Deck 9: Asset Pricing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/97

Play

Full screen (f)

Deck 9: Asset Pricing

1

The payment to get out of a risky situation is best described as:

A) a payoff.

B) a risk premium.

C) a risk avoidance fee.

D) an insurance premium.

A) a payoff.

B) a risk premium.

C) a risk avoidance fee.

D) an insurance premium.

an insurance premium.

2

If a friend offers you $75 dollars if the coin flip to open a football game turns out to be heads, but you have to pay him $50 if the coin flip turns out to be tails. What is the risk premium?

A) $12.50

B) $25.00

C) $50.00

D) $75.00

E) $125.00

A) $12.50

B) $25.00

C) $50.00

D) $75.00

E) $125.00

$12.50

3

In an office pool, you will win $50 if a coworker has a female child, but will have to pay $30 if they have a male child. What is the risk premium in the office pool?

A) -$15

B) $10

C) $20

D) $25

A) -$15

B) $10

C) $20

D) $25

$10

4

The risky portfolio on the efficient frontier whose tangent line cuts the vertical axis at the risk-free rate is best described as:

A) market portfolio.

B) efficient frontier.

C) tangent portfolio.

D) risk-free intercept.

A) market portfolio.

B) efficient frontier.

C) tangent portfolio.

D) risk-free intercept.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

5

The idea that the investment decision is separate from the financing decision is best described as:

A) decision theory.

B) separate finances.

C) separation theorem.

D) two-step decision model.

A) decision theory.

B) separate finances.

C) separation theorem.

D) two-step decision model.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

6

The portfolio that contains all risky securities in the market is best described as the:

A) risky portfolio.

B) market portfolio.

C) non-diversified portfolio.

A) risky portfolio.

B) market portfolio.

C) non-diversified portfolio.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following would be considered risk averse?

A) Sky diving

B) Playing the lottery

C) Gambling in Las Vegas

D) Purchasing health insurance

A) Sky diving

B) Playing the lottery

C) Gambling in Las Vegas

D) Purchasing health insurance

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

8

What is the pricing model that describes the expected return as the sum of the risk-free rate of interest and a premium for bearing market risk?

A) Fama-French model

B) Economic value added

C) Arbitrage pricing theory

D) Capital asset pricing model

A) Fama-French model

B) Economic value added

C) Arbitrage pricing theory

D) Capital asset pricing model

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

9

In the capital asset pricing model, the expected return on an asset with a beta of zero is the:

A) market risk premium.

B) risk-free rate of interest.

C) market risk premium, less the risk-free rate of interest.

D) risk-free rate of interest, plus the market risk premium.

A) market risk premium.

B) risk-free rate of interest.

C) market risk premium, less the risk-free rate of interest.

D) risk-free rate of interest, plus the market risk premium.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

10

What of the following does not describe the Sharpe ratio?

A) (rp - rf) / ?P

B) Reward -to-risk ratio

C) Reward-to-variability ratio

D) Expected returns are the sum of the risk free rate, plus the premium for bearing market risk.

A) (rp - rf) / ?P

B) Reward -to-risk ratio

C) Reward-to-variability ratio

D) Expected returns are the sum of the risk free rate, plus the premium for bearing market risk.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is not an assumption of the capital asset pricing model (CAPM)?

A) Capital markets are in equilibrium.

B) Transaction costs are the same for all investors.

C) All investors can borrow or lend money at the risk-free rate of return.

D) All investors have identical expectations about expected returns, standard deviations, and correlation coefficients for all securities.

A) Capital markets are in equilibrium.

B) Transaction costs are the same for all investors.

C) All investors can borrow or lend money at the risk-free rate of return.

D) All investors have identical expectations about expected returns, standard deviations, and correlation coefficients for all securities.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements is incorrect?

A) CAPM was developed by William Sharpe and John Lintner.

B) An assumption of CAPM is that capital markets are in equilibrium.

C) CAPM includes many assumptions, all of which must be strictly adhered to for the main implications of CAPM to hold true.

D) CAPM is a pricing model that describes the expected return as the sum of the risk-free rate of interest and a premium for bearing market risk.

A) CAPM was developed by William Sharpe and John Lintner.

B) An assumption of CAPM is that capital markets are in equilibrium.

C) CAPM includes many assumptions, all of which must be strictly adhered to for the main implications of CAPM to hold true.

D) CAPM is a pricing model that describes the expected return as the sum of the risk-free rate of interest and a premium for bearing market risk.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following would be the best proxy for market portfolio?

A) Wal-Mart stock

B) Dow Transportation Index

C) S & P 500 Composite Index

D) Dow jones Industrial Average

A) Wal-Mart stock

B) Dow Transportation Index

C) S & P 500 Composite Index

D) Dow jones Industrial Average

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

14

If the risk-free rate is 2%, the Sharpe ratio for Security A, which has an expected return of 6% and a standard deviation of returns of 4% is closest to:

A) 0.02

B) 0.04

C) 0.50

D) 1.00

A) 0.02

B) 0.04

C) 0.50

D) 1.00

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

15

If The risk-free rate is 2 percent, the Sharpe ratio for a security that has an expected return of 5% and a standard deviation of returns of 4% is closest to:

A) 0.02

B) 0.04

C) 0.75

D) 1.00

A) 0.02

B) 0.04

C) 0.75

D) 1.00

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

16

A friend who knows little about finance calls asking you which stock she should purchase. She knows little about the stocks, but tells you Stock 1 has a Sharpe ratio of 0.43, Stock 2 has a Sharpe ratio of 0.25, Stock 3 has a Sharpe ratio of 0.33 and Stock 4 has a Sharpe ratio of 0.52. Which stock would be best for your friend to purchase?

A) Stock 1

B) Stock 2

C) Stock 3

D) Stock 4

A) Stock 1

B) Stock 2

C) Stock 3

D) Stock 4

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

17

It is two minutes before finance class starts and you just remembered you were supposed to have your stock recommendation for class today. You quickly pull out the information and notice that Stock 1 has a Sharpe ratio of 0.38, Stock 2 has a Sharpe ratio of 0.25, Stock 3 has a Sharpe ratio of 0.33 and Stock 4 has a Sharpe ratio of 0.18. Which stock are you going to choose for your class recommendation?

A) Stock 1

B) Stock 2

C) Stock 3

D) Stock 4

A) Stock 1

B) Stock 2

C) Stock 3

D) Stock 4

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following does not describe market price of risk?

A) [E(rM) - rf]

B) Equilibrium price of risk in the capital market

C) Incremental expected return divided by the incremental risk

D) Additional expected return that the market demands for an increase in risk

A) [E(rM) - rf]

B) Equilibrium price of risk in the capital market

C) Incremental expected return divided by the incremental risk

D) Additional expected return that the market demands for an increase in risk

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

19

The measure of market risk, or performance volatility, that relates the extent to which the return on an asset moves with that on the overall market is best described as:

A) beta.

B) alpha.

C) covariance.

D) standard deviation.

A) beta.

B) alpha.

C) covariance.

D) standard deviation.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

20

The expected return on the market less the risk-free rate is best described as the:

A) beta.

B) profit.

C) market risk premium.

D) security market line (SML).

A) beta.

B) profit.

C) market risk premium.

D) security market line (SML).

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

21

Suppose you have a portfolio consisting of Asset A, which has a beta of 1.4, and Asset B, which has a beta of 0.85. If you have 60 percent of the portfolio in Asset A and the rest in Asset B, the beta of your portfolio is closest to:

A) 1.000.

B) 1.070.

C) 1.125.

D) 1.180.

A) 1.000.

B) 1.070.

C) 1.125.

D) 1.180.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

22

Suppose you have a portfolio consisting of Asset C, which has a beta of 1.5, and Asset D, which has a beta of 0.8. If you have 80 percent of the portfolio in Asset C and the rest in Asset D, the beta of your portfolio is closest to:

A) 0.460.

B) 1.000.

C) 1.150.

D) 1.360.

A) 0.460.

B) 1.000.

C) 1.150.

D) 1.360.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

23

Suppose you have a portfolio consisting of Asset E, which has a beta of 1.5, and the risk-free asset. If you have 80 percent of the portfolio in Asset E and the rest in the risk-free asset, the beta of your portfolio is closest to:

A) 0.75.

B) 1.00.

C) 1.20.

D) 1.36.

A) 0.75.

B) 1.00.

C) 1.20.

D) 1.36.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

24

You have invested all of your retirement funds in your company's stock, which has a beta of 1.0. When you hear on the radio that the stock market is down 150 points, what should you expect from your company stock in your retirement plan?

A) Should be a great day, your stock should be up significantly.

B) Rats! Your company stock is likely down more than the market today.

C) Your company stock is likely down with the market today in similar proportion.

D) It's anyone's guess as the market does not move at all in relation to your company stock.

A) Should be a great day, your stock should be up significantly.

B) Rats! Your company stock is likely down more than the market today.

C) Your company stock is likely down with the market today in similar proportion.

D) It's anyone's guess as the market does not move at all in relation to your company stock.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

25

You have invested all of your retirement funds in your company's stock, which has a beta of -1.0. When you hear on the radio that the stock market is down 150 points, what should you expect from your company stock in your retirement plan?

A) Should be a great day, your stock should be up significantly.

B) Rats! Your company stock is likely down more than the market today.

C) Your company stock is likely down with the market today in similar proportion.

D) It's anyone's guess as the market does not move at all in relation to your company stock.

A) Should be a great day, your stock should be up significantly.

B) Rats! Your company stock is likely down more than the market today.

C) Your company stock is likely down with the market today in similar proportion.

D) It's anyone's guess as the market does not move at all in relation to your company stock.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

26

A beta of zero means:

A) no market risk (risk-free security).

B) less market risk than the average security.

C) more market risk than the average security.

D) negative correlation with the market return.

E) market risk the same as the average security.

A) no market risk (risk-free security).

B) less market risk than the average security.

C) more market risk than the average security.

D) negative correlation with the market return.

E) market risk the same as the average security.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

27

The latest hot stock has a beta of 1.5. If the returns on the market decline by 2 percent, you should expect the price of the latest hot stock to go:

A) up 3%

B) up 3.5%

C) down 2%

D) down 3%

E) down 3.5%

A) up 3%

B) up 3.5%

C) down 2%

D) down 3%

E) down 3.5%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

28

The latest hot stock has a beta of 1.5. If the returns on the market increase by 4 percent, you should expect the price of the latest hot stock to go:

A) up 6%

B) up 5.5%

C) down 4%

D) down 5.5%

E) down 6.0%

A) up 6%

B) up 5.5%

C) down 4%

D) down 5.5%

E) down 6.0%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

29

Sysco Corporation has a beta of 0.71. If the returns on the market increase by 1%, what should you expect from Sysco Corporation?

A) It will go up 1%

B) It will go up .71%

C) It will go down 1%

D) It will go down .71%

A) It will go up 1%

B) It will go up .71%

C) It will go down 1%

D) It will go down .71%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements is incorrect?

A) Betas are constant.

B) High growth companies tend to have betas much larger than one.

C) Portfolio betas are the weighted average of the betas of the stocks in the portfolio.

D) Betas for companies in the same industry are generally similar, but will exhibit differences based on financial risk, size, and other factors.

A) Betas are constant.

B) High growth companies tend to have betas much larger than one.

C) Portfolio betas are the weighted average of the betas of the stocks in the portfolio.

D) Betas for companies in the same industry are generally similar, but will exhibit differences based on financial risk, size, and other factors.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

31

An investor has a three stock portfolio: $25,000 in McDonald's, which has a beta of 0.41; $25,000 in Home Depot, which has a beta of 0.81; and $50,000 in Cardinal Health, which has a beta of 0.76. The beta of this investor's portfolio is closest to:

A) 0.660

B) 0.685

C) 1.000

D) 1.980

A) 0.660

B) 0.685

C) 1.000

D) 1.980

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

32

An investor has a four stock portfolio: $25,000 in Comcast, which has a beta of 1.08; $25,000 in Coca Cola Bottling Company, which has a beta of .50; $50,000 in Microsoft, which has a beta of .98; and $100,000 in Apple, Inc., which has a beta of 1.21. The beta of this investor's portfolio is closest to:

A) 0.685

B) 1.0000

C) 1.0475

D) 3.7700

A) 0.685

B) 1.0000

C) 1.0475

D) 3.7700

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements is incorrect?

A) The SML is downward sloping.

B) SML can be used with individual assets or portfolios.

C) The SML depicts the relation between the required return and market risk, as measured by beta.

D) According to SML, assets with betas greater than the market beta of 1 will have larger risk premiums.

E) According to SML, assets with betas less than the market beta of 1 are less risky and will have lower required rates of return.

A) The SML is downward sloping.

B) SML can be used with individual assets or portfolios.

C) The SML depicts the relation between the required return and market risk, as measured by beta.

D) According to SML, assets with betas greater than the market beta of 1 will have larger risk premiums.

E) According to SML, assets with betas less than the market beta of 1 are less risky and will have lower required rates of return.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

34

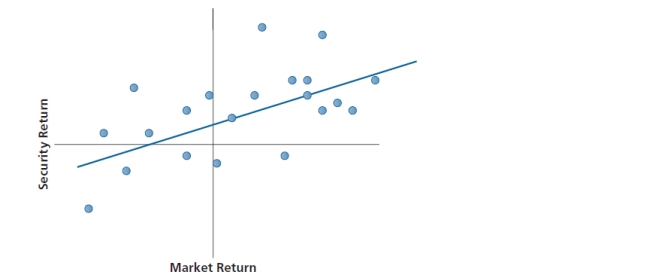

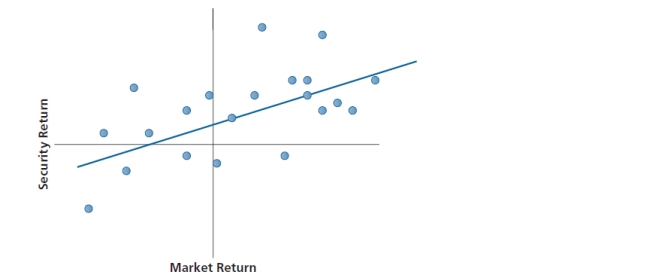

Which of the following best describes the diagonal line in the following diagram?

A) The characteristic line

B) The capital market line

C) The security capital line

D) The security market line

A) The characteristic line

B) The capital market line

C) The security capital line

D) The security market line

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is a three-factor pricing model that uses a market factor, the market value of a firm's common equity, and the ratio of a firm's book equity value to its market value of equity to relate expected returns to risk?

A) Fama-French model

B) Arbitrage pricing theory

C) Capital asset pricing model

D) Capital planning asset model

A) Fama-French model

B) Arbitrage pricing theory

C) Capital asset pricing model

D) Capital planning asset model

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is not an example of arbitrage?

A) A retailer buying a product at a certain price from a wholesaler and selling for more to customers.

B) The new reader selling for the same price at retailers, online retailers, and directly from the company.

C) Buying a popular toy at a discount store and selling it on e-Bay for 10 times the price you bought it for.

D) Foreign visitors buying items on a visit to the U.S., which they can sell for more when they return home.

A) A retailer buying a product at a certain price from a wholesaler and selling for more to customers.

B) The new reader selling for the same price at retailers, online retailers, and directly from the company.

C) Buying a popular toy at a discount store and selling it on e-Bay for 10 times the price you bought it for.

D) Foreign visitors buying items on a visit to the U.S., which they can sell for more when they return home.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

37

A multifactor asset pricing model that does not depend on the existence of an underlying market portfolio and allows for the possibility that several types of risk may affect asset returns is best described as:

A) Fama-French model.

B) Economic value added.

C) Arbitrage pricing theory.

D) Capital asset pricing model.

A) Fama-French model.

B) Economic value added.

C) Arbitrage pricing theory.

D) Capital asset pricing model.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

38

The theory that markets are efficient and that prices accurately reflect all information at any point in time is best described as:

A) Fama-French Model.

B) Arbitrage Pricing Theory.

C) Efficient market hypothesis.

D) Capital asset pricing model (CAPM).

A) Fama-French Model.

B) Arbitrage Pricing Theory.

C) Efficient market hypothesis.

D) Capital asset pricing model (CAPM).

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

39

The study of historical trading information to identify patterns in trading data that can be used to invest successfully can best be described as:

A) event study.

B) pattern analysis.

C) technical analysis.

D) behavioral analysis.

A) event study.

B) pattern analysis.

C) technical analysis.

D) behavioral analysis.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is incorrect?

A) A market that is semi-strong form efficient cannot be weak form efficient.

B) Semi-strong form efficient markets have asset prices that reflect all publicly known and available information.

C) The fact that professional fund managers do not outperform the market is strong evidence for the semi-strong form of market efficiency.

D) One way of testing for semi-strong form efficiency is to examine the speed of adjustment of stock prices to announcements of significant new information.

A) A market that is semi-strong form efficient cannot be weak form efficient.

B) Semi-strong form efficient markets have asset prices that reflect all publicly known and available information.

C) The fact that professional fund managers do not outperform the market is strong evidence for the semi-strong form of market efficiency.

D) One way of testing for semi-strong form efficiency is to examine the speed of adjustment of stock prices to announcements of significant new information.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

41

Which form of efficient market asserts that asset prices fully reflect all information, which includes both public and private information?

A) Weak-form efficient

B) Strong-form efficient

C) Semi-strong efficient

A) Weak-form efficient

B) Strong-form efficient

C) Semi-strong efficient

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

42

Evidence supports that the U.S. market is what form of market efficiency?

A) Weak-form efficient

B) Weak-form and Semi-strong form efficient

C) Weak-form and Semi-strong form and strong-form efficient

A) Weak-form efficient

B) Weak-form and Semi-strong form efficient

C) Weak-form and Semi-strong form and strong-form efficient

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

43

Evidence supports that the U.S. market is what form of market efficiency?

A) Weak-form efficient

B) Weak-form and Semi-strong form efficient

C) Weak-form and Semi-strong form and strong-form efficient

A) Weak-form efficient

B) Weak-form and Semi-strong form efficient

C) Weak-form and Semi-strong form and strong-form efficient

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

44

A market that is weak form efficient is not consistent with abnormal returns from:

A) insider trading.

B) financial analysis.

C) technical analysis.

A) insider trading.

B) financial analysis.

C) technical analysis.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

45

A market that is semi-strong form efficient is consistent with the idea that there are abnormal returns from:

A) insider trading.

B) financial analysis.

C) technical analysis.

A) insider trading.

B) financial analysis.

C) technical analysis.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is not a cognitive bias that occurs in financial management?

A) Framing

B) Anchoring

C) Random walk

D) Loss aversion

E) Overconfidence

A) Framing

B) Anchoring

C) Random walk

D) Loss aversion

E) Overconfidence

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

47

Suppose a company provides a press release that states that earnings are higher than last year, ignoring the fact that the earnings last year were the lowest in a decade. What cognitive bias is the company using in the way it created its press release?

A) Framing

B) Anchoring

C) Loss aversion

D) Overconfidence

A) Framing

B) Anchoring

C) Loss aversion

D) Overconfidence

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

48

Suppose companies recently went through a credit squeeze, in which companies had difficulty obtaining credit, no matter how credit worthy the company. If a company's financial managers are keeping more cash on hand than typical, despite forecasts for an improving economy, this is possibly a result of:

A) framing

B) anchoring

C) random walk

D) overconfidence

A) framing

B) anchoring

C) random walk

D) overconfidence

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

49

A college student who looks at the spending of money from loans differently from the spending of scholarships, differently from the spending of money from parents, and differently from money earned would be exhibiting what cognitive bias?

A) Loss aversion

B) Overconfidence

C) Mental accounting

D) Representativeness

A) Loss aversion

B) Overconfidence

C) Mental accounting

D) Representativeness

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

50

An insurance premium is required by a risk-averse person to enter into a risky situation.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

51

The existence of insurance markets indicates how risk aversion creates a demand to remove risk.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

52

The existence of insurance markets indicates how risk aversion generates risk premiums required to induce people to bear risk.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

53

Portfolios composed of the risk-free rate and the tangent portfolio that offer the highest expected rate of return for any given level of risk are best described as super-tangent portfolios.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

54

Buying stock on margin is an example of a short position.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

55

The standard deviation of a risk-free asset is 1.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

56

The market portfolio is observable.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

57

The risk measurement associated with the capital market line (CML) is beta.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

58

All rational and risk averse investors will seek to be on the capital market line (CML).

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

59

The CML must always be upward sloping.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

60

If the expected return on a diversified portfolio lies below the CML, an investor should not buy the stock.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

61

If the expected return on a diversified portfolio lies above the CML, an investor should not buy the stock.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

62

If a portfolio is on the CML, it is at equilibrium condition and required rate of return equals expected rate of return.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

63

In the CAPM, rational investors are compensated for all risk with increased returns.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

64

A stock that you are analyzing has a beta of less than zero. This means that the market risk is less than the average security.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

65

Beta can range from -1 to +1.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

66

The security market line (SML) depicts the relation between the required return and the market risk, as measured by beta.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

67

If a security lies below the SML, that security is undervalued.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

68

If a security lies below the SML, that security is overvalued.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

69

The primary difference between SML and CML is the measure of risk.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

70

The stock of a certain company increases in correlation with the market return. As a result, its beta will decrease.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

71

When the market risk premium decreases, securities become overvalued.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

72

The beta of the market portfolio is 1.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

73

Arbitrage price theory is based on the no-arbitrage principle.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

74

The theory that price changes over time are independent of one another is best described as random walk hypothesis.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

75

An abnormal profit is one that is over 4%.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

76

You discover that in the past a stock you are following splits when it hits 50. In a weak-form efficient market, you should be able to generate an abnormal profit with this information.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

77

Securities markets in some developing nations are not weak-form efficient.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

78

Strong form efficiency asserts that insiders could not profit from private inside information.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

79

Based on the evidence, active trading strategies are unlikely to outperform passive portfolio management strategies on a consistent basis.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

80

A portfolio manager who believes that markets are efficient and investors are rational is most likely to use a passive strategy in managing the portfolio.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck