Deck 16: Dividend Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/76

Play

Full screen (f)

Deck 16: Dividend Policy

1

The date on which the board of directors decides that the company will pay a dividend is best described as:

A) Payment date.

B) Date of record.

C) Declaration date.

D) Ex-dividend date.

A) Payment date.

B) Date of record.

C) Declaration date.

D) Ex-dividend date.

Declaration date.

2

A cash dividend paid in addition to a regular dividend is best described as a:

A) stock split.

B) stock dividend.

C) special dividend.

D) dividend reinvestment plan.

A) stock split.

B) stock dividend.

C) special dividend.

D) dividend reinvestment plan.

special dividend.

3

Your aunt tells you about owning Procter and Gamble stock and explains that "instead of receiving a check each quarter it buys more shares of the company." What is she talking about?

A) Stock split

B) Capital gains

C) Special dividend

D) Dividend reinvestment plan

A) Stock split

B) Capital gains

C) Special dividend

D) Dividend reinvestment plan

Dividend reinvestment plan

4

The holder of record is best described as the:

A) person who owns the stock.

B) trust that holds the stock for the shareholder.

C) broker who holds the stock for the shareholder.

A) person who owns the stock.

B) trust that holds the stock for the shareholder.

C) broker who holds the stock for the shareholder.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

5

A dividend paid in the form of additional shares of 25 percent of the outstanding shares is best described as a:

A) capital gains.

B) stock dividend.

C) special dividend.

D) dividend reinvestment plan.

A) capital gains.

B) stock dividend.

C) special dividend.

D) dividend reinvestment plan.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

6

If a company has 200,000 shares outstanding before a 2:1 stock split, the number of shares outstanding after the split is closest to:

A) 100,000.

B) 200,000.

C) 300,000.

D) 400,000.

A) 100,000.

B) 200,000.

C) 300,000.

D) 400,000.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

7

If a company has 1 million shares outstanding before a 1.5:1 stock split, the number of shares outstanding after the split is closest to:

A) 0.7 million.

B) 1 million.

C) 1.5 million.

D) 2 million.

A) 0.7 million.

B) 1 million.

C) 1.5 million.

D) 2 million.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

8

Olive Company pays an 8 percent stock dividend. Olive Company had 500,000 shares outstanding and a stock price of $22 before the stock dividend. The price of Olive Company stock after the dividend is nearest to:

A) $20.37.

B) $22.00.

C) $23.76.

D) $25.00.

A) $20.37.

B) $22.00.

C) $23.76.

D) $25.00.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

9

You hear on the financial news that a stock you own is splitting 3 for 2. If you currently own 300 shares, how many shares will you have after the split?

A) 200

B) 450

C) 600

D) 900

A) 200

B) 450

C) 600

D) 900

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following would be most appropriate for a company which is in danger of being delisted from the stock exchange because of too low of a price?

A) Stock split

B) Cash dividend

C) Stock dividend

D) Reverse stock split

E) Dividend reinvestment plan

A) Stock split

B) Cash dividend

C) Stock dividend

D) Reverse stock split

E) Dividend reinvestment plan

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following results in a reduction in the number of shares outstanding?

A) Stock split

B) Cash dividend

C) Stock dividend

D) Reverse stock split

E) Dividend reinvestment plan

A) Stock split

B) Cash dividend

C) Stock dividend

D) Reverse stock split

E) Dividend reinvestment plan

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is most likely going to increase the price of shares of stock of a company?

A) Stock split.

B) Stock dividend

C) Reverse stock split

A) Stock split.

B) Stock dividend

C) Reverse stock split

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following results in taxable income to the investor?

A) Stock split

B) Cash dividend

C) Stock dividend

D) Reverse stock split

A) Stock split

B) Cash dividend

C) Stock dividend

D) Reverse stock split

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following effects retained earnings?

A) Stock split

B) Stock dividend

C) Reverse stock split

A) Stock split

B) Stock dividend

C) Reverse stock split

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following should result in an increase in the underlying stock price?

A) Stock split

B) Cash dividend

C) Stock dividend

D) Share repurchase

A) Stock split

B) Cash dividend

C) Stock dividend

D) Share repurchase

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is not a reason that motivates share repurchases by companies?

A) Take the company private

B) Repurchase dissidents' shares

C) Provide a payout of funds to shareholders

D) Signal that management thinks that the shares are overvalued

E) Remove cash without generating expectations for future distributions

A) Take the company private

B) Repurchase dissidents' shares

C) Provide a payout of funds to shareholders

D) Signal that management thinks that the shares are overvalued

E) Remove cash without generating expectations for future distributions

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

17

The method companies use when repurchasing shares in the market through brokers is best described as:

A) tender offer.

B) open market repurchase.

C) Dutch auction tender offer.

A) tender offer.

B) open market repurchase.

C) Dutch auction tender offer.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

18

The method of repurchasing shares that companies use when make offers to repurchase directly to shareholders is best described as:

A) tender offer.

B) open market repurchase.

C) Dutch auction tender offer.

A) tender offer.

B) open market repurchase.

C) Dutch auction tender offer.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

19

A 200 percent stock dividend is the same as which of the following?

A) 1 for 1 stock split

B) 2 for 1 stock split

C) 3 for 1 stock split

D) 3 for 2 stock split

A) 1 for 1 stock split

B) 2 for 1 stock split

C) 3 for 1 stock split

D) 3 for 2 stock split

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following will result in an increase in the number of shares outstanding?

A) A stock split

B) A share repurchase

C) A reverse stock split

A) A stock split

B) A share repurchase

C) A reverse stock split

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

21

When is the ex-dividend date if the holder of record date is June 15, 2012?

A) June 13

B) June 14

C) June 15

D) June 16

E) June 17

A) June 13

B) June 14

C) June 15

D) June 16

E) June 17

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

22

Your boss, the Chief Financial Officer, explains to you that while the firm's stock is currently trading at $90 per share, he feels the optimal range for the stock would be more around $25 - $35 per share. Which of the following would you recommend?

A) A 3 for 1 stock split

B) A stock repurchase of up to 60% of the shares

C) A reverse stock split of 1 share for every 3 shares

A) A 3 for 1 stock split

B) A stock repurchase of up to 60% of the shares

C) A reverse stock split of 1 share for every 3 shares

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

23

Under which theory regarding dividends, do dividends not affect the value of the company, but investment projects the company undertakes do affect the value of the company?

A) Agency theory

B) Residual theory

C) Signaling theory

D) Tax clientele theory

E) "Bird in the hand " theory

A) Agency theory

B) Residual theory

C) Signaling theory

D) Tax clientele theory

E) "Bird in the hand " theory

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

24

If a company only pays a dividend when there is cash flow remaining after funding all positive net present value investment projects, this would follow what theory?

A) Agency theory

B) Residual theory

C) Signaling theory

D) Tax clientele theory

E) "Bird in the hand " theory

A) Agency theory

B) Residual theory

C) Signaling theory

D) Tax clientele theory

E) "Bird in the hand " theory

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

25

Iris, Inc. follows a residual dividend policy. Iris, Inc. will have $400,000 in profits this year. It is accepting two positive net present value projects for a total cost of $450,000. How much will Lafayette, Inc. pay out to its shareholders this year?

A) $0

B) $50,000

C) $400,000

D) $450,000

E) $850,000

A) $0

B) $50,000

C) $400,000

D) $450,000

E) $850,000

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

26

Lafayette, Inc. follows a residual dividend policy. Lafayette, Inc. will have $750,000 in profits this year. It is accepting five positive net present value projects for a total cost of $450,000. How much will Lafayette, Inc. pay out to its shareholders this year?

A) $300,000

B) $450,000

C) $750,000

D) $1,200,000

A) $300,000

B) $450,000

C) $750,000

D) $1,200,000

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

27

If Generic Company's stock goes up after a dividend is announced, it could be because the payout of the dividend aligns management objectives with shareholder objectives and controls management by having them justify expenditures on projects through prospectuses, etc. Which of the following would best describe this?

A) Agency theory

B) Residual theory

C) Signaling theory

D) Tax clientele theory

E) "Bird in the hand " theory

A) Agency theory

B) Residual theory

C) Signaling theory

D) Tax clientele theory

E) "Bird in the hand " theory

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

28

Which model indicates that dividend changes have information content, which fills an important role for dividend policy?

A) Agency theory

B) Residual theory

C) Signaling theory

D) Tax clientele theory

E) "Bird in the hand " theory

A) Agency theory

B) Residual theory

C) Signaling theory

D) Tax clientele theory

E) "Bird in the hand " theory

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

29

The theory that dividends may not impact the general level of share prices, but that dividends will be an important influence on the type of investors that a company attracts is best described as:

A) agency theory.

B) residual theory.

C) signaling theory.

D) tax clientele theory.

E) "bird in the hand " theory.

A) agency theory.

B) residual theory.

C) signaling theory.

D) tax clientele theory.

E) "bird in the hand " theory.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is not a common dividend payout pattern?

A) Constant dividend per share

B) Constant dividend payout ratio

C) Constant growth in dividend per share

D) Constant increase in the dividend by a fixed amount

E) All of the above are common dividend payout patterns

A) Constant dividend per share

B) Constant dividend payout ratio

C) Constant growth in dividend per share

D) Constant increase in the dividend by a fixed amount

E) All of the above are common dividend payout patterns

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

31

A stock you are considering purchasing pays $1.00 per share dividend and has for years. The dividend payout policy this company follows is best described as having a:

A) dividend per share.

B) dividend payout ratio.

C) growth in dividend per share.

D) increase in the dividend by a fixed amount.

A) dividend per share.

B) dividend payout ratio.

C) growth in dividend per share.

D) increase in the dividend by a fixed amount.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

32

Your roommate is starting a business and wants to pay investors 35 percent of earnings. You explain this would be__________________ dividend policy.

A) constant dividend per share

B) constant dividend payout ratio

C) constant growth in dividend per share

D) constant increase in the dividend by a fixed amount

A) constant dividend per share

B) constant dividend payout ratio

C) constant growth in dividend per share

D) constant increase in the dividend by a fixed amount

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

33

Everything Fig Company has net income of $5,000,000 and pays dividends of $750,000. Everything Fig Company has a dividend payout ratio closest to:

A) 0.15%.

B) 1.5%.

C) 5.0%.

D) 15% .

E) 150%.

A) 0.15%.

B) 1.5%.

C) 5.0%.

D) 15% .

E) 150%.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following would not make a company's stock price decline?

A) Stock Split

B) Dividend cut

C) Stock Dividend

D) Share repurchase

A) Stock Split

B) Dividend cut

C) Stock Dividend

D) Share repurchase

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following would not likely increase a company's stock price?

A) Share repurchase

B) Dividend increase

C) Dividend omission

D) Dividend initiation

E) Reverse stock split

A) Share repurchase

B) Dividend increase

C) Dividend omission

D) Dividend initiation

E) Reverse stock split

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

36

A company that has net income of $250,000 and pays dividends of $50,000 has a dividend payout ratio closest to:

A) 0.2%.

B) 2%.

C) 20%.

D) 200%.

E) 500%.

A) 0.2%.

B) 2%.

C) 20%.

D) 200%.

E) 500%.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

37

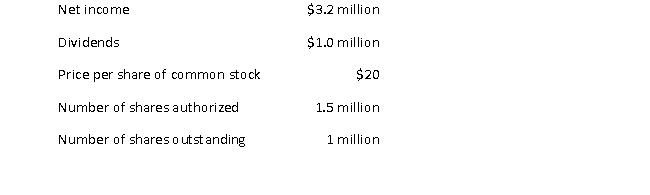

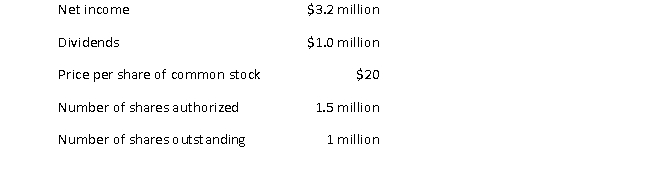

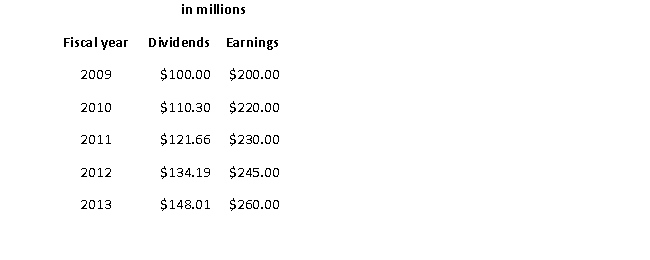

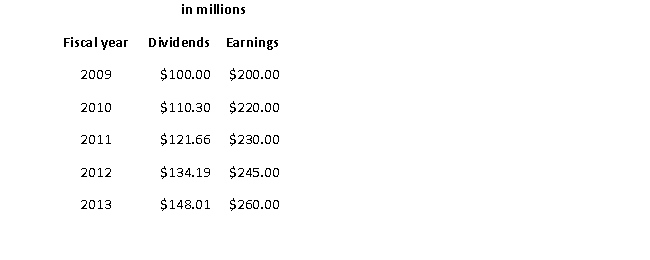

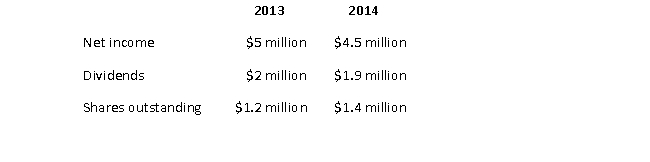

Suppose a company that has the following financial outcomes:

Its dividend yield is closest to:

Its dividend yield is closest to:

A) 3.2%

B) 3.3%

C) 5.0%.

D) 31.25%

Its dividend yield is closest to:

Its dividend yield is closest to:A) 3.2%

B) 3.3%

C) 5.0%.

D) 31.25%

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

38

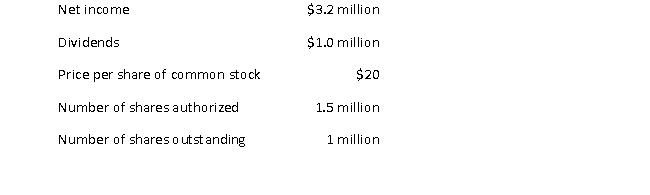

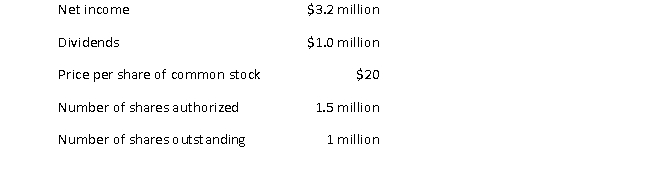

Suppose a company that has the following financial outcomes:

Its dividend payout is closest to:

Its dividend payout is closest to:

A) 3.2%.

B) 20.83%

C) 31.25%.

D) 32%.

Its dividend payout is closest to:

Its dividend payout is closest to:A) 3.2%.

B) 20.83%

C) 31.25%.

D) 32%.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

39

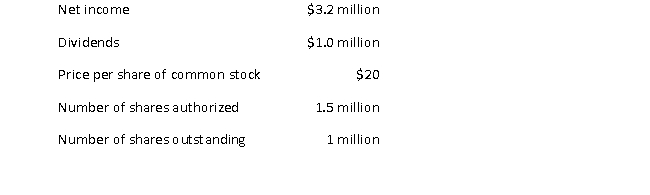

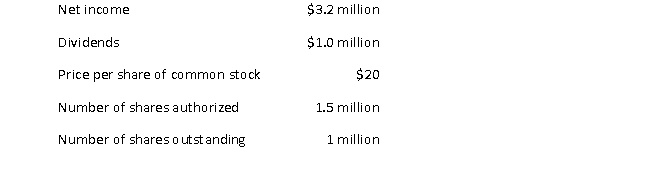

Suppose a company that has the following financial outcomes:

Its retention ratio is closest to:

Its retention ratio is closest to:

A) 68.00%

B) 68.75%.

C) 79.17%

Its retention ratio is closest to:

Its retention ratio is closest to:A) 68.00%

B) 68.75%.

C) 79.17%

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

40

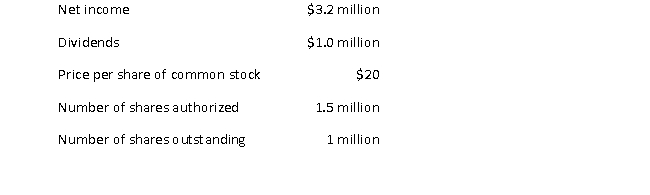

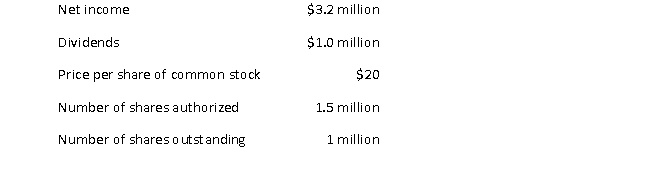

Suppose a company that has the following financial outcomes:

Its dividends per share is closest to:

Its dividends per share is closest to:

A) $0.67

B) $1.00

C) $2.13

D) $3.20

Its dividends per share is closest to:

Its dividends per share is closest to:A) $0.67

B) $1.00

C) $2.13

D) $3.20

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

41

The dividend yield of Purple Company dropped at the end of 2012. Reasons the dividend yield fell could include all of the following except:

A) Purple Company cut its' dividend.

B) the price of Purple Company's stock rose.

C) the price of Purple Company's stock declined.

A) Purple Company cut its' dividend.

B) the price of Purple Company's stock rose.

C) the price of Purple Company's stock declined.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

42

The dividend yield of Pink Company increased at the end of 2012. Reasons the dividend yield rose could include all of the following except:

A) Pink Company increased its' dividend.

B) the price of Pink Company's stock fell.

C) the price of Pink Company's stock increased.

A) Pink Company increased its' dividend.

B) the price of Pink Company's stock fell.

C) the price of Pink Company's stock increased.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

43

The dividend payout of the GoGreen Company increased at the end of 2012. Reasons the dividend payout rose could include all of the following except that:

A) GoGreen's earnings fell.

B) Go Green's earnings increased.

C) the Go Green Company increased its' dividend.

A) GoGreen's earnings fell.

B) Go Green's earnings increased.

C) the Go Green Company increased its' dividend.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

44

Suppose Company ABC has a current value of $35 per share and pays a dividend of $2.50 per share. Company ABCs dividend yield is closest to:

A) 0.7143% .

B) 2.500%.

C) 7.143%.

D) 35.000%.

A) 0.7143% .

B) 2.500%.

C) 7.143%.

D) 35.000%.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

45

A stock you are considering investing in has a relatively high dividend yield. You have been reading research that questions the firm's ability to continue its dividend. You decide to look at the dividend coverage. Which of the following formulas should you use?

A) Dividend per share / Price per share

B) Dividend per share /Earnings per share

C) Earnings per share /Dividends per share

D) Total dividends / Number of shares outstanding

A) Dividend per share / Price per share

B) Dividend per share /Earnings per share

C) Earnings per share /Dividends per share

D) Total dividends / Number of shares outstanding

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

46

You decide to calculate some ratios to assess the safety of your firm's stock, which you hold in your profit-sharing plan. You find that the dividend coverage ratio is 0.85. What does this mean?

A) The firm pays a dividend of $0.85 quarterly.

B) The firm's dividend is 85% of other similar size firms in the same industry.

C) The firm paid 85% of the dividend out of current period earnings, the other 15% of the dividend came out of retained earnings.

D) The firm has a high dividend payout. It pays out 85% of its earnings, the other 15% are retained for use on investment projects.

A) The firm pays a dividend of $0.85 quarterly.

B) The firm's dividend is 85% of other similar size firms in the same industry.

C) The firm paid 85% of the dividend out of current period earnings, the other 15% of the dividend came out of retained earnings.

D) The firm has a high dividend payout. It pays out 85% of its earnings, the other 15% are retained for use on investment projects.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

47

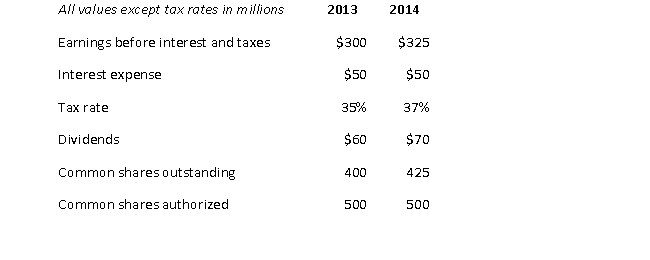

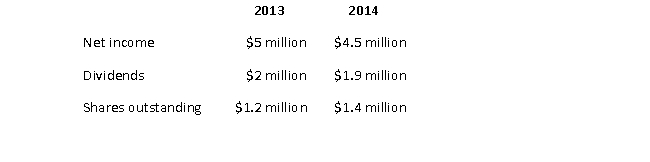

The following information is available for the Trio Corporation for fiscal years 2013 and 2014:

Comparing 2014 with 2013, the times interest coverage ratio, dividend payout, and dividends per share, respectively:

Comparing 2014 with 2013, the times interest coverage ratio, dividend payout, and dividends per share, respectively:

A) increased, increased, and increased.

B) increased, decreased, and increased.

C) increased, decreased, and decreased.

D) decreased, decreased, and decreased.

E) decreased, increased, and decreased.

Comparing 2014 with 2013, the times interest coverage ratio, dividend payout, and dividends per share, respectively:

Comparing 2014 with 2013, the times interest coverage ratio, dividend payout, and dividends per share, respectively:A) increased, increased, and increased.

B) increased, decreased, and increased.

C) increased, decreased, and decreased.

D) decreased, decreased, and decreased.

E) decreased, increased, and decreased.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

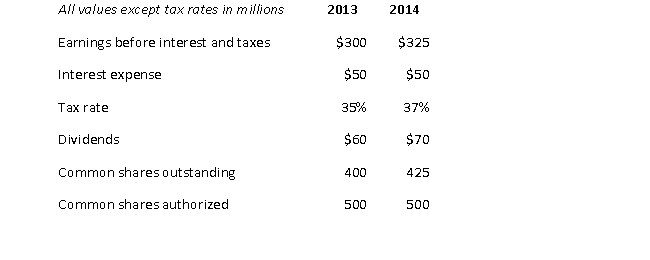

48

The following information is available for the Windchime Corporation for fiscal years 2013 and 2014:

Comparing 2014 with 2013, the times interest coverage ratio, dividend payout, and dividends per share, respectively:

Comparing 2014 with 2013, the times interest coverage ratio, dividend payout, and dividends per share, respectively:

A) increased, increased, and increased.

B) increased, decreased, and increased.

C) increased, decreased, and decreased.

D) decreased, decreased, and decreased.

E) decreased, increased, and decreased.

Comparing 2014 with 2013, the times interest coverage ratio, dividend payout, and dividends per share, respectively:

Comparing 2014 with 2013, the times interest coverage ratio, dividend payout, and dividends per share, respectively:A) increased, increased, and increased.

B) increased, decreased, and increased.

C) increased, decreased, and decreased.

D) decreased, decreased, and decreased.

E) decreased, increased, and decreased.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

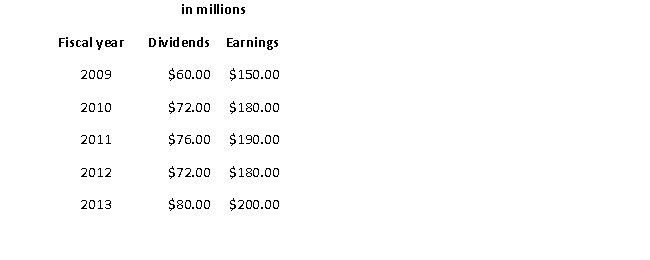

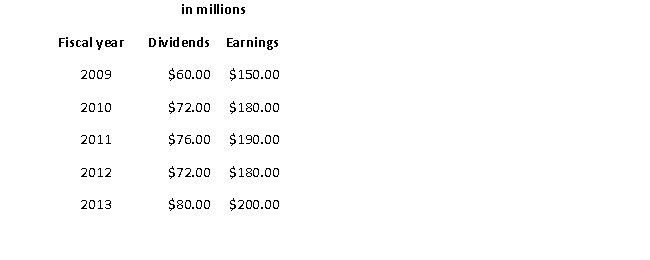

49

The following information is available for the Abbie Corporation for fiscal years 2013 and 2014:

Shares outstanding, 2009-2013: 100 million

Shares outstanding, 2009-2013: 100 million

The Abbie Corporation's dividend policy over the period 2009 through 2013 can best be described as:

A) level dividends per share.

B) constant dividend payout.

C) constant dividends per share.

D) constant growth in dividends per share.

Shares outstanding, 2009-2013: 100 million

Shares outstanding, 2009-2013: 100 millionThe Abbie Corporation's dividend policy over the period 2009 through 2013 can best be described as:

A) level dividends per share.

B) constant dividend payout.

C) constant dividends per share.

D) constant growth in dividends per share.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

50

The following information is available for the Wind Corporation for fiscal years 2013 and 2014:

Shares outstanding, 2009-2013: 100 million

Shares outstanding, 2009-2013: 100 million

The Wind Corporation's dividend policy over the period 2009 through 2013 can best be described as:

A) level dividends per share.

B) constant dividend payout.

C) constant dividends per share.

D) constant growth in dividends per share.

Shares outstanding, 2009-2013: 100 million

Shares outstanding, 2009-2013: 100 millionThe Wind Corporation's dividend policy over the period 2009 through 2013 can best be described as:

A) level dividends per share.

B) constant dividend payout.

C) constant dividends per share.

D) constant growth in dividends per share.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

51

Companies tend to adjust dividends instantly in an economic downturn.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

52

The ex-dividend date for dividends comes after the record date.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

53

The correct ordering in time of the dates associated with a dividend is declaration date, date of record, ex-dividend date, payment date.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

54

If you buy a stock on the ex-dividend date, you will not get the forthcoming declared dividend.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

55

In an open market repurchase, shareholders submit bids for the price they are willing to sell their shares so the company will pay the minimum price necessary to buy the stated number of shares.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

56

If the holder of record date is March 31, 2012 the ex-dividend date will be April 2, 2012.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

57

Under the residual theory of dividends, high-growth companies should be paying dividends, while profitable, mature companies would not pay dividends.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

58

The "bird in the hand" argument of dividend theory indicates that by paying a large dividend and forcing the company to justify future expenditures, value is created by controlling management.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

59

The idea that there are different preferences for receiving dividend income as a result of investors having different tax situations is best described as tax brackets.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

60

If the dividend payout is 1.2, this means the company is paying part of this period's dividends out of retained earnings.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

61

Most companies vary their dividend each period based on their earnings performance.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

62

Companies are reluctant to cut dividends when earnings decline.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

63

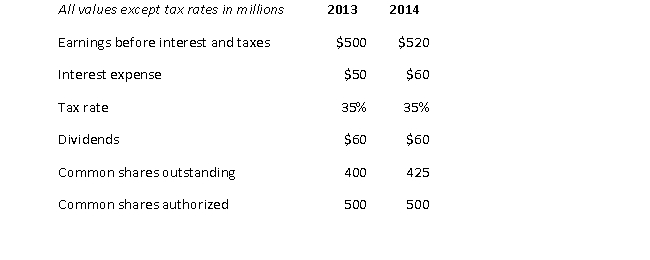

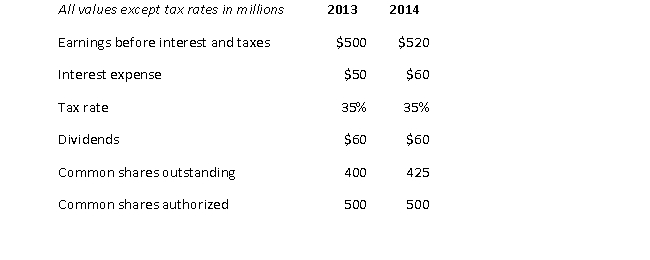

Consider the following financial information for the Gadget Corporations:

The dividend payout ratio for Gadget decreased from 2013 to 2014

The dividend payout ratio for Gadget decreased from 2013 to 2014

The dividend payout ratio for Gadget decreased from 2013 to 2014

The dividend payout ratio for Gadget decreased from 2013 to 2014

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

64

Generic Company pays a 10 percent stock dividend. There were 2 million shares of Generic Company stock outstanding before the stock dividend and the stock price before the dividend was $25. How many shares are outstanding after the dividend? What is the expected price of the stock following the dividend?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

65

A fellow employee brings to your attention that the company you work for is having a stock split soon. He then asks you why companies have stock splits. How do you answer?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

66

List at least three of the reasons companies pay dividends.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following will not result in a reduction of the retained earnings account?

A) Stock split.

B) Cash dividend.

C) Stock dividend.

A) Stock split.

B) Cash dividend.

C) Stock dividend.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

68

The dividend declaration specifies all but which of the following?

A) Record date.

B) Payment date.

C) Ex-dividend date.

D) Amount of the dividend per share of stock.

A) Record date.

B) Payment date.

C) Ex-dividend date.

D) Amount of the dividend per share of stock.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following occurs soonest in time?

A) Record date.

B) Payment date.

C) Ex-dividend date.

A) Record date.

B) Payment date.

C) Ex-dividend date.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

70

Dividends are declared by the:

A) shareholders.

B) company's management.

C) company's board of directors.

A) shareholders.

B) company's management.

C) company's board of directors.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is equivalent, in terms of share dilution, to a 1.5 stock split?

A) 50 percent stock dividend

B) 100 percent stock dividend

C) 150 percent stock dividend

A) 50 percent stock dividend

B) 100 percent stock dividend

C) 150 percent stock dividend

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

72

If investors prefer cash dividends to the more uncertain stock price appreciation, this view is consistent with the:

A) residual explanation of dividend policy.

B) signaling explanation of dividend policy.

C) agency cost explanation of dividend policy.

D) bird-in-the-hand explanation of dividend policy.

A) residual explanation of dividend policy.

B) signaling explanation of dividend policy.

C) agency cost explanation of dividend policy.

D) bird-in-the-hand explanation of dividend policy.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

73

A company that only pays dividends when it has exhausted all value-enhancing projects is consistent with the:

A) residual explanation of dividend policy.

B) signaling explanation of dividend policy.

C) agency cost explanation of dividend policy.

D) bird-in-the-hand explanation of dividend policy.

A) residual explanation of dividend policy.

B) signaling explanation of dividend policy.

C) agency cost explanation of dividend policy.

D) bird-in-the-hand explanation of dividend policy.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

74

In practice, all companies that pay dividends tend to pay dividends such that there is a constant rate of growth.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

75

A company that pays dividends at the rate of $2 per share, has a book value of equity of $10 per share, a market price of $15 per share, and net income of $5 per share, has a dividend yield closest to:

A) 13 percent.

B) 20 percent.

C) 33 percent.

D) 40 percent.

A) 13 percent.

B) 20 percent.

C) 33 percent.

D) 40 percent.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

76

A company that pays dividends at the rate of $2 per share, has a book value of equity of $10 per share, a market price of $15 per share, and net income of $5 per share, has a dividend payout closest to:

A) 13 percent.

B) 20 percent.

C) 33 percent.

D) 40 percent.

A) 13 percent.

B) 20 percent.

C) 33 percent.

D) 40 percent.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck