Deck 10: Leases, Pensions, and Income Taxes

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/68

Play

Full screen (f)

Deck 10: Leases, Pensions, and Income Taxes

1

Capitalizing leases have little effect on a company's return on equity (ROE) ratio.

True

2

Failure to recognize lease assets and liabilities results in understated financial leverage and understated net operating profit (NOPAT).

False

3

Using the capital lease method requires that both the lease asset and lease liability be reported off the balance sheet.

False

4

The defined contribution plan and the defined benefit plan are the two general types of pension plans offered by companies.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

5

The increase in pension obligation due to an employee working an additional year for the employer will cause the net pension liability on the balance sheet to increase.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

6

Income tax expense is not recorded at the amount owing to the tax authorities even if this is the most objectively measured amount.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

7

When a company reports a deferred tax asset it means that the company will receive a tax benefit in the future.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

8

Under the new accounting standard for leases (effective 2019), companies classify all capitalized leases as either:

A) Non-operating or operating leases

B) Finance or operating leases

C) Capital or operating leases

D) Variable interest or fixed rate leases

E) None of the above

A) Non-operating or operating leases

B) Finance or operating leases

C) Capital or operating leases

D) Variable interest or fixed rate leases

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

9

Under the pre-2019 accounting standards, how are operating leases reported in the lessee's balance sheet?

A) As an asset that is depreciated, similar to the company's other assets.

B) As either a short-term or long-term liability, depending on the length of the lease

C) At the present value of the future minimum lease payments.

D) Operating leases are not disclosed in the lessee's balance sheet or annual report.

E) None of the above

A) As an asset that is depreciated, similar to the company's other assets.

B) As either a short-term or long-term liability, depending on the length of the lease

C) At the present value of the future minimum lease payments.

D) Operating leases are not disclosed in the lessee's balance sheet or annual report.

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

10

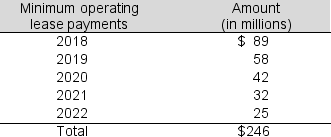

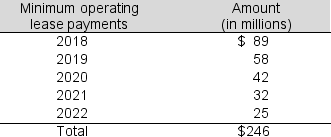

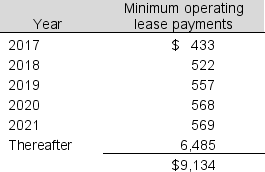

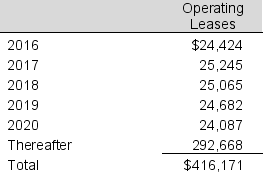

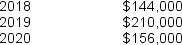

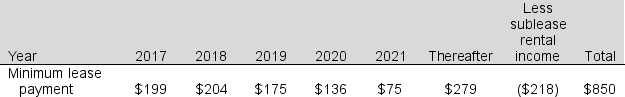

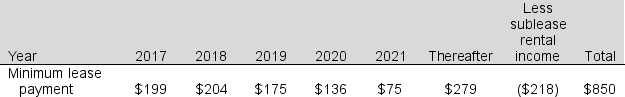

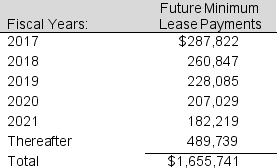

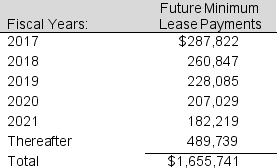

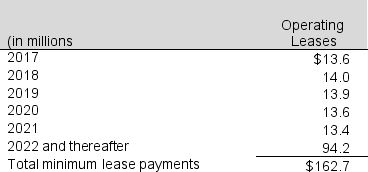

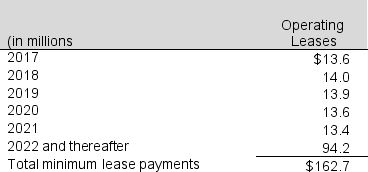

Beacon Industries disclosed the following minimum rental commitments under non-cancelable operating leases in its 2017 annual report:

What is the present value of these operating lease payments, assuming a 6% discount rate?

What is the present value of these operating lease payments, assuming a 6% discount rate?

A) $246 million

B) $215 million

C) $ 70 million

D) $225 million

E) None of the above

What is the present value of these operating lease payments, assuming a 6% discount rate?

What is the present value of these operating lease payments, assuming a 6% discount rate?A) $246 million

B) $215 million

C) $ 70 million

D) $225 million

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

11

Under the pre-2019 accounting standards, which of the following is not a condition requiring the use of the capital lease reporting method?

A) The lease, by its terms, automatically transfers ownership of the leased asset from the lessor to the lessee at the termination of the lease.

B) The lease term is at least 75% of the economic useful life of the leased asset

C) The lease, by its terms, does not automatically transfer ownership of the leased asset from the lessor to the lessee at the termination of the lease.

D) The lease provides that the lessee can purchase the leased asset for a nominal amount (bargain purchase price) at the termination of the lease.

E) None of the above

A) The lease, by its terms, automatically transfers ownership of the leased asset from the lessor to the lessee at the termination of the lease.

B) The lease term is at least 75% of the economic useful life of the leased asset

C) The lease, by its terms, does not automatically transfer ownership of the leased asset from the lessor to the lessee at the termination of the lease.

D) The lease provides that the lessee can purchase the leased asset for a nominal amount (bargain purchase price) at the termination of the lease.

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

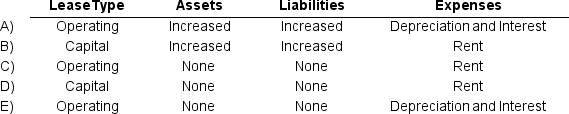

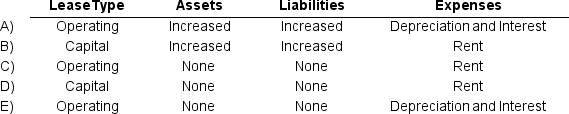

12

Under the pre-2019 accounting standards, GAAP identifies two different approaches in the reporting of leases by the lessee: capital and operating. Which of the following best describes the effects of leasing on the financial statements of the lessee?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

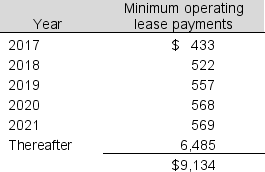

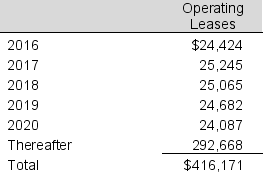

13

Whole Foods Markets reports operating lease information in its 2016 annual report (in millions). You determine that a discount rate of 6.0% is appropriate for Whole Foods and calculate the following. What economic liability is potentially left off Whole Foods' balance sheet? Round the remaining lease term to the nearest whole year.

A) $12,912 million

B) $ 5,356 million

C) $ 5,569 million

D) $ 9,134 million

E) None of the above

A) $12,912 million

B) $ 5,356 million

C) $ 5,569 million

D) $ 9,134 million

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

14

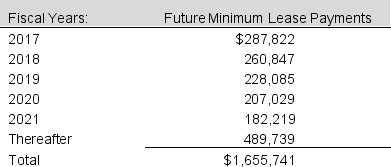

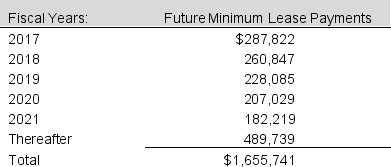

Cabela's Corp disclosed the following minimum rental commitments under non-cancelable operating leases in its 2015 annual report (in millions).

What is the approximate present value of the minimum lease payments? Assume a discount rate of 6.0% and round the remaining lease term to the nearest whole year.

What is the approximate present value of the minimum lease payments? Assume a discount rate of 6.0% and round the remaining lease term to the nearest whole year.

A) $233,357 million

B) $ 15,113 million

C) $255,007 million

D) $373,713 million

E) None of the above

What is the approximate present value of the minimum lease payments? Assume a discount rate of 6.0% and round the remaining lease term to the nearest whole year.

What is the approximate present value of the minimum lease payments? Assume a discount rate of 6.0% and round the remaining lease term to the nearest whole year.A) $233,357 million

B) $ 15,113 million

C) $255,007 million

D) $373,713 million

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

15

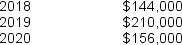

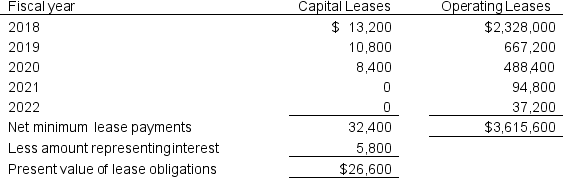

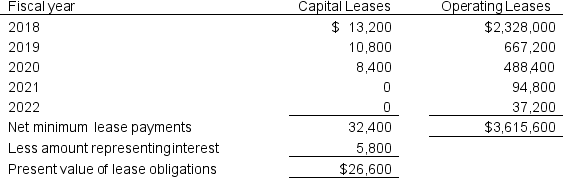

Falls Financial Corp. 2017 annual report discloses the following lease payments:

What is the approximate implicit rate of return on the capital leases?

What is the approximate implicit rate of return on the capital leases?

A) 8.8%

B) 11.5%

C) 10.2%

D) 12.6%

E) 9.1%

What is the approximate implicit rate of return on the capital leases?

What is the approximate implicit rate of return on the capital leases?A) 8.8%

B) 11.5%

C) 10.2%

D) 12.6%

E) 9.1%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

16

Falls Financial Corp. 2017 annual report discloses the following lease payments:

Compute the approximate present value of Falls Financial Corporation's operating leases using a discount rate of 11%.

Compute the approximate present value of Falls Financial Corporation's operating leases using a discount rate of 11%.

A) $3,080,445 million

B) $3,615,600 million

C) $3,326,998 million

D) $3,589,000 million

E) $3,255,985 million

Compute the approximate present value of Falls Financial Corporation's operating leases using a discount rate of 11%.

Compute the approximate present value of Falls Financial Corporation's operating leases using a discount rate of 11%.A) $3,080,445 million

B) $3,615,600 million

C) $3,326,998 million

D) $3,589,000 million

E) $3,255,985 million

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

17

What are the four basic components of pension expense?

A) Service cost, benefits paid, expected return on plan assets, and amortization of deferred amounts

B) Service cost, benefits paid, actual return on plan assets, and amortization of deferred amounts

C) Service cost, interest cost, actual return on plan assets, and amortization of deferred amounts

D) Service cost, interest cost, expected return on plan assets, and amortization of deferred amounts

E) None of the above

A) Service cost, benefits paid, expected return on plan assets, and amortization of deferred amounts

B) Service cost, benefits paid, actual return on plan assets, and amortization of deferred amounts

C) Service cost, interest cost, actual return on plan assets, and amortization of deferred amounts

D) Service cost, interest cost, expected return on plan assets, and amortization of deferred amounts

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

18

Actuarial gains and losses arise from:

A) Changes in mortality rates

B) Changes in discount rate

C) Changes in estimates of wage inflation

D) A and C only

E) All of the above

A) Changes in mortality rates

B) Changes in discount rate

C) Changes in estimates of wage inflation

D) A and C only

E) All of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

19

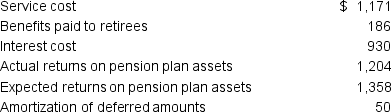

Nevada, Inc. reported the following items in the 2017 pension footnote (in millions).

The company's pension expense for the year is:

The company's pension expense for the year is:

A) $790 million

B) $976 million

C) $774 million

D) $903 million

E) $793 million

The company's pension expense for the year is:

The company's pension expense for the year is:A) $790 million

B) $976 million

C) $774 million

D) $903 million

E) $793 million

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

20

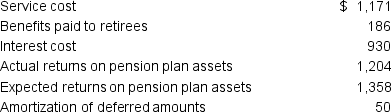

Nevada, Inc. reported the following items in the 2017 pension footnote (in millions).

The increase in the company's pension obligation during the year is:

The increase in the company's pension obligation during the year is:

A) $1,793 million

B) $1,965 million

C) $1,948 million

D) $ 661 million

E) $ 506 million

The increase in the company's pension obligation during the year is:

The increase in the company's pension obligation during the year is:A) $1,793 million

B) $1,965 million

C) $1,948 million

D) $ 661 million

E) $ 506 million

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

21

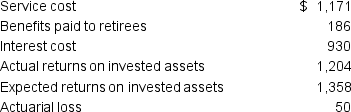

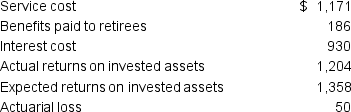

Lower Lake Corp. reported the following items in the 2017 pension footnote (in millions).

The company's pension expense for the year is:

The company's pension expense for the year is:

A) $810 million

B) $255 million

C) $248 million

D) $431 million

E) None of the above

The company's pension expense for the year is:

The company's pension expense for the year is:A) $810 million

B) $255 million

C) $248 million

D) $431 million

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

22

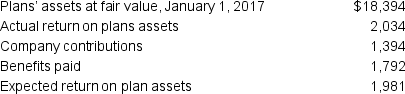

Redding Corp. reported the following information in its 2017 annual report (in millions). What were the pension plan assets at the end of the year?

A) $20,030 million

B) $16,712 million

C) $13,855 million

D) $16,668 million

E) None of the above

A) $20,030 million

B) $16,712 million

C) $13,855 million

D) $16,668 million

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

23

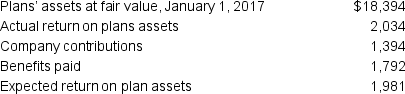

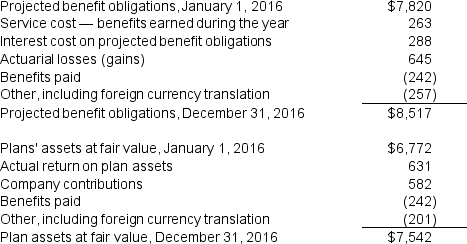

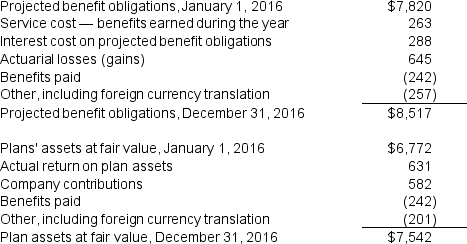

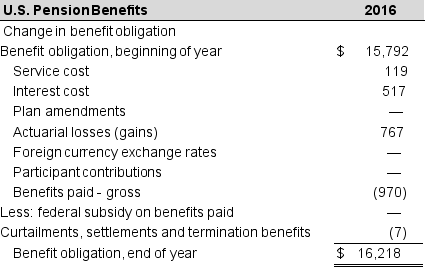

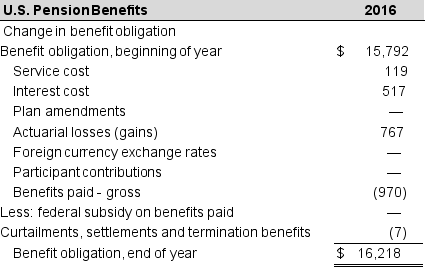

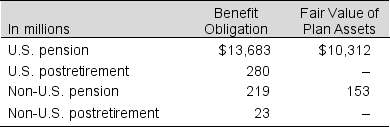

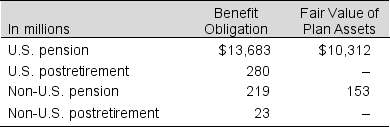

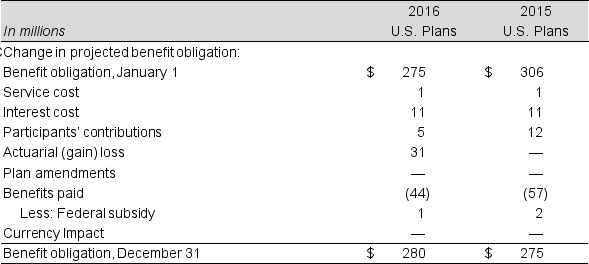

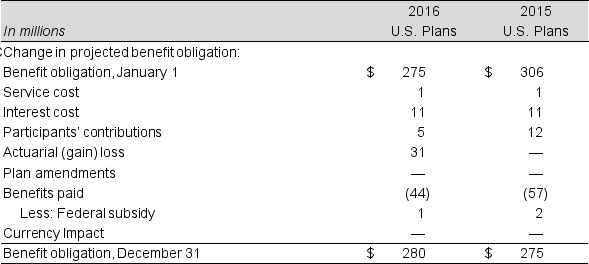

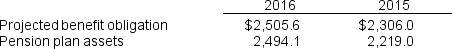

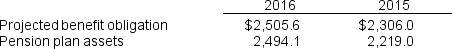

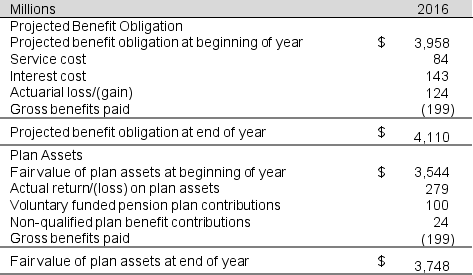

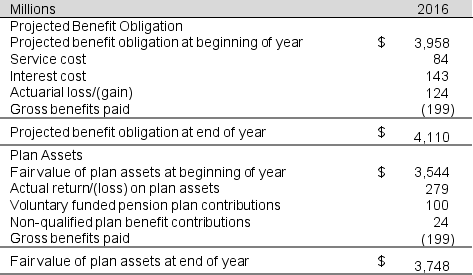

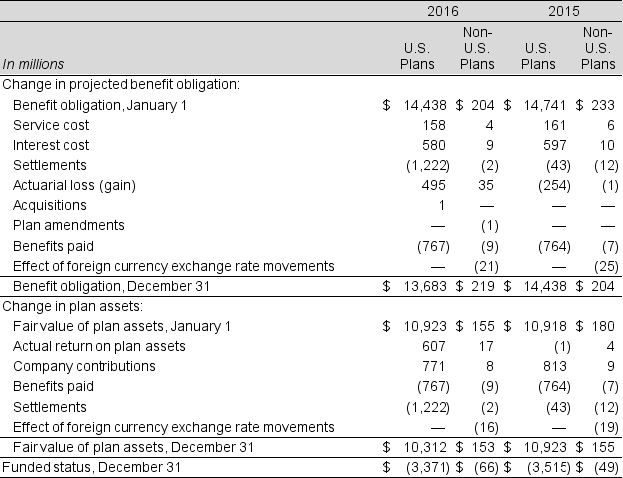

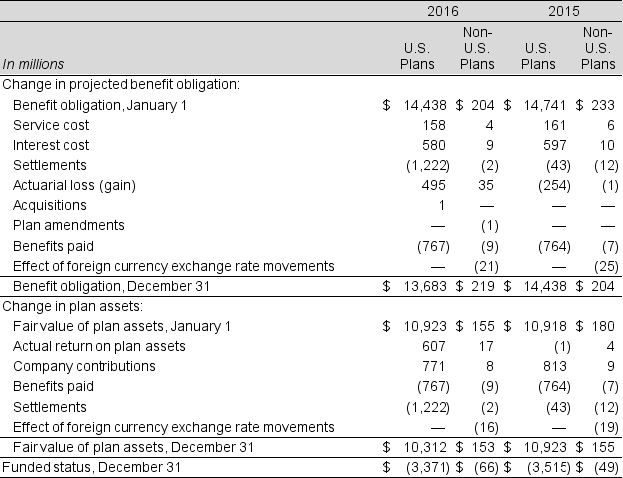

Abbott Laboratories' has a defined benefit retirement plan. The company's 2016 annual report includes the following excerpt about these plans (in millions):

What is the funded status of this plan?

What is the funded status of this plan?

A) The plan is underfunded by $975 million

B) The plan is overfunded by $975 million

C) The plan is underfunded by $8,517 million

D) The plan is overfunded by $7,542 million

E) None of the above

What is the funded status of this plan?

What is the funded status of this plan?A) The plan is underfunded by $975 million

B) The plan is overfunded by $975 million

C) The plan is underfunded by $8,517 million

D) The plan is overfunded by $7,542 million

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

24

Abbott Laboratories' has a defined benefit retirement plan. The company's 2016 annual report includes the following excerpt about these plans (in millions). What was the pension-related cash flow for Abbott Labs' during 2016?

A) $631 million cash outflow

B) $582 million cash inflow

C) $582 million cash outflow

D) $631 million cash inflow

E) $242 million cash outflow

A) $631 million cash outflow

B) $582 million cash inflow

C) $582 million cash outflow

D) $631 million cash inflow

E) $242 million cash outflow

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

25

During 2016, Abbott Laboratories decreased its discount rate used to calculate pension obligation from 4.3% to 3.8%. The effect on the company's pension expense for the year and pension obligation balance at year end is:

A) Increase pension expense, decrease pension obligation

B) Decrease pension expense, decrease pension obligation

C) Decrease pension expense, increase pension obligation

D) Increase pension expense, increase pension obligation

E) No effect on pension expense, decrease pension obligation

A) Increase pension expense, decrease pension obligation

B) Decrease pension expense, decrease pension obligation

C) Decrease pension expense, increase pension obligation

D) Increase pension expense, increase pension obligation

E) No effect on pension expense, decrease pension obligation

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

26

Caterpillar, Inc. discloses the following pension footnote in its 2016 10-K report (in millions):

The fair value of Caterpillar's U.S. pension assets is $11,354 million as of 2016.

The fair value of Caterpillar's U.S. pension assets is $11,354 million as of 2016.

What is the funded status of the plan, and how will this be reflected on Caterpillar's balance sheet?

A) The pension plan is underfunded by $4,864 million and is reported as a liability on the company's balance sheet.

B) The pension plan is overfunded by $4,438 million and is reported as an asset on the company's balance sheet.

C) The pension plan is underfunded by $6,804 million and is reported as a liability on the company's balance sheet.

D) The pension plan is overfunded by $4,864 million and is reported as an asset on the company's balance sheet.

E) The pension plan is underfunded by $4,438 million and is reported as a liability on the company's balance sheet.

The fair value of Caterpillar's U.S. pension assets is $11,354 million as of 2016.

The fair value of Caterpillar's U.S. pension assets is $11,354 million as of 2016.What is the funded status of the plan, and how will this be reflected on Caterpillar's balance sheet?

A) The pension plan is underfunded by $4,864 million and is reported as a liability on the company's balance sheet.

B) The pension plan is overfunded by $4,438 million and is reported as an asset on the company's balance sheet.

C) The pension plan is underfunded by $6,804 million and is reported as a liability on the company's balance sheet.

D) The pension plan is overfunded by $4,864 million and is reported as an asset on the company's balance sheet.

E) The pension plan is underfunded by $4,438 million and is reported as a liability on the company's balance sheet.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

27

In fiscal 2016, Microsoft Corp. reported a statutory tax rate of 35% and an effective tax rate of approximately 15%. The 2016 income statement reported income tax expense of $2,953 million.

What did Microsoft report as income before income tax expense that year?

A) $14,826 million

B) $19,687 million

C) $27,054 million

D) $ 7,571 million

E) None of the above

What did Microsoft report as income before income tax expense that year?

A) $14,826 million

B) $19,687 million

C) $27,054 million

D) $ 7,571 million

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

28

In fiscal 2016, Snap-On Inc. reported a statutory tax rate of 35%, an effective tax rate of 30.5%. Income before income tax for 2016 was $801.4 million.

What did Snap-On report as tax expense (on its income statement) in 2016?

A) $166.7 million

B) $170.0 million

C) $244.4 million

D) $184.7 million

E) None of the above

What did Snap-On report as tax expense (on its income statement) in 2016?

A) $166.7 million

B) $170.0 million

C) $244.4 million

D) $184.7 million

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

29

The 2016 Form 10-K of Dow Chemical Company disclosed a valuation allowance of $1,061 million related to various deferred tax assets. The 2015 valuation allowance had a balance of $1,000 million.

What effect did this decrease in the allowance have on Dow Chemical's net income in 2016?

A) Decrease net income by $61 million

B) Increase net income by $61 million

C) Increase net income by $1,000 million

D) Decrease net income by $1,000 million

E) None of the above

What effect did this decrease in the allowance have on Dow Chemical's net income in 2016?

A) Decrease net income by $61 million

B) Increase net income by $61 million

C) Increase net income by $1,000 million

D) Decrease net income by $1,000 million

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

30

The 2016 Form 10-K of Dow Chemical disclosed the following: Deferred tax assets increased by $939 million and deferred tax liabilities increased by $336 million.

How do these balance-sheet changes affect tax expense on the income statement for the year?

A) Increase tax expense by $1,275 million

B) Decrease tax expense by $1,275 million

C) Increase tax expense by $603 million

D) Decrease tax expense by $603 million

E) None of the above

How do these balance-sheet changes affect tax expense on the income statement for the year?

A) Increase tax expense by $1,275 million

B) Decrease tax expense by $1,275 million

C) Increase tax expense by $603 million

D) Decrease tax expense by $603 million

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

31

As a result of using accelerated depreciation for tax purposes, The Amin Corporation reported $651 million income tax expense in its income statement, while the actual amount of taxes paid by the company was $721 million.

How did these tax transactions affect the company's balance sheet?

A) Increase deferred tax liability by $70 million

B) Decrease deferred tax assets by $651 million

C) Decrease retained earnings by $651 million

D) Decrease cash by $651 million

E) Both C and D

How did these tax transactions affect the company's balance sheet?

A) Increase deferred tax liability by $70 million

B) Decrease deferred tax assets by $651 million

C) Decrease retained earnings by $651 million

D) Decrease cash by $651 million

E) Both C and D

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

32

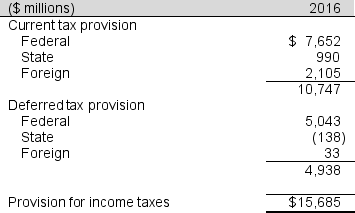

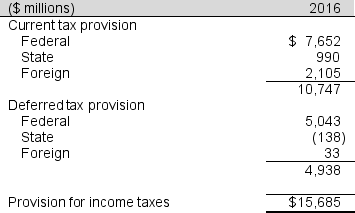

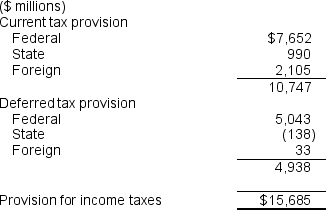

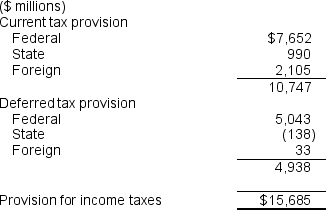

The income tax footnote to the financial statements of Apple Inc., for the year ended December 31, 2016, includes the following information (in millions). How much of the income tax expense is payable in 2016?

A) $10,747 million

B) $ 4,938 million

C) $15,685 million

D) $13,547 million

E) None of the above

A) $10,747 million

B) $ 4,938 million

C) $15,685 million

D) $13,547 million

E) None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

33

On its 2017 balance sheet, Petaluma Manufacturers Inc. reports minimum capital lease payments of $510,000 to be paid as follows:

The company also discloses a net present value of these payments of $432,000.

The company also discloses a net present value of these payments of $432,000.

a. How is Petaluma Manufacturers' balance sheet affected by these capital leases?

b. What is the interest rate implicit in this net present value?

The company also discloses a net present value of these payments of $432,000.

The company also discloses a net present value of these payments of $432,000. a. How is Petaluma Manufacturers' balance sheet affected by these capital leases?

b. What is the interest rate implicit in this net present value?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

34

Falls Financial Corp. 2017 annual report discloses the following lease payments:

a. What is the implicit rate of return on the capital leases?

b. Compute the present value of Falls Financial Corporation's operating leases using a discount rate of 11%.

a. What is the implicit rate of return on the capital leases?

b. Compute the present value of Falls Financial Corporation's operating leases using a discount rate of 11%.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

35

Blasfield and Associates, reports the following operating lease payments in its 2017 annual report. Calculate the present value of operating lease payments using a discount rate of 10%.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

36

Reyes Corp. disclosed the following lease information in its 2016 annual report related to its leasing activities (in millions).

a. What effect does the failure to capitalize operating leases have on Reyes Corp.'s balance sheet? Over the life of the lease, what effect does this classification have on net income?

b. Calculate the lease-related liabilities that are potentially missing from Reyes's 2016 balance sheet. Assume a discount rate of 12% and round the remaining lease life to the nearest whole year.

a. What effect does the failure to capitalize operating leases have on Reyes Corp.'s balance sheet? Over the life of the lease, what effect does this classification have on net income?

b. Calculate the lease-related liabilities that are potentially missing from Reyes's 2016 balance sheet. Assume a discount rate of 12% and round the remaining lease life to the nearest whole year.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

37

HP Inc. leases certain real and personal property under non-cancelable operating leases. HP Inc. reports the following operating lease payments in its 2016 annual report.

($ millions)

Calculate the lease-related liabilities that are potentially missing from HP's 2016 balance sheet.

Calculate the lease-related liabilities that are potentially missing from HP's 2016 balance sheet.

Assume a discount rate of 7% and rounding the remaining lease term to the nearest whole year.

($ millions)

Calculate the lease-related liabilities that are potentially missing from HP's 2016 balance sheet.

Calculate the lease-related liabilities that are potentially missing from HP's 2016 balance sheet.Assume a discount rate of 7% and rounding the remaining lease term to the nearest whole year.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

38

American Eagle Outfitters reported the following operating lease information in a footnote to the 2016 annual report (in thousands):

a. Calculate the liabilities potentially left off the balance sheet. Assume that the company's implicit discount rate on leases is 6% and round the remaining lease term to the nearest whole year.

b. American Eagle Outfitters' balance sheet reveals that the company has $1,782,660 thousand total assets and $578,091 thousand total liabilities. What proportion of assets and liabilities are on balance sheet versus off balance sheet?

a. Calculate the liabilities potentially left off the balance sheet. Assume that the company's implicit discount rate on leases is 6% and round the remaining lease term to the nearest whole year.

b. American Eagle Outfitters' balance sheet reveals that the company has $1,782,660 thousand total assets and $578,091 thousand total liabilities. What proportion of assets and liabilities are on balance sheet versus off balance sheet?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

39

International Paper Company's 2016 annual report disclosed the following pension information for its U.S. plans:

a. What effect does the discount rate of 4.10% have on the company's pension liability?

b. How does the change in the discount rate from 4.40% in 2015 to 4.10% in 2016 have on the company's pension liability?

c. What effect does the expected long-term return on plan assets of 7.75% have on the company's pension liability? On the pension assets?

a. What effect does the discount rate of 4.10% have on the company's pension liability?

b. How does the change in the discount rate from 4.40% in 2015 to 4.10% in 2016 have on the company's pension liability?

c. What effect does the expected long-term return on plan assets of 7.75% have on the company's pension liability? On the pension assets?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

40

International Paper Company's 2016 annual report disclosed the following pension information:

Benefit obligations and fair values of plan assets as of December 31, 2016, for International Paper's pension and postretirement plans are as follows:

a. What is the funded status of the company's U.S. pension plans? What proportion of total pension obligation is funded?

b. What proportion of total post-employment obligation is funded? Briefly explain why this is so.

Benefit obligations and fair values of plan assets as of December 31, 2016, for International Paper's pension and postretirement plans are as follows:

a. What is the funded status of the company's U.S. pension plans? What proportion of total pension obligation is funded?

b. What proportion of total post-employment obligation is funded? Briefly explain why this is so.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

41

International Paper Company's 2016 annual report disclosed the following pension information:

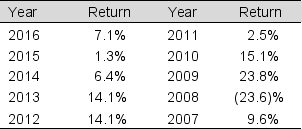

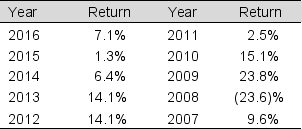

Actual rates of return earned on U.S. pension plan assets for each of the last 10 years were:

The footnote also reports that International Paper's expected long-term rate of return on plan assets is 7.75%.

The footnote also reports that International Paper's expected long-term rate of return on plan assets is 7.75%.

a. Calculate the actual (long-term) rate of return over the past 10 years.

b. Does the company's expected rate of return seem reasonable? Why or why not?

Actual rates of return earned on U.S. pension plan assets for each of the last 10 years were:

The footnote also reports that International Paper's expected long-term rate of return on plan assets is 7.75%.

The footnote also reports that International Paper's expected long-term rate of return on plan assets is 7.75%. a. Calculate the actual (long-term) rate of return over the past 10 years.

b. Does the company's expected rate of return seem reasonable? Why or why not?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

42

International Paper Company's 2016 annual report disclosed the following post-employment information:

Table continued next page

Table continued next page

Table continued

a. How much total benefits did former employees receive during the year?

b. How much did the company pay to former employees for post-employment benefits during the year?

c. What proportion of the obligation is funded? Explain.

Table continued next page

Table continued next pageTable continued

a. How much total benefits did former employees receive during the year?

b. How much did the company pay to former employees for post-employment benefits during the year?

c. What proportion of the obligation is funded? Explain.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

43

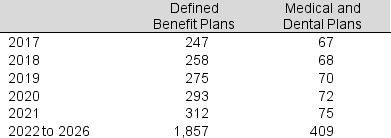

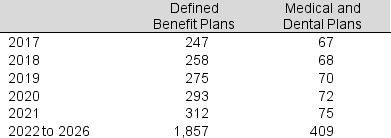

Abbott Laboratories reports the following information in its 2016 annual report (in millions):

Total benefit payments expected to be paid to participants, which includes payments funded from company assets as well as paid from the plans, are as follows: ($ in millions)

Abbott Labs reports $3,203 million of net cash inflows from operating activities and $1,121 million in capital expenditures for 2016. How does this information, combined with the expected benefit payments above impact our evaluation of Abbott Labs' financial condition?

Abbott Labs reports $3,203 million of net cash inflows from operating activities and $1,121 million in capital expenditures for 2016. How does this information, combined with the expected benefit payments above impact our evaluation of Abbott Labs' financial condition?

Total benefit payments expected to be paid to participants, which includes payments funded from company assets as well as paid from the plans, are as follows: ($ in millions)

Abbott Labs reports $3,203 million of net cash inflows from operating activities and $1,121 million in capital expenditures for 2016. How does this information, combined with the expected benefit payments above impact our evaluation of Abbott Labs' financial condition?

Abbott Labs reports $3,203 million of net cash inflows from operating activities and $1,121 million in capital expenditures for 2016. How does this information, combined with the expected benefit payments above impact our evaluation of Abbott Labs' financial condition?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

44

PACCAR Inc. reports the following information in its 2016 annual report (in millions):

a. Calculate the funded status of the pension plan in 2016 and compare it to the funded status in 2015. Are these amounts significant?

b. How does this funded status affect the company's balance sheet?

a. Calculate the funded status of the pension plan in 2016 and compare it to the funded status in 2015. Are these amounts significant?

b. How does this funded status affect the company's balance sheet?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

45

International Paper Company reports the following information for its U.S. Pension Plan in its 2016 annual report (in millions):

Table continued

Table continued

a. What is the funded status of the pension plan in 2016?

b. How does this funded status affect the company's balance sheet?

Table continued

Table continued

a. What is the funded status of the pension plan in 2016?

b. How does this funded status affect the company's balance sheet?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

46

Union Pacific reports the following information in its 2016 annual report (in millions):

a. How much retirement benefits did former employees receive during the year?

b. How much did the company pay to former employees for retirement benefits during the year?

c. What rate did Union Pacific 's pension assets actually earn during 2016?

d. What average rate did Union Pacific use to calculate interest cost during 2016?

a. How much retirement benefits did former employees receive during the year?

b. How much did the company pay to former employees for retirement benefits during the year?

c. What rate did Union Pacific 's pension assets actually earn during 2016?

d. What average rate did Union Pacific use to calculate interest cost during 2016?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

47

In fiscal 2016, Microsoft Corp. reported a statutory tax rate of 35% and an effective tax rate of 15%. The 2016 income statement reported income tax expense of $2,953 million.

What did Microsoft report as income before income tax expense that year?

What did Microsoft report as income before income tax expense that year?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

48

In fiscal 2016, Snap-On Inc. reported a statutory tax rate of 35%, an effective tax rate of 30.5%. Income before income tax for 2016 was $801.4 million.

What did Snap-On report as tax expense (on its income statement) in 2016?

What did Snap-On report as tax expense (on its income statement) in 2016?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

49

The 2016 Form 10-K of Dow Chemical disclosed a valuation allowance of $1,061 million related to various deferred tax assets. During 2016, the company increased this allowance from $1,000 million reported in 2015.

Quantify the effect that this increase in the allowance had on Dow Chemical's net income in 2016.

Quantify the effect that this increase in the allowance had on Dow Chemical's net income in 2016.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

50

The 2016 Form 10-K of Dow Chemical disclosed the following: Deferred tax assets increased by $939 million and Deferred tax liabilities increased by $336 million. Dow Chemical also reports income tax expense for 2016 of $9 million.

Determine the amount Dow Chemical paid in cash for income taxes for 2016.

Determine the amount Dow Chemical paid in cash for income taxes for 2016.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

51

As a result of using accelerated depreciation for tax purposes, The Starburst Company reported $651 million income tax expense in its income statement, while the actual amount of taxes paid by the company was $721 million.

How did this tax transaction affect the company's balance sheet?

How did this tax transaction affect the company's balance sheet?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

52

Cranberry Chemical recorded a pretax restructuring charge of $1,916 million in 2017. By year-end (December 31, 2017), the company had paid only $216 million of cash related to the restructuring charges.

How did the restructuring charge of $1,916 million affect income before taxes? How did this charge affect deferred taxes on the balance sheet? Assume a tax rate of 35%.

How did the restructuring charge of $1,916 million affect income before taxes? How did this charge affect deferred taxes on the balance sheet? Assume a tax rate of 35%.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

53

The income tax footnote to the financial statements of Apple Inc., for the year ended December 31, 2016, includes the following information:

a. What income tax expense did Apple Inc. report in its 2016 income statement?

b. How much of the income tax expense is payable in 2016?

a. What income tax expense did Apple Inc. report in its 2016 income statement?

b. How much of the income tax expense is payable in 2016?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

54

American Eagle Outfitters includes the following in its fiscal 2016 annual report (in thousands):

Required:

Required:

a. Calculate the present value of operating lease payments using a discount rate of 6% and rounding the remaining lease life to the nearest whole year.

b. Assume that the leased equipment has a useful life of 9 years, no salvage value, and straight-line depreciation is used. Estimate the effect on net operating profit before tax of capitalizing these leases. Assume that rental expense in 2016 is the same as 2017 lease payments.

c. How would ROE and the other financial ratios from the ROE decomposition be affected if the company capitalized these operating leases?

Required:

Required:a. Calculate the present value of operating lease payments using a discount rate of 6% and rounding the remaining lease life to the nearest whole year.

b. Assume that the leased equipment has a useful life of 9 years, no salvage value, and straight-line depreciation is used. Estimate the effect on net operating profit before tax of capitalizing these leases. Assume that rental expense in 2016 is the same as 2017 lease payments.

c. How would ROE and the other financial ratios from the ROE decomposition be affected if the company capitalized these operating leases?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

55

The following is an excerpt from the Union Pacific 2016 annual report:

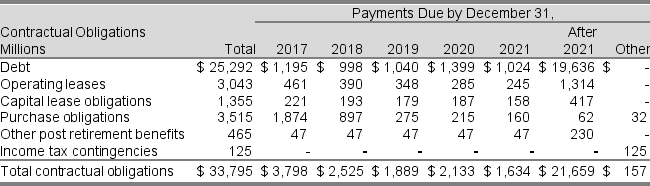

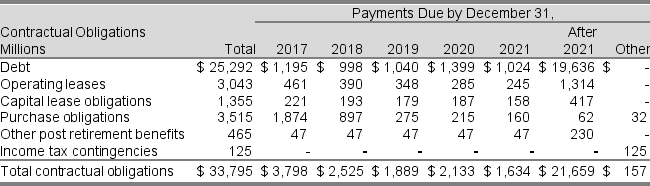

The following tables identify material obligations and commitments as of December 31, 2016:

Required:

a. Calculate the present value of operating lease payments using a discount rate of 7% and rounding the remaining lease term to the nearest whole year.

b. Union Pacific reported net operating assets (NOA) of $35,726 million in 2016. If the operating leases were capitalized, what would net operating assets have been?

c. Assume that the leased equipment has a useful life of 11 years, no salvage value, and straight-line depreciation is used. Estimate the effect on net operating profit before tax of capitalizing these leases. Assume that rental expense in 2016 is the same as 2017 lease payments.

d. Union Pacific reported net operating profit after tax (NOPAT) of $4,746 million and net operating assets (NOA) of $35,726 million for 2016. Calculate RNOA for 2016. Recalculate RNOA under the assumption that the company capitalized its operating leases. Use the effect calculated in c. above (ignore taxes). Is the difference significant?

(Hint: for the purpose of part d., use NOA versus average NOA in your computations.)

The following tables identify material obligations and commitments as of December 31, 2016:

Required:

a. Calculate the present value of operating lease payments using a discount rate of 7% and rounding the remaining lease term to the nearest whole year.

b. Union Pacific reported net operating assets (NOA) of $35,726 million in 2016. If the operating leases were capitalized, what would net operating assets have been?

c. Assume that the leased equipment has a useful life of 11 years, no salvage value, and straight-line depreciation is used. Estimate the effect on net operating profit before tax of capitalizing these leases. Assume that rental expense in 2016 is the same as 2017 lease payments.

d. Union Pacific reported net operating profit after tax (NOPAT) of $4,746 million and net operating assets (NOA) of $35,726 million for 2016. Calculate RNOA for 2016. Recalculate RNOA under the assumption that the company capitalized its operating leases. Use the effect calculated in c. above (ignore taxes). Is the difference significant?

(Hint: for the purpose of part d., use NOA versus average NOA in your computations.)

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

56

Federated Investors, Inc. includes the following in its 2016 annual report:

The following is a schedule by year of future minimum payments required under the operating leases that have initial or remaining noncancelable lease terms in excess of one year as of December 31, 2016:

Required:

Required:

a. Calculate the present value of operating lease payments using a discount rate of 6% and rounding the remaining lease term to the nearest whole year.

b. For 2016, the company reported total assets of $1,155.107 million and total liabilities of $527.961 million. What would total assets and total liabilities have been if the company had capitalized these leases. Does capitalizing make a significant difference on the company's balance sheet?

c. Assume that the leased equipment has a useful life of 13 years and no salvage value. Estimate the effect on net operating profit before tax of capitalizing these leases, assuming the rent expense in 2016 is equal to 2017 rent expense.

d. Explain how ROE, FLEV, RNOA, and NOAT would be affected if these leases are capitalized.

The following is a schedule by year of future minimum payments required under the operating leases that have initial or remaining noncancelable lease terms in excess of one year as of December 31, 2016:

Required:

Required: a. Calculate the present value of operating lease payments using a discount rate of 6% and rounding the remaining lease term to the nearest whole year.

b. For 2016, the company reported total assets of $1,155.107 million and total liabilities of $527.961 million. What would total assets and total liabilities have been if the company had capitalized these leases. Does capitalizing make a significant difference on the company's balance sheet?

c. Assume that the leased equipment has a useful life of 13 years and no salvage value. Estimate the effect on net operating profit before tax of capitalizing these leases, assuming the rent expense in 2016 is equal to 2017 rent expense.

d. Explain how ROE, FLEV, RNOA, and NOAT would be affected if these leases are capitalized.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

57

California Enterprises Inc. reports the following in its 2016 annual report:

($ thousands)

Required:

Required:

a. Calculate the present value of operating lease payments using a discount rate of 5%.

b. California Enterprises' balance sheet reports total assets of $24,109.2 thousand and total liabilities of $6,580.8 thousand. Calculate the company's total liabilities to equity ratio with and without the operating leases being capitalized.

c. Assume that the leased equipment has a useful life of 4 years and no salvage value. Estimate the effect on net operating profit before tax of capitalizing these operating leases. Assume rent expense in 2016 equals 2017 rent expense.

d. Estimate the effect on interest expense of capitalizing these operating leases.

($ thousands)

Required:

Required: a. Calculate the present value of operating lease payments using a discount rate of 5%.

b. California Enterprises' balance sheet reports total assets of $24,109.2 thousand and total liabilities of $6,580.8 thousand. Calculate the company's total liabilities to equity ratio with and without the operating leases being capitalized.

c. Assume that the leased equipment has a useful life of 4 years and no salvage value. Estimate the effect on net operating profit before tax of capitalizing these operating leases. Assume rent expense in 2016 equals 2017 rent expense.

d. Estimate the effect on interest expense of capitalizing these operating leases.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

58

The following pension information was disclosed by PACCAR Inc. in its 2016 annual report:

Required:

Required:

a. What is "service cost"? How does it affect PACCAR's total pension expense for the year?

b. PACCAR reports an actuarial loss of $186.4 million for 2016. What is this loss and how does PACCAR account for it?

c. How much did PACCAR contribute to the pension plan during the year?

d. What amount of pension benefits were paid to former PACCAR employees during the year?

e. Explain the funded status of the pension plan in 2016 and compare it to the funded status in 2015. Are these amounts significant?

Required:

Required: a. What is "service cost"? How does it affect PACCAR's total pension expense for the year?

b. PACCAR reports an actuarial loss of $186.4 million for 2016. What is this loss and how does PACCAR account for it?

c. How much did PACCAR contribute to the pension plan during the year?

d. What amount of pension benefits were paid to former PACCAR employees during the year?

e. Explain the funded status of the pension plan in 2016 and compare it to the funded status in 2015. Are these amounts significant?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

59

International Paper Company disclosed the following pension information in its 2016 annual report:

Net periodic pension expense for qualified and nonqualified U.S. defined benefit plans comprised the following:

Required:

Required:

a. Briefly explain the following components of the company's pension expense for the year: service cost, interest cost, and actuarial loss.

b. International Paper reports an actual return on plan assets for its U.S. Plans of $607 million for the year. Why is this different from the expected return of $815 million reported above?

c. What cash contribution did the company make to the pension plan during the year?

Net periodic pension expense for qualified and nonqualified U.S. defined benefit plans comprised the following:

Required:

Required: a. Briefly explain the following components of the company's pension expense for the year: service cost, interest cost, and actuarial loss.

b. International Paper reports an actual return on plan assets for its U.S. Plans of $607 million for the year. Why is this different from the expected return of $815 million reported above?

c. What cash contribution did the company make to the pension plan during the year?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

60

International Paper, Inc. disclosed the following pension information in its 2016 annual report:

Required:

Required:

a. The U.S. pension plan is underfunded by $3,371 million in 2016. How does this fact affect International Paper's 2016 balance sheet?

b. What is "service cost"? How does it affect the company's pension expense for the year?

c. What average interest rate did International Paper use to calculate interest cost on its U.S. pension plan during 2016?

d. How much did International Paper contribute to both of its pension plans during 2016? How does that compare to the contribution in 2015?

e. What amount of pension benefits were paid to former employees for all plans during 2016?

f. Why do the benefits paid affect both the pension obligation and the pension assets?

Required:

Required: a. The U.S. pension plan is underfunded by $3,371 million in 2016. How does this fact affect International Paper's 2016 balance sheet?

b. What is "service cost"? How does it affect the company's pension expense for the year?

c. What average interest rate did International Paper use to calculate interest cost on its U.S. pension plan during 2016?

d. How much did International Paper contribute to both of its pension plans during 2016? How does that compare to the contribution in 2015?

e. What amount of pension benefits were paid to former employees for all plans during 2016?

f. Why do the benefits paid affect both the pension obligation and the pension assets?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

61

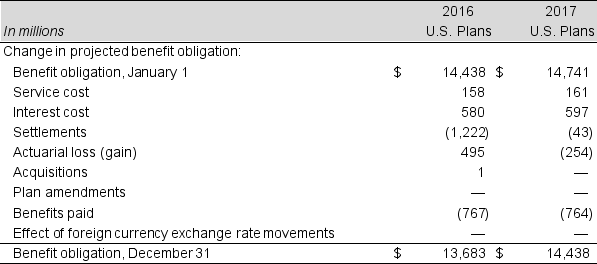

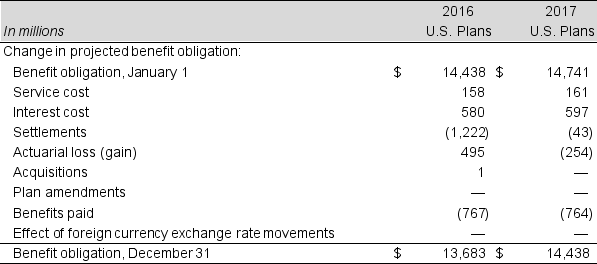

The following pension information was disclosed by Abbott Laboratories:

Continued next page

Continued next page

Required:

a. What is the funded status of the pension plan in 2016 and 2015?

b. How does the funded status affect Abbott's 2016 balance sheet?

c. What is service cost? How does it affect Abbott Labs' total pension expense for the year?

d. How much did Abbott Labs contribute to the pension plan during 2016 How does that compare to the contribution in 2015?

e. What amount of pension benefits were paid to former Abbott Labs' employees during the year?

f. Why do the benefits paid affect both the pension obligation and the pension assets?

Continued next page

Continued next pageRequired:

a. What is the funded status of the pension plan in 2016 and 2015?

b. How does the funded status affect Abbott's 2016 balance sheet?

c. What is service cost? How does it affect Abbott Labs' total pension expense for the year?

d. How much did Abbott Labs contribute to the pension plan during 2016 How does that compare to the contribution in 2015?

e. What amount of pension benefits were paid to former Abbott Labs' employees during the year?

f. Why do the benefits paid affect both the pension obligation and the pension assets?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

62

The following are excerpts from the 2016 Form 10-K of Valero Energy. Use the information to answer the requirements.

Components of income tax expense related to continuing operations were as follows (in millions):

The tax effects of significant temporary differences representing deferred income tax assets and liabilities were as follows (in millions):

The tax effects of significant temporary differences representing deferred income tax assets and liabilities were as follows (in millions):

December 31,

a. What income tax expense does Valero Energy report in its 2016 income statement? How much of this expense is currently payable?

b. If Valero Energy had reported deferred tax liabilities related to "Property, plant and equipment," describe how these liabilities would have arisen. How likely is it that these liabilities would have been paid? Specifically, describe a scenario that would (i) defer these taxes indefinitely, and (ii) would result in these liabilities requiring payment within the near future.

c. Valero Energy reports a deferred tax asset relating to "Compensation and employee benefit liabilities." When a company has a pension plan it records an expense and related liability each year while the employee works for the company. Pension payments are not made to employees until they retire. Explain why pension plans create a deferred tax asset.

d. Valero Energy reports deferred tax assets from net loss carry forwards. Explain how these arise and how they will result in a future benefit.

e. Valero Energy reports a valuation allowance of $374 million in 2016 and of $435 million in 2015, which is deducted from the deferred tax assets. Why? How did the change in the allowance from 2015 to 2016 affect net income in 2016? How can a company use this allowance to meet its income targets in a particular year?

Components of income tax expense related to continuing operations were as follows (in millions):

The tax effects of significant temporary differences representing deferred income tax assets and liabilities were as follows (in millions):

The tax effects of significant temporary differences representing deferred income tax assets and liabilities were as follows (in millions):December 31,

a. What income tax expense does Valero Energy report in its 2016 income statement? How much of this expense is currently payable?

b. If Valero Energy had reported deferred tax liabilities related to "Property, plant and equipment," describe how these liabilities would have arisen. How likely is it that these liabilities would have been paid? Specifically, describe a scenario that would (i) defer these taxes indefinitely, and (ii) would result in these liabilities requiring payment within the near future.

c. Valero Energy reports a deferred tax asset relating to "Compensation and employee benefit liabilities." When a company has a pension plan it records an expense and related liability each year while the employee works for the company. Pension payments are not made to employees until they retire. Explain why pension plans create a deferred tax asset.

d. Valero Energy reports deferred tax assets from net loss carry forwards. Explain how these arise and how they will result in a future benefit.

e. Valero Energy reports a valuation allowance of $374 million in 2016 and of $435 million in 2015, which is deducted from the deferred tax assets. Why? How did the change in the allowance from 2015 to 2016 affect net income in 2016? How can a company use this allowance to meet its income targets in a particular year?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

63

The 2016 Form 10-K of Netflix, Inc. includes the following footnote.

The components of provision for income taxes for all periods presented were as follows:

Deferred tax assets (liabilities) were as follows (in thousands):

Deferred tax assets (liabilities) were as follows (in thousands):

a. Use the financial statement effects template below to record income tax expense for Netflix for 2016.

b. Netflix reports a deferred tax liability relating to depreciation. Describe how this liability arises. How likely is it that this liability will be paid?

c. Assume that Netflix records deferred tax liabilities at a rate of 35%. The balance sheet reports net property, plant and equipment, of $250,395 thousand. Compute the tax basis for these assets. Hint: recall that the difference between the assets' net book value and the tax basis is the timing difference and that deferred taxes are recorded as timing difference × tax rate.

d. Netflix reports a significant deferred tax asset relating to stock-based compensation. The company has compensated executives and other managers with stock options. Explain why this gives rise to a deferred tax asset.

The components of provision for income taxes for all periods presented were as follows:

Deferred tax assets (liabilities) were as follows (in thousands):

Deferred tax assets (liabilities) were as follows (in thousands):

a. Use the financial statement effects template below to record income tax expense for Netflix for 2016.

b. Netflix reports a deferred tax liability relating to depreciation. Describe how this liability arises. How likely is it that this liability will be paid?

c. Assume that Netflix records deferred tax liabilities at a rate of 35%. The balance sheet reports net property, plant and equipment, of $250,395 thousand. Compute the tax basis for these assets. Hint: recall that the difference between the assets' net book value and the tax basis is the timing difference and that deferred taxes are recorded as timing difference × tax rate.

d. Netflix reports a significant deferred tax asset relating to stock-based compensation. The company has compensated executives and other managers with stock options. Explain why this gives rise to a deferred tax asset.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

64

Under the pre-2019 standards, GAAP identifies two approaches for the reporting of leases by the leasee. Explain the accounting treatment for the two types of types of leases. Is one preferable to the other? Explain.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

65

Under the new accounting standard for leases (effective 2019), there are four tests established by GAAP to determine whether a lease is a finance lease. List the four tests that lessors use to assess whether the lease is a finance lease. How do these tests differ from the criteria used to determine if a lease should be capitalized under the pre-2019 accounting standard for leases?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

66

Why would most corporations prefer to use long-term expected return rates instead of actual returns when computing pension expense?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

67

Companies have raised at least two objections with respect to pension accounting. First, companies oppose putting pension assets and liabilities on the balance sheet at gross amounts (as opposed to netting the assets and liabilities). Second, companies oppose marking pension assets and liabilities to fair value each period. Explain both of these objections and describe how GAAP accounts for each.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

68

Alleghany Corporation includes the following in its 2016 annual report (in thousands).

On an ongoing basis, we evaluate our estimates, including those related to the value of deferred acquisition costs, incentive compensation, income taxes, pension benefits and contingencies and litigation. Our estimates are based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances.

What estimates does the company make when accounting for defined benefit pensions?

On an ongoing basis, we evaluate our estimates, including those related to the value of deferred acquisition costs, incentive compensation, income taxes, pension benefits and contingencies and litigation. Our estimates are based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances.

What estimates does the company make when accounting for defined benefit pensions?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck