Deck 18: Derivatives

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/94

Play

Full screen (f)

Deck 18: Derivatives

1

Which of the following statements about a call option is true?

A) A call option is the obligation to buy the underlying asset.

B) A call option always has time value up to and including expiration.

C) A call option is in the money if the asset price is less than the strike price.

D) A call option is at the money if the asset price is the same as the strike price.

A) A call option is the obligation to buy the underlying asset.

B) A call option always has time value up to and including expiration.

C) A call option is in the money if the asset price is less than the strike price.

D) A call option is at the money if the asset price is the same as the strike price.

A call option is at the money if the asset price is the same as the strike price.

2

Which of the following statements about a call option is false?

A) A call option can be exercised on the expiration date.

B) A call option is in the money if the asset price is above the strike price.

C) A call option is out of the money if the asset price is above the strike price.

D) A call option is at the money if the asset price is the same as the strike price.

A) A call option can be exercised on the expiration date.

B) A call option is in the money if the asset price is above the strike price.

C) A call option is out of the money if the asset price is above the strike price.

D) A call option is at the money if the asset price is the same as the strike price.

A call option is out of the money if the asset price is above the strike price.

3

If the intrinsic value and market value of a call option are $17.00 and $29.00 respectively before expiration, the time value of the option is closest to:

A) $0.

B) $12.

C) $17.

D) $46.

A) $0.

B) $12.

C) $17.

D) $46.

$12.

4

Which of the following most likely decreases the value of a call option?

A) The price of the underlying decreases.

B) The volatility of the underlying increases.

C) Time to expiry of the call option increases.

D) The underlying discontinues dividend payments.

A) The price of the underlying decreases.

B) The volatility of the underlying increases.

C) Time to expiry of the call option increases.

D) The underlying discontinues dividend payments.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following increases the value of a call option?

A) Interest rates decline.

B) The strike price decreases.

C) The underlying becomes less risky.

D) The price of the underlying decreases.

A) Interest rates decline.

B) The strike price decreases.

C) The underlying becomes less risky.

D) The price of the underlying decreases.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

6

If the underlying asset price is $25 and the strike price is $32, the intrinsic value of the option if it is a call option is ___________ and if it is a put option is ____________.

A) $0; $0

B) $0; $7

C) $7; $0

D) $7; $7

A) $0; $0

B) $0; $7

C) $7; $0

D) $7; $7

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

7

If the underlying asset price is $25 and the strike price is $22, the intrinsic value of the option if it is a call option is ___________ and if it is a put option is ____________.

A) 0, 0

B) 0, 3

C) 3, 0

D) 3, 3

A) 0, 0

B) 0, 3

C) 3, 0

D) 3, 3

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following options are in the money?

A) Price of the underlying = $17; Exercise price of the put option = $16

B) Price of the underlying = $20; Exercise price of the put option = $28

C) Price of the underlying = $30; Exercise price of the call option = $45

D) Price of the underlying = $30; Exercise price of the call option = $30

E) Price of the underlying = $35; Exercise price of the call option = $45

A) Price of the underlying = $17; Exercise price of the put option = $16

B) Price of the underlying = $20; Exercise price of the put option = $28

C) Price of the underlying = $30; Exercise price of the call option = $45

D) Price of the underlying = $30; Exercise price of the call option = $30

E) Price of the underlying = $35; Exercise price of the call option = $45

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following options are at the money?

A) Price of the underlying = $18; Exercise price of the put option = $22

B) Price of the underlying = $45; Exercise price of the put option = $38

C) Price of the underlying = $20; Exercise price of the call option = $21

D) Price of the underlying = $33; Exercise price of the call option = $33

E) Price of the underlying = $21; Exercise price of the call option = $20

A) Price of the underlying = $18; Exercise price of the put option = $22

B) Price of the underlying = $45; Exercise price of the put option = $38

C) Price of the underlying = $20; Exercise price of the call option = $21

D) Price of the underlying = $33; Exercise price of the call option = $33

E) Price of the underlying = $21; Exercise price of the call option = $20

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following options are out of the money?

A) Price of the underlying = $18; Exercise price of the put option = $20

B) Price of the underlying = $30; Exercise price of the put option = $30

C) Price of the underlying = $50; Exercise price of the call option = $55

D) Price of the underlying = $50; Exercise price of the call option = $45

E) Price of the underlying = $45; Exercise price of the call option = $45

A) Price of the underlying = $18; Exercise price of the put option = $20

B) Price of the underlying = $30; Exercise price of the put option = $30

C) Price of the underlying = $50; Exercise price of the call option = $55

D) Price of the underlying = $50; Exercise price of the call option = $45

E) Price of the underlying = $45; Exercise price of the call option = $45

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following factors would not affect the value of a call option?

A) Decrease in interest rates

B) Change in price of underlying

C) Change in the risk of the underlying

D) New call option written on underlying stock

E) Increase in the dividend payments on the underlying

A) Decrease in interest rates

B) Change in price of underlying

C) Change in the risk of the underlying

D) New call option written on underlying stock

E) Increase in the dividend payments on the underlying

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is best described as a derivative?

A) Common stock

B) Preferred stock

C) Municipal bond

D) Corporate bond

E) Interest rate swap

A) Common stock

B) Preferred stock

C) Municipal bond

D) Corporate bond

E) Interest rate swap

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is not a derivative?

A) Swaps

B) Bonds

C) Futures

D) Options

E) Forwards

A) Swaps

B) Bonds

C) Futures

D) Options

E) Forwards

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is not true regarding derivatives?

A) Derivatives create leverage.

B) Derivatives are used to shift risks.

C) The use of derivatives is a fairly recent development.

D) The value of derivatives is derived from some other asset.

E) About 95% of the world's biggest companies use derivatives.

A) Derivatives create leverage.

B) Derivatives are used to shift risks.

C) The use of derivatives is a fairly recent development.

D) The value of derivatives is derived from some other asset.

E) About 95% of the world's biggest companies use derivatives.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

15

The right, but not the obligation to buy an underlying asset at a fixed price within or at a specified time is best described as a:

A) swap.

B) future.

C) forward.

D) put option.

E) call option.

A) swap.

B) future.

C) forward.

D) put option.

E) call option.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is false?

A) An investor who is long a call option is the option buyer.

B) To exercise an option is the same as writing an option.

C) An investor who is short a call option is the option writer.

D) Expiration date is the last date on which options can be converted or exercised.

E) The strike price, which is also called exercise price, is the price at which an investor can buy the underlying asset.

A) An investor who is long a call option is the option buyer.

B) To exercise an option is the same as writing an option.

C) An investor who is short a call option is the option writer.

D) Expiration date is the last date on which options can be converted or exercised.

E) The strike price, which is also called exercise price, is the price at which an investor can buy the underlying asset.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

17

A call option has a strike price of $33 and the underlying stock price is $25. The moneyness of this call option is best described as:

A) in the money.

B) at the money.

C) out of the money.

A) in the money.

B) at the money.

C) out of the money.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

18

A call option has a strike price of $33 and the underlying stock price is $33. The moneyness of this call option is best described as:

A) in the money.

B) at the money.

C) out of the money.

A) in the money.

B) at the money.

C) out of the money.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

19

A call option has a strike price of $33 and the underlying stock price is $23. The moneyness of this call option is best described as:

A) in the money.

B) at the money.

C) out of the money.

A) in the money.

B) at the money.

C) out of the money.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

20

The payoff for an investor who is long a call option with a strike price of $60 and the underlying asset price is $45 is closest to:

A) -$15

B) $0

C) $15

D) $45

E) $60

A) -$15

B) $0

C) $15

D) $45

E) $60

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

21

The payoff for an investor who is long a call option with a strike price of $45 and the underlying asset price is $60 is closest to:

A) -$15

B) $0

C) $15

D) $45

E) $60

A) -$15

B) $0

C) $15

D) $45

E) $60

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements is incorrect?

A) A call option writer has a short position in the call.

B) The longer the time to expiration, the greater the option's time value.

C) A company issues call options on their stock, just like they issue the underlying stock.

D) The market value of an option is calculated as option premium = intrinsic value + time value.

E) The call option writer makes money from the premium the call option buyer pays to buy the option.

A) A call option writer has a short position in the call.

B) The longer the time to expiration, the greater the option's time value.

C) A company issues call options on their stock, just like they issue the underlying stock.

D) The market value of an option is calculated as option premium = intrinsic value + time value.

E) The call option writer makes money from the premium the call option buyer pays to buy the option.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements is correct?

A) Options are securities with linear payoffs.

B) Option writers pay a premium to sell the option.

C) Option writers have assumed a long position in the option.

D) The payoff for the option writer is the mirror image of the option buyer.

A) Options are securities with linear payoffs.

B) Option writers pay a premium to sell the option.

C) Option writers have assumed a long position in the option.

D) The payoff for the option writer is the mirror image of the option buyer.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements is incorrect?

A) The value of an option at expiration is its intrinsic value.

B) The longer the time to expiration, the larger the options intrinsic value.

C) The market value of an option is the sum of its intrinsic value and time value.

D) Before expiration, the value of an option will exceed its intrinsic value because of time value.

A) The value of an option at expiration is its intrinsic value.

B) The longer the time to expiration, the larger the options intrinsic value.

C) The market value of an option is the sum of its intrinsic value and time value.

D) Before expiration, the value of an option will exceed its intrinsic value because of time value.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is correct?

A) Intrinsic value = Option premium + Time value

B) Option premium = Intrinsic value + Time value

C) Intrinsic value = Underlying asset price + Time value

D) Option premium = Intrinsic value + Underlying asset price

A) Intrinsic value = Option premium + Time value

B) Option premium = Intrinsic value + Time value

C) Intrinsic value = Underlying asset price + Time value

D) Option premium = Intrinsic value + Underlying asset price

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

26

A call option has a strike price of $65 and is selling for $5 in the market. The underlying asset is trading at $48. What is the intrinsic value and time value respectively, of this option?

A) Intrinsic value $0, Time value $0

B) Intrinsic value $0, Time value $5

C) Intrinsic value $5, Time value $0

D) Intrinsic value $17, Time value $0

E) Intrinsic value $17, Time value $5

A) Intrinsic value $0, Time value $0

B) Intrinsic value $0, Time value $5

C) Intrinsic value $5, Time value $0

D) Intrinsic value $17, Time value $0

E) Intrinsic value $17, Time value $5

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

27

A call option has a strike price of $65 and is selling for $7 in the market. The underlying asset is trading at $65. What is the intrinsic value and time value respectively, of this option?

A) Intrinsic value $0, Time value $0

B) Intrinsic value $7, Time value $0

C) Intrinsic value $0, Time value $7

D) Intrinsic value $7, Time value $7

A) Intrinsic value $0, Time value $0

B) Intrinsic value $7, Time value $0

C) Intrinsic value $0, Time value $7

D) Intrinsic value $7, Time value $7

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

28

A call option has a strike price of $65 and is selling for $5 in the market. The underlying asset is trading at $68. What is the intrinsic value and time value respectively, of this option?

A) Intrinsic value $0, Time value $0

B) Intrinsic value $0, Time value $5

C) Intrinsic value $2, Time value $3

D) Intrinsic value $3, Time value $2

E) Intrinsic value $3, Time value $5

A) Intrinsic value $0, Time value $0

B) Intrinsic value $0, Time value $5

C) Intrinsic value $2, Time value $3

D) Intrinsic value $3, Time value $2

E) Intrinsic value $3, Time value $5

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements is incorrect?

A) Call options tend to increase with increases in interest rates.

B) Call options on riskier assets are worth more than those on low-risk assets.

C) Call options on risky assets with a long time to expiration are very valuable.

D) Options on high-dividend paying stocks or assets with large cash distributions are worth more than those on non-cash flow generating assets.

A) Call options tend to increase with increases in interest rates.

B) Call options on riskier assets are worth more than those on low-risk assets.

C) Call options on risky assets with a long time to expiration are very valuable.

D) Options on high-dividend paying stocks or assets with large cash distributions are worth more than those on non-cash flow generating assets.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following gives the owner the right, but not the obligation to sell an underlying asset at a fixed price for a specified time?

A) Futures

B) Forward

C) Warrant

D) Put Option

E) Call Option

A) Futures

B) Forward

C) Warrant

D) Put Option

E) Call Option

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following would not be considered as holding a short position?

A) Option writer of a call option

B) Option buyer of a put option

C) Purchaser of corporate bonds

D) Seller common stock that you do not currently own

A) Option writer of a call option

B) Option buyer of a put option

C) Purchaser of corporate bonds

D) Seller common stock that you do not currently own

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following would not be considered as holding a long position?

A) Purchaser of preferred stock

B) Option buyer of a put option

C) Option buyer of a call option

D) Purchaser of corporate bonds

E) Purchaser of an exchange traded fund

A) Purchaser of preferred stock

B) Option buyer of a put option

C) Option buyer of a call option

D) Purchaser of corporate bonds

E) Purchaser of an exchange traded fund

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

33

A put option has a strike price of $51 and is selling for $5 in the market. The underlying asset is trading at $48. What is the intrinsic value and time value respectively, of this option?

A) Intrinsic value $0, Time value $2

B) Intrinsic value $0, Time value $3

C) Intrinsic value $0, Time value $5

D) Intrinsic value $3, Time value $2

E) Intrinsic value $3, Time value $5

A) Intrinsic value $0, Time value $2

B) Intrinsic value $0, Time value $3

C) Intrinsic value $0, Time value $5

D) Intrinsic value $3, Time value $2

E) Intrinsic value $3, Time value $5

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

34

A put option has a strike price of $65 and is selling for $7 in the market. The underlying asset is trading at $65. What is the intrinsic value and time value respectively, of this option?

A) Intrinsic value $0, Time value $0

B) Intrinsic value $7, Time value $0

C) Intrinsic value $0, Time value $7

D) Intrinsic value $7, Time value $7

A) Intrinsic value $0, Time value $0

B) Intrinsic value $7, Time value $0

C) Intrinsic value $0, Time value $7

D) Intrinsic value $7, Time value $7

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

35

A call option has a strike price of $65 and is selling for $5 in the market. The underlying asset is trading at $68. What is the intrinsic value and time value respectively, of this option?

A) Intrinsic value $0, Time value $0

B) Intrinsic value $0, Time value $5

C) Intrinsic value $2, Time value $3

D) Intrinsic value $3, Time value $2

E) Intrinsic value $3, Time value $5

A) Intrinsic value $0, Time value $0

B) Intrinsic value $0, Time value $5

C) Intrinsic value $2, Time value $3

D) Intrinsic value $3, Time value $2

E) Intrinsic value $3, Time value $5

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

36

A put option has a strike price of $33 and the underlying stock price is $25. The moneyness of this put option is best described as:

A) in the money.

B) at the money.

C) out of the money.

A) in the money.

B) at the money.

C) out of the money.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

37

A put option has a strike price of $33 and the underlying stock price is $33. The moneyness of this put option is best described as:

A) in the money.

B) at the money.

C) out of the money.

A) in the money.

B) at the money.

C) out of the money.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

38

A put option has a strike price of $23 and the underlying stock price is $33. The moneyness of this put option is best described as:

A) in the money.

B) at the money.

C) out of the money.

A) in the money.

B) at the money.

C) out of the money.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements is incorrect?

A) Put options pay off when the asset price drops below the strike price.

B) Put options are worthless when the asset price is above the strike price.

C) When a put option is deep in the money its price approaches its intrinsic value.

D) An increase in the risk of the underlying asset decreases the value of the put option.

E) Intrinsic value of a put option = Maximum {exercise price - value of the underlying, 0}

A) Put options pay off when the asset price drops below the strike price.

B) Put options are worthless when the asset price is above the strike price.

C) When a put option is deep in the money its price approaches its intrinsic value.

D) An increase in the risk of the underlying asset decreases the value of the put option.

E) Intrinsic value of a put option = Maximum {exercise price - value of the underlying, 0}

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is correct regarding straddles?

A) Straddles involve purchasing an option on a stock that you currently own.

B) Straddles profit when the price moves either direction away from the exercise price.

C) Straddles profit when the market goes up and lose money when the market declines.

D) Straddles include two options with the same strike price, but different expiration dates.

A) Straddles involve purchasing an option on a stock that you currently own.

B) Straddles profit when the price moves either direction away from the exercise price.

C) Straddles profit when the market goes up and lose money when the market declines.

D) Straddles include two options with the same strike price, but different expiration dates.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

41

The two factors that affect both call option values and put option values in the same direction are:

A) higher dividends and greater volatility.

B) higher dividends and higher interest rates.

C) higher asset price, and higher exercise price.

D) greater volatility and longer time to expiration.

E) higher interest rates and longer time to expiration.

A) higher dividends and greater volatility.

B) higher dividends and higher interest rates.

C) higher asset price, and higher exercise price.

D) greater volatility and longer time to expiration.

E) higher interest rates and longer time to expiration.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is not a difference between forward contracts and options?

A) Forward contracts carry credit risk, the possibility that the other party will not repay. Options do not have credit risk.

B) Forward contracts have a counter party. Options are standardized and the exchange is on the other side of the transaction.

C) Forward contracts are traded over-the-counter; options are traded on exchanges including the Chicago Board Options Exchange.

D) Forward contracts are an agreement for the immediate purchase of an asset, while options are commitments by two parties for a transaction at a specific point of time in the future.

A) Forward contracts carry credit risk, the possibility that the other party will not repay. Options do not have credit risk.

B) Forward contracts have a counter party. Options are standardized and the exchange is on the other side of the transaction.

C) Forward contracts are traded over-the-counter; options are traded on exchanges including the Chicago Board Options Exchange.

D) Forward contracts are an agreement for the immediate purchase of an asset, while options are commitments by two parties for a transaction at a specific point of time in the future.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

43

Uncertainty that a borrower will repay what is owed is best described as:

A) currency risk.

B) open interest.

C) spot market risk.

D) counterparty risk.

A) currency risk.

B) open interest.

C) spot market risk.

D) counterparty risk.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

44

The London Metals Exchange would be an example of a(n):

A) stock exchange.

B) futures exchange.

C) options exchange.

D) over-the-counter market.

A) stock exchange.

B) futures exchange.

C) options exchange.

D) over-the-counter market.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is most likely incorrect regarding futures?

A) All contracts are marked to market each day.

B) Buyers can cancel the futures contract by making an offsetting sale.

C) Both buyer and seller have a margin requirement as good faith deposit.

D) The minimal amount that must be maintained in a margin account is the notional amount.

E) Investors may trade futures on a variety of commodities, ranging from traditional agricultural products to newer energy and base metal contracts.

A) All contracts are marked to market each day.

B) Buyers can cancel the futures contract by making an offsetting sale.

C) Both buyer and seller have a margin requirement as good faith deposit.

D) The minimal amount that must be maintained in a margin account is the notional amount.

E) Investors may trade futures on a variety of commodities, ranging from traditional agricultural products to newer energy and base metal contracts.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

46

Cancelling a futures position by making an equivalent but opposite transaction is best described as:

A) offsetting.

B) margin call.

C) marked to market.

D) daily resettlement.

A) offsetting.

B) margin call.

C) marked to market.

D) daily resettlement.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

47

A position formulated to reduce or eliminate an exposure to risk, generally by taking a position opposite a position that the investor has already assumed is best described as a(n):

A) hedge.

B) short position.

C) long position.

D) open interest.

A) hedge.

B) short position.

C) long position.

D) open interest.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

48

The requirement to add money and increase an equity position to a minimum level is best described as a(n):

A) margin call.

B) initial margin.

C) open interest.

D) notional amount.

E) maintenance margin.

A) margin call.

B) initial margin.

C) open interest.

D) notional amount.

E) maintenance margin.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

49

A contact in which parties agree to exchange a future set of cash flows is best described as a(n):

A) swap contract.

B) futures contract.

C) options contract.

D) forward contract.

A) swap contract.

B) futures contract.

C) options contract.

D) forward contract.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements is incorrect regarding swaps?

A) Swaps involve the use of a dealer or over-the-counter market and there is credit risk with swaps.

B) Many firms enter into swap arrangements to convert an existing fixed rate liability into a floating rate liability or vice versa.

C) Swaps allow companies to better manage risks by shifting the risk to other parties, who are willing to bear this risk for a price.

D) Common types of swaps are interest rate swaps, currency swaps, commodity swaps, equity swaps, and credit default swaps.

E) A plain vanilla swap is a type of currency swap in which a party transforms a liability in one currency for a liability in another currency.

A) Swaps involve the use of a dealer or over-the-counter market and there is credit risk with swaps.

B) Many firms enter into swap arrangements to convert an existing fixed rate liability into a floating rate liability or vice versa.

C) Swaps allow companies to better manage risks by shifting the risk to other parties, who are willing to bear this risk for a price.

D) Common types of swaps are interest rate swaps, currency swaps, commodity swaps, equity swaps, and credit default swaps.

E) A plain vanilla swap is a type of currency swap in which a party transforms a liability in one currency for a liability in another currency.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

51

If the time value and the market value of a call option are $5.00 and $15.00, respectively, then the intrinsic value of the option is $20.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

52

A decrease in the risk of the underlying asset decreases the value of a put option.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

53

Derivatives were involved in many of the events that led up to the 2007-2008 financial crisis in the U.S.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

54

The right, but not the obligation, to sell an underlying asset at a fixed price within or at a specified price within or at a specified time is a call option.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

55

The intrinsic value of a call is the difference between the value of the underlying asset and the exercise price. When the value of the underlying asset is above the exercise price, the intrinsic value is positive. When the value of the underlying asset is below the exercise price, the intrinsic value is negative.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

56

The longer the time remaining to expiration, the greater the option's time value.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

57

A deep out of the money call option on a risky asset with a very long time to expiration may be very valuable.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

58

Call options on high-dividend paying stocks can be very valuable because option owners receive dividends on the underlying stock.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

59

An increase in the expiration date of a put option or an increase in the risk of a put option increases the put price same as it would increase a call price.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

60

Company XYZ increases its cash dividend. This should decrease the price of put options on Company XYZ stock.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

61

Options that can only be exercised at maturity are considered American options.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

62

European options are designated as such because they can only be traded in Europe.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

63

Put options must be exercised at maturity.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

64

Call options that can be sold, should never be exercised before maturity.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

65

Higher interest rates decrease call option values and increase put option values.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

66

In the U.S. options are traded mainly on the NYSE / Euronext exchange.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

67

Straddles involve purchasing a call option and put option with the same exercise price and expiration.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

68

Most futures contracts are closed out by actual deliveries of the underlying assets.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

69

The primary difference between a forward contract and a futures contract is that a futures contract is standardized, while a forward contract is not.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

70

A spot contract is an agreement by two parties for a transaction at a specific point of time in the future.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

71

Futures contracts are designed to share the price risk and not actually transfer the underlying asset.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

72

If an investor purchases a futures contract for delivery of a commodity at $15 per unit, when the spot price of the commodity is $12.50 per unit the investor expects the price of the commodity to increase in the future.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

73

Characteristics of forward contracts are customized contracts, traded by dealers or OTC markets, default risk, no initial deposit required, and settlement on maturity date.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

74

Characteristics of futures contracts are customized contracts, traded by dealers or OTC markets, default risk, no initial deposit required, and settlement on maturity date.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

75

Companies enter into currency swaps primarily to speculate on anticipated changes in the currency market.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

76

List as many things as you can that would increase the value of a put option.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

77

List explanations why two different put options with the same strike price and the same expiration date could trade at different prices.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

78

List four types of derivatives and an explanation of what each type is.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

79

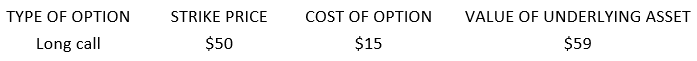

For the following call option which is at expiration, list the intrinsic value, the profit or loss, and whether the option would be exercised or let to expire.

Intrinsic value = ___________, Profit / loss (circle one) = ___________, Exercise/Allow to Expire (circle one)

Intrinsic value = ___________, Profit / loss (circle one) = ___________, Exercise/Allow to Expire (circle one)

Intrinsic value = ___________, Profit / loss (circle one) = ___________, Exercise/Allow to Expire (circle one)

Intrinsic value = ___________, Profit / loss (circle one) = ___________, Exercise/Allow to Expire (circle one)

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

80

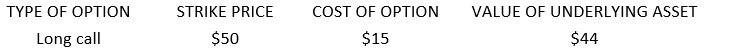

For the following call option which is at expiration, list the intrinsic value, the profit or loss, and whether the option would be exercised or let to expir

Intrinsic value = ___________, Profit / loss (circle one) = ___________, Exercise/Allow to Expire (circle one)

Intrinsic value = ___________, Profit / loss (circle one) = ___________, Exercise/Allow to Expire (circle one)

Intrinsic value = ___________, Profit / loss (circle one) = ___________, Exercise/Allow to Expire (circle one)

Intrinsic value = ___________, Profit / loss (circle one) = ___________, Exercise/Allow to Expire (circle one)

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck