Colfax in January 2020 for sales taxes collected by merchants in December 2019. The County considers taxes expected to be collected by the end of February 2020 as available.

a. The state collects sales taxes on behalf of Colfax County. It sends the County $150,000 for sales taxes collected during the year.

b. To prepare financial statements for the year, the County comptroller determines that the state will remit $10,000 to Colfax in January 2020 for sales taxes collected by merchants in December 2019. The County considers taxes expected to be collected by the end of February 2020 as available.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

56

The City of Ayers accounts for the following activities in its Special Revenue Fund. The City receives the following grants:

a. The City of Ayers seeks to be reimbursed by the state for costs incurred in training police officers to better handle stressful situations. To receive reimbursement, the City must submit quarterly reports showing its expenditures, which it has done. Its expenditures for the quarter January through March 2019 were $320,000. Prepare separate journal entries to record (1) its expenditures under the grant and (2) its billing to the state.

b. The City of Ayers receives an expenditure-driven grant from the federal government to provide public concerts to traditionally underserved communities. The grant contains no time limits, but the City of Ayers must sponsor "qualifying" concerts as an eligibility requirement to be reimbursed for concert costs. The City will be reimbursed for each dollar it spends on qualifying concerts up to a maximum of $60,000.

Prepare three separate journal entries in the City of Ayers' Parks and Recreation Special Revenue Fund to record (1) receipt of a $20,000 of grant proceeds that is received from the federal government prior to City sponsoring a qualifying concert, (2) incurring $65,000 of cash expenditures in the Special Revenue Fund for qualifying concerts during the current year, and (3) recording revenue from and the billing to the federal government.

a. The City of Ayers seeks to be reimbursed by the state for costs incurred in training police officers to better handle stressful situations. To receive reimbursement, the City must submit quarterly reports showing its expenditures, which it has done. Its expenditures for the quarter January through March 2019 were $320,000. Prepare separate journal entries to record (1) its expenditures under the grant and (2) its billing to the state.

b. The City of Ayers receives an expenditure-driven grant from the federal government to provide public concerts to traditionally underserved communities. The grant contains no time limits, but the City of Ayers must sponsor "qualifying" concerts as an eligibility requirement to be reimbursed for concert costs. The City will be reimbursed for each dollar it spends on qualifying concerts up to a maximum of $60,000.

Prepare three separate journal entries in the City of Ayers' Parks and Recreation Special Revenue Fund to record (1) receipt of a $20,000 of grant proceeds that is received from the federal government prior to City sponsoring a qualifying concert, (2) incurring $65,000 of cash expenditures in the Special Revenue Fund for qualifying concerts during the current year, and (3) recording revenue from and the billing to the federal government.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

57

Prepare entries for the General fund to record the following transactions and events related to the City of Sandy Loam's fiscal year-ending December 31, 2019 financial statements:

a. The City paid $85,000 of salaries during December 2019.

b. City workers earned an additional $20,000 for work done during the last week of December 2019 that will not be paid until January 4, 2020.

c. The City of Sandy Loam was involved in two lawsuits during 2019. (1) The first suit was settled for $24,000 on December 24, 2019 but will not be paid until January 12, 2020. (2) The City is in the process of negotiating a settlement for the second lawsuit. The attorneys believe that an agreement will likely be reached in late 2020 or early 2021 with payment of around $45,000 likely to be made late in 2021.

a. The City paid $85,000 of salaries during December 2019.

b. City workers earned an additional $20,000 for work done during the last week of December 2019 that will not be paid until January 4, 2020.

c. The City of Sandy Loam was involved in two lawsuits during 2019. (1) The first suit was settled for $24,000 on December 24, 2019 but will not be paid until January 12, 2020. (2) The City is in the process of negotiating a settlement for the second lawsuit. The attorneys believe that an agreement will likely be reached in late 2020 or early 2021 with payment of around $45,000 likely to be made late in 2021.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

58

The General Fund of the City of Mineral Wells shows $40,000 in supplies inventory on January 1, 2019. During the year 2019, General Fund cash is used to purchase $110,000 of supplies. On December 31, 2019, the city conducts an inventory count and finds $50,000 of supplies inventory remains. Using the purchases method of accounting for inventory, prepare the journal entries necessary to record (a) the purchase of the supplies and (b) to make the year-end adjustment to inventory.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

59

The General Fund of the City of Mineral Wells shows $40,000 in supplies inventory on January 1, 2019. During the year 2019, General Fund cash is used to purchase $110,000 of supplies. On December 31, 2019, the city conducts an inventory count and finds $50,000 of supplies inventory remains. The city used supplies inventory of $100,000 during 2019. Using the consumption method of accounting for inventory, prepare the journal entries necessary to record (a) the purchase of the inventory and (b) the use of inventory during the year.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

60

The General Fund of the City of Davis Fort has a total fund balance of $1,000,000 as of its fiscal year-end, December 31, 2019. Please review the following additional information regarding its General Fund activities and determine how much fund balance should be classified as nonspendable, restricted, committed, assigned, and unassigned. Show the calculations necessary for making the fund balance determinations.

1. The balance sheet of the City of Davis Fort showed $100,000 of inventory on December 31, 2019.

2. The highest level of decision making authority for the city (the city council) passed an ordinance that any royalty payments received from oil production on city property must be used for city park maintenance. At year-end, the city had not spent $220,000 of the oil royalty proceeds that it had received.

3. The General Fund made a long-term loan of $60,000 to the Civic Center Capital Projects Fund during 2019. None had been repaid by December 31, 2019, and none is expected to be repaid until 2022.

4. The city council of the City of Davis Fort approves its 2020 budget in December, 2019. It appropriates $110,000 of the December 31, 2019 fund balance to eliminate an anticipated General Fund budget deficit in the 2020 budget. The anticipated budget deficit is the result of expected 2020 expenditures exceeding expected 2020 revenues.

5. The General Fund receives a grant from a local foundation that must be used for park maintenance. The grant had no time restrictions. At year-end, the General Fund had unspent resources of $10,000. (The City decided to account for this in the General Fund because it is considered immaterial and most of the grant proceeds had been spent in 2019.)

6. The city council authorized the city's finance director to set aside a portion of General Fund balance for future repairs to the city's administrative building. During 2019, the finance director set aside $20,000; none of which had been spent at year-end.

1. The balance sheet of the City of Davis Fort showed $100,000 of inventory on December 31, 2019.

2. The highest level of decision making authority for the city (the city council) passed an ordinance that any royalty payments received from oil production on city property must be used for city park maintenance. At year-end, the city had not spent $220,000 of the oil royalty proceeds that it had received.

3. The General Fund made a long-term loan of $60,000 to the Civic Center Capital Projects Fund during 2019. None had been repaid by December 31, 2019, and none is expected to be repaid until 2022.

4. The city council of the City of Davis Fort approves its 2020 budget in December, 2019. It appropriates $110,000 of the December 31, 2019 fund balance to eliminate an anticipated General Fund budget deficit in the 2020 budget. The anticipated budget deficit is the result of expected 2020 expenditures exceeding expected 2020 revenues.

5. The General Fund receives a grant from a local foundation that must be used for park maintenance. The grant had no time restrictions. At year-end, the General Fund had unspent resources of $10,000. (The City decided to account for this in the General Fund because it is considered immaterial and most of the grant proceeds had been spent in 2019.)

6. The city council authorized the city's finance director to set aside a portion of General Fund balance for future repairs to the city's administrative building. During 2019, the finance director set aside $20,000; none of which had been spent at year-end.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

61

The Town of Elderville accounts for its revenues and day-to-day operating expenditures in its General Fund. The Town uses encumbrance accounting to keep budgetary control over the appropriation for "other expenditures." Prepare journal entries to record these transactions in the General Fund for the calendar year 2019.

a. A long-time employee of the Town of Elderville retires. Per Town policy, the employee is paid $9,800 for accumulated vacation pay.

b. To raise the required $315,000 in property taxes, property owners are billed for a total of $317,000. This will allow $2,000 for estimated uncollectible property taxes and refunds.

c. To provide cash at the start of the year, the Town borrows $100,000 from the Electric Utility Enterprise Fund. The borrowing will be repaid in six months.

d. The Town sends a purchase order for $4,000 to a vendor for supplies.

e. The General Fund pays $85,000 to the Debt Service Fund (DSF) to enable the DSF to pay interest and principal on Town debt.

f. The vendor in d., above, delivers the supplies ordered by the Town, and bills the Town for $4,200. The Town accepts delivery and prepares a voucher for the full amount of the bill. The Town uses the purchases method to account for supplies inventory.

g. Property owners pay property taxes in the amount of $300,000.

h. The Town repays the $100,000 borrowed in c., above.

i. The voucher in f., above, is paid.

j. The Town receives $80,000 for sales taxes collected by the state on behalf of the Town.

k. S. Sparrow, a long-time resident, is unable to pay his $3,000 property tax bill in full. He pays $1,000, and the Town writes off the remaining $2,000 as uncollectible.

l. The Town declares all remaining unpaid property taxes to be delinquent. It also notifies delinquent property owners that they owe penalties of $2,000 on the delinquent taxes.

m. The General Fund receives a bill from the Water Utility Fund for $6,000.

n. The Town pays personal services in the amount of $253,000.

o. The Town is notified by the state that it collected an additional $3,000 in December 2019 sales taxes that it will remit to the Town on January 20, 2020. The Town considers sales taxes collected within 60 days of its fiscal year-end available.

p. The Town files a tax lien against one of the delinquent taxpayers (in l. above). The taxpayer is past due on $4,000 of property taxes and owes penalties and interest of $400 on delinquent taxes.

q. The city sold the property (in p.) at auction for $6,000. The auctioneer charged $300 for his services, which has not yet been paid.

a. A long-time employee of the Town of Elderville retires. Per Town policy, the employee is paid $9,800 for accumulated vacation pay.

b. To raise the required $315,000 in property taxes, property owners are billed for a total of $317,000. This will allow $2,000 for estimated uncollectible property taxes and refunds.

c. To provide cash at the start of the year, the Town borrows $100,000 from the Electric Utility Enterprise Fund. The borrowing will be repaid in six months.

d. The Town sends a purchase order for $4,000 to a vendor for supplies.

e. The General Fund pays $85,000 to the Debt Service Fund (DSF) to enable the DSF to pay interest and principal on Town debt.

f. The vendor in d., above, delivers the supplies ordered by the Town, and bills the Town for $4,200. The Town accepts delivery and prepares a voucher for the full amount of the bill. The Town uses the purchases method to account for supplies inventory.

g. Property owners pay property taxes in the amount of $300,000.

h. The Town repays the $100,000 borrowed in c., above.

i. The voucher in f., above, is paid.

j. The Town receives $80,000 for sales taxes collected by the state on behalf of the Town.

k. S. Sparrow, a long-time resident, is unable to pay his $3,000 property tax bill in full. He pays $1,000, and the Town writes off the remaining $2,000 as uncollectible.

l. The Town declares all remaining unpaid property taxes to be delinquent. It also notifies delinquent property owners that they owe penalties of $2,000 on the delinquent taxes.

m. The General Fund receives a bill from the Water Utility Fund for $6,000.

n. The Town pays personal services in the amount of $253,000.

o. The Town is notified by the state that it collected an additional $3,000 in December 2019 sales taxes that it will remit to the Town on January 20, 2020. The Town considers sales taxes collected within 60 days of its fiscal year-end available.

p. The Town files a tax lien against one of the delinquent taxpayers (in l. above). The taxpayer is past due on $4,000 of property taxes and owes penalties and interest of $400 on delinquent taxes.

q. The city sold the property (in p.) at auction for $6,000. The auctioneer charged $300 for his services, which has not yet been paid.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

62

Presented below is the adjusted trial balance for the General Fund of the Town of Tranquil Bay at December 31, 2019, the end of the fiscal year. Based on this information, prepare, in good form:

a. Closing entries

b. The statement of revenues, expenditures, and changes in fund balance for the year

c. The balance sheet at December 31, 2019. (Assume all fund balance is unassigned.)

a. Closing entries

b. The statement of revenues, expenditures, and changes in fund balance for the year

c. The balance sheet at December 31, 2019. (Assume all fund balance is unassigned.)

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck