Deck 20: Leasing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/66

Play

Full screen (f)

Deck 20: Leasing

1

When examining a trucking company's balance sheet, you don't notice any trucks listed as assets. The trucks must be leased and the leases are classified as:

A) capital leases.

B) nontax leases.

C) financial leases.

D) operating leases.

A) capital leases.

B) nontax leases.

C) financial leases.

D) operating leases.

operating leases.

2

Which of the following is not an example of asset-based lending?

A) Leases

B) Secured loans

C) Unsecured loans

D) Conditional sales contracts

A) Leases

B) Secured loans

C) Unsecured loans

D) Conditional sales contracts

Unsecured loans

3

Leasing is best described as a form of:

A) securitization.

B) debt financing.

C) asset-based lending.

D) working capital financing.

A) securitization.

B) debt financing.

C) asset-based lending.

D) working capital financing.

asset-based lending.

4

Which of the following terms does not describe a financial lease?

A) Capital lease.

B) Operating lease.

C) Full payout lease.

A) Capital lease.

B) Operating lease.

C) Full payout lease.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

5

A tax lease is best described by all but which of the following?

A) The lessor owns the asset and takes the depreciation on the asset.

B) The lessee owns the asset and takes the depreciation on the asset.

C) The lessor owns the asset, yet the lessee takes the depreciation on the asset.

A) The lessor owns the asset and takes the depreciation on the asset.

B) The lessee owns the asset and takes the depreciation on the asset.

C) The lessor owns the asset, yet the lessee takes the depreciation on the asset.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

6

Harley Davidson Financial Services, Ford Motor Credit Company, and Mitsubishi Motors Credit of America are best described as:

A) manufacturers.

B) commercial banks.

C) captive finance company (CFC).

D) small and medium-sized enterprises (SME).

A) manufacturers.

B) commercial banks.

C) captive finance company (CFC).

D) small and medium-sized enterprises (SME).

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is not correct regarding an operating lease?

A) Basically a rental agreement

B) Lessor expenses depreciation on the income statement

C) Some of the benefits of ownership do not transfer to the lessee

D) Original cost of the asset is shown on the balance sheet of the lessee

E) Lease payment is rental income for the lessor, rental expense for the lessee

A) Basically a rental agreement

B) Lessor expenses depreciation on the income statement

C) Some of the benefits of ownership do not transfer to the lessee

D) Original cost of the asset is shown on the balance sheet of the lessee

E) Lease payment is rental income for the lessor, rental expense for the lessee

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is not correct regarding a capital lease?

A) Lessor expenses depreciation on the income statement

B) Also referred to as a financial lease or a full payout lease

C) Essentially all the benefits of ownership transfer to the lessee

D) Present value of lease payments are shown as an asset on the balance sheet of the lessee

E) Present value of lease obligations are shown as a liability on the balance sheet of the lessee

A) Lessor expenses depreciation on the income statement

B) Also referred to as a financial lease or a full payout lease

C) Essentially all the benefits of ownership transfer to the lessee

D) Present value of lease payments are shown as an asset on the balance sheet of the lessee

E) Present value of lease obligations are shown as a liability on the balance sheet of the lessee

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

9

Accounting, legal and tax definitions regarding leases are slightly different. Which of the following accounting, legal, or tax terms refers to something different than the other choices?

A) Tax lease

B) True lease

C) Operating lease

D) Full payout lease

A) Tax lease

B) True lease

C) Operating lease

D) Full payout lease

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is not one of the provisions of a capital lease?

A) Bargain purchase option

B) 100% of the payment is rental expense

C) Lease term is equal to 75% or more of the economic life of the property

D) Title of the property transfers automatically at the end of the lease period

E) Present value of lease payments at the beginning of the lease is equal to or greater than 90% of the value of the leased asset

A) Bargain purchase option

B) 100% of the payment is rental expense

C) Lease term is equal to 75% or more of the economic life of the property

D) Title of the property transfers automatically at the end of the lease period

E) Present value of lease payments at the beginning of the lease is equal to or greater than 90% of the value of the leased asset

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

11

A contractual agreement in which the party owning the asset records a lease receivable for the promised lease payments as well as earns interest on the financing is best described as:

A) leveraged lease.

B) direct financing lease.

C) sale-leaseback agreement.

A) leveraged lease.

B) direct financing lease.

C) sale-leaseback agreement.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following organizations is most likely to be the lessee on a sale-leaseback agreement?

A) Law firm

B) Wholesaler

C) Manufacturer

D) Nonprofit hospital

E) Real estate company

A) Law firm

B) Wholesaler

C) Manufacturer

D) Nonprofit hospital

E) Real estate company

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

13

Barrett Accounting firm purchases a new computer system, which it leases from Financial Equipment Supply. Financial Equipment Supply actually only puts down 20 percent of the money to purchase the new computer system and borrows the rest from Third Street Bank. What best describes this type of lease?

A) Leverage lease

B) Sales-type lease

C) Direct financing lease

A) Leverage lease

B) Sales-type lease

C) Direct financing lease

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

14

A nonprofit organization, which runs a baseball league for children, purchases land, lighting equipment, stadium seating, and dugouts. They also purchase a stand-alone building for concessions sales and all of the equipment to operate the concessions. Because of the nonprofit paying little or no taxes, they sell everything they purchased for the baseball league to a profitable organization in a higher tax bracket. The nonprofit leases everything back from the profitable organization. What best describes this type of lease?

A) Leverage lease

B) Sales-type lease

C) Direct financing lease

A) Leverage lease

B) Sales-type lease

C) Direct financing lease

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is not a benefit of leveraged leases?

A) Lender receives principal and interest payments

B) Lessor has lease payments available to service the loan payments

C) Lessee receives the leased object at higher lease payment due to tax benefits received by lessor

D) Lessor puts up only a portion of asset purchase price, but receives all the tax benefits of ownership

A) Lender receives principal and interest payments

B) Lessor has lease payments available to service the loan payments

C) Lessee receives the leased object at higher lease payment due to tax benefits received by lessor

D) Lessor puts up only a portion of asset purchase price, but receives all the tax benefits of ownership

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following leases is classified as an operating lease?

A) A 1 year apartment lease. The apartment has a life expectancy of 30 years.

B) A 6 year lease of a computer system. The computer system is expected to last 8 years.

C) A 5 year copier lease in which the title will transfer to the lessee at the end of the 5 year period

D) A 5 year car lease in which the lessee can buy the vehicle very inexpensively at the end of the 5 years.

E) A 10 year lease of a crane, which costs $1,000,000. The present value of the lease payments are $1,100,000.

A) A 1 year apartment lease. The apartment has a life expectancy of 30 years.

B) A 6 year lease of a computer system. The computer system is expected to last 8 years.

C) A 5 year copier lease in which the title will transfer to the lessee at the end of the 5 year period

D) A 5 year car lease in which the lessee can buy the vehicle very inexpensively at the end of the 5 years.

E) A 10 year lease of a crane, which costs $1,000,000. The present value of the lease payments are $1,100,000.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following leases is classified as a financial lease?

A) A 2 year office lease. The office has a life expectancy of 30 years.

B) A 1 year apartment lease. The apartment has a life expectancy of 30 years.

C) A 5 year security system lease, in which the lessee receives ownership of the security system at the end of the 5 years.

D) A 2 year hunting lease, in which the land and the hunting lodge cost $675,000 and the present value of lease payments are $50,000.

A) A 2 year office lease. The office has a life expectancy of 30 years.

B) A 1 year apartment lease. The apartment has a life expectancy of 30 years.

C) A 5 year security system lease, in which the lessee receives ownership of the security system at the end of the 5 years.

D) A 2 year hunting lease, in which the land and the hunting lodge cost $675,000 and the present value of lease payments are $50,000.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is not a motivation for leasing an asset instead of purchasing the asset?

A) Can be tax advantages to leasing if it is a capital lease

B) Can have use of the asset with less money down than purchasing the asset

C) Sometimes there are better financing terms associated with a lease resulting in lower costs

D) Do not have to pass a credit check if leasing, when one would have to have a credit check if purchasing

E) May not have to show the asset or associated liability on the balance sheet, therefore making the company appear better than under a purchase

A) Can be tax advantages to leasing if it is a capital lease

B) Can have use of the asset with less money down than purchasing the asset

C) Sometimes there are better financing terms associated with a lease resulting in lower costs

D) Do not have to pass a credit check if leasing, when one would have to have a credit check if purchasing

E) May not have to show the asset or associated liability on the balance sheet, therefore making the company appear better than under a purchase

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

19

On a tax lease _______________ gets the depreciation and tax credits, and _________________ has legal ownership of the asset.

A) lessee, lessee

B) lessee, lessor

C) lessor, lessee

D) lessor, lessor

A) lessee, lessee

B) lessee, lessor

C) lessor, lessee

D) lessor, lessor

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

20

On a nontax lease _______________ gets the depreciation and tax credits, and _________________ has legal ownership of the asset.

A) lessor, lessor

B) lessee, lessor

C) lessor, lessee

D) lessee, lessee

A) lessor, lessor

B) lessee, lessor

C) lessor, lessee

D) lessee, lessee

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

21

Suppose a lease is offered for four years, with lease payments of $500,000 paid at the end of each year. The lessee's borrowing rate is 8 percent. The present value of the lease payments is closest to:

A) $1,656,063

B) $1,788,548

C) $3,366,372

A) $1,656,063

B) $1,788,548

C) $3,366,372

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

22

Suppose a lease is offered for six years, with lease payments of $1 million paid at the end of each year. The lessee's borrowing rate is 10 percent. The present value of the lease payments is closest to:

A) $4.36 million.

B) $4.79 million.

C) $7.36 million.

D) $7.80 million.

A) $4.36 million.

B) $4.79 million.

C) $7.36 million.

D) $7.80 million.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is an example of off-balance sheet financing for the borrower / lessee?

A) Bank loan

B) Financial lease

C) Bond financing

D) Operating lease

E) Commercial paper

A) Bank loan

B) Financial lease

C) Bond financing

D) Operating lease

E) Commercial paper

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is not correct regarding accounting for a financial lease?

A) Periodic interest paid is shown as an expense for the lessee

B) Periodic interest received is shown as income for the lessor

C) Periodic principal repayment is shown as an expense for the lessee

D) Depreciation expense related to the asset is reported by the lessee

E) The lessor reports a gain or loss on the asset at the time of the arrangement

A) Periodic interest paid is shown as an expense for the lessee

B) Periodic interest received is shown as income for the lessor

C) Periodic principal repayment is shown as an expense for the lessee

D) Depreciation expense related to the asset is reported by the lessee

E) The lessor reports a gain or loss on the asset at the time of the arrangement

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following statements is incorrect?

A) Total cash flow will be higher using an operating lease as compared to a financial lease.

B) Net income will be higher in the early years using an operating lease and lower in the later years as compared to a financial lease.

C) Cash flow from operations will be lower using an operating lease, but cash flow from financing will be higher as compared to a financial lease.

D) Current ratios will be higher, debt and leverage ratios will be higher, asset turnover and profitability ratios will be lower for operating leases as compared to a financial lease.

A) Total cash flow will be higher using an operating lease as compared to a financial lease.

B) Net income will be higher in the early years using an operating lease and lower in the later years as compared to a financial lease.

C) Cash flow from operations will be lower using an operating lease, but cash flow from financing will be higher as compared to a financial lease.

D) Current ratios will be higher, debt and leverage ratios will be higher, asset turnover and profitability ratios will be lower for operating leases as compared to a financial lease.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

26

Bonuses for your entire department are based on financial ratios for your firm. Your firm is undertaking a large equipment lease and your boss asks for your recommendation as to what would be the best way to classify the equipment lease. You recommend:

A) a financial lease.

B) an operating lease.

C) an equipment purchase.

A) a financial lease.

B) an operating lease.

C) an equipment purchase.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements is correct regarding the classification of leases as either operating leases or financial leases?

A) Total cash flow for the lessee will be higher using an operating lease as opposed to a financial lease.

B) The choice of classification as financial or operating lease has no effect on the financial ratios for the lessee.

C) An operating lease is disclosed in the footnotes to the financial statements for the lessor instead of the balance sheet.

D) The lessee's company will appear larger and have more debt if the lease is classified as a financial lease as opposed to an operating lease.

A) Total cash flow for the lessee will be higher using an operating lease as opposed to a financial lease.

B) The choice of classification as financial or operating lease has no effect on the financial ratios for the lessee.

C) An operating lease is disclosed in the footnotes to the financial statements for the lessor instead of the balance sheet.

D) The lessee's company will appear larger and have more debt if the lease is classified as a financial lease as opposed to an operating lease.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

28

Under financial leases, the following ratios are lower, compared with operating leases?

A) P/E ratio

B) Debt ratio

C) Current ratio

D) Leverage ratio

A) P/E ratio

B) Debt ratio

C) Current ratio

D) Leverage ratio

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is lower under operating leases as opposed to financial leases?

A) Profitability

B) Current ratio

C) Leverage ratio

D) Asset turnover

A) Profitability

B) Current ratio

C) Leverage ratio

D) Asset turnover

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is higher under operating leases as opposed to financial leases?

A) Depreciation

B) Leverage ratio

C) Total cash flow

D) Profitability in the early years

A) Depreciation

B) Leverage ratio

C) Total cash flow

D) Profitability in the early years

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is not a motive for leasing?

A) Cheaper financing

B) Financial statement effects

C) Purchase the asset at a lower cost

D) Reduce the risk of asset ownership

E) Circumvent capital budget restrictions

A) Cheaper financing

B) Financial statement effects

C) Purchase the asset at a lower cost

D) Reduce the risk of asset ownership

E) Circumvent capital budget restrictions

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is not a motive for leasing?

A) Flexibility

B) Convenience

C) Maintenance by the lessee

D) Implicit fixed interest rates

A) Flexibility

B) Convenience

C) Maintenance by the lessee

D) Implicit fixed interest rates

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

33

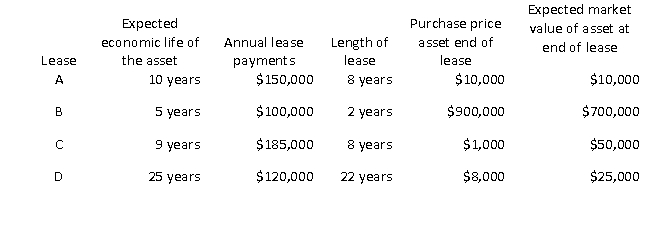

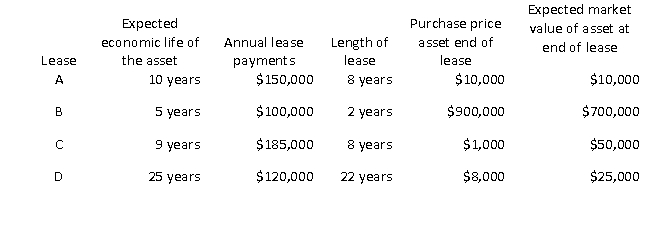

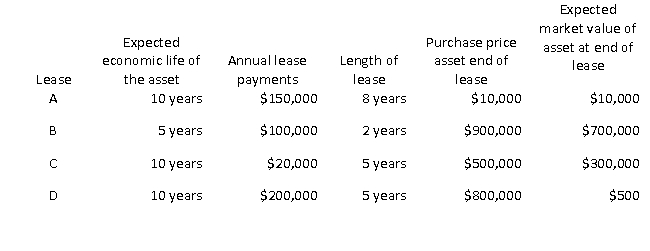

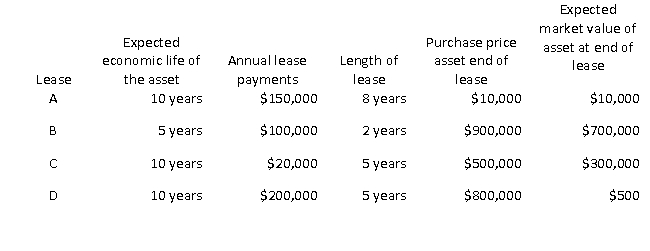

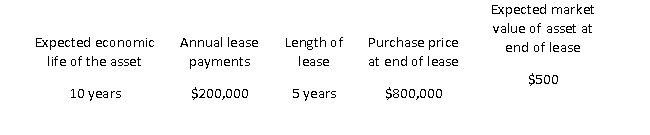

Which of the following leases would best be classified as an operating lease?

A) Lease A

B) Lease B

C) Lease C

D) Lease D

A) Lease A

B) Lease B

C) Lease C

D) Lease D

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

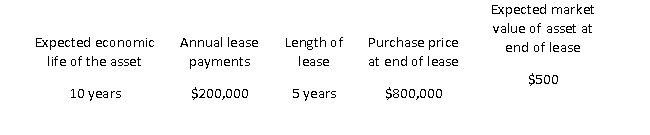

34

Which of the following leases would best be classified as a capital lease?

A) Lease A

B) Lease B

C) Lease C

D) Lease D

A) Lease A

B) Lease B

C) Lease C

D) Lease D

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

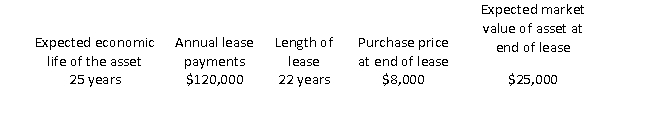

35

Why would the following lease be classified as a capital lease?

A) A bargain purchase option

B) It would not be classified as a capital lease

C) Lease term is equal to 75 percent or more of the economic life

D) Title of the property transfers automatically at the end of lease period

E) Present value of the minimum lease payments at the beginning of the lease is equal to or greater than 90 percent of the value of the leased asset.

A) A bargain purchase option

B) It would not be classified as a capital lease

C) Lease term is equal to 75 percent or more of the economic life

D) Title of the property transfers automatically at the end of lease period

E) Present value of the minimum lease payments at the beginning of the lease is equal to or greater than 90 percent of the value of the leased asset.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

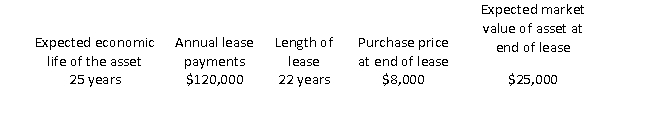

36

Why would the following lease be classified as a capital lease?

A) A bargain purchase option

B) It would not be classified as a capital lease

C) Lease term is equal to 75 percent or more of the economic life

D) Title of the property transfers automatically at the end of lease period

E) Present value of the minimum lease payments at the beginning of the lease is equal to or greater than 90 percent of the value of the leased asset.

A) A bargain purchase option

B) It would not be classified as a capital lease

C) Lease term is equal to 75 percent or more of the economic life

D) Title of the property transfers automatically at the end of lease period

E) Present value of the minimum lease payments at the beginning of the lease is equal to or greater than 90 percent of the value of the leased asset.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

37

On what basis would the following lease most likely be classified as a capital lease?

A) A bargain purchase option

B) It would not be classified as a capital lease

C) Lease term is equal to 75 percent or more of the economic life

D) Title of the property transfers automatically at the end of lease period

E) Present value of the minimum lease payments at the beginning of the lease is equal to or greater than 90 percent of the value of the leased asset.

A) A bargain purchase option

B) It would not be classified as a capital lease

C) Lease term is equal to 75 percent or more of the economic life

D) Title of the property transfers automatically at the end of lease period

E) Present value of the minimum lease payments at the beginning of the lease is equal to or greater than 90 percent of the value of the leased asset.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

38

The lessor of an office copier is the owner of the copier who conveys to the lessee the right to use the copier in exchange for a number of specified payments over an agreed period of time.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

39

Businesses classified as small and medium-sized enterprises generally have fewer than 150 employees.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

40

A capital lease is considered as the acquisition of an asset with payments comprising both the interest and the principal repayment.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

41

Capital leases are not shown on the balance sheet of the lessee.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

42

Madison Company leases a copier, in what is classified as an operating lease. Minimum annual lease payment at the beginning of each year = $2,000; lease term = 3 years; appropriate discount rate = 6 percent; salvage value = $1,000. The asset and liability recognized on Madison Company's (the lessee's) balance sheet at the beginning of the lease is $5,300.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

43

Monroe Company leases a tractor trailer, in what is classified as an operating lease. Minimum annual lease payment at the beginning of each year = $15,000; lease term = 4 years; appropriate discount rate = 6 percent; salvage value = $20,000. The asset and liability recognized on Monroe Company's (the lessee's) balance sheet at the beginning of the lease is $0.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

44

On a nontax lease, the lessor retains legal ownership of the asset, while the lessee gets the depreciation and tax credit benefits.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

45

Operating leases are an example of off-balance sheet financing for the lessor and are included only in the notes to the financial statements.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

46

Managers have an incentive to have leases classified as operating rather than financial from a financial ratio point of view.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

47

For a lessee, cash flow from operations will be higher when a lease is classified as operating as opposed to financial.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

48

For a lessee, financial leverage is greater based on typical financial leverage ratios with a financial lease as opposed to an operating lease.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

49

Total cash flow is unchanged regardless of the type of lease.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

50

Leverage ratios will be unchanged regardless of whether a lease is classified as an operating lease or a financial lease.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

51

Financial statement effects are a motive for leasing assets.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

52

If markets are efficient, leasing for the purpose of enhancing financial statement effects would be a good idea.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

53

Diagram a leveraged lease, labeling the direction of the initial and periodic cash flows associated with the arrangement.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

54

What is the difference between an operating and a capital lease from the perspective of the lessor?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

55

List at least four of the motives for leasing.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

56

Explain how you evaluate a lease versus buy decision, what cash flows should be considered if it is an operating lease. How do you make the decision?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

57

In a sale-leaseback, who owns title to the leased asset?

A) Lessor

B) Lessee

C) Third party

A) Lessor

B) Lessee

C) Third party

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

58

A lease in which the lessor acquires the asset with a small down payment, financing the remainder of the purchase price, is best described as a:

A) financed lease.

B) leveraged lease.

C) borrowed lease.

A) financed lease.

B) leveraged lease.

C) borrowed lease.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

59

In the case of a tax lease, the depreciation and tax credits associated with leased asset will accrue to the:

A) lessor.

B) lessee.

C) third-party financer.

A) lessor.

B) lessee.

C) third-party financer.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

60

A subsidy that finances the purchases of the customers of a company that manufactures and sells trailers is best described as a:

A) financier company.

B) captive finance company.

C) third-party finance company.

A) financier company.

B) captive finance company.

C) third-party finance company.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

61

An agreement that specifies that the party owning the asset records a lease receivable for lease payments and earns interest on the financing is best described as a:

A) capital lease.

B) operating lease.

C) direct financing lease.

D) lease-purchase agreement.

A) capital lease.

B) operating lease.

C) direct financing lease.

D) lease-purchase agreement.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

62

The obligation of which of the following appears on the lessee's balance sheet?

A) Operating lease

B) Capital lease

A) Operating lease

B) Capital lease

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following would not be affected by the lease classification as operating or capital? The leasee's:

A) current ratio.

B) total cash flow.

C) debt-equity ratio.

D) total asset turnover.

A) current ratio.

B) total cash flow.

C) debt-equity ratio.

D) total asset turnover.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is not a motive for leasing an asset, rather than buy it?

A) Flexibility.

B) Risk reduction.

C) Cost of financing.

D) Use of MACRS for tax purposes.

A) Flexibility.

B) Risk reduction.

C) Cost of financing.

D) Use of MACRS for tax purposes.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

65

Consider an asset that is being evaluated in a leasing versus purchase decision. The asset is costs $100,000 and is considered a 3-year MACRS asset. If the discount rate is 10%, the present value of depreciation tax shields is closest to:

A) $33,289.

B) $49,934.

C) $83,224

A) $33,289.

B) $49,934.

C) $83,224

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

66

Information on operating leases can be found in a company's:

A) balance sheet.

B) income statement.

C) statement of cash flows.

D) footnotes to the financial statements.

A) balance sheet.

B) income statement.

C) statement of cash flows.

D) footnotes to the financial statements.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck