Deck 2: Professional Ethics, Legal Liability, Audit Responsibilities and Objectives

Question

Question

Question

Question

Question

Question

Question

Question

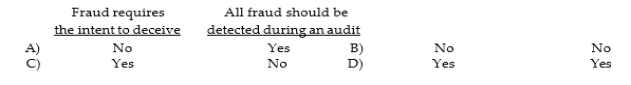

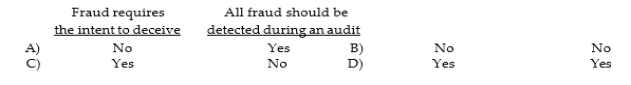

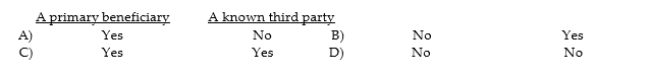

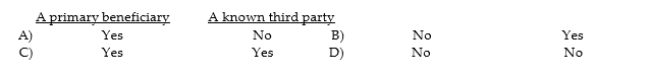

Question

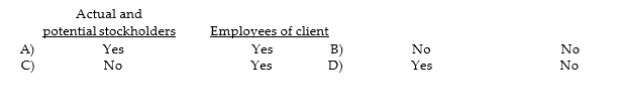

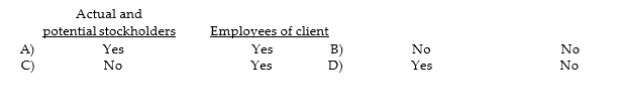

Question

Question

Question

Question

Question

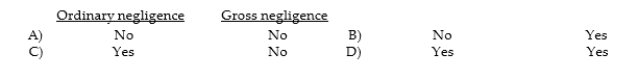

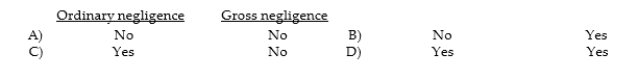

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/103

Play

Full screen (f)

Deck 2: Professional Ethics, Legal Liability, Audit Responsibilities and Objectives

1

While performing services for their clients, professionals have a duty to provide a level of care which is:

A) greater than average.

B) free from judgment errors.

C) superior.

D) reasonable.

A) greater than average.

B) free from judgment errors.

C) superior.

D) reasonable.

reasonable.

2

Which of the following may give rise to a business failure?

A) Poorly trained auditors may perform a company's audit.

B) Management may make ill- advised business decisions.

C) Auditors may fail to uncover employee fraud.

D) An erroneous audit opinion is issued.

A) Poorly trained auditors may perform a company's audit.

B) Management may make ill- advised business decisions.

C) Auditors may fail to uncover employee fraud.

D) An erroneous audit opinion is issued.

Management may make ill- advised business decisions.

3

A(n) ________ failure occurs when an auditor issues an erroneous opinion as the result of an underlying failure to comply with auditing standards.

A) process

B) ethics

C) audit

D) business

A) process

B) ethics

C) audit

D) business

audit

4

Laws that have been passed through a country's parliament are:

A) statutory laws.

B) judicial laws.

C) permanent laws.

D) common laws.

A) statutory laws.

B) judicial laws.

C) permanent laws.

D) common laws.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

5

________ risk represents the possibility that the auditor concludes after conducting an adequate audit that the financial statements were fairly stated when they were actually misstated.

A) Process

B) Failure

C) Audit

D) Business

A) Process

B) Failure

C) Audit

D) Business

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

6

There are a number of things that a professional accountants' association, representing the profession as a whole, can do to reduce an auditor's exposure to lawsuits. One of them is to:

A) perform quality audits.

B) hire qualified auditors and train and supervise them.

C) deal only with clients possessing integrity.

D) sanction members for improper conduct and performance.

A) perform quality audits.

B) hire qualified auditors and train and supervise them.

C) deal only with clients possessing integrity.

D) sanction members for improper conduct and performance.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

7

Historically, most major lawsuits against audit firms have dealt with:

A) audited and unaudited financial statements.

B) disputes arising in the performance of government contracts.

C) disputes over the accuracy of bookkeeping services.

D) disputes over income tax preparation services.

A) audited and unaudited financial statements.

B) disputes arising in the performance of government contracts.

C) disputes over the accuracy of bookkeeping services.

D) disputes over income tax preparation services.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

8

'Privileged communication' between client and auditor is:

A) available in many Arab countries.

B) available for matters involving income taxes only.

C) available in all courts.

D) not available in any court.

A) available in many Arab countries.

B) available for matters involving income taxes only.

C) available in all courts.

D) not available in any court.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements is True?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

10

A group typically included as 'third parties' in common law is:

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

11

Under common law, a foreseen user would be treated the same as:

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

12

Historically, one of the leading case of criminal action against CPAs is the:

A) 1136 Tenants case.

B) United States v. Simon case.

C) Ultramares Corporation v. Touche case.

D) Escott et al. v. Bar Chris case, aka Bar Chris.

A) 1136 Tenants case.

B) United States v. Simon case.

C) Ultramares Corporation v. Touche case.

D) Escott et al. v. Bar Chris case, aka Bar Chris.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

13

A major purpose of capital market authority regulations is to:

A) establish the qualifications for accountants who are members of the profession.

B) provide a set of uniform standards and tests for accountants, attorneys, and others.

C) eliminate incompetent attorneys and accountants who participate in the registration of securities to be offered to the public.

D) provide sufficient reliable information to the investing public who purchases securities in the marketplace.

A) establish the qualifications for accountants who are members of the profession.

B) provide a set of uniform standards and tests for accountants, attorneys, and others.

C) eliminate incompetent attorneys and accountants who participate in the registration of securities to be offered to the public.

D) provide sufficient reliable information to the investing public who purchases securities in the marketplace.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is True?

A) An auditor cannot render an opinion unless the auditor has audited all affiliates of a company.

B) An auditor may not successfully assert that the auditor had no motive to be part of a fraud.

C) An auditor is primarily responsible for a client's footnotes in its financial statements.

D) An auditor may be exposed to criminal as well as civil liability.

A) An auditor cannot render an opinion unless the auditor has audited all affiliates of a company.

B) An auditor may not successfully assert that the auditor had no motive to be part of a fraud.

C) An auditor is primarily responsible for a client's footnotes in its financial statements.

D) An auditor may be exposed to criminal as well as civil liability.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

15

Tort actions can be based on which of the following?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

16

The similarity that exists in both the United States v. Natelli case (i.e., the National Student Marketing case of 1975), and the ESM Government Securities v. Alexander Grant & Co. case of 1986 is that in each case:

A) a partner in a national audit firm served prison time.

B) the partners were punished for the shoddy work of their subordinates.

C) a presidential pardon kept them from serving time in prison and allowed them to retain their CPA licenses.

D) the auditors were not convicted for failing to discover the problem in year 1, but for failing to disclose the problem when it was discovered in year 2.

A) a partner in a national audit firm served prison time.

B) the partners were punished for the shoddy work of their subordinates.

C) a presidential pardon kept them from serving time in prison and allowed them to retain their CPA licenses.

D) the auditors were not convicted for failing to discover the problem in year 1, but for failing to disclose the problem when it was discovered in year 2.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

17

Hussain & Shah, a medium- sized audit firm, employed Sonya as a staff accountant. Sonya was negligent while auditing several of the firm's clients. Under these circumstances, which of the following statements is True?

A) Hussain & Shah is not liable for Sonya's negligence because auditors are generally considered to be independent contractors.

B) Sonya would have no personal liability for negligence.

C) Hussain & Shah would not be liable for Sonya's negligence if she disobeyed specific instructions in the performance of the audits.

D) Hussain & Shah can recover against its insurer on its malpractice policy even if one of the partners was also negligent in reviewing Sonya's work.

A) Hussain & Shah is not liable for Sonya's negligence because auditors are generally considered to be independent contractors.

B) Sonya would have no personal liability for negligence.

C) Hussain & Shah would not be liable for Sonya's negligence if she disobeyed specific instructions in the performance of the audits.

D) Hussain & Shah can recover against its insurer on its malpractice policy even if one of the partners was also negligent in reviewing Sonya's work.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

18

The King Surety Company wrote a general bond covering thefts of assets by the employees of Fayed, Inc. Thereafter, an employee of Fayed embezzled US$17,200 of company funds. When the activities were discovered, King paid Fayed the full amount in accordance with the terms of the fidelity bond, and then sought recovery against Fayed's auditors, Patel & Patel. Which of the following would be Patel & Patel's best defense?

A) Patel & Patel were not guilty either of gross negligence or fraud.

B) King is not in privity of contract.

C) Patel & Patel were not aware of the King- Fayed surety relationship.

D) The theft was the result of clever forgeries and collusive fraud which would not be detected by an examination made in accordance with auditing standards.

A) Patel & Patel were not guilty either of gross negligence or fraud.

B) King is not in privity of contract.

C) Patel & Patel were not aware of the King- Fayed surety relationship.

D) The theft was the result of clever forgeries and collusive fraud which would not be detected by an examination made in accordance with auditing standards.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

19

Distinguish between ordinary negligence and gross negligence.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

20

Distinguish between audit risk and audit failure.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

21

Distinguish between gross negligence and fraud.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

22

Discuss each of the four defenses an auditor can normally use when facing legal claims by clients. Which of these defenses is ordinarily not available against third- party suits?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

23

Discuss some of the steps that professional associations and the accounting profession as a whole can and are taking to reduce the practitioner's exposure to lawsuits.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

24

Explain what each of the following terms means: (1) Business failure; (2) Audit failure; (3) Audit risk.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

25

Match each of the definition with the following terms

-Laws that have been passed by a country's parliament and other governmental units.

A) Common law

B) Breach of contract

C) Joint and several liability

D) Ordinary negligence

E) Third-party beneficiary

F) Gross negligence

G) Statutory law

H) Fraud

I) Separate and proportionate liability

-Laws that have been passed by a country's parliament and other governmental units.

A) Common law

B) Breach of contract

C) Joint and several liability

D) Ordinary negligence

E) Third-party beneficiary

F) Gross negligence

G) Statutory law

H) Fraud

I) Separate and proportionate liability

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

26

Match each of the definition with the following terms

-A situation in which the auditor issues an erroneous audit opinion as the result of an underlying failure to comply with the requirements of generally accepted auditing standards.

A) Ultramares doctrine

B) Audit risk

C) Audit failure

D) Standards failure

E) Business failure

F) Absence of causal connection

G) Contributory negligence

H) Lack of duty to perform

I) Non-negligent performance

-A situation in which the auditor issues an erroneous audit opinion as the result of an underlying failure to comply with the requirements of generally accepted auditing standards.

A) Ultramares doctrine

B) Audit risk

C) Audit failure

D) Standards failure

E) Business failure

F) Absence of causal connection

G) Contributory negligence

H) Lack of duty to perform

I) Non-negligent performance

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

27

Match each of the definition with the following terms

-An auditor's legal defense under which the auditor claims that the client failed to perform certain obligations and that it is the client's failure to perform those obligations that brought about the claimed damages.

A) Ultramares doctrine

B) Audit risk

C) Audit failure

D) Standards failure

E) Business failure

F) Absence of causal connection

G) Contributory negligence

H) Lack of duty to perform

I) Non-negligent performance

-An auditor's legal defense under which the auditor claims that the client failed to perform certain obligations and that it is the client's failure to perform those obligations that brought about the claimed damages.

A) Ultramares doctrine

B) Audit risk

C) Audit failure

D) Standards failure

E) Business failure

F) Absence of causal connection

G) Contributory negligence

H) Lack of duty to perform

I) Non-negligent performance

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

28

Match each of the definition with the following terms

-An auditor's legal defense under which the auditor claims that the audit was performed in accordance with auditing standards .

A) Ultramares doctrine

B) Audit risk

C) Audit failure

D) Standards failure

E) Business failure

F) Absence of causal connection

G) Contributory negligence

H) Lack of duty to perform

I) Non-negligent performance

-An auditor's legal defense under which the auditor claims that the audit was performed in accordance with auditing standards .

A) Ultramares doctrine

B) Audit risk

C) Audit failure

D) Standards failure

E) Business failure

F) Absence of causal connection

G) Contributory negligence

H) Lack of duty to perform

I) Non-negligent performance

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

29

Match each of the definition with the following terms

-An auditor's legal defense under which the auditor contends that the damages claimed by the client were not brought about by any act of the auditor.

A) Ultramares doctrine

B) Audit risk

C) Audit failure

D) Standards failure

E) Business failure

F) Absence of causal connection

G) Contributory negligence

H) Lack of duty to perform

I) Non-negligent performance

-An auditor's legal defense under which the auditor contends that the damages claimed by the client were not brought about by any act of the auditor.

A) Ultramares doctrine

B) Audit risk

C) Audit failure

D) Standards failure

E) Business failure

F) Absence of causal connection

G) Contributory negligence

H) Lack of duty to perform

I) Non-negligent performance

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

30

Several Arab countries have statutes that permit privileged communication between the client and auditor, that in theory allow an auditor to refuse to testify in a court of law.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

31

Securities laws in several Arab countries include specific requirements that in cases of fraudulent financial reporting affecting investors' investments the auditor should be imprisoned.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

32

A challenge associated with the fundamental ethical principles stated in the Code of Ethics for Professional Accountants is:

A) that there are too many to remember.

B) it is impossible to define every situation that creates threats to compliance.

C) that they identify ideal conduct.

D) the emphasis on what accountants can do rather than what they cannot do.

A) that there are too many to remember.

B) it is impossible to define every situation that creates threats to compliance.

C) that they identify ideal conduct.

D) the emphasis on what accountants can do rather than what they cannot do.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

33

Maintaining financial statements users' perception of independence is referred to as independence in:

A) fact.

B) conduct.

C) total.

D) appearance.

A) fact.

B) conduct.

C) total.

D) appearance.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements is True? An audit firm will breach Section 290 of the Code of Ethics on financial interest if:

A) an audit manager in an office different than the office providing audit services has a direct financial interest in the audit client.

B) a family member of one of the audit team has an indirect, immaterial financial interest in an audit client.

C) a member of the auditor's tax services department whom provides 15 hours of non- audit services to the client acquires stock in that client.

D) a staff auditor providing audit services to the client acquires stock in that client.

A) an audit manager in an office different than the office providing audit services has a direct financial interest in the audit client.

B) a family member of one of the audit team has an indirect, immaterial financial interest in an audit client.

C) a member of the auditor's tax services department whom provides 15 hours of non- audit services to the client acquires stock in that client.

D) a staff auditor providing audit services to the client acquires stock in that client.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

35

Section 290 of the Code of Ethics prohibits specific members of an audit firm from owning any stock or having indirect material interest in audit clients. This includes all but which of the following?

A) Members of the audit team working on the engagement.

B) The immediate family of partners working on the engagement.

C) Partners in the office that have no responsibility for the engagement.

D) Staff members of the office that are not involved in the engagement.

A) Members of the audit team working on the engagement.

B) The immediate family of partners working on the engagement.

C) Partners in the office that have no responsibility for the engagement.

D) Staff members of the office that are not involved in the engagement.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

36

The financial interests of which of the following parties would not be included as a 'direct financial interest' of the CPA?

A) Spouse.

B) Sibling.

C) Dependent child.

D) Relative supported by the auditor.

A) Spouse.

B) Sibling.

C) Dependent child.

D) Relative supported by the auditor.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

37

Rules regarding financial allow an auditor to serve as:

A) an honorary director for a not- for- profit charitable or religious organization.

B) a director or officer of an audit client.

C) a trustee of a client's pension fund.

D) an underwriter for the sale of a client's securities.

A) an honorary director for a not- for- profit charitable or religious organization.

B) a director or officer of an audit client.

C) a trustee of a client's pension fund.

D) an underwriter for the sale of a client's securities.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

38

When the question arises whether a CPA firm may do both bookkeeping and auditing services for the same private company client, the Code of Ethics:

A) encourages it.

B) prohibits it.

C) permits it providing certain requirements are meet.

D) permits it in all cases.

A) encourages it.

B) prohibits it.

C) permits it providing certain requirements are meet.

D) permits it in all cases.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following activities is allowed for a audit firm's public interest audit clients?

A) Preparation of tax returns.

B) Accounting and bookkeeping services.

C) Valuation services that have a material effect on financial statements.

D) Recruiting services.

A) Preparation of tax returns.

B) Accounting and bookkeeping services.

C) Valuation services that have a material effect on financial statements.

D) Recruiting services.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

40

The IESBA Code of Ethics (Section 290) requires that an individual shall not be a key audit partner in respect of a public interest entity for more than?

A) five years.

B) ten years.

C) seven years.

D) three years.

A) five years.

B) ten years.

C) seven years.

D) three years.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

41

The fundamental principles of professional ethics for accountants require auditors to maintain objectivity. The term 'objectivity' in the code refers to a auditor's ability to:

A) not allow bias, conflict of interest, or undue influence of others to override professional judgments.

B) distinguish between auditing practices that are acceptable and those that are not.

C) be unyielding in all matters dealing with auditing procedures.

D) choose independently between alternate accounting principles and auditing standards.

A) not allow bias, conflict of interest, or undue influence of others to override professional judgments.

B) distinguish between auditing practices that are acceptable and those that are not.

C) be unyielding in all matters dealing with auditing procedures.

D) choose independently between alternate accounting principles and auditing standards.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

42

Auditors are allowed which of the following forms of advertising?

A) Advertising that respect the fundamental principle of integrity and professional behavior.

B) All forms of advertising-there are no restrictions on how auditors market their services.

C) Advertising that is cleared by the auditor's professional association.

D) No advertising-all advertising is prohibited by the Code of Ethics.

A) Advertising that respect the fundamental principle of integrity and professional behavior.

B) All forms of advertising-there are no restrictions on how auditors market their services.

C) Advertising that is cleared by the auditor's professional association.

D) No advertising-all advertising is prohibited by the Code of Ethics.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following statements is not True with respect to audit committees?

A) Individuals not on a firm's board of directors should comprise the audit committee.

B) An audit committee has responsibility for the engagement of the audit firm.

C) Audit committees are required for all companies.

D) The audit committee generally helps auditors remain independent of a client's management.

A) Individuals not on a firm's board of directors should comprise the audit committee.

B) An audit committee has responsibility for the engagement of the audit firm.

C) Audit committees are required for all companies.

D) The audit committee generally helps auditors remain independent of a client's management.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is not one of the three parts of the IESBA's Code of Ethics?

A) Guidelines for professional accountants on professional services requiring accountancy skills.

B) Guidelines for professional accountants in business.

C) Fundamental principles and general application of the code.

D) Guidelines for professional accountants in public practice.

A) Guidelines for professional accountants on professional services requiring accountancy skills.

B) Guidelines for professional accountants in business.

C) Fundamental principles and general application of the code.

D) Guidelines for professional accountants in public practice.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

45

Where there are differences between the IESBA code and the standards issued by a member body of the IFAC, professional accountants must:

A) comply with the IESBA code.

B) comply with the less stringent requirements and guidance.

C) comply with the standards issued by the IFAC body of which they are members.

D) comply with the more stringent requirements and guidance (unless prohibited by law or regulation).

A) comply with the IESBA code.

B) comply with the less stringent requirements and guidance.

C) comply with the standards issued by the IFAC body of which they are members.

D) comply with the more stringent requirements and guidance (unless prohibited by law or regulation).

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

46

An example of an 'indirect financial interest' in a client would be ownership of a client's stock by the auditor's:

A) nondependent grandparent.

B) spouse.

C) dependent child.

D) all of the above are examples of indirect financial interest.

A) nondependent grandparent.

B) spouse.

C) dependent child.

D) all of the above are examples of indirect financial interest.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

47

The IESBA Code of Ethics permits an audit firm to do both bookkeeping and auditing for the same client if three criteria are met. Which of the following is not one of those criteria?

A) The client is required to file an annual report, including audited financial statements.

B) The practitioner must not assume the role of employee or of manager.

C) The client must accept full responsibility for the financial statements.

D) The client is not a public interest entity.

A) The client is required to file an annual report, including audited financial statements.

B) The practitioner must not assume the role of employee or of manager.

C) The client must accept full responsibility for the financial statements.

D) The client is not a public interest entity.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

48

An increasing number of public companies require shareholders to approve the selection of a new audit firm or the continuation of the existing audit firm because:

A) many capital market authorities requires it.

B) many professional accounting bodies requires it.

C) the shareholders are in a better position to evaluate the performance of previous or potential auditors.

D) shareholders are presumably more objective than management.

A) many capital market authorities requires it.

B) many professional accounting bodies requires it.

C) the shareholders are in a better position to evaluate the performance of previous or potential auditors.

D) shareholders are presumably more objective than management.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

49

Section 140 of the IESBA's Code of Ethics requires CPAs to maintain the confidentiality of client information. The code would be violated if an auditor disclosed information without a client's consent as a result of a:

A) requirement to disclose infringements in law to appropriate public authorities.

B) request by a client's largest stockholder.

C) an order in the course of legal proceedings.

D) a professional obligation to take part in a peer review.

A) requirement to disclose infringements in law to appropriate public authorities.

B) request by a client's largest stockholder.

C) an order in the course of legal proceedings.

D) a professional obligation to take part in a peer review.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

50

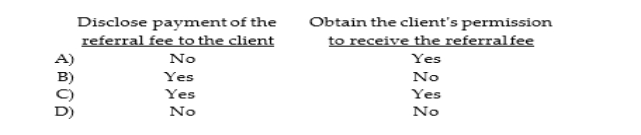

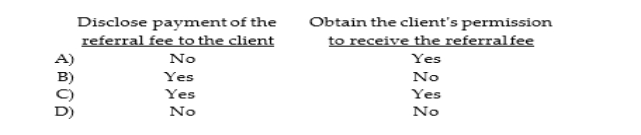

A professional accountant may accept a referral fee for recommending a client to another accountancy firm, but should:

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

51

Section 290 requires a cooling off period of how long before a key audit partner can resume work on audits for a public interest entity after reaching the maximum period of association?

A) Two years.

B) One year.

C) Eighteen months.

D) It is not specified; instead it is left to the auditor's discretion.

A) Two years.

B) One year.

C) Eighteen months.

D) It is not specified; instead it is left to the auditor's discretion.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

52

In which of the following circumstances would an auditor be bound by the fundamental principles to refrain from disclosing any confidential information about a client?

A) An inquiry by a disciplinary body of a national professional accountancy association requests confidential client information.

B) The auditor is issued a summons enforceable by a court order that orders the auditor to present confidential information.

C) Confidential client information is made available as part of a quality review by an authorized peer review team.

D) A major stockholder of a client company seeks accounting information from the auditor after management declined to disclose the requested information.

A) An inquiry by a disciplinary body of a national professional accountancy association requests confidential client information.

B) The auditor is issued a summons enforceable by a court order that orders the auditor to present confidential information.

C) Confidential client information is made available as part of a quality review by an authorized peer review team.

D) A major stockholder of a client company seeks accounting information from the auditor after management declined to disclose the requested information.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

53

Interpretations of the IESBA's Code of Ethics are dominated by the concept of:

A) compliance with standards.

B) acts discreditable to the profession.

C) threats to ethical principles.

D) accounting.

A) compliance with standards.

B) acts discreditable to the profession.

C) threats to ethical principles.

D) accounting.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

54

Generally, loans between an audit firm or a member of the firm and an audit client are prohibited because they create a financial relationship. Which of the following is not an exception to this rule?

A) Unsecured loans guaranteed by the audit client.

B) Home mortgages, from a financial institution audit client, made under normal lending procedures.

C) Loans fully collateralized by cash deposits at the same financial institution.

D) Automobile loans made under normal lending procedures.

A) Unsecured loans guaranteed by the audit client.

B) Home mortgages, from a financial institution audit client, made under normal lending procedures.

C) Loans fully collateralized by cash deposits at the same financial institution.

D) Automobile loans made under normal lending procedures.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

55

Section 290 indicates that materiality is a consideration for evaluating an auditor's:

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is not a violation of one or more of the fundamental principles of the IESBA?

A) An auditor was arrested recently on his way home from the firm's annual social function for staff. He was a passenger in a car driven by his brother and he was charged with 'driving while intoxicated.'

B) An auditor retains a client's books and records to enforce payment of the auditor's bill, even after the client has demanded they be returned.

C) An auditor firm discriminates in its hiring practices based on the age of the applicant.

D) An auditor has issued the standard unmodified audit report after auditing a governmental agency, although auditing standards were not followed because the agency required different procedures.

A) An auditor was arrested recently on his way home from the firm's annual social function for staff. He was a passenger in a car driven by his brother and he was charged with 'driving while intoxicated.'

B) An auditor retains a client's books and records to enforce payment of the auditor's bill, even after the client has demanded they be returned.

C) An auditor firm discriminates in its hiring practices based on the age of the applicant.

D) An auditor has issued the standard unmodified audit report after auditing a governmental agency, although auditing standards were not followed because the agency required different procedures.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

57

In which of the following instances would the independence of the auditor most likely not be considered to be impaired? The auditor has been engaged to audit:

A) cooperative apartment house in which the auditor owns an apartment and is not part of the management.

B) municipality in which the auditor's firm owns US$250,000 of the US$2,500,000 indebtedness of the municipality.

C) charitable organization in which an employee of the auditor's firm serves as treasurer.

D) company in which the auditor's investment club owns a one- tenth interest.

A) cooperative apartment house in which the auditor owns an apartment and is not part of the management.

B) municipality in which the auditor's firm owns US$250,000 of the US$2,500,000 indebtedness of the municipality.

C) charitable organization in which an employee of the auditor's firm serves as treasurer.

D) company in which the auditor's investment club owns a one- tenth interest.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

58

Part A of the IESBA code requires professional accountants to comply with certain fundamental principles. Which of the following is not a fundamental principle addressed in Part A?

A) Integrity.

B) Professional competence and due care.

C) Planning and supervision.

D) Professional behavior.

A) Integrity.

B) Professional competence and due care.

C) Planning and supervision.

D) Professional behavior.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

59

Identify and describe each of the three parts to the IESBA's Code of Ethics.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

60

Discuss the ways in which the accounting profession can ensure it conducts itself in a professional manner by highlighting safeguards and procedures that can be put in place to reduce or eliminate threats to ethical conduct.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

61

What are the five ethical principles stated in the Code of Ethics? Briefly discuss each principle.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

62

Discuss the possible threats to the fundamentals principles in the marketing of professional accountancy services and outline any restrictions on the type of advertising that is permitted.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

63

Section 140 sets out of IESBA's Code of Ethics concerns the principle of confidentiality. Set out some situations in which it might be appropriate to disclose information collected in the course of an audit engagement.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

64

Discuss the obligations placed on auditors by the IESBA code when deciding whether to accept an audit engagement.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

65

For each of the following situations, (1) decide whether the Code of Ethics has been violated, and (2) briefly explain how the situation violates (or does not violate) the code.

-Saif Darwish is an audit manager with Bait Shai & Co., a one- office audit firm. Saif owns 100 shares of common stock in one of the firm's audit clients, but he does not provide any audit or nonaudit services to the company.Violation?

-Saif Darwish is an audit manager with Bait Shai & Co., a one- office audit firm. Saif owns 100 shares of common stock in one of the firm's audit clients, but he does not provide any audit or nonaudit services to the company.Violation?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

66

For each of the following situations, (1) decide whether the Code of Ethics has been violated, and (2) briefly explain how the situation violates (or does not violate) the code.

-The accounting firm of Mutran & Taha provides bookkeeping and tax services for Yunus Corporation, a privately held company. Mutran & Taha also performs the annual audit of Yunus Corporation.Violation?

-The accounting firm of Mutran & Taha provides bookkeeping and tax services for Yunus Corporation, a privately held company. Mutran & Taha also performs the annual audit of Yunus Corporation.Violation?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

67

For each of the following situations, (1) decide whether the Code of Ethics has been violated, and (2) briefly explain how the situation violates (or does not violate) the code.

-Abdul Al Futtaim is the auditor of SJT Trading. A couple of weeks ago, SJT Trading's management expressed an intention to commence litigation against Abdul, alleging he was negligent in last year's audit. Abdul believes there is a strong possibility that management will proceed with the litigation. However, SJT Trading has not fired Abdul as its auditor, and he is now working on the current year's audit.Violation?

-Abdul Al Futtaim is the auditor of SJT Trading. A couple of weeks ago, SJT Trading's management expressed an intention to commence litigation against Abdul, alleging he was negligent in last year's audit. Abdul believes there is a strong possibility that management will proceed with the litigation. However, SJT Trading has not fired Abdul as its auditor, and he is now working on the current year's audit.Violation?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

68

For each of the following situations, (1) decide whether the Code of Ethics has been violated, and (2) briefly explain how the situation violates (or does not violate) the code.

-Youssef Nour has a successful dentistry practice. Youssef has recommended one of his patients to Mokhtar Bassily, an auditor. To show gratitude for the referral, Mokhtar has agreed to pay Youssef a token gift of US$50. Mokhtar discloses the payment arrangement to his new clients.Violation?

-Youssef Nour has a successful dentistry practice. Youssef has recommended one of his patients to Mokhtar Bassily, an auditor. To show gratitude for the referral, Mokhtar has agreed to pay Youssef a token gift of US$50. Mokhtar discloses the payment arrangement to his new clients.Violation?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

69

For each of the following situations, (1) decide whether the Code of Ethics has been violated, and (2) briefly explain how the situation violates (or does not violate) the code.

-The audit firm of Ibrahim and Soueif is negotiating a fee with a new audit client. They agree the client will pay US$50,000 if Ibrahim and Soueif issues a clean, unmodified opinion, US$40,000 if a qualified opinion is issued, and only US$20,000 if an adverse opinion is issued.Violation?

-The audit firm of Ibrahim and Soueif is negotiating a fee with a new audit client. They agree the client will pay US$50,000 if Ibrahim and Soueif issues a clean, unmodified opinion, US$40,000 if a qualified opinion is issued, and only US$20,000 if an adverse opinion is issued.Violation?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

70

For each of the following situations, (1) decide whether the Code of Ethics has been violated, and (2) briefly explain how the situation violates (or does not violate) the code.

-Wael Amin is a member of the engagement team that performs the audit of Hady Corporation. Wael's daughter, Mona, received 10 shares of Shaw Corporation's common stock for her fifth birthday. The stock was a gift from Mona's grandmother.Violation?

-Wael Amin is a member of the engagement team that performs the audit of Hady Corporation. Wael's daughter, Mona, received 10 shares of Shaw Corporation's common stock for her fifth birthday. The stock was a gift from Mona's grandmother.Violation?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

71

For each of the following situations, (1) decide whether the Code of Ethics has been violated, and (2) briefly explain how the situation violates (or does not violate) the code.

-Yaqub Sonbol is a partner in a one- office audit firm that audits Sultan, Inc., a closely held corporation. Yaqub's sister was recently appointed as the chief financial officer for Sutlan, Inc.Violation?

-Yaqub Sonbol is a partner in a one- office audit firm that audits Sultan, Inc., a closely held corporation. Yaqub's sister was recently appointed as the chief financial officer for Sutlan, Inc.Violation?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

72

An auditor is not permitted under the IESBA code to perform both audit services and bookkeeping services for a public interest company in the same year.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

73

In determining the threats to independence and deciding on the appropriate course of action, auditors must rely on rulings and not use their own judgment.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

74

A contingent fee arrangement represents a self- review threat.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

75

An advocacy threat is one that might compromise an auditor's objectivity.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

76

The financial interest of an auditor's brother constitute a direct financial interest.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

77

An auditor can be trustee of a an audit client's pension fund.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

78

Section 290 of the IESBA code states that when total fees from an audit client represent a significant percentage of the total fees for of an audit fee it creates a self- interest or intimidation threat. The code does not set specific limits on the percentage of fees that can be earned from a single client.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

79

Audit firms are not permitted to have contingent fee arrangement for nonattestation services.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

80

Independence is unaffected when an audit firms sues a client's management for fraudulent financial reporting.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck