Deck 14: Cost of Capital

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/91

Play

Full screen (f)

Deck 14: Cost of Capital

1

The required rate of return from the perspective of the suppliers of funds (that is, the creditor or owner) is referred to as the:

A) cost of capital.

B) cannibalization.

C) competitive advantage.

D) comparative advantage.

A) cost of capital.

B) cannibalization.

C) competitive advantage.

D) comparative advantage.

cost of capital.

2

Capital is best described as:

A) sum of debt and equity funds.

B) the operating funds of a business.

C) the funds invested in current assets.

D) equity raised in an initial public offering.

A) sum of debt and equity funds.

B) the operating funds of a business.

C) the funds invested in current assets.

D) equity raised in an initial public offering.

sum of debt and equity funds.

3

The weighted average cost of capital is:

A) what it cost the company to raise capital in the past.

B) the average cost of acquiring additional capital funds.

C) the marginal cost of acquiring additional capital funds.

D) the average of the past costs of capital and the anticipated costs of capital.

A) what it cost the company to raise capital in the past.

B) the average cost of acquiring additional capital funds.

C) the marginal cost of acquiring additional capital funds.

D) the average of the past costs of capital and the anticipated costs of capital.

the marginal cost of acquiring additional capital funds.

4

Marginal cost of capital schedule represents:

A) what it cost the company to raise capital in the past.

B) the average costs of acquiring additional capital funds.

C) the marginal costs of acquiring additional capital funds.

D) the average of the past costs of capital and the anticipated costs of capital.

A) what it cost the company to raise capital in the past.

B) the average costs of acquiring additional capital funds.

C) the marginal costs of acquiring additional capital funds.

D) the average of the past costs of capital and the anticipated costs of capital.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

5

Return on equity is the ratio of:

A) net income to total assets.

B) net income to invested capital.

C) net income to shareholders' equity.

D) earnings before interest and taxes to shareholders' equity.

A) net income to total assets.

B) net income to invested capital.

C) net income to shareholders' equity.

D) earnings before interest and taxes to shareholders' equity.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

6

Net income divided by the book value of equity is the:

A) return on equity.

B) market-to-book ratio.

C) marginal cost of capital.

D) return on invested capital.

A) return on equity.

B) market-to-book ratio.

C) marginal cost of capital.

D) return on invested capital.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

7

Earnings before interest and taxes divided by the book value of invested capital is the:

A) return on equity.

B) market-to-book ratio.

C) marginal cost of capital.

D) return on invested capital.

A) return on equity.

B) market-to-book ratio.

C) marginal cost of capital.

D) return on invested capital.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

8

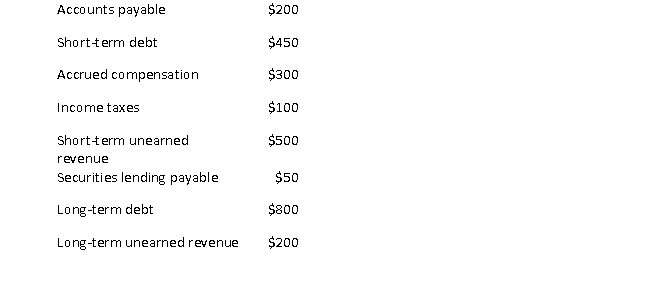

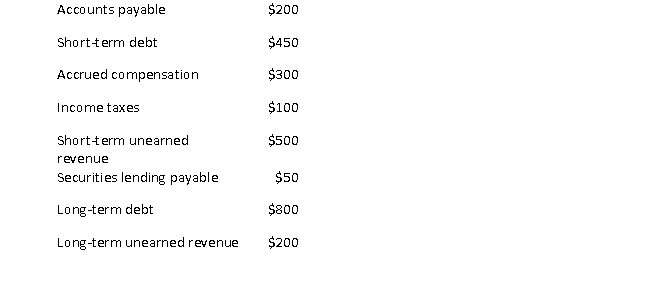

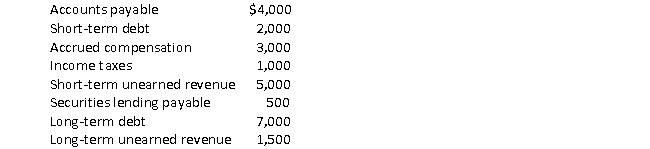

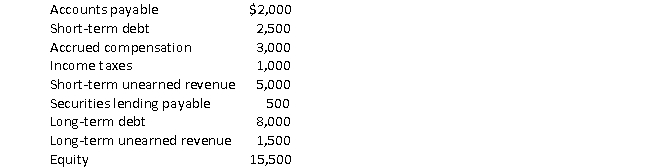

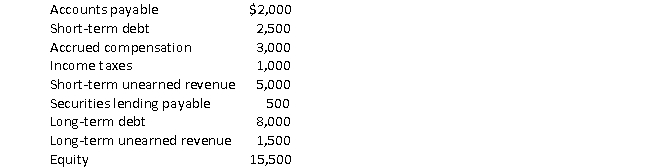

Consider the following data from the balance sheet of XYZ company:

XYZ's total liabilities are closest to:

XYZ's total liabilities are closest to:

A) $1,250

B) $1,350

C) $1,600

D) $2,600

XYZ's total liabilities are closest to:

XYZ's total liabilities are closest to:A) $1,250

B) $1,350

C) $1,600

D) $2,600

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

9

Consider the following data from the balance sheet of DEF company:

The debt capital of DEF is closest to:

The debt capital of DEF is closest to:

A) $1,250

B) $1,350

C) $1,600

D) $2,600

The debt capital of DEF is closest to:

The debt capital of DEF is closest to:A) $1,250

B) $1,350

C) $1,600

D) $2,600

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

10

Suppose an investment requires the purchase of equipment for $15,000 and increases working capital by $1,000. Further, the company must spend $500 to install the equipment. The investment cash flow for the project is closest to:

A) - $13,500

B) - $14,000

C) - $15,500

D) - $16,500

A) - $13,500

B) - $14,000

C) - $15,500

D) - $16,500

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

11

Suppose an investment requires the purchase of equipment for $10,000 and decreases working capital by $500. The company must spend $1,000 to install the equipment. The investment cash flow for this project is closest to:

A) - $8,500

B) - $9,500

C) - $10,500

D) - $11,500

A) - $8,500

B) - $9,500

C) - $10,500

D) - $11,500

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

12

Suppose ABC Company can issue new 10-year bonds, with 6 percent coupon, paid semi-annually. Assume a tax rate of 30 percent. The company's before-tax cost of debt if these bonds are issued at 102 is closest to:

A) 0.83%

B) 1.94%

C) 3.88%

D) 5.54%

E) 6.00%

A) 0.83%

B) 1.94%

C) 3.88%

D) 5.54%

E) 6.00%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

13

Suppose ABC Company can issue new 10-year bonds, with 6 percent coupon, paid semi-annually. Assume a tax rate of 30 percent. The company's after-tax cost of debt if these bonds are issued at 102 is closest to:

A) 0.83%

B) 1.94%

C) 3.88%

D) 5.54%

E) 6.00%

A) 0.83%

B) 1.94%

C) 3.88%

D) 5.54%

E) 6.00%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

14

Suppose company ABC can issue new 10-year bonds, with 8 percent coupon, paid semi-annually. Assume a tax rate of 30 percent. The company's before-tax cost of debt if these bonds are issued at 100 is closest to:

A) 2.40%

B) 2.80%

C) 4.00%

D) 5.60%

E) 8.00%

A) 2.40%

B) 2.80%

C) 4.00%

D) 5.60%

E) 8.00%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

15

Suppose company ABC can issue new 10-year bonds, with 8 percent coupon, paid semi-annually. Assume a tax rate of 30 percent. The company's after-tax cost of debt if these bonds are issued at 100 is closest to:

A) 2.40%

B) 2.80%

C) 4.00%

D) 5.60%

E) 8.00%

A) 2.40%

B) 2.80%

C) 4.00%

D) 5.60%

E) 8.00%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

16

Suppose company ABC can issue new 10-year bonds, with 6 percent coupon, paid semi-annually. Assume a tax rate of 30 percent. The company's before-tax cost of debt, if these bonds are issued at 95, is closest to:

A) 1.08%

B) 2.52%

C) 5.04%

D) 6.00%

E) 7.20%

A) 1.08%

B) 2.52%

C) 5.04%

D) 6.00%

E) 7.20%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

17

Suppose company ABC can issue new 10-year bonds, with 6 percent coupon, paid semi-annually. Assume a tax rate of 30 percent. The company's after-tax cost of debt, if these bonds are issued at 95, is closest to:

A) 1.08%

B) 2.52%

C) 5.04%

D) 6.00%

E) 7.20%

A) 1.08%

B) 2.52%

C) 5.04%

D) 6.00%

E) 7.20%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

18

Suppose a company can issue new preferred shares with a par value of $100 at $98. This preferred stock issue has annual dividends of $5. The estimate of the company's cost of preferred equity is closest to:

A) 2.50%

B) 4.90%

C) 5.00%

D) 5.10%

A) 2.50%

B) 4.90%

C) 5.00%

D) 5.10%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

19

Suppose a company can issue new preferred shares with a par value of $100 at $102. This preferred stock issue has annual dividends of $5. The estimate of the company's cost of preferred equity is closest to:

A) 2.50%

B) 4.90%

C) 5.00%

D) 5.10%

A) 2.50%

B) 4.90%

C) 5.00%

D) 5.10%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose a company can issue new preferred shares with a par value of $100 at $100. This preferred stock issue has annual dividends of $5. The estimate of the company's cost of preferred equity is closest to:

A) 2.50%

B) 4.90%

C) 5.00%

D) 5.10%

A) 2.50%

B) 4.90%

C) 5.00%

D) 5.10%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

21

Consider the following information:

Expected dividend next period = $2.00

Required return by common share investors = 12.00%

Forecast long-run growth rate = 3.00%

The price per share of stock for this company is closest to:

A) $13.33

B) $16.67

C) $22.22

D) $66.67

Expected dividend next period = $2.00

Required return by common share investors = 12.00%

Forecast long-run growth rate = 3.00%

The price per share of stock for this company is closest to:

A) $13.33

B) $16.67

C) $22.22

D) $66.67

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

22

Consider the following information:

Expected dividend next period = $2.00

Required return by common share investors = 9.00%

Forecast long-run growth rate = 3.00%

The price per share of stock for this company is closest to:

A) $16.67

B) $22.22

C) $33.33

D) $66.67

Expected dividend next period = $2.00

Required return by common share investors = 9.00%

Forecast long-run growth rate = 3.00%

The price per share of stock for this company is closest to:

A) $16.67

B) $22.22

C) $33.33

D) $66.67

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

23

Assume a company paid a dividend per share this year of $2.00, which is expected to grow at 4 percent per year indefinitely. If its share price is $40, what is the cost of common equity?

A) 4.00%

B) 5.00%

C) 5.20%

D) 9.00%

E) 9.20%

A) 4.00%

B) 5.00%

C) 5.20%

D) 9.00%

E) 9.20%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

24

Assume a company paid a dividend per share this year of $3.00, which is expected to grow at 4 percent per year indefinitely. If its share price is $30, what is the cost of common equity?

A) 4.00%

B) 10.00%

C) 10.40%

D) 14.00%

E) 14.40%

A) 4.00%

B) 10.00%

C) 10.40%

D) 14.00%

E) 14.40%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

25

Assume a company's retention rate is 60 percent, its cost of equity capital is 10 percent, its forecasted earnings per share are $3.00, and its ROE is 12 percent. The company's expected growth rate is closest to:

A) 4.80%

B) 6.00%

C) 7.20%

D) 10.00%

E) 12.00%

A) 4.80%

B) 6.00%

C) 7.20%

D) 10.00%

E) 12.00%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

26

Assume a company's retention rate is 60 percent, its cost of equity capital is 10 percent, its forecasted earnings per share are $3.00, and its ROE is 12 percent. The company's dividend next period is closest to:

A) $0.30

B) $1.20

C) $1.80

D) $3.00

A) $0.30

B) $1.20

C) $1.80

D) $3.00

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

27

Assume a company's retention rate is 60 percent, its cost of equity capital is 10 percent, its forecasted earnings per share are $3.00, and its ROE is 12 percent. The company's share price, using to the dividend valuation model, is closest to:

A) $16.67

B) $22.22

C) $33.33

D) $66.67

A) $16.67

B) $22.22

C) $33.33

D) $66.67

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

28

Assume a company's retention rate is 70 percent, its cost of equity capital is 12 percent, its forecasted earnings per share are $8.00, and its ROE is 6 percent. The company's expected growth rate is closest to:

A) 2.10%

B) 4.20%

C) 6.00%

D) 8.40%

E) 12.00%

A) 2.10%

B) 4.20%

C) 6.00%

D) 8.40%

E) 12.00%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

29

Assume a company's retention rate is 70 percent, a cost of equity capital is 12 percent, forecasted earnings per share are $8.00, and a return on equity of 6 percent. The company's forecast dividend is closest to:

A) $2.40

B) $4.80

C) $5.60

D) $8.00

E) $9.60

A) $2.40

B) $4.80

C) $5.60

D) $8.00

E) $9.60

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

30

Assume a company's retention rate is 70 percent, its cost of equity capital is 12 percent, its forecasted earnings per share are $8.00, and its return on equity is 6 percent. Its share price is closest to:

A) $8.00

B) $28.57

C) $30.77

D) $38.77

E) $40.00

A) $8.00

B) $28.57

C) $30.77

D) $38.77

E) $40.00

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

31

In the CAPM equation E(ri) = rf + [E(rM) - rf]?i, which of the following represents the market risk premium?

A) ?i

B) E(ri)

C) E(rM)

D) [E(rM) - rf]

E) [E(rM) - rf]?i

A) ?i

B) E(ri)

C) E(rM)

D) [E(rM) - rf]

E) [E(rM) - rf]?i

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

32

Assume the beta for a company's stock is 2.00 and that the risk-free rate is 4.5 percent, whereas the expected return on the market is 10.0 percent. The market risk premium is closest to:

A) 4.50%

B) 5.50%

C) 9.00%

D) 10.00%

E) 15.50%

A) 4.50%

B) 5.50%

C) 9.00%

D) 10.00%

E) 15.50%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

33

Assume the beta for a company's stock is 2.00 and that the risk-free rate is 4.5 percent, whereas the expected return on the market is 10.0 percent. The company's cost of equity for internal funds using CAPM is closest to:

A) 4.50%

B) 5.50%

C) 9.00%

D) 10.00%

E) 15.50%

A) 4.50%

B) 5.50%

C) 9.00%

D) 10.00%

E) 15.50%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

34

Assume the beta for a company's stock is 0.75 and that the risk-free rate is 5.0 percent, whereas the expected return on the market is 8.0 percent. The market risk premium is closest to:

A) 2.25%

B) 3.00%

C) 5.00%

D) 7.25%

E) 8.00%

A) 2.25%

B) 3.00%

C) 5.00%

D) 7.25%

E) 8.00%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

35

Assume the beta for a company's stock is 0.75 and that the risk-free rate is 5.0 percent, whereas the expected return on the market is 8.0 percent. The company's cost of equity using CAPM is closest to:

A) 2.25%

B) 3.00%

C) 5.00%

D) 7.25%

E) 8.00%

A) 2.25%

B) 3.00%

C) 5.00%

D) 7.25%

E) 8.00%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

36

The Trumpet Corporation has a capital structure consisting of 30 percent debt and 70 percent common equity. The financial managers of Trumpet believe that these capital proportions represent the company's target capital structure. If Trumpet were to issue new debt, it expects this debt will yield 8 percent. Currently, Trumpet's stock is trading at $30 per shares, the current dividend is $1 per share, and Trumpet's financial managers believe that this dividend will grow at a rate of 3 percent per year. If Trumpet's weighted average cost of capital is closest to:

A) 4.487%

B) 5.817%

C) 6.063%

D) 6.903%

A) 4.487%

B) 5.817%

C) 6.063%

D) 6.903%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

37

The St. Johns Corporation has a capital structure consisting of 40 percent debt and 60 percent common equity. The financial managers of St. Johns believe that these capital proportions represent the company's target capital structure. If St. Johns were to issue new debt, it expects this debt will yield 8 percent. Currently, St. Johns stock is trading at $20 per shares, the current dividend is $1 per share, and St. Johns' financial managers believe that this dividend will grow at a rate of 6 percent per year. If St. John's weighted average cost of capital is closest to:

A) 6.487%

B) 8.250%

C) 8.860%

D) 9.980%

A) 6.487%

B) 8.250%

C) 8.860%

D) 9.980%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

38

The Pluto Corporation has a capital structure consisting of 60 percent debt and 40 percent common equity. The financial managers of Pluto believe that these capital proportions represent the company's target capital structure. It Pluto was to issue new debt, it expects this debt will yield 10 percent. Currently, Pluto's stock is trading at $10 per shares, the current dividend is $0.10 per share, and Pluto's financial managers believe that this dividend will grow at a rate of 10 percent per year. If Pluto's marginal tax rate is 35 percent, Pluto's weighted average cost of capital is closest to:

A) 6.786%

B) 8.340%

C) 8.800%

D) 10.440%

A) 6.786%

B) 8.340%

C) 8.800%

D) 10.440%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

39

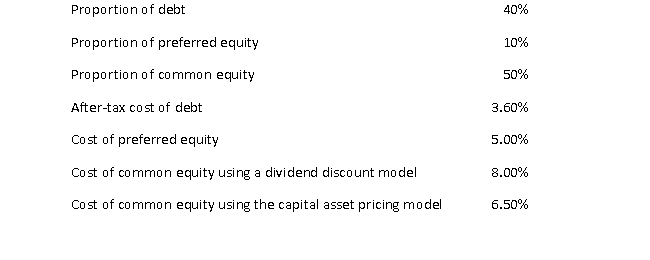

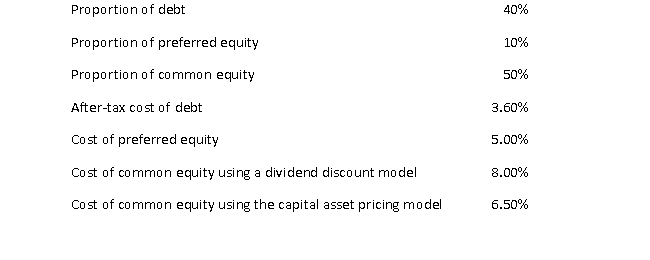

Use the following information for XYZ Company:

XYZ's cost of capital using the capital asset pricing model (CAPM) is closest to:

XYZ's cost of capital using the capital asset pricing model (CAPM) is closest to:

A) 4.23%

B) 4.88%

C) 4.53%

D) 5.70%

E) 6.35%

XYZ's cost of capital using the capital asset pricing model (CAPM) is closest to:

XYZ's cost of capital using the capital asset pricing model (CAPM) is closest to:A) 4.23%

B) 4.88%

C) 4.53%

D) 5.70%

E) 6.35%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

40

Use the following information for Company ZZZ:

Company ZZZ's weighted average cost of capital, using the CAPM, is closest to:

Company ZZZ's weighted average cost of capital, using the CAPM, is closest to:

A) 4.23%

B) 4.88%

C) 4.53%

D) 5.70%

E) 6.35%

Company ZZZ's weighted average cost of capital, using the CAPM, is closest to:

Company ZZZ's weighted average cost of capital, using the CAPM, is closest to:A) 4.23%

B) 4.88%

C) 4.53%

D) 5.70%

E) 6.35%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

41

Consider the following financial information for a company:

The company's weighted cost of capital, using the capital asset pricing model, is closest to:

The company's weighted cost of capital, using the capital asset pricing model, is closest to:

A) 3.25%

B) 3.75%

C) 5.35%

D) 5.85%

E) 6.50%

The company's weighted cost of capital, using the capital asset pricing model, is closest to:

The company's weighted cost of capital, using the capital asset pricing model, is closest to:A) 3.25%

B) 3.75%

C) 5.35%

D) 5.85%

E) 6.50%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

42

Consider the following information for a company:

The company's weighted cost of capital, using the dividend discount model, is closest to:

The company's weighted cost of capital, using the dividend discount model, is closest to:

A) 3.25%

B) 3.75%

C) 5.35%

D) 5.85%

E) 6.50%

The company's weighted cost of capital, using the dividend discount model, is closest to:

The company's weighted cost of capital, using the dividend discount model, is closest to:A) 3.25%

B) 3.75%

C) 5.35%

D) 5.85%

E) 6.50%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

43

The simple definition of capital is that it is the sum of all the debt (interest-bearing and non-interesting- bearing) and the equity of a company.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

44

A company's financial structure is the entire set of liabilities and equity accounts.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

45

Invested capital is the sum of the debt capital and equity capital.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

46

A firm's Return on Equity is net income divided by the firm's market value.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

47

Pp = Dp / rp is the formula to calculate the required rate of return on preferred shares.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

48

The Dividend Discount Model with constant growth and the Gordon Model are the same thing.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

49

An increase in earnings per share increases share price.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

50

If ROE is positive, the greater the portion of earnings retained, the smaller the share price.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

51

The higher the required rate of return, the higher the share price.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

52

If ROE is less than re, the company can be characterized as a growth company.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

53

In the CAPM equation E(ri) = rf + [E(rM) - rf]?i, the term ?i measures the company's systematic or market risk.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

54

The required rate of return is the sum of the expected dividend yield and the expected cost of capital.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

55

The dividend discount approach to estimating the cost of equity capital cannot be used if dividends are declining.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

56

We cannot use the dividend discount approach to estimating the cost of equity capital when the expected growth rate exceeds the required rate of return.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

57

What is the basic equation for the weighted average cost of capital?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

58

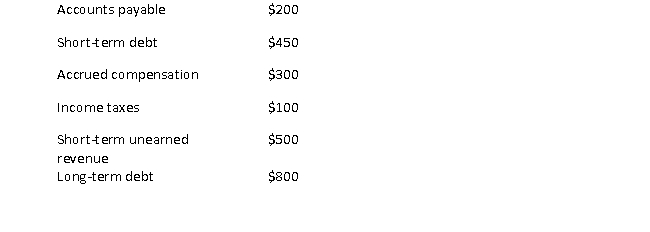

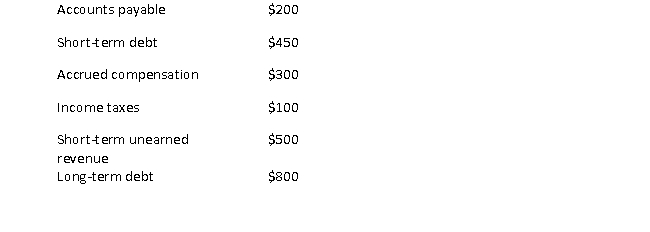

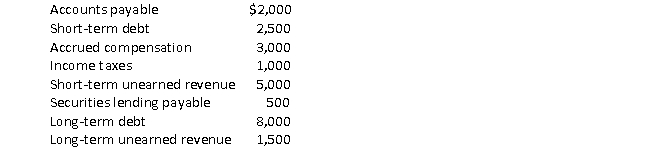

Use the following data from the balance sheet of ×YZ company and calculate the total liabilities and the debt for ×YZ company:

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

59

Use the following data from the balance sheet of ×YZ company and calculate the total liabilities and the debt for ×YZ company:

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

60

Use the following data from the balance sheet of ×YZ company and calculate the debt to equity ratio for ×YZ company:

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

61

Consider a company that has $100 face value of debt outstanding. The debt consists of 10-year bonds with a coupon rate of 5 percent. These bonds have a current yield to maturity of 6 percent. What is the market value of the company's debt?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

62

Consider a company that has $100 face value of debt outstanding. The debt consists of 10-year bonds with a coupon rate of 6 percent. These bonds have a current yield to maturity of 5 percent. What is the market value of the company's debt?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

63

Consider a company that has $100 face value of debt outstanding. The debt consists of 10-year bonds with a coupon rate of 6 percent. These bonds have a current yield to maturity of 6 percent. What is the market value of the company's debt?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

64

Suppose company ABC can issue new 10-year bonds, with 6 percent coupon, paid semi-annually. Assume a tax rate of 30 percent. What is the company's before- and after-tax cost of debt if these bonds are issued at par value?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

65

Suppose company ABC can issue new 10-year bonds, with 6 percent coupon, paid semi-annually. Assume a tax rate of 30 percent. What is the company's before- and after-tax cost of debt if these bonds are issued at 99?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

66

Suppose company ABC can issue new 10-year bonds, with 6 percent coupon, paid semi-annually. Assume a tax rate of 30 percent. What is the company's before- and after-tax cost of debt if these bonds are issued at 101?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

67

Suppose a company can issue new preferred shares with a par value of $100 at $100. Assume a tax rate of 30 percent. This preferred stock issue has annual dividends of $8. What is the estimate of the company's cost of preferred equity?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

68

Suppose a company can issue new preferred shares with a par value of $100 at $100. Assume a tax rate of 30 percent. This preferred stock issue has annual dividends of 7 percent. What is the estimate of the company's cost of preferred equity?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

69

Suppose a company can issue new preferred shares with a par value of $100 at $94. Assume a tax rate of 30 percent. This preferred stock issue has annual dividends of 7 percent. What is the estimate of the company's cost of preferred equity?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

70

Suppose a company can issue new preferred shares with a par value of $100 at $103. Assume a tax rate of 30 percent. This preferred stock issue has annual dividends of 7 percent. What is the estimate of the company's cost of preferred equity?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

71

Given the following information, calculate the price per share of stock for × Company:

Expected dividend next period = $2.00

Required return by common share investors = 8.00%

Forecast long-run growth rate = 3.00%

Expected dividend next period = $2.00

Required return by common share investors = 8.00%

Forecast long-run growth rate = 3.00%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

72

Given the following information, calculate the price per share of stock for × Company:

Expected dividend next period = $2.00

Required return by common share investors = 10.00%

Forecast long-run growth rate = 3.00%

Expected dividend next period = $2.00

Required return by common share investors = 10.00%

Forecast long-run growth rate = 3.00%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

73

Assume a company paid a dividend per share this year of $1.00, which is expected to grow at 3 percent per year indefinitely. If its share price is $20, what is the cost of common equity?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

74

Assume a company paid a dividend per share this year of $1.00, which is expected to grow at 5 percent per year indefinitely. If its share price is $15, what is the cost of common equity?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

75

Assume a company's retention rate is 70 percent, its cost of equity capital is 12 percent, and its forecasted earnings per share are $4. If the company's ROE is 10 percent, what is the company's forecast growth rate, the forecast dividend and the share price?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

76

Assume a company's retention rate is 70 percent, its cost of equity capital is 12 percent, and its forecasted earnings per share are $4. If the company's ROE is 10 percent, what is the company's forecast growth rate, the forecast dividend and the share price?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

77

Assume the beta for a company's stock is 1.15 and that the risk-free rate is 4.5 percent, whereas the expected return on the market is 10.0 percent. Estimate the company's cost of equity for internal funds using CAPM?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

78

Assume the beta for a company's stock is .85 and that the risk-free rate is 4.5 percent, whereas the expected return on the market is 10.0 percent. Estimate the company's cost of equity for internal funds using CAPM?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

79

Given the following, what is ×YZ Company's Debt to Equity ratio?

Proportion of Debt - 40%

Proportion of Preferred Equity - 10%

Proportion of Common Equity - ?%

Proportion of Debt - 40%

Proportion of Preferred Equity - 10%

Proportion of Common Equity - ?%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

80

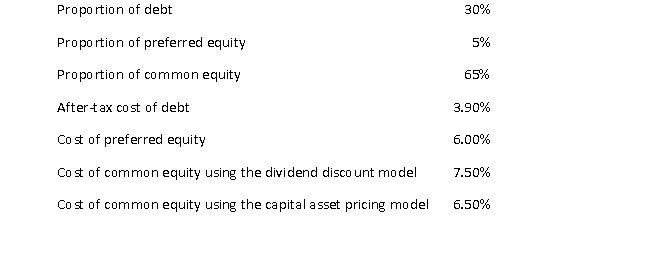

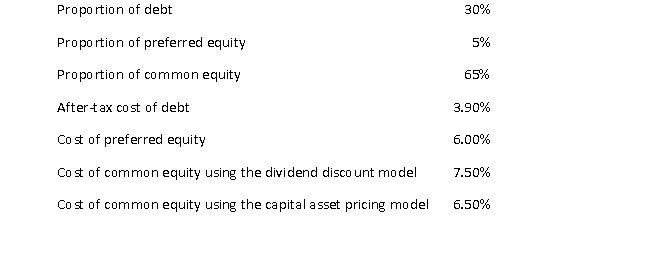

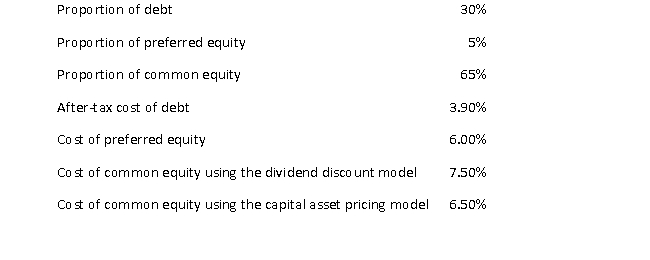

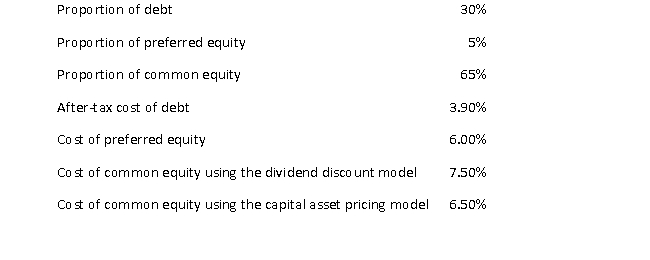

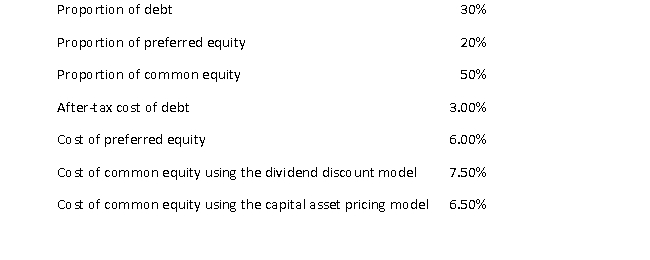

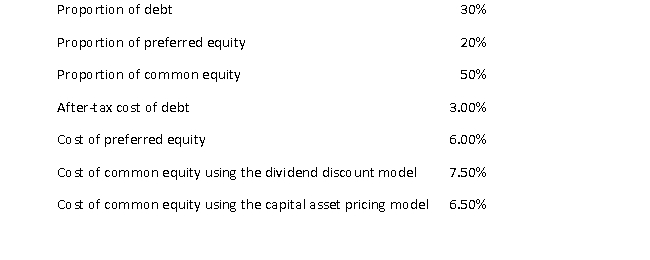

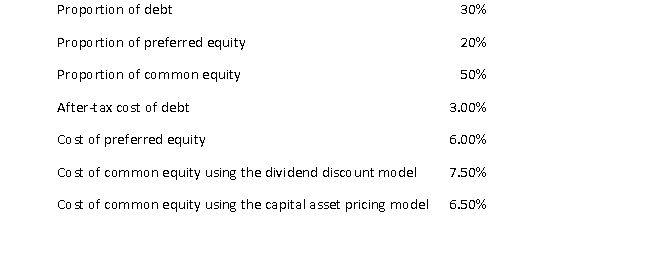

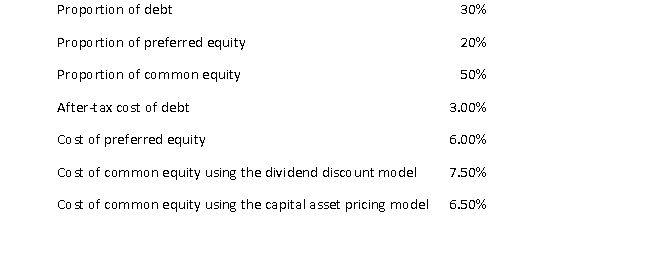

Use the following information to calculate ×YZ Company's WACC using the Dividend Discount Model (DDM).

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck